Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parts and Service Update April 2014

NEWS FROM THE AFTERMARKET PARTS TEAM AT GRAYSON THERMAL SYSTEMS APRIL 2014 PARTS AND SERVICE UPDATE COOL WAY TO SAVE MONEY Sales of our radiators for leading British and European commercial vehicle models have really taken off in the last 12 months and no wonder – operators can save up to 50 per cent compared with OEM-branded aftermarket products. READ MORE ON PAGE 2 PRODUCTS CUT COSTS, NOT CORNERS Grayson’s range of replacement radiators for standards, which match or exceed OEM commercial vehicles now includes products for specifications, and they are fully guaranteed. DAF, Dennis Eagle, Mercedes, Scania and Volvo. We’ll be introducing radiators for more And they’re flying off the shelves as more leading truck brands soon, and we’re working and more operators choose our own-brand on a complete intercooler range which should radiators to help them cut costs without start to come onto the market at the end of this scrimping on quality. Like all our aftermarket year. products they have been developed and Call the sales desk for more information on manufactured to our own strict quality +44 (0) 121 700 5610 NEW MANIFOLD KIT OPTIMISES RELIABILITY If you are operating Scania OmniCity or OmniDekka buses, you might be interested to know that we’ve developed a valve manifold kit for these vehicles. It is a direct replacement for the air-operated manifold kit that is currently fitted, but it takes away the need for the air operation, reducing the possibility of failure. The price of replacement valves is also lower, so our kit cuts maintenance costs in the future. -

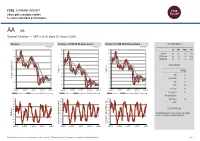

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance AA AA. General Retailers — GBP 0.25 at close 03 August 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 03-Aug-2020 03-Aug-2020 03-Aug-2020 0.7 140 140 1D WTD MTD YTD 130 130 Absolute 4.6 4.6 4.6 -57.0 0.6 Rel.Sector 2.4 2.4 2.4 -48.8 120 120 Rel.Market 2.5 2.5 2.5 -46.1 110 110 0.5 100 100 VALUATION 90 0.4 90 80 Trailing Relative Price Relative Relative Price Relative 80 70 0.3 PE 1.6 70 Absolute Price (local currency) (local Price Absolute 60 EV/EBITDA 8.0 60 50 0.2 PB -ve 50 40 PCF 0.7 0.1 40 30 Div Yield 2.6 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Price/Sales 0.1 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity - 100 90 90 Div Payout 4.6 90 80 80 ROE - 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 The principal activity of the Company is providing 40 RSI RSI (Absolute) service of consumer roadside assistance. -

Rightmove Plc, Winterhill (RMV:LN)

Rightmove Plc, Winterhill (RMV:LN) Real Estate/Real Estate Services Price: 737.40 GBX Report Date: September 22, 2021 Business Description and Key Statistics Rightmove operates as an online property portal. Co.'s segments Current YTY % Chg include The Agency, which includes resale and lettings property advertising services provided on Co.'s platforms and tenant Revenue LFY (M) 289 8.0 referencing and insurance products sold by Van Mildert Landlord EPS Diluted LFY 0.19 10.2 and Tenant Protection Limited; and The New Homes, which provides property advertising services to new home developers Market Value (M) 6,453 and housing associations on Co.'s platforms. Co.'s customers are primarily estate agents, lettings agents and new homes developers Shares Outstanding LFY (000) 875,062 advertising properties for sale and to rent in the United Kingdom. Book Value Per Share 0.05 EBITDA Margin % 75.10 Net Margin % 60.8 Website: www.rightmove.co.uk Long-Term Debt / Capital % 20.3 ICB Industry: Real Estate Dividends and Yield TTM 0.04 - 0.61% ICB Subsector: Real Estate Services Payout Ratio TTM % 34.9 Address: 2 Caldecotte Lake;Business Park;Caldecotte Lake Drive 60-Day Average Volume (000) 1,679 Milton Keynes 52-Week High & Low 746.80 - 555.80 GBR Employees: 538 Price / 52-Week High & Low 0.99 - 1.33 Price, Moving Averages & Volume 756.4 756.4 Rightmove Plc, Winterhill is currently trading at 737.40 which is 4.4% above its 50 day 730.1 730.1 moving average price of 706.13 and 15.3% above its 703.8 703.8 200 day moving average price of 639.56. -

Energy in Wales

House of Commons Welsh Affairs Committee Energy in Wales Third Report of Session 2005–06 Volume I Report, together with formal minutes, Ordered by The House of Commons to be printed 11 July 2006 HC 876-I Published on Thursday 20 July 2006 by authority of the House of Commons London: The Stationery Office Limited £0.00 The Welsh Affairs Committee The Welsh Affairs Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Office of the Secretary of State for Wales (including relations with the National Assembly for Wales.) Current membership Dr Hywel Francis MP (Chairman) (Labour, Aberavon) Mr Stephen Crabb MP (Conservative, Preseli Pembrokeshire) David T. C. Davies MP (Conservative, Monmouth) Nia Griffith MP (Labour, Llanelli) Mrs Siân C. James MP (Labour, Swansea East) Mr David Jones MP (Conservative, Clwyd West) Mr Martyn Jones MP (Labour, Clwyd South) Albert Owen MP (Labour, Ynys Môn) Jessica Morden MP (Labour, Newport East) Hywel Williams MP (Plaid Cymru, Caernarfon) Mark Williams MP (Liberal Democrat, Ceredigion) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk. Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at www.parliament.uk/parliamentary_committees/welsh_affairs_committee.cfm. A list of Reports of the Committee in the present Parliament is at the back of this volume. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Case 15-11663-LSS Doc 212 Filed 10/12/15 Page 1 of 109 Case 15-11663-LSS Doc 212 Filed 10/12/15 Page 2 of 109

Case 15-11663-LSS Doc 212 Filed 10/12/15 Page 1 of 109 Case 15-11663-LSS Doc 212 Filed 10/12/15 Page 2 of 109 EXHIBIT A Response Genetics, Inc. - U.S. CaseMail 15-11663-LSS Doc 212 Filed 10/12/15 Page 3 of 109 Served 10/9/2015 12 WEST CAPITAL MANAGEMENT LP 1727 JFK REALTY LP 3S CORPORATION 90 PARK AVENUE, 41ST FLOOR A PARTNERSHIP 1251 E. WALNUT NEW YORK, NY 10016 1727 JFK REALTY LLC CARSON, CA 90746 100 ENGLE ST CRESSKILL, NJ 07626-2269 4281900 CANADA INC. A C PHILLIPS AAAGENT SERVICES, LLC ATTN: DEBORAH DOLMAN 2307 CRESTVIEW ST 125 LOCUST ST. 100 RUE MARIE-CURIE THE VILLAGES, FL 32162-3455 HARRISBURG, PA 17101 DOLLARD-DES-ORMEAUX, QC H9A 3C6 CANADA AARON D SUMMERS AARON K BROTEN IRA TD AMERITRADE AARON WANG 202 S SUNNY SLOPE ST CLEARING CUSTODIAN 6880 SW 44TH ST #215 W FRANKFORT, IL 62896-3104 1820 PLYMOUTH LN UNIT 2 MIAMI, FL 33155-4765 CHANHASSEN, MN 55317-4837 AASHISH WAGLE ABBOTT MOLECULAR INC. ABBOTT MOLECULAR INC. 2220 W MISSION LN APT 1222 1300 EAST TOUHY AVENUE 75 REMITTANCE DRIVE SUTIE 6809 PHOENIX, AZ 85021 DES PLAINES, IL 60068 CHICAGO, IL 60675-6809 ABBOTT MOLECULAR INC. ABDUL BASIT BUTT ABE OFFICE FURNITURE OUTLET DIVISION COUNSEL 14 RENOIR DRIVE 3400 N. PECK RD. 1350 E. TOUHY AVE., STE 300W MONMOUTH JUNCTION, NJ 08852 EL MONTE, CA 91731 DES PLAINES, IL 60018 ABEDIN JAMAL ABEY M GEORGE ABHIJIT D NAIK 9253 REGENTS RD UNIT A207 3206 LOCHAVEN DR 1049 W OGDEN AVE LA JOLLA, CA 92037-9161 ROWLETT, TX 75088 APT 103 NAPERVILLE, IL 60563 ABRAHAM BROWN ACCENT - 1 ACCENT - 2 DESIGNATED BENE PLAN/TOD P.O. -

2021 North American Forest Insect Work Conference

2021 North American Forest Insect Work Conference Shaping Forests: Action in a Changing World May 26-28, 2021 1 2021 North American Forest Insect Work Conference Organizers Organizing Committee: Jess Hartshorn (Chair) – Clemson University, Clemson, SC Brian Aukema – University of Minnesota, St. Paul, MN Rachael Arango – USDA Forest Service, Madison, WI Jeff Garnas – University of New Hampshire, Durham, NH Rich Hofstetter – Northern Arizona University, Flagstaff, AZ Kier Klepzig – The Jones Center at Ichauway, Newton, GA Robert Rabaglia – USDA Forest Service, Washington, DC Program Committee: Kier Klepzig (Co-Chair) – The Jones Center at Ichauway, Newton, GA Rich Hostetter (Co-Chair) – Northern Arizona University, Flagstaff, AZ Deepa Pureswaran – Canadian Forest Service, Quebec, QC Jeff Garnas – University of New Hampshire, Durham, NH Sponsorship: Kevin Chase - Bartlett Tree Experts, Charlotte, NC Posters: Rich Hofstetter - Northern Arizona University 2 Tuesday, May 25 2:00 Forest Health Task Force 4:00 SFIWC Business Meeting WFIWC Business Meeting Wednesday, May 26 8:00 Welcome Remarks 8:15 Plenary Session 1 A. Shannon Lotthammer, Assistant Forestry Commissioner, Minnesota Department of Natural Resources B. EAB impacts: what does the loss of ash mean for wildlife? - Alexis Grinde, Wildlife Ecologist, Natural Resources Research Institute, University of Minnesota - Duluth C. Connections - Eli Sagor, Cloquet Forest, University of Minnesota 9:45 Break 10:30 Student Paper Competition - 1 - Jess Hartshorn A. Following Celtis laevigata Willd. mortality and the commonly associated insects in the southeastern US - Emilee M. Poole, Michael D. Ulyshen, and Scott Horn. Celtis laevigata Willd. (sugarberry) is a native tree commonly found along floodplains and rivers in the southeastern US. -

MAINSTAY FUNDS TRUST Form N-Q Filed 2018-09-25

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-25 | Period of Report: 2018-07-31 SEC Accession No. 0001144204-18-050628 (HTML Version on secdatabase.com) FILER MAINSTAY FUNDS TRUST Mailing Address Business Address 51 MADISON AVENUE 51 MADISON AVENUE CIK:1469192| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 NEW YORK NY 10010 NEW YORK NY 10010 Type: N-Q | Act: 40 | File No.: 811-22321 | Film No.: 181084976 212 576 7000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-22321 MainStay Funds Trust (Exact name of registrant as specified in charter) 51 Madison Avenue, New York, New York 10010 (Address of principal executive offices) (Zip Code) J. Kevin Gao, Esq., 30 Hudson Street, Jersey City, NJ 07302 (Name and address of agent for service) Registrant's telephone number, including area code: 800-624-6782 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. Schedule of Investments. The schedule of investments for the period ended July 31, 2018 is filed herewith. MainStay Balanced Fund -

Purplebricks Group Plc Annual Report 2017 Contents

Purplebricks Group plc Annual Report 2017 Contents Company information 5 Highlights 6 Chairman’s statement 8 Strategic report 11 Customer case studies 18 Directors’ report 22 Independent auditor’s report to the members of Purplebricks Group plc 28 Consolidated statement of comprehensive income 29 Consolidated statement of financial position 30 Company statement of financial position 31 Consolidated statement of changes in equity 32 Company statement of changes in equity 34 Consolidated statement of cash flows 36 Company statement of cash flows 37 Notes to the financial statements 38 Purplebricks Group plc Annual Report 2017 / 3 Contents Paul Pindar I would like to thank all of our people for their hard work, dedication, commitment and absolute belief in our customers and our brand. They have created thousands of brand advocates in an industry that is often talked about, criticised and disliked. I would also like to thank our customers who have embraced what we are trying to achieve and have actively helped and supported us in our journey to date. Michael Bruce CEO Purplebricks Group plc Annual Report 2017 / 4 Company Information Directors M P D Bruce J R Davies W E Whitehorn P R M Pindar N S Discombe Registered company number 08047368 Registered and head office Suite 7 Cranmore Place Cranmore Drive Shirley West Midlands B90 4RZ Solicitor to the Company Norton Rose Fulbright LLP 3 More London Riverside London SE1 2AQ Auditor to the Company Grant Thornton UK LLP Chartered Accountants and Statutory Auditor The Colmore Building 20 Colmore -

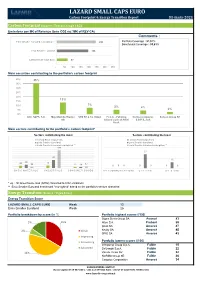

Carbon Footprint & Energy Transition Report

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Prehistory - Central Balkans Cradle of Aegean Culture

Prehistory - Central Balkans Cradle of Aegean culture By Antonije Shkokljev Slave Nikolovski – Katin Translated from Macedonian to English and edited By Risto Stefov Prehistory - Central Balkans Cradle of Aegean culture Published by: Risto Stefov Publications [email protected] Toronto, Canada All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system without written consent from the author, except for the inclusion of brief and documented quotations in a review. Copyright 2013 by Antonije Shkokljev, Slave Nikolovski – Katin & Risto Stefov e-book edition 2 Index Index........................................................................................................3 COMMON HISTORY AND FUTURE ..................................................5 I - GEOGRAPHICAL CONFIGURATION OF THE BALKANS.........8 II - ARCHAEOLOGICAL DISCOVERIES .........................................10 III - EPISTEMOLOGY OF THE PANNONIAN ONOMASTICS.......11 IV - DEVELOPMENT OF PALEOGRAPHY IN THE BALKANS....33 V – THRACE ........................................................................................37 VI – PREHISTORIC MACEDONIA....................................................41 VII - THESSALY - PREHISTORIC AEOLIA.....................................62 VIII – EPIRUS – PELASGIAN TESPROTIA......................................69 IX – BOEOTIA – A COLONY OF THE MINI AND THE FLEGI .....71 X – COLONIZATION