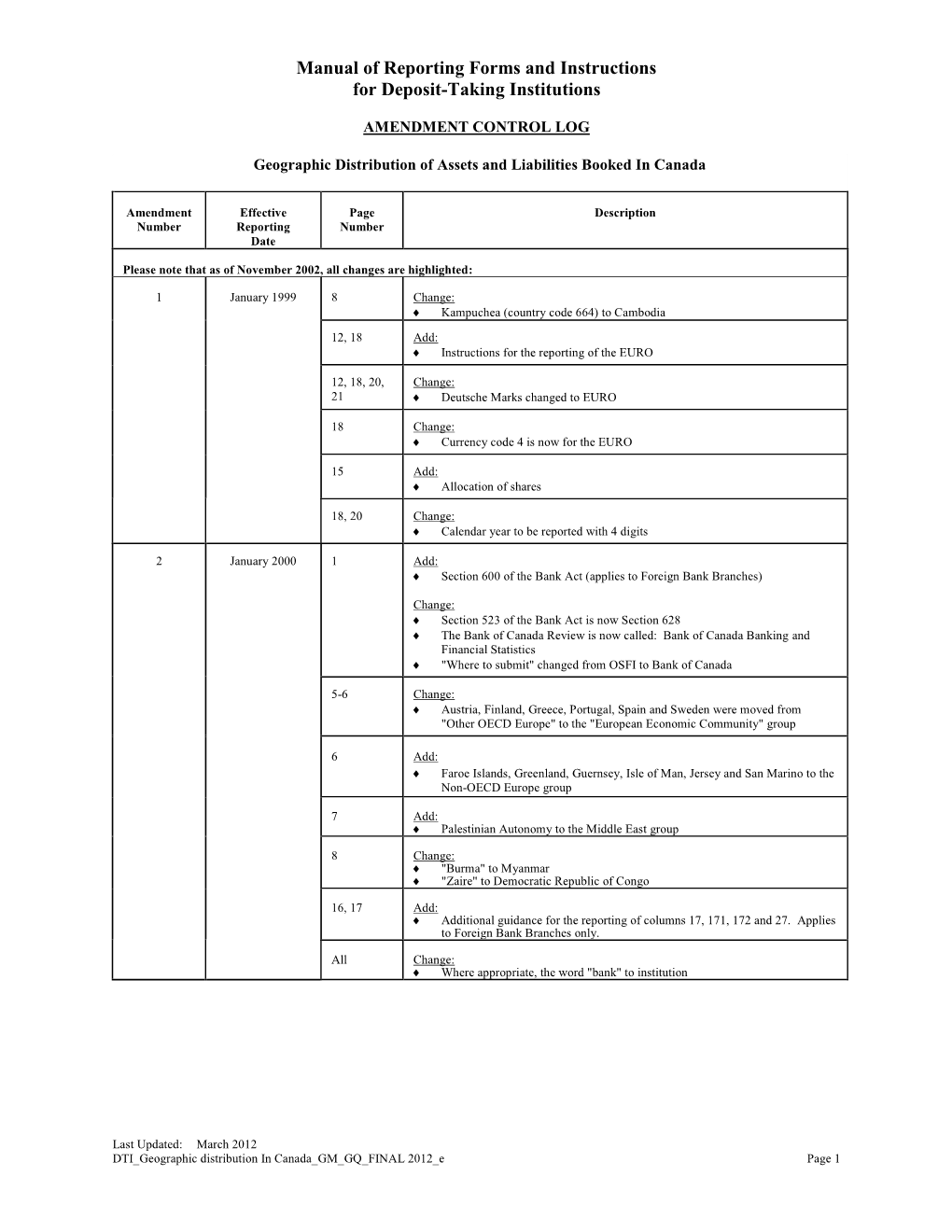

Geographic Distribution of Assets and Liabilities Booked in Canada

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Syria and Repealing Decision 2011/782/CFSP

30.11.2012 EN Official Journal of the European Union L 330/21 DECISIONS COUNCIL DECISION 2012/739/CFSP of 29 November 2012 concerning restrictive measures against Syria and repealing Decision 2011/782/CFSP THE COUNCIL OF THE EUROPEAN UNION, internal repression or for the manufacture and maintenance of products which could be used for internal repression, to Syria by nationals of Member States or from the territories of Having regard to the Treaty on European Union, and in Member States or using their flag vessels or aircraft, shall be particular Article 29 thereof, prohibited, whether originating or not in their territories. Whereas: The Union shall take the necessary measures in order to determine the relevant items to be covered by this paragraph. (1) On 1 December 2011, the Council adopted Decision 2011/782/CFSP concerning restrictive measures against Syria ( 1 ). 3. It shall be prohibited to: (2) On the basis of a review of Decision 2011/782/CFSP, the (a) provide, directly or indirectly, technical assistance, brokering Council has concluded that the restrictive measures services or other services related to the items referred to in should be renewed until 1 March 2013. paragraphs 1 and 2 or related to the provision, manu facture, maintenance and use of such items, to any natural or legal person, entity or body in, or for use in, (3) Furthermore, it is necessary to update the list of persons Syria; and entities subject to restrictive measures as set out in Annex I to Decision 2011/782/CFSP. (b) provide, directly or indirectly, financing or financial assistance related to the items referred to in paragraphs 1 (4) For the sake of clarity, the measures imposed under and 2, including in particular grants, loans and export credit Decision 2011/273/CFSP should be integrated into a insurance, as well as insurance and reinsurance, for any sale, single legal instrument. -

How Over-Compliance Limits Humanitarian Work on Syria Challenges of Fund Transfer for Non-Profit Organizations Working on Syria

Invisible Sanctions: How over-compliance limits humanitarian work on Syria Challenges of Fund Transfer for Non-Profit Organizations Working on Syria 1 Invisible Sanctions: How over-compliance limits humanitarian work on Syria Challenges of Fund Transfer for Non-Profit Organizations Working on Syria Principal Researcher: Dr. Joseph Daher Review and editing: Dr. Erica Moret IMPACT - Civil Society Research and Development e.V. Principal Researcher: Dr. Joseph Daher Review and editing: Dr. Erica Moret Graphic Design: Tammam Al-Omar Published by: IMPACT - Civil Society Research and Development e.V Keithstraße 10 , 10787 Berlin Not for Sale. IMPACT e.V - ©2020 All rights reserved, no part of this publication can be printed, reissued or used in any shape or form without the publisher’s prior written consent. The views and opinions expressed in this report are the authors’ own and do not necessarily reflect those of IMPACT e.V . Despite going to great lengths to verify the authenticity of the information contained in this report, IMPACT e.V cannot guarantee their total impartiality. Table of Contents Acknowledgement ................................................................................................................................... 2 Executive summary and Main Findings of the Research ............................................................................ 3 Added value to the literature ................................................................................................................... 4 Recommendations .................................................................................................................................. -

Country Profile, Russia

Update November 2008 COUNTRY PROFILE, RUSSIA Introduction and Country Background 2 Banking Environment 4 Financial Authorities 7 Legal & Regulatory Issues 8 Market Dominant Banks 11 Clearing Systems 14 Payments & Collections Methods & Instruments 17 Electronic Banking 20 Cash Pooling Solutions 21 Tax Issues 22 Source and Contacts 27 Page 1 of 27 Country profile, Russia Introduction and Country Background Russia has the larg- Key Facts est population in Europe Moscow (Moskva)⎯ St Petersburg, Novosibirsk, Yekater- Capital - Major Cities inburg, Nizhniy Novgorod, Omsk, Samara, Kazan, Chely- abinsk, Rostov-on-Don, Ufa, Volgograd, Perm Area 17,075,200 km2 Population 141.9m (2008 estimate) Languages Russian, many minority languages Currency RUB (Russian Rouble) Telephone Code +7 National / Religious / 2009: 1-5 Jan, 6, 7, 8, 9 Jan; 23 Feb; 8,9 Mar; 1,9,11 Bank Holidays May; 12 Jun; 4 Nov. Extra bank day 11 Jan (Sun) Bank Hours 09:0018:00 (MonFri) Business Hours 10:00 (Mon-Sat) RTS Stock Exchange, Moscow Interbank Currency Ex- Stock Exchange change (MICEX) Moscow Stock Exchange (MSE) Leading Share Index RTS Index, S&P/RUX Composite Index, MICEX Index Strong economic Economic Performance growth, helped along by high oil prices, has 2004 2005 2006 2007 been the norm in re- Exchange Rate RUB/EUR1 35.7639 35.1897 34.1886 35.0297 cent years Exchange Rate RUB/USD1 28.8042 28.2960 27.2578 25.5515 Money Market Rate (%)1 3.3 2.7 3.4 6.03 Consumer Inflation (%)2 10.9 12.6 9.7 12.0 Unemployment Rate (%)3 8.5 8.3 7.6 5.9 GDP (RUB billions) 16,966 21,598 -

Annex a Italian “White List” Countries and Lists of Supranational Entities and Central Banks (Identified by Acupay System LLC As of July 1, 2014)

Important Notice The Depository Trust Company B #: 1361-14 Date: July 17, 2014 To: All Participants Category: Dividends From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief – Country: Italy Intesa Sanpaolo S.p.A. CUSIP: 46115HAP2 Subject: Record Date: 12/28/2014 Payable Date: 01/12/2015 EDS Cut-Off: 01/09/2015 8:00 P.M Participants can use DTC’s Elective Dividend System (EDS) function over the Participant Terminal System (PTS) or Tax Relief option on the Participant Browser System (PBS) web site to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult the PTS or PBS function TAXI or TaxInfo respectively before certifying their elections over PTS or PBS. Important: Prior to certifying tax withholding elections, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TAXI or TaxInfo in PTS or PBS respectively. ***Please read this Important Notice fully to ensure that the self-certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay 212-422-1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. -

“Current Trends in the Russian Financial System”

“CURRENT TRENDS IN THE RUSSIAN FINANCIAL SYSTEM” Edited by Morten Balling Chapters by: Stephan Barisitz Zeljko Bogetic Zuzana Fungačova and Laura Solanko Peter Havlik Valery Invushin, Vladimir V. Osakovsky and Debora Revoltella Alexander Lehmann Ewald Nowotny Cyril Pineau-Valencienne Pekka Sutela A joint publication with the Austrian Society for Bank Research SUERF – The European Money and Finance Forum Vienna 2009 CIP CURRENT TRENDS IN THE RUSSIAN FINANCIAL SYSTEM Editor: Morten Balling; Authors: Stephan Barisitz; Zeljko Bogetic; Zuzana Fungačova and Laura Solanko; Peter Havlik; Valery Invushin, Vladimir V. Osakovsky and Debora Revoltella; Alexander Lehmann; Ewald Nowotny; Cyril Pineau-Valencienne; Pekka Sutela Vienna: SUERF (SUERF Studies: 2009/2) ISBN-13: 978-3-902109-47-7 Keywords: Russia, rouble, oil price, banking, transition economics, global financial crisis, Central Bank of Russia JEL Classification Numbers: E5, O5, P2, Q43 © 2009 SUERF, Vienna Copyright reserved. Subject to the exception provided for by law, no part of this publication may be reproduced and/or published in print, by photocopying, on microfilm or in any other way without the written consent of the copyright holder(s); the same applies to whole or partial adaptations. The publisher retains the sole right to collect from third parties fees payable in respect of copying and/or take legal or other action for this purpose. TABLE OF CONTENTS Table of Contents 3 1. Introduction 7 2. Opening Remarks 13 3. Russian Finance: Drag or Booster for Future Growth? 23 1. References 39 4. Russian Banking in Recent Years: Gaining Depth in a Fragile Environment 43 1. Abstract 43 2. Introduction 44 3. -

Central Bank Eligibility (CBE) Data

A Bloomberg Professional Services Offering Content & Data Solutions Central Bank Eligibility (CBE) Data A consolidated resource for collateral guidelines Regulation Tracking collateral details is repetitive & time-consuming Among major central banks, there are no consistent standards CBE data from Bloomberg gives buy-side and sell-side for securities accepted as eligible collateral. Some central firms an easier, more efficient way to monitor the eligibility banks provide detailed lists of eligible securities while others of securities among fourteen major central banks, including: offer basic guidelines. In addition, central banks have different • United States Federal Reserve (FRB) haircut requirements. All of these details may change over time. • Riksbank (RIKS) Gathering this information can be a labor-intensive and • Hong Kong Monetary Authority (HKMA) time-consuming process for both buy-side and sell-side firms. • Reserve Bank of Australia (RBA) Treasury portfolio managers, collateral management departments and repo traders all tend to struggle with the process of collecting • European Central Bank (ECB) data from multiple central banks, mapping it to a master list • Bank of England (BOE) of securities and updating it regularly. In many cases, firms • Swiss National Bank (SNB) must also interpret and apply collateral guidelines. • Bank of Canada (BOC) • Bank of Japan (BOJ) Bloomberg provides up-to-date results • Bank of Korea (BOK) Central Bank Eligibility (CBE) data from Bloomberg eliminates • People’s Bank of China (PBOC) the need for this repetitive, manual process. It provides essential • Central Bank of the Republic details about all securities accepted as collateral by 14 major of China-Taiwan (CBC) central banks. Bloomberg updates the list of eligible assets • Monetary Authority of Singapore (MAS) daily with haircuts and delivers a consolidated enterprise data • Reserve Bank of New Zealand (RBNZ) feed for each asset category. -

South Sudan's Financial Sector

South Sudan’s Financial Sector Bank of South Sudan (BSS) Presentation Overview . Main messages & history/perspectives . Current state of the industry . Key issues – regulations, capitalization, skills, diversification, inclusion . The way forward “The road is under construction” Main Messages & History/perspectives . The history of financial institutions in South Sudan is a short one. Throughout Khartoum rule till the end of civil war in 2005, there were very few commercial banks concentrated in Juba, Wau and Malakal. South Sudanese were deliberately excluded from the economic system. As a result 90% of the population in South Sudan were not exposed to banking services . Access to finance was limited to Northern traders operating in Southern Sudan. In February 2008, Islamic banks left the South since the Bank of Southern Sudan(BOSS) introduced conventional banking . However, after the CPA the Bank of Southern Sudan, although a mere branch of the central bank of Sudan took a bold step by licensing local and expatriate banks that took interest to invest in South Sudan. South Sudan needs a stable, well diversified financial sector providing the right kinds of products and services with a level of intermediation and inclusion to support the country’s ambitions Current State of the Sector As of November 2013 . 28 Commercial Banks are now operating in South Sudan and more than 70 applications on the pipeline . 10 Micro Finance Institutions . 86 Forex Bureaus . A handful of Insurance companies Current state of the Sector (2) . Despite the increased number of financial institutions, competition is still limited and services are mainly concentrated in the urban hubs . -

COUNCIL DECISION 2013/255/CFSP of 31 May 2013 Concerning Restrictive Measures Against Syria

L 147/14 EN Official Journal of the European Union 1.6.2013 COUNCIL DECISION 2013/255/CFSP of 31 May 2013 concerning restrictive measures against Syria THE COUNCIL OF THE EUROPEAN UNION, products which could be used for internal repression, to Syria by nationals of Member States or from the territories of Having regard to the Treaty on European Union, and in Member States or using their flag vessels or aircraft, shall be particular Article 29 thereof, prohibited, whether originating or not in their territories. Whereas: The Union shall take the necessary measures in order to (1) On 27 May 2013, the Council agreed to adopt for a determine the relevant items to be covered by this paragraph. period of 12 months restrictive measures against Syria in the following fields, as specified in Council Decision 2012/739/CFSP of 29 November 2012 concerning 2. It shall be prohibited to: restrictive measures against Syria ( 1): — export and import restrictions with the exception of arms and related material and equipment which (a) provide, directly or indirectly, technical assistance, brokering might be used for internal repression; services or other services related to the items referred to in paragraph 1 or related to the provision, manufacture, main — restrictions on financing of certain enterprises; tenance and use of such items, to any natural or legal person, entity or body in, or for use in, Syria; — restrictions on infrastructure projects; — restrictions of financial support for trade; (b) provide, directly or indirectly, financing or financial assistance related to the items referred to in paragraph 1, — financial sector; including in particular grants, loans and export credit insurance, as well as insurance and reinsurance, for any — transport sector; sale, supply, transfer or export of such items, or for the provision of related technical assistance, brokering services or other services to any natural or legal person, entity or — restrictions on admission; body in, or for use in, Syria. -

Digital Financial Services (Dfs) Working Group

DIGITAL FINANCIAL SERVICES (DFS) WORKING GROUP Bringing policymakers together to discuss regulatory issues related to digital financial services (DFS), and promote DFS as a major driver of financial inclusion in emerging and developing countries. The DFS Working Group develops policy guidelines, conducts peer reviews, and actively engages the DFS and FinTech industry and global Standard-Setting Bodies (SSBs). WWW.AFI-GLOBAL.ORG #DFS #AFIWG AT A GLANCE KEY OBJECTIVES > Create an enabling policy and regulatory environment for transformational DFS at national levels; > Develop a shared understanding of the risk profiles of emerging digital financial services business models, which is essential in designing appropriate regulatory frameworks; > Stimulate discussion and learning on new approaches and good practices in DFS regulation by encouraging policymakers to exchange experiences; > Provide a platform for capturing, tracking and sharing information on innovative DFS, products, business models and appropriate new policy responses; > Establish linkages and provide inputs, where appropriate, to global Standard-Setting bodies (SSBs) and other stakeholders seeking to establish proportionate supervisory practices for DFS. PLANNED ACTIVITIES > DFS and Consumer Protection Policy Model Subgroup (jointly with CEMCWG): Policy model on DFS and Consumer protection. > Data Protection & Privacy Subgroup: White paper - Data Protection & Privacy in the Age of Data Driven Financial Services. > QR Code Standardization Subgroup: Guideline Note on QR code standardization including case studies to understand different models and issues related to QR codes payments and standardization. > Digital Financial Literacy and Capability subgroup (jointly with CEMCWG): Guideline Note on Digital Financial Literacy and Capability. > Regulatory Sandboxes Subgroup: Toolkit on Regulatory Sandboxes. > Regtech Technical Taskforce (DFSWG Focal Points): Special Report: Regtech for Financial Inclusion. -

Legislative Decree No. 33 the President of the Republic, Acting in Accordance with the Provisions of the Constitution, Hereby Decrees the Following

Legislative Decree No. 33 The President of the Republic, Acting in accordance with the provisions of the Constitution, Hereby decrees the following: Article 1 The following terms and expressions shall have, in the application of the present legislative decree, the respective meanings indicated below: A. Money-laundering: any comportment intended to conceal or alter the identity of funds having a connection with unlawful operations by disguising their origins so that they appear to have originated in lawful operations; B. Funds: assets of all types, whether tangible or intangible, movable or immovable, regardless of their manner of acquisition, and legal instruments or documents, whatever their form, including electronic and digital, constituting evidence of a right of ownership in such assets or a share therein, and everything arising from such ownership and any right connected therewith, including, by way of example and without limitation, national currency, foreign currencies, banking facilities, travellers cheques, bank cheques, money orders, shares, securities, bonds, documentary credits, drafts and bills of exchange; C. Illegal funds: funds obtained or resulting from the perpetration of any of the following offences, whether occurring in the territory of the Syrian Arab Republic or abroad: 1. The growing, manufacturing, smuggling or transporting of, or illegal trafficking in, narcotic drugs or psychotropic substances; 2. Acts committed by criminal associations, as provided in articles 325 and 326 of the Penal Code, and all offences internationally considered as constituting organized crime; 3. Terrorist offences, as provided in articles 304 and 305 of the Penal Code or in the international, regional or bilateral agreements to which Syria is a party; 4. -

Financial Infrastructure

CONFIDENTIAL FOR RESTRICTED USE ONLY (NOT FOR USE BY THIRD PARTIES) Public Disclosure Authorized FINANCIAL SECTOR ASSESSMENT PROGRAM Public Disclosure Authorized RUSSIAN FEDERATION FINANCIAL INFRASTRUCTURE TECHNICAL NOTE JULY 2016 Public Disclosure Authorized This Technical Note was prepared in the context of a joint World Bank-IMF Financial Sector Assessment Program mission in the Russian Federation during April, 2016, led by Aurora Ferrari, World Bank and Karl Habermeier, IMF, and overseen by Finance & Markets Global Practice, World Bank and the Monetary and Capital Markets Department, IMF. The note contains technical analysis and detailed information underpinning the FSAP assessment’s findings and recommendations. Further information on the FSAP program can be found at www.worldbank.org/fsap. THE WORLD BANK GROUP FINANCE & MARKETS GLOBAL PRACTICE Public Disclosure Authorized i TABLE OF CONTENT Page I. Executive Summary ........................................................................................................ 1 II. Introduction ................................................................................................................... 15 III. Payment and Settlement Systems ............................................................................. 16 A. Legal and regulatory framework .......................................................................... 16 B. Payment system landscape .................................................................................... 18 C. Systemically important payment systems -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution.