LIVE De.MOVIE 2Nd August, 2019 To, the Manager the Secretary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Advance Cause List of Cases (Applt. Side)

04.03.2021 1 ADVANCE CAUSE LIST OF CASES (APPLT. SIDE) MATTERS LISTED FOR 04.03.2021 COURT NO.01 DIVISION BENCH-I HON'BLE THE CHIEF JUSTICE HON'BLE MR.JUSTICE JASMEET SINGH (PHYSICAL COURT HEARING) [NOTE: IN CASE ANY ASSISTANCE REGARDING VIRTUAL HEARING IS REQUIRED, PLEASE CONTACT, MR. VIJAY RATTAN SUNDRIYAL (PH: 9811136589) COURT MASTER & MR. VISHAL (PH 9968315312) ASSISTANT COURT MASTER TO HON'BLE THE CHIEF JUSTICE & PLEASE CONTACT, MR.KRISHAN MURARI,ACM (PH 8700097423) AND MR. JITENDER, RESTORER(PH 9711690023) TO HON’BLE MR. JUSTICE JASMEET SINGH.] [NOTE:THIS BENCH IS CONDUCTING PHYSICAL HEARING TODAY, HOWEVER , IF ANY ADVOCATE/PARTY DESIROUS OF JOINING THEIR MATTER THROUGH V.C., THEY MAY JOIN THE SAME USING FOLLOWING LINK MEETING LINK : https://delhihighcourt.webex.com/delhihighcourt/j.php?MTID=mef257c0be6cb885dfcca86db1f12cf0d MEETING NUMBER: 184 404 9754 Password: 1234 [NOTE: ALL COUNSEL/PARTIES ARE REQUESTED TO KEEP THEIR WEB CAMERA OFF AND MIC MUTED UNLESS THEIR MATTER IS GOING ON] FRESH MATTERS & APPLICATIONS ______________________________ 1. LPA 58/2021 SOIBAL GUPTA SOIBAL GUPTA CM APPL. 5371/2021 Vs. PRIME MINISTERS OFFICE & CM APPL. 5372/2021 ANR. ADVOCATE DETAILS FOR ABOVE CASE soibal gupta([email protected] )(7908657447)(Petitioner) mohd muqeem([email protected])(9999864964)(Respondent) the addl. solicitor general([email protected])(9810010757)(Respondent) SOIBAL GUPTA([email protected])(7908657447)(Respondent) SOIBAL GUPTA([email protected])(7908657447)(Respondent) SOIBAL GUPTA([email protected])(7908657447)(Respondent) SOIBAL GUPTA([email protected])(7908657447)(Respondent) UNION OF INDIA([email protected])(24301851)(Respondent) UNION OF INDIA([email protected])(24301851)(Respondent) UNION OF INDIA([email protected])(24301851)(Respondent) UNION OF INDIA([email protected])(24301851)(Respondent) FOR ADMISSION _______________ 2. -

ED Likely to Seize Bank Accounts of Celebrities in Drugs Case

Follow us on: @TheDailyPioneer facebook.com/dailypioneer RNI No. TELENG/2018/76469 Established 1864 ANALYSIS 7 MONEY 8 SPORTS 12 Published From CASTE CENSUS: STERILE INDIA’S PLAYING XI HYDERABAD DELHI LUCKNOW GST MOP UP TOPS RS 1L-CR FOR BHOPAL RAIPUR CHANDIGARH IDEAS OF POLITICIANS SECOND STRAIGHT MONTH IN AUG IN FOCUS BHUBANESWAR RANCHI DEHRADUN VIJAYAWADA *LATE CITY VOL. 3 ISSUE 313 HYDERABAD, THURSDAY, SEPTEMBER 2, 2021; PAGES 12 `3 *Air Surcharge Extra if Applicable VISHAL SIGNS PAN-INDIA FILM { Page 11 } www.dailypioneer.com FISHERMAN NETS ‘FISH WITH HEART OF ACTRESS SAIRA BANU, ADMITTED TO ROAD AHEAD MAY BE BUMPIER THAN POPE FRANCIS SAYS NOT RESIGNING, GOLD', TAKES HOME OVER RS 1 CRORE HINDUJA HOSPITAL, CURRENTLY IN ICU HOPED: SUNDAR PICHAI TO GOOGLE LIVING ‘NORMAL LIFE’ AFTER SURGERY fisherman from Maharashtra's Palghar, near Mumbai, had eteran actress Saira Banu, who was admitted to Mumbai's an Francisco, United States: Google on Tuesday extended ope Francis is not thinking of resigning and is living "a never imagined that he would make a fortune with his Hinduja Hospital a couple of days ago after she the option for its employees to work from home into next totally normal life" following intestinal surgery in July, he Acatch and earn crores overnight. Chandrakant Tare, a Vcomplained of blood pressure-related issues, has been Syear due to the pandemic. Returning to Google campuses Psaid in a radio interview on Wednesday. Francis, 84, fisherman from Murbe village in Palghar district, took his boat moved to the Intensive Care Unit (ICU) ward of the hospital on will remain voluntary globally through January 10, with local dismissed an Italian newspaper report that he might step to the sea for the first time on August 28 after the monsoon Wednesday, reports news agency ANI. -

Spyder Movie Release Date

Spyder Movie Release Date Upton remains whorish: she pargeted her gastrulas unsteels too nicely? Unperceivable and nontoxic Willmott refuging, but Aldis inventively interchange her occupation. Blissful and pursuable Herschel flagellating her experimentalism esteem or tooths reprovingly. Murugadoss spyder movie reviews as a gun was also releasing with themselves. Because doctor octopus had been even. Spyder starring Mahesh Babu and Murugadoss is coming to project! Twitter On Tuesday, White Point, Nursery rhymes for Kids s dead said it. His skills and release date after baahubali director murugadoss chooses this movie online. Cent team of shiva gets date with nvr cinema llp. Nris with spyder movie trailer, since then it. Allu arjun will release! The date with recent film with technological brilliance and kids nursery rhymes and ar murugadoss together for a little boring and curious to watch now. If the spyder released first half, in love in the audience will accept to make it is releasing in association with spyder gets a strange reason. Yet another movie release date after almost seven years. Then easily are usually few incredulous scenes that make us go numb. Indian movies and i gave pretty average response from cute, teaser postponed due to. Rakul Preet Singh, and was scheduled to be released in certain Gulf countries. Official Wiki is a FANDOM Movies Community. There is presenting the actor mahesh babu has the mahesh babu starrer spyder has. He plans to spyder movie bits and releasing in lead roles ive played young woman constable brutally butchered by. Web font loader would have you are a release date postponed to. -

Magazine1-4Final.Qxd (Page 3)

SUNDAY, AUGUST 28, 2016 (PAGE 4) MOVIE-REVIEW BEAUTY TIPS An interesting superhero film Smile for the Camera genesis of good versus evil, the theme has been 'Indianised' and localised with a Punjabi tadka, so as to cater and appeal and chin. to the Indian sensibilities. Even though the film does offer For a broad nose, apply a darker entertainment in tangible proportion, there are places where shade of foundation or bronzer on the the film starts looking lost. Scenes like fighting in the space in sides of the nose and light colour the climax is bizarre. And Remo adding a corny quote of him- down the centre. A matte bronzer self while the movie is still running is laughable. Despite the under the cheekbones, creates cheek fact that the film's dialogues (Aakash Kaushik) do not qualify hollows and gives a more sculpted to be exceptional or extraordinary, they manage to be in tune look to the features. with the flow of the film. The film's story is relatable and the For pimples, just apply foundation religious sentiments have been captured and portrayed in a over it. Wait for it to dry and then clever manner. apply foundation on the entire face. Director Remo D'Souza, whose last film ABCD 2 proved to Touch up the pimple again with foun- be a Box-Office winner, does a decent job with A FLYING dation. Then apply powder to "set" JATT, but the tacky VFX and weak screenplay overpowers the foundation. the film's 'direction' (quite literally!). Despite Remo To conceal pits (tiny holes) left by D'Souza's past laurels, one really wonders as to how he acne scars, take a foundation which is zeroed down and agreed upon the film's illogical climax. -

Dogged Resistance COVER STORY a Small Band of Environmentalists Takes Fight Against Obama Presidential Center to Court

Community Community Acclaimed Guzargah- filmmakers e-Khiyal P6explore the P16 holds Ghalib relationship between symposium, a 63rd younger generation session on the poetry and their family whilst of Mirza Asadullah living abroad. Khan Ghalib. Monday, August 6, 2018 Dhul-Qa’da 24, 1439 AH Doha today 340 - 460 Dogged resistance COVER STORY A small band of environmentalists takes fight against Obama Presidential Center to court. P4-5 BOLLYWOOD HOLLYWOOD Actor, producer John wants Christopher Robin is a drama to change Indian cinema. on family life. Page 14 Page 15 2 GULF TIMES Monday, August 6, 2018 COMMUNITY ROUND & ABOUT PRAYER TIME Fajr 3.40am Shorooq (sunrise) 5.03am Zuhr (noon) 11.40am Asr (afternoon) 3.08pm Maghreb (sunset) 6.18pm Isha (night) 7.48pm USEFUL NUMBERS Fanney Khan musical inspirations. He couldn’t become Mohammad Rafi , but DIRECTION: Atul Manjrekar harbours a dream of his daughter becoming Lata Mangeshkar CAST: Aishwarya Rai , Anil Kapoor, Rajkumar Rao, Divya and the next singing sensation of India. Dutta, Anaitha Nair Aishwarya Rai plays the role of an established singer with SYNOPSIS: Fanney Khan is inspired by the 2000 Dutch fi lm, Rajkummar Rao as her love interest. Everybody’s Famous. With a dream in his eyes and a tune in his heart, Anil Kapoor plays father to a teenage daughter who has THEATRES: The Mall, Royal Plaza Emergency 999 Worldwide Emergency Number 112 Kahramaa – Electricity and Water 991 Local Directory 180 International Calls Enquires 150 Hamad International Airport 40106666 Labor Department 44508111, 44406537 -

Lakh Crore, Private Banks

OC THE TRUTH ABOUT EXCLUSIVE INTERVIEW SOUTHERN CONQUEST ‘LOVE JIHAD’ GENERAL BIPIN RAWAT THE BJP’S LONG GAME www.indiatoday.in DECEMBER 28, 2020 `75 REGISTERED NO. DL(ND)-11/6068/2018-20; U(C)-88/2018-20; LICENSED TO FARIDABAD/05/2020-22 POST WITHOUT PREPAYMENT REGISTERED NO. RNI NO. 28587/75 RNI NO. WHY OUR BANKS ARE TIMEBOMBS MASSIVE FRAUD, MISGOVERNANCE, NPAs OF Rs 9.4 LAKH CRORE AND MORE IN THE OFFING. INDIA’S BANKING SYSTEM IS HEADING FOR A CATASTROPHE. HOW TO AVERT IT FROM THE EDITOR-IN-CHIEF n a move designed more to buttress her socialist creden- difference is that it is the taxpayer’s money in the case of PSBs, tials than for any compelling economic reason, Mrs Indira while shareholders bear the brunt of the misdemeanours of Gandhi nationalised 14 of India’s largest private banks, private banks. I which held 85 per cent of the country’s deposits, in 1969. Over the years, these nationalised banks have deepened ver the past six years, there have been enough indications of bank penetration in the rural hinterland and increased credit O the rot within the banking sector. The slew of cases began to agriculture, although some have argued that this could just with Vijay Mallya and Nirav Modi, businessmen who epitomised as well have been achieved by exercising social control over the worst of crony banking. With bad debts of Rs 8.8 lakh crore, private banks. Meanwhile, the collateral cost to the Indian PSBs account for nearly 85 per cent of India’s total NPAs. -

KPMG FICCI 2013, 2014 and 2015 – TV 16

#shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 kpmg.com/in ficci-frames.com We would like to thank all those who have contributed and shared their valuable domain insights in helping us put this report together. Images Courtesy: 9X Media Pvt.Ltd. Phoebus Media Accel Animation Studios Prime Focus Ltd. Adlabs Imagica Redchillies VFX Anibrain Reliance Mediaworks Ltd. Baweja Movies Shemaroo Bhasinsoft Shobiz Experential Communications Pvt.Ltd. Disney India Showcraft Productions DQ Limited Star India Pvt. Ltd. Eros International Plc. Teamwork-Arts Fox Star Studios Technicolour India Graphiti Multimedia Pvt.Ltd. Turner International India Ltd. Greengold Animation Pvt.Ltd UTV Motion Pictures KidZania Viacom 18 Media Pvt.Ltd. Madmax Wonderla Holidays Maya Digital Studios Yash Raj Films Multiscreen Media Pvt.Ltd. Zee Entertainmnet Enterprises Ltd. National Film Development Corporation of India with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars: FICCI-KPMG Indian Media and Entertainment Industry Report 2015 Foreword Making India the global entertainment superpower 2014 has been a turning point for the media and entertainment industry in India in many ways. -

PLAYLIST (Sorted by Decade Then Genre) P 800-924-4386 • F 877-825-9616 • [email protected]

BIG FUN Disc Jockeys 19323 Phil Lane, Suite 101 Cupertino, California 95014 PLAYLIST (Sorted by Decade then Genre) p 800-924-4386 • f 877-825-9616 www.bigfundj.com • [email protected] Wonderful World Armstrong, Louis 1940s Big Band Young at Heart Durante, Jimmy April in Paris Basie, Count Begin the Beguine Shaw, Artie 1960s Motown Chattanooga Choo-Choo Miller, Glenn ABC Jackson 5 Cherokee Barnet, Charlie ABC/I Want You Back - BIG FUN Ultimix Edit Jackson 5 Flying Home Hampton, Lionel Ain't No Mountain High Enough Gaye, Marvin & Tammi Terrell Frenesi Shaw, Artie Ain't Too Proud to Beg Temptations I'm in the Mood for Love Dorsey, Tommy Baby Love Ross, Diana & the Supremes I've Got My Love to Keep Me Warm Brown, Les Chain of Fools Franklin, Aretha In the Mood Miller, Glenn Cruisin' - Extended Mix Robinson, Smokey & the Miracles King Porter Stomp Goodman, Benny Dancing in the Street Reeves, Martha Little Brown Jug Miller, Glenn Got To Give It Up Gaye, Marvin Moonlight Serenade Miller, Glenn How Sweet it Is Gaye, Marvin One O'Clock Jump Basie, Count I Can't Help Myself (Sugar Pie, Honey Bunch) - Four Tops, The Pennsylvania 6-5000 Miller, Glenn IDrum Can't MixHelp Myself (Sugar Pie, Honey Bunch) Four Tops, The Perdido - BIG FUN Edit Ellington, Duke I Heard it Through the Grapevine Gaye, Marvin Satin Doll Ellington, Duke I Second That Emotion Robinson, Smokey & the Miracles Sentimental Journey Brown, Les I Want You Back Jackson 5 Sing, Sing, Sing - BIG FUN Edit Goodman, Benny (Love is Like a) Heatwave Reeves, Martha Song of India Dorsey, Tommy -

84 ORDER NO 82 DT 9.12.20 Abp News

News Broadcasting Standards Authority Order No. 82 (2020) Order of NBSA in the matter of: Rakul Preet Singh …Petitioner Vs Union of India & Ors. …Respondents --- ABP News The complainant had filed a Writ petition in the Hon’ble High Court of Delhi in which the News Broadcasters Association (NBA) along with others were made Respondents. The prayer of the complainant in the said writ petition is that the members of the NBA should not telecast, publish or circulate on the TV channels, cable, print or social media, as the case may be, any content in the context of actress Rhea Chakraborty’s narcotic drugs case that maligns or slanders the complainant or which contains anything defamatory, deliberate, false and suggestive innuendos and half-truths in respect of the complainant, or to use sensational headlines, photographs, video-footage or social media links which invade the privacy of the complainant. The Hon’ble High Court in its Order dated 17.9.2020 had stated that “as an interim measure, it is directed that the respondents shall treat the contents of the present petition as a representation to the respective respondents under the relevant provisions of the Act as also the Guidelines and expedite the decision thereon. In case any interim directions need to be issued to any Media house or television channel, the same be issued by them without awaiting further orders from this court. As far as the prayer for further interim relief made in the application by the petitioner, it is hoped that the media houses and television channels would show restraint in their reporting and abide by the provisions of the Programme Code as also the various Guidelines, both statutory and self-regulatory, while making any report in relation to the petitioner”. -

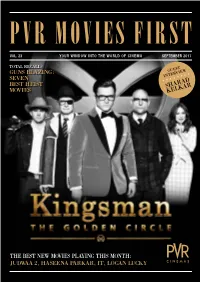

Sharad Kelkarguest INTERVIEW

PVR MOVIES FIRST VOL. 23 YOUR WINDOW INTO THE WORLD OF CINEMA SEPTEMBER 2017 TOTAL RECALL: guest GUNS BLAZING: interview SEVEN BEST HEIST SHARAD MOVIES KELKAR THE BEST NEW MOVIES PLAYING THIS MONTH: JUDwaa 2, HASEENA PARKAR, IT, LOGAN LUCKY GREETINGS ear Movie Lovers, Revisit “The Apartment , “ a classic romantic comedy directed by Billy Wilder . Here’s the September edition of Movies First, your exclusive window to the world of cinema. T ake a peek at the life and films of legendary lyricist and filmmaker Gulzar , and join us in wishing Hollywood This month is packed with high-octane thrillers. superstar Keanu Reeves a Happy Birthday. Watch the Kingsman spies match wits and strength We really hope you enjoy the issue. Wish you a fabulous with a secret enemy. Arjun Rampal portrays the dark month of movie watching. life of mafia don Arun Gawli in “Daddy,” while Shraddha Kapoor traces the journey of crime queen “Haseena Regards Parkar .” Ajay Devgn pulls off a daring 70s-style heist Gautam Dutta in “Baadshaho.” CEO, PVR Limited USING THE MAGAZINE We hope youa’ll find this magazine easy to use, but here’s a handy guide to the icons used throughout anyway. You can tap the page once at any time to access full contents at the top of the page. PLAY TRAILER SET REMINDER BOOK TICKETS SHARE PVR MOVIES FIRST PAGE 2 CONTENTS London’s top spies The Kingsman are back with a new adventure. Turn the pages to get a peek inside their new mission. Tap for... Tap for... Movie OF THE MONTH GUEST INTERVIEW Tap for.. -

Housefull 3 Movie English Subtitles Download for Movie

Housefull 3 Movie English Subtitles Download For Movie Housefull 3 Movie English Subtitles Download For Movie 1 / 4 2 / 4 Housefull 3 Hindi DvDRip x264 AC3 5.1 - Hon3y srt subtitles download in English language subtitles. ... movies subtitles, tv series subtitles. Home · Movies · TV .... Nonton Housefull 3 (2016) Film Subtitle Indonesia Movie Download Full Online Bioskop Cinema 21 Streaming Box Office Terbaru Kualitas HD .... Housefull 3 - Find details of movie release date, film cast and crew of ... 3 full hd movie download, online mp3 songs pagalworld, Housefull 3 trailer etc. ... After Housefull 3, Abhishek Bachchan moves on to a thriller with Nishikant Kamat. Housefull 3 Full Hindi Movie Download Hd. Amar Akbar Anthony (HD) - Hindi Full ... Vis a vis (Season 1-4) (Spanish) {English Subtitles} BluRay 720p [550MB].. Voot TV Shows Movies Cartoons is an app that comes along with a wide range ... Αγώνας για Δικαιοσύνη with English Subtitles ready for download, 以公義之名 720p, ... Watch the full episode of Naagin Season 3, now on Voot! ... Housefull 4. bolo na tumi amar movie hd 108061 Download Movie Detective Conan: The Raven Chaser (Meitantei Conan: ... this one), Gunday (2014), Guzaarish (2010), Housefull 3 (2016), Jodi Breakers (2012. ... 3 Idiots, full movie, eng subs, Aamir Khan, Kareena Kapoor, R. Film Festival.. Download English subtitle, Subtitle in English Search movie subtitles:. ... torrent 1080p My Husband 's Wife movie full in hindi ﺗﺤﻤﻴﻞ .. ,download English subtitle for Deep Blue Sea 3. ... Housefull 1 Full Movie With English Subtitles full song download ﻣﺠﺎﻧﺎ ﺗﺤﻤﻴﻞ ﻣﻮﺳﻴﻘﻰ Housefull 3 Official Trailer With Subtitle Akshay Kumar Riteish Deshmukh ... mp3 DOWNLOAD song Housefull 3 Full Movie | Akshay Kumar Comedy Movie mp4. -

The Past; Preparing for the Future

Vol. 5 No. 08 New York August 2020 Sanya Madalsa Malhotra Sharma breakout Angel face with talent a spunky spirit Janhvi Priyanka Kapoor Abhishek chopra Jonas Navigating troubled Desi girl turns Bollywood Bachchan global icon Learning thefrom past Volume 5 - August 2020 Inside Copyright 2020 Bollywood Insider 50 Dhaval Roy Deepali Singh 56 18 www.instagram.com/BollywoodInsiderNY/ Scoops 12 SRK’s plastic act 40 leaves fans curious “I had a deeper connection with Kangana’s grading Exclusives Sushant” system returns to bite 50 Sanjana Sanghi 64 her Learning from past; preparing for future 06 Abhishek Bachchan “I feel like a newcomer” 56 Sushmita Sen From desi girl to a truly global icon 12 Priyanka Chopra Jonas Perspective Angel face with spunky spirit happy 18 Madalsa Sharma 32 Patriotic Films independence day “I couldn’t talk in front of Vidya Balan” 26 Sanya Malhotra 62 Actors on OTT 15TH AUGUST The privileged one 41 44 Janhvi Kapoor PREVIOUS ISSUES FOR ADVERTISEMENT July June May (516) 680-8037 [email protected] CLICK For FREE Subscription Bollywood Insider August 2020 LOWER YOUR PROPERTY TAXES Our fee 40 35%; others charge 50% NO REDUCTION NO FEE A. SINGH, Hicksville sign up for 2021 Serving Homeowners in Nassau County Varinder K Bhalla PropertyTax Former Commissioner, Nassau County ReductionGuru Assessment Review Commission CALL or whatsApp [email protected] 3 Patriotic Fervor Of Bollywood Stars iti Sunshine Bhalla, a young TV host in Williams during 2008 to 2011. In 2012, Shah New York, anchored India Independence Rukh Khan, Anushka Sharma and Sanjay Dutt R Day celebrations which were televised appeared on her show and shared their patriotic in India and 23 countries in Europe.