Asia Semiconductor Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Android 6.0 Update Overzicht | PHC Tailored Telecom

Android 6.0 update overzicht | PHC tailored telecom Wil je weten wanneer jouw toestel een update krijgt? Kijk dan hieronder naar het overzicht: Inhoud Google ..................................................................................................................................................... 2 Motorola .................................................................................................................................................. 2 Samsung .................................................................................................................................................. 3 LG ............................................................................................................................................................. 4 Sony ......................................................................................................................................................... 5 HTC .......................................................................................................................................................... 6 OnePlus.................................................................................................................................................... 7 Huawei/Honor ......................................................................................................................................... 7 Asus ........................................................................................................................................................ -

Iphone Iphone 4 / 4S Completa –Trasera- Flex- Bateria 50 – 60 – 30 – 25

IPHONE IPHONE 4 / 4S COMPLETA –TRASERA- FLEX- BATERIA 50 – 60 – 30 – 25 IPHONE 5- 5C- 5S- SE COMPLETA –CHASIS- FLEX- BATERIA 60 – 100 – 35 – 35 IPHONE 6 COMPLETA –CHASIS- FLEX- BATERIA 70 – 120 – 35 – 35 IPHONE 6 PLUS / IPHONE 6S COMPLETA –CHASIS- FLEX- BATERIA 80 – 140 – 35 – 35 IPHONE 6S PLUS COMPLETA –CHASIS- FLEX- BATERIA 100 – 150 – 40 – 40 IPHONE 7 COMPLETA –CHASIS- FLEX- BATERIA 110 - 180 - 40 - 40 IPHONE 7 PLUS COMPLETA –CHASIS- FLEX- BATERIA 125 - 200 - 45 - 45 IPHONE 8 COMPLETA –CHASIS- FLEX- BATERIA 135 - 220 - 50 - 50 IPHONE 8 PLUS COMPLETA –CHASIS- FLEX- BATERIA 150 – 250 - 50 - 50 IPHONE X PANTALLA COMPLETA 340 IPAD 2 – 3 - 4, IPAD MINI / MINI 2 TACTIL /COMPLETA/ FLEX/ BATERIA 60/ 100/ 50/ 60 AIPAD AIR TACTIL / COMPLETA/ FLEX/ BATERIA 70 / 150/ 60/ 60 IPAD AIR 2 PANTALLA COMPLETA 280 IPAD MINI 4 PANTALLA COMPLETA 220 IPOD 4G / 5G COMPLETA 50 / 90 S2, S4 MINI, MEGA, J1 2016, J5, J3 (2016), J3 2017, J5 2016, COMPLETA 80 EXPRESS, A3, A5, S3, S3 NEO, S4, J7 2016, ACE 4, J4 PLUS, J6 PLUS, J6, A6 COMPLETA 90 A3 2016, j5 2017, A7 2018 COMPLETA 100 A3 2017, A5 2016, J7, A6 PLUS COMPLETA 110 J7 2017 , ALFA, S5 MINI, A5 2017, S5, S5 NEO, A8 2018 COMPLETA 120 NOTE 3, NOTE 4, S6, S7 COMPLETA 150 S6 EDGE G925, S6 EDGE PLUS G928 COMPLETA 200 S7 EDGE, S8, S8 PLUS COMPLETA 250 NOTE 8, S9, S9 PLUS COMPLETA 275 S9, S9 PLUS, NOTE 9 COMPLETA 295 SERIE CORE, SERIE GRAND, EXPRESS 2, J1, J1 mini y anteriores TACTIL / COMPLETA 40 / 50 GALAXY TAB 10” 2,3,4, A , E, A(2016) T580, T550, T560 TACTIL / COMPLETA 60 / 100 TAB 7” 2,3,4 3 LITE TACTIL / COMPLETA -

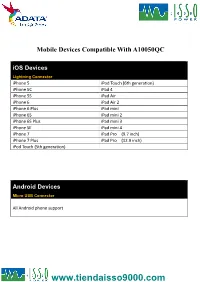

Android Devices

Mobile Devices Compatible With A10050QC iOS Devices Lightning Connector iPhone 5 iPod Touch (6th generation) iPhone 5C iPad 4 iPhone 5S iPad Air iPhone 6 iPad Air 2 iPhone 6 Plus iPad mini iPhone 6S iPad mini 2 iPhone 6S Plus iPad mini 3 iPhone SE iPad mini 4 iPhone 7 iPad Pro (9.7 inch) iPhone 7 Plus iPad Pro (12.9 inch) iPod Touch (5th generation) Android Devices Micro USB Connector All Android phone support Smartphone With Quick Charge 3.0 Technology Type-C Connector Asus ZenFone 3 LG V20 TCL Idol 4S Asus ZenFone 3 Deluxe NuAns NEO VIVO Xplay6 Asus ZenFone 3 Ultra Nubia Z11 Max Wiley Fox Swift 2 Alcatel Idol 4 Nubia Z11miniS Xiaomi Mi 5 Alcatel Idol 4S Nubia Z11 Xiaomi Mi 5s General Mobile GM5+ Qiku Q5 Xiaomi Mi 5s Plus HP Elite x3 Qiku Q5 Plus Xiaomi Mi Note 2 LeEco Le MAX 2 Smartisan M1 Xiaomi MIX LeEco (LeTV) Le MAX Pro Smartisan M1L ZTE Axon 7 Max LeEco Le Pro 3 Sony Xperia XZ ZTE Axon 7 Lenovo ZUK Z2 Pro TCL Idol 4-Pro Smartphone With Quick Charge 3.0 Technology Micro USB Connector HTC One A9 Vodafone Smart platinum 7 Qiku N45 Wiley Fox Swift Sugar F7 Xiaomi Mi Max Compatible With Quick Charge 3.0 Technology Micro USB Connector Asus Zenfone 2 New Moto X by Motorola Sony Xperia Z4 BlackBerry Priv Nextbit Robin Sony Xperia Z4 Tablet Disney Mobile on docomo Panasonic CM-1 Sony Xperia Z5 Droid Turbo by Motorola Ramos Mos1 Sony Xperia Z5 Compact Eben 8848 Samsung Galaxy A8 Sony Xperia Z5 Premium (KDDI Japan) EE 4GEE WiFi (MiFi) Samsung Galaxy Note 4 Vertu Signature Touch Fujitsu Arrows Samsung Galaxy Note 5 Vestel Venus V3 5070 Fujitsu -

Htc Desire Turn Off App Download Htc Desire Turn Off App Download

htc desire turn off app download Htc desire turn off app download. #1 Bootloader S-OFF/Unlock Tool. For Your HTC or Motorola Smartphone! HTC 10, One m9, m8, m7, Droid Turbo, Moto x 2013/2014 and more. Verizon HTC 10, HTC 10 TempRoot and NO WIPE S-OFF now in SunShine 3.4! App not compatible? Try our mail in service for almost ALL HTC Phones (Verizon HTC 10 Nougat too!) unlock Your Phone! Turn your phone into a dev phone. SunShine can turn many consumer devices into developer phones with the click of a few buttons. Unlocking and s-off'ing your phone will allow you to easily root the device, install the latest firmware and custom roms. Unlike the other unlock solutions, including the manufacturer solutions, SunShine does not wipe your data. Making it perfect for data recovery, or rooting without the hassle of setting up your device again. Supported Models. (This list is incomplete, run app tests if unsure)) Droid Turbo (SU44/SU49, and now 6.x!) Moto X 2013 (4.4.3 and Lower) Moto X 2014 (All Variants) Droid Mini/Maxx/Uultra (4.4.3 and Lower) Moto G (4.4.3 and Lower) HTC 10 (All Variants) HTC 10 Lifestyle (All Variants) HTC One M9 (All Variants) HTC One A9 (All Variants) HTC One M8 (All Variants) HTC One M7 (All Variants) HTC One E9 (All Variants) HTC One E9+ (All Variants) HTC One M9+ (All Variants) HTC One M9e (All Variants) HTC One Max (All Variants) HTC One Mini (All Variants) HTC One Mini 2 (All Variants) HTC One Remix (All Variants) HTC Butterfly (All Variants) HTC Butterfly 2 (All Variants) HTC Butterfly 3 (All Variants) HTC J (All Variants) HTC DNA (All Variants) HTC Desire 820 (All Variants) HTC Desire 816x (All Variants) HTC Desire 816 (All Variants) HTC Desire 626s (All Variants) HTC Desire 612 (All Variants) HTC Desire 610 (All Variants) HTC Desire 601 (All Variants) HTC Desire 530 (Not Verizon) HTC Desire 510 (32bit Variants Only) HTC Desire Eye (All Variants) and many more (run the app tests!) User Friendly. -

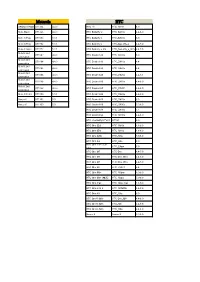

Factory Model Device Model

Factory Model Device Model Acer A1-713 acer_aprilia Acer A1-811 mango Acer A1-830 ducati Acer A3-A10 G1EA3 Acer A3-A10 mtk6589_e_lca Acer A3-A10 zara Acer A3-A20 acer_harley Acer A3-A20FHD acer_harleyfhd Acer Acer E320-orange C6 Acer Aspire A3 V7 Acer AT390 T2 Acer B1-723 oban Acer B1-730 EverFancy D40 Acer B1-730 vespatn Acer CloudMobile S500 a9 Acer DA220HQL lenovo72_we_jb3 Acer DA222HQL N451 Acer DA222HQLA A66 Acer DA222HQLA Flare S3 Power Acer DA226HQ tianyu72_w_hz_kk Acer E330 C7 Acer E330 GT-N7105T Acer E330 STUDIO XL Acer E350 C8n Acer E350 wiko Acer G100W maya Acer G1-715 A510s Acer G1-715 e1808_v75_hjy1_5640_maxwest Acer Icona One 7 vespa Acer Iconia One 7 AT1G* Acer Iconia One 7 G1-725 Acer Iconia One 7 m72_emmc_s6_pcb22_1024_8g1g_fuyin Acer Iconia One 7 vespa2 Acer Iconia One 8 vespa8 Acer Iconia Tab 7 acer_apriliahd Acer Iconia Tab 8 ducati2fhd Acer Iconia Tab 8 ducati2hd Acer Iconia Tab 8 ducati2hd3g Acer Iconia Tab 8 Modelo II - Professor Acer Iconia Tab A100 (VanGogh) vangogh Acer Iconia Tab A200 s7503 Acer Iconia Tab A200 SM-N9006 Acer Iconia Tab A501 ELUGA_Mark Acer Iconia Tab A501 picasso Acer Iconia Tab A510 myPhone Acer Iconia Tab A510 picasso_m Acer Iconia Tab A510 ZUUM_M50 Acer Iconia Tab A701 picasso_mf Acer Iconia Tab A701 Revo_HD2 Acer Iconia TalkTab 7 acer_a1_724 Acer Iconia TalkTab 7 AG CHROME ULTRA Acer Liquid a1 Acer Liquid C1 I1 Acer Liquid C1 l3365 Acer Liquid E1 C10 Acer Liquid E2 C11 Acer Liquid E3 acer_e3 Acer Liquid E3 acer_e3n Acer Liquid E3 LS900 Acer Liquid E3 Quasar Acer Liquid E600 e600 Acer Liquid -

Totalmem),Form Factor,System on Chip,Screen Sizes,Screen Densities,Abis,Android SDK Versions,Opengl ES Versions

Manufacturer,Model Name,Model Code,RAM (TotalMem),Form Factor,System on Chip,Screen Sizes,Screen Densities,ABIs,Android SDK Versions,OpenGL ES Versions 10.or,E,E,2846MB,Phone,Qualcomm MSM8937,1080x1920,480,arm64-v8a 10.or,G,G,3603MB,Phone,Qualcomm MSM8953,1080x1920,480,arm64-v8a 10.or,D,10or_D,2874MB,Phone,Qualcomm MSM8917,720x1280,320,arm64-v8a 4good,A103,4GOOD_Light_A103,907MB,Phone,Mediatek MT6737M,540x960,240,armeabi- v7a 4good,4GOOD Light B100,4GOOD_Light_B100,907MB,Phone,Mediatek MT6737M,540x960,240,armeabi-v7a 7Eleven,IN265,IN265,466MB,Phone,Mediatek MT6572,540x960,240,armeabi-v7a 7mobile,DRENA,DRENA,925MB,Phone,Spreadtrum SC7731C,480x800,240,armeabi-v7a 7mobile,KAMBA,KAMBA,1957MB,Phone,Mediatek MT6580,720x1280,320,armeabi-v7a 7mobile,SWEGUE,SWEGUE,1836MB,Phone,Mediatek MT6737T,1080x1920,480,arm64-v8a A.O.I. ELECTRONICS FACTORY,A.O.I.,TR10CS1_11,965MB,Tablet,Intel Z2520,1280x800,160,x86 Aamra WE,E2,E2,964MB,Phone,Mediatek MT6580,480x854,240,armeabi-v7a Accent,Pearl_A4,Pearl_A4,955MB,Phone,Mediatek MT6580,720x1440,320,armeabi-v7a Accent,FAST7 3G,FAST7_3G,954MB,Tablet,Mediatek MT8321,720x1280,160,armeabi-v7a Accent,Pearl A4 PLUS,PEARL_A4_PLUS,1929MB,Phone,Mediatek MT6737,720x1440,320,armeabi-v7a Accent,SPEED S8,SPEED_S8,894MB,Phone,Mediatek MT6580,720x1280,320,armeabi-v7a Acegame S.A. -

Device Support for Beacon Transmission with Android 5+

Device Support for Beacon Transmission with Android 5+ The list below identifies the Android device builds that are able to transmit as beacons. The ability to transmit as a beacon requires Bluetooth LE advertisement capability, which may or may not be supported by a device’s firmware. Acer T01 LMY47V 5.1.1 yes Amazon KFFOWI LVY48F 5.1.1 yes archos Archos 80d Xenon LMY47I 5.1 yes asus ASUS_T00N MMB29P 6.0.1 yes asus ASUS_X008D MRA58K 6.0 yes asus ASUS_Z008D LRX21V 5.0 yes asus ASUS_Z00AD LRX21V 5.0 yes asus ASUS_Z00AD MMB29P 6.0.1 yes asus ASUS_Z00ED LRX22G 5.0.2 yes asus ASUS_Z00ED MMB29P 6.0.1 yes asus ASUS_Z00LD LRX22G 5.0.2 yes asus ASUS_Z00LD MMB29P 6.0.1 yes asus ASUS_Z00UD MMB29P 6.0.1 yes asus ASUS_Z00VD LMY47I 5.1 yes asus ASUS_Z010D MMB29P 6.0.1 yes asus ASUS_Z011D LRX22G 5.0.2 yes asus ASUS_Z016D MXB48T 6.0.1 yes asus ASUS_Z017DA MMB29P 6.0.1 yes asus ASUS_Z017DA NRD90M 7.0 yes asus ASUS_Z017DB MMB29P 6.0.1 yes asus ASUS_Z017D MMB29P 6.0.1 yes asus P008 MMB29M 6.0.1 yes asus P024 LRX22G 5.0.2 yes blackberry STV100-3 MMB29M 6.0.1 yes BLU BLU STUDIO ONE LMY47D 5.1 yes BLUBOO XFire LMY47D 5.1 yes BLUBOO Xtouch LMY47D 5.1 yes bq Aquaris E5 HD LRX21M 5.0 yes ZBXCNCU5801712 Coolpad C106-7 291S 6.0.1 yes Coolpad Coolpad 3320A LMY47V 5.1.1 yes Coolpad Coolpad 3622A LMY47V 5.1.1 yes 1 CQ CQ-BOX 2.1.0-d158f31 5.1.1 yes CQ CQ-BOX 2.1.0-f9c6a47 5.1.1 yes DANY TECHNOLOGIES HK LTD Genius Talk T460 LMY47I 5.1 yes DOOGEE F5 LMY47D 5.1 yes DOOGEE X5 LMY47I 5.1 yes DOOGEE X5max MRA58K 6.0 yes elephone Elephone P7000 LRX21M 5.0 yes Elephone P8000 -

Select Smartphones with Qualcomm® Quick Charge™ 3.0 Technology

Select Smartphones with Qualcomm® Quick Charge™ 3.0 Technology + Asus ZenFone 3 + NuAns NEO + Asus ZenFone 3 Deluxe + Nubia Z11 + Asus ZenFone 3 Ultra + Nubia Z11 Max + General Mobile GM5+ + Qiku Q5 + HP Elite x3 + Qiku Q5 Plus + HTC 10 + Sugar F7 + HTC One A9 + TCL Idol4S + LeEco Le MAX 2 + Vodafone Smart platinum 7 + LeEco (LeTV) Le MAX Pro + Xiaomi Mi 5 + Lenovo ZUK Z2 Pro + Xiaomi Mi Max + LG G5 + ZTE Axon 7 These devices contain the hardware necessary to achieve Quick Charge 3.0. It is at the device manufacturer’s discretion to fully enable this feature. A Quick Charge 3.0 certifi ed power adapter is required. Diff erent Quick Charge 3.0 implementations may result in diff erent charging times. www.qualcomm.com/quickcharge Qualcomm Quick Charge is a product of Qualcom Technologies, Inc. Updated 09/2016 Certifi ed Accessories + Acell Power Bank (PQacell102S-UC) + AUKEY Wall Charger (PA-T16) + Anker PowerDrive+ 1 + CE Link Car Adapter (C0554-2U01FS) + Anker PowerPort+ 1 + CE Link Wall Adapter (W0920X-1U02F) + APE Tech. MPA820QW1 + DBK Power Bank (AS233Q3) + APE Tech. Power Adapter MPA820QF + DBK Power Bank (MS023Q3) + APE Tech. Power Adapter MPA820QFC + DBK Power Bank (MS066Q3) + APE Tech. Power Adapter MPA820QW1 + EasyAcc Power Bank (10000mAh) + APE Tech. Power Bank MP10000Q3C + EasyAcc Power Bank (20000mAh) + APE Tech. Power Bank MP10000Q3M + Elecjar AC Charger (Kwall8s) + APE Tech. Power Bank MP8000Q3C + HTC Wall adapter (TC P5000-AU) + APE Tech. Power Bank MP8000Q3M + HTC Wall adapter (TC P5000-CN) + APE Tech. Wall Adapter MPA820QFD + HTC Wall adapter (TC P5000-EU) + Archeer Wall Charger (AR-QC-24C) + HTC Wall adapter (TC P5000-IN) + AUKEY 18W Wall Charger (PA-T9) + HTC Wall adapter (TC P5000-UK) + AUKEY 3-Port Car Charger (CC-Y3) + HTC Wall adapter (TC P5000-US) + AUKEY Car Charger (CC-T7) + iKits Wall Adapter (W0920X-1U02F) + AUKEY Wall Charger (PA-T13) + JDB Travel adapter (QC5800) UL has been selected as the testing and certifi cation laboratory for Quick Charge 3.0. -

Motorola HTC DROIDTURBO XT1254 4.4.3 HTC 10 HTC M10h 6.0

Motorola HTC DROIDTURBO XT1254 4.4.3 HTC 10 HTC_M10h 6.0 Moto Maxx XT1225 4.4.3 HTC Butterfly 2 HTC_B810x 4.4-6.0 Moto X Play XT1563 5.1.1 HTC Butterfly 3 HTC_B830x 6.0 Moto X Play XT1562 5.1.1 HTC Butterfly s HTC_Butterfly_s 4.4-5.0 Moto X Style XT1572 5.1.1 HTC Butterfly s 4G HTC_Butterfly_s_901s 4.4-5.0 MotoX 2nd XT1097 4.4.3 HTC Desire 530 HTC_D530x 6.0 generation MotoX 2nd XT1094 4.4.3 HTC Desire 610 HTC_D610x 4.4 generation MotoX 2nd XT1093 4.4.3 HTC Desire 620 HTC_D620x 4.4 generation MotoX 2nd XT1095 4.4.3 HTC Desire 626 HTC_D626x 4.4-5.1 generation MotoX 2nd XT1096 4.4.3 HTC Desire 816 HTC_D816x 4.4-6.0 generation MotoX 2nd XT1092 4.4.3 HTC Desire 820 HTC_D820f 4.4-6.0 generation Moto X Force XT1580 5.1.1 HTC Desire 820 HTC_D820u 4.4-6.0 Nexus 6 XT1103 5.0 HTC Desire 825 HTC_D825x 6.0 Nexus 6 XT1100 5.0 HTC Desire 826 HTC_D826x 5.0-6.0 HTC Desire 830 HTC_D830x 5.1 HTC Desire Eye HTC_M910x 4.4-6.0 HTC J butterfly HTV31 HTV31 6.0 HTC One (E8) HTC_M8Sx 4.4-6.0 HTC One (E8) HTC_M8Sy 4.4-6.0 HTC One (M9) HTC_M9u 5.0-6.0 HTC One A9 HTC_A9u 6.0 HTC One E9+ Dual HTC_E9pw 5.0 SIM HTC One M7 HTC One 4.4-5.0 HTC One M7 HTC One 801e 4.4-5.0 HTC One M7 HTC One 801s 4.4-5.0 HTC One M7 HTC_PN071 4.4 HTC One M9+ HTC_M9pw 5.0-6.0 HTC One M9+ (極光) HTC_M9px 5.0-6.0 HTC One max HTC_One_max 4.4-5.0 HTC One mini 2 HTC_M8MINx 4.4-6.0 HTC One X9 HTC_X9u 6.0 HTC One® (M8) HTC One_M8 4.4-6.0 HTC One® (M8) HTC_M8 4.4-6.0 HTC One® (M8) HTC_M8x 4.4-6.0 Nexus 9 Nexus 9 5.0-6.0 HUAWEI LG HUAWEI GRA- P8 6.0 AKA LG-H788n 4.4 L09 P8 Lite HUAWEI ALE-L21 5.0 F90 -

Barometer of Mobile Internet Connections in Indonesia Publication of March 14Th 2018

Barometer of mobile Internet connections in Indonesia Publication of March 14th 2018 Year 2017 nPerf is a trademark owned by nPerf SAS, 87 rue de Sèze 69006 LYON – France. Contents 1 Methodology ................................................................................................................................. 2 1.1 The panel ............................................................................................................................... 2 1.2 Speed and latency tests ....................................................................................................... 2 1.2.1 Objectives and operation of the speed and latency tests ............................................ 2 1.2.2 nPerf servers .................................................................................................................. 2 1.3 Tests Quality of Service (QoS) .............................................................................................. 2 1.3.1 The browsing test .......................................................................................................... 2 1.3.2 YouTube streaming test ................................................................................................ 3 1.4 Filtering of test results .......................................................................................................... 3 1.4.1 Filtering of devices ........................................................................................................ 3 2 Overall results 2G/3G/4G ............................................................................................................ -

Compatibility Sheet

COMPATIBILITY SHEET SanDisk Ultra Dual USB Drive Transfer Files Easily from Your Smartphone or Tablet Using the SanDisk Ultra Dual USB Drive, you can easily move files from your Android™ smartphone or tablet1 to your computer, freeing up space for music, photos, or HD videos2 Please check for your phone/tablet or mobile device compatiblity below. If your device is not listed, please check with your device manufacturer for OTG compatibility. Acer Acer A3-A10 Acer EE6 Acer W510 tab Alcatel Alcatel_7049D Flash 2 Pop4S(5095K) Archos Diamond S ASUS ASUS FonePad Note 6 ASUS FonePad 7 LTE ASUS Infinity 2 ASUS MeMo Pad (ME172V) * ASUS MeMo Pad 8 ASUS MeMo Pad 10 ASUS ZenFone 2 ASUS ZenFone 3 Laser ASUS ZenFone 5 (LTE/A500KL) ASUS ZenFone 6 BlackBerry Passport Prevro Z30 Blu Vivo 5R Celkon Celkon Q455 Celkon Q500 Celkon Millenia Epic Q550 CoolPad (酷派) CoolPad 8730 * CoolPad 9190L * CoolPad Note 5 CoolPad X7 大神 * Datawind Ubislate 7Ci Dell Venue 8 Venue 10 Pro Gionee (金立) Gionee E7 * Gionee Elife S5.5 Gionee Elife S7 Gionee Elife E8 Gionee Marathon M3 Gionee S5.5 * Gionee P7 Max HTC HTC Butterfly HTC Butterfly 3 HTC Butterfly S HTC Droid DNA (6435LVW) HTC Droid (htc 6435luw) HTC Desire 10 Pro HTC Desire 500 Dual HTC Desire 601 HTC Desire 620h HTC Desire 700 Dual HTC Desire 816 HTC Desire 816W HTC Desire 828 Dual HTC Desire X * HTC J Butterfly (HTL23) HTC J Butterfly (HTV31) HTC Nexus 9 Tab HTC One (6500LVW) HTC One A9 HTC One E8 HTC One M8 HTC One M9 HTC One M9 Plus HTC One M9 (0PJA1) -

Electronic 3D Models Catalogue (On July 26, 2019)

Electronic 3D models Catalogue (on July 26, 2019) Acer 001 Acer Iconia Tab A510 002 Acer Liquid Z5 003 Acer Liquid S2 Red 004 Acer Liquid S2 Black 005 Acer Iconia Tab A3 White 006 Acer Iconia Tab A1-810 White 007 Acer Iconia W4 008 Acer Liquid E3 Black 009 Acer Liquid E3 Silver 010 Acer Iconia B1-720 Iron Gray 011 Acer Iconia B1-720 Red 012 Acer Iconia B1-720 White 013 Acer Liquid Z3 Rock Black 014 Acer Liquid Z3 Classic White 015 Acer Iconia One 7 B1-730 Black 016 Acer Iconia One 7 B1-730 Red 017 Acer Iconia One 7 B1-730 Yellow 018 Acer Iconia One 7 B1-730 Green 019 Acer Iconia One 7 B1-730 Pink 020 Acer Iconia One 7 B1-730 Orange 021 Acer Iconia One 7 B1-730 Purple 022 Acer Iconia One 7 B1-730 White 023 Acer Iconia One 7 B1-730 Blue 024 Acer Iconia One 7 B1-730 Cyan 025 Acer Aspire Switch 10 026 Acer Iconia Tab A1-810 Red 027 Acer Iconia Tab A1-810 Black 028 Acer Iconia A1-830 White 029 Acer Liquid Z4 White 030 Acer Liquid Z4 Black 031 Acer Liquid Z200 Essential White 032 Acer Liquid Z200 Titanium Black 033 Acer Liquid Z200 Fragrant Pink 034 Acer Liquid Z200 Sky Blue 035 Acer Liquid Z200 Sunshine Yellow 036 Acer Liquid Jade Black 037 Acer Liquid Jade Green 038 Acer Liquid Jade White 039 Acer Liquid Z500 Sandy Silver 040 Acer Liquid Z500 Aquamarine Green 041 Acer Liquid Z500 Titanium Black 042 Acer Iconia Tab 7 (A1-713) 043 Acer Iconia Tab 7 (A1-713HD) 044 Acer Liquid E700 Burgundy Red 045 Acer Liquid E700 Titan Black 046 Acer Iconia Tab 8 047 Acer Liquid X1 Graphite Black 048 Acer Liquid X1 Wine Red 049 Acer Iconia Tab 8 W 050 Acer