2020 Annual Report Journey Well 2020 Annual Report Newburyport Bank 2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

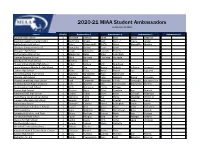

2020-21 MIAA Student Ambassadors (Updated 02/12/2021)

2020-21 MIAA Student Ambassadors (updated 02/12/2021) School District Ambassador 1 Ambassador 2 Ambassador 3 Ambassador 4 Agawam High School 1 Elizabeth Santore Sarah Ross David Dagenais Baystate Academy Charter Public 1 Cashmere Givens Dion Byrd, Jr. Travis Jordan Belchertown High School 1 Avery Klingensmith Griffin Weiss Meredith Medina Chicopee Comprehensive HS 1 Samantha Breton Gavin Baker Chicopee High School 1 Jacob Montalvo Hannah Powers Easthampton High School 1 Mackenzie Bates Gabe Colenback Frontier Regional School 1 Skyla Burniske Charlotte Doulette Granby Jr./Sr. High School 1 Brianna Sosa Hoosac Valley Middle/High School 1 Aiden Koczela Lilly Boudreau Lenox Memorial Middle & High School 1 Ted Yee Ariana Roberts Julianne Harwood Ludlow High School 1 Fiona Elliott Aaron Picard Leo Laguerre Minnechaug Reg. High School 1 Gabrielle Bartolomei Ryan McConnell Monson High School 1 Connor Santos Colin Beaupre Emilia Finnegan Mount Everett Reg. High School 1 Jack Carpenter Makenzie Ullrich Armando Bautista-Cruz Mount Greylock Regional School 1 John Skavlem Mia VanDeurzen Mackenzie Sheehy Northampton High School 1 Seth Finnessey Emma Kellogg Palmer High School 1 Chelsea Bigos Olivia Coughlin Ava Denault Pathfinder RVT High School 1 Jordan Talbot Gavin Baral Cordelia Hageman Paulo Freire Social Justice Charter 1 Veronica Cotto Zyir Harris Chandler Wilson, Jr. Pioneer Valley Regional School 1 Samuel Cahill Lucy Koester Jason Quinn Renaissance School 1 Samiyah Cabrera Karina Eddington Jaidin Lizardi Sabis International Charter School 1 Jayden Dow Grace Blase Colin Considine Smith Academy 1 Story Goldman Rose McCollough Riley Intrator Springfield HS of Sci. and Tech. 1 Elaine Bertram Quincy Mack Izzy Verdejo Turners Falls High School 1 Taylor Murphy Jade Tyler Haleigh Greene Ware Jr/Sr High School 1 Jackie Dugay John Soltys Lexie Orszulak Westfield High School 1 Joseph Taupier Maya Guillotte Westfield Technical Academy 1 Dakota Durkee Advanced Math & Science Acad. -

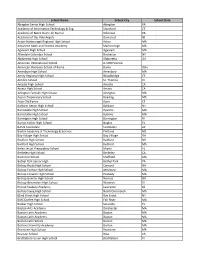

Participating School List 2018-2019

School Name School City School State Abington Senior High School Abington PA Academy of Information Technology & Eng. Stamford CT Academy of Notre Dame de Namur Villanova PA Academy of the Holy Angels Demarest NJ Acton-Boxborough Regional High School Acton MA Advanced Math and Science Academy Marlborough MA Agawam High School Agawam MA Allendale Columbia School Rochester NY Alpharetta High School Alpharetta GA American International School A-1090 Vienna American Overseas School of Rome Rome Italy Amesbury High School Amesbury MA Amity Regional High School Woodbridge CT Antilles School St. Thomas VI Arcadia High School Arcadia CA Arcata High School Arcata CA Arlington Catholic High School Arlington MA Austin Preparatory School Reading MA Avon Old Farms Avon CT Baldwin Senior High School Baldwin NY Barnstable High School Hyannis MA Barnstable High School Hyannis MA Barrington High School Barrington RI Barron Collier High School Naples FL BASIS Scottsdale Scottsdale AZ Baxter Academy of Technology & Science Portland ME Bay Village High School Bay Village OH Bedford High School Bedford NH Bedford High School Bedford MA Belen Jesuit Preparatory School Miami FL Berkeley High School Berkeley CA Berkshire School Sheffield MA Bethel Park Senior High Bethel Park PA Bishop Brady High School Concord NH Bishop Feehan High School Attleboro MA Bishop Fenwick High School Peabody MA Bishop Guertin High School Nashua NH Bishop Hendricken High School Warwick RI Bishop Seabury Academy Lawrence KS Bishop Stang High School North Dartmouth MA Blind Brook High -

Green Community Designations Reach 185

GREEN COMMUNITY DESIGNATIONS REACH 185 MA Green Designation Designation Grant 100% Census 2013 Grant Project Summary Communities Date / Award Award Done Population $35,241,958 125 July-12 $2,419,773 18 July-13 $3,621,952 20 185 July-14 $7,626,535 39 4,295,504 July-15 $8,646,511 48 July-16 $9,452,234 26 July-17 $14,043,257 to fund energy conservation measures and lighting upgrades at the Memorial Library, an HVAC analysis of Town Hall and 5/25/10 $150,794 installation of a tankless hot water heater and vending misers; lighting retrofits with LED technology at the Public Safety Facility X building and Davis Memorial; and an energy education outreach program in the Acton-Boxborough Regional School District To fund the following energy efficiency measures in municipal school buildings: in the RJ Grey School, installation of demand July-12 $140,738 control ventilation, resetting the unit ventilator controls, air sealing with caulking, and re-commissioning of boiler and rooftop X unit; and air sealing with caulking at Conant, Douglas, Gates Elementary schools and the Administration building. July-14 $229,819 to fund energy conservation measures in the Memorial Library and five schools X Acton 22,891 to fund the following energy conservation measures: a town wide LED streetlight conversion; interior LED lighting upgrades in Parker Damon Building, RJ Grey Junior High School and Acton-Boxborough Regional High School; HVAC efficiency upgrades July-15 $245,000 in Parker Damon; efficiency improvements of the cooling system at Acton-Boxborough RHS; and installation of Wi-Fi X programmable thermostats in Douglas Elementary, Conant Elementary, and RJ Grey JHS to fund energy conservation measures in municipal facilities including Parker Damon Building, Acton-Boxborough Regional July-17 $245,497 High School, and RJ Grey Junior High School. -

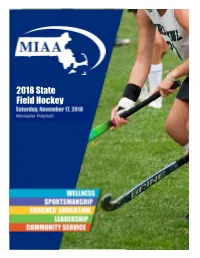

2018 Field Hockey Program Cover and Back.Pub

2018 State Field Hockey Division 1 Division 2 Whitman-Hanson Greenfield Regional High School High School Award History 2017 – Division 1 Amherst Pelham Regional High School 2017 – Division 2 Sutton High School 2016 – Division 1 North Middlesex Regional High School 2016 – Division 2 Hull High School 2015 – Division 2 Old Rochester Regional High School 2014 - Division 1 Nashoba Regional High School 2013 – Division 1 Central Catholic High School 2013 – Division 2 David Prouty High School 2011 – Division 1 Springfield Central High School 2010 – Division 1 Oliver Ames High School 2010 – Division 2 Hopedale Jr/Sr High School 2008 – Division 1 Malden High School 2008 – Division 2 Hanover High School 2007 – Division 1 Agawam High School 2007 – Division 2 Littleton High School 2006 – Division 1 Agawam High School 2006 – Division 2 Douglas High School 2005 – Division 1 Stoughton High School 2005 – Division 2 North Reading High School 2004 – Division 1 Shrewsbury High School 2004 – Division 2 Hamilton-Wenham Regional High School 2003 – Division 1 Nashoba Regional High School 2003 – Division 2 North Andover High School 2002 – Division 1 Lawrence High School 2002 – Division 2 R.C. Mahar Regional School The 2018 MIAA Sportsmanship Essay Contest "How do I model sportsmanship and how will it support my future success in today’s world? SECOND PLACE Eryn Flynn Ashland High School Sportsmanship and Success What constitutes a good player is not only talent, but sportsmanship as well. Players who embody sportsmanship play with integrity and have empathy for their opponents and teammates alike. I believe that I model these virtues and that they will lead to my future success by treating others with respect and handling adversity with poise. -

MIT Beaver Works Summer Institute

Lockheed Martin Project BAE Project Sierra Nevada Corp Project Raytheon Project MITRE Project Massachusetts Institute of Technology MIT Lincoln Laboratory MIT Lincoln Laboratory / School of Engineering Beaver Works MIT Beaver Works Summer Institute Dear Friends, Family, and Engineering Enthusiasts, Welcome to the 2019 Beaver Works Summer Institute Final Challenge and Awards Ceremony! The MIT Beaver Works Summer Institute is a rigorous, world-class STEM program for talented rising high school seniors. The 2019 program featured ten project-based, workshop- style courses: Autonomous RACECAR Grand Prix, Autonomous Air Vehicle Racing, Autonomous Cognitive Assistant, Data Science for Health and Medicine, Build a CubeSat, UAS-SAR, Embedded Security and Hardware Hacking, Hack a 3D Printer, Assistive Technologies Hack-a-thon, and Remote Sensing for Disaster Response. This year’s MIT Beaver Works Summer Institute was a complete success thanks to the enthusiasm of our students, the dedication of our instructors, and the hard work of our team members. We partnered with 140 high schools to recruit the future engineers who participated in our program. We had the pleasure of working with 239 high school students, 143 of whom joined our program from outside Massachusetts. We also inaugurated the first BWSI middle school class with 24 Massachusetts middle school students taking a specially tailored RACECAR course. In the coming years, we will integrate new programs into this initiative, increasing participation substantially. We will support high school STEM teachers who use our teaching materials to help better prepare their students for college and beyond. We will also help other universities and high schools create similar programs, working to build a network of institutes to collectively improve engineering education worldwide. -

Sanctioned Cheer Teams - 2018-19 Activity SCHOOL Mailcity Coed Fall Cheer Abington High School Abington Acton-Boxborough Reg H.S

Sanctioned Cheer Teams - 2018-19 Activity SCHOOL MailCITY Coed Fall Cheer Abington High School Abington Acton-Boxborough Reg H.S. Acton Agawam High School Agawam Algonquin Reg. High School Northborough Amesbury High School Amesbury Andover High School Andover Apponequet Regional H.S. Lakeville Archbishop Williams High School Braintree Arlington High School Arlington Ashland High School Ashland Assabet Valley Reg Tech HS Marlboro Attleboro High School Attleboro Auburn High School Auburn Austin Preparatory School Reading Barnstable High School Hyannis Bartlett Jr./Sr. H.S. Webster Bay Path RVT High School Charlton Bedford High School Bedford Bellingham High School Bellingham Belmont High School Belmont Beverly High School Beverly Billerica Memorial High School Billerica Bishop Feehan High School Attleboro Blackstone-Millville Reg HS Blackstone Boston Latin School Boston Braintree High School Braintree Bridgewater-Raynham Reg High School Bridgewater Bristol-Plymouth Reg Voc Tech Taunton Brookline High School Brookline Burlington High School Burlington Canton High School Canton Carver Middle/High School Carver Central Catholic High School Lawrence Chelmsford High School North Chelmsford Chicopee Comprehensive HS Chicopee Clinton High School Clinton Cohasset Middle-High School Cohasset Concord-Carlisle High School Concord Tuesday, January 22, 2019 Sanctioned Cheer Teams - 2018-19 Activity SCHOOL MailCITY Coed Fall Cheer Coyle & Cassidy High School Taunton Danvers High School Danvers Dartmouth High School South Dartmouth David Prouty High School -

The Clipper's Compass

The Clipper’s Compass The Student/Parent Handbook of Newburyport High School 2019-2020 NEWBURYPORT HIGH SCHOOL One hundred fifty-first year 1868-2020 Seventy-ninth edition 1940-1941 ~ 2019-2020 The Newburyport Public School System does not discriminate on the basis of race, color, religion, national origin, age, gender, sexual orientation, or disability in admission to, access to, employment in, or treatment in its programs and activities. The Newburyport Public School System is committed to maintaining a school environment free of harassment based on sex, race, color, national origin, religion, age, disability, sexual orientation or gender identity. Harassment by administrators, certified and support personnel, students, vendors and other individuals at school or at school-sponsored events are unlawful and are strictly prohibited. The Newburyport Public School System requires all employees and students to conduct themselves in an appropriate manner with respect to their fellow employees, students and all members of the school community. The High School 241 High Street Newburyport, Massachusetts 01950 Tel: (978) 465-4440 / Fax: (978) 465-4439 www.newburyport.k12.ma.us District’s Mission Statement The mission of the Newburyport Public Schools, the port where tradition and innovation converge, is to ensure each student achieves intellectual and personal excellence and is equipped for life experiences through a system distinguished by students, staff, and community who: - practice kindness and perseverance - celebrate each unique individual -

Sanctioned Cheer Teams

Sanctioned Cheer Teams - 2010-2011 Activity SCHOOL MailCITY Coed Cheer Abby Kelley Foster Reg Charter School Worcester Abington High School Abington Academy of Notre Dame Tyngsboro Acton-Boxborough Reg H.S. Acton Agawam High School Agawam Algonquin Reg. High School Northborough Amesbury High School Amesbury Andover High School Andover Apponequet Regional H.S. Lakeville Archbishop Williams High School Braintree Arlington Catholic High School Arlington Arlington High School Arlington Ashland High School Ashland Assabet Valley Reg Voc HS Marlboro Attleboro High School Attleboro Auburn High School Auburn Auburn Middle School Auburn Austin Preparatory School Reading Avon Mid/High School Avon Ayer Middle-High School Ayer Barnstable High School Hyannis Bartlett Jr./Sr. H.S. Webster Bay Path RVT High School Charlton Bedford High School Bedford Belchertown High School Belchertown Bellingham High School Bellingham Beverly High School Beverly Billerica Memorial High School Billerica Bishop Feehan High School Attleboro Bishop Fenwick High School Peabody Bishop Stang High School North Dartmouth Blackstone Valley Reg Voc/Tech HS Upton Blackstone-Millville Reg HS Blackstone Boston Latin School Boston Bourne High School Bourne Braintree High School Braintree Bridgewater-Raynham Reg High School Bridgewater Bristol-Plymouth Reg Voc Tech Taunton Thursday, February 03, 2011 Page 1 of 7 Sanctioned Cheer Teams - 2010-2011 Activity SCHOOL MailCITY Coed Cheer Brockton High School Brockton Brookline High School Brookline Burlington High School Burlington Cambridge -

Registered Schools

Moody’s Mega Math Challenge A contest for high school students SIAM Society for Industrial and Applied Mathematics 3600 Market Street, 6th Floor Philadelphia, PA 19104 USA [email protected] M3Challenge.siam.org 2009 M3 Registered Schools Connecticut Fairfield County Bethel High School, Bethel Bassick High School, Bridgeport New Canaan High School, New Canaan (two teams) Brien McMahon High School, Norwalk Ridgefield High School, Ridgefield Stamford High School, Stamford (two teams) Weston High School, Weston (two teams) Staples High School, Westport Hartford County Miss Porter's School, Farmington Greater Hartford Academy of Math and Science, Hartford (two teams) Newington High School, Newington Conard High School, West Hartford Litchfield County Kent School, Kent New Milford High School, New Milford (two teams) Northwestern Regional High School, Winsted (two teams) Middlesex County Valley Regional High School, Deep River East Hampton High School, East Hampton New Haven County Hamden High School, Hamden (two teams) Francis T. Maloney High School, Meriden Joseph A. Foran High School, Milford Wilbur Cross High School, New Haven Wolcott High School, Wolcott (two teams) New London County East Lyme High School, East Lyme New London Public Schools, New London Norwich Free Academy, Norwich Delaware New Castle County Sanford School, Hockessin Pencader Charter, New Castle Charter School of Wilmington, Wilmington (two teams) Salesianum School, Wilmington District of Columbia Coolidge High School, Washington, D.C. Benjamin Banneker Academic High -

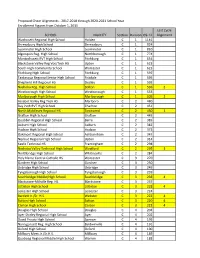

Copy of Cheer Alignment Data.Xlsx

Proposed Cheer Alignments ‐ 2017‐2018 through 2020‐2021 School Year Enrollment Figures from October 1, 2015 Last Cycle SCHOOL MailCITY Section Division G9‐12 Alignment Wachusett Regional High School Holden C 1 1141 Shrewsbury High School Shrewsbury C 1 924 Leominster High School Leominster C 1 810 Algonquin Reg. High School Northborough C 1 774 Montachusett RVT High School Fitchburg C 1 654 Blackstone Valley Reg Voc/Tech HS Upton C 1 623 South High Community School Worcester C 1 623 Fitchburg High School Fitchburg C 1 597 Tantasqua Regional Senior High School Fiskdale C 1 595 Shepherd Hill Regional HS Dudley C 1 593 Nashoba Reg. High School Bolton C 1 536 2 Westborough High School Westborough C 1 533 Marlborough High School Marlborough C 1 505 2 Assabet Valley Reg Tech HS Marlboro C 2 480 Bay Path RVT High School Charlton C 2 451 North Middlesex Regional HS Townsend C 2 450 1 Grafton High School Grafton C 2 445 Quabbin Regional High School Barre C 2 385 Auburn High School Auburn C 2 382 Hudson High School Hudson C 2 373 Oakmont Regional High School Ashburnham C 2 347 Nipmuc Regional High School Upton C 2 314 Keefe Technical HS Framingham C 2 298 Nashoba Valley Technical High School Westford C 2 295 3 Northbridge High School Whitinsville C 2 284 Holy Name Central Catholic HS Worcester C 3 270 Gardner High School Gardner C 3 250 Uxbridge High School Uxbridge C 3 249 Tyngsborough High School Tyngsborough C 3 239 Southbridge Middle/High School Southbridge C 3 238 4 Blackstone‐Millville Reg. -

Ocm09668846-20012002.Pdf

2001-2002 Public Officers of the COMMONWEALTH of MASSACHUSETTS Prepared and printed under authority of Section 1 8 of Chapter 5 of the General Laws by PATRICK F. SCANLAN Senate Clerk and STEVEN T. JAMES Clerk of the House of Representatives SENATORS FROM MASSACHUSETTS IN THE CONGRESS OF THE UNITED STATES U.S. SENATE EDWARD M. KENNEDY Hyannisport, Democrat. Born: February 22, 1932. Education: Milton Academy; Harvard University, B.A., '56; International Law School, The Hague, Netherlands, '58; University of Virginia Law School, LL.B., '59. Profession: Lawyer. Organizations: Ranking Democrat, Senate Labor and Human Resources Committee; Member, Senate Judiciary Committee, Senate Armed Services Com- mittee, Congressional Joint Economic Committee; Member, Congressional Friends of Ireland, Senate Arms Control Observer Group; Trustee, John F. Kennedy Center for the Performing Arts. Public Office: United States Senate, 1962-2006. U.S. SENATE JOHN F. KERRY One Bowdoin Square, 10th Floor, Boston. Democrat. Born: Denver, CO, December 11, 1943. Education: Yale. '66; Boston College Law School, "76. Profession: Lawyer. Organizations: Vietnam Veterans of America; Honorary Trustee, Museum of Science. Public Office: First Assistant District Attorney , (Middlesex County) 1977- 79; Lieutenant Governor, 1983-'85; United States Senate, 1985- 2002. REPRESENTATIVES FROM MASSACHUSETTS IN THE CONGRESS UNITED STATES U.S. HOUSE MICHAEL EVERETT CAPUANO PO Box 440305, Somerville, 8th District, Democrat. Born: Somerville, January 9, 1952. Education: Dartmouth College; Boston College Law School. Profession: Attorney. Public Office: Alderman; Alderman-at-Large; Mayor of Somerville; Representative in Congress (106th - 107th) 1999-2002. U.S. HOUSE WILLIAM D. DELAHUNT 9 Ketch Lane, Quincy, 10th District, Democrat. Born: Quincy, July 18, 1941. -

SELECT PUBLIC SCHOOLS Schuldistrikt / Schule

SELECT PUBLIC SCHOOLS Programmgebühr Programmgebühr Schuldistrikt / Schule Semester Schuljahr ARIZONA BASIS Chandler / $36,945 BASIS Scottsdale / $36,945 Gilbert Public Schools $17,645 $24,645 Hamilton High School $16,645 $24,645 Higley Unified School District $16,645 $23,945 Mesa Public Schools $16,645 $23,645 Mission Heights Preparatory High School $15,645 $21,645 Odyssey Institute High School $16,645 $23,645 Paradise Valley Unified School District $17,645 $25,645 Scottsdale Unified District $16,645 $23,645 Sequoia Schools – Arizona Conservatory for the Arts Academy $16,720 $23,720 Sequoia Schools – Secondary Charter School $16,645 $23,645 Sierra Vista Unified School District $16,645 $23,645 CALIFORNIA Alameda Unified School District / $37,895 Birmingham Community Charter High School $19,645 $28,645 Chaffey Joint Union High School $21,645 $32,645 Chico Unified School District $25,645 $29,645 Chino Valley Unified School District $21,795 $33,795 El Camino Real Charter High School $20,645 $31,645 Escondido Charter High School $24,645 $39,145 Las Virgenes – Calabasas High School $20,645 $31,645 Los Angeles Unified School District $24,995 $39,995 Morgan Hill Unified School District $20,645 $31,645 Oak Park Unified School District $20,645 $32,645 San Luis Coastal Unified School District – Morro Bay High School $19,645 $30,645 San Luis Coastal Unified School District – San Luis Obispo High School $19,645 $30,645 Santa Barbara Unified School District $23,645 $36,645 Torrance Unified School District $26,795 $33,795 COLORADO Poudre School District