50-164 Application for September 1 Inventory Appraisal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transactions Posted to Pathway

When Payment Net transactions will post to Banner July 3, 2015 through June 30, 2016 From To Post to Banner Notes July 03, 2015 July 09, 2015 July 14, 2015 July 10, 2015 July 16, 2015 July 21, 2015 July 17, 2015 July 23, 2015 July 28, 2015 July 24, 2015 July 30, 2015 August 4, 2015 July 31, 2015 August 6, 2015 August 11, 2015 Will post for August August 7, 2015 August 13, 2015 August 18, 2015 August 14, 2015 August 20, 2015 August 25, 2015 August 21, 2015 August 27, 2015 September 1, 2015 August 28, 2015 September 3, 2015 September 9, 2015 Due to holiday at Monday Will post for August September 4, 2015 September 10, 2015 September 15, 2015 September 11, 2015 September 17, 2015 September 22, 2015 September 18, 2015 September 24, 2015 September 29, 2015 September 25, 2015 October 1, 2015 October 6, 2015 Will post for September October 2, 2015 October 8, 2015 October 13, 2015 October 9, 2015 October 15, 2015 October 20, 2015 October 16, 2015 October 22, 2015 October 27, 2015 October 23, 2015 October 29, 2015 November 3, 2015 October 30, 2015 November 5, 2015 November 10, 2015 Will post for November November 6, 2015 November 12, 2015 November 17, 2015 November 13, 2015 November 19, 2015 November 24, 2015 November 20, 2015 November 26, 2015 December 2, 2015 Due to holiday November 27, 2015 December 3, 2015 December 8, 2018 Will post for December December 4, 2015 December 10, 2015 December 15, 2015 December 11, 2015 December 17, 2015 December 22, 2015 December 18, 2015 December 31, 2015 January 6, 2016 Due to holiday closure Will post for December -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

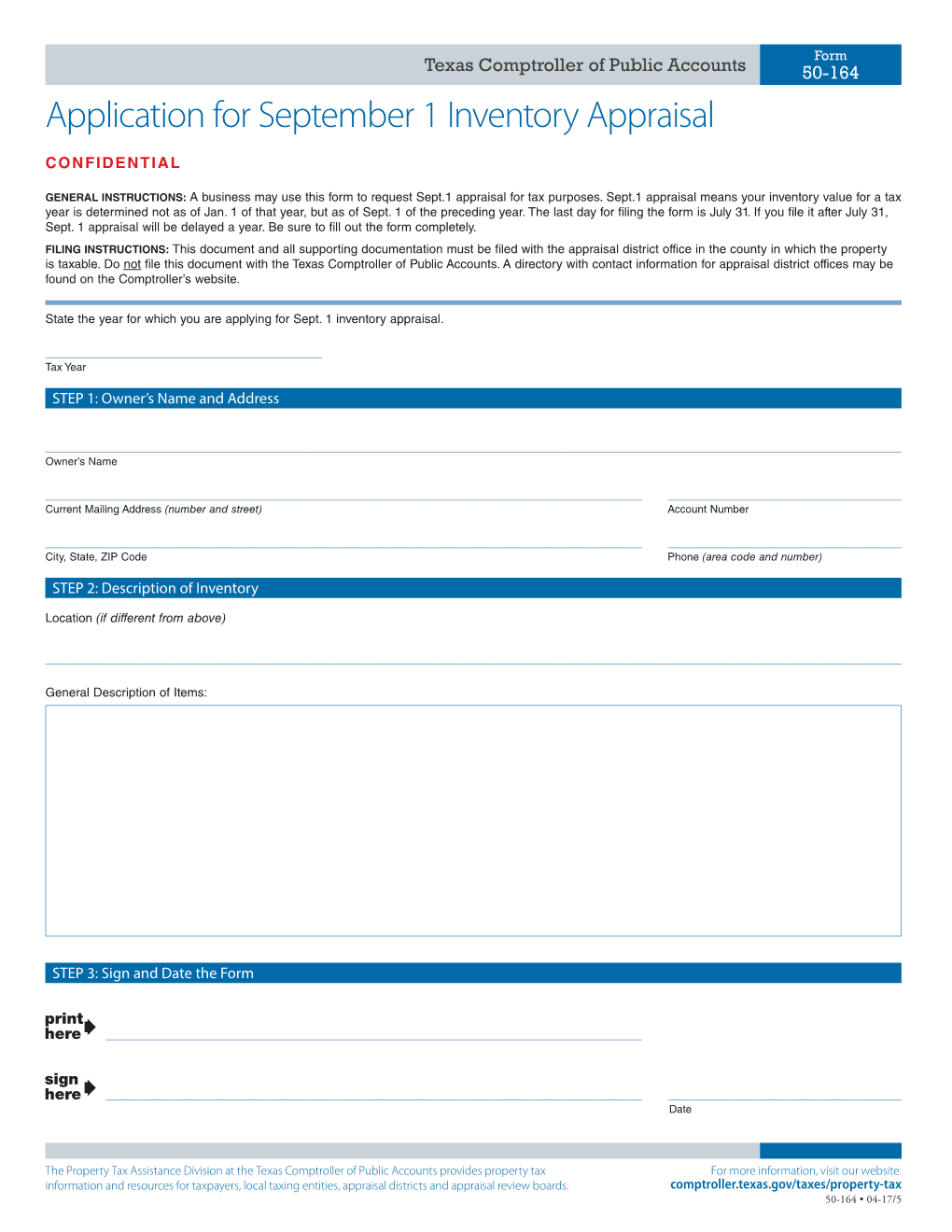

50-164, Application for September 1 Inventory Appraisal (PDF)

Form Texas Comptroller of Public Accounts 50-164 Application for September 1 Inventory Appraisal CONFIDENTIAL GENERAL INSTRUCTIONS: A business may use this form to request Sept.1 appraisal for tax purposes. Sept.1 appraisal means your inventory value for a tax year is determined not as of Jan. 1 of that year, but as of Sept. 1 of the preceding year. The last day for filing the form is July 31. If you file it after July 31, Sept. 1 appraisal will be delayed a year. Be sure to fill out the form completely. FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices may be found on the Comptroller’s website. State the year for which you are applying for Sept. 1 inventory appraisal. ________________________________ Tax Year STEP 1: Owner’s Name and Address ___________________________________________________________________________________________________ Owner’s Name _____________________________________________________________________ ___________________________ Current Mailing Address (number and street) Account Number _____________________________________________________________________ ___________________________ City, State, ZIP Code Phone (area code and number) STEP 2: Description of Inventory Location (if different from above) ___________________________________________________________________________________________________ -

September”—Earth Wind & Fire (1978) Added to the National Registry: 2018 Essay by Rickey Vincent (Guest Post)*

“September”—Earth Wind & Fire (1978) Added to the National Registry: 2018 Essay by Rickey Vincent (guest post)* “Do you remember, the 21st night of September…?” those were the opening lyrics to one of the biggest hits of 1978, and still one of the most entertaining pop songs over the decades. It is a song about memory, memories that have happened, and memories yet to come. A contagious joy emanates from the song, with lyrics that tease with importance, yet captivate with a repeating “ba-de-ya” refrain that is as memorable as any lyrical phrase. The song is a staple of movie soundtracks (such as “Ted 2,” “Barbershop--The Next Cut,” and “Night at the Museum”), commercial jingles, and family gatherings everywhere. With music providing tickles of percussion, soaring yet comforting horn lines, and the breathtaking harmonies, “September” is one of Earth Wind & Fires’ most catchy sing- along favorites. The lyrics spoke of dancing under the stars, and of celebrating moments in our lives. The words captured ideas that seemed so meaningful, yet really were not. The 21st night of September? What date was that? Was it someone’s birthday? How could a song tug at one’s memories, and yet refer to so little? Co-writer Allee Willis has said the date was used simply because it “sounded right when sung.” The irony was that Earth Wind & Fire had had a run of some of the most thought- provoking and inspiring messages in their catalogue of hit songs, from “Keep Your Head To the Sky” to “Shining Star” and “That’s the Way of the World,” there was an expectation of something deeper underpinning the uplifting experience. -

Peoria Unified School District 6-Day Rotation Schedule

Peoria Unified School District 2020 – 2021 School Year Six-Day Rotation Schedule August 2020 January 2021 Day 1: August 17, 19 AM, 26 PM and 27 Day 1: January 6 PM, 11 and 22 Day 2: August 18 and 28 Day 2: January 12, 13 AM, 20 PM and 25 Day 3: August 23 and 31 Day 3: January 4, 14, 26 and 27 AM Day 4: August 21 Day 4: January 5, 15 and 28 Day 5: August 24 Day 5: January 7, 19 and 29 Day 6: August 25 Day 6: January 8 and 21 September 2020 February 2021 Day 1: September 8, 18 and 29 Day 1: February 2, 12 and 25 Day 2: September 2 AM, 9 PM, and 21 Day 2: February 4, 16 and 26 Day 3: September 11, 16 AM and 23 PM Day 3: February 3 PM, 5 and 18 Day 4: September 1, 14, 24 and 30 AM Day 4: February 8, 10 AM, 17 PM and 19 Day 5: September 3, 15 and 25 Day 5: February 9, 22 and 24 AM Day 6: September 4, 17 and 28 Day 6: February 1, 11 and 23 October 2020 March 2021 Day 1: October 9 and 22 Day 1: March 8, 25 and 31 AM Day 2: October 1, 13 and 23 Day 2: March 9 and 26 Day 3: October 2, 15 and 26 Day 3: March 1, 11 and 29 Day 4: October 5, 7 PM, 16 and 27 Day 4: March 2, 12 and 30 Day 5: October 6, 14 AM, 21 PM and 29 Day 5: March 3 PM, 4 and 22 Day 6: October 8, 20, 28 AM and 30 Day 6: March 5, 10 AM, 23 and 24 PM November 2020 April 2021 Day 1: November 2, 12 and 20 Day 1: April 5, 7 PM, 15 and 27 Day 2: November 3, 13 and 30 Day 2: April 6, 14 AM, 16, 21 PM and 29 Day 3: November 5 and 16 Day 3: April 8, 19, 28 AM and 30 Day 4: November 6 and 17 Day 4: April 9 and 20 Day 5: November 9 and 18 Day 5: April 1, 12 and 22 Day 6: November 4 PM, 10 and 19 Day 6: April 2, 13 and 26 December 2020 May 2021 Day 1: December 7, 15 and 16 AM Day 1: May 7 and 18 Day 2: December 8 and 17 Day 2: May 10 and 19 Day 3: December 1 and 9 Day 3: May 5 PM, 11 and 20 Day 4: December 2 and 10 Day 4: May 3, 12 AM, 13 Day 5: December 3 and 11 Day 5: May 4 and 14 Day 6: December 4 and 14 Day 6: May 6 and 17 EARLY RELEASE or MODIFIED WEDNESDAY • Elementary schools starting at 8 a.m. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

Federal Register/Vol. 85, No. 179/Tuesday, September 15, 2020

57280 Federal Register / Vol. 85, No. 179 / Tuesday, September 15, 2020 / Notices on August 28, 2020, the Board a registered management investment I. Self-Regulatory Organization’s unanimously determined that failure to company. Statement of the Terms of Substance of redeem the Fund’s shares would likely 4. Applicant will comply with the the Proposed Rule Change result in adverse consequences to all of books and records provisions of Section Pursuant to the provisions of Section the Fund’s shareholders. 31 of the Act, and the rules thereunder 19(b)(1) under the Act,4 and Rule 19b– Applicant’s Conditions as set forth in the response to Item 7 of 4 thereunder,5 IEX is filing is filing with Applicant has agreed to the following the application. Such books and records the Commission a proposed rule change as conditions to deregistration under the shall promptly be made available to the to correct two typographical errors in Act: staff of the Commission as requested. IEX Rules 2.220(a)(7) and 11.410(a). The 1. Applicant will continue to 5. Applicant will operate in Exchange has designated this rule maintain its internet website and shall compliance with Section 17 of the Act change as ‘‘non-controversial’’ under 6 post its semi-annual (unaudited) and as if it were a registered management Section 19(b)(3)(A) of the Act and annual (audited by the Applicant’s investment company. provided the Commission with the notice required by Rule 19b–4(f)(6) independent accountants) financial 6. Neither (i) the Applicant’s statements to its website. -

BILLING CYCLE SCHEDULE Department of Procurement, Disbursements & Contract Services 1135 Old Main 600 Lincoln Avenue Charleston, IL 61920

Eastern Illinois University BILLING CYCLE SCHEDULE Department of Procurement, Disbursements & Contract Services 1135 Old Main 600 Lincoln Avenue Charleston, IL 61920 Billing Cycle Beginning Date Billing Cycle Ending Date June 26, 2018 July 25, 2018 Tuesday Wednesday July 26, 2018 August 24, 2018 Thursday Friday August 26, 2018 September 25, 2018 Sunday Tuesday September 26, 2018 October 25, 2018 Wednesday Thursday October 26, 2018 November 26, 2018 Friday Monday November 27, 2018 December 26, 2018 Tuesday Wednesday December 27, 2018 January 25, 2019 Thursday Friday January 26, 2019 February 25, 2019 Saturday Monday February 26, 2019 March 25, 2019 Tuesday Monday March 26, 2019 April 25, 2019 Tuesday Thursday April 26, 2019 May 24, 2019 Friday Friday May 26, 2019 June 25, 2019 Sunday Tuesday June 26, 2019 July 25, 2019 Wednesday Thursday Revised 2/2/18 1 Transactions with a Post Date of: Must be Reviewed Upload to Banner & Approved by: July 1, 2018 – July 6, 2018 July 12, 2018 July 13, 2018 Thursday Friday July 7, 2018 – July 13, 2018 July 19, 2018 July 20, 2018 Thursday Friday July 14, 2018 – July 20, 2018 July 26, 2018 July 27, 2018 Thursday Friday July 21, 2018 – July 27, 2018 August 2, 2018 August 3, 2018 Thursday Friday July 28, 2018 – August 3, 2018 August 9, 2018 August 10, 2018 Thursday Friday August 4, 2018 – August 10, 2018 August 16, 2018 August 17, 2018 Thursday Friday August 11, 2018 – August 17, 2018 August 23, 2018 August 24, 2018 Thursday Friday August 18, 2018 – August 24, 2018 August 30, 2018 August 31, 2018 Thursday -

2021 Schedule of Meetings

2021 Schedule of Meetings Zionsville Zionsville Community Town Council Town Council Board of Police Redevelopment Development Board of Zoning 1st Monthly Meeting 2nd Monthly Meeting Commissioners Commission (RDC) Corporation (CDC) Parks and Recreation Plan Commission Appeals ZARC Third Monday After First Monday Third Monday TC Meeting Fourth Monday Second Wednesday Third Monday First Wednesday Fourth Tuesday 7:00 p.m. 7:30 a.m. Council 8:30 a.m. 6:30 p.m. Second or Third Friday 7:00 p.m. Council 7:00 p.m. 6:30 p.m. 8:00 a.m. Council Chambers(TBD) Chambers(TBD) Council Chambers(TBD) Council Chambers(TBD) 8:30 a.m. Chambers(TBD) Council Chambers(TBD) Council Chambers(TBD) Council Chambers(TBD) Zoom Zoom Zoom Zoom Zoom/TBD Zoom Zoom Zoom Zoom January 4, 2021 January 19, 2021 T January 19, 2021 T January 25, 2021 January 15, 2021 January 13, 2021 January 19, 2021 T January 6, 2021 January 26, 2021 February 1,2021 February 16, 2021 T February 16, 2021 T February 22, 2021 February 12, 2021 February 10, 2021 February 16, 2021 T February 3, 2021 February 23, 2021 March 1, 2021 March 15, 2021 March 15, 2021 March 22, 2021 March 12, 2021 March 10, 2021 March 15, 2021 March 3, 2021 March 23, 2021 April 12. 2021 April 19, 2021 April 19, 2021 April 26, 2021 April 16, 2021 April 14, 2021 April 19, 2021 April 7, 2021 April 27, 2021 May 3, 2021 May 17, 2021 May 17, 2021 May 24, 2021 T May 14, 2021 May 12, 2021 May 17, 2021 May 5, 2021 May 25, 2021 June 7, 2021 June 21, 2021 June 21, 2021 June 28, 2021 June 18, 2021 June 9, 2021 June 21, 2021 June 2, -

Pay Week Begin: Saturdays Pay Week End: Fridays Check Date

Pay Week Begin: Pay Week End: Due to UCP no later Check Date: Saturdays Fridays than Monday 7:30am week 1 December 10, 2016 December 16, 2016 December 19, 2016 December 30, 2016 week 2 December 17, 2016 December 23, 2016 December 26, 2016 week 1 December 24, 2016 December 30, 2016 January 2, 2017 January 13, 2017 week 2 December 31, 2016 January 6, 2017 January 9, 2017 week 1 January 7, 2017 January 13, 2017 January 16, 2017 January 27, 2017 week 2 January 14, 2017 January 20, 2017 January 23, 2017 January 21, 2017 January 27, 2017 week 1 January 30, 2017 February 10, 2017 week 2 January 28, 2017 February 3, 2017 February 6, 2017 week 1 February 4, 2017 February 10, 2017 February 13, 2017 February 24, 2017 week 2 February 11, 2017 February 17, 2017 February 20, 2017 March 3, 2017 week 1 February 18, 2017 February 24, 2017 February 27, 2017 ***1 Week Pay Period Transition*** week 1 February 25, 2017 March 3, 2017 March 6, 2017 March 17, 2017 week 2 March 4, 2017 March 10, 2017 March 13, 2017 week 1 March 11, 2017 March 17, 2017 March 20, 2017 March 31, 2017 week 2 March 18, 2017 March 24, 2017 March 27, 2017 week 1 March 25, 2017 March 31, 2017 April 3, 2017 April 14, 2017 week 2 April 1, 2017 April 7, 2017 April 10, 2017 week 1 April 8, 2017 April 14, 2017 April 17, 2017 April 28, 2017 week 2 April 15, 2017 April 21, 2017 April 24, 2017 week 1 April 22, 2017 April 28, 2017 May 1, 2017 May 12, 2017 week 2 April 29, 2017 May 5, 2017 May 8, 2017 week 1 May 6, 2017 May 12, 2017 May 15, 2017 May 26, 2017 week 2 May 13, 2017 May 19, 2017 May -

August September October July November December January

2019 2020 JULY JANUARY S M T W T F S 2019-20 BVSD CALENDAR S M T W T F S 1 2 3 4 5 6 1 2 3 4 July 4 Independence Day 7 8 9 10 11 12 13 August 7-13 District professional development days 5 D 7 8 9 S 11 14 15 16 17 18 19 20 14 & 15 *Kindergarten Assessment Days 12 13 14 15 16 17 18 21 22 23 24 25 26 27 14 First day of school for 1-5, 6th and 9th grade 19 20 21 22 23 24 25 28 29 30 31 15 First day for 7, 8, 10-12 26 27 28 29 30 31 16 & 19 *Staggered start for Kindergarten *Schools will inform parents of their schedules including any assessment days. AUGUST September 2 Labor Day – no school FEBRUARY S M T W T F S 13 Elementary Assessment Day S M T W T F S 1 2 3 16 District professional development day – no school 1 4 5 6 D D D 10 October 14 District professional development day – no school 2 3 4 5 6 7 8 November 11 Veterans Day – no school 11 D D 14 15 16 17 9 10 11 12 T D 15 25-26 Fall conference exchange days/no classes 16 17 18 19 20 21 22 18 19 20 21 22 23 24 28-29 Thanksgiving break – no school 25 26 27 28 29 30 31 Dec. 23-Jan. 3 Winter break 23 24 25 26 27 28 29 January 6 District professional development day – no school SEPTEMBER 20 Martin Luther King, Jr. -

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April