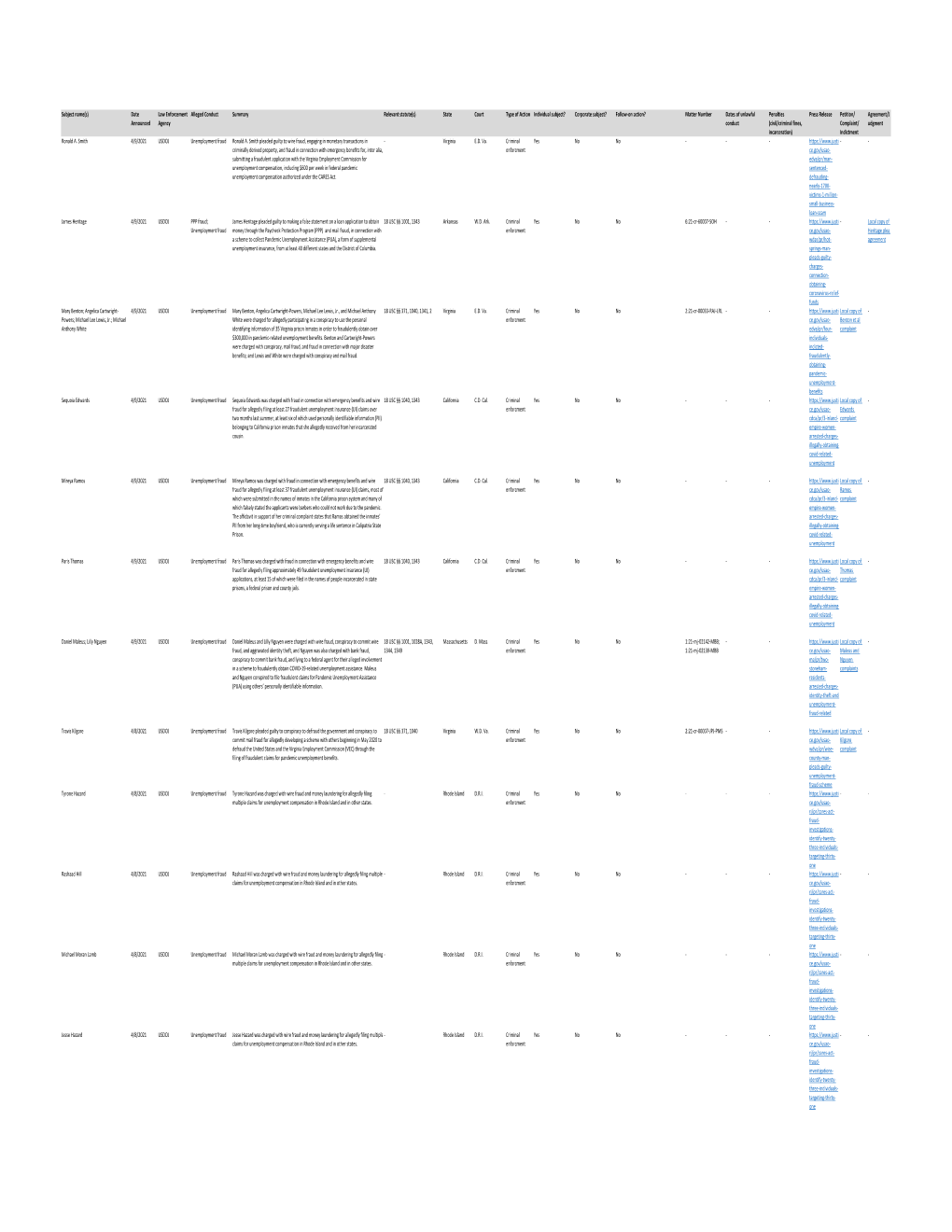

Covid Fraud Tracker (Through 4-9-21).Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Health Care Fraud and Abuse Control Program Annual Report for Fiscal Year 2019

The Department of Health and Human Services And The Department of Justice Health Care Fraud and Abuse Control Program Annual Report for Fiscal Year 2019 June 2020 TABLE OF CONTENTS I. Executive Summary 1 II. Statutory Background 3 III. Program Results and Accomplishments 5 Monetary Results 5 Expenditures 7 Overall Recoveries 8 Health Care Fraud Prevention and Enforcement Action Team 8 Health Care Fraud Prevention Partnership 10 Strike Forces 10 Opioid Fraud and Abuse Detection Unit 13 Highlights of Successful Criminal and Civil Investigations 14 IV. Department of Health and Human Services 39 Office of Inspector General 39 Centers for Medicare & Medicaid Services 61 Administration on Community Living 85 Office of the General Counsel 88 Food and Drug Administration Pharmaceutical Fraud Program 91 V. Department of Justice 95 United States Attorneys 95 Civil Division 96 Criminal Division 102 Civil Rights Division 107 Department of Justice Office of Inspector General 110 VI. Appendix 112 Federal Bureau of Investigation 112 Return on Investment Calculation 116 Total HCFAC Resources 117 VII. Glossary of Terms 118 GENERAL NOTE All years are fiscal years unless otherwise stated in the text. EXECUTIVE SUMMARY The Health Insurance Portability and Accountability Act of 1996 (HIPAA) established a national Health Care Fraud and Abuse Control Program (HCFAC or the Program) under the joint direction of the Attorney General and the Secretary of the Department of Health and Human Services (HHS),1 acting through the Inspector General, designed to coordinate federal, state and local law enforcement activities with respect to health care fraud and abuse. In its twenty-third year of operation, the Program’s continued success confirms the soundness of a collaborative approach to identify and prosecute the most egregious instances of health care fraud, to prevent future fraud and abuse, and to protect program beneficiaries. -

Hot Topics in Fraud and Abuse Enforcement Involving Health Care Providers

Hot Topics in Fraud and Abuse Enforcement Involving Health Care Providers Stephen C. Payne (moderator) Winston Y. Chan John D. W. Partridge Jonathan M. Phillips September 22, 2016 Agenda • Applicable Law • Enforcement Trends • Enforcement Theories • Recent Legal Developments • Questions 2 Applicable Law The False Claims Act (FCA) • The FCA, 31 U.S.C. §§ 3729-3733, is the federal government’s primary weapon to redress fraud against government agencies and programs. • The FCA provides for recovery of civil penalties and treble damages from any person who knowingly submits or causes the submission of false or fraudulent claims to the United States for money or property. “It seems quite clear that the objective of Congress was broadly • Under the FCA, the Attorney General, through DOJ to protect the funds attorneys, investigates and pursues FCA cases (except in and property of the declined qui tam cases). Government from fraudulent claims ….” Rainwater v. United States, 356 U.S. 590 (1958) 4 FCA – Key Provisions 31 U.S.C. Statutory Prohibition Summary § 3729(a)(1) (A) Knowingly presents, or causes to be presented, False/Fraudulent Claim a false or fraudulent claim for payment or approval (B) Knowingly makes, uses or causes to be made or False used, a false record or statement material to a Record/Statement false or fraudulent claim (C) Knowingly conceals or knowingly and improperly “Reverse” False Claim avoids or decreases an obligation to pay or transmit money or property to the Government (G) Conspires to violate a liability provision of -

White Collar Crime by Health Care Providers Pamela H

NORTH CAROLINA LAW REVIEW Volume 67 | Number 4 Article 7 4-1-1989 Fraud by Fright: White Collar Crime by Health Care Providers Pamela H. Bucy Follow this and additional works at: http://scholarship.law.unc.edu/nclr Part of the Law Commons Recommended Citation Pamela H. Bucy, Fraud by Fright: White Collar Crime by Health Care Providers, 67 N.C. L. Rev. 855 (1989). Available at: http://scholarship.law.unc.edu/nclr/vol67/iss4/7 This Article is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Law Review by an authorized administrator of Carolina Law Scholarship Repository. For more information, please contact [email protected]. FRAUD BY FRIGHT: WHITE COLLAR CRIME BY HEALTH CARE PROVIDERSt PAMELA H. Bucyt Fraudby health care providers is one of the most deleterious of all white collar crimes. It is also one of the most difficult to prosecute. In her Article, ProfessorBucy comparesfraud by health care providers with other types of white collar crime and analyzes the theories offraud his- torically used to prosecute health careproviders. She concludes that the strongest theory--prosecutionfor providing unnecessary or substandard health care-is the theory that has been used the least. ProfessorBucy suggests ways for prosecutors to use this theory more often and more effectively in order to combat a problem that ravishes human dignity and personal health as well as the nationalpocketbook "I will apply measures for the benefit of the sick according to my ability and judgment; I will keep them from harm and injustice." Portion of Oath of Hippocrates, Sixth Century B.C.- First Century A.D.; currently administered by many medical schools to graduating medical students.1 "[I c]ould make a million dollars out of the suckers ..... -

Regulation of Dietary Supplements Hearing

S. HRG. 108–997 REGULATION OF DIETARY SUPPLEMENTS HEARING BEFORE THE COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION UNITED STATES SENATE ONE HUNDRED EIGHTH CONGRESS FIRST SESSION OCTOBER 28, 2003 Printed for the use of the Committee on Commerce, Science, and Transportation ( U.S. GOVERNMENT PUBLISHING OFFICE 20–196 PDF WASHINGTON : 2016 For sale by the Superintendent of Documents, U.S. Government Publishing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate Nov 24 2008 11:04 May 24, 2016 Jkt 075679 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 S:\GPO\DOCS\20196.TXT JACKIE SENATE COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION ONE HUNDRED EIGHTH CONGRESS FIRST SESSION JOHN MCCAIN, Arizona, Chairman TED STEVENS, Alaska ERNEST F. HOLLINGS, South Carolina, CONRAD BURNS, Montana Ranking TRENT LOTT, Mississippi DANIEL K. INOUYE, Hawaii KAY BAILEY HUTCHISON, Texas JOHN D. ROCKEFELLER IV, West Virginia OLYMPIA J. SNOWE, Maine JOHN F. KERRY, Massachusetts SAM BROWNBACK, Kansas JOHN B. BREAUX, Louisiana GORDON SMITH, Oregon BYRON L. DORGAN, North Dakota PETER G. FITZGERALD, Illinois RON WYDEN, Oregon JOHN ENSIGN, Nevada BARBARA BOXER, California GEORGE ALLEN, Virginia BILL NELSON, Florida JOHN E. SUNUNU, New Hampshire MARIA CANTWELL, Washington FRANK R. LAUTENBERG, New Jersey JEANNE BUMPUS, Republican Staff Director and General Counsel ROBERT W. CHAMBERLIN, Republican Chief Counsel KEVIN D. KAYES, Democratic Staff Director and Chief Counsel GREGG ELIAS, Democratic General Counsel (II) VerDate Nov 24 2008 11:04 May 24, 2016 Jkt 075679 PO 00000 Frm 00002 Fmt 5904 Sfmt 5904 S:\GPO\DOCS\20196.TXT JACKIE C O N T E N T S Page Hearing held on October 28, 2003 ......................................................................... -

Task Force Initial Six Month Report

I Initial Six-Month Report October 2016 Table of Contents Page 1 Page 2 Page 3 I. Executive Summary the Office of Inspector General for the Department of Healthcare and Family Services (“HFS-OIG”) will report $220.2 million in savings, recoupment, and avoidance in the State Medicaid program (references to Medicaid savings and recoveries include State and federal dollars). In addition, during federal FY 2015, referrals to the Illinois State Police Medicaid Fraud Control Unit (“ISP-MFCU”) led to 42 fraud convictions and $16.9 million in recoveries through criminal prosecutions, civil actions, and/or administrative referrals.4 In addition to the Medicaid program, the State of Illinois also administers insurance for over The Illinois Health Care Fraud Elimination Task 450,000 State employees, dependents, and retirees,5 and Force (the “Task Force”) is pleased to submit this six- administers the Workers’ Compensation Program for month report, detailing the Task Force’s fraud, waste, and approximately 100,000 State employees. State employee abuse identification efforts, to Governor Bruce Rauner. health insurance benefits cost Illinois taxpayers State of Illinois (“State”) government-administered approximately $3 billion on an annual basis.6 For FY health care programs provide important services to 2017, the Illinois Department of Central Management citizens and State employees. The State, however, must Services (“Illinois CMS”) estimates the liability for be ever-diligent in the administration and monitoring employee health insurance benefits to be $2.86 billion.7 of such programs in order to ensure that taxpayer funds This estimate represents a 4.1 percent growth rate from are being spent properly and in the best interest of the FY 2016 to FY 2017.8 The State’s cost per participant taxpayers. -

Fostering Innovation to Fight Waste, Fraud, and Abuse in Health Care

FOSTERING INNOVATION TO FIGHT WASTE, FRAUD, AND ABUSE IN HEALTH CARE HEARING BEFORE THE SUBCOMMITTEE ON HEALTH OF THE COMMITTEE ON ENERGY AND COMMERCE HOUSE OF REPRESENTATIVES ONE HUNDRED THIRTEENTH CONGRESS FIRST SESSION FEBRUARY 27, 2013 Serial No. 113–10 ( Printed for the use of the Committee on Energy and Commerce energycommerce.house.gov U.S. GOVERNMENT PRINTING OFFICE 80–160 WASHINGTON : 2013 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate Nov 24 2008 12:32 May 15, 2013 Jkt 037690 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 F:\MY DOCS\HEARINGS 113\113-10 CHRIS COMMITTEE ON ENERGY AND COMMERCE FRED UPTON, Michigan Chairman RALPH M. HALL, Texas HENRY A. WAXMAN, California JOE BARTON, Texas Ranking Member Chairman Emeritus JOHN D. DINGELL, Michigan ED WHITFIELD, Kentucky Chairman Emeritus JOHN SHIMKUS, Illinois EDWARD J. MARKEY, Massachusetts JOSEPH R. PITTS, Pennsylvania FRANK PALLONE, JR., New Jersey GREG WALDEN, Oregon BOBBY L. RUSH, Illinois LEE TERRY, Nebraska ANNA G. ESHOO, California MIKE ROGERS, Michigan ELIOT L. ENGEL, New York TIM MURPHY, Pennsylvania GENE GREEN, Texas MICHAEL C. BURGESS, Texas DIANA DEGETTE, Colorado MARSHA BLACKBURN, Tennessee LOIS CAPPS, California Vice Chairman MICHAEL F. DOYLE, Pennsylvania PHIL GINGREY, Georgia JANICE D. SCHAKOWSKY, Illinois STEVE SCALISE, Louisiana ANTHONY D. WEINER, New York ROBERT E. LATTA, Ohio JIM MATHESON, Utah CATHY MCMORRIS RODGERS, Washington G.K. BUTTERFIELD, North Carolina GREGG HARPER, Mississippi JOHN BARROW, Georgia LEONARD LANCE, New Jersey DORIS O. -

Entire Issue (PDF)

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 114 CONGRESS, SECOND SESSION Vol. 162 WASHINGTON, THURSDAY, FEBRUARY 4, 2016 No. 21 House of Representatives The House met at 10 a.m. and was last day’s proceedings and announces Red, White, and Blue’s great work in called to order by the Speaker pro tem- to the House his approval thereof. enriching the lives of veterans in need. pore (Mr. MOONEY of West Virginia). Pursuant to clause 1, rule I, the Jour- I had the great privilege of knowing f nal stands approved. Ted personally and was inspired by his kindness, his humor, and his love for DESIGNATION OF THE SPEAKER f his family and country. Ted will al- PRO TEMPORE PLEDGE OF ALLEGIANCE ways be remembered as an honorable The SPEAKER pro tempore laid be- The SPEAKER pro tempore. Will the young man who touched many lives, fore the House the following commu- gentlewoman from New York (Ms. having a lasting positive impact on all nication from the Speaker: STEFANIK) come forward and lead the who knew and loved him. WASHINGTON, DC, House in the Pledge of Allegiance. May his name forever be remembered February 4, 2016. Ms. STEFANIK led the Pledge of Al- in the CONGRESSIONAL RECORD and in I hereby appoint the Honorable ALEXANDER legiance as follows: the great United States of America. X. MOONEY to act as Speaker pro tempore on this day. I pledge allegiance to the Flag of the United States of America, and to the Repub- f PAUL D. -

In the United States District Court for the Middle District of Alabama Northern Division

Case 2:13-cr-00144-LSC-TFM Document 38 Filed 12/19/13 Page 1 of 28 IN THE UNITED STATES DISTRICT COURT FOR THE MIDDLE DISTRICT OF ALABAMA NORTHERN DIVISION UNITED STATES OF AMERICA ) ) v. ) CASE NO. 2:13-cr-144-MEF-TFM ) [wo] EDMUND MCCALL ) RECOMMENDATION OF THE MAGISTRATE JUDGE I. INTRODUCTION Pursuant to 28 U.S.C. § 636(b)(1) this case was referred to the undersigned United States Magistrate Judge for review and submission of a report with recommended findings of fact and conclusions of law. On August 22, 2013, the Grand Jury for the Middle District of Alabama returned an indictment against Antonio Harris (“Harris”) and defendant, Edmund McCall (“McCall” or “Defendant”). Count 1 of the Indictment alleges McCall and others conspired to use the mail and wire communications to execute a scheme and artifice to defraud the United States by filing false, federal income tax returns from 2010 through October 29, 2012. Count 2-6 of the Indictment alleges McCall and others executed the scheme and artifice to defraud the United States by 5 wire communications between January 16, 2012 and March 7, 2012. Counts 7 and 8 of the Indictment allege Harris and McCall engaged in identity theft and aggravated identity theft in relation to wire fraud. Counts 9 through 12 of the Indictment alleges Harris, McCall and others presented false claims against the United States by filing false tax returns between January 16, 2012 and February 29, 2012. Page 1 of 28 Case 2:13-cr-00144-LSC-TFM Document 38 Filed 12/19/13 Page 2 of 28 Counts 13 through 15 of the Indictment allege Harris filed false claims against the United States by filing false tax returns between January 30, 2013, and February 9, 2013. -

Unconventional Cancer Treatments

Unconventional Cancer Treatments September 1990 OTA-H-405 NTIS order #PB91-104893 Recommended Citation: U.S. Congress, Office of Technology Assessment, Unconventional Cancer Treatments, OTA-H-405 (Washington, DC: U.S. Government Printing Office, September 1990). For sale by the Superintendent of Documents U.S. Government Printing OffIce, Washington, DC 20402-9325 (order form can be found in the back of this report) Foreword A diagnosis of cancer can transform abruptly the lives of patients and those around them, as individuals attempt to cope with the changed circumstances of their lives and the strong emotions evoked by the disease. While mainstream medicine can improve the prospects for long-term survival for about half of the approximately one million Americans diagnosed with cancer each year, the rest will die of their disease within a few years. There remains a degree of uncertainty and desperation associated with “facing the odds” in cancer treatment. To thousands of patients, mainstream medicine’s role in cancer treatment is not sufficient. Instead, they seek to supplement or supplant conventional cancer treatments with a variety of treatments that exist outside, at varying distances from, the bounds of mainstream medical research and practice. The range is broad—from supportive psychological approaches used as adjuncts to standard treatments, to a variety of practices that reject the norms of mainstream medical practice. To many patients, the attractiveness of such unconventional cancer treatments may stem in part from the acknowledged inadequacies of current medically-accepted treatments, and from the too frequent inattention of mainstream medical research and practice to the wider dimensions of a cancer patient’s concerns. -

Medicare Fraud and Improper Billing

Medicare Fraud and Improper Billing ISSUE BRIEF • July 2018 Part I. Medicare Fraud Prevention Micki Nozaki, Director, California Health Advocates, Senior Medicare Patrol California Health Advocates Founded in 1997, California Health Advocates (CHA) is the leading Medicare advocacy and education non-profit in California. We advocate on behalf of Medicare beneficiaries and their families; conduct public policy research to support improved rights and protections for Medicare beneficiaries; and provide accurate and up-to-date Medicare information for both Medicare beneficiaries and their families as well as the advocates and providers who serve them. Senior Medicare Patrol The California Senior Medicare Patrol (SMP) is a project under CHA. We empower and assist Medicare beneficiaries, their families, and caregivers to prevent, detect, and report healthcare fraud, errors and abuse through: (1) Education: SMPs give presentations to groups, exhibit at events and work one-on-one with Medicare beneficiaries; (2) Counseling: SMPs work to protect older adults’ health, finances and medical identity while saving precious Medicare dollars; and (3) Assisting Medicare beneficiaries, caregivers and family members when they bring their concerns or complaints to the SMP. We determine whether fraud, errors, or abuse are suspected. When fraud or abuse is assumed, we make referrals to the appropriate state and federal agencies for further investigation. There are 54 Senior Medicare Patrol (SMP) programs throughout the country. SMPs are grant-funded projects of the federal U.S. Department of Health and Human Services, Administration for Community Living. Key Lessons 1. The Medicare Trust Fund loses $60–$90 billion every year to fraud, errors, and abuse.Although the exact figure is impossible to measure, the U.S. -

Annual Report 2020

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR For the transition period from _____ to ______ ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ________________ Commission file number 001-35165 BrainsWay Ltd. (Exact name of Registrant as specified in its charter) N/A (Translation of Registrant’s name into English) Israel (Jurisdiction of incorporation or organization) 19 Hartum Street, Bynet Building, 3rd Floor, Har HaHotzvim, Jerusalem, 9777518, Israel (Address of principal executive offices) Hadar Levy, Senior Vice President, General Manager North America and Interim Chief Financial Officer 300 Knickerbocker Road, Cresskill, New Jersey, 07626 Tel: +1-844-386-7001 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of class Trading Symbol(s) Name of each exchange on which registered American Depositary Shares, each representing two Ordinary Shares BWAY NASDAQ Global Market (1) Ordinary Shares, par value NIS 0.04 per share BWAY Tel Aviv Stock Exchange (1) Evidenced by American Depositary Receipts. Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 22,250,534 Ordinary Shares. -

Fraud Against Financial Institutions: Judging Materiality Post- Escobar

William & Mary Business Law Review Volume 12 (2020-2021) Issue 3 Article 3 April 2021 Fraud Against Financial Institutions: Judging Materiality Post- Escobar Matthew A. Edwards Follow this and additional works at: https://scholarship.law.wm.edu/wmblr Part of the Banking and Finance Law Commons, and the Courts Commons Repository Citation Matthew A. Edwards, Fraud Against Financial Institutions: Judging Materiality Post-Escobar, 12 Wm. & Mary Bus. L. Rev. 621 (2021), https://scholarship.law.wm.edu/wmblr/vol12/iss3/3 Copyright c 2021 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmblr FRAUD AGAINST FINANCIAL INSTITUTIONS: JUDGING MATERIALITY POST-ESCOBAR MATTHEW A. EDWARDS* ABSTRACT In Neder v. United States, 527 U.S. 1 (1999), the Supreme Court held that proof of materiality is required for convictions under the federal mail, wire and bank fraud statutes. During the past 20 years, the federal courts have endeavored to apply the complex com- mon law concept of materiality to the federal criminal law context. The Supreme Court’s recent decision in Universal Health Services, Inc. v. United States ex rel. Escobar, 136 S. Ct. 1989 (2016), a civil case involving the False Claims Act, provided the federal appellate courts with an ideal opportunity to reconsider materiality standards in federal fraud cases. In particular, criminal fraud defendants have argued that Escobar’s “subjective” materiality standard should be applied in mail, wire and bank fraud cases involving financial institutions. Thus far, these arguments have failed. Instead, the Courts of Appeals have endorsed an objective materiality standard tethered to what a reasonable bank would do—not the behavior of renegade lenders.