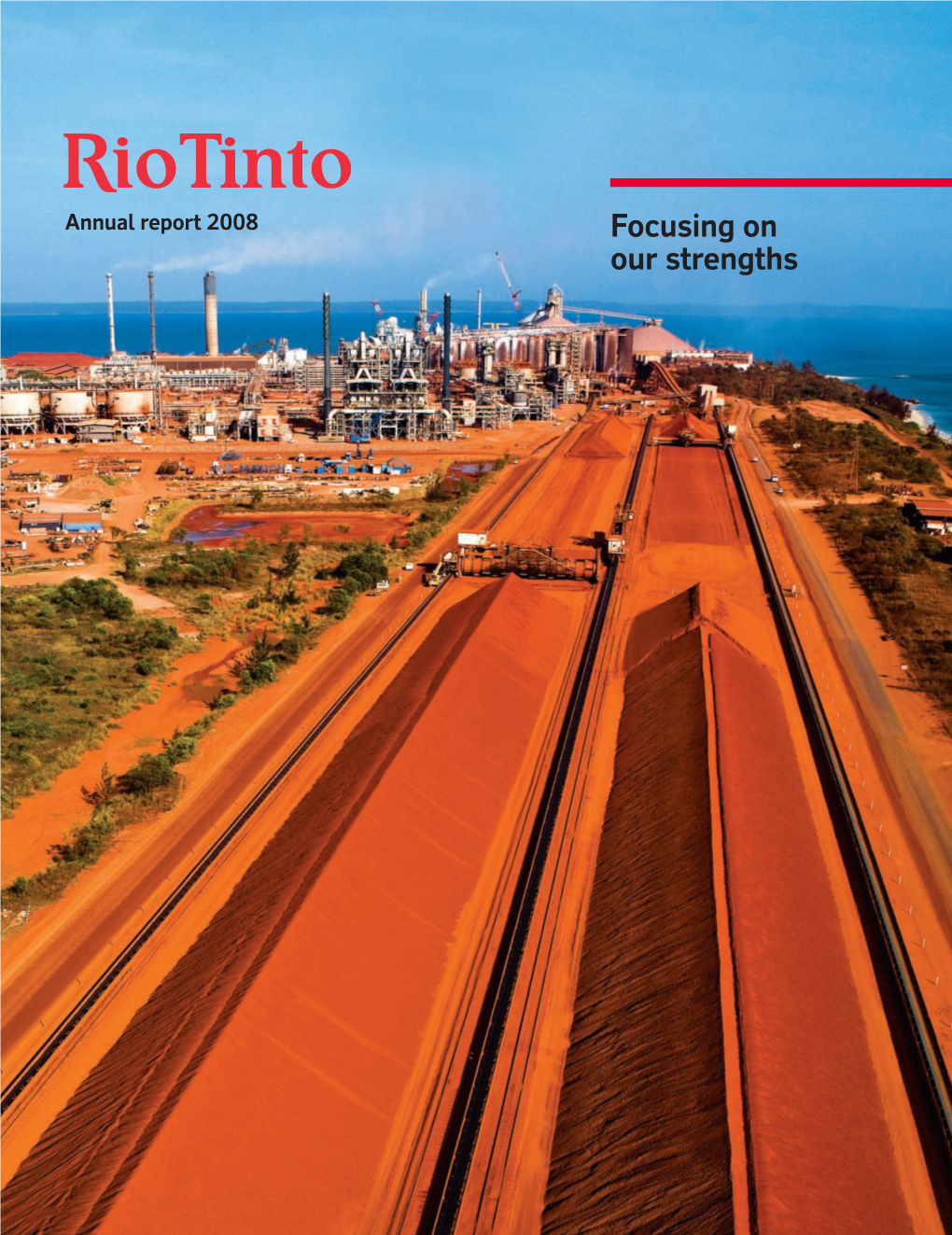

62389 RIO Tinto Annual Report Cover

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

League Information

Leagues at Woodcrest Golf Club General League Guidelines Leagues start as early as the last week of April and end as late as the first week in September, are typically 16 weeks unless changed by Woodcrest Golf Club or the participating league and are typically a minimum of 24 players unless approved by Woodcrest Golf Club. Substitutes, where allowed by leagues, playing for a Woodcrest Member are required to pay the weekly per person League Greens Fee Rate. Woodcrest Golf Club will be the final arbiter of when the golf course is or is not playable. No more than four (4) players are allowed in any group. Tee times are scheduled consecutively for the 1st and 10th tees. Starting on any other hole is not allowed. What we guarantee you: Tee Times Guaranteed recurring tee times will be scheduled on a weekly basis according to a posted League Schedule. If outside tournaments are scheduled that interfere with the leagues scheduled tee times, alternate tee times or a cancellation for that week will be scheduled. Woodcrest Golf Club will make every attempt to notify the leagues in a timely fashion should this situation occur. The same is true for holidays falling on league nights. Please note that when a week has been skipped due to holiday or an outside club event that the league will end up playing the same nine holes for two consecutive league nights. Greens Fees and Cart Fees Fees for league play are a current special reduced greens fee rate and are due for each league participant who is not a Woodcrest Golf Club member. -

New Board and Job Announcements August 2017

New Board and Job Announcements August 2017 Louise Adamany has started a role as Independent Director at Wood Group PLC Irene Chang Britt has started a role as Independent Director at Brighthouse Financial, Inc. http://investor.brighthousefinancial.com/corporate-governance/board-of-directors Carmen Bowser will become an Independent Director at Peapack Gladstone Financial and Peapack Gladstone Bank on September 28. http://philadelphia.citybizlist.com/article/436644/peapack-gladstone-financial-corp-appoints- carmen-m-bowser-director Leslie Anne Coolidge has started a role as Independent Director at Power Solutions International, a leader in the design, engineer and manufacture of emissions-certified, alternative-fuel power systems. http://investors.psiengines.com/releasedetail.cfm?ReleaseID=1033699 Tanuja Majumdar Dehne has started a role as Independent Director of Advanced Disposal Services, the fourth largest solid waste company in the U.S. http://www.advanceddisposal.com/news/2017/advanced-disposal-announces-that-tanuja- dehne-has-been-elected-to-its-board-of-directors.aspx Carol Eicher has changed roles from President/CEO to Chairman at Innocor, Inc. Ambassador April H. Foley has changed role from Independent Director to Lead Independent Director of Vista Outdoor, Inc., a designer, manufacturer, and marketer of outdoor sports and recreation products. https://vistaoutdoor.com/investors-information/corporate-governance/board-of-directors/ Andrea Funk has joined the board of Crown Holdings, Inc., supplier of packaging products to consumer marketing companies. https://www.crowncork.com/news/press-room/crown-holdings-inc-elects-andrea-j-funk-its-board- directors Elizabeth Noël Harwerth has started a role as NED at Charter Court Financial Services Group Ltd, one of the fastest growing specialty mortgage banks in the UK. -

BP and Rio Tinto Plan Clean Coal Project for Western Australia I P

BP and Rio Tinto Plan Clean Coal Project for Western Australia I p... http://www.bp.com/genericarticle.do?categoryId=2012968&content... Site Index | Contact us | Reports and publications | BP worldwide | Home Search: Go About BP Environment and society Products and services Investors Press Careers BP Global Press Press releases Press releases BP and Rio Tinto Plan Clean Coal Project for Western Speeches Australia Features and news Images and graphics Release date: 21 May 2007 Contact Information In this section BP and Rio Tinto today announced that they are beginning feasibility studies and work on plans for the potential BP Takes Delivery of development of a A$2 billion (US$1.5 billion) coal-fired World's Largest LNG Carrier power generation project at Kwinana in Western Australia What is RSS? BP and D1 Oils Form Joint that would be fully integrated with carbon capture and Venture to Develop Jatropha storage to reduce its emissions of greenhouse gases. This Biodiesel Feedstock will be the first new project for Hydrogen Energy, the new BP Announces Significant company launched by BP and Rio Tinto last week, subject North Sea Investment to Boost to regulatory approval. The planned project would be an UK Gas Supplies industrial-scale coal-fired power and carbon capture and storage project. It would generate enough electricity to BP, ABF and DuPont Unveil $400 Million Investment in UK meet 15 per cent of the demand of south west Western Biofuels Australia, while each year capturing and permanently storing about four million tonnes of carbon dioxide which BP and TNK-BP Plan otherwise would have been emitted to the atmosphere.The Strategic Alliance with project would gasify locally-produced coal from the Collie Gazprom as TNK-BP Sells its region to produce hydrogen and carbon dioxide. -

Equilibrium Gasification of Spent Pot Lining from the Aluminum Industry

Equilibrium Gasification of Spent Pot lining from the Aluminum Industry Isam Janajreh1, Khadije Elkadi1, Olawale Makanjuola1, Sherien El-Agroudy2 1Khalifa University of Science and Technology, Mechanical Engineering Department, Abu Dhabi, UAE 1AinShams University, Environment Engineering Department, Cairo, Egypt 2Sharjeh University, Sustainable and Renewable Energy Department, Sharjah, UAE Abstract: The notion of reuse, recycle and reduce is suited for almost all streams of solid waste; including municipal solid waste as well as many streams of industrial wastes. Spent potlining (SPL) is a poisonous and potentially explosive solid waste from aluminum industry that defies this general consensus, being hazardous to reuse, non-recyclable, and increasing with over 2Mt annually. In this work, the technical feasibility of gasification of SPL through equilibrium modeling following different levels of treatment (water washed-WWSPL, acid treated-ATSPL, fully treated-FTSPL) is pursued. The model considers 12 species (CO, H2, CH4, N2, NH3, H2S, COS, H2O and Ash) including the molar ratio of the moderator (H2O) and the oxidizer (O2) to that of the SPL. The process metrics are assessed via the produced syngas fraction (CO and H2), gasification efficiency (GE) and in comparison/validation to the gasification of a baseline bituminous coal. The SPL results for each of the WWSPL, ATSPL, FTSPL, respectively, revealed GE of 40%, 65%, and 75% with corresponding syngas (CO & H2) molar fractions at 0.804 & 0.178, 0.769 & 0.159, and 0.730 & 0.218 at temperatures of 1450 oC, 1100 oC, and 1150 oC. These results suggest the potential and feasibility of gasifying only the treated SPL. Keywords: Spent potlining; Aluminum waste; Gasification; Syngas 1. -

Preparing for Carbon Pricing: Case Studies from Company Experience

TECHNICAL NOTE 9 | JANUARY 2015 Preparing for Carbon Pricing Case Studies from Company Experience: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company Acknowledgments and Methodology This Technical Note was prepared for the PMR Secretariat by Janet Peace, Tim Juliani, Anthony Mansell, and Jason Ye (Center for Climate and Energy Solutions—C2ES), with input and supervision from Pierre Guigon and Sarah Moyer (PMR Secretariat). The note comprises case studies with three companies: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E). All three have operated in jurisdictions where carbon emissions are regulated. This note captures their experiences and lessons learned preparing for and operating under policies that price carbon emissions. The following information sources were used during the research for these case studies: 1. Interviews conducted between February and October 2014 with current and former employees who had first-hand knowledge of these companies’ activities related to preparing for and operating under carbon pricing regulation. 2. Publicly available resources, including corporate sustainability reports, annual reports, and Carbon Disclosure Project responses. 3. Internal company review of the draft case studies. 4. C2ES’s history of engagement with corporations on carbon pricing policies. Early insights from this research were presented at a business-government dialogue co-hosted by the PMR, the International Finance Corporation, and the Business-PMR of the International Emissions Trading Association (IETA) in Cologne, Germany, in May 2014. Feedback from that event has also been incorporated into the final version. We would like to acknowledge experts at Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E)—among whom Laurel Green, David Hone, Sue Lacey and Neil Marshman—for their collaboration and for sharing insights during the preparation of the report. -

Green Parties and Elections to the European Parliament, 1979–2019 Green Par Elections

Chapter 1 Green Parties and Elections, 1979–2019 Green parties and elections to the European Parliament, 1979–2019 Wolfgang Rüdig Introduction The history of green parties in Europe is closely intertwined with the history of elections to the European Parliament. When the first direct elections to the European Parliament took place in June 1979, the development of green parties in Europe was still in its infancy. Only in Belgium and the UK had green parties been formed that took part in these elections; but ecological lists, which were the pre- decessors of green parties, competed in other countries. Despite not winning representation, the German Greens were particularly influ- enced by the 1979 European elections. Five years later, most partic- ipating countries had seen the formation of national green parties, and the first Green MEPs from Belgium and Germany were elected. Green parties have been represented continuously in the European Parliament since 1984. Subsequent years saw Greens from many other countries joining their Belgian and German colleagues in the Euro- pean Parliament. European elections continued to be important for party formation in new EU member countries. In the 1980s it was the South European countries (Greece, Portugal and Spain), following 4 GREENS FOR A BETTER EUROPE their successful transition to democracies, that became members. Green parties did not have a strong role in their national party systems, and European elections became an important focus for party develop- ment. In the 1990s it was the turn of Austria, Finland and Sweden to join; green parties were already well established in all three nations and provided ongoing support for Greens in the European Parliament. -

Restructuring the Australian Economy to Emit Less Carbon: Detailed Analysis

April 2010 Restructuring the Australian Economy to Emit Less Carbon: Detailed Analysis John Daley and Tristan Edis Restructuring the Australian economy to emit less carbon – detailed analysis Founding members Senior Institutional Grattan Institute Report No. 2010-2 April 2010 Affiliates This report of detailed analysis accompanies a publication: National Australia Bank Restructuring the Australian economy to emit less carbon: main report. The main report can be downloaded from the Grattan Institute website This report was written by John Daley, CEO, and Tristan Edis, Research Fellow. Katherine Molyneux, Helen Morrow, Marcus Walsh and Julian Reichl provided extensive research assistance and made substantial contributions to the report. We would like to thank the members of Grattan Institute’s Energy Reference Group for their helpful comments, as well as numerous industry participants and officials for their input. The opinions in this report are those of the authors and do not necessarily represent the views of Grattan Institute’s founding members, Institutional Affiliates affiliates, individual board members or reference group members. Any remaining errors or omissions are the responsibility of the authors. Arup Grattan Institute is an independent think-tank focused on Urbis Australian public policy. Our work is thoughtful, evidence-based, and non-aligned. We aim to improve policy outcomes by engaging with both decision-makers and the community. For further information on Grattan Institute’s Energy program please go to: http://www.grattan.edu.au/programs/energy.php To join our mailing list please go to: http://www.grattan.edu.au/signup.html ISBN: 978-1-925015-03-4 GRATTAN Institute 2010 2 Restructuring the Australian economy to emit less carbon – detailed analysis Table of Contents 1. -

Avg Rtg Corporate Bonds Redeemable Pfd Stock Government

TORCHMARK CORPORATION Bond Exposures $50M and Over From All Operations (Millions of $) December 31, 2014 Amortized Cost ($ millions) Asset- Avg Corporate Redeemable Government Backed Rtg Bonds Pfd Stock & GSE Municipals Securities Total Fair Value BERKSHIRE HATHAWAY INC A 197 - - - - 197 239 GENERAL ELECTRIC CO AA- 113 - - - - 113 148 TENN VALLEY AUTHORITY AAA - - 108 - - 108 107 DUKE ENERGY CORP BBB+ 108 - - - - 108 142 NATIONAL GRID PLC A- 106 - - - - 106 117 FANNIE MAE AAA - - 101 - - 101 107 SOUTHERN CO/THE A 97 - - - - 97 108 EXELON CORP BBB+ 79 17 - - - 97 120 DOW CHEMICAL CO/THE BBB 87 - - - - 87 93 CARGILL INC A 85 - - - - 85 104 CSX CORP BBB+ 85 - - - - 85 101 METLIFE INC BBB+ 70 15 - - - 85 99 JOHNSON CONTROLS INC BBB 83 - - - - 83 96 UNION PACIFIC CORP A- 82 - - - - 82 89 EATON CORP PLC BBB+ 81 - - - - 81 79 COOPERATIEVE CENTRALE RAIFFEIS AA- 81 - - - - 81 96 UNITED TECHNOLOGIES CORP A 81 - - - - 81 84 ENTERPRISE PRODUCTS PARTNERS L BBB+ 80 - - - - 80 91 ATMOS ENERGY CORP A- 79 - - - - 79 88 AGL RESOURCES INC BBB+ 79 - - - - 79 93 NORFOLK SOUTHERN CORP BBB+ 79 - - - - 79 79 DOMINION RESOURCES INC/VA BBB+ 72 6 - - - 79 81 NAVIENT CORP BB 75 - - - - 75 66 FREDDIE MAC AAA - - 74 - - 74 76 US TREASURY AAA - - 74 - - 74 73 GLENCORE PLC BBB 74 - - - - 74 82 NEWMONT MINING CORP BBB 73 - - - - 73 74 AMERICAN INTERNATIONAL GROUP I BBB 71 - - - - 71 80 AT&T INC A- 70 - - - - 70 77 TRAVELERS COS INC/THE BBB+ 25 45 - - - 70 82 LINCOLN NATIONAL CORP BBB+ 69 - - - - 69 83 AMERICAN UNITED MUTUAL INSURAN A- 69 - - - - 69 73 MOSAIC CO/THE BBB -

ALLIANCE 90/THE GREENS: Party Program and Principles the Future Is Green

The future is green. ALLIANCE 90/THE GREENS: Party Program and Principles The future is green. ALLIANCE 90/THE GREENS: Party Program and Principles Preamble 7 I. Our values 7 Ecology is sustainability 8 Freedom is realised through self-determination 8 Extending equitability 9 Democracy is the basis 10 The touchstone of our values: Human rights and non-violence 11 II. Challenges in a changing world 12 III. Where we come from – who we are 16 IV. Twelve for 2020 17 Towards the ecological age 18 I. The fundamental principles of our environmental policy 19 II. Sustainable development as a principle for action 20 III. Economical use of resources and the efficiency revolution 21 IV. Ecology and lifestyle 22 V. New energy – from the fossil and nuclear age to the solar future 22 A key project: Towards the solar age 24 Sustainable development in towns and local areas 25 VI. Environmentally-friendly traffic systems 27 A key project: Ecologically mobile 29 1 The future is green. VII. Nature and landscape conservancy 30 VIII. Animals need rights 31 IX. A global perspective for the environment and development 32 Towards an ecological and social market economy 34 I. The foundations of our economic policy 35 A key project: The future of a united Germany 38 II. Market economy and regulative policy 39 A key project: Transparency for consumers 40 III. Ecological fiscal reform 40 IV. Consumer protection 41 V. The knowledge economy 41 VI. Regional economies 42 A key project: A new form of agriculture 43 VII. A sustainable fiscal policy 45 VIII. -

The Mineral Industry of Australia in 2007

2007 Minerals Yearbook AUSTRALIA U.S. Department of the Interior December 2009 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing Constitution belong to the States and Territories. All powers that countries and ranked among the top 10 countries in the world in relate to mineral resources and their production belong to the the production of bauxite, coal, cobalt, copper, gem and near- States and Territories. Except for the Australian Capital Territory gem diamond, gold, iron ore, lithium, manganese ore, tantalum, (that is, the capital city Canberra and its environs), all Australian and uranium. Reflecting an increase in world demand for States and Territories have identified mineral resources and mineral commodities, the Australian economy grew at a rate of established mineral industries. 3.9% during 2007. Owing to anticipated higher prices of mineral The Mineral Council of Australia (MCA) urged the Federal commodities in the world markets, the Australian economy Government to establish a nationwide project approval process continued expanding and, as a result, surplus productive that would be consistent across all jurisdictions to reduce capacity was expected in the future. Owing to an increase in regulatory burdens that were affecting the mineral sector. In domestic demand and a tightening in the labor market, the addition, 10 principal statutes govern occupational health and consumer price index increased by 4.2% in 2007. safety in Australia, and, according to the MCA, this multilayer Australia’s total mineral exploration spending, excluding regulatory regime imposes a significant administrative burden petroleum, was $1,751.9 million (A$2,061.1 million) in 2007. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Rio Tinto BHP, Tesco, Sainsbury, Arcelormittal, National Grid

Quarterly Engagement Rio Tinto Report July-September BHP, Tesco, 2020 Sainsbury, ArcelorMittal, National Grid 2 LAPFF QUARTERLY ENGAGEMENT REPORT | JULY-SEPTEMBER 2020 lapfforum.org CLIMATE EMERGENCY Puutu Kunti Kurrama and Pinikura Aboriginal Corporation Rio Tinto under pressure from investors over Juukan Gorge As LAPFF has been learning more about “My interaction with Mr. Rio Tinto’s involvement in the destruc- Thompson, in his roles as Chair tion of the historically significant caves of both Rio Tinto and 3i, has been at Juukan Gorge in Western Australia, there have been increasing concerns positive thus far. However, I sense about the company’s corporate govern- that investors are losing confidence ance practices. Consequently, the Forum in his leadership and in his board at – along with other investor groups, most Rio Tinto. It will be a long road back What happened at prominently the Australasian Centre for for the company.” Juukan Gorge? Corporate Responsibility (ACCR) - has been pushing the company to review its Cllr Doug McMurdo In May, Rio Tinto destroyed 46,000-year- corporate governance arrangements. old Aboriginal caves in the Juukan One of the main strategies in this Gorge region of Western Australia. The engagement has been to issue press responding to information issued by explosions were part of a government releases citing LAPFF’s concerns as vari- Australian Parliamentary inquiries into sanctioned mining exploration in ous details of Rio Tinto’s practices were this matter. There appears to be increas- the region. The caves are of cultural revealed through a range of investiga- ing evidence of corporate governance fail- significance to the Puutu Kunti tions.