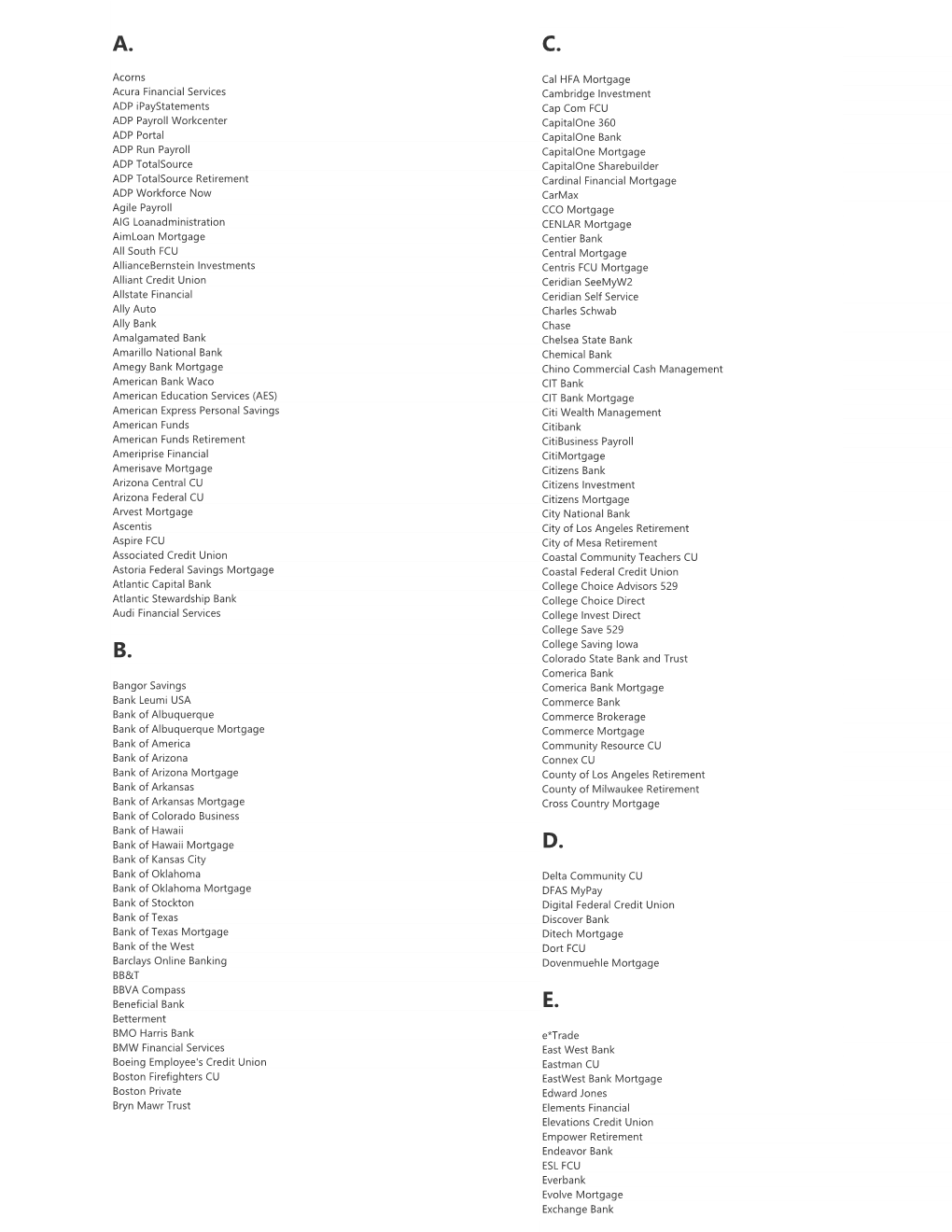

Compatible Financial Institutions List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Fund Finance Symposium

8TH ANNUAL Global Fund Finance Symposium MARCH 21, 2018 NAME _________ GRAND HYATT, NEW YORK 8TH ANNUAL Global Fund Finance Symposium TABLE OF CONTENTS Letter from the Chairman ...3 Agenda at a Glance ............. 4 Session Details .................... 5 Sponsors ............................ 13 Speakers ............................ 31 FFA Leadership .................. 78 2 LETTER FROM THE CHAIRMAN Industry colleagues, The WFF committees have a great set of events planned for As I sit here on a Sunday night, with a glass of pinot in hand, 2018, and a special thanks to each of the firms that are helping trying to think of how to best encapsulate the feeling of the to sponsor these events. To help broaden the audience to 2017 market, my mind keeps wandering off to the pleading include more male participation, we’ve structured a great words of RiRi….. feature panel here today as part of the symposium. It’s my early favorite for winner of Best Panel of the day. “Please don’t stop the, please don’t stop the, please don’t stop the music” Couple of housekeeping notes - this year, we’ll be hosting our Rihanna 2007 (…and investors everywhere in 2017) Sponsor Dinner in London prior to the European symposium. Markets across the board were up, volatility was low, three The European fund finance market continues to grow, and the quarters of global GDP saw a pick-up in year-on-year terms in Board is looking forward to an evening there to both thank 2017, and the IMF is projecting stronger global GDP growth in our participating sponsors, but importantly provide a forum 2018 & 19 than 2017. -

Signature Bank: Fasten Your Seat Belts; It's Going to Be a Bumpy Taxi

Signature Bank | March 31, 2016 MORGAN STANLEY RESEARCH March 31, 2016 MORGAN STANLEY & CO. LLC Ken A Zerbe, CFA Signature Bank [email protected] +1 212 761-7417 Adam Jonas, CFA Fasten Your Seat Belts; It's Going to Be a [email protected] +1 212 761-1726 Steven M Wald Bumpy Taxi Ride … but Worth It [email protected] +1 212 761-0474 Neel Mehta Industry View Stock Rating Price Target [email protected] +1 212 761-8582 In-Line Overweight $163.00 Signature Bank ( SBNY.O, SBNY US ) The negative impact of ride-sharing on the taxi industry should not Midcap Banks / United States of America be underestimated, and could drive sharply higher credit losses in Stock Rating Overweight Industry View In-Line SBNY's taxi portfolio (we estimate a 25% cumulative loss). We Price target $163.00 explore both the risks and offsets to taxi lending, and why SBNY Shr price, close (Mar 30, 2016) $138.26 Mkt cap, curr (mm) $7,038 remains a key Overweight. 52-Week Range $163.15-119.60 Ride-sharing companies pose a significant threat to the taxi industry Fiscal Year Ending 12/15 12/16e 12/17e 12/18e and, by default, to the creditworthiness of taxi medallion borrowers. Our work ModelWare EPS ($) 7.30 8.17 9.36 10.86 with our Autos and Shared Mobility colleague Adam Jonas highlights how Prior ModelWare EPS - 8.27 9.42 10.60 ($) rapidly ride-sharing companies have overtaken taxis in less dense urban Consensus EPS ($)§ 7.21 8.29 9.50 11.00 markets, with more drivers who also broadly earn more per hour than their P/E 21.0 16.9 14.8 12.7 taxi counterparts. -

May 2017 Dear UMB Federal Funds “As Agent” Customer

May 2017 Dear UMB Federal Funds “As Agent” Customer: Attached is an extract of certain reported financial information taken from the most current Call Report data (dated as of December 31, 2016) of the banks that are currently on the “Approved List” provided to participants in our “As Agent” Federal Funds Program. As a participant in that Program, you have appointed us as your agent to place your funds with banks listed on the Approved List, all as provided for in, and governed by, the UMB “As Agent” Federal Funds Program Agreement that you executed with us at the time you started participating in our “As Agent” Program. By allocating your funds among all of the banks identified on the Approved List, you are able to help reduce your concentration of credit with any given individual bank on the list. We suggest that you present and review this information (together with the terms of your executed UMB “As Agent” Federal Funds Program Agreement) with your Board of Directors, and retain both for your permanent records and regulatory and audit review, since you and your Board of Directors have the ultimate responsibility to track and approve those banks to whom your federal funds are sold. We are also pleased to provide the following information for UMB Bank, n.a. as of March 31, 2017, which you should also retain related to the requirements of Regulation F. UMB Bank, n.a. Tier 1 Risk-based Capital Ratio 10.83 % Total Risk-based Capital Ratio 11.46 % Tier 1 Leverage Ratio 8.26 % * Full Reg F disclosure on second page I appreciate that you have elected to appoint us as your agent to facilitate your federal funds transactions under our “As Agent” program. -

The Securities and Exchange Commission Has Not Necessarily Reviewed the Information in This Filing and Has Not Determined If It Is Accurate and Complete

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. The reader should not assume that the information is accurate and complete. UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL Washington, D.C. 20549 OMB Number: 3235-0006 FORM 13F Expires: July 31, 2015 Estimated average burden FORM 13F COVER PAGE hours per response: 23.8 Report for the Calendar Year or Quarter Ended: 03-31-2019 Check here if Amendment Amendment Number: This Amendment (Check only one.): is a restatement. adds new holdings entries. Institutional Investment Manager Filing this Report: Name: AMALGAMATED BANK Address: 275 SEVENTH AVENUE 9TH FLOOR NEW YORK, NY 10001 Form 13F File 028-04148 Number: The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: GREGORY W SPOCK VICE PRESIDENT - TRUST COMPLIANCE Title: OFFICER Phone: 212-895-4836 Signature, Place, and Date of Signing: GREGORY W SPOCK NEW YORK, NY 05-15-2019 [Signature] [City, State] [Date] Report Type (Check only one.): X 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) 13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager(s).) 13F COMBINATION REPORT. -

Nationally Approved Lenders, Visit

Together, America Prospers Active Single Family Housing Guaranteed Loan Program (SFHGLP) Lenders Maine Oregon Alabama Maryland Pennsylvania Alaska Massachusetts Puerto Rico Arizona Michigan Rhode Island Arkansas Minnesota South Carolina California Mississippi South Dakota Colorado Missouri Tennessee Connecticut Montana Texas Delaware Nebraska Utah Florida Nevada Vermont Georgia New Hampshire Virginia Hawaii New Jersey Washington Idaho New Mexico West Virginia Illinois New York Western Pacific Indiana North Carolina Wisconsin Iowa North Dakota Wyoming Kansas Ohio Kentucky Oklahoma Louisiana This list includes institutions that have recently originated a Single Family Housing Guaranteed Loan in the state listed. For a complete list of nationally approved lenders, visit https://www.rd.usda.gov/files/SFHGLDApprovedLenders.pdf. If you have a question regarding this list, contact the Single Family Housing Guaranteed Loan Program (SFHGLP) Lender and Partner Activities branch at [email protected]. Active Single Family Housing Guaranteed Lenders Alabama 1STwww.1stalliancelending.com ALLIANCE LENDING, LLC. ARCADIAwww.arcadialending.com FINANCIAL GROUP, LLC CAHABAwww.cahabamortgage.com HOME MORTGAGE, LLC A MORTGAGEwww.amortgageboutique.com BOUTIQUE, LLC ARK-LA-TEXwww.benchmark.us FINANCIAL SERVICES, LLC DBA CALCONwww.onetrusthomeloans.com MUTUAL MORTGAGE, LLC ACADEMYwww.academymortgage.com MORTGAGE CORPORATION ARMYwww.allincu.com AVIATION CENTER FEDERAL CREDIT CALIBERhttps://www.caliberhomeloans.com/ HOME LOANS, INC. UNION ACOPIA,www.acopiahomeloans.com -

Financial Services Fund

SCHEDULE OF INVESTMENTS (Unaudited) June 30, 2020 FINANCIAL SERVICES FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 99.9% Taubman Centers, Inc. 450 $ 16,992 Park Hotels & Resorts, Inc. 1,650 16,318 REITs - 30.1% Macerich Co.1 1,374 12,325 American Tower Corp. — Class A 474 $ 122,548 Crown Castle International Corp. 566 94,720 Total REITs 2,230,982 Prologis, Inc. 998 93,143 BANKS - 25.4% Equinix, Inc. 126 88,490 JPMorgan Chase & Co. 1,968 185,110 Digital Realty Trust, Inc. 496 70,487 Bank of America Corp. 6,585 156,394 SBA Communications Corp. 225 67,032 Citigroup, Inc. 2,218 113,340 Public Storage 339 65,051 Wells Fargo & Co. 4,313 110,413 AvalonBay Communities, Inc. 334 51,650 Morgan Stanley 2,038 98,435 Equity Residential 875 51,468 Goldman Sachs Group, Inc. 477 94,265 Simon Property Group, Inc. 743 50,806 U.S. Bancorp 2,210 81,372 Welltower, Inc. 975 50,456 Truist Financial Corp. 2,040 76,602 Alexandria Real Estate Equities, Inc. 307 49,811 PNC Financial Services Group, Inc. 695 73,121 Realty Income Corp. 823 48,968 Bank of New York Mellon Corp. 1,695 65,512 Weyerhaeuser Co. 2,045 45,931 State Street Corp. 833 52,937 Invitation Homes, Inc. 1,574 43,332 First Republic Bank 440 46,636 Essex Property Trust, Inc. 187 42,855 Northern Trust Corp. 564 44,748 Healthpeak Properties, Inc. 1,547 42,635 HDFC Bank Ltd. ADR 931 42,323 Boston Properties, Inc. 464 41,936 M&T Bank Corp. -

August 2019 Dear UMB Federal Funds “As Agent” Customer

August 2019 Dear UMB Federal Funds “As Agent” Customer: Attached is an extract of certain reported financial information taken from the most current Call Report data (dated as of March 31, 2019) of the banks that are currently on the “Approved List” provided to participants in our “As Agent” Federal Funds Program. As a participant in that Program, you have appointed us as your agent to place your funds with banks listed on the Approved List, all as provided for in, and governed by, the UMB “As Agent” Federal Funds Program Agreement that you executed with us at the time you started participating in our “As Agent” Program. By allocating your funds among all of the banks identified on the Approved List, you are able to help reduce your concentration of credit with any given individual bank on the list. We suggest that you present and review this information (together with the terms of your executed UMB “As Agent” Federal Funds Program Agreement) with your Board of Directors, and retain both for your permanent records and regulatory and audit review, since you and your Board of Directors have the ultimate responsibility to track and approve those banks to whom your federal funds are sold. We are also pleased to provide the following information for UMB Bank, n.a. as of June 30, 2019, which you should also retain related to the requirements of Regulation F. UMB Bank, n.a. Tier 1 Risk-based Capital Ratio 11.51 % Total Risk-based Capital Ratio 12.11 % Tier 1 Leverage Ratio 8.80 % * Full Reg F disclosure on second page I appreciate that you have elected to appoint us as your agent to facilitate your federal funds transactions under our “As Agent” program. -

February 2021 Dear UMB Federal Funds

February 2021 Dear UMB Federal Funds “As Agent” Customer: Attached is an extract of certain reported financial information taken from the most current Call Report data (dated as of September 30, 2020) of the banks that are currently on the “Approved List” provided to participants in our “As Agent” Federal Funds Program. As a participant in that Program, you have appointed us as your agent to place your funds with banks listed on the Approved List, all as provided for in, and governed by, the UMB “As Agent” Federal Funds Program Agreement that you executed with us at the time you started participating in our “As Agent” Program. By allocating your funds among all of the banks identified on the Approved List, you are able to help reduce your concentration of credit with any given individual bank on the list. We suggest that you present and review this information (together with the terms of your executed UMB “As Agent” Federal Funds Program Agreement) with your Board of Directors, and retain both for your permanent records and regulatory and audit review, since you and your Board of Directors have the ultimate responsibility to track and approve those banks to whom your federal funds are sold. We are also pleased to provide the following information for UMB Bank, n.a. as of December 31, 2020, which you should also retain related to the requirements of Regulation F. UMB Bank, n.a. Tier 1 Risk-based Capital Ratio 11.92 % Total Risk-based Capital Ratio 12.81 % Tier 1 Leverage Ratio 8.28 % * Full Reg F disclosure on second page I appreciate that you have elected to appoint us as your agent to facilitate your federal funds transactions under our “As Agent” program. -

Of 6 Voya Mid Cap Research Enhanced Index Fund Portfolio Holdings As of August 31, 2021 (Unaudited)

Voya Mid Cap Research Enhanced Index Fund Portfolio Holdings as of August 31, 2021 (Unaudited) Ticker Security Name Crncy Country Price Quantity Market Value TXG 10X Genomics, Inc. USD United States 175.92 396 $69,664 AYI Acuity Brands, Inc. USD United States 184.53 4,771 $880,393 ADNT Adient plc USD Ireland 39.34 5,716 $224,867 ATGE Adtalem Global Education, Inc. USD United States 37.00 6,929 $256,373 WMS Advanced Drainage Systems, Inc. USD United States 114.15 679 $77,508 AGCO AGCO Corp. USD United States 137.62 6,556 $902,237 A Agilent Technologies, Inc. USD United States 175.47 2,683 $470,786 AKAM Akamai Technologies, Inc. USD United States 113.25 1,678 $190,034 ACI Albertsons Cos, Inc. USD United States 30.36 4,296 $130,427 Y Alleghany Corp. USD United States 676.69 122 $82,556 ALLE Allegion Public Ltd. USD United States 143.99 1,644 $236,720 ADS Alliance Data Systems Corp. USD United States 98.11 2,316 $227,223 ALSN Allison Transmission Holdings, Inc. USD United States 36.98 7,557 $279,458 ALLY Ally Financial, Inc. USD United States 52.90 7,850 $415,265 ATUS Altice USA, Inc. USD United States 27.44 7,544 $207,007 DOX Amdocs Ltd. USD United States 77.03 3,082 $237,406 AMED Amedisys, Inc. USD United States 183.45 2,492 $457,157 ACC American Campus Communities, Inc. USD United States 50.85 12,701 $645,846 AEO American Eagle Outfitters, Inc. USD United States 30.52 8,022 $244,831 AMH American Homes 4 Rent USD United States 41.94 3,382 $141,841 AWK American Water Works Co., Inc. -

T. Rowe Price® Moderate Allocation

ANNUAL REPORT December 31, 2020 T. ROWE PRICE Moderate Allocation Portfolio For more insights from T. Rowe Price investment professionals, go to troweprice.com. arpsp_1220_P5Proof # T. ROWE PRICE MODerate ALLocatioN PortfoLIO HIGHLIGHTS n The Moderate Allocation Portfolio returned 14.54% in the 12 months ended December 31, 2020, outperforming its combined index portfolio benchmark and its Lipper peer group average. n Favorable tactical allocation decisions and security selection in the portfolio’s underlying investments drove outperformance. The inclu- sion of diversifying sectors such as real assets equities and high yield bonds had a negative impact on relative results due to height- ened volatility and risk aversion early in the year. n We have a balanced view of the current market and are neutral between stocks and bonds. We tilted to an overweight to international stocks relative to U.S. stocks. After being overweight to growth stocks in the U.S. for much of the year, we shifted to an overweight to value stocks. n We believe that the Moderate Allocation Portfolio’s diversification and flexibility to identify investment opportunities across sectors and regions should allow us to generate solid long-term returns in a variety of market environments. Go Paperless It’s fast—receive your statements and Sign up for e-delivery of your statements, confirmations, confirmations faster than U.S. mail. and prospectuses or shareholder reports. It’s convenient—access your important account TO ENROLL: documents whenever you need them. If you invest directly with T. Rowe Price, It’s secure—we protect your online accounts using go to troweprice.com/paperless. -

Authorized Depositories Region 9

UNITED STATES TRUSTEE OFFICE FOR REGION 9 Uniform Depository Agreements for Region 9 (Ohio and Michigan) As of 9/1/2021 Allegiance Bank Key Bank, NA Axos Bank LaSalle Bank, NA Banc of California, N.A. Level One Bank Bank of New York Mellon Macatawa Bank - *W Bank of Texas MB Financial Bank, N.A. Bank of Kansas City Mechanics Bank BOKF N.A. dba Bank of Texas Metropolitan Commercial Bank BOKF N.A. dba Mobank New York Community Bank Bank of the West Old National Bank Cadence Bank NA Peoples Bank California Republic People’s United Bank Capital One NA Pinnacle Bank CIBC Bank PNC Bank, NA - ** Citibank NA The Private Bank Citizens Bank NA River Valley Bank Citizens National Bank of SW Ohio Signature Bank City National Bank Stearns Bank/Holdingford/Upsala NA Comerica Bank Sterling Bank Commerce Bank TD Bank - *E Cortland Savings & Banking Co -*N Traverse City State Bank - *W East West Bank Tristate Capital Bank Emigrant Mercantile Bank Truist Bank EncoreBankNA UMB Bank NA - *N FC Bank, a division of CNB Bank Union Bank Fifth Third Bank United Bank First Bank, UP - *W U.S. Bank NA -*E, *N, *S First Federal Bank of Midwest Veritex Community Bank First Federal Community Bank Virginia National Bank First Financial Bank, NA Wachovia Bank NA - *N First Independence Bank Wells Fargo Bank NA The First National Bank of Dennison WesBanco Bank First Source Bank - *W Western Alliance Bank (First) 1st State Bank Wolverine Bank The Freedom Bank of Virginia Zions First National Bank The Home Loan Savings Bank Home Savings and Loan *N *E – Eastern District of Michigan only. -

PPP Lender Activity Lookup.Xlsx

The Citizens Bank ID The Bancorp Bank ID Bank of Bridger, National Association ID MetaBank, National Association ID First Northern Bank of Wyoming ID America's Christian CU ID The State Bank ID Catlin Bank ID UniBank ID FinWise Bank ID Community First Bank ID Rock Canyon Bank ID HOMEBANK ID First State Bank Southwest ID Settlers Bank ID First Financial Bank ID John Marshall Bank ID Pioneer Trust Bank, National Association ID First Federal Bank & Trust ID Great Southern Bank ID United Community Bank ID FMS Bank ID Dacotah Bank ID First Savings Bank ID Madison Valley Bank ID People's United Bank, National Association ID American Bank of Commerce ID Small Business Bank ID Central National Bank ID Alaska USA FCU ID Thayer County Bank ID First Federal Savings Bank ID Pinnacle Bank ID Northrim Bank ID The Converse County Bank ID Unity Bank ID NebraskaLand National Bank ID McCurtain County National Bank ID First Financial Northwest Bank ID River Valley Community Bank ID BMO Harris Bank National Association IL JPMorgan Chase Bank, National Association IL Updated as of April 23, 2020 Fifth Third Bank IL CIBC Bank USA IL Wintrust Bank, National Association IL First Midwest Bank IL PNC Bank, National Association IL Busey Bank IL The Huntington National Bank IL Village Bank and Trust, National Association IL Wheaton Bank & Trust Company, National IL Association Morton Community Bank IL Byline Bank IL First American Bank IL First Mid Bank & Trust, National Association IL Signature Bank IL Hinsdale Bank & Trust Company, National IL Association Midland States Bank IL American Community Bank & Trust IL Lake Forest Bank & Trust Company, IL National Association West Suburban Bank IL Cornerstone National Bank & Trust IL Company The First National Bank of Ottawa IL Barrington Bank & Trust Company, National IL Association Heartland Bank and Trust Company IL Northbrook Bank & Trust Company, IL National Association St.