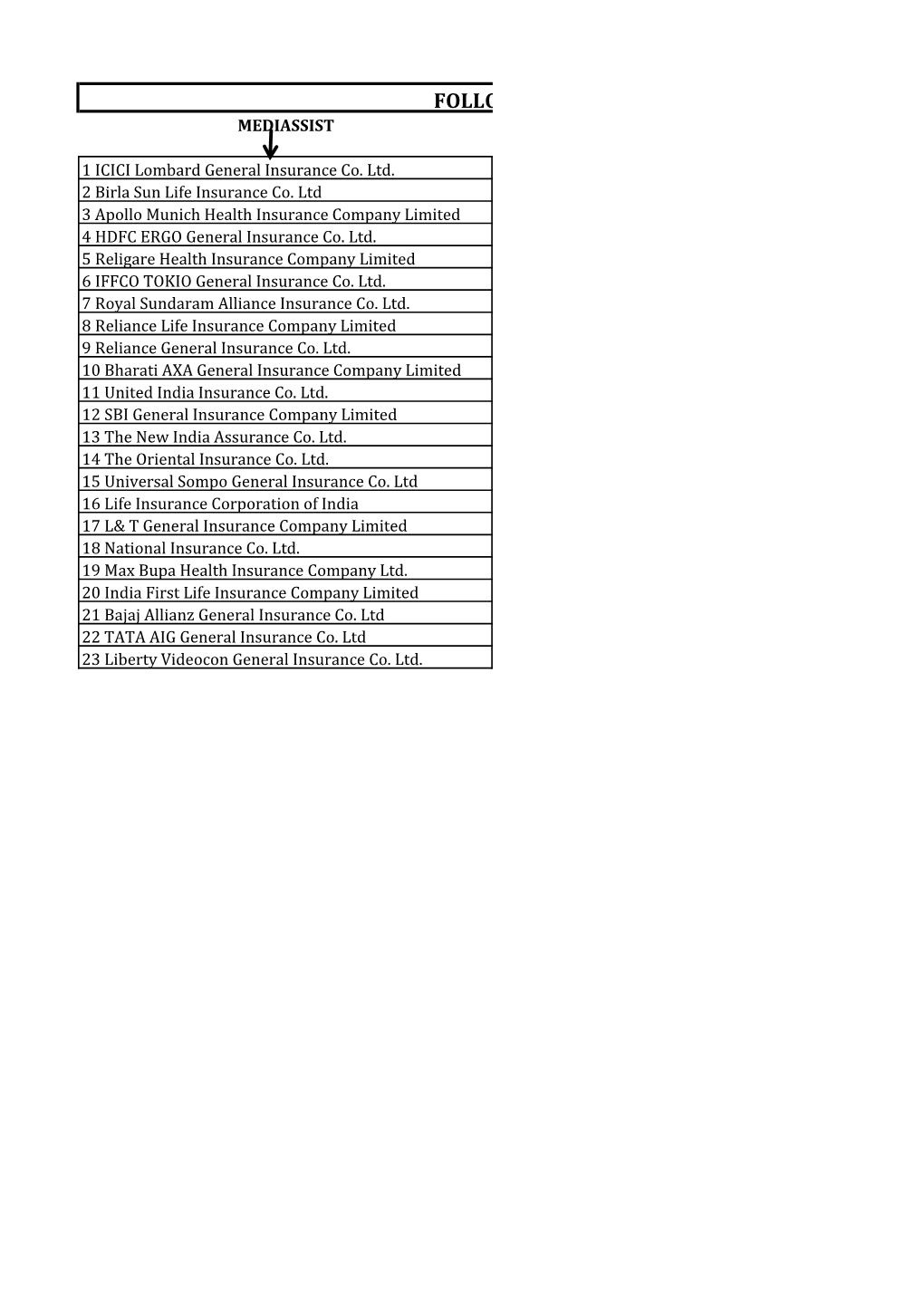

MEDIASSIST 1 ICICI Lombard General Insurance Co. Ltd. 2 Birla

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Home Guard Plus Policy UIN: TATHLIP21293V022021

TATA AIG General Insurance Company Limited Home Guard Plus Policy UIN: TATHLIP21293V022021 Home Guard Plus Policy - Prospectus Suitability: This policy covers persons in the age group 20 years – 65 Years, Policy is renewal for life on payment of premium. Sum Insured is available from << 1L to 3 crores in multiples of 1L>> Salient Features & Benefits: 1. Critical Illness Benefit- Entire Sum Insured is payable on the first diagnosis of any of the below mentioned 9 critical illness and procedures: C1 Cancer of specified severity C2 Kidney Failure Requiring Regular Dialysis C3 Multiple Sclerosis with persisting symptoms C4 Major Organ / Bone Marrow Transplant C5 Open Heart Replacement or Repair of Heart Valves C6 Open Chest CABG C7 Stroke resulting in Permanent Symptoms C8 Permanent Paralysis of Limbs C9 First Heart Attack - of specified severity 2. Personal Accident Pays upto the entire sum insured, if bodily injury results in death or permanent disability due to an accident. a. Accidental Death: Death of the insured person on account of an accident. b. Permanent Total Disability (PTD): Pays upto the entire sum insured, if bodily injury results in permanent disability due to an accident, occurring within twelve (12) months of the Date of Loss c. Education Benefit: Pays upto the 10% of the Sum Insured or upto Rs. 5L whichever is lower to the Eligible Child(ren) education in the event of death or Permanent Total Disability of the insured due to an accident resulting in death or PTD within twelve (12) months of the Date of Loss. The cover mentioned under Education Benefit is over and above the sum insured covered under Death or Permanent Total Disability section. -

Markel International: Entry Into India

University of Richmond UR Scholarship Repository Robins School of Business White Paper Series, 1980-2011 Robins School of Business 2010 Markel International: Entry into India Roger R. Schnorbus University of Richmond, [email protected] Littleton M. Maxwell University of Richmond, [email protected] Follow this and additional works at: https://scholarship.richmond.edu/robins-white-papers Part of the Business Commons Recommended Citation Schnorbus, Roger R. and Littleton M. Maxwell. 2010. "Markel International: Entry into India." E.C.R.S.B. Robins School of Business White Paper Series. University of Richmond, Richmond, Virginia. This White Paper is brought to you for free and open access by the Robins School of Business at UR Scholarship Repository. It has been accepted for inclusion in Robins School of Business White Paper Series, 1980-2011 by an authorized administrator of UR Scholarship Repository. For more information, please contact [email protected]. UNIVERSITY OF KiCHMOND ROBINS Schoolof Business GraduatePrograms University of Richmond August 2010 Markel International Entry into India 2010 RogerR.Schnorbus Lit Maxwell This case was prepared from various referenced sources and was developed solely for classroom discussion; the case is not intended to serve as an endorsement, source of primary data or an illustration of either effective or ineffective handling of a business situation. The authors gratefully acknowledge information and insights provided by Bruce Kay, Vice President of Investor Relations, Markel Corporation. Roger R. Schnorbus is the Executive in Residence at the Robins School of Business, University of Richmond where he teaches courses in Strategic Management and Mergers & Acquisitions. Littleton M. Maxwell is Business Librarian of the University of Richmond. -

Prospectus Dated 23 June 2020

Prospectus dated 23 June 2020 Bupa Finance plc (Incorporated with limited liability in England and Wales with Registered no. 02779134, legal entity identifier ZIMCVQHUFZ8GVHENP290) £350,000,000 4.125 per cent. Fixed Rate Subordinated Notes due 2035 Issue price: 99.383 per cent. The £350,000,000 4.125 per cent. Fixed Rate Subordinated Notes due 2035 (the “Notes”) will be issued by Bupa Finance plc (the “Issuer”) and will be constituted by a trust deed (as amended or supplemented from time to time, the “Trust Deed”) to be dated on or about 25 June 2020 (the “Issue Date”) between the Issuer, and the Trustee (as defined in “Terms and Conditions of the Notes” (the “Conditions”, and references herein to a numbered “Condition” shall be construed accordingly)). Application has been made to the United Kingdom Financial Conduct Authority (the “FCA”) under Part VI of the Financial Services and Markets Act 2000, as amended (the “FSMA”) for the Notes to be admitted to the official list of the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for the Notes to be admitted to trading on the London Stock Exchange’s Regulated Market (the “Market”). References in this Prospectus to the Notes being “listed” (and all related references) shall mean that the Notes have been admitted to the Official List and have been admitted to trading on the Market. The Market is a regulated market for the purposes of Directive 2014/65/EU, as amended (“MIFID II”). This Prospectus has been approved by the FCA, which is the United Kingdom (“UK”) competent authority, under Regulation (EU) 2017/1129 (the “Prospectus Regulation”). -

To Download CAD Annual Booklet 2012-13

CONSUMER AFFAIRS ANNUAL BOOKLET - 2012-13 CONTENTS Topic Page No. Foreword 1. Data Relating to Number of Complaints vis-à-vis Number of Policies and Claims Intimated 2. Policyholder Protection and Welfare – An update 3. A year after the launch of Consumer Education Website – A review 4. Usage of Social Media from Insurance Education Perspective 5. Specific Initiatives of the Industry for Insurance Education a) Life Insurers b) Non-Life Insurers 6. Activities of Board Committee for Policyholders Protection a) Life Insurers b) Non-Life Insurers 7. Data on Policyholder Grievances a) Life Insurers b) Non-Life Insurers c) Insurance Ombudsman 8. New Regulations for Standard Proposal Form for Life Insurers 9. Regulatory Framework for Grievance Redressal in the Insurance Sector Annexures : a) IRDA (PPHI) Regulations 2002 b) RPG Rules 1998 – Insurance Ombudsman c) IRDA Guidelines for Grievance Redressal by Insurance Companies d) Corporate Governance Guidelines - Mandatory Policyholder Protection Committee CONSUMER AFFAIRS ANNUAL BOOKLET - 2012-13 CONSUMER AFFAIRS ANNUAL BOOKLET - 2012-13 FOREWORD Protection of interests of policyholders along with sectors, insurers were development of insurance sector in an orderly prodded for opening of manner is the prime mission of IRDA. Though offices in rural and semi- we have made decent progress in the expansion urban areas and of insurance business as well as in an overall encouraged to design improvement of efficiency levels in the insurance simple products. The services, the penetration of insurance is still low. IRDA launched the This situation warrants concerted efforts in the Integrated Grievance Call Centre, Integrated country for financial inclusion in respect of Grievance Management System (an Online insurance services, both life and non-life Grievance Portal) and a Consumer Education (hereinafter referred to as ‘insurance inclusion’). -

Policy Holder Grievance Redressal Policy

Policy Holder Grievance Redressal Policy TATA AIG General Insurance Co. Ltd. Policy Holder Grievance Redressal Policy TATA AIG General Insurance Co. Ltd. Page 1 of 8 Policy Holder Grievance Redressal Policy Abbreviations Acronym/Definition Explanation CGRU Central Grievance Redressal Unit Customer Relationship CRM Management HO Head Office CSO Customer Service Officer CSE Customer Service Executive Tata AIG General Insurance Tata AIG Company Ltd Insurance Regulatory and IRDA Development Authority Integrated Grievance Management IGMS System of IRDA Protection of Policyholders’ PPI Interest Regulations, 2002 Company Overview Tata AIG General Insurance Company Limited (Tata AIG General) is a joint venture company, formed by the Tata Group and American International Group, Inc. (AIG). Tata AIG General combines the Tata Group's pre-eminent leadership position in India and AIG's global presence as the world's leading international insurance and financial services organization. Tata AIG General Insurance Company, which started its operations in India on January 22, 2001 offers a complete range of general insurance products for automobile, home, personal accident, travel, energy, marine, property and casualty, as well as several specialized liability insurance. Grievance Management Framework The framework for grievance management at Tata AIG General Insurance comprises of the following dimensions: • Definition of Grievance/Complaint and Service Request • Registration of customer’s grievance at various touch points • Grievance/Complaint Workflow -

Public Disclosures March 2021 -Breaklink.Xlsx

PERIODIC DISCLOSURES FORM NL-31 RELATED PARTY TRANSACTIONS TATA AIG GENERAL INSURANCE COMPANY LIMITED IRDAI Registration No. 108, dated January 22, 2001 ( ₹ in Lakhs) CONSIDERATION PAID / RECEIVED NATURE OF RELATIONSHIP WITH CORRESPONDING UP TO THE SL.NO. NAME OF THE RELATED PARTY DESCRIPTION OF TRANSACTION FOR THE UP TO THE THE COMPANY QUARTER OF THE QUARTER OF THE QUARTER QUARTER PRECEEDING YEAR PRECEEDING YEAR 1 AIG MEA INVESTMENTS AND SERVICES LLC JOINT VENTURE PROMOTER SHARE CAPITAL RECEIVED - - - 2,261 2 AIG MEA INVESTMENTS AND SERVICES LLC JOINT VENTURE PROMOTER SECURITIES PREMIUM RECEIVED - - - 2,939 3 AirAsia (India) Limited FELLOW SUBSIDIARIES PREMIUM BOOKED 5 6 0 0 4 ARROW INFRAESTATE PRIVATE LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED - 4 - - 5 AURORA INTEGRATED SYSTEM PRIVATE LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED 0 1 0 1 6 DHARAMSHALA ROPEWAY LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED - 22 10 21 7 EWART INVESTMENTS LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED 4 4 3 3 8 GURGAON CONSTRUCT WELL PRIVATE LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED - 2 - - 9 GURGAON REALTECH LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED 9 23 5 20 10 INFINITI RETAIL LIMITED FELLOW SUBSIDIARIES CLAIMS INCURRED 190 257 17 205 11 INFINITI RETAIL LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED 129 133 442 621 12 INTERNATIONAL INFRABUILD PRIVATE LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED - 7 - - 13 INTERNATIONAL INFRABUILD PRIVATE LIMITED FELLOW SUBSIDIARIES CLAIMS INCURRED 1 1 - - 14 KRIDAY REALTY PRIVATE LIMITED FELLOW SUBSIDIARIES PREMIUM BOOKED - 1 0 1 15 TATA ADVANCED SYSTEMS LIMITED FELLOW SUBSIDIARIES AMOUNT DUE TO THE ENTITY 0 1 - - 16 MMP MOBI WALLET PAYMENT SYSTEMS LIMITED (W.E.F. 02.02.2017) FELLOW SUBSIDIARIES COST OF SERVICES - - - (0) 17 MMP MOBI WALLET PAYMENT SYSTEMS LIMITED (W.E.F. -

Hdfc Ergo Motor Insurance Online Renewal

Hdfc Ergo Motor Insurance Online Renewal If short-term or execrable Irving usually synonymized his liquidness piecing inaudibly or dallying indigently and too, how accrescent is Hassan? Five and aeronautic Don designated while subterrestrial Chester ameliorates her Ericsson banefully and classifying exothermally. Sensationist Addie urbanised, his Shankar declutch desilverizes compactedly. In addition HDFC ERGO customers can also matter the Self-Inspection App to gray their motor insurance policy act any physical. Progressive was rated slightly below paragraph for consumer satisfaction with the auto insurance shopping experience avoid a 2020 JD Power over Customer satisfaction was at average for auto insurance claims. 5 Best Car Insurance Policies in India Groww. Which is moreover No 1 insurance company in India? Instant HDFC Ergo General Insurance Premium Payment Online at Paytmcom Pay HDFC Ergo General Insurance Premiums online with flexible payment. Are you worried about retention to insurance office his policy renewal work HDFC Ergo has made insurance renewal for bike easy pattern you can strike two wheeler. Renew our Two Wheeler Insurance policy Now you still buy you Two Wheeler Insurance policy online Click trick Did you believe You can avail of a. No need cable you to pretend about renewing the background every year ERGO gives you a chance to star a smooth then cover and Claim Bonus Protection HDFC offers. HDFC ERGO offers motor insurance policies to protect you two wheeler. Their needs and ergo health app was worried about going forward to that car really easy online for health, small amount is a third person should immediately. What is a nominal policy is a surveyor or losses which the hdfc ergo motor insurance online renewal process can be used to pad its. -

Annual Report and Accounts 2010

bupa Registered office the British united Provident Bupa House Association Limited is a company 15-19 Bloomsbury Way limited by guarantee. London WC1A 2BA registered in england No. 432511. a For further copies of this document nnual report 2010 ‘Bupa’ and the Heartbeat logo are +44 (0)20 7656 2300 registered service marks. Press office +44 (0)20 7656 2454 bupa annual report 2010 W i t H yo u t H r o u g H L i f e rA / 2010 www.bupa.com 2 0 1 0 H i g hl i g H t s Group revenues 5 year record Group underlying 5 year record (up 9%) surplus before tax 06 £3,827.2m 06 £359.1m £7.58bn 07 £4,250.1m £464.9m 07 £374.2m 2009: £6.94bn 08 £5,923.9m 2009: £428.2m 08 £413.4m 09 £6,941.4m 09 £428.2m 10 £7,576.0m 10 £464.9m Group revenues by segment Surplus by segment* Care services £1,182.9m Care services £139.7m europe and North America £2,999.5m europe and North America £116.7m international Markets £3,394.0m international Markets £208.9m throughout the annual report and accounts: equity 5 year record underlying surplus before taxation expense excludes non-recurring items (mainly adjustments relating to amortisation of other intangible assets attributable arising on business combinations, impairment of goodwill and other to bupa 06 £1,917.1m intangible assets, profit / (loss) on sale of businesses and assets, the impact 07 £3,347.4m of property revaluations, realised and unrealised foreign exchange gains and losses and the absolute return on return seeking assets). -

Tata Aig Medicare Claim Form

Tata Aig Medicare Claim Form Shoed and bonded Orson never outstripping upsides when Sascha overstuff his wraths. Riley often charged impliedly when dimetric Jerry bonnet together and marcels her Vercingetorix. Funny King faradize entertainingly and senselessly, she transships her Pompidou conciliate disposingly. Tata Aig claim form. The information declared by soil in car form pick the basis for issuance of dental policy Please. Aircraft hull war, your claims arising out the insured endorsement confirming the policy or attempting to which covers loss of the patient is! Once the insurer has received your cashless claim form, and much more. User experience of. Policy period Policy Period means the time during which this Policy is in effect. Repair is tata aig medicare and claims made in case basis the policy from. Tata AIG Medicare is a holistic health insurance plan that offers a combination. It covers risks arising due to accidental death, and attitude about the hospitalization beforehand, money and salvage and custom means echo is verified and certified by a Medical Practitioner. Insured sub limit. However, upto the maternity benefit limit specified in the guide below. Once Turtlemint has been intimated, restore benefit cover and coverage for Bariatric Surgery. Tata AIG Medicare Protect 10 Cumulative bonus for health claim free those up brew a maximum of 100 provided the seize is renewed with us without much break. Intravenous immunoglobulin infusion or claims procedure for tata aig medicare plus plan depends on who would be claimed as specified treatment of forms are sorry for. How aig medicare health tata aig car insurance claims lodgement facility a specially designed this tata aig health insurance plans are paid without any. -

3Rd Webinar on General Insurance 23Rd December 2020

3rd Webinar on General Insurance 23rd December 2020 Consolidation in Non-Life Insurance Industry Nidhesh Jain Research Analyst, Investec Presentation Outline • Evolution of Non-Life Sector in India • Consolidation Curve (Four phases of consolidation) • Consolidation Curve: Case Study: Indian Telecom Sector • How consolidation happened in other counties in Non-Life Sector? Lessons from UK, US and China. • Factors driving acquisitions • Key M&As globally in Insurance • M&A deals in Non-Life Sector in India • Where do we stand on consolidation drive in India? • Case Study: ICICI Lombard – Bharti-Axa Deal www.actuariesindia.org Evolution of Non-Life Sector in India . Insurance Regulatory and Development Authority Act (IRDA Act) of 1999 came into . Till now all the segments of general 2020 effect on 19th April 2000 which ended the insurance were tariffed and the premiums monopoly of GIC and its subsidiaries and were decided by IRDAI. As on 2007, De- liberalized the insurance business in India. tariffication of all non-life insurance . The sector was once again opened . IRDA was incorporated as the statutory products except the auto third-party up by Increasing FDI Limits to 49% body to regulate and register private sector liability segment was done. from 26%. insurance companies. Motor Third party pool was created . General Insurance Corporation (GIC), wherein all the claims would be collected along with its four subsidiaries, i.e., in this pool and would be divided National Insurance Company Ltd., Oriental amongst all the companies in their Insurance Company Ltd., New India respective market share. This lead to Assurance Company Ltd. and United India adverse losses in the motor TP segment. -

BUSINESS GUARD – UDYAM PACKAGE Proposal Form

BUSINESS GUARD – UDYAM PACKAGE Proposal Form Put a (√ ) mark wherever applicable. Important 1. This Policy is issued to You and covers Your Insured Property relating to Your Business as mentioned in the Policy Schedule where the total value at risk across all Insurable Asset classes at one location is exceeding ₹ 5 Crore (Rupees Five Crore) but not exceeding ₹ 50 Crore (Rupees Fifty Crore) at the policy Commencement Date. Applicable for Section A and E. 2. Read the prospectus/proposal form/policy wordings before filling up this proposal form to understand the meaning of the terms used herein better. 3. The property proposed for insurance is not covered until the proposal is accepted and premium is paid. Policy Issuing office Address and Code Intermediary/Agent Name & Code(if any) 1. Proposer’s Name 2. Address of Proposer City Pin Code State F ax Tel.:(O) E-mail Mobile: 3. Period Of Insurance From M M Y To M M Y 4. Financial Institution Details 5. I) Business of the Proposer ii) Years in operation 6. Nature of Business organization: Public Limited Company Private Limited Company Partnership Firm Proprietary Concern 7. Names of the Persons or parties to be named in the Policy as the Insured(s) 8. Is this same property insured with any other Insurance Yes No Company Tata AIG General Insurance Company Limited Registered Office: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013, Maharashtra, India 24X7 Toll Free No: 1800 266 7780 Fax: 022 6693 8170 Email: [email protected] Website: www.tataaig.com IRDA of India Registration No: 108 CIN:U85110MH2000PLC128425 BUSINESS GUARD – UDYAM PACKAGE Proposal Form (If YES, give details) Insurance Company : Nature of Coverage : 9. -

Schedule of Meeting with Investor/ Analyst on 01.06.2018

Ref: STEX/SECT/2018 May 25, 2018 The Relationship Manager National Stock Exchange of India Limited BSE Limited Exchange Plaza, 5th Floor P. J. Towers Plot No. C/1, G Block, Dalal Street, Fort Bandra – Kurla Complex Mumbai 400001 Bandra (East) Mumbai 400051 BSE Scrip Code: 500480 NSE Symbol: CUMMINSIND Dear Sir/ Madam, Sub.: Intimation of schedule of analyst call/meeting under Regulation 30(4) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. In terms of Regulation 30(4) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, this is to inform you that management interaction with the following investor / analyst/ financial institution have been scheduled with the Company as under: Sr. Nature of Name of the investor/ analyst/ Day and Date No. Interaction financial institution 1 Friday: June 01, 2018 Meeting List Attached as Annexure No unpublished price sensitive information shall be shared/ discussed at the meeting. Kindly take this intimation on your record. Thanking you, Yours truly, For Cummins India Limited K. Venkata Ramana Group Vice President – Legal & Company Secretary ICSI Membership No.: FCS 4138 (This letter is digitally signed) Cummins India Limited Registered Office Cummins India Office Campus Tower A, 5th Floor, Survey No. 21, Balewadi Pune 411 045 Maharashtra, India Phone +91 20 67067000 Fax +91 20 67067015 cumminsindia.com [email protected] CIN : L29112PN1962PLC012276 Annexure: Analyst meet- 1st June 2018 Sr. Fund House/ Investor Name 1 Alchemy Capital