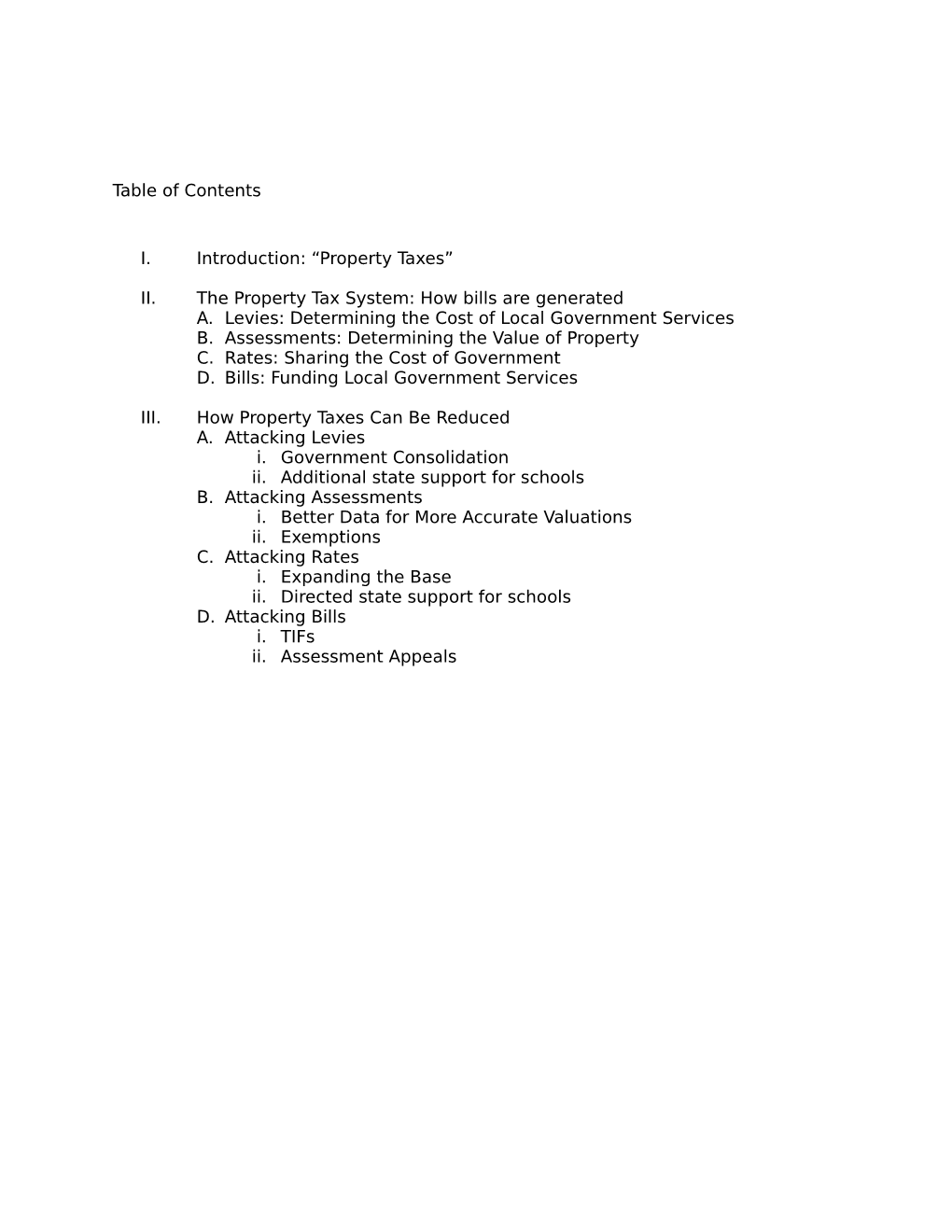

II. the Property Tax System: How Bills Are Generated A. Levies: Determining the Cost of Local Government Services B

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Expiration and Vacancies Governor July 2021

State of Illinois Commission on Government Forecasting and Accountability Expiration and Vacancies Governor July 2021 802 Stratton Office Building Springfield, IL 62706 Phone: 217/782-5320 Fax: 217/782-3515 http://cgfa.ilga.gov JOINT COMMITTEE ON LEGISLATIVE SUPPORT SERVICES House Republican Leader/Chairperson Rep. Jim Durkin Senate Republican Leader Sen. Dan McConchie President of the Senate Sen. Don Harmon Speaker of the House Rep. Emanuel “Chris” Welch COMMISSION ON GOVERNMENT FORECASTING AND ACCOUNTABILITY Co-Chairperson Sen. David Koehler Co-Chairperson Rep. C. D. Davidsmeyer Executive Director Clayton Klenke Deputy Director Laurie Eby Senators Representatives Omar Aquino Amy Elik Darren Bailey Amy Grant Donald P. DeWitte Sonya Harper Elgie Sims Elizabeth Hernandez Dave Syverson Anna Moeller The Commission on Government Forecasting & Accountability is a bipartisan legislative support service agency that is responsible for advising the Illinois General Assembly on economic and fiscal policy issues and for providing objective policy research for legislators and legislative staff. The Commission’s board is comprised of twelve legislators-split evenly between the House and Senate and between Democrats and Republicans. The Commission has three internal units--Revenue, Pensions, and Research, each of which has a staff of analysts and researchers who analyze policy proposals, legislation, state revenues & expenditures, and benefit programs, and who provide research services to members and staff of the General Assembly. The Commission’s Revenue and Pension Units annually publish a number of statutorily mandated reports as well as on-demand reports in regard to Illinois’ financial and economic condition, the annual operating and capital budgets, public employee retirement systems, and other policy issues. -

Illinois American Job Centers

I LL I NO I S A MER I C A N J OB C ENTERS — C ONT A CT I NFORM A T I ON Illinois American Job Centers LWIA 1 Renee Renken, Dana Washington, Director LWIA 19 Kevin Pierce, WIOA Assistant Director for Kankakee Workforce Services Services Representative Laura Gergely, Workforce Development 450 N. Kinzie Avenue Workforce Investment Solutions Phone: 217-238-8224 Coordinator Kane County Office of Bradley, IL 60915 757 W. Pershing Rd. E-mail: kpierce69849@ Lake County Workforce Community Reinvestment Phone: 815-802-8964 Springcreek Plaza lakelandcollege.edu Development Board 1 Smoke Tree Office Complex, E-mail: [email protected] Decatur, IL 62526 1 N. Genesee Street, 1st Floor Unit A LWIA 24 Waukegan, IL 60085 North Aurora, IL 60542 LWIA 13 Rocki Wilkerson, Phone: 847-377-2234 Phone: 630-208-1486 Executive Director St. Clair County E-mail: [email protected] E-mail: renkenrenee@ Rock Island Phone: 217-875-8720 Intergovernmental countyofkane.org Tri-County Consortium E-mail: [email protected] Grants Department Jennifer Serino, 19 Public Square, Suite 20 1504 Third Avenue, Room 114 Karen Allen, Director LWIA 6 Rock Island, IL 61201 Belleville, IL 62220 Lake County Workforce Program Manager Phone: 217-875-8281 Rick Stubblefield, Development Lisa Schvach, Director Mark E. Lohman, E-mail: [email protected] Executive Director Phone: 847-377-2224 DuPage County Workforce Executive Director Phone: 618-825-3203 E-mail: [email protected] Development Division Phone: 309-793-5206 LWIA 20 E-Mail: rstubblefield@ 2525 Cabot Drive, Suite 302 E-mail: Mark.Lohman@ LWIA 2 AmericanJob.Center co.st-clair.il.us Lisle, IL 60532 Sarah Graham, Phone: 630-955-2044 ® Matt Jones, Morris Jeffery Poynter, WIB Director American Job Center Executive Director E-mail: lschvach@ Program Coordinator, McHenry County Phone: 309-788-7587 Land of Lincoln worknetdupage.org Workforce Development Group Workforce Network Board Phone: 309-852-6544 Workforce Alliance Phone: 618-825-3254 500 Russel Court 1300 S. -

Denotes Contested Primary Races Personal PAC Preliminary

Personal PAC Preliminary 2020 Primary Election Endorsement List As of January 14, 2020 List by Office Illinois State Senate (only seats up for election) *SD 1 – Antonio Munoz SD 16 – Jacqueline Collins *SD 40 – Patrick Joyce SD 4 – Kimberly Lightford SD 19 – Michael Hastings SD 43 – John Connor SD 7 – Heather Steans *SD 22 – Cristina Castro SD 46 – Dave Koehler *SD 10 – Robert Martwick SD 28 – Laura Murphy SD 52 – Scott Bennett SD 11 – Celina Villanueva SD 31 – Melinda Bush *SD 13 – Robert Peters SD 34 – Steve Stadelman Illinois House of Representatives *HD 1 – Aaron Ortiz *HD 31 – Mary Flowers HD 64 – Leslie Armstrong-McLeod *HD 2 – Theresa Mah *HD 32 – Andre Thapedi *HD 65 – Martha Paschke HD 4 – Delia Ramirez HD 33 – Marcus Evans *HD 66 – Suzanne Ness HD 5 – Lamont Robinson HD 34 – Nicholas Smith HD 67 – Maurice West HD 6 – Sonya Harper HD 37 – Michelle Fadeley HD 68 – Dave Vella HD 7 – Emanuel "Chris" Welch HD 38 – Debbie Meyers-Martin HD 71 – Joan Padilla HD 8 – LaShawn Ford HD 39 – Will Guzzardi HD 72 – Michael Halpin *HD 10 – Jawaharial Williams *HD 40 – Jaime Andrade HD 77 – Kathleen Willis HD 11 – Ann Williams *HD 41 – Janet Yang Rohr HD 78 – Camille Lilly *HD 12 – Sara Feigenholtz HD 42 – Ken Mejia-Beal *HD 79 – Charlene Eads HD 13 – Gregory Harris HD 43 – Anna Moeller HD 80 – Anthony DeLuca HD 14 – Kelly Cassidy HD 44 – Fred Crespo HD 81 – Anne Stava-Murray HD 15 – John D'Amico HD 45 – Diane Pappas *HD 83 – Barbara Hernandez *HD 16 – Denyse Wang Stoneback HD 46 – Deb Conroy HD 84 – Stephanie Kifowit HD 17 – Jennifer Gong-Gershowitz -

Joint Commission Minutes for January 30, 2020 Meeting

STATE OF ILLINOIS 101ST GENERAL ASSEMBLY JOINT COMMISSION ON ETHICS AND LOBBYING REFORM MEETING MINUTES JANUARY 30, 2020 AT 9:30 AM ROOM 118 CAPITOL BUILDING SPRINGFIELD, ILLINOIS Members Present in Person: Greg Harris Elgie Sims Kelly Burke James Burns Cristina Castro Richard Cenar John Curran David Harris Nathan Maddox Dan McConchie Christine Radogno Diane Soultan Ann Spillane Juliana Stratton Grant Werhli Patrick Windhorst I. Call to Order Co-Chair Harris called the January 30th meeting of the Joint Commission on Ethics and Lobbying Reform to order. The hearing was moved from Room 114 to Room 118 to ensure all members of the Joint Commission had access to their seats. Room 114 is not wheelchair accessible. II. Adopt Minutes of Prior Meeting In adopting the minutes of the January 15th meeting, Member Werhli moved to make a correction to the minutes to specify that Member Radogno was not absent, but present. The motion was seconded by Member Stratton. There was also a request to allow a livestream of the hearing, pursuant to Senate Rules, no objections were made and request was granted. III. Testimony on the Illinois Governmental Ethics Act, Conflicts and Disclosures of Public Officials and Employees a. Panel 1: Nicholas Birdsong, Police Specialist for the National Conference of State Legislatures (“NCSL”); Brad Cole, Executive Director of the Illinois Municipal League; Charles Northrup, General Counsel of the Illinois State Bar Association; David Weisbaum and Steve Roth, Secretary of State. Each panelist discussed the particular issues related to disclosure of state and local officials’ financial interests, restrictions on conflicts and points of potential for change. -

Federal, State and County Offices

September 12, 2018 : 9:20:51AM 1 2018 General DuPage County Election Commission Candidate Listing Unofficial State Of Illinois Governor-Lt Governor Vote for 1 JB Pritzker 1435 N Aster St Chicago, IL 60610 Democratic Juliana Stratton Bruce Rauner 720 Rosewood Ave Winnetka, IL 60093 Republican Evelyn Sanguinetti Grayson Kash Jackson 18713 W Edwards Rd Antioch, IL 60002 Libertarian Sanjeev Mohip William "Sam" McCann 9955 Lake Catatoga Rd Plainview, IL 62685 Conservative Aaron Merreighn Attorney General Vote for 1 Kwame Raoul 855 E Drexel Square Chicago, IL 60615 Democratic Erika Harold 1828 E Amber Ln Urbana, IL 61802 Republican Bubba Harsy 849 Wells Street Rd DuQuoin, IL 62832 Libertarian Secretary Of State Vote for 1 Jesse White 300 W Hill St Chicago, IL 60610 Democratic Jason Helland 619 Main St Mazon, IL 60444 Republican Steve Dutner 602 Kenneth Cir Elgin, IL 60120 Libertarian State Comptroller Vote for 1 Susana A. Mendoza 4147 N Mason Ave Chicago, IL 60634 Democratic Darlene Senger 2821 Blakely Ln Naperville, IL 60540 Republican Claire Ball 325 Harvard Ave Addison, IL 60101 Libertarian State Treasurer Vote for 1 Michael W. Frerichs 45 Greencroft Dr Champaign, IL 61821 Democratic Jim Dodge 17544 Dolorosa Orland Park, IL 60467 Republican Michael Leheney 2210 Crescent St Bourbonnais, IL 60914 Libertarian 3rd Congressional District Vote for 1 Daniel William Lipinski 5204 Howard Ave Western Springs, IL 60558 Democratic Arthur J. Jones 7744 Ogden Ave Lyons, IL 60534 Republican 5th Congressional District Vote for 1 Mike Quigley 2652 N Southport Ave Chicago, IL 60614 Democratic Tom Hanson 2 E Erie St Chicago, IL 60611 Republican 6th Congressional District Vote for 1 Sean Casten 4915 Woodward Ave Downers Grove, IL 60515 Democratic Peter J. -

Report Options HB0118 Will Guzzardi (Karina Villa) HB0253 H

AGC (NEW) Report Options WAGE THEFT-DAMAGES 05/13/2021 Senate Placed on Calendar Order of 3rd HB0118 Will Guzzardi AMOUNT Reading May 14, 2021 (Karina Villa) **** ** Oppose. Increases liability exposure and increases chances of litigation for employers. HB0253 h Kambium Buckner IDOT-ASSET MANAGEMENT 05/20/2021 Senate Placed on Calendar Order of 3rd PLAN Reading May 21, 2021 (Ram Villivalam) **** ** Watch/Oppose. Brings in outside 3rd parties to set IDOT priorities. Will not be a benefit to downstate. HB0270 s Anna Moeller BICYCLE & PEDESTRIAN 05/13/2021 Senate Placed on Calendar Order of 3rd WAYS Reading May 14, 2021 (Christopher Belt) **** * Oppose. Arbitrary mandate on IDOT urban projects. Amends the Illinois Highway Code. Provides that, in and within one mile of an urban area, the Department of Transportation shall establish and solely fund bicycle and pedestrian ways in conjunction with the construction, reconstruction, or other change of any State transportation facility. HB0396 h Martin J. Moylan VEH CD-OVERWEIGHT 05/20/2021 Senate Placed on Calendar Order of 3rd PERMITS Reading May 21, 2021 (Laura M. Murphy) **** * Watch. New classification for truck size weight limitations. Amends the Article of the Illinois Vehicle Code concerning size, weight, load, and permits. Creates a new class of weight limits for vehicles with a distance between 8 and 9 feet between the extremes of any group of 2 or more consecutive axles, with a maximum weight of 38,000 pounds on 2 axles and 42,000 pounds on 3 axles. HB0398 Martin J. Moylan COMPLETE STREETS ACT 04/23/2021 Senate Referred to Assignments (Steven M. -

2017 Senate Vote Record

2017 Senate Vote Record Name Party District % Right Pamela Althoff R 32 15 Neil Anderson R 36 60 Omar Aquino D 2 100 Jason Barickman R 53 10 Scott Bennett D 52 85 Jennifer Bertino-Tarrant D 49 95 Daniel Biss D 9 100 Tim Bivins R 45 25 William Brady R 44 10 Melinda Bush D 31 90 Cristina Castro D 22 90 James Clayborne, Jr D 57 75 Jacqueline Collins D 16 100 Michael Connelly R 21 10 John Cullerton D 6 75 Thomas Cullerton D 23 65 Bill Cunningham D 18 90 John Curran R 41 Inc Dale Fowler R 59 40 William Haine D 56 60 Don Harmon D 39 75 Napoleon Harris, III D 15 65 Michael Hastings D 19 90 Linda Holmes D 42 85 Mattie Hunter D 3 75 Toi Hutchinson D 40 90 Emil Jones, III D 14 90 David Koehler D 46 75 Steven Landek D 12 75 Kimberly Lightford D 4 100 Terry Link D 30 75 Andy Manar D 48 100 Iris Martinez D 20 75 Wm. Sam McCann R 50 80 Kyle McCarter R 54 0 Dan McConchie R 26 0 Karen McConnaughay R 33 15 Patrick McGuire D 43 75 Name Party District % Right Julie Morrison D 29 55 John Mulroe D 10 90 Tony Munoz D 1 75 Laura Murphy D 28 90 Chris Nybo R 24 10 Jim Oberweis R 25 10 Kwame Raoul D 13 70 Sue Rezin R 38 30 Dale Righter R 55 35 Tom Rooney R 27 10 Chapin Rose R 51 10 Martin Sandoval D 11 75 Paul Schimpf R 58 35 Ira Silverstein D 8 70 Steve Stadelman D 34 75 Heather Steans D 7 75 Dave Syverson R 35 10 Jill Tracy R 47 10 Donne Trotter D 17 75 Patricia Van Pelt D 5 85 Chuck Weaver R 37 10 2017 House Vote Record Name Party District % Right Carol Ammons D 103 85 Steven Andersson R 65 25 Jaime Andrade D 40 90 Luis Arroyo D 3 90 Mark Batinick R 97 0 Dan Beiser D 111 90 Patricia Bellock R 47 0 Thomas Bennett R 106 0 Avery Bourne R 95 10 Dan Brady R 105 10 Peter Breen R 48 0 Terri Bryant R 115 60 Daniel Burke D 1 100 Kelly Burke D 36 85 Tim Butler R 87 10 John Cabello R 68 25 Jonathan Carroll D 57 Inc Kelly Cassidy D 14 100 John Cavaletto R 107 0 Linda Chapa LaVia D 83 90 John Connor D 85 59 Deborah Conroy D 46 90 Melissa Conyears D 10 90 Jerry Costello D 116 75 Fred Crespo D 44 75 Barbara Flynn Currie D 25 90 John D'Amico D 15 90 C.D. -

Cumulative Results (PDF)

Cumulative Report — Official Kane County, Illinois — 2016 General Primary — March 15, 2016 Page 1 of 71 04/07/2016 10:02 AM Total Number of Voters : 95,153 of 230,189 = 41.33% Precincts Reporting 228 of 228 = 100.00% Party Candidate Vote by Mail Early/Grace Election/Grace Total FOR PRESIDENT OF THE UNITED STATES R, Vote For 1 R Jeb Bush 25 2.31% 57 0.53% 187 0.46% 269 0.51% R Chris Christie 4 0.37% 16 0.15% 53 0.13% 73 0.14% R Donald J. Trump 364 33.67% 4,220 39.51% 14,559 35.58% 19,143 36.34% R Ted Cruz 230 21.28% 2,487 23.28% 11,847 28.96% 14,564 27.65% R Marco Rubio 222 20.54% 1,383 12.95% 3,501 8.56% 5,106 9.69% R Rand Paul 4 0.37% 26 0.24% 145 0.35% 175 0.33% R Carly Fiorina 3 0.28% 19 0.18% 43 0.11% 65 0.12% R Mike Huckabee 3 0.28% 12 0.11% 58 0.14% 73 0.14% R Rick Santorum 2 0.19% 9 0.08% 38 0.09% 49 0.09% R John R. Kasich 204 18.87% 2,351 22.01% 10,259 25.07% 12,814 24.33% R Ben Carson 20 1.85% 102 0.95% 224 0.55% 346 0.66% Cast Votes: 1,081 99.08% 10,682 99.06% 40,914 99.30% 52,677 99.25% FOR PRESIDENT OF THE UNITED STATES D, Vote For 1 D Hillary Clinton 389 57.80% 4,314 44.80% 12,849 41.00% 17,552 42.15% D Willie L. -

BLET/ISLB 2020 Primary Election Endorsements

Illinois BLET/ISLB AFL-CIO 2020 2020 Primary Primary Election ElectionEndorsements Endorsements Italics – incumbent 8th – La Shawn Ford (D) 67th – Maurice West II (D) *- union member 9th – Lakesia Collins (D)* 68th – John Cabello (R) 10th – Omar Williams (D)* 70th – Paul Stoddard (D)* Ballot question 11th – Ann Williams (D) 71st – Joan Padilla (D) Support Fair Tax Constitutional 12th – Margaret Croke (D) 72nd – Mike Halpin (D) Amendment 13th – Greg Harris (D) 74th – Dan Swanson (R) 14th – Kelly Cassidy (D) 75th- David Welter (R) U.S. Senate 15th – John D’Amico (D)* 76th – Lance Yednock (D)* Dick Durbin (D) 16th – Yehiel “Mark” Kalish (D) 77th – Kathleen Willis (D) 17th – Jennifer Gong-Gershowitz (D) 78th – Camille Lilly (D) U.S. House 18th – Robyn Gabel (D) 79th – Charlene Eads (D)* 1st – Bobby Rush (D) 20th – Michelle Darbro (D)* 80th – Anthony DeLuca (D) 2nd – Robin Kelly (D) 20th – Brad Stephens (R)* 81st – Anne Stava-Murray (D) 3rd – Dan Lipinski (D) 21st – Edgar Gonzalez (D) 83rd – Barbara Hernandez (D) 4th – Chuy Garcia (D) 22nd – Michael Madigan (D) 84th – Stephanie Kifowit (D) 5th – Mike Quigley (D) 23rd – Mike Zalewski (D) 85th – Dagmara “Dee” Avelar (D)* 6th – Sean Casten (D) 24th – Lisa Hernandez (D) 86th – Larry Walsh Jr (D)* 7th – Danny Davis (D) 25th – Curtis Tarver II (D) 88th – Karla Bailey-Smith (D) 8th – Raja Krishnamoorthi (D) 26th – Kam Buckner (D) 90th – Seth Wiggins (D) 9th – Jan Schakowsky (D)* 27th – Justin Slaughter (D) 91st – Mark Luft (R) 10th – Brad Schneider (D) 28th – Bob Rita (D) 92nd – Jehan Gordon-Booth -

Ameren Il 2020 Mid-Year Corporate Political

AMEREN IL 2020 MID-YEAR CORPORATE POLITICAL CONTRIBUTION SUMMARY CommitteeID CommitteeName ContributedBy RcvdDate Amount Address1 City State Zip D2Part 25530 Friends of Mark Batinick Ameren 06/30/2020 $ 1,000.00 PO Box 66892 St. Louis MO 63166 Individual Contribution 17385 Friends of Mattie Hunter Ameren 06/30/2020 $ 2,500.00 P.O. Box 66892 St. Louis MO 63166 Individual Contribution 19155 Citizens for Tom Morrison Ameren 06/30/2020 $ 1,000.00 PO Box 66892 St. Louis MO 63166 Individual Contribution 31972 Citizens for Colonel Craig Wilcox Ameren 06/10/2020 $ 3,000.00 PO Box 66892 St Louis MO 63166 Individual Contribution 35553 Brad Stephens for State RepresentativeAmeren 06/04/2020 $ 1,000.00 P.O. BOX 66892 St. Louis MO 63166 Individual Contribution 34053 Committee to Elect Dan Caulkins Ameren 05/29/2020 $ 1,000.00 200 W Washington Springfield IL 62701 Individual Contribution 31821 Fowler for Senate Ameren 05/09/2020 $ 1,000.00 P.O. Box 66892 St. Louis MO 63166 Individual Contribution 35553 Brad Stephens for State RepresentativeAmeren 04/27/2020 $ 1,000.00 P.O. BOX 66892 St. Louis MO 63166 Individual Contribution 4261 Friends of Mary E Flowers Ameren 04/22/2020 $ 2,000.00 607 E. Adams Street Springfield IL 62739 Individual Contribution 34053 Committee to Elect Dan Caulkins Ameren 03/17/2020 $ 1,000.00 200 W Washington Springfield IL 62701 Individual Contribution 22882 Friends of Rita Mayfield Ameren 03/17/2020 $ 1,000.00 P.O. Box 66892 St. Louis MO 63166 Transfer In 25530 Friends of Mark Batinick Ameren 03/11/2020 $ 1,000.00 PO Box 66892 St. -

IHA Members by IL House District

IHA Members by IL House District Hospital City District: 1 Aaron Ortiz D none none 02-Aug-21 Members IL House District Page 1 of 119 IHA Members by IL House District Hospital City District: 2 Theresa Mah D none none 02-Aug-21 Members IL House District Page 2 of 119 IHA Members by IL House District Hospital City District: 3 Eva Dina Delgado D none none 02-Aug-21 Members IL House District Page 3 of 119 IHA Members by IL House District Hospital City District: 4 Delia Ramirez D AMITA Health Sts. Mary & Elizabeth Med Ctr, St. Chicago AMITA Health Sts. Mary & Elizabeth Med Ctr, St. Chicago Humboldt Park Health Chicago 02-Aug-21 Members IL House District Page 4 of 119 IHA Members by IL House District Hospital City District: 5 Lamont Robinson D Insight Hospital & Medical Center Chicago Jackson Park Hospital & Medical Center Chicago 02-Aug-21 Members IL House District Page 5 of 119 IHA Members by IL House District Hospital City District: 6 Sonya Harper D Holy Cross Hospital Chicago St. Bernard Hospital & Health Care Ctr Chicago 02-Aug-21 Members IL House District Page 6 of 119 IHA Members by IL House District Hospital City District: 7 Emanuel Chris Welch D Riveredge Hospital Forest Park 02-Aug-21 Members IL House District Page 7 of 119 IHA Members by IL House District Hospital City District: 8 La Shawn Ford D Hartgrove Behavioral Health System Chicago Loretto Hospital Chicago Loyola University Medical Center Maywood 02-Aug-21 Members IL House District Page 8 of 119 IHA Members by IL House District Hospital City District: 9 Lakesia Collins D Jesse Brown Veterans Administration Medical C Chicago John H. -

SUAA MINI BRIEFING December 8, 2016

SUAA MINI BRIEFING December 8, 2016 Sticking to the facts is always the best decision. Veto Session ended this past week with lingering decisions still to be made. The Stop-gap budget ends on December 31st. No budget agreement is in sight even though the Democrat and Republican Leaders are meeting with the Governor. The news keeps repeating the words balanced budget, but in truth there hasn’t been a true balanced budget in decades. The Governor is demanding a property tax freeze and term limits. Neither seem reachable and neither have anything to do with the State Budget. During the Veto Session a super majority was required to pass any legislation. The winner went to the ComEd rate hike to save the nuclear plants and, of course, jobs. Governor Rauner vetoed the $215 million going to the Chicago Public Schools for the Chicago teachers’ pension. And the House of Representatives did not have the votes to override the Governor’s veto of SB 250 – the Automatic Voters Registration bill. HJRCA0062 passed the House with a super majority. It “provides that a bill passed on or after the date of a general election but on or before the second Wednesday of January following the general election that would result in the increase of revenue to the State by an increase of a tax on or measured by income or the selling price of any item of tangible personal property or any service may become law only with the concurrence of three-fifths of the members elected to each house of the General Assembly.” In other words, no tax increase would be allowed without a super majority passage in both houses.