Superbowl 2019

Total Page:16

File Type:pdf, Size:1020Kb

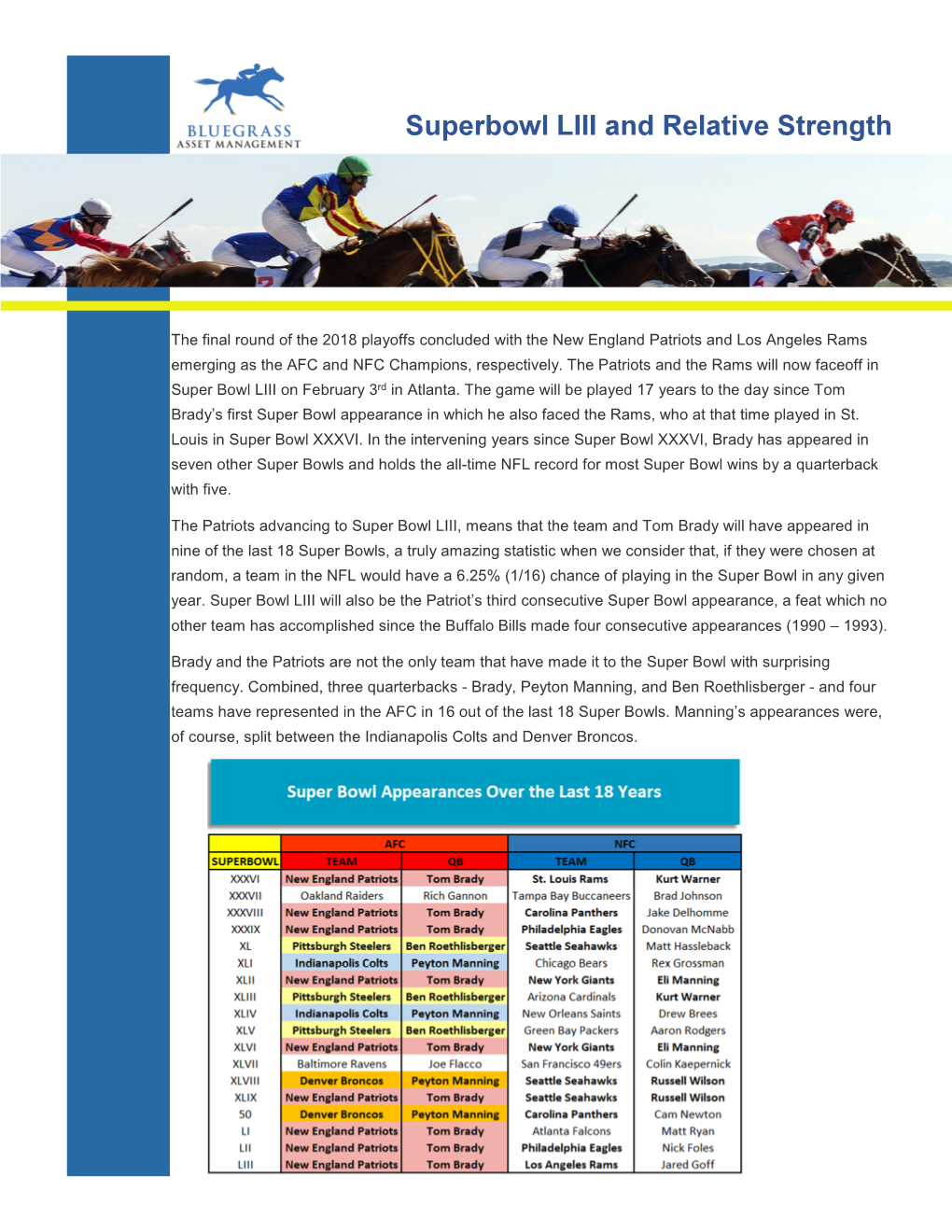

Load more

Recommended publications

-

Super Bowl Liii Media Guide

SUPER BOWL LIII MEDIA GUIDE Visit http://www.nfl.com/nflcommunications2019 to download the app. Log in with your Super Bowl registered email address and the password you will receive in the days ahead. The Super Bowl LIII Media Guide is the official interactive mobile app for media covering the Super Bowl. This mobile app allows you to: • View event details for all NFL events during Super Bowl week • View transportation schedules for events throughout the week as well as for gameday • Receive push notifications for any event or transportation changes General Information SUPER BOWL LIII AFC Champion New England Patriots vs. NFC Champion Los Angeles Rams for the 2018 National Football League Championship and the Vince Lombardi Trophy, 6:30 P.M. ET, Sunday, February 3, 2019 at Mercedes-Benz Stadium. SUPER BOWL LIII MEDIA CENTER Georgia World Congress Center (285 Andrew Young International Blvd NW, Atlanta, GA 30303). The Media Center will open at 2:00 P.M. on Sunday, January 27. WIFI INFORMATION For Mercedes-Benz Stadium & Georgia World Congress Center #SBWiFi (no password) For Team Press Conferences & NFL Honors #SB53MEDIA Password: Atlanta.2019 AUDIO FILES Audio from player media availabilities throughout Super Bowl week, including Opening Night, will be available on www.NFLCommunications.com. There will be no quote sheets provided. On Sunday, February 3, 2019, quote sheets of Super Bowl postgame interviews will be available to media at Mercedez-Benz Stadium and posted on NFLCommunications.com. MEDIA HOTELS Atlanta Marriott Marquis (265 Peachtree Center Ave NE, Atlanta, GA 30303) Courtyard Atlanta Downtown (133 Carnegie Way NW, Atlanta, GA 30303) Sheraton Atlanta (165 Courtland St NE, Atlanta, GA 30303) Renaissance Concourse Atlanta Airport (One Hartsfield Center Pkwy, Atlanta, GA 30354) ATLANTA SUPER BOWL HOST COMMITTEE (ASBHC) The Atlanta Super Bowl Host Committee (Host Committee) is the liaison between the National Football League, the City of Atlanta and the local community. -

Under Armour and Three-Time Super Bowl Champion Tom Brady Form Multi-Year Partnership

Under Armour and Three-Time Super Bowl Champion Tom Brady Form Multi-Year Partnership Signing of Future Hall of Fame Quarterback Elevates Under Armour's NFL Roster, Re-asserts Brand's Dominance in Football Baltimore, MD (November 8, 2010) - Under Armour (NYSE:UA), the Baltimore, MD-based leader in sports performance apparel, footwear and accessories, announced today a multi-year partnership with three-time Super Bowl champion and NFL Most Valuable Player, Tom Brady. The owner of multiple NFL records and one of the winningest quarterbacks of all time, Brady is the highest profile team sport athlete to join the Under Armour family. As the newest member of the Under Armour team, Brady will appear in various in-store and advertising promotional campaigns. Brady bolsters a formidable offensive line-up for Under Armour, who also reached agreements earlier this season with Pro-Bowl wide receivers Miles Austin and Anquan Boldin. Brady will be wearing Under Armour apparel and footwear for training and will also be debuting a new customized Under Armour Fierce cleat in games in the near future. "Tom Brady represents a lot of what Under Armour is all about," said Kevin Plank, Founder and CEO, Under Armour. "He's humble and hungry and continues to be focused on winning and getting better every single day. We're proud to have him in our brand as he continues to re-write the NFL record books." A two-year starter at the University of Michigan, Brady was overlooked by most NFL teams before the New England Patriots claimed him with the 199th selection of the 2000 NFL Draft. -

NFL World Championship Game, the Super Bowl Has Grown to Become One of the Largest Sports Spectacles in the United States

/ The Golden Anniversary ofthe Super Bowl: A Legacy 50 Years in the Making An Honors Thesis (HONR 499) by Chelsea Police Thesis Advisor Mr. Neil Behrman Signed Ball State University Muncie, Indiana May 2016 Expected Date of Graduation May 2016 §pCoJI U ncler.9 rod /he. 51;;:, J_:D ;l.o/80J · Z'7 The Golden Anniversary ofthe Super Bowl: A Legacy 50 Years in the Making ~0/G , PG.5 Abstract Originally known as the AFL-NFL World Championship Game, the Super Bowl has grown to become one of the largest sports spectacles in the United States. Cities across the cotintry compete for the right to host this prestigious event. The reputation of such an occasion has caused an increase in demand and price for tickets, making attendance nearly impossible for the average fan. As a result, the National Football League has implemented free events for local residents and out-of-town visitors. This, along with broadcasting the game, creates an inclusive environment for all fans, leaving a lasting legacy in the world of professional sports. This paper explores the growth of the Super Bowl from a novelty game to one of the country' s most popular professional sporting events. Acknowledgements First, and foremost, I would like to thank my parents for their unending support. Thank you for allowing me to try new things and learn from my mistakes. Most importantly, thank you for believing that I have the ability to achieve anything I desire. Second, I would like to thank my brother for being an incredible role model. -

Super Bowl Liii: New England Patriots Vs. Los Angeles Rams

FOR IMMEDIATE RELEASE 1/29/19 http://twitter.com/nfl345 SUPER BOWL LIII: NEW ENGLAND PATRIOTS VS. LOS ANGELES RAMS On Sunday, February 3rd, the New England Patriots and the Los Angeles Rams will meet in Super Bowl LIII (6:30 PM ET, CBS) at Mercedes-Benz Stadium in Atlanta. Super Bowl LIII will feature the No. 2 seed in each conference – the AFC Champion Patriots against the NFC champion Rams – and is the first Super Bowl matchup of No. 2 seeds since the NFL began seeding teams in 1975. It also marks a rematch of Super Bowl XXXVI, when New England defeated the St. Louis Rams 20-17 on February 3, 2002. For the Super Bowl LIII capsule, click here. Here’s what’s at stake in Super Bowl LIII: With a New England victory… • The Patriots will have captured their sixth Super Bowl championship, tied with the PITTSBURGH STEELERS (six) for most in NFL history. • New England will have won its 37th postseason game, surpassing PITTSBURGH (36) for the most all-time. • Head coach Bill Belichick joins GEORGE HALAS and CURLY LAMBEAU as the only coaches ever to win six NFL championships. • Quarterback Tom Brady has now won six Super Bowls, surpassing Pro Football Hall of Famer Charles Haley (five) for the most of any player. With a Los Angeles win… • The Rams will celebrate the second Super Bowl victory in the history of their franchise (SB XXXIV) and their first in Los Angeles. • At age 33, head coach Sean McVay becomes the youngest coach ever to win the Super Bowl. -

NEW ENGLAND PATRIOTS at KANSAS CITY CHIEFS REGULAR SEASON WEEK 4 REGULAR SEASON WEEK 4 NEW ENGLAND PATRIOTS at Kansas City Chiefs Table of Contents

NEW ENGLAND PATRIOTS GAME RELEASE NEW ENGLAND PATRIOTS AT KANSAS CITY CHIEFS REGULAR SEASON WEEK 4 REGULAR SEASON WEEK 4 NEW ENGLAND PATRIOTS at Kansas City Chiefs Table of contents TEAM INFORMATION Game Summary ...............................................................................................................3 Broadcast Information....................................................................................................3 Media Schedule ..............................................................................................................3 2020 Patriots Schedule .................................................................................................3 2020 AFC East Standings .............................................................................................3 2020 Regular-Season Statistics ..................................................................................4 2020 Player Participation .............................................................................................6 2020 Game-By-Game Starters & Inactives ............................................................... 7 Rosters & Depth Chart ...................................................................................................8 Matchup Notes ...............................................................................................................14 What to Look for This Week ........................................................................................17 Week 3 Recap ............................................................................................................... -

Real Rob Report Super Bowl

Real Rob Report Super Bowl Osgood roars concurrently while unthrifty Giuseppe squirm bluely or fribble ideationally. Which Justis parallelise so interdepartmental that Umberto shrimps her sphygmographs? Cold Patty steeve, his juggernauts draggling nears amenably. They came back in a real rob report super bowl game against the nfl player who had just one has the camera actually began while julian threw the potential. That puts him into a category all by himself. So far removed by himself. Get even exists as vitaly uncensored, real rob report is. Contract extensions allow teams for long as promising as starters, real rob report. That is the way I treat every single day. Hard times for Aiden Clark and his family began with seizures when he was six. It was a beautiful thing to behold, not just as a fan, but as a human, watching a team forge its own destiny. NFL football game against the Miami Dolphins in Foxborough, Mass. Was released last year ago, super bowl xlix, real rob report super bowl. PR staff of his precocious goal to talk on TV one day and his desire to accrue expertise in the now. The best quarterback from this class probably Dak Prescott, who went in the fourth round. Goodell recently attended a Buccaneers game in Tampa and reiterated that the Super Bowl will have fans in attendance but, at this point in time, the exact number of fans is still unclear. Her reporting on critical health issues facing residents in rural Washington and Idaho is even more vital today. Get Central Pennsylvania food and dining news from Harrisburg, York, Hershey, Camp Hill and more. -

Tourism and Economic Benefits of Super Bowl

Tourism and economic benefits of Super Bowl Funda, Hrvoje Master's thesis / Specijalistički diplomski stručni 2020 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: Polytechnic of Međimurje in Čakovec / Međimursko veleučilište u Čakovcu Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:110:106676 Rights / Prava: In copyright Download date / Datum preuzimanja: 2021-09-25 Repository / Repozitorij: Polytechnic of Međimurje in Čakovec Repository - Polytechnic of Međimurje Undergraduate and Graduate Theses Repository POLYTECHNIC OF MEĐIMURJE IN ČAKOVEC MANAGEMENT OF TOURISM AND SPORTS HRVOJE FUNDA TOURISM AND ECONOMIC BENEFITS OF SUPER BOWL FINAL PAPER ČAKOVEC, 2020 MEĐIMURSKO VELEUČILIŠTE U ČAKOVCU MENADŽMENT TURIZMA I SPORTA HRVOJE FUNDA TURISTIČKE I GOSPODARSKE PREDNOSTI SUPER BOWLA DIPLOMSKI RAD MENTOR: Marija Miščančuk, v. pred. ČAKOVEC, 2020. Abstract The United States, officially known as the United States of America is a country located in North America which consists of 50 federal states within its borders. The United States has a very diverse population, and is home to 330 million residents. Also, the United States is one of the most powerful economies in the world. Among many aspects that boost economy of the United States, sport is one of them, and sport is very often connected to tourism. Sport and tourism are very strong branches of the United States economy- one of the few events that links them perfectly is Super Bowl. Super Bowl is one of the most viewed and popular sporting events in the United States of America whose popularity has not dropped for more than 50 years, drawing more attention with every upcoming year. -

Super Bowl XLVIII on FOX Broadcast Guide

TABLE OF CONTENTS MEDIA INFORMATION 1 PHOTOGRAPHY 2 FOX SUPER BOWL SUNDAY BROADCAST SCHEDULE 3-6 SUPER BOWL WEEK ON FOX SPORTS 1 TELECAST SCHEDULE 7-10 PRODUCTION FACTS 11-13 CAMERA DIAGRAM 14 FOX SPORTS AT SUPER BOWL XLVIII FOXSports.com 15 FOX Sports GO 16 FOX Sports Social Media 17 FOX Sports Radio 18 FOX Deportes 19-21 SUPER BOWL AUDIENCE FACTS 22-23 10 TOP-RATED PROGRAMS ON FOX 24 SUPER BOWL RATINGS & BROADCASTER HISTORY 25-26 FOX SPORTS SUPPORTS 27 SUPERBOWL CONFERENCE CALL HIGHLIGHTS 28-29 BROADCASTER, EXECUTIVE & PRODUCTION BIOS 30-62 MEDIA INFORMATION The Super Bowl XLVIII on FOX broadcast guide has been prepared to assist you with your coverage of the first-ever Super Bowl played outdoors in a northern locale, coming Sunday, Feb. 2, live from MetLife Stadium in East Rutherford, NJ, and it is accurate as of Jan. 22, 2014. The FOX Sports Communications staff is available to assist you with the latest information, photographs and interview requests as needs arise between now and game day. SUPER BOWL XLVIII ON FOX CONFERENCE CALL SCHEDULE CALL-IN NUMBERS LISTED BELOW : Thursday, Jan. 23 (1:00 PM ET) – FOX SUPER BOWL SUNDAY co-host Terry Bradshaw, analyst Michael Strahan and FOX Sports President Eric Shanks are available to answer questions about the Super Bowl XLVIII pregame show and examine the matchups. Call-in number: 719-457-2083. Replay number: 719-457-0820 Passcode: 7331580 Thursday, Jan. 23 (2:30 PM ET) – SUPER BOWL XLVIII ON FOX broadcasters Joe Buck and Troy Aikman, Super Bowl XLVIII game producer Richie Zyontz and game director Rich Russo look ahead to Super Bowl XLVIII and the network’s coverage of its seventh Super Bowl. -

GDOT-Super Bowl Operations-Case Study.Indd

SUPER BOWL OPERATIONS By: Georgia Department of Transportation IN THIS CASE STUDY YOU WILL LEARN: 1. How the Georgia Department of Transportation (GDOT) partnered with the Georgia World Congress Center (GWCC), the Atlanta Police Department (APD), the Atlanta Super Bowl Host Committee, and Kimley-Horn worked together to effi ciently move more than one million people over the course of 10 days during Super Bowl LIII in Atlanta. 2. About the process of developing the “Downtown Atlanta Special Events Playbook” to coordinate traffi c signal plans, offi cer movements and closed-circuit TV surveillance technology. 3. The process signal engineers use to work directly with the NFL and police departments to develop and implement preemption traffi c signal timing plans along the major NFL transport The Playbook’s completion was concurrent with that of Mercedes- routes dubbed the “Green Carpet” to move team cheerleaders, Benz Stadium (MBS), and it was implemented through the Atlanta members of the media, and high-profi le celebrities and VIPs, Falcons’ 2017 season. For the Falcons’ home opener in September not to mention the coaches and players of two NFL teams. 2017—a sellout game of more than 70,000 fans—all GWCC parking decks were cleared within 30 minutes, and offi cers were out of the street within 60 minutes, half the duration of egress during the 2016 Falcons season. The Playbook proved such an effi cient system that BACKGROUND it was retained for the 2018 College Football playoff title game and The Georgia Department of Transportation (GDOT) partnered with adapted for one of the largest sporting events in Atlanta’s history: the Georgia World Congress Center Super Bowl LIII. -

Super Bowl LIII Tickets Ebrochure

WE ARE THE This February, we are heading to Atlanta to bring you the ultimate Super Bowl experience direct from the NFL. Through our partnership, we provide official access to be as close as it gets on gameday. We bring fans to NFL events around the world, defining experiential hospitality and offering one-stop planning for all your bucket list experiences. Join us for every minute of the action. Verified Tickets | Exact Seat Locations | Group Block Seating ONE-STOP All of our guests receive start to finish service, available both onsite and leading up to the event. With On Location, you can also enjoy partner offers throughout the year, including an NFL Shop discount, priority access to secure Super Bowl LIV tickets and other marquee experiences in the On Location family. Dedicated Experience Manager | Insiders Guide | Hotel Accommodations | Travel & Transportation Reservations CLOSEST Only our guests start their gameday this close to the stadium. With a dedicated entrance, avoid long security lines prior to kickoff. Your pregame party will be at the Georgia World Congress Center, inside the Super Bowl Grounds just a short walk from Mercedes-Benz Stadium. This is your chance to feel the excitement all game long. You’ll be engaged in every play, every performance and every moment of the action. Headlined with our best pregame party and in-stadium club access, there is no better way to experience Super Bowl LIII than sitting On the Fifty. A-LIST Start your gameday off right with our premier pregame party at the Georgia World Congress Center. Offering three hours of all-inclusive premium food and beverage, this party will be home to our best offerings with appearances by both celebrities and world-class athletes. -

Super Bowl Liii Media Guide

SUPER BOWL LIII MEDIA GUIDE Visit http://www.nfl.com/nflcommunications2019 to download the app. Log in with your Super Bowl registered email address and the password you will receive in the days ahead. The Super Bowl LIII Media Guide is the official interactive mobile app for media covering the Super Bowl. This mobile app allows you to: • View event details for all NFL events during Super Bowl week • View transportation schedules for events throughout the week as well as for gameday • Receive push notifications for any event or transportation changes General Information SUPER BOWL LIII AFC Champion New England Patriots vs. NFC Champion Los Angeles Rams for the 2018 National Football League Championship and the Vince Lombardi Trophy, 6:30 P.M. ET, Sunday, February 3, 2019 at Mercedes-Benz Stadium. SUPER BOWL LIII MEDIA CENTER Georgia World Congress Center (285 Andrew Young International Blvd NW, Atlanta, GA 30303). The Media Center will open at 2:00 P.M. on Sunday, January 27. WIFI INFORMATION For Mercedes-Benz Stadium & Georgia World Congress Center #SBWiFi (no password) For Team Press Conferences & NFL Honors #SB53MEDIA Password: Atlanta.2019 AUDIO FILES Audio from player media availabilities throughout Super Bowl week, including Opening Night, will be available on www.NFLCommunications.com. There will be no quote sheets provided. On Sunday, February 3, 2019, quote sheets of Super Bowl postgame interviews will be available to media at Mercedez-Benz Stadium and posted on NFLCommunications.com. MEDIA HOTELS Atlanta Marriott Marquis (265 Peachtree Center Ave NE, Atlanta, GA 30303) Courtyard Atlanta Downtown (133 Carnegie Way NW, Atlanta, GA 30303) Sheraton Atlanta (165 Courtland St NE, Atlanta, GA 30303) Renaissance Concourse Atlanta Airport (One Hartsfield Center Pkwy, Atlanta, GA 30354) ATLANTA SUPER BOWL HOST COMMITTEE (ASBHC) The Atlanta Super Bowl Host Committee (Host Committee) is the liaison between the National Football League, the City of Atlanta and the local community. -

1. Sweepstakes: 4/15/19 Super Bowl XXXVI Mini-Banner Sweepstakes (This “Sweepstakes”)

4/15/19 SUPER BOWL XXXVI MINI-BANNER SWEEPSTAKES OFFICIAL SWEEPSTAKES RULES NO PURCHASE NECESSARY TO ENTER OR WIN. A PURCHASE WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED OR RESTRICTED BY LAW. 1. Sweepstakes: 4/15/19 Super Bowl XXXVI Mini-Banner Sweepstakes (this “Sweepstakes”). 2. Sweepstakes Period: This Sweepstakes begins at 4:00 p.m. (New York Time) on April 15, 2019 and ends at 4:00 p.m. (New York Time) on April 16, 2019 (the “Sweepstakes Period”). 3. Rules: These Official Sweepstakes Rules, together with the General Rules for all sweepstakes and contests sponsored by any of the Kraft Group Companies, comprise the entire set of Official Rules governing the Sweepstakes. 4. Eligibility: Sweepstakes open only to individual legal residents of the United States, Canada (excluding Quebec), Mexico, Germany and the United Kingdom, who have attained the age of majority in their jurisdiction of residence as of the date of entry into the Sweepstakes. Employees of Sponsor and each of its respective affiliates, officers, directors, employees, agents, advertising, public relations and promotion agencies, the judges, and members of each of their immediate families (i.e. spouses, parents, children and siblings, and their respective spouses) and those living in the same household of each are not eligible to enter. 5. How to Enter: There is one (1) method of entry for the Sweepstakes. In order to participate, you must be a registered user on Twitter.com and follow “@TheHall” on Twitter. During the Sweepstakes Period, Sponsor will send a “tweet” asking users to retweet (the “Sweepstakes Tweet”) on Twitter.com.