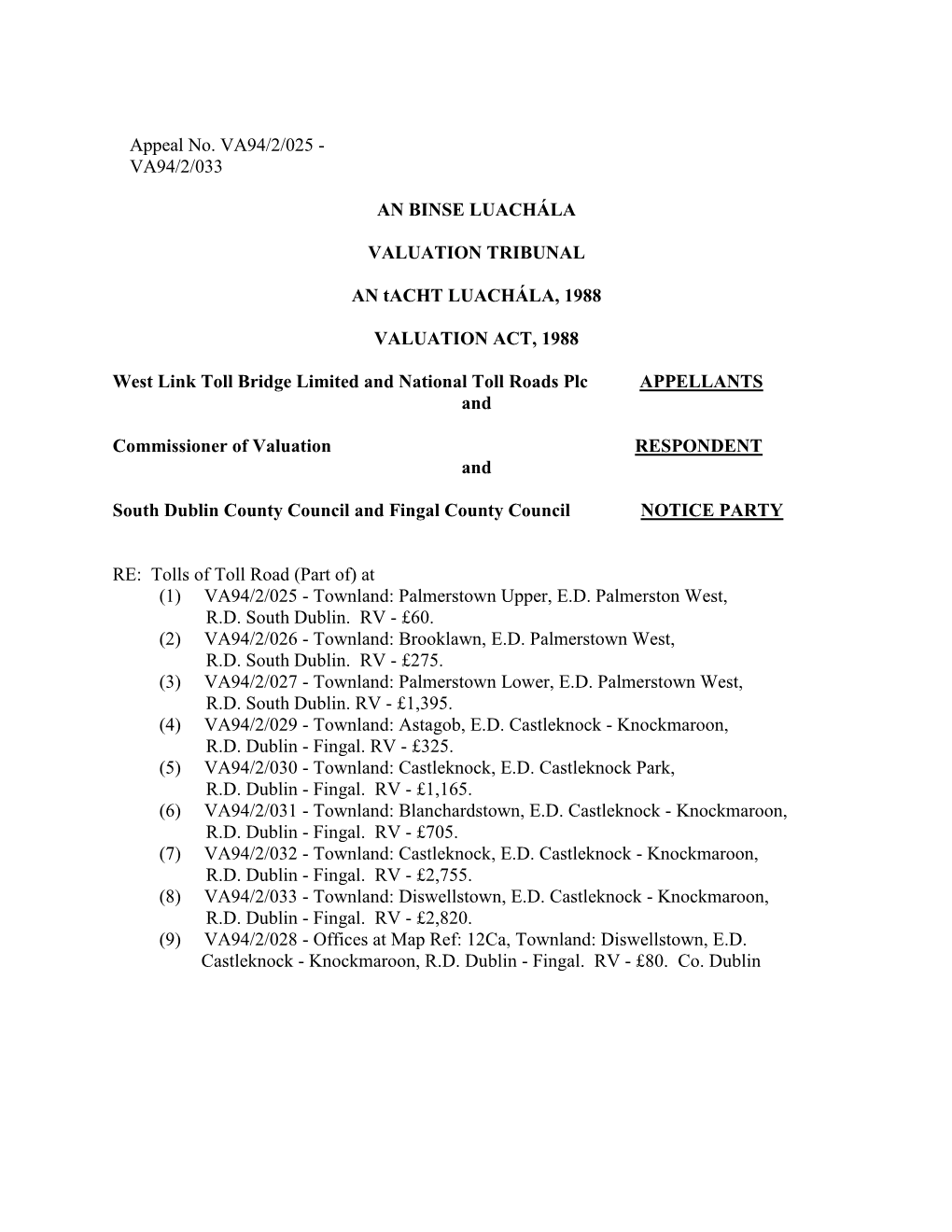

West Link Toll Bridge Limited & National Toll Roads

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dun Laoghaire-Rathdown County Council

Environment Department An Rannóg Comhshaoil Parks & Landscape Services Helena McGorman, Senior Executive Parks Superintendent Direct Tel: 01 2054300 Fax: 01 284 1379 [email protected] L14586 Review of Section 40 Department of Arts, Heritage & the Gaeltacht, 7 Ely Place, Dublin 2 Review of Section 40 of the Wildlife Acts 1976-2012 – Burning / Cutting Controls – Public Consultation Submission to the Department of Arts, Heritage and the Gaeltacht from Dún Laoghaire Rathdown County Council 8th January 2015 Dún Laoghaire Rathdown County Council welcomes the opportunity to comment on the review of Section 40 of the Wildlife Acts 1976-2012 governing the control of burning and hedge cutting. We have liaised on the matter with our colleagues in South Dublin County Council who are also making a submission and our recommendations are predominantly the same. This local authority manages a large number of street trees which are located along streets, roads, on public pathways, parks, open spaces, woodlands and cemeteries. The local authority also manages hedgerows both natural and ornamental and trees growing within them throughout out the council jurisdiction. There is a requirement for clarity in relation to exemptions on cultivated lands and this review affords the opportunity to clarify this issue. 1. Amendment of closed period In relation to amending the closed period from March 1st to August 31st, it is considered that no change is required in regard to cutting of field hedgerows. 2. Maintenance of street trees It is understood that street trees are on cultivated land and as such, this allows for tree maintenance works to be carried out during the closed period, subject to prior inspection of the trees for active nests or nesting birds. -

Fingal County Council

Development Name Address Line 1 Address Line 2 County / City Council GIS X GIS Y Ballalease Court Portrane Road Donabate Fingal Belmayne Phase 3 Belmayne Clongriffin Fingal Belmayne Phase 4 Belmayne Clongriffin Fingal Bremore Lodge Hamlet lane Balbriggan Fingal Bremore Pastures Bremore Balbriggan Fingal Casleland Rise Castleland Balbriggan Fingal Castlegrange Hansfield Fingal Castleland Park Castleland Balbriggan Fingal Castlemoyne Phase2 Balgriffin Pk House Balgriffin, D17 Fingal Charlestown St Margarets Rd Finglas Fingal Courtneys Way Garristown Village Garristown Fingal Creston Park St Margarets Rd Finglas Fingal Delvin Banks Balbriggan Road Naul Fingal Golden Ridge Skerries Road Rush Fingal Hampton Gardens Naul Road Balbriggan Fingal Hastings Lawn Bremore Balbriggan Fingal Hayestown Close Old Hayestown Rush Fingal Heathfield Cappagh Finglas Fingal Knocksedan Naul road Brackenstown Fingal Lynwood Ballyboughal Village Ballyboughal Fingal Mayeston Hall St Margarets Finglas, D11 Fingal Mill Hill Park Mill Hill Skerries Fingal Murragh House Murragh Oldtown Fingal Oldtown Avenue Fieldstown road Oldtown Fingal Plan Ref F02A/0358 (Windmill) Porterstown Clonsilla Fingal 706393 737838 Plan Ref F03A/1640 Drinan Kinsealy Fingal 719333 745053 Plan Ref F04A/1584 Cruise Park Tyrrelstown Fingal 706636 742278 Plan Ref F04A/1655 Phoenix Park Ashtown Fingal 710470 737140 Plan Ref F05A/0265 (Ridgewood — Phase 7A) Forest Road Swords Fingal 716660 745332 Plan Ref F06A/0671 (Stapolin Phase 3) Stapolin Baldoyle Fingal 723269 740731 Plan Ref F06A/0903 Carrickhill -

Ecological Study of the Coastal Habitats in County Fingal Habitats Phase I & II Flora

Ecological Study of the Coastal Habitats in County Fingal Habitats Phase I & II Flora Fingal County Council November 2004 Supported by Ecological Study of the Coastal Habitats in County Fingal Phase I & II Habitats & Flora Prepared by: Dr. D. Doogue, Ecological Consultant D. Tiernan, Fingal County Council, Parks Division H. Visser, Fingal County Council, Parks Division November 2004 Supported by Michael A. Lynch, Senior Parks Superintendent. Table of contents 1. INTRODUCTION 1.1 Objectives 2 1.2 The Study Area 3 1.3 Acknowledgements 4 2. METHODOLOGY 2.1 The Habitat Mapping 6 2.2 The Vegetation Survey 6 2.3 The Rare Plant Survey 6 3 RESULTS 3.1 Habitat Classes 8 3.1.1 The Coastland 8 3.1.1.1 Rocky Sea Cliffs 8 3.1.2.2 Sea stacks and islets 9 3.1.1.3 Sedimentary sea cliffs 9 3.1.1.4 Shingle and Gravel banks 10 3.1.1.5 Embryonic dunes 10 3.1.1.6 Marram dunes 11 3.1.1.7 Fixed dunes 11 3.1.1.8 Dune scrub and woodland 12 3.1.1.9 Dune slacks 12 3.1.1.10 Coastal Constructions 12 3.1.2 Estuaries 12 3.1.2.1 Mud shores 13 3.1.2.2 Lower saltmarsh 13 3.1.2.3 Upper saltmarsh 14 3.1.3 Seashore 15 3.1.3.1 Sediment shores 15 3.1.3.2 Rocky seashores 15 3.2 Habitat Maps & Site Reports 16 3.2.1 Delvin 17 3.2.2 Cardy Point 19 3.2.3 Balbriggan 21 3.2.4 Isaac’s Bower 23 3.2.5 Hampton 26 3.2.6 Skerries – Barnageeragh 28 3.2.7 Red Island 31 3.2.8 Skerries Shore 31 3.2.9 Loughshinny 33 3.2.10 North Rush to Loughshinny 37 3.2.11 Rush Sandhills 38 3.2.12 Rogerstown Shore 41 3.2.13 Portrane Burrow 43 3.2.14 Corballis 46 3.2.15 Portmarnock 49 3.2.16 The Howth Peninsula 56 4. -

Local Authorities Transparency International Ireland Is an Independent, Non-Profit and Nonpartisan Organisation

NATIONAL INTEGRITY INDEX 2018 Local Authorities Transparency International Ireland is an independent, non-profit and nonpartisan organisation. Our vision is of an Ireland that is open and fair – and where entrusted power is used in the interests of everyone. Our mission is to empower people with the support they need to promote integrity and stop corruption in all its forms. www.transparency.ie Author: Kelly McCarthy Editor: John Devitt Assistant Researcher: Pauline Lowe Additional copy-editing: Angela Long Design: sophieeverett.com.au © Cover photo: iStockphoto (CC) Transparency International (Ireland) Limited 2018. This work is licensed under a Creative Commons AttributionNonCommercial-NoDerivatives 4.0 International License. Any use of or reliance on the information contained in this report is solely at the user’s risk. This study was published with the financial support of the Community Foundation for Ireland, however, it reflects the views of Transparency International Ireland alone. Neither Transparency International Ireland nor the Community Foundation for Ireland can be held responsible for any use which may be made of the information contained herein. NATIONAL INTEGRITY INDEX 2018 Local Authorities CONTENTS 04 INTRODUCTION 06 RESULTS 10 RECOMMENDATIONS 10 Local authorities 11 Department of Housing, Planning and Local Government 11 Local Government Management Agency and County and City Management Association 11 Legislators, including with regard to the Public Sector Standards Bill 2015 12 Standards in Public Office Commission/Lobbying -

Dublin Building Project

DUBLIN BUILDING PROJECT Complied by Pr. Dan Serb on behalf of the Irish Mission Officers’ Committee 24 April 2020 (updated on 29 May) CONTENTS INTRODUCTION ( 3 ) INITIAL MOTIVATION ( 12 ) PROJECT TIMELINE ( 12 ) CURRENT DEVELOPMENTS ( 19 ) FINANCES ( 22 ) TENTATIVE COMPLETION TIMELINE ( 25 ) CURRENT MOTIVATION ( 26 ) LIST OF ANNEXES ( 28 ) 2 INTRODUCTION Brief History of the Irish Mission and the Dublin Seventh-day Adventist Church The Advent message reached the Isle of Ireland in 1889 through the work of American colporteurs such as William Hutchinson, with the first Seventh-day Adventist Church being officially organized on Sunday, 5 July 1891, in Banbridge. The meeting was held in Parkmount House, Banbridge, there being representatives from Banbridge, Tandragee, Clones, Coleraine and Belfast, and was called by Elder D. A. Robinson. The Belfast church was organized shortly after that and initially met in Florenceville Avenue, Ormeau Road, Belfast; around 1956-1957, a purpose-built church was constructed at 74 Lisburn Road, which still houses the recently extended Belfast Church today. The Irish Mission of Seventh-day Adventists was organized in 1902, and in 1917 it numbered 141 members; in 1922 the Church grew to 200. However, from that year, the membership began to be negatively affected by emigration. [It is significant to mention that from that period until the late 1990s the Church found it difficult to record any significant growth; and while emigration played an important role in its stagnation, immigration marked the Church’s resurgence]. The work in Dublin was started in 1898 by M. A. Altman, with a small church group meeting in various locations around the city (ibidem). -

Fingal CYPSC Children and Young People's Plan 2019-2021

Fingal Children and Young People’s Services Committee Fingal Children and Young People’s Plan 2019–2021 Contact Fingal Children and Young People’s Services Committee welcomes comments, views and opinions about our Children and Young People’s Plan. Copies of this plan are available at http://www.cypsc.ie. For further information or to comment on the plan, contact: Úna Caffrey Co-ordinator of FCYPSC Mail: [email protected] Tel: 01 870 8000 2 Map 1: Fingal County 3 Contents Contact .......................................................................................................................................................... 2 List of Acronyms ............................................................................................................................................ 5 Foreword ....................................................................................................................................................... 7 Section 1: Introduction .................................................................................................................................. 8 Background to Children and Young People’s Services Committees .................................................................... 9 Who we are ...................................................................................................................................................... 10 Sub-group structure ........................................................................................................................................ -

Contents Section I

Contents Section I ................................................................................................................................................... 2 Section II .................................................................................................................................................. 3 Section II.3 - quantitative .................................................................................................................... 3 Section III ................................................................................................................................................. 7 Section III.3 - quantitative ................................................................................................................... 7 Section IV .............................................................................................................................................. 10 Section IV.3 - quantitative ................................................................................................................. 10 Section V ............................................................................................................................................... 11 1- Green Procurement. ................................................................................................................. 11 2- Socially responsible public procurement ('SRPP')..................................................................... 11 3- Public procurement of innovation ........................................................................................... -

06 Special Speed Limit Bye-Laws 2020.Pdf

To the Lord Mayor and Report No. 06/2020 Members of Dublin City Council Report of the Traffic & Transportation Strategic Policy Committee _________________________________________________________________________ With reference to proposal to adopt Dublin City Council Special Speed Limit Bye-Laws 2020 _________________________________________________________________________ The following report in relation to the Draft Dublin City Council Parking Control Bye-Laws 2020 was considered by the Transportation Strategic Policy Committee at its meeting of 4th December 2019. Introduction Dublin City Council has undertaken a review of speed limits within its’ administrative area and has engaged through consultation with members of the public, with particular regard to the extension of the 30km/hr speed limit into further residential areas of our city. The review of current speed limits is being undertaken in accordance with the publication of the ‘Guidelines for Setting & Managing Speed Limits in Ireland’ (March 2015) published by the Department of Transport Tourism & Sport. The principle objective of assessing the appropriate speed limits for our roads and streets is to ensure that the set speed limits are as safe and appropriate as possible for vulnerable road users, including children. The Road Traffic Act of 2004 (Section 9) sets out the current legislative basis for the setting of speed limits. The setting of special speed limits is a function of the Elected Members of the council. The current speed limits were last reviewed and updated in 2018. The default speed limit in Dublin City is 50km/hr with a selection of areas, roads and streets where a special speed limit of 30, 60 or 80km/hr are also in place. -

Finalists 2019

FINALISTS 2019 BEST ARTS/CULTURE (INCL. FESTIVALS & EVENTS) Carrickmacross Market House Initiative (Monaghan) Enniscorthy Rockin Food Festival (Wexford) European Outdoor Arts Academy: School of Spectacle (Limerick) Flavours of Fingal County Show (Fingal) Francis Ledwidge Centenary 2017 (Meath) Kenmare Halloween Howl (Kerry) Summer in Bray (Wicklow) Tubbercurry Old Fair Day Festival (Sligo) BEST BUSINESS WORKING WITH THE COMMUNITY Sponsored by An Post Development of Community & Business Alliance Structures (Kerry) Dynamic Purchasing System for Plant Hire (Kerry) Ray of Sunshine after school (Wicklow) Sherry Fitz Support (SDCC) The Urban Co-op (Limerick) BEST COMMUNITY BASED INITIATIVE Athboy HUB (Meath) County Carlow Community First Responder Co-ordination Committee (Carlow) Cranmore Community Co-Operative Society Ltd (Sligo) Fingal Comhairle na nÓg 'Perfect Imperfections' short film (Fingal) Galway Community Heritage - Working together for our Heritage (Galway) Mayo Cancer Support, Rock Rose House (Mayo) Naas Community First Responders (Kildare) The Best Years of Our Lives Have Yet to Come' (Cavan) BEST COMMUNITY HEALTH INITIATIVE Drive Safer for Longer Programme (Mayo) Healthy Abbeyfeale (Limerick) MEDEX programme (SDCC) Moments in Time - Dementia Friendly Garden (Wicklow) Vartry Walks Project (Wicklow) We're Breastfeeding Friendly (Limerick) BEST COMMUNITY SPORTS TEAM/CLUB Kick Ass Adventures (SDCC) Running Club at Westport Leisure Park (Mayo) Wexford Swimming Pool & Leisure -

The Future Geomorphic Landscape in Ireland

IGIrish Geography NOVEMBER 2018 ISSN: 0075-0778 (Print) 1939-4055 (Online) http://www.irishgeography.ie The future geomorphic landscape in Ireland Eugene Farrell and Mary Bourke How to cite: Farrell, E. and Bourke, M. (2018) ‘The future geomorphic landscape in Ireland’. Irish Geography, 51(2), 141–154, DOI: 10.2014/ igj.v51i2.1368 Irish Geography Vol. 51, No. 2 November 2018 10.2014/igj.v51i2.1368 The future geomorphic landscape in Ireland Eugene J. Farrell1 and Mary C. Bourke2 1Discipline of Geography & Ryan Institute, National University Ireland Galway, Galway, Ireland 2 Department of Geography, Trinity College Dublin, College Green, Dublin 2 First received: 12 December 2018 Accepted for publication: 13 March 2019 Abstract: There are multifaceted challenges in conducting geomorphology research in third level institutions in Ireland in an academic era rife with pressures to publish and expectations to conduct relevant research with high societal impact. This special issue includes a series of innovative papers that address that challenge, focused specifically on the vulnerability of Irish landscape systems to climate change and human activity. A series of recommendations are presented that promote the visibility of geomorphology research and teaching and identify opportunities where geomorphologists can contribute to national plans on broad landscape planning and building climate resilience. These include: (i) using climate change as a vehicle to foster new cross- disciplinary research programmes and to bridge the physical-human divide in the discipline of geography; (ii) monetising ecosystems goods and services as a means to obtain proportional capital investment to conserve and protect our neglected and underappreciated geomorphic features and landscapes; and (iii) advocating for appropriately resourced research funding to support essential field-based research in the wider geomorphological field across universities. -

Dublin Canvas

DUBLIN CANVAS SUMMER 2020 CALLOUT Callout for Artwork Submissions - Summer/Autumn 2020 Dublin Canvas is an idea, a public art project intended to bring flashes of colour and creativity to everyday objects within County Dublin. Less grey, more play! The project takes previously unused public space and transforms it into canvases to help brighten up each area. Making Dublin a more beautiful place to live, work and visit. 'Inevitable' by Aoife Flynn Fallon. St. Margaret’s Road, Meakstown, County Dublin (2018) Dublin Canvas utilises traffic light control boxes. These boxes previously designed to go unnoticed will now become canvases for artwork. Leading on from the successful completion of over 430 pieces to date within County Dublin throughout the Summer/Autumn 2015 - 2019. Dublin Canvas is now seeking submissions of artwork for a further 15 boxes located throughout the Fingal County Council area. This is a fantastic opportunity to have your artwork displayed to the public in prime locations. Completed artwork will brighten up and turn these once dull, heavily tagged boxes into beautiful works of art, transforming each area into a walking gallery of public art. Artists and community groups who wish to participate and paint one of this Summer’s available boxes are asked to carefully read the guidelines below on how to enter and then forward on their correctly prepared submissions to [email protected] Visit website www.dublincanvas.com to view all artist’s profiles, to sign up to our mailing list and to further explore the background to Dublin Canvas. Please forward on this brief to family, friends, and work colleagues that you believe may be interested in public art and helping Dublin Canvas to continue to “Colour in the County”. -

€180M Investment Programme for Fingal

FINGAL COUNTY COUNCIL €180M INVESTMENT PROGRAMME FOR FINGAL Fingal County Council’s recent €70 million Framework Loan Agreement with the European Investment Bank (EIB), which will trigger a €180 million investment in strategic infrastructure projects within the Capital Development Plan, is set to benefit more than 300,000 living across the County of Fingal. Report by Grace Heneghan. his Framework Local Agreement, the first EIB support for county-wide investment in partnership Twith an Irish local authority for more than a decade, will enable a step-change in economic growth prospects for Fingal. The agreement with EIB will give Fingal, which has Ireland’s fastest growing and youngest population, the capacity to borrow €70m over the next five years and this will be invested in capital projects in areas such as: • Transport, connectivity and housing land activation. • Enterprise development and job creation including development of new industrial sites. • Tourism promotion and visitor attractions including investment in Pictured at the signing of the Framework Loan Agreement at County Hall in Swords (l-r): historic properties and cycle ways. European Investment Bank’s Vice-President Andrew McDowell, and President Werner Hoyer; • Social and cultural facilities Cllr Mary McCamley, Mayor of Fingal; and Paul Reid, Chief Executive, Fingal County Council. including libraries and facilities for the arts. • Environmental investment. invest,” said the Mayor. Since Fingal County Council was formed in 1994, she EIB President Werner Hoyer and Vice President Andrew pointed to the huge growth across the county in terms of McDowell joined Mayor of Fingal Cllr Mary McCamley and population and economic development.