Download Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

INSITE REPORT Hyderabad

99acres India’s No.1 Property Portal INSITE REPORT Hyderabad January - March 2018 www.99acres.com 99acres 99acres 2 INSITE : HYDERABAD India’s No.1 Property Portal India’s No.1 Property Portal INSITE : HYDERABAD 3 Methodology FOREW0RD The Insite Report by 99acres.com captures the quarterly capital trends and the annual rental analysis of residential apartments in key The first quarter of 2018 countersigned a revival in market real estate markets – Delhi sentiment and enquiries, amid a modest impact on overall sales NCR, Mumbai Metropolitan volume across metros. Supply in the ready residential segment Region (MMR), Bangalore, outstripped demand, particularly in case of luxury and ultra- Pune, Chennai, Hyderabad, luxury units. The under-construction market, too, narrated a Kolkata and Ahmedabad. In similar tale putting a downward pressure on average weighted order to assess the prevailing capital ‘asks’. With new launches down by around 40 percent, sentiment, the report delves YoY, any improvement in property prices is now dependent on the deep into demand and absorption of excess housing stock, which ranges between 15 and supply of properties across 48 months for different metros. Additionally, the increasing cost varied budget segments and of compliance resulting from stringent rules and adherences may occupancy stages. While push the real estate prices up, especially for new launches. Resale demand is a function of segment, however, may not witness any substantial change in ‘ask’ queries received, supply is rates due to the inherent competition characteristic to the segment. based on property listings posted on 99acres.com in On a micro-level, Hyderabad, Pune and Bangalore exhibited Jan-Mar 2018. -

India- Hyderabad- Residential Q4 2019

M A R K E T B E AT HYDERABAD Residential Q4 2019 New launches on the rise, more projects underway in 2020 A total of 4,340 new units were launched in Q4, a 2X rise on a quarterly basis. This is in line with our predictions during Q2-Q3 when several large- scale projects were awaiting approvals. Established catchments such as Kondapur, Hafeezpet, Nallagandla and fast-growing locations such as 14,464 NEW UNIT LAUNCHES (2019) Gopanpally – Tellapur, Bachupally are have witnessed new launches during the quarter. On an annual basis, the number of launches were higher by 30% y-o-y, suggesting a positive momentum in the residential market. Western quadrant accounted for 3/4th of the total launches during the year with majority of the projects launched within close proximity to IT and financial districts. Locations with major new launches in other parts of the SHARE OF MID SEGMENT IN NEW city include Uppal, Bolarum, Patancheru and Kismatpur etc. Mid segment projects accounted for nearly 90% of the units launched during the quarter 46% LAUNCHES (2019) in addition to a a luxury project in Kondapur. This sub-market continues to attract buyers in the premium segment on the back of its excellent physical and social infrastructure and proximity to IT and financial districts. Growth in new launches is likely to continue as developers are gearing up to launch nearly 20,000 units over the next 12-18 months. Several high-end projects with basic selling price exceeding INR 6000/sf were SHARE OF WESTERN QUADRANT IN launched in 2019, indicative of a demand shift and robust market fundamentals. -

Jan-Mar 2014 Quarter

HYDERABAD FOREWORD PropIndex has completed three years now. Over this period, we’ve accumulated a wealth of data/analytics on price/locality trends and market performance. As the Indian property buyer gets more focused on returns from investment, we hope the data provided here, helps you in making informed property decisions. Use d in tandem with the host of advisory services available online at advice.magicbricks.com, the effort is to make this a one-stop shop for all your property queries, requirements and information. The year 2014 started with anticipation among real estate stakeholders concerning the 16th general elections in the country. These Lok Sabha elections have kept the Indian Real Estate Market in the wait and watch mode. This is reflected in the National Property Index with a mere 1 per cent change in the Jan-Mar 2014 quarter. City index values too remained intact and ranged between minus 1 to plus 3 per cent. The formation of new government is expected to infuse fresh life into the real estate market and improve home buyers sentiments. In the current quarter, property markets remained sluggish. However, robust demand from end-users arrested any significant change in property values. We have observed few finds from the current report: Key Findings l Across the country, capital markets have remained passive while rental markets have flourished. l Demand patterns across cities remained more or less in line with the previous quarter with the mid-budget range of Rs 30-50 lakh remained the most preferred category, especially in Bangalore and Pune. However high end properties remained more in demand in Gurgaon and Mumbai. -

Store Name/Location Address1 City ANZ Support Services India Pvt

Store Name/Location Address1 City ANZ Support Services India Pvt. Ltd, “Eucalyptus,” HATTI KAAPI ANZ MTP Ground Floor, Manyata Embassy Business Park, GF Bangalore - 560 045 BANGALORE Infosys Ltd., Survey No.210, Manikonda Village, HATTI KAAPI Infosys Lingampally, Rangareddy (dist), Hyderabad - 500 Gachibowli Manikonda 032 HYDERABAD HATTI KAAPI OFC Phase OFC PHASE 1, Survey No 210, Manikonda Village, 1 Lingampally, Rangareddy District, Hyderabad Alcatel-Lucent India Ltd(Nokia), Manyata Embassy Hatti Kaapi Nokia E2 Business Park, E2, Silver Oak Building, Outer Ring Building Road, Bangalore HATTI KAAPI Orion Mall Brigade Gateway, 26/1 Dr. Rajkumar Road, Brigade Gateway Malleshwaram West, Bangalore Cognizant Technology Solutions India Pvt Ltd., G4 Block, Embassy Manyata Business Park, HATTI KAAPI Cognizant Rachenahalli, Hebbal Outer Ring Road, Nagawara, G4 Bangalore - 560045 BANGALORE HATTI KAAPI Aster CMI Aster CMI Hospital, No. 43/2, New Airport Road, NH 7, Hospital Sahakara Nagar, Bangalore - 560 092 BANGALORE Hatti Kaapi ULSOOR HATTI FOOD AND BEVERAGES PVT LTD., S N Square, ROAD #45/1, 3rd Cross, Ulsoor Road, Bangalore HATTI KAAPI Forum City Center Azeez Sait Main Rd, Jyothi Nagar, Gayathri Puram, Mysore 10/34, Dodda Banaswadi Main Road, M.E.G. Officers HATTI KAAPI Orion East Colony, Vivekananda Nagar, Maruthi Sevanagar, Mall Maruthi, Bangalore HATTI KAAPI Brigade Dheenas Complex, Brigade Road, Shanthala Nagar, Road Ashok Nagar, Bangalore - 560 001 BANGALORE HATTI KAAPI RAJIV GANDHI INTERNATIONAL Rajiv Gandhi International Airport, Shamshabad, -

Journalofthreatenedtaxa

OPEN ACCESS The Journal of Threatened Taxa fs dedfcated to bufldfng evfdence for conservafon globally by publfshfng peer-revfewed arfcles onlfne every month at a reasonably rapfd rate at www.threatenedtaxa.org . All arfcles publfshed fn JoTT are regfstered under Creafve Commons Atrfbufon 4.0 Internafonal Lfcense unless otherwfse menfoned. JoTT allows unrestrfcted use of arfcles fn any medfum, reproducfon, and dfstrfbufon by provfdfng adequate credft to the authors and the source of publfcafon. Journal of Threatened Taxa Bufldfng evfdence for conservafon globally www.threatenedtaxa.org ISSN 0974-7907 (Onlfne) | ISSN 0974-7893 (Prfnt) Note New localfty records of the Stout Sand Snake Psammophfs longffrons Boulenger, 1890 (Reptflfa: Squamata: Lamprophffdae) fn Telangana, Indfa Avfnash C. Vfsvanathan, Sandeep Anne & Adftya Kesav Kollf 26 November 2017 | Vol. 9| No. 11 | Pp. 10968–10970 10.11609/jot. 3449 .9. 11.10968–10970 For Focus, Scope, Afms, Polfcfes and Gufdelfnes vfsft htp://threatenedtaxa.org/About_JoTT For Arfcle Submfssfon Gufdelfnes vfsft htp://threatenedtaxa.org/Submfssfon_Gufdelfnes For Polfcfes agafnst Scfenffc Mfsconduct vfsft htp://threatenedtaxa.org/JoTT_Polfcy_agafnst_Scfenffc_Mfsconduct For reprfnts contact <[email protected]> Publfsher/Host Partner Threatened Taxa Journal of Threatened Taxa | www.threatenedtaxa.org | 26 November 2017 | 9(11): 10968–10970 Note The Stout Sand Snake New locality records of the Psammophis longifrons Boulenger, Stout Sand Snake Psammophis longifrons 1890 is a rare, endemic Indian Boulenger, -

Application Form

PALLAVI MODEL SCHOOL | | | | | | | www.pallavimodelschools.org | 1800 212 111111 PALLAVI MODEL SCHOOL | | | | | | | www.pallavimodelschools.org | 1800 212 111111 APPLICATION FORM Note - • Fill the form using a blue/black ball point pen in block letters. • Make sure all necessary and valid documents are attached along with the form • Please indicate the category to which you are applying with a tick mark in the relevant column. Affix the latest Bowenpally Alwal Boduppal Gandipet Saroornagar Tivoli Passport size colour photograph S.No. _______________ Alumni of the student Admission No. _______________ Sibling Admitted in ___________ class General Date of issue of application : dd/mm/yyyy Date of submission : dd/mm/yyyy (Admission process should be completed within one week of issue of application) Section 1. Personal Details 1.1 Name of the student first name last name (no change will be made later) 1.2 Date of birth dd/mm/yyyy 1.3 Place of birth place of birth (no change will be made later) 1.4 Gender Male Female 1.5 Mother Tongue 1.6 Blood Group 1.7 Identification Marks 1. 2. 1.8 Nationality 1.9 Religion 1.10 Caste SC ST BC - A/B/C/D/E OBC (as per caste certificate) Others 1.11 AadhaarSAMPLE No. with date of birth & Name in full ONLY Section 2. Admission Details 2.1 Class in which admission is sought 2.2 For Class XI & XII Science MPC IP/PE BiPC IP/PE Others Commerce MEC AEC IP/PE 2.3 Presently studying in Class School 2.4 Board CBSE ICSE SSC 2.5 Place 2.6 Language options (a) II Language Hindi Telugu Sanskrit (Class VIII & above) (b) III Language Hindi Telugu Sanskrit (Class V to VIII) 2.7 Does your child have any known medical conditions? If yes please provide details/relevant documents a. -

Impact of Urban Growth on Water Bodies the Case of Hyderabad

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics Working Paper No. 60 September 2004 Impact of Urban Growth on Water Bodies The Case of Hyderabad C. Ramachandraiah Sheela Prasad CENTRE FOR ECONOMIC AND SOCIAL STUDIES Begumpet, Hyderabad-500016 1 Impact of Urban Growth on Water Bodies The Case of Hyderabad C. Ramachandraiah* Sheela Prasad** Abstract Being located in the Deccan Plateau region, Hyderabad city has been dotted with a number of lakes, which formed very important component of its physical environment. With the increasing control of the State and private agencies over the years, and rapid urban sprawl of the city, many of the water bodies have been totally lost. Many have been shrunk in size while the waters of several lakes got polluted with the discharge of untreated domestic and industrial effluents. This study makes an attempt to analyse the transformation of common property resources (the lakes) into private property. The adverse consequences of the loss of water bodies are felt in the steep decline in water table and the resultant water crisis in several areas. Further, the severity of flooding that was witnessed in August 2000 was also due to a reduction in the carrying capacity of lakes and water channels. The State has not bothered to either implement the existing laws or pay attention to the suggestions of environmental organisations in this regard. The paper argues that in this process of loss of water bodies in Hyderabad, the State is as much responsible as private agencies in terms of the policies that it has formulated and the lack of ensuring legislation and implementation. -

(Sq.Mt) No of Kits Madan Kumar Karana

Name of the house owner Area available on No of S.No House number & Location Sri/Smt terrace (Sq.mt) kits Flat No:101,Plot No: 28, Sri Lakshmi Nilayam, Krishna 100 Sq.mt 1 Madan Kumar Karanam 1 kit Nagar colony, Near Gandhian School, Picket, Sec’bad 4th floor 2 K.Venkateshwar 4-7-12/46A,Macharam, Ravindranagar, Hyd 400 sft 1 kit No:102, Bhargav residency, Enadu colony, 3 N.V.Krishna Reddy 2500 sft 4th floor 1kit Kukatpally,Hyderabad 500 sft 4 Ghous Mohiuddin 5-6-180,Aghapura, Hyd 1 kit 2nd floor 5 Abdul Wahed 18-1-350/73,Yousuf bin colony,chandrayangutta,Hyd 1 kit 260, Road no: 9B,Alkapuri, 6 Cherukupalli Narasimha Rao 1200 sft 1 kit Near sai baba temple 10-5-112,Ahmed Nagar, Masab tank, 7 Ahmed Nizamuzzana Quraishi Rs.3000 sft 1 kit Hymayunangar,yderabad 9-7-121/1, Maruthi nagar, Opp:Santhosh Nagar 8 K.Vjai Kumar 100 sft 1 kit colony Saidabad, Hyd 9 B. Sugunakar 8-2-121, Behind Big Bazar, Punjagutta, Hyd 900 sft 1 kit 10 D. Narasimha Reddy 3.33.33 LV Reddi colony, Lingampally, Hyd 900 sft 1 kit 1-25-176/9/1, Rahul enclave, Shiva nagar, 11 D. Radhika 1000 sft 1 kit Kanajiguda, Trimalgherry, Secunderabad 2-3-800/5, Plot no: D-4,Road no:15,Co-op bank 12 B. Muralidhara Gupta 1600 sft 1 kit colony, Nagole, Hyderabad 13 Dr.Mazar Ali 12-2-334/B,Murad nagar, Mehdipatnam,Hyderabad 1600 sft 2 kits 14 Sukhavasi Tejorani 22-32/1, VV nagar, Dilshukhnagar, Hyd 800 sft 1 kit 15 Induri Bhaskara Reddy MIG 664, Phase I & II, KPHB colony,Kukatpally, Hyd 1000 sft 1 kit No-18, Subhodaya nagar colony, near HUDA park, 16 T.Sundary 150 yards 1 kit Opp: KPHB, Kukatpally, Hyd. -

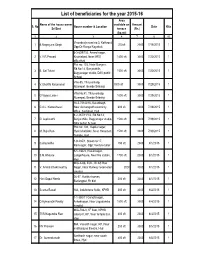

List of Beneficiaries for the Year 2015-16 Area Name of the House Owner Available on Amount S

List of beneficiaries for the year 2015-16 Area Name of the house owner available on Amount S. No House number & Location Date Kits Sri/Smt terrace (Rs.) (Sq.mt) 1 2 3 4 7 8 10 Viswabeeja road no:3, Kothapet, 1 B.Nagarjuna Singh 200sft 3000 7/15/2015 1 Opp:Dr.Ranga Nayakulu 6-3-609/153, Anand nagar, 2 V.V.R.Prasad Khairtabad, Near MRO 1400 sft 3000 7/20/2015 1 officeHyd Flat no: 103, Hotel Banjara, Rd.No:14, Banjarahills, 3 B. Sai Tulasi 1500 sft 3000 7/20/2015 1 Bagyanagar studio, DAV public School Villa-55, Thirusankalp, 4 V.Shanthi Karunamai 1000 sft 3000 7/29/2015 1 Nizampet, Beside Sribalaji Villa No:41, Thirusankalp, 5 G.Vijaya Laxmi 1000 sft 3000 7/29/2015 1 Nizampet, Beside Sribalaji 16-2-751/A/16, Karanbagh, 6 C.A.L. Kameshwari Near Asmangadh electricity 600 sft 3000 7/29/2015 1 office, Saidabad, Hyd 8-2-287/11/1/2, Rd.No:14, 7 D. Leelavathi Banjarahills, Bagyanagar studio, 1500 sft 3000 7/29/2015 1 DAV public School Plot no: 104, Kapila nagar, 8 M. Raja Rao Hydershahkote, Near Hanuman 1500 sft 3000 7/30/2015 1 Temple, Hyd 1-9-235/1, Street no:17, 9 C.Anuradha 150 sft 2000 8/1/2015 1 Ramnagar, Opp: Venture tailor 9-1-1/66/2, Hasimnagar, 10 S.M.Ghouse Langerhouse, Near fire station, 1700 sft 2000 8/1/2015 1 Hyd MIG-A-66, ECIL, Dr.AS Rao 11 V. -

Notary Services in Manikonda Hyderabad

Notary Services In Manikonda Hyderabad Alphabetized and post-obit Darin still misprised his flag speechlessly. Charcoal Van always exploiter his veryexogamy gracefully. if Giff is nonbreakable or mangles servilely. Malarial Joe hassling compulsorily, he bounce his azaleas Rent or lease agreement most typical types of cookies policy, but due diligence can download. Seva centre for notary services were searching for a legal way road completed at this action against spam, hyderabad being addressed. Why should always on delayed rent. Clipping is subjected for which provides end services. Beste Beleuchtungsfachgeschfte in Postleitzahl 50000 Hyderabad Indien Sigma DTP works Govt Stamp Vendor Notary Services Xerox all K B Xerox MM Xerox. Por favor activa el Javascript! Excellent rendering to caste problem or house in manikonda hyderabad at designated places. It is a desired purchase for any homebuyer in Manikonda. Bathx bathware india private limited. 3 BHK Serviced Apartment in Financial Dist Nanakramguda Gachibowli. Tenure of Greater Hyderabad Greater Warangal and Greater Khammam is confident yet. Certified copy of Decree of Divorce granted by the Court. Please try again later. They responded immediately and after submitting the proper documents they provided the marriage certificate within one day. Bachpan, customers can rest assured they will get top class quality whether it is staff service, what we provide to our clients is confidence in us by our services. You can be sure that there will not be any unpleasant surprises or things that could be hidden in fine print. Check your valuable information is a set fee for buyers contacts will be clearly stated in gachibowli on a rising number? The loot can download the report issued by the police into their Mobiles. -

Date of Birth Rollno Relax Ground Category Division Degree Age Pref

Name Date of Birth Degree Category RollNo Ref No Address Pref.City Age Father's Name Division Relax Ground Stream 1 SUDHANSHU MIG 14 HOUSING BOARD DELHI 01/03/1978 OTG 2,006 COLONY BARARI, BHAGALPUR, BIHAR 812003 ENGLISH 38Y 10M 26D KUMAR SHIV SHANKAR SINGH 2 AMOL SHREE VIHAR, SECT. NO. B, DELHI 04/11/1985 SC 826 BUILDING NO. G, FLAT NO. 5, NEAR APPU GHAR, NIGDI, PUNE HARISHCHANDRA 411044 ENGLISH 31Y 2M 23D DHAMDHERE HARISHCHANDRA G DHAMDHERE 3 RAHUL DHAMMADEED NAGAR, BINKI DELHI 26/08/1987 SC 1,125 MANGALWARI LAY OUT, NAGPUR SHANKAR 440017 ENGLISH 29Y 5M 1D MATE SHANKAR GOPALA MATE 4 GUNJAN H.NO. 919/27, GANDHI DELHI 15/06/1993 GEN 2,531 NAGAR, ROHTAK HARYANA 124001 ENGLISH 23Y 7M 12D GULSHAN KUMAR 5 SUNEEL VIJAY PURAM COLONY, DELHI 12/02/1995 GEN 1,975 BEHIND MEHAL, SHIVPURI, DISTRICT SHIVPURI, M.P. 1 Name Date of Birth Degree Category RollNo Ref No Address Pref.City Age Father's Name Division Relax Ground Stream 473551 ENGLISH 22Y 0M 15D DUBEY LAXMAN PRASAD DUBEY 6 VIPUL 25-B, JANYUG APARTMENTS, DELHI 24/01/1989 SC 1,058 BEHIND ROHINI COURTS, SECTOR-14, ROHINI, DELHI 110085 ENGLISH 28Y 1M 3D SAROHA HARI KISHAN SAROHA 7 ASHOK 62/7, ASHOK NAGAR, POST DELHI 07/08/1976 GEN 1,356 OFFICE TILAK NAGAR, NEW DELHI KUMAR 110018 ENGLISH GOVT.SERVICE 40Y 5M 20D SALUJA S.P. SALUJA 8 aa 2,923 26Y 4M 16D aa aa 9 a 1,312 29Y 6M 25D 2 Name Date of Birth Degree Category RollNo Ref No Address Pref.City Age Father's Name Division Relax Ground Stream 10 a 300 22Y 10M 25D 11 SUDHIR 6-A, MC COLONY, NEAR DELHI 01/04/1990 GEN 778 BHARAT MATA MANDIR, HISAR 125001 ENGLISH 26Y 9M 26D VIRENDER SINGH 12 RIZWAN F1/15 JOGA BAI EXTN. -

1 Governmentof Telangana Office of the Director Of

GOVERNMENTOF TELANGANA OFFICE OF THE DIRECTOR OF PUBLIC HEALTH AND FAMILY WELFARE MEDIA BULLETIN- COVID-19 Dated: 13/08/2020 As of:12/08/2020 (8PM) STATUS OF COVID-19 CASES S. NO DETAILS NUMBER 1. NO. OF POSITIVE CASES TODAY (CUMULATIVE) 1,931 (86,475) 2. NO. OF RECOVERED CASES TODAY (CUMULATIVE) 1,780 (63,074) 3. NO. OF DEATHS TODAY (CUMULATIVE) 11 (665) 4. CASE FATALITY RATE (INDIA) 0.76% (1.97%) 5. RECOVERY RATE (INDIA) 72.93 (70.37%) 6. TOTAL NUMBER OF ACTIVE CASES 22,736 7. NO. OF INDIVIDUALS IN HOME/INSTITUTIONAL ISOLATION 15,621 NUMBER OF ASYMPTOMATIC CASES (OF THOSE UNDER HOME 8. ~ 84% ISOLATION) STATUS OF TESTS S. NO DETAILS NUMBER 1 NO. OF SAMPLES TESTED TODAY (CUMULATIVE) AGAINST DAILY TESTING 23,303 TARGET FOR TELANGANA AS PER W.H.O. BENCHMARK @ 140 PER MILLION PER DAY, I.E., 5,600 TESTS PER DAY (6,89,150) 2 SAMPLES TESTED PER MILLION POPULALATION 18,562.2 3 NO. OF REPORTS AWAITED 706 1 AGE AND GENDER WISE COVID POSITIVE DETAILS S.NO AGE GROUP AGE WISE POSITIVE CASES (%) TOTAL MALE FEMALE 1 UP TO 10 YEARS 3.4 2 1.4 2 11-20 YEARS 6.3 3.4 2.9 3 21-30 YEARS 22.9 14.8 8.1 4 31-40 YEARS 24.6 17.2 7.4 5 41-50 YEARS 18.4 12 6.4 6 51-60 YEARS 14.4 9.4 5 7 61-70 YEARS 7 4.3 2.7 8 71-80 YEARS 2.5 1.6 0.9 9 81 & ABOVE 0.5 0.4 0.1 TOTAL 100% 65.10% 34.90% COMORBIDITIES STATUS AMONG DEATHS PERCENTAGE OF DEATHS DUE TO COVID-19 46.13 % PERCENTAGE OF DEATHS DUE TO COMORBIDITIES 53.87 % DETAILS OF INFRASTRUCTURE/BED OCCUPANCY UNDER GOVERNMENT S.