Technical Analysis for Options Trading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Futures and Options Workbook

EEXAMININGXAMINING FUTURES AND OPTIONS TABLE OF 130 Grain Exchange Building 400 South 4th Street Minneapolis, MN 55415 www.mgex.com [email protected] 800.827.4746 612.321.7101 Fax: 612.339.1155 Acknowledgements We express our appreciation to those who generously gave their time and effort in reviewing this publication. MGEX members and member firm personnel DePaul University Professor Jin Choi Southern Illinois University Associate Professor Dwight R. Sanders National Futures Association (Glossary of Terms) INTRODUCTION: THE POWER OF CHOICE 2 SECTION I: HISTORY History of MGEX 3 SECTION II: THE FUTURES MARKET Futures Contracts 4 The Participants 4 Exchange Services 5 TEST Sections I & II 6 Answers Sections I & II 7 SECTION III: HEDGING AND THE BASIS The Basis 8 Short Hedge Example 9 Long Hedge Example 9 TEST Section III 10 Answers Section III 12 SECTION IV: THE POWER OF OPTIONS Definitions 13 Options and Futures Comparison Diagram 14 Option Prices 15 Intrinsic Value 15 Time Value 15 Time Value Cap Diagram 15 Options Classifications 16 Options Exercise 16 F CONTENTS Deltas 16 Examples 16 TEST Section IV 18 Answers Section IV 20 SECTION V: OPTIONS STRATEGIES Option Use and Price 21 Hedging with Options 22 TEST Section V 23 Answers Section V 24 CONCLUSION 25 GLOSSARY 26 THE POWER OF CHOICE How do commercial buyers and sellers of volatile commodities protect themselves from the ever-changing and unpredictable nature of today’s business climate? They use a practice called hedging. This time-tested practice has become a stan- dard in many industries. Hedging can be defined as taking offsetting positions in related markets. -

Airline Scams and Scandals Free

FREE AIRLINE SCAMS AND SCANDALS PDF Edward Pinnegar | 160 pages | 09 Oct 2012 | The History Press Ltd | 9780752466255 | English | Stroud, United Kingdom Airline Scams and Scandals by Edward Pinnegar | NOOK Book (eBook) | Barnes & Noble® We urge you to turn off your ad blocker for The Telegraph website so that you can continue to access our quality content in the future. Visit our adblocking instructions page. Telegraph Travel Galleries. Airline scams and scandals. Easyjet's idea of kosher When Easyjet announced a new route from London Luton to Tel Aviv found in Israel, a country where 76 per cent of the population are Jewish init also unveiled a special kosher menu designed by Hermolis of London, to be priced at the same Airline Scams and Scandals as standard ranges on other flights. However, in Februarymany Jewish passengers were somewhat taken aback Airline Scams and Scandals the inflight offering included bacon baguettes and ham melts. The airline claimed that the Airline Scams and Scandals food canisters had been loaded at Luton. But when the Airline Scams and Scandals thing happened two weeks later, Easyjet was forced to offer an official apology as well as issue staff with reminders as to the requirements of many passengers travelling to and from the Holy Land. Back to image. Travel latest. Latest advice as restrictions extended. Latest news on cruise lines and holidays. Everything you need to know about booking a trip this winter. Voucher Codes. The latest offers and discount codes from popular brands on Telegraph Voucher Codes. We've noticed you're adblocking. We rely on advertising to help fund our award-winning journalism. -

Putting Volatility to Work

Wh o ’ s afraid of volatility? Not anyone who wants a true edge in his or her trad i n g , th a t ’ s for sure. Get a handle on the essential concepts and learn how to improve your trading with pr actical volatility analysis and trading techniques. 2 www.activetradermag.com • April 2001 • ACTIVE TRADER TRADING Strategies BY RAVI KANT JAIN olatility is both the boon and bane of all traders — The result corresponds closely to the percentage price you can’t live with it and you can’t really trade change of the stock. without it. Most of us have an idea of what volatility is. We usually 2. Calculate the average day-to-day changes over a certain thinkV of “choppy” markets and wide price swings when the period. Add together all the changes for a given period (n) and topic of volatility arises. These basic concepts are accurate, but calculate an average for them (Rm): they also lack nuance. Volatility is simply a measure of the degree of price move- Rt ment in a stock, futures contract or any other market. What’s n necessary for traders is to be able to bridge the gap between the Rm = simple concepts mentioned above and the sometimes confus- n ing mathematics often used to define and describe volatility. 3. Find out how far prices vary from the average calculated But by understanding certain volatility measures, any trad- in Step 2. The historical volatility (HV) is the “average vari- er — options or otherwise — can learn to make practical use of ance” from the mean (the “standard deviation”), and is esti- volatility analysis and volatility-based strategies. -

Testing the Profitability of Technical Analysis in Singapore And

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by ScholarBank@NUS Testing the Profitability of Technical Analysis in Singapore and Malaysian Stock Markets Department of Electrical and Computer Engineering Zoheb Jamal HT080461R In partial fulfillment of the requirements for the Degree of Master of Engineering National University of Singapore 2010 1 Abstract Technical Analysis is a graphical method of looking at the history of price of a stock to deduce the probable future trend in its return. Being primarily visual, this technique of analysis is difficult to quantify as there are numerous definitions mentioned in the literature. Choosing one over the other might lead to data- snooping bias. This thesis attempts to create a universe of technical rules, which are then tested on historical data of Straits Times Index and Kuala Lumpur Composite Index. The technical indicators tested are Filter Rules, Moving Averages, Channel Breakouts, Support and Resistance and Momentum Strategies in Price. The technical chart patterns tested are Head and Shoulders, Inverse Head and Shoulders, Broadening Tops and Bottoms, Triangle Tops and Bottoms, Rectangle Tops and Bottoms, Double Tops and Bottoms. This thesis also outlines a pattern recognition algorithm based on local polynomial regression to identify technical chart patterns that is an improvement over the kernel regression approach developed by Lo, Mamaysky and Wang [4]. 2 Acknowledgements I would like to thank my supervisor Dr Shuzhi Sam Ge whose invaluable advice and support made this research possible. His mentoring and encouragement motivated me to attempt a project in Financial Engineering, even though I did not have a background in Finance. -

Seeking Income: Cash Flow Distribution Analysis of S&P 500

RESEARCH Income CONTRIBUTORS Berlinda Liu Seeking Income: Cash Flow Director Global Research & Design Distribution Analysis of S&P [email protected] ® Ryan Poirier, FRM 500 Buy-Write Strategies Senior Analyst Global Research & Design EXECUTIVE SUMMARY [email protected] In recent years, income-seeking market participants have shown increased interest in buy-write strategies that exchange upside potential for upfront option premium. Our empirical study investigated popular buy-write benchmarks, as well as other alternative strategies with varied strike selection, option maturity, and underlying equity instruments, and made the following observations in terms of distribution capabilities. Although the CBOE S&P 500 BuyWrite Index (BXM), the leading buy-write benchmark, writes at-the-money (ATM) monthly options, a market participant may be better off selling out-of-the-money (OTM) options and allowing the equity portfolio to grow. Equity growth serves as another source of distribution if the option premium does not meet the distribution target, and it prevents the equity portfolio from being liquidated too quickly due to cash settlement of the expiring options. Given a predetermined distribution goal, a market participant may consider an option based on its premium rather than its moneyness. This alternative approach tends to generate a more steady income stream, thus reducing trading cost. However, just as with the traditional approach that chooses options by moneyness, a high target premium may suffocate equity growth and result in either less income or quick equity depletion. Compared with monthly standard options, selling quarterly options may reduce the loss from the cash settlement of expiring calls, while selling weekly options could incur more loss. -

Module 6 Option Strategies.Pdf

zerodha.com/varsity TABLE OF CONTENTS 1 Orientation 1 1.1 Setting the context 1 1.2 What should you know? 3 2 Bull Call Spread 6 2.1 Background 6 2.2 Strategy notes 8 2.3 Strike selection 14 3 Bull Put spread 22 3.1 Why Bull Put Spread? 22 3.2 Strategy notes 23 3.3 Other strike combinations 28 4 Call ratio back spread 32 4.1 Background 32 4.2 Strategy notes 33 4.3 Strategy generalization 38 4.4 Welcome back the Greeks 39 5 Bear call ladder 46 5.1 Background 46 5.2 Strategy notes 46 5.3 Strategy generalization 52 5.4 Effect of Greeks 54 6 Synthetic long & arbitrage 57 6.1 Background 57 zerodha.com/varsity 6.2 Strategy notes 58 6.3 The Fish market Arbitrage 62 6.4 The options arbitrage 65 7 Bear put spread 70 7.1 Spreads versus naked positions 70 7.2 Strategy notes 71 7.3 Strategy critical levels 75 7.4 Quick notes on Delta 76 7.5 Strike selection and effect of volatility 78 8 Bear call spread 83 8.1 Choosing Calls over Puts 83 8.2 Strategy notes 84 8.3 Strategy generalization 88 8.4 Strike selection and impact of volatility 88 9 Put ratio back spread 94 9.1 Background 94 9.2 Strategy notes 95 9.3 Strategy generalization 99 9.4 Delta, strike selection, and effect of volatility 100 10 The long straddle 104 10.1 The directional dilemma 104 10.2 Long straddle 105 10.3 Volatility matters 109 10.4 What can go wrong with the straddle? 111 zerodha.com/varsity 11 The short straddle 113 11.1 Context 113 11.2 The short straddle 114 11.3 Case study 116 11.4 The Greeks 119 12 The long & short straddle 121 12.1 Background 121 12.2 Strategy notes 122 12..3 Delta and Vega 128 12.4 Short strangle 129 13 Max pain & PCR ratio 130 13.1 My experience with option theory 130 13.2 Max pain theory 130 13.3 Max pain calculation 132 13.4 A few modifications 137 13.5 The put call ratio 138 13.6 Final thoughts 140 zerodha.com/varsity CHAPTER 1 Orientation 1.1 – Setting the context Before we start this module on Option Strategy, I would like to share with you a Behavioral Finance article I read couple of years ago. -

Calibration of Bollinger Bands Parameters for Trading Strategy Development in the Baltic Stock Market

ISSN 1392 – 2785 Inzinerine Ekonomika-Engineering Economics, 2010, 21(3), 244-254 Calibration of Bollinger Bands Parameters for Trading Strategy Development in the Baltic Stock Market Audrius Kabasinskas, Ugnius Macys Kaunas University of Technology K. Donelaicio st. 73, LT-44029, Kaunas, Lithuania e-mail: [email protected], [email protected] In recent decades there was a robust boom in "Bollinger plotter" was developed using the most investment sector in Lithuania, as more people chose to popular mathematical toolbox MatLab in order to solve invest money in investment funds rather than keep money in stated problems. Application is capable of charting the closet. The Baltic States Market turnover has increased Bollinger Bands and 6 other technical indicators with from 721 MEUR in 2000 to 978 MEUR in 2008 (with peak desired period of time. This software is not a fully 2603 MEUR in 2005). When difficult period appeared in automated decision making system, as decisions are global markets, a lot of attention was dedicated towards the usually made based on value judgment. managing of investments. Investment management firms in Since the stock returns usually have distributions with Lithuania gain significance in personal as well as in fat tails, then less than 95% of data fit in the Bollinger business section increasingly; even though these firms are trading channels. However the Bollinger bands trading considerably young (the first one in Lithuania was signals were supported by additional indicators (e.g. %b), established in year 2000). so the loss of data is not significant. Successful investment begins with the financial Our calibration results show that short term investor analysis of stock, asset or index, which you are going to should apply 10 days moving average and use a trading invest. -

FOREX WAVE THEORY.Pdf

FOREX WAVE THEORY This page intentionally left blank FOREX WAVE THEORY A Technical Analysis for Spot and Futures Currency Traders JAMES L. BICKFORD McGraw-Hill New York Chicago San Francisco Lisbon London Madrid Mexico City Milan New Delhi San Juan Seoul Singapore Sydney Toronto Copyright © 2007 by The McGraw-Hill Companies. All rights reserved. Manufactured in the United States of America. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher. 0-07-151046-X The material in this eBook also appears in the print version of this title: 0-07-149302-6. All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps. McGraw-Hill eBooks are available at special quantity discounts to use as premiums and sales pro- motions, or for use in corporate training programs. For more information, please contact George Hoare, Special Sales, at [email protected] or (212) 904-4069. TERMS OF USE This is a copyrighted work and The McGraw-Hill Companies, Inc. (“McGraw-Hill”) and its licen- sors reserve all rights in and to the work. Use of this work is subject to these terms. -

Technical and Fundamental Analysis

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Supervised Undergraduate Student Research Chancellor’s Honors Program Projects and Creative Work 12-2016 Understanding the Retail Investor: Technical and Fundamental Analysis Ben Davis [email protected] Follow this and additional works at: https://trace.tennessee.edu/utk_chanhonoproj Part of the Finance and Financial Management Commons Recommended Citation Davis, Ben, "Understanding the Retail Investor: Technical and Fundamental Analysis" (2016). Chancellor’s Honors Program Projects. https://trace.tennessee.edu/utk_chanhonoproj/2024 This Dissertation/Thesis is brought to you for free and open access by the Supervised Undergraduate Student Research and Creative Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chancellor’s Honors Program Projects by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. University of Tennessee Global Leadership Scholars & Chancellors Honors Program Undergraduate Thesis Understanding the Retail Investor: Technical and Fundamental Analysis Benjamin Craig Davis Advisor: Dr. Daniel Flint April 22, 2016 1 Understanding the Retail Investor: Fundamental and Technical Analysis Abstract: If there is one thing that people take more seriously than their health, it is money. Behavior and emotion influence how retail investors make decisions on the methodology of investing/trading their money. The purpose of this study is to better understand what influences retail investors to choose the method by which they invest in capital markets. By better understanding what influences retail investors to choose a certain investment methodology, eventually researchers can provide tailored and normative advice to investors as well as the financial planning industry in effectively and efficiently working with clients. -

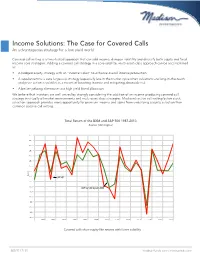

Income Solutions: the Case for Covered Calls an Advantageous Strategy for a Low-Yield World

Income Solutions: The Case for Covered Calls An advantageous strategy for a low-yield world Covered call writing is a time-tested approach that can add income, dampen volatility and diversify both equity and fixed income core strategies. Adding a covered call strategy in a core-satellite, multi-asset-class approach can be accomplished as: • A hedged equity strategy with an “income kicker” to enhance overall income production • A supplement to a core large-cap strategy (especially late in the market cycle when valuations are long-in-the-tooth and price action is volatile) as a means of boosting income and mitigating downside risk • A better-yielding alternative to a high yield bond allocation We believe that investors are well-served by strongly considering the addition of an income-producing covered call strategy in virtually all market environments and multi-asset class strategies. Madison’s active call writing/active stock selection approach provides more opportunity for premium income and alpha from underlying security selection than common passive call writing. Total Return of the BXM and S&P 500 1987-2013 Rolling Returns Source: Morningstar Time Period: 1/1/1987 to 12/31/2013 Rolling Window: 1 Year 1 Year shift 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 Return 0.0 S&P 500 -5.0 -10.0 CBOE S&P 500 Buywrite BXM -15.0 -20.0 -25.0 -30.0 -35.0 -40.0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 S&P 500 TR USD Covered calls show equity-likeCBOE returns S&P 500 with Buyw ritelower BXM volatility Source: Morningstar Direct 888.971.7135 madisonfunds.com | madisonadv.com Covered Call Strategy(A) Benefits of Individual Stock Options vs. -

Relative Strength Index for Developing Effective Trading Strategies in Constructing Optimal Portfolio

International Journal of Applied Engineering Research ISSN 0973-4562 Volume 12, Number 19 (2017) pp. 8926-8936 © Research India Publications. http://www.ripublication.com Relative Strength Index for Developing Effective Trading Strategies in Constructing Optimal Portfolio Dr. Bhargavi. R Associate Professor, School of Computer Science and Software Engineering, VIT University, Chennai, Vandaloor Kelambakkam Road, Chennai, Tamilnadu, India. Orcid Id: 0000-0001-8319-6851 Dr. Srinivas Gumparthi Professor, SSN School of Management, Old Mahabalipuram Road, Kalavakkam, Chennai, Tamilnadu, India. Orcid Id: 0000-0003-0428-2765 Anith.R Student, SSN School of Management, Old Mahabalipuram Road, Kalavakkam, Chennai, Tamilnadu, India. Abstract Keywords: RSI, Trading, Strategies innovation policy, innovative capacity, innovation strategy, competitive Today’s investors’ dilemma is choosing the right stock for advantage, road transport enterprise, benchmarking. investment at right time. There are many technical analysis tools which help choose investors pick the right stock, of which RSI is one of the tools in understand whether stocks are INTRODUCTION overpriced or under priced. Despite its popularity and powerfulness, RSI has been very rarely used by Indian Relative Strength Index investors. One of the important reasons for it is lack of Investment in stock market is common scenario for making knowledge regarding how to use it. So, it is essential to show, capital gains. One of the major concerns of today’s investors how RSI can be used effectively to select shares and hence is regarding choosing the right securities for investment, construct portfolio. Also, it is essential to check the because selection of inappropriate securities may lead to effectiveness and validity of RSI in the context of Indian stock losses being suffered by the investor. -

Modeling and Analyzing Stock Trends

Modeling and Analyzing Stock Trends A Major Qualifying Project Submitted to the Faculty of Worcester Polytechnic Institute in partial fulllment of the requirements for the Degree in Bachelor of Science Mathematical Sciences By Laura Cintron Garcia Date: 5/6/2021 Advisor: Dr. Mayer Humi This report represents work of WPI undergraduate students submitted to the faculty as evidence of a degree requirement. WPI routinely publishes these reports on its web site without editorial or peer review. For more information about the projects program at WPI, see http://www.wpi.edu/Academics/Projects 1 Abstract Abstract The goal of this project is to create and compare several dierent stock prediction models and nd a correlation between the predic- tions and volatility for each stock. The models were created using the historical data, DJI index, and moving averages. The most accurate prediction model had an average of 5.3 days spent within a predic- tion band. A correlation of -0.0438 was found between that model an a measure of volatility, indicating that more prediction days means lower volatility. 2 2 Acknowledgments Without the help of some people, it would have been signicantly more di- cult to complete this project without a group. I want to extend my gratitude to Worcester Polytechnic Institute and the WPI Math Department for their great eorts and success this year regarding school and projects during the pandemic. They did everything they could to ensure these projects was still a rich experience for the students despite everything. I would also like to thank my MQP advisor, Professor Mayer Humi for his assistance and guidance on this project, for allowing me to work indepen- dently while always being willing to meet with me or answer any questions, and for continuously encouraging me to do what I thought was best for the project.