Pandemic Unemployment Assistance (PUA) Program

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

November 24, 2020 President Donald J

November 24, 2020 President Donald J. Trump The White House 1600 Pennsylvania Avenue NW Washington, D.C. 20500 Dear Mr. President: We write to once again convey the urgent need for federal resources in New Jersey to improve testing capacity. The coronavirus disease of 2019 (COVID-19) continues to reach record highs; case rates in November are surpassing even our highest rates from the spring. On November 23, New Jersey reported 3,592 new COVID-19 cases and 11 new deaths. State- wide case totals are over 300,000 and confirmed deaths will soon surpass 15,000 people. New Jersey’s hospitals are also experiencing record admissions. On November 23, 2,785 hospital beds were filled with COVID-19 patients; 522 of those patients were in an Intensive Care Unit (ICU); and 265 of those in the ICU are currently breathing via a ventilator. We commend New Jersey for taking swift action to address this latest surge. The state has more than 2,300 contact tracers working to help mitigate the spread of infection. Governor Murphy has also signed an Executive Order limiting indoor gatherings to 10 people, requiring masks indoors, issuing travel restrictions, and urging social distancing. Despite the state’s best efforts, the positivity rate for COVID-19 testing currently averages about 10 percent. As you know, experts suggest anything over a five percent positive testing rate requires urgent containment and mitigation efforts. However, containment and mitigation efforts rely on sufficient testing capacity to ensure that cases are being quickly identified and New Jersey is once again facing extended lines at testing locations and turn-around times for results becoming longer by the day. -

Congressional Report Card

Congressional Report Card NOTE FROM BRIAN DIXON Senior Vice President for Media POPULATION CONNECTION and Government Relations ACTION FUND 2120 L St NW, Suite 500 Washington, DC 20037 ou’ll notice that this year’s (202) 332–2200 Y Congressional Report Card (800) 767–1956 has a new format. We’ve grouped [email protected] legislators together based on their popconnectaction.org scores. In recent years, it became twitter.com/popconnect apparent that nearly everyone in facebook.com/popconnectaction Congress had either a 100 percent instagram.com/popconnectaction record, or a zero. That’s what you’ll popconnectaction.org/116thCongress see here, with a tiny number of U.S. Capitol switchboard: (202) 224-3121 exceptions in each house. Calling this number will allow you to We’ve also included information connect directly to the offices of your about some of the candidates senators and representative. that we’ve endorsed in this COVER CARTOON year’s election. It’s a small sample of the truly impressive people we’re Nick Anderson editorial cartoon used with supporting. You can find the entire list at popconnectaction.org/2020- the permission of Nick Anderson, the endorsements. Washington Post Writers Group, and the Cartoonist Group. All rights reserved. One of the candidates you’ll read about is Joe Biden, whom we endorsed prior to his naming Sen. Kamala Harris his running mate. They say that BOARD OF DIRECTORS the first important decision a president makes is choosing a vice president, Donna Crane (Secretary) and in his choice of Sen. Harris, Joe Biden struck gold. Carol Ann Kell (Treasurer) Robert K. -

MBCACA House Cosponsors 117Th Congress 136 As of 7/30/2021

MBCACA House Cosponsors 117th Congress Nanette Diaz Barragan (D-44) (Original 136 as of 7/30/2021 Cosponsor) Katie Porter (D-45) (Original Cosponsor) Alabama J. Luis Correa (D-46) Terri Sewell (D-07) Alan Lowenthal (D-47) Juan Vargas (D-51) Arizona Scott Peters (D-52) Raul Grijalva (D-03) Sara Jacobs (D-53) Arkansas Connecticut Rick Crawford (R-01) Joe Courtney (D-02) (Original Cosponsor) Bruce Westerman (R-04) (Original Cosponsor) Jim Himes (D-04) (Original Cosponsor) Jahana Hayes (D-05) American Samoa Aumua Amata Coleman Radewagen (R-At Large) District of Columbia Eleanor Holmes Norton (D-At Large) California Doug LaMalfa (R-01) (Original Cosponsor) Delaware John Garamendi (D-03) Lisa Blunt Rochester (D-At Large) Mike Thompson (D-05) Doris Matsui (D-06) Florida Jerry McNerney (D-09) Gus Bilirakis (R-12) (Original Cosponsor) Josh Harder (D-10) Kathy Castor (D-14)* (Lead) Mark DeSaulnier (D-11) Brian Mast (R-18) (Original Cosponsor) Barbara Lee (D-13) Theodore Deutch (D-22) Jackie Speier (D-14) Debbie Wasserman Schultz (D-23) (Original Eric Swalwell (D-15) Cosponsor) Jim Costa (D-16) Anna Eshoo (D-18) Georgia Zoe Lofgren (D-19) Lucy McBath (D-06) Salud. Carbajal (D-24) Judy Chu (D-27) Illinois Adam Schiff (D-28) (Original Cosponsor) Bradley Scott Schneider (D-10) Tony Cardenas (D-29) Rodney Davis (R-13) (Original Cosponsor) Brad Sherman (D-30) Pete Aguilar (D-31) Iowa Grace Napolitano (D-32) Mariannette Miller-Meeks (IA-02) Ted Lieu (D-33) Cindy Axne (D-03) (Original Cosponsor) Karen Bass (D-37) Randy Feenstra (R-04) Linda T. -

August 10, 2021 the Honorable Nancy Pelosi the Honorable Steny

August 10, 2021 The Honorable Nancy Pelosi The Honorable Steny Hoyer Speaker Majority Leader U.S. House of Representatives U.S. House of Representatives Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader Hoyer, As we advance legislation to rebuild and renew America’s infrastructure, we encourage you to continue your commitment to combating the climate crisis by including critical clean energy, energy efficiency, and clean transportation tax incentives in the upcoming infrastructure package. These incentives will play a critical role in America’s economic recovery, alleviate some of the pollution impacts that have been borne by disadvantaged communities, and help the country build back better and cleaner. The clean energy sector was projected to add 175,000 jobs in 2020 but the COVID-19 pandemic upended the industry and roughly 300,000 clean energy workers were still out of work in the beginning of 2021.1 Clean energy, energy efficiency, and clean transportation tax incentives are an important part of bringing these workers back. It is critical that these policies support strong labor standards and domestic manufacturing. The importance of clean energy tax policy is made even more apparent and urgent with record- high temperatures in the Pacific Northwest, unprecedented drought across the West, and the impacts of tropical storms felt up and down the East Coast. We ask that the infrastructure package prioritize inclusion of a stable, predictable, and long-term tax platform that: Provides long-term extensions and expansions to the Production Tax Credit and Investment Tax Credit to meet President Biden’s goal of a carbon pollution-free power sector by 2035; Extends and modernizes tax incentives for commercial and residential energy efficiency improvements and residential electrification; Extends and modifies incentives for clean transportation options and alternative fuel infrastructure; and Supports domestic clean energy, energy efficiency, and clean transportation manufacturing. -

Congress of the United States Washington, DC 20515

Congress of the United States Washington, DC 20515 January 27, 2021 Honorable Janet Yellen Secretary U.S. Department of the Treasury 1500 Pennsylvania Avenue N.W. Washington, D.C. 20220 Dear Secretary Yellen: Congratulations on your swift confirmation by the Senate. To help American families and businesses weather the brutal hardships imposed by the continuing pandemic, it is essential for Treasury and Congress to work hand-in-hand. Only close collaboration can deliver needed support for our States and citizens so we can “Build Back Better.” To commence that work, we write you today to urge you to support the immediate repeal of the State and Local Tax (SALT) Deduction cap put in place by the disastrous 2017 partisan tax hike bill. As you know, the SALT deduction has historically strengthened state and local government functions, including public health programs, safety nets for low-income residents, and emergency response services. During your confirmation hearing before the Senate Finance Committee on January 19, 2021, you rightly acknowledged the burden on the shoulders of our states and the need to help to keep essential frontline public workers on the job.1 Unfortunately, according to the December 2020 Bureau of Labor Statistics Employment Situation Report, government employment overall is down by 1.3 million jobs since February 2020 when the pandemic exploded.2 The data shows that these layoffs are unfortunately concentrated most among those who educate our children, protect our cities and towns, and keep our communities clean. While New Jersey has done herculean work to prevent job losses in these critical services, our state has borne the brunt of the pandemic by cutting the government workforce by 4.8% from November 2019 to November 2020.3 These workers serve essential roles, and their job losses are further holding back our recovery. -

1 April 2, 2020 the Honorable Nancy Pelosi Speaker, U.S. House Of

April 2, 2020 The Honorable Nancy Pelosi Speaker, U.S. House of Representatives H-232, United States Capitol Washington, DC 20515 Dear Speaker Pelosi: We are grateful for your tireless work to address the needs of all Americans struggling during the COVID-19 pandemic, and for your understanding of the tremendous burdens that have been borne by localities as they work to respond to this crisis and keep their populations safe. However, we are concerned that the COVID-19 relief packages considered thus far have not provided direct funding to stabilize smaller counties, cities, and towns—specifically, those with populations under 500,000. As such, we urge you to include direct stabilization funding to such localities in the next COVID-19 response bill, or to lower the threshold for direct funding through the Coronavirus Relief Fund to localities with smaller populations. Many of us represent districts containing no or few localities with populations above 500,000. Like their larger neighbors, though, these smaller counties, cities, and towns have faced enormous costs while responding to the COVID-19 pandemic. These costs include deploying timely public service announcements to keep Americans informed, rapidly activating emergency operations, readying employees for telework to keep services running, and more. This work is essential to keeping our constituents safe and mitigating the spread of the coronavirus as effectively as possible. We fear that, without targeted stabilization funding, smaller localities will be unable to continue providing these critical services to our constituents at the rate they are currently. We applaud you for including a $200 billion Coronavirus Relief Fund as part of H.R. -

March 31, 2020 the Honorable Nancy Pelosi Office Of

March 31, 2020 The Honorable Nancy Pelosi Office of the Speaker of the House U.S. Capitol H-232 Washington, D.C. 20515 Dear Speaker Pelosi: Thank you for your tremendous leadership on behalf of the American people, most recently in connection with passage of the CARES Act. The relief provided to everyday Americans in this legislation represents a substantial and meaningful step toward combatting the economic harm caused by this unprecedented pandemic. We also agree with you that moving forward more will need to be done, particularly for some of the most distressed regions in the country. In that regard, we write to respectfully request that the next phase of legislation addressing the COVID-19 crisis include a repeal of the 2017 Tax Cuts and Jobs Act (TCJA) provision that capped the state and local tax (SALT) deduction and property tax deduction at $10,000. Not only is the cap unfair to working families, it is incentivizing high earners to flee states like New York, New Jersey, Massachusetts, Illinois and California that have been ravaged by the coronavirus pandemic.1 At a time when the nation is relying on its governors and mayors, the loss of these tax revenues to state and local coffers is further hindering the ability of these and other hard-hit states to address the current crisis. The SALT deduction historically strengthened state and local government functions, including public health programs, safety-nets for low-income residents and emergency response services. The TCJA dealt a serious blow to state and local budgets when it capped the deduction at $10,000 in order to pay for other provisions in the bill. -

April 21, 2020 I. Washington Needs to Recognize Municipal Efforts

Click to view newsletter archives View a Featured Ad at the End of this Email. April 21, 2020 I. Washington Needs to Recognize Municipal Efforts II. Governor’s Office Briefing Calls for Mayors Municipal Clerks: Please forward to your Mayor, Governing Body and Department Heads. To assist in providing guidance and information we have created a COVID-19 resource page. We will continue to update the page as we get pertinent information and include announcements in our Daily Updates. ****************************************************************************************************** I. Washington Needs to Recognize Municipal Efforts At this time–and it could change in a heartbeat–it seems that aid to New Jersey municipalities will not be included in the compromise legislation being negotiated in Washington. There appears to be strong opposition coming from Senate Majority Leader Mitch McConnell and from the White House for that, at this time. Both Senator McConnell and U.S. Treasury Secretary Mnuchin have indicated a willingness to further consider the plight of state and local governments, in future legislation. We need to continue to push for passage of the Coronavirus Community Relief Act (the CCRA - H.R.6467) and its U.S. Senate companion, which awaits formal introduction. Currently on record sponsoring and supporting the CCRA are Senator Booker and House Members Malinowski, Gottheimer, Sherrill, Sires, Van Drew, and Watson Coleman. Please contact your Congressman, if not yet a cosponsor, and urge him to get on board by cosponsoring the CCRA. New Jersey Congressman Bill Pascrell, Jr., along with Florida Congressman John Rutherford, is spearheading another effort to secure relief for our State and its local governments. -

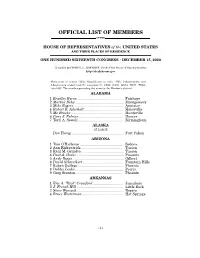

Official List of Members

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTEENTH CONGRESS • DECEMBER 15, 2020 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives http://clerk.house.gov Democrats in roman (233); Republicans in italic (195); Independents and Libertarians underlined (2); vacancies (5) CA08, CA50, GA14, NC11, TX04; total 435. The number preceding the name is the Member's district. ALABAMA 1 Bradley Byrne .............................................. Fairhope 2 Martha Roby ................................................ Montgomery 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................ -

ʻitʼs Like They Canʼt Wait to Voteʼ

https://nyti.ms/3k8N8FG ʻItʼs Like They Canʼt Wait to Voteʼ Democrats in New Jersey are voting at higher rates than Republicans in conservative strongholds with three weeks to go before Election Day. By Tracey Tully Oct. 16, 2020, 5:00 a.m. ET With less than three weeks to go before a pandemic-era election that is being conducted mainly by mail, Democrats in New Jersey are returning ballots at rates that outpace Republicans in some of the state’s most conservative strongholds. In the rural north, on the Jersey Shore and in horse country, Democrats are beating Republicans to the mailbox — and the drop box — in an election where every voter was mailed a paper ballot to turn in by Nov. 3. In Ocean County, home to more Republicans than any other part of the state, nearly 39 percent of registered Democrats had voted as of Wednesday, compared with 25 percent of Republicans, county records show. Rural Sussex County had a nearly identical split: More than 39 percent of Democrats had returned ballots by Wednesday, compared with 24 percent of Republicans. While many states have seen a surge in mail-in voting, New Jersey is one of only four states where the rate of return has already eclipsed 25 percent of the state’s total turnout four years ago. Pollsters, lawmakers and campaign consultants see it as a sign of intensity among Democrats eager to show their displeasure with a polarizing president and a measure of distrust among Republicans toward mail voting — a method President Trump has attacked, without evidence, as being ripe for fraud. -

Congress of the United States Washington D.C

Congress of the United States Washington D.C. 20515 April 29, 2020 The Honorable Nancy Pelosi The Honorable Kevin McCarthy Speaker of the House Minority Leader United States House of Representatives United States House of Representatives H-232, U.S. Capitol H-204, U.S. Capitol Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader McCarthy: As Congress continues to work on economic relief legislation in response to the COVID-19 pandemic, we ask that you address the challenges faced by the U.S. scientific research workforce during this crisis. While COVID-19 related-research is now in overdrive, most other research has been slowed down or stopped due to pandemic-induced closures of campuses and laboratories. We are deeply concerned that the people who comprise the research workforce – graduate students, postdocs, principal investigators, and technical support staff – are at risk. While Federal rules have allowed researchers to continue to receive their salaries from federal grant funding, their work has been stopped due to shuttered laboratories and facilities and many researchers are currently unable to make progress on their grants. Additionally, researchers will need supplemental funding to support an additional four months’ salary, as many campuses will remain shuttered until the fall, at the earliest. Many core research facilities – typically funded by user fees – sit idle. Still, others have incurred significant costs for shutting down their labs, donating the personal protective equipment (PPE) to frontline health care workers, and cancelling planned experiments. Congress must act to preserve our current scientific workforce and ensure that the U.S. -

Jefferson Van Drew

DECEMBER 2019 GLOBE 2019 YEAR IN REVIEW NONE OF THE ABOVE WINNER OF THE YEAR BRITTANY O’NEILL OPERATIVE OF THE YEAR DONALD TRUMP’S : NEW BEST FRIEND JEFFERSON VAN DREW 2019: YEAR IN REVIEW | 1 2019: YEAR IN REVIEW | 2 NEW JERSEY GLOBE POWER LIST 2019 That removes one typically automatic Sweeney vote from the Senate Democrats, unless the senate president can convert Mike Testa into a Sweeneycan. There were also two prominent party switchers: freshman Rep. Jeff Van Drew became a Republican, and State Sen. Dawn Addiego is now a Democrat. In the year of the unlikely voter, just 27% of New Jersey voters cast their ballots in 2019 – a number that was up 5% over 2015 thanks to the state’s new vote-by-mail law that caused the participation of many New Jerseyans who would never have voted if ballots didn’t show up at their homes. A 5% increase was significant. Off-off year elections like 2019 when State Assembly candidates head the ticket happens twice every other decade, so New Jersey won’t see another one until 2035. The race for Democratic State Chairman ended in a draw – John Currie keeps the job for eighteen months, when LeRoy Jones takes over. Legislative reapportionment, which was the entire reason for the state chairman battle, gives an edge to the anti-Murphy faction – if that’s where Jones is when the new districts are drawn. Murphy continues to struggle to win the approval of New Jersey voters, yet he appears – at least right now – to have a lock on the Democratic nomination when he seeks re-election in 2021.