Arab Media Outlook 2009-2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Land Plots for Sale

Land plots for sale Dubai Holding Creating impact for generations to come Dubai Holding is a global conglomerate that plays a pivotal role in developing Dubai’s fast-paced and increasingly diversified economy. Managing a USD 22 billion portfolio of assets with operations in 12 countries and employing over 20,000 people, the company continues to shape a progressive future for Dubai by growing $22 Billion 12 121 the city’s business, tourism, hospitality, real estate, media, ICT, Worth of assets Industry sectors Nationalities education, design, trade and retail. With businesses that span key sectors of the economy, Dubai Holding’s prestigious portfolio of companies includes TECOM Group, Jumeirah Group, Dubai Properties, Dubai Asset Management, Dubai Retail and Arab Media Group. 12 20,000 $4.6 Billion For the Good of Tomorrow Countries Employees Total revenue 1 Dubai Industrial Park 13 The Villa Imagining the city of tomorrow 2 Jumeirah Beach Residences(JBR) 14 Liwan 1 3 Dubai Production City 15 Liwan 2 4 Dubai Studio City 16 Dubailand Residences Complex Dubai Holding is responsible for some of Dubai’s most iconic 5 Arjan 17 Dubai Design District (d3) destinations, districts and master developments that attract a network 6 Dubai Science Park 18 Emirates Towers District of global and local investors alike. With our extensive land bank we 7 Jumeirah Central 19 Jaddaf Waterfront have created an ambitious portfolio of property and investment 8 Madinat Jumeirah 20 Dubai Creek Harbour opportunities spanning the emirate across diverse sectors. 9 Marsa Al Arab 21 Dubai International Academic City 10 Majan 22 Sufouh Gardens 11 Business Bay 23 Barsha Heights 12 Dubailand Oasis 9 2 8 22 7 18 23 11 17 19 3 5 6 20 4 1 10 14 1 Dubai Industrial Park 15 13 16 12 21 Dubailand Oasis This beautifully planned mixed-use master community is located in the heart of Dubailand, with easy access to main highways of Freehold 1M SQM Emirates Road, Al Ain Road (E66) and Mohammed bin Zayed Road. -

Arab Republic of Egypt

Egypt Country Profile ARAB REPUBLIC OF EGYPT OFFICE OF COMMERCIAL AFFAIRS, ROYAL THAI EMBASSY, CAIRO THAI TRADE CENTER 1 Thai Trade Center, Cairo ٍ Sherif Yehya Egypt Country Profile Background: The regularity and richness of the annual Nile River flood, coupled with semi-isolation provided by deserts to the east and west, allowed for the development of one of the world's great civilizations. A unified kingdom arose circa 3200 B.C., and a series of dynasties ruled in Egypt for the next three millennia. The last native dynasty fell to the Persians in 341 B.C., who in turn were replaced by the Greeks, Romans, and Byzantines. It was the Arabs who introduced Islam and the Arabic language in the 7th century and who ruled for the next six centuries. A local military caste, the Mamluks took control about 1250 and continued to govern after the conquest of Egypt by the Ottoman Turks in 1517. Following the completion of the Suez Canal in 1869, Egypt became an important world transportation hub, but also fell heavily into debt. Ostensibly to protect its investments, Britain seized control of Egypt's government in 1882, but nominal allegiance to the Ottoman Empire continued until 1914. Partially independent from the UK in 1922, Egypt acquired full sovereignty with the overthrow of the British- backed monarchy in 1952. The completion of the Aswan High Dam in 1971 and the resultant Lake Nasser have altered the time-honored place of the Nile River in the agriculture and ecology of Egypt. A rapidly growing population (the largest in the Arab world), limited arable land, and dependence on the Nile all continue to overtax resources and stress society. -

PRESS RELEASE for IMMEDIATE RELEASE JUNE 6, 2016 Contact: Shafer Busch, America Abroad Media [email protected] 202-2

View this email in your browser PRESS RELEASE FOR IMMEDIATE RELEASE JUNE 6, 2016 Contact: Shafer Busch, America Abroad Media [email protected] 202-249-7380 From Left: Paul Baker, Maryam Almheiri, Aaron Lobel, H.E. Noura Al Kaabi, Ben Silverman, Greg Daniels, and Howard Owens. America Abroad Media Brings Top Hollywood Writer and Producers to Abu Dhabi Last week America Abroad Media (AAM) helped organize a delegation of leading Hollywood producers and writers who traveled to Abu Dhabi for a groundbreaking series of workshops and events aimed at supporting young creative talent in the UAE and the broader Arab World. The delegation included AAM Founder and President Aaron Lobel; Ben Silverman, the Emmy, Golden Globe, and Peabody Award-winning executive producer of The Office, Ugly Betty, The Tudors, Jane the Virgin, and Marco Polo; Greg Daniels, a leading comedy writer, producer, and director on shows such as Saturday Night Live and The Simpsons and co-creator of The Office, King of the Hill, and Parks and Recreation; and Howard Owens, Founder and co-CEO of Propagate Content and former CEO of National Geographic Channels. “Our partners in the Middle East have the ambition and the talent to bring about a new golden age in Arab drama and entertainment," said Lobel, "and they feel that the experience of Hollywood professionals can benefit their efforts. We look forward to forging long term partnerships for Arabic drama and entertainment programming that will reach audiences across the Middle East and far beyond." During their visit, Ben Silverman and Howard Owens shared their experiences in Hollywood with over 100 Arab counterparts and explored how the UAE can become a regional and global center for storytelling, while Greg Daniels hosted two invitation- only screenwriting workshops with writers from around the region. -

Chiffres Cles D'audience Tv

Communiqué de presse hebdomadaire CHIFFRES CLES D'AUDIENCE TV Semaine du 06 au 12 Septembre 2017 Audience de la télévision Durée d’écoute quotidienne de la télévision par individu en heures et en minutes. Jour moyen Lundi/Dimanche - De 3H à 27H - Individus âgés de 5 ans ou plus. Durée d'écoute par individu¹ Semaine du 06 au 12 Septembre 2017 2H 52MIN Audience des chaînes nationales Jour moyen Lundi/Dimanche - Individus âgés de 5 ans ou plus. Tranche horaire Chaîne² Part d'audience (%) Al Aoula 6,1 Al Maghribia 3,1 Ensemble de la journée Autres chaînes SNRT³ 2,2 (03h00-27h00) 2M 32,9 Autres chaînes4 55,7 Al Aoula 10,8 Al Maghribia 3,6 Prime time (20h50-22h30) Autres chaînes SNRT³ 3,2 2M 28,0 Autres chaînes4 54,4 ¹ : Du 06 au 12 Septembre 2017, un individu âgé de 5 ans ou plus regarde en moyenne par jour la TV pendant 2 heures et 52 minutes. ² : Les chaînes nationales étudiées sont Al Aoula, Al Aoula Internationale, 2M, 2M Monde, Arryadia, Al Maghribia, Tamazight, Assadissa, TV Laayoune ³ : Total «Autres chaînes SNRT» : Al Aoula Internationale, Arryadia, Tamazight, Assadissa et TV Laayoune. 4: "Autres chaînes" regroupe plus d'une centaine de chaînes (Base études Intermétries). NB : Al Aoula Internationale est comprise dans «Autres Chaînes SNRT» lorsqu’elle diffuse sur satellite un programme différent de celui diffusé en hertzien (décrochage satellitaire). Les audiences de Medi1TV ne sont pas indiquées dans ce communiqué en raison de l’absence de signature de la chaîne. 1/3 Source Marocmétrie, tous droits réservés par CIAUMED, reproduction et diffusion interdites sauf autorisation, commercialisation exclusive par Marocmétrie Palmarès des émissions des chaînes nationales Les chaînes nationales étudiées sont Al Aoula et 2M. -

Engaging and Empowering Our Audience

2012 Annual Report U.S. INTERNATIONAL BROADCASTING Engaging and Empowering Our Audience IBB bbg.gov BBG languages Table of Contents GLOBAL EASTERN/ L etter From the Broadcasting Board of Governors 5 English CENTRAL (including EUROPE Learning Albanian English) Bosnian Croatian AFRICA* Greek Afaan Oromoo Macedonian Amharic Montenegrin French Romanian Hausa to Moldova Overview 6 T hreats Against Journalists 10 Kinyarwanda Serbian Kirundi Ndebele EURASIA Portuguese Armenian Shona Avar Somali Azerbaijani Swahili Bashkir Tigrigna Belarusian Chechen CENTRAL ASIA Circassian International 2012 Election Coverage 18 Kazakh Crimean Tatar Broadcasting Bureau 12 Kyrgyz Georgian Tajik Russian Turkmen Tatar Uzbek Ukrainian EAST ASIA LATIN AMERICA Burmese Creole Cantonese Spanish Indonesian Voice of America 20 R adio Free Europe/ Khmer NEAR EAST/ Radio Liberty 26 Korean NORTH AFRICA Lao Arabic Mandarin Kurdish Thai Turkish Tibetan Uyghur SOUTH ASIA Vietnamese Bangla Dari Pashto Office of Cuba Broadcasting 30 R adio Free Asia 34 Persian Urdu * In 2012, the BBG worked toward [I]f you want to be free, you have to know how free people live. establishing broadcasts in Songhai If you’ve never known how free people live, you might not ever know and Bambara. “ that you are not free. This is why programs like Radio Free Asia are On cover: A Syrian man uses his mobile phone so very important. – Aung San Suu Kyi to capture demonstrators marching in the neighborhood of Bustan Al-Qasr, Aleppo, Syria. Middle East Broadcasting Board Broadcasting Networks 38 of Governors 44 Burmese opposition leader” Aung San Suu Kyi waves to admirers before the April by-elections, (AP Photo, Andoni Lubaki) A wards & Honors 42 Financial Highlights 47 in which she became a member of parliament. -

LES CHAÎNES TV by Dans Votre Offre Box Très Haut Débit Ou Box 4K De SFR

LES CHAÎNES TV BY Dans votre offre box Très Haut Débit ou box 4K de SFR TNT NATIONALE INFORMATION MUSIQUE EN LANGUE FRANÇAISE NOTRE SÉLÉCTION POUR VOUS TÉLÉ-ACHAT SPORT INFORMATION INTERNATIONALE MULTIPLEX SPORT & ÉCONOMIQUE EN VF CINÉMA ADULTE SÉRIES ET DIVERTISSEMENT DÉCOUVERTE & STYLE DE VIE RÉGIONALES ET LOCALES SERVICE JEUNESSE INFORMATION INTERNATIONALE CHAÎNES GÉNÉRALISTES NOUVELLE GÉNÉRATION MONDE 0 Mosaïque 34 SFR Sport 3 73 TV Breizh 1 TF1 35 SFR Sport 4K 74 TV5 Monde 2 France 2 36 SFR Sport 5 89 Canal info 3 France 3 37 BFM Sport 95 BFM TV 4 Canal+ en clair 38 BFM Paris 96 BFM Sport 5 France 5 39 Discovery Channel 97 BFM Business 6 M6 40 Discovery Science 98 BFM Paris 7 Arte 42 Discovery ID 99 CNews 8 C8 43 My Cuisine 100 LCI 9 W9 46 BFM Business 101 Franceinfo: 10 TMC 47 Euronews 102 LCP-AN 11 NT1 48 France 24 103 LCP- AN 24/24 12 NRJ12 49 i24 News 104 Public Senat 24/24 13 LCP-AN 50 13ème RUE 105 La chaîne météo 14 France 4 51 Syfy 110 SFR Sport 1 15 BFM TV 52 E! Entertainment 111 SFR Sport 2 16 CNews 53 Discovery ID 112 SFR Sport 3 17 CStar 55 My Cuisine 113 SFR Sport 4K 18 Gulli 56 MTV 114 SFR Sport 5 19 France Ô 57 MCM 115 beIN SPORTS 1 20 HD1 58 AB 1 116 beIN SPORTS 2 21 La chaîne L’Équipe 59 Série Club 117 beIN SPORTS 3 22 6ter 60 Game One 118 Canal+ Sport 23 Numéro 23 61 Game One +1 119 Equidia Live 24 RMC Découverte 62 Vivolta 120 Equidia Life 25 Chérie 25 63 J-One 121 OM TV 26 LCI 64 BET 122 OL TV 27 Franceinfo: 66 Netflix 123 Girondins TV 31 Altice Studio 70 Paris Première 124 Motorsport TV 32 SFR Sport 1 71 Téva 125 AB Moteurs 33 SFR Sport 2 72 RTL 9 126 Golf Channel 127 La chaîne L’Équipe 190 Luxe TV 264 TRACE TOCA 129 BFM Sport 191 Fashion TV 265 TRACE TROPICAL 130 Trace Sport Stars 192 Men’s Up 266 TRACE GOSPEL 139 Barker SFR Play VOD illim. -

Saudi Arabia Page 1 of 18

Saudi Arabia Page 1 of 18 Published on Freedom House (https://freedomhouse.org) Home > Saudi Arabia Saudi Arabia Country: Saudi Arabia Year: 2015 Status: Not Free Total Score: 73 (0 = Best, 100 = Worst) Obstacles to Access: 15 (0 = Best, 25 = Worst) Limits on Content: 24 (0 = Best, 35 = Worst) Violations of User Rights: 34 (0 = Best, 40 = Worst) Population: 30.8 million Internet Penetration: 64 percent Social Media/ICT Apps Blocked: Yes Political/Social Content Blocked: Yes Bloggers/ICT Users Arrested: Yes Press Freedom Status: Not Free Key Developments: https://freedomhouse.org/print/47723 12/8/2016 Saudi Arabia Page 2 of 18 June 2014–May 2015 • The Saudi television channel Rotana ordered Google to take down a video of the satirical YouTube show “Fitnah” on copyright grounds, after the show had used footage from Rotana to criticize its owner, Prince Waleed bin Talal. The video was later restored by YouTube (see Content Removal). • Human rights activists Waleed Abu al-Khair and Fowzan al-Harbi have had their prison sentences extended to 15 and 10 years, respectively, upon appeals by the public prosecutor (see Prosecutions and Detentions for Online Activities). • Raif Badawi, who co-founded the website Saudi Arabia Liberals, had his 10-year sentence suspended and later upheld by the Supreme Court and received the first set of 50 lashes in January. He was sentenced to a total 1,000 lashes, to be carried out in public (see Prosecutions and Detentions for Online Activities). • During a funeral for the victims of an attack by Islamic State (IS) militants on a Shiite mosque, political activist Waleed Sulais was beaten by two men who accused him of insulting them on social networks (see Intimidation and Violence). -

English Newspapers in the United Arab Emirates: Navigating the Crowded Market

English newspapers in the United Arab Emirates: Navigating the crowded market By Peyman Pejman January, 2009. Dubai’s rapid growth has made the United Arab Emirates a global household name in the space of a few short years. A recent New York Times story referring to the country’s star emirate, perhaps put it best: "You name it, Dubai has it. Or if it doesn’t have it, it’s building it. Or if it’s not building it, it's dredging up an island to put it on.”1 Dubai’s growth has helped turn the United Arab Emirates, a country not yet forty years old, into a symbol of economic development for the rest of the region. But as the country debates its place in the global financial and political arena, there is another field in which the UAE will be tested, sooner rather than later: media development. As the country finds itself more tied to the global economy, English daily newspapers are realizing that the old system of uncritically reporting news in deference to political and business elites is no longer adequate if the papers want to be considered a player in the media market. They are realizing that timid reporting can no longer be washed off with a sea of advertising revenue and that good reporting is becoming more and more essential for earning respectability. This paper is based on first-hand interviews conducted with editors of all six daily English newspapers in the United Arab Emirates.2 As such, it is the most comprehensive research carried out on the topic to date. -

Jordan Parliamentary Elections, 20 September

European Union Election Observation Mission The Hashemite Kingdom of Jordan Parliamentary Election 20 September 2016 Final Report European Union Election Observation Mission The Hashemite Kingdom of Jordan Parliamentary Election 20 September 2016 Final Report European Union Election Observation Mission The Hashemite Kingdom of Jordan Parliamentary Election, 20 September 2016 Final Report, 13 November 2016 THE HASHEMITE KINGDOM OF JORDAN Parliamentary Election, 20 September 2016 EUROPEAN UNION ELECTION OBSERVATION MISSION FINAL REPORT Table of Contents Page 1 Key Abbreviations Page 3 1. Executive Summary Page 4 2. Introduction and Acknowledgements Page 7 3. Political Context Page 8 4. Legal Framework Page 10 4.1 Applicability of International Human Rights Law 4.2 Constitution 4.3 Electoral Legislation 4.4 Right to Vote 4.5 Right to Stand 4.6 Right to Appeal 4.7 Electoral Districts 4.8 Electoral System 5. Election Administration Page 22 5.1 Election Administration Bodies 5.2 Voter Registration 5.3 Candidate Registration 5.4 Voter Education and Information 5.5 Institutional Communication 6 Campaign Page 28 6.1 Campaign 6.2 Campaign Funding 7. Media Page 30 7.1 Media Landscape 7.2 Freedom of the Media 7.3 Legal Framework 7.4 Media Violations 7.5 Coverage of the Election 8. Electoral Offences, Disputes and Appeals Page 35 9. Participation of Women, Minorities and Persons with Disabilities Page 38 __________________________________________________________________________________________ While this Final Report is translated in Arabic, the English version remains the only original Page 1 of 131 European Union Election Observation Mission The Hashemite Kingdom of Jordan Parliamentary Election, 20 September 2016 Final Report, 13 November 2016 9.1 Participation of Women 9.2 Participation of Minorities 9.3 Participation of Persons with Disabilities 10. -

George Saltsman Curriculum Vitae

George Saltsman Curriculum Vitae Postal: 9900 Brookwood Ln. College Station, TX 77845 Phone: (325) 829-5872 Web: www.georgesaltsman.com Email: [email protected] Education Ed.D. Educational Leadership. Lamar University (2014) Awarded: Outstanding doctoral student Dissertation: Global Leadership Competencies in Education: A Delphi Study of UNESCO Delegates and Administrators (Conducted in English, French, and Spanish) M.S. Organizational & Human Resource Development. Abilene Christian University (1995) B.S. Computer Science. Abilene Christian University (1990) Professional Employment Director, Center for Educational Innovation and Digital Learning Lamar University: Office of the President 9/2016 - Present Continuation of all previous duties as Director, Educational Innovation. New duties include the establishment and administration of the Center for Educational Innovation and Digital Learning. Currently establishing a $50M USD program, at the request of the Prime Minister of Vietnam, to provide computer science bootcamp training to 200,000 individuals in eight locations. Content and curriculum are sourced and currently in pilot stage. Current activity now involves extending curriculum into secondary and post- secondary institutions. Expected additional funding from Government of Vietnam, Microsoft, Amazon, IBM, and the Prince Andrew Charitable Trust. Currently establishing an Education Design Center, located in Austin Texas, to assist PK-12 school leaders in selecting appropriate pedagogy, training, technology, and educational support -

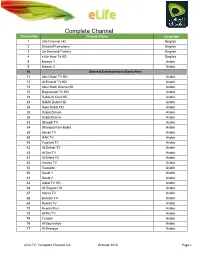

Complete Channel List October 2015 Page 1

Complete Channel Channel No. List Channel Name Language 1 Info Channel HD English 2 Etisalat Promotions English 3 On Demand Trailers English 4 eLife How-To HD English 8 Mosaic 1 Arabic 9 Mosaic 2 Arabic 10 General Entertainment Starts Here 11 Abu Dhabi TV HD Arabic 12 Al Emarat TV HD Arabic 13 Abu Dhabi Drama HD Arabic 15 Baynounah TV HD Arabic 22 Dubai Al Oula HD Arabic 23 SAMA Dubai HD Arabic 24 Noor Dubai HD Arabic 25 Dubai Zaman Arabic 26 Dubai Drama Arabic 33 Sharjah TV Arabic 34 Sharqiya from Kalba Arabic 38 Ajman TV Arabic 39 RAK TV Arabic 40 Fujairah TV Arabic 42 Al Dafrah TV Arabic 43 Al Dar TV Arabic 51 Al Waha TV Arabic 52 Hawas TV Arabic 53 Tawazon Arabic 60 Saudi 1 Arabic 61 Saudi 2 Arabic 63 Qatar TV HD Arabic 64 Al Rayyan HD Arabic 67 Oman TV Arabic 68 Bahrain TV Arabic 69 Kuwait TV Arabic 70 Kuwait Plus Arabic 73 Al Rai TV Arabic 74 Funoon Arabic 76 Al Soumariya Arabic 77 Al Sharqiya Arabic eLife TV : Complete Channel List October 2015 Page 1 Complete Channel 79 LBC Sat List Arabic 80 OTV Arabic 81 LDC Arabic 82 Future TV Arabic 83 Tele Liban Arabic 84 MTV Lebanon Arabic 85 NBN Arabic 86 Al Jadeed Arabic 89 Jordan TV Arabic 91 Palestine Arabic 92 Syria TV Arabic 94 Al Masriya Arabic 95 Al Kahera Wal Nass Arabic 96 Al Kahera Wal Nass +2 Arabic 97 ON TV Arabic 98 ON TV Live Arabic 101 CBC Arabic 102 CBC Extra Arabic 103 CBC Drama Arabic 104 Al Hayat Arabic 105 Al Hayat 2 Arabic 106 Al Hayat Musalsalat Arabic 108 Al Nahar TV Arabic 109 Al Nahar TV +2 Arabic 110 Al Nahar Drama Arabic 112 Sada Al Balad Arabic 113 Sada Al Balad -

SAUDI ARABIA: a BRIEF GUIDE to ITS POLITICS and PROBLEMS by Nimrod Raphaeli*

SAUDI ARABIA: A BRIEF GUIDE TO ITS POLITICS AND PROBLEMS By Nimrod Raphaeli* This article examines the familial structure of the Saudi ruling oligarchy and considers this regime’s performance given the economic and demographic challenges it faces. Oligarchy is a form of government where a billion in 1981 to $186.5 billion in 2001, few rule the many. In Saudi Arabia, the the average GDP per capita shrunk roughly few are predominantly royal male princes 2.5 percent per year.(2) In fact, the per who are all descended from the founder of capita GDP was worse in 1999 than it was the modern Saudi kingdom, King Abd al- in 1965 before the massive rise in the price Aziz who, upon his death in 1953, left of oil.(3) Even the Saudi press has noted behind 44 sons (and an uncounted number how, in nominal terms, GDP per capita of daughters) by 17 wives. Today, Saudi went from $10,330 in 1989 to $7,743 in Arabia’s ruling structure is capped by a 2001.(4) unique, almost unprecedented, form of Additionally, a review of the Saudi oligarchy, whose members are connected economy by the International Monetary through a bloodline to Saudi Arabia's Fund indicates that, with the exception of polygamous founder. The princes have the year 2000, in which the overall central treated the country's wealth of oil and government budget registered a sharp minerals as their personal domain and turnaround due largely to a rise in oil made themselves famous for their prices, "in every other year, the budget has extravagant life style.