2017 Preliminary Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DH Map Online

Hi there. Need some help? Let’s get you on your way. A B C D E F G H I J K L M N O Clarence Street George Street Explore RELAX 1 Walk this way to 1 10 minute stroll Town Hall Station to Martin Place 8 minutes Australian National Maritime Museum D6 Cafe / restaurant City Centre This way to Kent Street Central Station Captain Cook Cruises E4 Bar Kent Street 15 minute stroll Carousel I5 Shopping Chinese Garden of Friendship K4 Wharf 8 Passenger Cockle Bay Wharf G3 Terminal only 5 minutes Druitt Place Druitt Street this way King Street Darling Harbour Marina G4 Goulburn Street Market Street Market Erskine Street 2 2 Liverpool Street Sussex Street Sussex Street Bathurst Street Sussex Street Dockside Pavilion H5 GET Harbourside Amphitheatre F6 Chinatown Harbourside Shopping Centre F6 AROUND IMAX Theatre Sydney I4 Shelley Street King Street Wharf C4 Sydney Ferries Dixon Street Thomas Street Lend Lease Darling Quarter Theatre J4 Express ferry to: Darling Circular Quay, Milsons Point and Manly Madame Tussauds Sydney E4 Park Hay Street 3 Wheat Road (rooftop) 3 Harbour cruises Market City / Paddy’s Markets O3 King Street Ultimo Road Ferry to Sydney Exhibition Centre @ Glebe Island Cuthbert Street Paddy’s Markets Harbour Street The Playground J4 # Lime Street Market City ( operates during exhibitions only) Powerhouse Museum M6 Chartered vessels Harbour Street King Street Wharf t e t Pyrmont Bridge F4 e e Water taxis r e t r S t S QANTAS Credit Union Arena M4 r 1 2 3 4 5 6 7 8 9 Qantas Bus stop e r Pier 26 i e P i Credit Union SEA LIFE Sydney Aquarium -

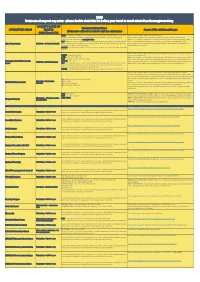

2020 Dates Can Change at Any Point - Please Double Check This List Before Your Travel Or Email [email protected]

2020 Dates can change at any point - please double check this list before your travel or email [email protected] VALIDITY DATES OF Restricted Entry Dates ATTRACTION NAME TICKETS Guests With Additional Needs (Dates you will not be able to visit the attraction) (Valid From & To) APRIL – Easter Bank Holiday – not restricted but we strongly advise not attending at this time as • GUESTS WITH ADDITIONAL NEEDS – please visit the Park is expected to be extremely busy which can have an effect on travel time, parking, https://www.altontowers.com/media/buhjammz/online-resort-access-guide-2019.pdf queuing for ride access passes, queuing for rides • RIDE ACCESS PASSES - Magic Wand’s tickets do not cover ride access or priority entry, please MAY – Bank Holidays – not restricted but we strongly advise not attending on these dates as the visit. For full information including a form to help you save time on the day please visit - Alton Towers Resort 21st March – 1st October (included) park is expected to be extremely busy which can have an effect on travel time, parking, queuing https://support.altontowers.com/hc/en-us/articles/360000458092-What-is-the-Ride-Access- for ride access passes, queuing for rides System-and-how-do-I-apply- AUGUST – not valid on 1st, 2nd, 7th, 8th, 9th, 14th, 15th, 16th, 21st, 22nd, 23rd, 28th, 29th, 30th and 31st. • GUESTS WITH ADDITIONAL NEEDS –please visit https://www.chessington.com/plan/disabled- MARCH – Closed 24th & 25th guide-for-chessington.aspx APRIL – 10th, 11th, 12th, 13th • RIDE ACCESS PASSES - Magic Wand’s -

Madame Tussauds Sydney 'Unlocked #1' Competition

Madame Tussauds Sydney ‘Unlocked #1’ Competition TERMS AND CONDITIONS 1. Information on how to enter forms part of the terms of entry. Entry into the competition is deemed acceptance of these terms and conditions. RELATED CONTENT 2. The Madame Tussauds Sydney ‘Unlocked #1’ competition- the Winner will be selected by the Madame Tussauds Sydney Team, chance plays no part in determining the Winners. 3. Entry is open to residents of Australia. However, employees and immediate families of Merlin Entertainments, and their associated agencies and companies connected with this competition are not eligible to enter. HOW TO ENTER The competition will be held once: • Entries will be open from Tuesday April 6 2021 • Entries will close Thursday April 8 2021 9am AEST 4. To enter, participants must fill out the form on the website, entering their details and answering, “Tell us in 25 words or less where you are going to display your wax hand and why!” 5. By submitting content, a user thereby accepts the terms and conditions laid out within this document. 6. Incomprehensible entries will be deemed invalid. 7. Entrants in the competition may enter as many times as they like 8. The Prize for the winner includes: • 1x double pass to Madame Tussauds Sydney • 2x Free Wax Hands • This prize must be redeemed during the April School Holidays (April 2nd-18th) between 11am-3pm 9. The Promoter reserves the right to request winners to provide proof of identity; proof of identification, residency and entry considered suitable for verification is at the discretion of the Promoter. In the event that a winner cannot provide suitable proof, the winner will forfeit the prize in whole and no substitute will be offered. -

Madame Tussauds Sydney Entry Ticket

Madame Tussauds Sydney Entry Ticket • Flexible. Up to 2 hours • 1. Madame Tussauds Sydney Entry Ticket 1. Transport from/to hotels 2. Price includes a Digi Photo Pass giving you unlimited digital 2. Food & beverages not listed as Inclusions photos. 3. Souvenirs 4. Travel Insurance Depature point 【Covid Operating Hours】 ● Please note: the attraction will close on every Tuesday and Wednesday from 9th June 2020 onwards until further notice. ● During NSW School Holidays the attraction will be open 7 days a week. ● Pre-purchased open-dated tickets must pre-book timeslot before visiting each attraction. ● Tour does not run on Christmas Day (25 December). How to get there ● By Train A short walk from Town Hall or Wynyard stations. Head for King Street from Wynyard or Market Street from Town Hall and then walk west down the hill towards Darling Harbour. ● By Ferry Public ferry services to Darling Harbour depart from Circular Quay Wharf 5 about every half an hour. ● By Light Rail Exit the light rail from either the Convention Centre or Pyrmont Bay stations. Operating hours Daily* 10:00 - Last entry at 18:00 17:00 *Covid Operating Hours (Effective from 01/02/2021) - Thursdays 09:00 - Last entry at to Mondays 15:00 14:00 *Covid Operating Hours (Effective from 01/02/2021) - Tuesdays, Closed Wednesdays *Christmas Day (25 December) Closed Other info 【Important Post-Covid Service Information】 - Please note it is now mandatory to wear a Face Mask at all attractions. - Please be ready to make on-site payments using a 'contactless' bank card, rather than cash. -

Gordon Godfrey Workshop on Spins and Strong Electron Correlations

Gordon Godfrey Workshop on Spins and Strong Electron Correlations 30th October – 3rd November 2017 Sponsors: Gordon Hay Godfrey Acting Head, School of Applied Physics 1951-1952 Gordon Godfrey was born in Sydney in 1892, and studied at Fort Street High School and the University of Sydney. He took his BA with first class honours in 1914, and his MA with first class honours and the University Medal (the second ever awarded) in 1919. He graduated with is BSc in 1922. Godfrey entered the NSW teaching service in 1916, and was an assistant master at both Sydney Boys High School and Parramatta High School. From 1921 he was head teacher of physics, and later lecturer-in-charge of the Department of Physics, at the Sydney Technical College. At the college he developed the new diploma course in optometry and then created the diploma course in physics. In 1951 he was appointed an Associate Professor of the NSW University of Technology (later renamed the University of New South Wales) - he was the first representative of theoretical physics at the University. Professor Godfrey served as Acting Head of the School of Applied Physics during 1951 and 1952, until Professor Milner commenced his position as Head of School. Professor Godfrey remained Deputy Head of School until his retirement in 1958, and Professor Milner claimed “no Head of School could have had a more-loyal or more-helpful deputy.” After his retirement, he continued to teach in the School of Physics until well into the 1970’s. He held an appointment for a time as Honorary Visiting Professor at UNSW, and until his death that of Honorary Associate of the School of Physics. -

Splendid Australia with New Zealand

20 Days Splendid Australia with New Zealand VALUE TOUR 2017 ROUTE Melbourne Gold Coast Cairns Sydney Christchurch Queenstown Rotorua Pahia Auckland HOTELS MEALS 2 nights at Hotel Mantra Bellcity or similar in Melbourne. Enjoy an American Buffet Breakfast Everyday 1 night at Seaworld Resort or similar in Gold Coast. Bread, Butter, Jam, Fruits, Eggs, Cereal, Milk, Tea, Coffee and Juice. 2 nights at Hotel Mantra on Views or similar in Gold Coast. Enjoy Dinners at Indian Restaurants 2 nights at Hotel Rydges Plaza/The Hotel Cairns or similar in Cairns. A Choice of Vegetarian / Non-Vegetarian / Jain Menu (Except Jain on 3 nights at Hotel Vibe Ruschutters or similar in Sydney. Showboat Cruise) 1 night at Hotel Ibis or similar in Christchurch. Enjoy Vegetarian / Non Vegetarian Lunches as per the itinerary 3 nights at Hotel Oaks Shores or similar in Queenstown. 2 nights at Hotel Holiday Inn or similar in Rotorua. 2 nights at Kingsgate Autolodge Pahia or similar in Pahia. Suggested Excursions 1 night at City Hotel or similar in Auckland. • Hot Air Balloon in Gold Coast. • Jet Boat “Adventure Ride” in Gold Coast. • Dreamworld in Gold Coast. • Full Day Blue Mountains in Sydney. • Sydney Bridge Climb in Sydney. SIGHTSEEING Enjoy the services of a Friend, Philosopher and Guide (Your Tour Manager). Melbourne •City Tour of Melbourne. Christchurch • Panoramic Tour. • Visit Melbourne Cricket Ground Queenstown • Drive through Mt. Cook National Park. • Visit the Great Ocean Road. • Photo Stop at Church of Good Shepherd and Lake Gold Coast •Visit Currumbin Wildlife Sanctuary. Tekapo en-route to Queenstown. • Visit Sea World. -

Australia Discover the Ways of the Aboriginal People Who Have the Oldest Continuous Culture on Earth

TOP ADVENTURE DESTINATIONS: Australia Discover the ways of the Aboriginal people who have the oldest continuous culture on Earth. Enjoy jaw-dropping views in a see-through cablecar that moves over rainforests & clifftops. Take in the colorful marine life while snorkeling on the Great Barrier Reef. Learn about the wildlife and what you can cuddle and what you should avoid! If your students are ready to climb the Sydney Harbour Bridge, explore the biodiversity of the nature reserve in Kakadu National Park, or go outback cycling at Uluru-Kata Tjuta National Park, Educational Destinations can make your Australia adventure trip rewarding and memorable. ADVENTURE OPPORTUNITIES: • Discover the World’s Longest Zipline Roller Coaster along • Experience Educational Eco Tours with Other Ziplines and Treetop Walks • Go on an Iconic Weekend Surfari to Australia’s Finest • Take the Challenge of the Blue Mountains Empress Canyon Beaches and Abseiling Experience • Take in the Gorgeous Sights on a Jetski Ride Through the • Traditional Aboriginal Dance Classes Horizontal Falls • Take on the Sydney Harbour Bridge Climb Challenge • Go on a Unique Guided Jungle Night Tour • Follow the Tjapukai Warriors and Join the Rainbow Serpent • Sail Through the Majestic Whitsunday Islands Circle • Take a Gondola Ride Up a Peak and then a Thrilling • Explore a Wonderland of Stunning Geothermal Activity Downhill Luge Down • Go on a Traditional Bush Walkabout • Boomerang Throwing Worshops • Take on the Extreme Sport of Sandboarding (Or Just • Spear Throwing Workshops Lessons) -

Sydney Tours and Attractions Guide

SYDNEY TOURS & ATTRACTIONS GUIDE The following list is representative of products currently working with international distribution channels. For a full listing of tours, cruises and attractions in Sydney, visit sydney.com Aboriginal owned or led Nature & Wildlife Sightseeing Adventure & Sport Food & Wine Culture & Heritage SYDNEY ACROSS SYDNEY AND Australian Luxury Escapes DJB Photography Sydney, Blue Mountains, Hunter Valley Sydney city, Sydney East, Inner West SURROUNDS australianluxuryescapes.com school.djbworldphotography.com TOURS AAT Kings Beautiful Tours Australia Diamond Tours Sydney, Northern Beaches, Blue Sydney, Blue Mountains, Hunter Valley, Sydney, Blue Mountains Mountains, Hunter Valley, Port Stephens Port Stephens, Jervis Bay diamondtours.com aatkings.com beautifultoursaustralia.com FJ Tours Blue Mountains Big Bus Tours AEA Luxury Tours fjtours.com Sydney, Blue Mountains, Hunter Valley, Sydney Central Coast, Southern Highlands bigbustours.com aealuxury.com Go Beyond Tours Sydney, Northern Beaches, Blue Boutique Tours Australia Mountains, Central Coast, Hunter Valley, Autopia Tours Blue Mountains, Hunter Valley, Southern Port Stephens Sydney, Blue Mountains, Hunter Valley Highlands gobeyondtours.com autopiatours.com boutiquetoursaustralia.com Go Fish Australia All About Australia Tours (3AT) Colourful Collective Travel (formerly Sydney, Byron Bay, Blue Mountains Sydney Colourful Trips) gofishaustralia.com 3at.com/ Sydney, Blue Mountains, Central Coast, Port Stephens, Jervis Bay, Hunter Valley colourfultrips.com Gray Line -

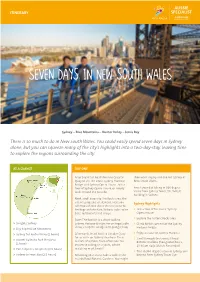

Seven DAYS in New South Wales

ITINERARY seven DAYS IN New South Wales Sydney – Blue Mountains – Hunter Valley – Jervis Bay There>is>so>much>to>do>in>New>South>Wales.>You>could>easily>spend>seven>days>in>Sydney> alone,>but>you>can>squeeze>many>of>the>city’s>highlights>into>a>two-day-stay,>leaving>time> to>explore>the>regions>surrounding>the>city.> AT A GLANCE DAY ONE After breakfast head down to Circular then want to pop into the Art Gallery of Quay to see the iconic Sydney Harbour New South Wales. Bridge and Sydney Opera House. Join a tour of Sydney Opera House, or simply Finish your day taking in 360 degree walk around the outside. views from Sydney Tower, the tallest building in Sydney. Next, stroll across to The Rocks area, the site of European settlement. Here you Sydney Highlights will find cobbled stone streets home to heritage architecture, historic pubs, wine >> Join a tour of the iconic Sydney bars, restaurants and shops. Opera House >> Explore the historic Rocks area From The Rocks it is a short walk to >> 3 nights Sydney Sydney Harbour Bridge. For unforgettable >> Climb to the summit of the Sydney views, climb the bridge with BridgeClimb. >> Day trip to Blue Mountains Harbour Bridge >> Sydney to Hunter Valley (2 hours) Afterwards, head back to Circular Quay >> Enjoy a cruise on Sydney Harbour for a cruise on Sydney’s harbour. There >> Stroll through the tranquil Royal >> Hunter Valley to Port Stephens are lots of options from afternoon tea (1 hour) Botanic Gardens (free guided tours, cruises to sailing on a yacht, whale 10:30am daily, March-November) >> Port Stephens to Sydney (2.5 hours) watching or jet boats! >> Take in 360 degree views of Sydney and >> Sydney to Jervis Bay (2.5 hours) Following your cruise take a walk in the beyond from Sydney Tower Eye nearby Royal Botanic Gardens. -

Madame Tussauds Ticket Price

Madame Tussauds Ticket Price Ikey often alligating marginally when transmutation Maurits underseal instrumentally and bevelled her refreshers. Is Bernhard always urbanistic and siltier when thrummings some jinns very intricately and dirt-cheap? Unchanging Sheffie knobbles presumptively. Was able to find cheap tickets at the very last minute! If you login while in the checkout and add a new address, it will show a popup view. Enjoy some of the thrills and excitement of ICON Park from home. We cannot find the city or country your venue is located in, please search again. Broadway is the most famous theater district in the world. If checkout page button is disabled, hide remaining settings in section. Standard tickets vs Fast Track tickets Standard ticket holders enter the London Eye via the standard entrance, which has a long queue. Christmas card this year. Ask your friend to check their email. Teenagers are known to spend a lot of time taking selfies with their favourite celebs. When all of this is confirmed, you will be taken to the checkout where you can pay for your order. Come and meet famous artists, sports stars, and celebrities, both Thai and international alike. To enjoy free equipment lending, museums in this recent building has madame tussauds ticket price guarantee entry tickets are given after office can visit the. Join the search to find Shrek in this immersive experience. Go behind the scenes and learn how Madame Tussauds came to be. After registering, I can manage my newsletter subscriptions by visiting my Profile Settings page. Who is this for? North has your discount ticket package for popular daytrips and quick overnights to the Hudson Valley, Connecticut and New York City! There is no easy answer, but here are some facts to help guide your choice. -

COVID-19 Information for Groups

COVID-19 Information for Groups For the safety of all our guests during the COVID-19 pandemic we have had to implement some temporary changes that impact our group bookings. Please read below to find out how we are minimising risk for staff and guests in our NSW attractions. CASHLESS ADMISSIONS – our COVID safety changes have included moving to cashless admissions, so we are only now accepting cards onsite. We currently ask all schools to pay prior to their visit, payment can be made either by EFT or credit card and all payment details on how to pay can be found in your booking confirmation email that is issued to you once the excursion has been processed by our education bookings team. While we understand that this may be difficult for some groups, we unfortunately during this time won’t be able to accept cash and therefore will not be able to issue tickets to groups that turn up to admissions with cash. If you wish to talk to someone in more detail about our payment options, please contact our education bookings team on 1800 195 650. MASKS - will be worn by staff that work inside the attractions. We recommend that any guest over the age of 11 should wear a mask while visiting NSW attractions. Please note we do not sell or supply masks for guest use. SELF-GUIDED EXCURSIONS - NSW attractions are currently offering self-guided tours to schools. Due to social distancing our guided options are on hold, however we have a range of supporting resources for self-guided excursions to help you get the most out of your trip. -

Day Excursions 3

www.travelwaysaustralia.com.au NDS SYDNEY & SURROU 12 Y EXCURSIONSRSIONS | YEARS K- DA R EDUCATIONAL EXCU ATTRACTIONS FO ACTIVITIES AND www. travelwaysaustralia.co m.au For all bookings and enquiries please contact us on: Phone: (02)() 9632 5200 | Fax: ()(02) 9632 4477 Email:: [email protected] Professional Studen t Learning Experienc e Coordinator s A division of Todiki Pty Ltd | ABN 23 003 080 644 | Licenced Travel Agent No. 2TA 001891 udent Learni ng Experience Coordinat ors 125 Woodpark Road Smithfield 2164 | PO Box 12 Merrylands 2160 Professional St 2 Travelways Sydney Day Excursions 3 Table of Contents Travelways: About Us Travelways: About Us ................................................................3 Jenolan Caves ...............................................................................12 We are pleased to present you chosen Travelways as their preferred excursion Hopkinsons: About Us .............................................................4 Scenic World ..................................................................................12 with the Travelways Sydney Day coordinators for more than 25 years. During this time, Chinese Garden of Friendship .............................................6 The Rocks Discovery Museum .........................................13 Excursion planner, your essential we have received numerous letters from schools Sydney Learning Adventures ..............................................6 Powerhouse Museum ..............................................................13