Ten Network Holdings' First Half 2016 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seven Network Ratings Report Nov 5 to Nov 11

13 November 2017 Seven Network Ratings Report Week 45: 5 November – 11 November 2017 Seven wins in primetime on primary channels - Seven is number 1 for total viewers, 16-39s, 18-49s and 25-54s. Seven wins in primetime on digital channels - 7mate is number 1 for total viewers, 18-49s and 25-54s. Seven wins in primetime on combined audiences - Seven’s broadcast platform of Seven + 7TWO + 7mate + 7flix combine to win primetime in total viewers, 16-39s, 18-49s and 25-54s on the combined audiences of all multiple channels. Seven wins in news - Seven News leads Nine News. Seven wins in breakfast television - Sunrise leads Today. Seven wins in morning television - The Morning Show leads Today Extra. Seven wins at 5:30pm - The Chase leads Hot Seat. The Rugby League World Cup dominates across the Screens of Seven - peaks at 1.1 million and reaches 2.2 million on Saturday. 7Live delivers 1.6 million streaming minutes. - across the Rugby League World Cup, Seven’s coverage across Seven and 7mate delivers an audience reach of 5.3 million Australians and 7.7 million live streaming minutes on 7Live. The Melbourne Cup dominates across the Screens of Seven - Seven’s television coverage peaks at 2.7 million and reaches 4.2 million in-home viewers. - 7Live delivers the biggest streaming day of any free-to-air broadcast event since the Australian Open: 350,000 concurrent streams up 22% on 2016 and across the day 10.9 million streaming minutes up 64% on 2016. - 7HorseRacing on Facebook reaches 850,000. -

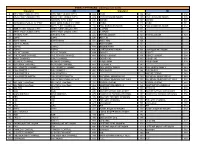

Las Vegas Channel Lineup

Las Vegas Channel Lineup PrismTM TV 222 Bloomberg Interactive Channels 5145 Tropicales 225 The Weather Channel 90 Interactive Dashboard 5146 Mexicana 2 City of Las Vegas Television 230 C-SPAN 92 Interactive Games 5147 Romances 3 NBC 231 C-SPAN2 4 Clark County Television 251 TLC Digital Music Channels PrismTM Complete 5 FOX 255 Travel Channel 5101 Hit List TM 6 FOX 5 Weather 24/7 265 National Geographic Channel 5102 Hip Hop & R&B Includes Prism TV Package channels, plus 7 Universal Sports 271 History 5103 Mix Tape 132 American Life 8 CBS 303 Disney Channel 5104 Dance/Electronica 149 G4 9 LATV 314 Nickelodeon 5105 Rap (uncensored) 153 Chiller 10 PBS 326 Cartoon Network 5106 Hip Hop Classics 157 TV One 11 V-Me 327 Boomerang 5107 Throwback Jamz 161 Sleuth 12 PBS Create 337 Sprout 5108 R&B Classics 173 GSN 13 ABC 361 Lifetime Television 5109 R&B Soul 188 BBC America 14 Mexicanal 362 Lifetime Movie Network 5110 Gospel 189 Current TV 15 Univision 364 Lifetime Real Women 5111 Reggae 195 ION 17 Telefutura 368 Oxygen 5112 Classic Rock 253 Animal Planet 18 QVC 420 QVC 5113 Retro Rock 257 Oprah Winfrey Network 19 Home Shopping Network 422 Home Shopping Network 5114 Rock 258 Science Channel 21 My Network TV 424 ShopNBC 5115 Metal (uncensored) 259 Military Channel 25 Vegas TV 428 Jewelry Television 5116 Alternative (uncensored) 260 ID 27 ESPN 451 HGTV 5117 Classic Alternative 272 Biography 28 ESPN2 453 Food Network 5118 Adult Alternative (uncensored) 274 History International 33 CW 503 MTV 5120 Soft Rock 305 Disney XD 39 Telemundo 519 VH1 5121 Pop Hits 315 Nick Too 109 TNT 526 CMT 5122 90s 316 Nicktoons 113 TBS 560 Trinity Broadcasting Network 5123 80s 320 Nick Jr. -

Everly IPTV Channel Guide 10-7-19.Xlsx

EVERLY IPTV BASIC (continued on back) Standard HD Standard HD 4 KTIV "NBC" (SIOUX CITY) KTIV "NBC" (SIOUX CITY) 404 CNN 104 CNN 504 9 KCAU "ABC" (SIOUX CITY) KCAU "ABC" (SIOUX CITY) 409 CNN HEADLINE NEWS 105 CNN HEADLINE NEWS 505 KDINDT2 "IPTV KIDS" 410 MSNBC 107 MSNBC 507 11 KDIN IOWA PUBLIC TV "PBS" KDIN IOWA PUBLIC TV "PBS" 411 CNBC 111 CNBC 511 KEYC "CBS" (MANKATO) 412 FOX BUSINESS NEWS 112 FOX BUSINESS NEWS 512 14 KMEG "CBS" (SIOUX CITY) KMEG "CBS" (SIOUX CITY) 414 C-SPAN 115 15 KPTH "FOX" (SIOUX CITY) KPTH "FOX" (SIOUX CITY) 415 C-SPAN2 116 22 KTIVDT2 "CW" KTIVDT2 "CW" 422 NICKELODEON 123 NICKELODEON 523 30 ESPN ESPN 430 NICK JR. 124 31 ESPN NEWS ESPN NEWS 431 NICK TOO 126 32 ESPN CLASSIC NICKTOONS 127 33 ESPNU ESPNU 433 BOOMERANG 129 35 ESPN2 ESPN2 435 CARTOON NETWORK 131 CARTOON NETWORK 531 39 NFL NETWORK NFL NETWORK 439 DISNEY 133 DISNEY 533 43 THE TENNIS CHANNEL THE TENNIS CHANNEL 443 DISNEY JUNIOR 134 DISNEY JUNIOR 534 44 GOLF CHANNEL GOLF CHANNEL 444 DISNEY XD 136 DISNEY XD 536 45 OLYMPIC CHANNEL OLYMPIC CHANNEL 445 FREEFORM 138 FREEFORM 538 47 OUTDOOR CHANNEL OUTDOOR CHANNEL 447 TEEN NICK 140 49 NBC SPORTS CHANNEL NBC SPORTS CHANNEL 449 DISCOVERY FAMILY 143 DISCOVERY FAMILY 543 50 FOX SPORTS 1 FOX SPORTS 1 450 DISCOVERY 144 DISCOVERY 544 51 FOX SPORTS 2 FOX SPORTS 2 451 MOTOR TREND 545 55 FOX SPORTS NORTH FOX SPORTS NORTH 455 NATIONAL GEOGRAPHIC 149 NATIONAL GEOGRAPHIC 549 FOX SPORTS NORTH PLUS 457 NATIONAL GEOGRAPHIC WILD 150 NATIONAL GEOGRAPHIC WILD 550 61 BIG TEN 1 (overflow) BIG TEN 1 (overflow) 461 ANIMAL PLANET 153 -

Eastern News: March 01, 1984 Eastern Illinois University

Eastern Illinois University The Keep March 1984 3-1-1984 Daily Eastern News: March 01, 1984 Eastern Illinois University Follow this and additional works at: http://thekeep.eiu.edu/den_1984_mar Recommended Citation Eastern Illinois University, "Daily Eastern News: March 01, 1984" (1984). March. 1. http://thekeep.eiu.edu/den_1984_mar/1 This is brought to you for free and open access by the 1984 at The Keep. It has been accepted for inclusion in March by an authorized administrator of The Keep. For more information, please contact [email protected]. nderland, again Forget the snow Special pullout section of snow dumped on Eastern Check out the latest men's and women's Check out the 4-page pullout section in the f4'88day provided everyone with fashions for this Spring in the Fashion Guide. Fashion Gulde for the latest sports news and W Arctic life. SM ltcOftd HCtlon classifieds. SM pullout Mellon . The Dally Thursday, March 1, 1 984 will be partly sunny. Highs in the low to mid 30's. Light and variable winds. · Tonight will be partly cloudy and cold. Lows5 to 15. iversity /Charleston, Ill. 61920 Vol. 69, No. 112 / s tions, 24 Pages EasternEastern Illinois U� I NewsThree ec Warmer conditions; more sn_ow Monday by Keith Clark area, so this recent snowfall is by no As people continue digging out from means a record," Wise explained. the near-foot of snow which blanketed Meanwhile, operations to clear the area this week, local weather streets and walkways continue observers are predicting a moderate Wednesday both in Charleston and at weather trend through the weekend. -

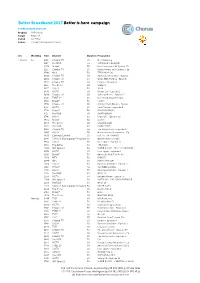

BB2017 Media Overview for Rsps

Better Broadband 2017 Better is here campaign TV PRE AIRDATE SPOTLIST Product All Products Target All 25-54 Period wc 7 May Source TVmap/The Nielsen Company w/c WeekDay Time Channel Duration Programme 7 May 17 Su 1112 Choice TV 30 No Advertising 7 May 17 Su 1217 the BOX 60 SURVIVOR: CAGAYAN 7 May 17 Su 1220 Bravo* 30 Real Housewives Of Sydney, Th 7 May 17 Su 1225 Choice TV 30 Better Homes and Gardens - Ep 7 May 17 Su 1340 MTV 30 TEEN MOM OG 7 May 17 Su 1410 Choice TV 30 American Restoration - Episod 7 May 17 Su 1454 Choice TV 60 Walks With My Dog - Episode 7 May 17 Su 1542 Choice TV 60 Empire - Episode 4 7 May 17 Su 1615 The Zone 60 SLIDERS 7 May 17 Su 1617 HGTV 30 16:00 7 May 17 Su 1640 HGTV 60 Hawaii Life - Episode 2 7 May 17 Su 1650 Choice TV 60 Jamie at Home - Episode 5 7 May 17 Su 1710 TVNZ 2* 60 Home and Away Omnibus 7 May 17 Su 1710 Bravo* 30 Catfish 7 May 17 Su 1710 Choice TV 30 Jimmy's Farm Diaries - Episod 7 May 17 Su 1717 HGTV 30 Yard Crashers - Episode 8 7 May 17 Su 1720 Prime* 30 RUGBY NATION 7 May 17 Su 1727 the BOX 30 SMACKDOWN 7 May 17 Su 1746 HGTV 60 Island Life - Episode 10 7 May 17 Su 1820 Bravo* 30 Catfish 7 May 17 Su 1854 The Zone 60 WIZARD WARS 7 May 17 Su 1905 the BOX 30 MAIN EVENT 7 May 17 Su 1906 Choice TV 60 The Living Room - Episode 37 7 May 17 Su 1906 HGTV 30 House Hunters Renovation - Ep 7 May 17 Su 1930 Comedy Central 30 LIVE AT THE APOLLO 7 May 17 Su 1945 Crime & Investigation Network 30 DEATH ROW STORIES 7 May 17 Su 1954 HGTV 30 Fixer Upper - Episode 6 7 May 17 Su 1955 The Zone 60 THE CAPE 7 May 17 Su 2000 -

Teuila Blakely. Height 170 Cm

Actor Biography Teuila Blakely. Height 170 cm Awards. 2006 Nominated for Best Actress Award for Siones Wedding Film. 2019 Brokenwood Episode 4 Angela Lafferty Dir. Various Prd. South Pacific Pictures 2017 The Breaker Upperers Client 8 Catch Casting - AKL Dir. Jackie van Beek, Madeleine Sami Prd. Carthew Neal, Ainsley Gardiner, Georgina Conder 2011 Sione's 2 Leilani South Pacific Pictures 2006 Siones Wedding Leilani South Pacific Pictures Feature Film. 2021 The Royal Treatment Queen Cleo Netflix (Support) Dir. Rick Jacobson Television. 2021 Power Rangers Dino Fury Commander Power Rangers Productions Ltd (Guest) Dir. Various 2020 Golden Boy Series 2 Gail Mediaworks (Guest) Dir. Various Prd. Bronwynn Bakker 2020 Cowboy Bebop Duero Dir. Alex Garcia Lopez Prd. Becky Clements, Simon Ambridge, Scott Rosenberg, Jeff Pinker, Andre Nemec and Josh Appelbaum PO Box 78340, Grey Lynn, www.johnsonlaird.com Tel +64 9 376 0882 Auckland 1245, NewZealand. www.johnsonlaird.co.nz Fax +64 9 378 0881 Teuila Blakely. Page 2 Television continued... 2018 Power Rangers Beast Morphers Commander Shaw Power Rangers Productions Ltd Dir. Various 2017 Murder is Forever EP 104 SGT NEGRON Dir. TBC Prd. Stephen David 2017 Funny Girls Various 2016 Filthy Rich Series 2 Malia Filthy Rich Productions (Guest) Dir. Various Prd. Steven Zanoski 2016 All Star Family Feud Guest Contestant Mediaworks Holdings Limited Prd. John McDonald 2015 Dancing with the Stars Celebrity Dancer Mediaworks Ltd (Contestant) 2015 Funny Girls Disney Prison Prd. Mediaworks 2014 West Side Story Talita South Pacific Pictures (Guest) 2010 Shortland Street Vasa Levi South Pacific Pictures (Core) Dir. Various Prd. Steven Zanoski&Simon Bennett 2009 This Is Not My Life Lani GRST Dir. -

Channel Lineup January 2018

MyTV CHANNEL LINEUP JANUARY 2018 ON ON ON SD HD• DEMAND SD HD• DEMAND SD HD• DEMAND My64 (WSTR) Cincinnati 11 511 Foundation Pack Kids & Family Music Choice 300-349• 4 • 4 A&E 36 536 4 Music Choice Play 577 Boomerang 284 4 ABC (WCPO) Cincinnati 9 509 4 National Geographic 43 543 4 Cartoon Network 46 546 • 4 Big Ten Network 206 606 NBC (WLWT) Cincinnati 5 505 4 Discovery Family 48 548 4 Beauty iQ 637 Newsy 508 Disney 49 549 • 4 Big Ten Overflow Network 207 NKU 818+ Disney Jr. 50 550 + • 4 Boone County 831 PBS Dayton/Community Access 16 Disney XD 282 682 • 4 Bounce TV 258 QVC 15 515 Nickelodeon 45 545 • 4 Campbell County 805-807, 810-812+ QVC2 244• Nick Jr. 286 686 4 • CBS (WKRC) Cincinnati 12 512 SonLife 265• Nicktoons 285 • 4 Cincinnati 800-804, 860 Sundance TV 227• 627 Teen Nick 287 • 4 COZI TV 290 TBNK 815-817, 819-821+ TV Land 35 535 • 4 C-Span 21 The CW 17 517 Universal Kids 283 C-Span 2 22 The Lebanon Channel/WKET2 6 Movies & Series DayStar 262• The Word Network 263• 4 Discovery Channel 32 532 THIS TV 259• MGM HD 628 ESPN 28 528 4 TLC 57 557 4 STARZEncore 482 4 ESPN2 29 529 Travel Channel 59 559 4 STARZEncore Action 497 4 EVINE Live 245• Trinity Broadcasting Network (TBN) 18 STARZEncore Action West 499 4 EVINE Too 246• Velocity HD 656 4 STARZEncore Black 494 4 EWTN 264•/97 Waycross 850-855+ STARZEncore Black West 496 4 FidoTV 688 WCET (PBS) Cincinnati 13 513 STARZEncore Classic 488 4 Florence 822+ WKET/Community Access 96 596 4 4 STARZEncore Classic West 490 Food Network 62 562 WKET1 294• 4 4 STARZEncore Suspense 491 FOX (WXIX) Cincinnati 3 503 WKET2 295• STARZEncore Suspense West 493 4 FOX Business Network 269• 669 WPTO (PBS) Oxford 14 STARZEncore Family 479 4 FOX News 66 566 Z Living 636 STARZEncore West 483 4 FOX Sports 1 25 525 STARZEncore Westerns 485 4 FOX Sports 2 219• 619 Variety STARZEncore Westerns West 487 4 FOX Sports Ohio (FSN) 27 527 4 AMC 33 533 FLiX 432 4 FOX Sports Ohio Alt Feed 601 4 Animal Planet 44 544 Showtime 434 435 4 Ft. -

O Verviewof a Ustralia

Overview of A ustralia's M edia O w nership Law s Commercial Free-to-Air TV Broadcasting 1975 (FATA), which applies to all media. All Control direct proposals for foreign investment of Licences A person who has company interests in a more than 5% are subject to case-by-case company which exceed 15% is regarded as A person must not control (see control below): examination, as are proposals for portfolio being in a position to exercise control of the shareholdings of more than 5%. Up to 25% • licences whose combined licence area company (the '15% rule’) (cl. 6, Sch. 1, BSA). foreign investment by a single shareholder populations exceed 75°/o of the population Company interests include shareholding, in a mass circulation newspaper is permitted, of Australia; voting, dividend or winding-up interests (s. 6 with a maximum of 30% for all foreign BSA). Importantly, the 15% rule does not only • more than one licence in the same licence interests. Aggregate investment in provincial apply to direct interests held in a company, it area (though see exception below) (s. 53 and suburban newspapers is limited to 50%. A also applies to an interest of more than 15% Broadcasting Services Act 1992 (BSA)). separate policy relates to foreign ownership of which is carried through a chain of companies ethnic newspapers in Australia. Similar limits apply to directors of companies (cl. 7, Sch. 1, BSA). Minor company interests can that control licences; a director of two or more also be traced through a chain of companies companies that between them control licences; Cross-Media Controls *• (fractional tracing method) and combined to a person who controls a licence and who is a A person must not control: determine a person's relevant interest in a director of a company that controls another company (cl. -

Colin Lane Comedian / Professional Show Off

Colin Lane Comedian / Professional Show Off As the ‘Lano’ from Lano & Woodley, Colin Lane was one half of Australia’s favourite comedy duo. They won comedy’s Oscar, the Perrier Award, and their series The Adventures of Lano & Woodley played in more than 30 countries. In 2006 they said Goodbye with a tour that played to 125,000 people in 34 towns. Since the farewell tour, Colin has toured to cabaret and comedy festivals around Australia, most notably teaming up with the hilarious David Collins from The Umbilical Brothers to tackle Gilbert and Sullivan in The 3 Mikados. Colin has been a regular on a wide variety of Aussie TV shows, including Spicks and Specks, Ready Steady Cook, The Circle, Good News Week & The Project. In 2013, he was a guest panellist on UK favourite QI alongside Stephen Fry and Alan Davies, and has returned several times since – most recently in 2019 on the new-look, Sandi Toksvig-hosted version of the hugely popular show. He has worked with both Red Stitch under director Nadia Tass, and The Production Company, in “Curtains”. He’s also teamed up with his friend of 25 years, opera singer David Hobson, for “In Tails”. They sing, dance and even tell some jokes in a unique and hilarious experiment that entertains and beguiles in a whole new way. Colin reunited with Frank Woodley as part of the Melbourne Comedy Festival 30th Birthday Bash at the Regent Theatre in 2016, for a surprise performance that brought the house down. It naturally led to a serious “Waddya reckon?” chat. -

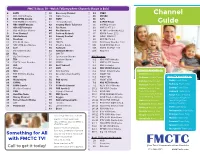

Channel Guide

FMCTC Basic TV - Watch TVEverywhere Channels Shown in Bold 2 ESPN 38 Discovery Channel 84 CNBC Channel 3 CBS KMTV-Omaha 39 WGN America 85 MSNBC 4 FOX KPTM-Omaha 40 HGTV 86 SyFy 5 FOX KDSM-Des Moines 41 History Channel 90 CSPAN-House Guide 6 NBC WOWT-Omaha 42 Country Music Television 91 CSPAN2-Senate 7 ABC KETV-Omaha 43 Fox News 93 KMTV LAFF 3.2 8 CBS KCCI-Des Moines 44 Fox Business 94 KPTM This-Omaha 42.2 9 Food Channel 45 Cartoon Network 95 KDSM Comet 17.2 10 USA Network 46 Comedy Central 96 WOWT COZI 6.2 11 Freeform 47 EWTN 98 KCCI MeTV 8.2 12 PBS KHIN-Iowa 48 FMCTV 100 WHO Iowa Weather 13.2 13 NBC WHO-Des Moines 49 Channel Guide 101 KXVO CHARGE 15.3 14 Golf 50 Hallmark 105 KDSM CHARGE 17.3 15 CW KXVO-Omaha 51 Hallmark Movies 108 KCCI 8.3 16 TLC 52 MAV TV 17 Big Ten Network 53 Sportsman Channel HD Channels 18 TBS 54 Outdoor Channel 3-1 CBS KMTV-Omaha 19 FMCTV Local Weather 55 RFDTV 3-2 KMTV LAFF-Omaha 23 VH1 56 Do It Yourself 3-3 KMTV Escape 24 TV Land 57 OWN 6-1 NBC WOWT-Omaha 25 MTC 58 BTN Overflow 6-2 WOWT COZI-Omaha Digital TV Available In: 26 PBS KYNE-Nebraska 59 Great American Country 6-3 WOWT H&I • Corley-Rural & Town 27 TNT 70 FX 6-4 WOWT ION • Defiance-Rural & Town Basic TV Available In: 28 Nickelodeon 71 FOX Sports 6-5 WOWT STAR • Earling-Rural & Town • Corley-Town Only 29 ESPN2 72 FXX 7-1 ABC KETV-Omaha • Defiance-Town Only 30 ESPN Classic 73 FX Movie Channel 7-2 KETV MeTV-Omaha • Hancock-Rural & Town 31 Weather Channel 74 FOX Sports 2 15-1 CW KXVO-Omaha • Harlan-Parts of Town, • Earling-Town Only 32 CNN 75 Olympic Channel -

List of Failed Companies.Xlsx

Date company Price when Date of Final price for Code Company flagged as flagged as corporate investors ($) unhealthy unhealthy ($) collapse GPA Greyhound Pioneer Australia Limited 17/03/1997 0.52 23/06/2000 0.00 PAS Pasminco Limited 4/09/2000 1.73 19/09/2001 0.00 AEH1 Aerosonde Holdings Limited 20/03/2002 0.15 30/08/2002 0.00 CHG Chieron Holdings Limited 17/03/1999 0.15 30/08/2002 0.00 HTS Harts Australasia Limited 18/09/2000 0.92 30/08/2002 0.00 LIB LibertyOne Limited 19/03/1999 0.77 30/08/2002 0.00 NFR Nonferral Recyclers Limited 21/03/2001 0.52 30/08/2002 0.00 SCG1 Smart Communications Group Limited 20/03/2001 0.69 30/08/2002 0.00 SFO Seafood Online.com Limited 28/08/2000 0.17 30/08/2002 0.00 AEL Antaeus Energy Limited 17/03/1997 2.80 19/09/2002 0.00 ASR Australian Rural Group Limited 21/03/2002 0.47 27/09/2002 0.00 BLR Black Range Minerals Limited 19/03/1997 0.24 31/03/2003 0.00 PPH1 Pan Pharmaceuticals Limited 3/03/2003 1.30 22/05/2003 0.00 CHV CMG CH China Investments Limited 6/03/2002 0.56 9/07/2003 0.00 BAE Barron Entertainment Limited 17/03/1997 55.97 1/09/2003 0.00 CRX1 China Region Investments Limited 12/03/1997 0.47 1/09/2003 0.00 EEI Earth Essence International Limited 21/03/2001 0.13 1/09/2003 0.00 IPW IPWorld Limited 1/05/1997 0.28 1/09/2003 0.00 NMW Normans Wines Limited 19/02/1999 0.94 1/09/2003 0.00 NWL1 New Tel Limited 19/03/1997 0.74 1/09/2003 0.00 BGN BresaGen Limited 25/02/2000 1.09 20/01/2004 0.00 YOW Yowie Group Ltd 14/09/2000 1.15 23/02/2004 0.00 AMV Alamain Investments Limited 20/03/2000 0.06 31/08/2004 0.00 -

2019 AACTA AWARDS PRESENTED by FOXTEL All Nominees – by Category FEATURE FILM

2019 AACTA AWARDS PRESENTED BY FOXTEL All Nominees – by Category FEATURE FILM AACTA AWARD FOR BEST FILM PRESENTED BY FOXTEL HOTEL MUMBAI Basil Iwanyk, Gary Hamilton, Julie Ryan, Jomon Thomas – Hotel Mumbai Double Guess Productions JUDY & PUNCH Michele Bennett, Nash Edgerton, Danny Gabai – Vice Media LLC, Blue-Tongue Films, Pariah Productions THE KING Brad Pitt, Dede Gardner, Jeremy Kleiner, Liz Watts, David Michôd, Joel Edgerton – Plan B Entertainment, Porchlight Films, A Yoki Inc, Blue-Tongue Films THE NIGHTINGALE Kristina Ceyton, Bruna Papandrea, Steve Hutensky, Jennifer Kent – Causeway Films, Made Up Stories RIDE LIKE A GIRL Richard Keddie, Rachel Griffiths, Susie Montague – The Film Company, Magdalene Media TOP END WEDDING Rosemary Blight, Kylie du Fresne, Kate Croser – Goalpost Pictures AACTA AWARD FOR BEST INDIE FILM PRESENTED BY EVENT CINEMAS ACUTE MISFORTUNE Thomas M. Wright, Virginia Kay, Jamie Houge, Liz Kearney – Arenamedia, Plot Media, Blackheath Films BOOK WEEK Heath Davis, Joanne Weatherstone – Crash House Productions BUOYANCY Rodd Rathjen, Samantha Jennings, Kristina Ceyton, Rita Walsh – Causeway Films EMU RUNNER Imogen Thomas, Victor Evatt, Antonia Barnard, John Fink – Emu Runner Film SEQUIN IN A BLUE ROOM Samuel Van Grinsven, Sophie Hattch, Linus Gibson AACTA AWARD FOR BEST DIRECTION HOTEL MUMBAI Anthony Maras – Hotel Mumbai Double Guess Productions JUDY & PUNCH Mirrah Foulkes – Vice Media LLC, Blue-Tongue Films, Pariah Productions THE KING David Michôd – Plan B Entertainment, Porchlight Films, A Yoki Inc,