Frequently Asked Questions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

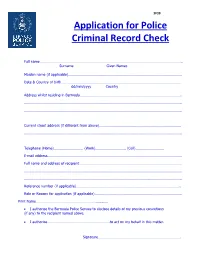

Application for Police Criminal Record Check

SF39 Application for Police Criminal Record Check Full name……………………………………………………………………………………………………………………………….. Surname Given Names Maiden name (if applicable)…………………………………………………………………………………………………….. Date & Country of birth…………………………………………………………………………………………………………… dd/mm/yyyy Country Address whilst residing in Bermuda………………………………………………………………………………………….. …………………………………………………………………………………………………………………………………………….. …………………………………………………………………………………………………………………………………………….. Current street address (if different from above)………………………………………………………………………… …………………………………………………………………………………………………………………………………………….. Telephone (Home)………………………… (Work)…………………………. (Cell)……………………….. E-mail address……………………………………………………………………………………………………………………….. Full name and address of recipient…………………………………………………………………………………………… …………………………………………………………………………………………………………………………………………….. …………………………………………………………………………………………………………………………………………….. Reference number (if applicable)…………………………………………………………………………………………….. Role or Reason for application (if applicable)…………………………………………………………………………….. Print Name……………………………………………………............ I authorize the Bermuda Police Service to disclose details of my previous convictions (if any) to the recipient named above. I authorize……………………………………………………….to act on my behalf in this matter. Signature…………………………………………………………………………. Instructions for Submitting Requests & Documentation IMPORTANT The Bermuda Police Service will only accept applications for Police Record Checks under the following circumstances: 1. Local applicants: A fee of $100 should be submitted -

Annual Report

HSBC BANK MALTA P.L.C. Contents 2 Chairman’s Statement 5 Chief Executive Officer’s Review 8 Chief Operating Officer’s Review 10 Board of Directors 12 Financial Review 14 Report of the Directors 18 Statement of Compliance with the Principles of Good Corporate Governance 22 Remuneration Report 23 Report of the Independent Auditors to the Shareholders of HSBC Bank Malta p.l.c. pursuant to Listing Rule 8.39 issued by the Listing Authority 24 Directors’ responsibility for the Financial Statements 25 Income Statements 26 Balance Sheets 27 Statements of Changes in Equity 29 Cash Flow Statements 30 Notes on the Accounts 84 Report of the Independent Auditors to the Shareholders of HSBC Bank Malta p.l.c. 86 Group Income Statement: Five-Year Comparison 87 Group Balance Sheet: Five-Year Comparison 88 Group Cash Flow Statement: Five-Year Comparison 89 Group Accounting Ratios: Five-Year Comparison 90 Group Financial Highlights in US dollars 91 Branches and Offices HSBC BANK MALTA P.L.C. Chairman’s Statement I am pleased to advise that 2008 was a satisfactory year the year the bank also issued §30.0 million worth of for HSBC Bank Malta p.l.c. in spite of the challenging subordinated bonds which attracted an overwhelming world economy. response and were oversubscribed on the first day. This shows the confidence the investment public has in our Results organisation and its future performance. HSBC Bank Malta p.l.c., a subsidiary of London- Profit before taxation was §96.1 million. This represents based HSBC Holdings plc, remains the largest and a decrease of 16.2 per cent over prior year but is most profitable company listed on the Malta Stock satisfactory taking into account a number of exceptional Exchange. -

Hsbc Premier Terms & Charges Disclosure

HSBC PREMIER The following information was correct as of 09/24/2021 Have questions or need current rate information? TERMS & CHARGES DISCLOSURE1 Call us at 888.662.HSBC (4722) It's important that you understand exactly how your HSBC Premier checking account works. We've created this summary to explain the fees and some key terms of your account. To qualify you must be a consumer and maintain: Balances of $75,000 in qualifying balances (see qualifying balance section); OR Monthly recurring direct deposits2 totaling at least $5,000 from a third party to an HSBC Premier checking account(s); OR HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of ELIGIBILITY multiple mortgages. Home Equity products are not included. Participation in HSBC Jade is available to holders of an HSBC Premier Checking Account who have maintained qualifying Personal Cash Accounts and Personal Investment Assets (excluding Retirement Accounts and Assets) in the United States which in aggregate and calculated as an average over each calendar month are equal to at least $1,000,000 (One million U.S. dollars) for a period of at least 1 calendar month (a “Qualifying Balance”) immediately prior to HSBC Premier Account Holders becoming HSBC Jade clients. As a HSBC Jade client, if you are no longer able to meet the HSBC Jade criteria, your access to all its benefits will be removed. RATE Minimum Balance to Obtain APY Interest Rate Annual Percentage Yield (APY) INFORMATION (For more details $5 or more 0.01% 0.01% see HOW INTEREST AND APY WORK section Less than $5 No Interest Earned No APY Earned in the Rules)3 Minimum Balance requirements to earn interest are met by maintaining a “Daily Balance” of specified dollar amounts in your relationship checking account.3 Method Used to Compute Daily This method applies a daily periodic rate to the principal in the account ADDITIONAL Interest Balance each day. -

Student Accounts

Student Accounts Students have unique banking needs. Whether you’re from the U.S. or overseas, you’ll feel right at home with HSBC accounts designed with you in mind. With access to student checking, savings and a credit card designed specifically for students, you’ll have all the tools you need to start building your credit history today so you can make the most out of tomorrow. Deposit Accounts Cash Rewards Mastercard® Credit Card HSBC Choice Checking offers students the value you are Student Account looking for. With no monthly maintenance fee for 6 years The HSBC Cash Rewards Mastercard® credit card Student 1 from account opening, and the option to link to a Savings Account offers convenience, cash back and a great way to account, it’s the smart way to bank. help you establish credit. Choice Checking Student Offer Build your credit • No monthly maintenance fee for 6 years from • No credit history required for approval7 account opening1 • Lower credit limits to help support responsible credit card use • No minimum deposit required2 • Make monthly payments to establish good payment habits HSBC Direct Savings Account3 • View your FICO® Credit Score for free on your HSBC Credit Card statement • $0 monthly maintenance fee • Variable Purchase APR8 of 13.99% to 23.99% • $1 minimum balance for account opening in New Money4 5 • An online-only, high-yield personal savings account Earn cash back • 1.5% cash back on all your purchases Earn a $100 Welcome Deposit6 • Redeem for cash back right into your HSBC checking account Here’s how: • Open an HSBC Choice Checking account from February 16, 2020 through and including October 30, 2020, listing Apply for the Cash Rewards Mastercard® Credit Card student as your occupation on your application; and Student Account • Deposit $25 or more within 30 calendar days of account Once you set up an HSBC Checking, opening; and Savings or Certificate of Deposit account, • Maintain a Qualifying Direct Deposit of $500, OR applying is easy; stop in to any branch. -

HSBC Holdings Plc Q1 2010 Interim Management Statement Conference Call

FINAL TRANSCRIPT HBC - HSBC Holdings plc Q1 2010 Interim Management Statement Conference Call Event Date/Time: May. 07. 2010 / 12:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2010 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. FINAL TRANSCRIPT May. 07. 2010 / 12:00PM, HBC - HSBC Holdings plc Q1 2010 Interim Management Statement Conference Call CORPORATE PARTICIPANTS Michael Geoghegan HSBC Holdings plc - Group Chief Executive Douglas Flint HSBC Holdings plc - Group Financial Officer, Executive Director Risk and Regulation Brendan McDonagh HSBC North America Holdings Inc. - CEO CONFERENCE CALL PARTICIPANTS Sunil Garg JPMorgan Securities, Ltd. - Analyst Jon Kirk Redburn Partners - Analyst Ian Smillie Royal Bank of Scotland - Analyst Steven Hayne Morgan Stanley - Analyst Simon Maughan MF Global Securities Limited - Analyst John Waddle Mirae Asset Securities - Analyst Manus Costello Autonomous Research LLP - Analyst Leigh Goodwin Citigroup - Analyst Tom Rayner Barclays Capital - Analyst Michael Helsby BofA Merrill Lynch - Analyst Arturo de Frias Evolution Securities - Analyst PRESENTATION Operator Welcome to the HSBC Holdings plc Interim Management Statement and HSBC Finance Corporation and HSBC USA Inc. first-quarter 2010 results. Today©s call is being chaired by Michael Geoghegan, Group Chief Executive, HSBC Holdings plc; Douglas Flint, Chief Financial Officer, Executive Director, Risk and Regulation HSBC Holdings plc; and Brendan McDonagh, Chief Executive Officer, HSBC North America[n] Holdings Inc. I would now like to hand over to Mr. -

HSBC HOLDINGS Plc Silent Social Report 1999-2000

HSBC HOLDINGS plc Silent Social Report 1999-2000 Report collated from information provide in the company’s reports and other documents issued directly by the company 1 DRAFT HSBC Holdings plc – Silent Social Report Mission and Policy Statement MISSION AND POLICY STATEMENTS HSBC is a global banking and financial services organisation headquartered in the United Kingdom. (…) We conduct business in a wide variety of social and business cultures and in a broad range of political environments. ......The HSBC Group’s international network comprises some 6,500 offices in 79 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. With listings on the London, Hong Kong, New York and Paris stock exchanges, shares in HSBC Holdings plc are held by around 190,000 shareholders in some 100 countries and territories. The HSBC Group is committed to five Core Business Principles: outstanding customer service; effective and efficient operations; strong capital and liquidity; conservative lending policy; strict expense discipline; through loyal and committed employees who make lasting customer relationships and international teamwork easier to achieve. (YL:11) 2 DRAFT HSBC Holdings plc – Silent Social Report Corporate Governance Statement CORPORATE GOVERNANCE STATEMENT The Group is committed to high standards of corporate governance. The Company has complied throughout the year with the provisions of Appendix 14 to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong and with the best practice provisions of the Combined Code on corporate governance introduced by the London Stock Exchange. As a commercial organisation, our governing objective is to provide a satisfactory return on shareholders’ capital. -

Brown Brothers Harriman Global Custody Network Listing

BROWN BROTHERS HARRIMAN GLOBAL CUSTODY NETWORK LISTING Brown Brothers Harriman (Luxembourg) S.C.A. has delegated safekeeping duties to each of the entities listed below in the specified markets by appointing them as local correspondents. The below list includes multiple subcustodians/correspondents in certain markets. Confirmation of which subcustodian/correspondent is holding assets in each of those markets with respect to a client is available upon request. The list does not include prime brokers, third party collateral agents or other third parties who may be appointed from time to time as a delegate pursuant to the request of one or more clients (subject to BBH's approval). Confirmations of such appointments are also available upon request. COUNTRY SUBCUSTODIAN ARGENTINA CITIBANK, N.A. BUENOS AIRES BRANCH AUSTRALIA CITIGROUP PTY LIMITED FOR CITIBANK, N.A AUSTRALIA HSBC BANK AUSTRALIA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) AUSTRIA DEUTSCHE BANK AG AUSTRIA UNICREDIT BANK AUSTRIA AG BAHRAIN* HSBC BANK MIDDLE EAST LIMITED, BAHRAIN BRANCH FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BANGLADESH* STANDARD CHARTERED BANK, BANGLADESH BRANCH BELGIUM BNP PARIBAS SECURITIES SERVICES BELGIUM DEUTSCHE BANK AG, AMSTERDAM BRANCH BERMUDA* HSBC BANK BERMUDA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BOSNIA* UNICREDIT BANK D.D. FOR UNICREDIT BANK AUSTRIA AG BOTSWANA* STANDARD CHARTERED BANK BOTSWANA LIMITED FOR STANDARD CHARTERED BANK BRAZIL* CITIBANK, N.A. SÃO PAULO BRAZIL* ITAÚ UNIBANCO S.A. BULGARIA* CITIBANK EUROPE PLC, BULGARIA BRANCH FOR CITIBANK N.A. CANADA CIBC MELLON TRUST COMPANY FOR CIBC MELLON TRUST COMPANY, CANADIAN IMPERIAL BANK OF COMMERCE AND BANK OF NEW YORK MELLON CANADA RBC INVESTOR SERVICES TRUST FOR ROYAL BANK OF CANADA (RBC) CHILE* BANCO DE CHILE FOR CITIBANK, N.A. -

HSBC Mexico Board of Directors

HSBC Mexico, S.A., Institución de Banca Múltiple, Grupo Financiero HSBC Board of Directors April 2021 Board of Directors Executive Directors • Paulo Cezar Torre Maia (Chairman) • Jorge Arturo Arce Gama • Brian Joseph McGuire Non Executive Directors • Claudia Jañez Sanchez • Andrés Rozental Gutman • Edgar Ancona • Eduardo Serrano Berry • Nick Fishwick • Deputy Non Executive Director • Luis Miguel Vilatela Riba |PUBLIC| Executive Directors - Appointment Date • Paulo Cezar Torre Maia, shareholders meeting held in July 3rd 2015. • Jorge Arturo Arce Gama, shareholders meeting held in February 24th 2020. • Brian Joseph McGuire, shareholders meeting held in April 27th 2018. |PUBLIC| Non Executive Directors - Appointment Date • Claudia Jañez Sanchez, shareholders meeting held in April 15st 2021. • Andrés Rozental Gutman, shareholders meeting held in September 9th 2013. • Edgar Ancona, shareholders meeting held in October 21st 2015. • Eduardo Serrano Berry, shareholders meeting held in October 21st 2015. • Nick Fishwick, shareholders meeting held in October 21st 2015. Deputy Non Executive Director - Appointment Date • Luis Miguel Vilatela Riba, shareholders meeting held in April 15st 2021. |PUBLIC| Executive Directors – Bio Data • Paulo Cezar Torre Maia He is the current CEO (Chief Executive Officer) of HSBC LAM since July 2015. Previously he was appointed as Chairman and CEO of HSBC Canada and before that in HSBC Australia. Mr. Maia has a Bachelor Degree in Mechanical Engineering and a Master in Industrial Engineering, both from the Catholic University of Rio de Janeiro in Brazil. • Jorge Arturo Arce Gama He is the current CEO (Chief Executive Officer) of HSBC Mexico since February 2020. Previously he worked in Banco Santander México appointed as Deputy General Director of Global Banking and Markets and before he was appointed as the CEO of Deutsche Bank México. -

Sort Code 403916 of Hsbc Bank Plc in Ruthin

https://rtn.one/uk/ UK Sort Codes 40-39-16 — Sort Code of Hsbc Bank plc in Ruthin The Hsbc Bank plc located in Ruthin has the following Sort Code: 40-39-16. This is the number for the Ruthin Branch only. You can find the complete details for the Ruthin branch of the Hsbc Bank plc in the below table, including the exact address of the institution, phone number, and more. More info: https://rtn.one/uk/hsbc-bank-plc/403916 Bank Hsbc Bank plc Branch / Location Ruthin SWIFT / BIC Code MIDLGB2152M CHAPS BIC Code MIDLGB22XXX Address St. Peter'S Square, Ruthin, Denbighshire, LL15, 1AB City Ruthin Change Date April 22, 2021 Supported Payment Methods Faster payments Faster Payments can be sent to this sort code. Direct debts Bacs Direct Debits can be set up on this sort code. C&CCC payments Eligible for Cheque & Credit Clearing. CHAPS Payments can be sent to this sort code. BACS Credit payments can be sent to this sort code. 1 / 4 https://rtn.one/uk/ UK Sort Codes How do I find my Sort Code on a Hsbc Bank plc cheque? Disclaimer: In the picture below, which is solely used for illustration purposes, the image is not an actual “Hsbc Bank plc“ document. Like most banking institutions, Hsbc Bank plc lists their Sort Code in two places on their cheques. If you look at the upper right-hand corner of the cheque, you will see a string of three numbers. This is the Sort Code. You can also look at the sequences of numbers at the bottom of the cheque. -

Criminal Background Check Procedures

Shaping the future of international education New Edition Criminal Background Check Procedures CIS in collaboration with other agencies has formed an International Task Force on Child Protection chaired by CIS Executive Director, Jane Larsson, in order to apply our collective resources, expertise, and partnerships to help international school communities address child protection challenges. Member Organisations of the Task Force: • Council of International Schools • Council of British International Schools • Academy of International School Heads • U.S. Department of State, Office of Overseas Schools • Association for the Advancement of International Education • International Schools Services • ECIS CIS is the leader in requiring police background check documentation for Educator and Leadership Candidates as part of the overall effort to ensure effective screening. Please obtain a current police background check from your current country of employment/residence as well as appropriate documentation from any previous country/countries in which you have worked. It is ultimately a school’s responsibility to ensure that they have appropriate police background documentation for their Educators and CIS is committed to supporting them in this endeavour. It is important to demonstrate a willingness and effort to meet the requirement and obtain all of the paperwork that is realistically possible. This document is the result of extensive research into governmental, law enforcement and embassy websites. We have tried to ensure where possible that the information has been obtained from official channels and to provide links to these sources. CIS requests your help in maintaining an accurate and useful resource; if you find any information to be incorrect or out of date, please contact us at: [email protected]. -

Mohammad Maziad Al-Tuwaijri

MOHAMMAD MAZIAD AL-TUWAIJRI Kingdom of Saudi Arabia Riyadh +966504219240 [email protected] Career highlights - Currently, Minister advising the royal court on international and local economic strategic matters. - Former Minister of Economy and Planning responsible of the Economic development agenda of the Kingdom of Saudi Arabia, and the interaction with international organizations and multilateral agencies - Long career in banking with the Saudi British Bank, J.P. Morgan and HSBC, eventually becoming the Group Managing Director, Deputy Chairman and CEO for Middle East, North Africa and Turkey. - Strong advocate of Saudi Vision 2030, worked tirelessly to bring it to life through the support of the Ministry of Economy, as well through the position occupied as a Board member of key organizations, institutions and companies in Saudi Arabia. - Former Saudi Air Force pilot. - Education Master’s degree in Business Administration (MBA) in finance with Honors from King Saud University 1997 B.Sc in Aeronautics, 1986, King Faisal Air Force Academy, Riyadh Experience 2016 - 2020 Minister of Economy and Planning, Saudi Arabia His priorities as a Minister have been to foster the Saudi economy through a comprehensive economic reforms, policies, strategic planning and regulations to achieve the Kingdom’s diversification objectives including removing obstacles to productivity and competitiveness. He has focused on strengthening the integration of SMEs into the local and global economy; encouraging privatization and PPP; and enhancing regional and international cooperation with trading partners and relevant stakeholders based on best standards to promote trade, and leverage on best practices to achieve economic prosperity and sustainability. While focusing on the realization of Saudi Vision 2030 and the National Transformation Program, He was keen to strengthen policy research and analysis that will better position the economy of the Kingdom to support the evolving trade and investment policy environment. -

Standard & Poor's Review of HSBC Bank Bermuda

Research Update: HSBC Bank Bermuda Ltd. Outlook Revised To Stable From Negative On Encouraging Indicators; Ratings Affirmed Primary Credit Analyst: Nikola G Swann, CFA, FRM, Toronto (1) 416-507-2582; [email protected] Secondary Contact: E.Robert Hansen, CFA, New York (1) 212-438-7402; [email protected] Table Of Contents Overview Rating Action Rationale Outlook Related Criteria Ratings List WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 19, 2019 1 Research Update: HSBC Bank Bermuda Ltd. Outlook Revised To Stable From Negative On Encouraging Indicators; Ratings Affirmed Overview • We continue to see encouraging recent economic indicators in Bermuda, the principal jurisdiction of operations for HSBC Bank Bermuda (HBBM), one of two banks that control the vast majority of the local market. • A strategy update by the bank's parent (HSBC Holdings PLC) appears to have concluded without meaningfully reducing HBBM's strategic importance to the group, lowering the likelihood of this downside risk. • We believe the likelihood that future capital payouts to the parent are as high a share of annual net income as the amounts paid in 2016 and certain previous years is also lower. • In light of this, we now view the probability of upside and downside movement in the ratings as approximately balanced. • Therefore, we are revising our outlook on HBBM to stable from negative and affirming our 'A-/A-2' issuer credit ratings on the bank. Rating Action On Feb. 19, 2019, S&P Global Ratings revised its outlook on HSBC Bank Bermuda (HBBM) to stable from negative. At the same time, S&P Global Ratings affirmed its 'A-/A-2' issuer credit ratings on the bank.