Gray Television, Inc. Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PUBLIC NOTICE Federal Communications Commission 445 12Th St., S.W

PUBLIC NOTICE Federal Communications Commission 445 12th St., S.W. News Media Information 202 / 418-0500 Internet: https://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 DA 18-782 Released: July 27, 2018 MEDIA BUREAU ESTABLISHES PLEADING CYCLE FOR APPLICATIONS FILED FOR THE TRANSFER OF CONTROL AND ASSIGNMENT OF BROADCAST TELEVISION LICENSES FROM RAYCOM MEDIA, INC. TO GRAY TELEVISION, INC., INCLUDING TOP-FOUR SHOWINGS IN TWO MARKETS, AND DESIGNATES PROCEEDING AS PERMIT-BUT-DISCLOSE FOR EX PARTE PURPOSES MB Docket No. 18-230 Petition to Deny Date: August 27, 2018 Opposition Date: September 11, 2018 Reply Date: September 21, 2018 On July 27, 2018, the Federal Communications Commission (Commission) accepted for filing applications seeking consent to the assignment of certain broadcast licenses held by subsidiaries of Raycom Media, Inc. (Raycom) to a subsidiary of Gray Television, Inc. (Gray) (jointly, the Applicants), and to the transfer of control of subsidiaries of Raycom holding broadcast licenses to Gray.1 In the proposed transaction, pursuant to an Agreement and Plan of Merger dated June 23, 2018, Gray would acquire Raycom through a merger of East Future Group, Inc., a wholly-owned subsidiary of Gray, into Raycom, with Raycom surviving as a wholly-owned subsidiary of Gray. Immediately following consummation of the merger, some of the Raycom licensee subsidiaries would be merged into Gray Television Licensee, LLC (GTL), with GTL as the surviving entity. The jointly filed applications are listed in the Attachment to this Public -

2010 Television Winners

2010 TELEVISION WINNERS Category Winner Title of Program 2nd Place Title of Program NON-METRO MARKET T-1 Best Public Service Announcement KKTV-TV Brainy Bunch KOAA-TV EPC Health Dept. - Rabies T-2 Best Community Service Project or Campaign KKTV-TV KKTV Toy Drive KKTV-TV 11 For Kids Day T-3 Best Single Public Affairs Program KOAA-TV Pikes Peak Challenge Proposal Video KOAA-TV 2010 MDA Telethon T-4 Best Promotional Campaign For a Station KKTV-TV Holiday Tips KKTV-TV School Closings T-5 Best Single Spot for a Station KKTV-TV Watch What Happens KKTV-TV Storm Headquarters T-6 Best Graphics and/or Animation for a Station KKTV-TV 11 Weather Graphics & Storm HQ KJCT-TV KJCT Graphics by Dylan Hardy T-7 Best Single Program including News Magazine, One-Time or Series KOAA-TV Live at the Balloon Classic KWHS-TV A Passion for Flying T-8 Best Single Sports Program or Play-by-Play, Outside a Newscast KKTV-TV Broncos Season in Review KKTV-TV Friday Night End Zone The Colorado National Monument - Celebrating 100 T-9 Best Documentary Outside of a Regular Newscast KRMJ-TV Years of John Otto's Dream KOAA-TV It Can't Happen To Me T-10 Best Commercial Advertising Spot for an Advertiser KOAA-TV Aspen Pointe - Empowering KXRM-TV ABBA Eye Care - Frames T-11 Best Advertising Sales Promotion for an Advertiser KOAA-TV Mike's Backyard BBQ KOAA-TV Teachers First T-12 Best News Feature KKTV-TV Trojan's Inspiration KOAA-TV Katrina Dog Rescue T-13 Best General, Hard News or In-Depth Coverage KKTV-TV Former Soldier's Honor Questioned KKTV-TV Dog Trainer Scam T-14 Best Breaking News Spot or News Coverage Under Deadline Pressure KOAA-TV Parkdale Wildfire KKTV-TV Wildfire T-15 Best Photo Essay with No Reporter Narrative KOAA-TV Pumpkin Carving KOAA-TV "Little Girl" Rescue T-16 Best Regularly Scheduled Full Newscast KOAA-TV News First 5 at 6pm KKTV-TV KKTV 11 News at 10 p.m. -

GRAY TELEVISION, INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934 Date of Report (Date of earliest event reported): October 16, 2013 (October 15, 2013) GRAY TELEVISION, INC. (Exact name of registrant as specified in its charter) Georgia 1-13796 58-0285030 (State of incorporation (Commission (IRS Employer or organization) File Number) Identification No.) 4370 Peachtree Road, NE, Atlanta, GA 30319 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (404) 504-9828 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 7.01. Regulation FD Disclosure. In connection with various meetings that management of Gray Television, Inc. (the “Company”) expects to hold with investors, the Company has prepared a slide presentation. A copy of the slides to be used in connection with such investor meetings is furnished as Exhibit 99.1 hereto and incorporated herein by this reference. -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees. -

COMPANY,INC. 5Th & Elizabeth BROWNSVILLE, TEXAS

I FAR NORTH AIR MAIL I EDMONTON. Alta.—The first step 1 the Territories Use Brownsville Herald Merchandise Radio Features Mrs. to open Northwest 1 ■ |,J •Today’s Wagner ■ ■—-——— with a of offices has 21 Miscellaneous t string post SUNDAY, SEPTEMBER 4 (Central and Eastern Standard Time) come with the announcement that 65 Houses Classified Ads 54 For Sale Miscel. Vrograms subject to change. Daytime. (Daylight time one hour later.) an air mail service may be opened RESTAURANT FIXTURES and Note—All New Head location for also also ^ programs to key and baslo chain or group* thereof unless spec!* Of to the far north, lncludmg points on good sale; barber to Get Results FURNISHED Apartments; »«<l; coast to coast (e to FIVE FOOT poultry wire; new c) designation includes all available stations. Great Bear Lake. The lake region shop fixtures, Frank Phillips, Sar. four room house; twelve room T/ie three nine roll water (By Associated Pratt) (MORNINO) is populated with miners after ra- Benito. D120 thirty pipe; boarding house; tourist cottages; NBC WEAF East. bought and sold. NETWORK Cent. Church dium pitch-blend. The planes will Classified rates are: galvanized roofing office rooms; restaurant location. • :00— Music*!*—wabc Group Texas. BASIC — East: wear weel wtle 7:00—Morning to on a 30 words or lass, one Insertion. .40c Auction Sales, Harlingen, (key) 7:00— 8:00— The Junior attempt operate regular | Phillips Hardware, San Benito. Wjar wtag wcsh wfl wilt wfbr wrc Bugle E14 wgy 8:00— 9:00—The Madison dally schedule. Oeer 30 words, one Insertion Hilt on wcae wtam wsal; Midwest: Singers JL wwj 8:30— 9:30—Salon Orchestra per word 3c wm aq wcfl ksd woc-who wow wdat (Special to the Herald) Business Services 9:00—10:00—Children's Hour — wabc More than six thousand locations 55 Boats A Accessories FOR RENT—One of nicest i room NORTHWEST A CANADIAN wtmj SAN BENITO. -

NBA Unveils New Website

Volume 43 No 2 | June 2020 In This Issue NBA Unveils New Website New NBA Webiste Unveiled Pinnacle Awards Livestream Date Announced Suicide Prevention Awareness Project Annual Meeting Date Set Chairman's Column Legislative Update Transactions NBA Donates to BFOA Members in the News Board Briefs Rewind Calendar In Remembrance We are excited to announce a complete redesign of the NBA website! The new site is live at our same address: www.ne-ba.org You’ll see a modern look for both desktop and mobile with streamlined menus, clear navigation and updated content. Our goal was to make it more useful for you and to that end, we have upgraded the home page with headlines, consolidated member services content and improved visibility of our job postings. It is best viewed in Firefox or Chrome browsers. If you have any difficulty in seeing the new site, you may need to clear your cache. A simple internet search will provide instructions on clearing cache for your specific browser. Take it for a test drive and let us know what you think. Thank you for your membership and continued support of the NBA! NBA Pinnacle Awards Via Live Stream on August 19 The Pinnacle Awards show will go on! Join us on Wednesday August 19 at 7:30 p.m. CDT for a live stream of our 2020 winners. Related details are tba. Winners’ plaques will be shipped in the following days. The NBA thanks Pinnacle Bank and Nebraska Public Power District for continuing as event cosponsors in this most unusual time. -

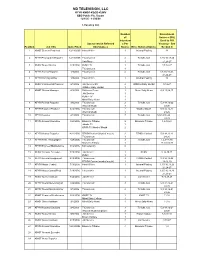

2006 EEO Report KFYR

ND TELEVISION, LLC KFYR-KMOT-KQCD-KUMV EEO Public File Report 12/1/05 - 11/30/06 I. Vacancy List Number Recruitment of Sources (RS) Interview Used to Fill Source which Referred s Per Vacancy - See Position Job Title Date Filled Interviewees Source Hiree Referral Source Section II 1 KMOT Director/Prod Asst 12/19/2005 Hired Within 1 Internal Posting 11 2 KFYR Photograher/Reporter 12/19/2005 TVJobs.Com 2 TVJobs.com 1,3,5-16,18,20 Univ Mary 1 21,24-27 3 KUMV News Director 1/19/2006 KUMV-TV 1 TVJobs.com 3,9-14,27 TVJobs.Com 4 4 KFYR Anchor/Reporter 1/9/2006 TVJobs.Com 4 TVJobs.com 1,5-16,18,20, 21,24-27 5 KFYR Morning Anchor 1/9/2006 Hired Within 1 Internal Posting 13 6 KUMV Commercial Producer 2/1/2006 Job Service ND 2 Williston Daily Herald 9-14,27 Williston Daily Herald 1 7 KMOT Station Manager 4/3/2006 Dickinson Press 1 Minot Daily News 6,9-15,24,27 Job Service 1 KUMV-TV 1 Minot Daily News 1 8 KFYR Political Reporter 3/6/2006 TVJobs.com 2 TVJobs.com 5,9-14,16-22 Word of Mouth 1 24-26 9 KFYR Reporter/Producer 3/14/2006 TVJobs.com 2 Word of Mouth 5,9-14,16-22 Word of Mouth 1 24-26 10 KFYR Reporter 4/1/2006 TVJobs.com 3 TVJobs.com 5,9-14,16-22 24-26 11 KFYR Account Executive 3/24/2006 Bismarck Tribune 9 Bismarck Tribune 1,9-10,28 Jobsite TV 1 KFYR-TV Word of Mouth 2 12 KFYR Medical Reporter 4/21/2006 RTNDAContact(Word of mouth) 2 RTNDA Contact 5,9-14,16-22 TVJobs.com 1 24-26 13 KFYR News Photographer 4/28/2006 TVJobs.com 2 TVJobs.com 1,5,9-14,16 Bismarck Tribune 1 18-22,24-26 14 KFYR Engineer/Maintenance 5/12/2006 Not replacing 0 15 KUMV -

Powernation Tv's Engine Power

FOR IMMEDIATE RELEASE RTM ANNOUNCES POWERNATION TV’S ENGINE POWER TO BUILD UMP MODIFIED DIRT TRACK CAR TO CELEBRATE SUMMIT RACING’S 50TH ANNIVERSARY FRANKLIN, TN, OCTOBER 27, 2017 Summit Racing Equipment will celebrate 50 years in business in Veteran UMP Modified driver Mike Harrison will assist with testing 2018. To celebrate that milestone, PowerNation TV’s Engine Power and tuning before a lucky racer wins the car at auction during the is teaming up to build a Summit Racing 50th Anniversary Tribute DIRTcar Summit Racing Modified Mania at Tri City Speedway in Car—a race car for DIRTcar UMP Modified dirt track competition. September 2018. The proceeds will benefit charity. “PowerNation is proud to be a part of Summit Racing’s 50th Harrison has 491 career feature race wins, six UMP National Modified anniversary by building this car,” RTM President Matthew Hawkins championships, and five Summit Racing Equipment Modified said. “It is a fitting tribute to a company that has supported the Nationals championships to his credit, so he knows his way around motorsports community and the automotive aftermarket industry for a dirt track car. much of the last half-century.” “With all Summit Racing does for UMP Dirt Modified racing, I’m “We’re excited to announce this partnership with our good friends happy to lend a hand on their 50th Anniversary race car,” Harrison at PowerNation TV,” said Nan Gelhard, Summit Racing Advertising said. “Don makes a great chassis and the Engine Power guys know and PR manager. “Summit Racing Equipment customers include how to make horsepower, so I’m looking forward to getting behind grassroots and sportsman racers, and we support them with the wheel and getting the car dialed in.” sponsorships in DIRTcar, IMCA, and USMTS.” Engine Power’s 2018 schedule begins January 21st, 2018. -

The Walking Dead,” Which Starts Its Final We Are Covid-19 Safe-Practice Compliant Season Sunday on AMC

Las Cruces Transportation August 20 - 26, 2021 YOUR RIDE. YOUR WAY. Las Cruces Shuttle – Taxi Charter – Courier Veteran Owned and Operated Since 1985. Jeffrey Dean Morgan Call us to make is among the stars of a reservation today! “The Walking Dead,” which starts its final We are Covid-19 Safe-Practice Compliant season Sunday on AMC. Call us at 800-288-1784 or for more details 2 x 5.5” ad visit www.lascrucesshuttle.com PHARMACY Providing local, full-service pharmacy needs for all types of facilities. • Assisted Living • Hospice • Long-term care • DD Waiver • Skilled Nursing and more Life for ‘The Walking Dead’ is Call us today! 575-288-1412 Ask your provider if they utilize the many benefits of XR Innovations, such as: Blister or multi-dose packaging, OTC’s & FREE Delivery. almost up as Season 11 starts Learn more about what we do at www.rxinnovationslc.net2 x 4” ad 2 Your Bulletin TV & Entertainment pullout section August 20 - 26, 2021 What’s Available NOW On “Movie: We Broke Up” “Movie: The Virtuoso” “Movie: Vacation Friends” “Movie: Four Good Days” From director Jeff Rosenberg (“Hacks,” Anson Mount (“Hell on Wheels”) heads a From director Clay Tarver (“Silicon Glenn Close reunited with her “Albert “Relative Obscurity”) comes this 2021 talented cast in this 2021 actioner that casts Valley”) comes this comedy movie about Nobbs” director Rodrigo Garcia for this comedy about Lori and Doug (Aya Cash, him as a professional assassin who grapples a straight-laced couple who let loose on a 2020 drama that casts her as Deb, a mother “You’re the Worst,” and William Jackson with his conscience and an assortment of week of uninhibited fun and debauchery who must help her addict daughter Molly Harper, “The Good Place”), who break up enemies as he tries to complete his latest after befriending a thrill-seeking couple (Mila Kunis, “Black Swan”) through four days before her sister’s wedding but decide job. -

Cable/Coax Channel Line up 01/20/2020 Installer: ______Effective January 20, 2020 CSR: ______

01/20/2020 Cable/Coax Channel Line Up Installer: _______________ Effective January 20, 2020 CSR: _______________ Economy Package: Expanded Package: 3 ION 3 ION 42 A&E 4 KAIT2 NBC 4 KAIT2 NBC 43 Turner Classic Movies 5 KJNB2 CBS 5 KJNB2 CBS 44 Freeform 6 Local Access 6 Local Access 45 Lifetime 7 TV Guide/POP 7 TV Guide/POP 46 Hallmark 8 KAIT ABC 8 KAIT ABC 47 Bravo 9 Me TV/My Network 9 Me TV/My Network 48 TBS 10 VTN 10 VTN 49 TNT 11 Cozi TV 11 Cozi TV 50 FX 12 The Weather Channel 12 The Weather Channel 51 USA 13 KJNB FOX 13 KJNB FOX 52 Hallmark Movies/Mysteries 14 FoxSports Plus-Cardinals 14 FoxSports Plus-Cardinals 53 SEC Network 15 KTEJ AETN2 Create 15 KTEJ AETN2 Create 54 TV Land 16 Qubo 16 Qubo 55 Nickelodeon 17 ION Plus 17 ION Plus 56 Cartoon Network 18 Grit TV 18 Grit TV 57 Disney 19 KTEJ AETN 19 KTEJ AETN 58 CMT 20 Trinity Broadcasting 20 Trinity Broadcasting 59 Paramount 21 HSN 21 HSN 60 MTV 22 QVC 22 QVC 61 VH-1 23 KJOS CW Plus 23 KJOS CW Plus 62 Outdoor Channel 24 WKNO PBS 24 WKNO PBS 63 History Channel 25 HGTV 25 HGTV 64 TLC 26 GCT 26 GCT 65 Discovery 27 PHS 27 PHS 66 E! TV 96 CSPAN 28 Travel Channel 67 Tru TV 97 KTEJ AETN 3 29 National Geographic 68 SyFy 98 CSPAN 2 30 Animal Planet 69 Comedy Central 31 Fox News 70 Food Network 32 Fox Sports SW 71 FXX 33 ESPN 72 Fox Sports 1 34 ESPN 2 73 BBC America 35 ESPN News 74 Oxygen 36 ESPN Classic 75 NBC Sports Network 37 CNN 76 Family Entertainment TV 38 Headline News 77 Pursuit 39 CNBC 96 CSPAN 40 MSNBC 97 KTEJ AETN 3 41 AMC 98 CSPAN2 99 SEC 2 Economy and Expanded Subscribers: If your TV is Digital Ready, using the TV’s remote, choose MENU and CHANNEL SCAN to receive programming. -

Raycom Media Customer Success Story

RAYCOM MEDIA CUSTOMER SUCCESS STORY “In our industry, the need to have a communications partner act quickly cannot be understated. Converged Networks is one of the most responsive and flexible support partners we work with at Raycom Media.” THOMAS STABLER | Director, IT Infrastructure, Raycom Media CUSTOMER BACKGROUND PROBLEM Headquartered in Montgomery, AL, Raycom Media is one of the No single issue pushed Raycom or any of its stations towards an all- nation’s largest privately-owned media companies. Raycom owns new communications solution. Rather, it was the nature of the industry and/or provides services for 63 television stations and 2 radio – one that tends to have very complex communications needs – stations in 42 markets located in 20 states. There are more than that created an ongoing challenge for their communications platform 4,600 employees in full and part-time positions. and equipment. From a communication system standpoint, one critical issue is First, unlike most businesses today, media companies need a heavy not only deciding on the best combination of technologies, but analog presence, primarily to connect to the reporters who are in the deciding what provider can most expeditiously handle the needs of field. Additionally, media companies have a need for “communication a large number of buildings geographically dispersed throughout system severability,” so that when a station is being sold, the system the county. “TV stations are prone to lightening strikes,“ in place does not create issues that would complicate or delay the stated Thomas Stabler, Raycom’s Director of IT Infrastructure. sale, or create a lot of work for the seller, in “unplugging” everything. -

59864 Federal Register/Vol. 85, No. 185/Wednesday, September 23

59864 Federal Register / Vol. 85, No. 185 / Wednesday, September 23, 2020 / Rules and Regulations FEDERAL COMMUNICATIONS C. Congressional Review Act II. Report and Order COMMISSION 2. The Commission has determined, A. Allocating FTEs 47 CFR Part 1 and the Administrator of the Office of 5. In the FY 2020 NPRM, the Information and Regulatory Affairs, Commission proposed that non-auctions [MD Docket No. 20–105; FCC 20–120; FRS Office of Management and Budget, funded FTEs will be classified as direct 17050] concurs that these rules are non-major only if in one of the four core bureaus, under the Congressional Review Act, 5 i.e., in the Wireline Competition Assessment and Collection of U.S.C. 804(2). The Commission will Bureau, the Wireless Regulatory Fees for Fiscal Year 2020 send a copy of this Report & Order to Telecommunications Bureau, the Media Congress and the Government Bureau, or the International Bureau. The AGENCY: Federal Communications indirect FTEs are from the following Commission. Accountability Office pursuant to 5 U.S.C. 801(a)(1)(A). bureaus and offices: Enforcement ACTION: Final rule. Bureau, Consumer and Governmental 3. In this Report and Order, we adopt Affairs Bureau, Public Safety and SUMMARY: In this document, the a schedule to collect the $339,000,000 Homeland Security Bureau, Chairman Commission revises its Schedule of in congressionally required regulatory and Commissioners’ offices, Office of Regulatory Fees to recover an amount of fees for fiscal year (FY) 2020. The the Managing Director, Office of General $339,000,000 that Congress has required regulatory fees for all payors are due in Counsel, Office of the Inspector General, the Commission to collect for fiscal year September 2020.