Council - 5 March 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

City and County of Swansea Pension Fund

PENSION FUND ANNUAL REPORT & STATEMENT OF ACCOUNTS 2017/2018 ANNUAL REPORT & STATEMENT OF ACCOUNTS 2017/2018 44484-18 ANNUAL REPORT & STATEMENT OF ACCOUNTS 2017/2018 PENSION FUND Page Introduction 2 Three Year Profile of Statistics of the Fund 3 Part A - Administration Report 4 Membership 5 Premature Retirement – Pension Costs 5 Administration 6 Legislative Changes 11 Wales Pension Partnership 13 Local Pension Board - Annual Report 14 Annual Governance Statement 17 Part B - Statement of Responsibilities 51 Independent Auditors Statement 52 Statement of Accounts 2017/18 5535 Notes to the Accounts 5568 Part C - Investment Report 8879 Budget Forecast 8879 Investment Strategy 9088 Investment Fund Management 9088 Valuation of Investments 9189 Distribution of Investments 9902 Investment Returns 9924 Market Commentary 9935 Investment Performance of the Fund 9946 Part D - Actuarial Report 9957 Actuarial Position 9957 Valuation Assumptions 9968 Certificate of the Actuary 10199 Appendices - Investment Strategy Statement 111214 Funding Strategy Statement 112224 Governance Statement 114952 Communications Policy 117377 1 PENSION FUND 1 Introduction The purpose of the Annual Report is to provide information for contributors and other interested parties on the management and administration of the Pension Fund during the year. The report for 2017/18 includes the accounts for the year, an outline of the City & County Council Pension Fund together with details of membership and changes to basic scheme details that have either taken place during the year or are proposed for the future. In addition, the report includes the Actuarial Statement applicable for the year and a report on Investments and Investment performance for the year. The accounts included in the report have been prepared in accordance with the Code of Practice on Local Authority Accounting in the United Kingdom 2017/18 which is based upon International Financial Reporting Standards (IFRS), as amended for the UK public sector. -

A Guide to Local and Welsh Newspapers and Microfilm in Swansea Central Library

A guide to Local and Welsh Newspapers and Microfilm in Swansea Central Library Current Local Newspapers These are located on the first floor of the Central Library. Please ask at the desk for the location. South Wales Evening Post (Daily) (Earlier issues are available in various formats. Please see below for details.) Online Newspaper Databases Swansea Library card holders can access various newspaper databases via our Online Resources webpage. The British Newspaper Archive provides searchable access to 600 digitised regional and national newspaper titles, dating from 1710-1959, taken from the collections of the British Library. It includes the South Wales Daily Post from 1893-1899 and other Welsh titles. You can only access this site from inside a Swansea library. You will also need to register on the site and provide an email address to view images. Our contemporary newspaper database, NewsBank, provides searchable versions of various current British national newspapers and the following Welsh newspapers. The description in brackets shows the areas they cover if unclear. This database does not include a newspaper’s photographs. Period Covered Carmarthen Journal 2007 – Current Daily Post [North Wales] 2009 – Current Glamorgan Gazette [Mid Glamorgan/Bridgend] 2005 – Current Llanelli Star 2007 – Current Merthyr Express 2005 – Current Neath Guardian 2005 – 2009 Port Talbot Guardian 2005 – 2009 South Wales Argus [Newport/Gwent] 2007 – Current South Wales Echo [Cardiff/South Glamorgan] 2001 – Current South Wales Evening Post [Swansea/West -

Dart18europeans

AUGUST 16TH - 22ND rt18euro da peans 2014 .org WELCOME CROESO A big warm welcome to one and all from The Mumbles Yacht Club and we hope you have a fantastic week both on and off the water. Our team has been working tirelessly for months to put this all together and I’m sure that it will be a memorable event for everyone involved. If you need, or are not sure of anything during your stay please don’t be shy - just ask, this whole week is part of all of our hols and is therefore meant to be fun and hassle free. May I just say a big thank you to the City and County of Swansea for their support, without which none of this would be possible, and also to ALL of our sponsors for their contributions enabling us to develop a packed programme both on and off the water. Welcome ashore... From peaceful retreats, to family fun, to energetic Again, Welcome and Enjoy. Visit the largest collection outdoor adventures, we have the best holiday of holiday homes in accomodation to suit your needs, all managed by Mumbles, Gower Gower’s most experienced locally-based agency. Chris Osborne Visit our website or give us a call. One of our Commodore & Swansea Marina dedicated local team will be happy to help. ( Dart 7256 ) OVER mumblesyachtclub.co.uk 2 Tel +44 (0) 1792 360624 | [email protected] | www.homefromhome.com 101 Newton Road, Mumbles, Swansea, SA3 4BN MUMBLES - the club that likes to say YES! special offer It was the Welsh Open Dart 18 Championships 2013. -

Newsletter 16

Number 16 March 2019 Price £6.00 Welcome to the 16th edition of the Welsh Stone Forum May 11th: C12th-C19th stonework of the lower Teifi Newsletter. Many thanks to everyone who contributed to Valley this edition of the Newsletter, to the 2018 field programme, Leader: Tim Palmer and the planning of the 2019 programme. Meet:Meet 11.00am, Llandygwydd. (SN 240 436), off the A484 between Newcastle Emlyn and Cardigan Subscriptions We will examine a variety of local and foreign stones, If you have not paid your subscription for 2019, please not all of which are understood. The first stop will be the forward payment to Andrew Haycock (andrew.haycock@ demolished church (with standing font) at the meeting museumwales.ac.uk). If you are able to do this via a bank point. We will then move to the Friends of Friendless transfer then this is very helpful. Churches church at Manordeifi (SN 229 432), assuming repairs following this winter’s flooding have been Data Protection completed. Lunch will be at St Dogmael’s cafe and Museum (SN 164 459), including a trip to a nearby farm to Last year we asked you to complete a form to update see the substantial collection of medieval stonework from the information that we hold about you. This is so we the mid C20th excavations which have not previously comply with data protection legislation (GDPR, General been on show. The final stop will be the C19th church Data Protection Regulations). If any of your details (e.g. with incorporated medieval doorway at Meline (SN 118 address or e-mail) have changed please contact us so we 387), a new Friends of Friendless Churches listing. -

Ilston Community Council Held at Penmaen and Nicholaston Parish Hall on Wednesday, 28Th February 2018

Community Council Minutes of Meeting held on 28th February 2018 At a meeting of the Ilston Community Council held at Penmaen and Nicholaston Parish Hall on Wednesday, 28th February 2018: Present: Councillors Mr J Howells, Mrs F Owen-John, Mr D Ponting and Mr Roy Church. Mr John Jacobs as advisor to the Clerk. In the Chair: Councillor Mr J Howells 1. Apologies for Absence Apologies for absence were received from Councillors A. Elliott, C Grove, J Kingham, V Jones and J Griffiths. 2. Declarations of Personal Interest An interest in planning application 2017/2632/FUL for 3 ponds at Webbsfield Ilston was declared by Councillor R Church. 3. Minutes. The minutes of the meeting held on 31st January 2018 could not be taken as read as none of the Councillors present were present at the last meeting. 4. Matters Arising. On 4. Welsh Government & AONB. Watching brief be kept. On 5. Welsh Water on Cefn Bryn - No progress to date. Clerk to meet with Cllr J Howells. Cllr D Ponting reported that the work has finished but that the area is still a mess, bits of concrete lying around and wooden shuttering still in place. On 5a. Speeding in Parkmill – Nicola Mathews, PA to Ms Antoniazzi to keep council informed. On 9a. Bus Shelter at Perriswood.- the shelter has been erected and examined by Cllr F Owen-John. It has been found to be inadequate and dangerous. It is open to the prevailing winds. Three vehicles have gone into the ditch where the road is eroded adjacent to the bus shelter. -

Report of the Cabinet Member for Investment, Regeneration and Tourism

Report of the Cabinet Member for Investment, Regeneration and Tourism Cabinet – 18 March 2021 Black Lives Matter Response of Place Review Purpose: To provide an update on the outcomes of the Review previously commissioned as a result of the Black Lives Matter Motion to Council and seek endorsement for the subsequent recommendations. Policy Framework: Creative City Safeguarding people from harm; Street Naming and Numbering Guidance and Procedure. Consultation: Access to Services, Finance, Legal; Regeneration, Cultural Services, Highways; Recommendation: It is recommended that Cabinet:- 1) Notes the findings of the review and authorises the Head of Cultural Services, in consultation and collaboration with the relevant Cabinet Members, to: 1.1 Commission interpretation where the place name is identified as having links to exploitation or the slave trade, via QR or other information tools; 1.2 Direct the further research required of the working group in exploring information and references, including new material as it comes forward, as well as new proposals for inclusion gleaned through collaboration and consultation with the community and their representatives; 1.3 Endorse the positive action of an invitation for responses that reflect all our communities and individuals of all backgrounds and abilities, including black history, lgbtq+ , cultural and ethnic diversity, in future commissions for the city’s arts strategy, events and creative programmes, blue plaque and other cultural activities; 1.4 Compile and continuously refresh the list of names included in Appendix B, in collaboration with community representatives, to be published and updated, as a reference tool for current and future opportunities in destination/ street naming. -

Geographical Indications: Gower Salt Marsh Lamb

SPECIFICATION COUNCIL REGULATION (EC) No 1151/2012 on protected geographical indications and protected designations of origin “Gower Salt Marsh Lamb” EC No: PDO (X) PGI ( ) This summary sets out the main elements of the product specification for information purposes. 1 Responsible department in the Member State Defra SW Area 2nd Floor Seacole Building 2 Marsham Street London SW1P 4DF Tel: 02080261121 Email: [email protected] 2 Group Name: Gower Salt Marsh Lamb Group Address: Weobley Castle, Llanrhidian Gower SA3 1HB Tel.: 01792 390012 e-mail:[email protected] Composition: Producers/processors (6) Other (1) 3 Type of product Class 1.1 Fresh Meat (and offal) 4 Specification 4.1 Name: ‘Gower Salt Marsh Lamb’ 4.2 Description: ‘Gower Salt Marsh Lamb’ is prime lamb that is born reared and slaughtered on the Gower peninsular in South Wales. It is the unique vegetation and environment of the salt marshes on the north Gower coastline, where the lambs graze, which gives the meat its distinctive characteristics. ‘Gower Salt Marsh Lamb’ is a natural seasonal product available from June until the end of December. There is no restriction on which breeds (or x breeds) of sheep can be used to produce ‘Gower Salt Marsh Lamb’. However, the breeds which are the most suitable, are hardy, lighter more agile breeds which thrive well on the salt marsh vegetation. ‘Gower Salt Marsh Lamb’ is aged between 4 to 10 months at time of slaughter. All lambs must spend a minimum of 2 months in total, (and at least 50% of their life) grazing the salt marsh although some lambs will graze the salt marsh for up to 8 months. -

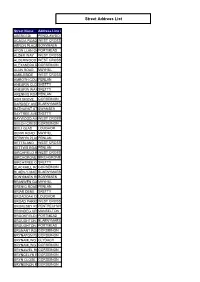

Street Address List

Street Address List Street Name Address Line 2 ABERCEDI PENCLAWDD ACACIA ROAD WEST CROSS AERON PLACEBONYMAEN AFON LLAN GARDENSPORTMEAD ALDER WAY WEST CROSS ALDERWOOD ROADWEST CROSS ALEXANDRA ROADGORSEINON ALUN ROAD MAYHILL AMBLESIDE WEST CROSS AMROTH COURTPENLAN ANEURIN CLOSESKETTY ANEURIN WAYSKETTY ARENNIG ROADPENLAN ASH GROVE GORSEINON BARDSEY AVENUEBLAENYMAES BATHURST STREETSWANSEA BAYTREE AVENUESKETTY BAYWOOD AVENUEWEST CROSS BEECH CRESCENTGORSEINON BEILI GLAS LOUGHOR BERW ROAD MAYHILL BERWYN PLACEPENLAN BETTSLAND WEST CROSS BETTWS ROADPENLAN BIRCHFIELD ROADWEST CROSS BIRCHGROVE ROADBIRCHGROVE BIRCHTREE CLOSESKETTY BLACKHILL ROADGORSEINON BLAEN-Y-MAESBLAENYMAES DRIVE BONYMAEN ROADBONYMAEN BRANWEN GARDENSMAYHILL BRENIG ROAD PENLAN BRIAR DENE SKETTY BROADOAK COURTLOUGHOR BROAD PARKSWEST CROSS BROKESBY ROADPENTRECHWYTH BRONDEG CRESCENTMANSELTON BROOKFIELD PLACEPORTMEAD BROUGHTON AVENUEBLAENYMAES BROUGHTON AVENUEPORTMEAD BRUNANT ROADGORSEINON BRYNAFON ROADGORSEINON BRYNAMLWG CLYDACH BRYNAMLWG ROADGORSEINON BRYNAWEL ROADGORSEINON BRYNCELYN ROADGORSEINON BRYN CLOSE GORSEINON BRYNEINON ROADGORSEINON BRYNEITHIN GOWERTON BRYNEITHIN ROADGORSEINON BRYNFFYNNONGORSEINON ROAD BRYNGOLAU GORSEINON BRYNGWASTADGORSEINON ROAD BRYNHYFRYD ROADGORSEINON BRYNIAGO ROADPONTARDULAIS BRYNLLWCHWRLOUGHOR ROAD BRYNMELIN STREETSWANSEA BRYN RHOSOGLOUGHOR BRYNTEG CLYDACH BRYNTEG ROADGORSEINON BRYNTIRION ROADPONTLLIW BRYN VERNEL LOUGHOR BRYNYMOR THREE CROSSES BUCKINGHAM ROADBONYMAEN BURRY GREENLLANGENNITH BWLCHYGWINFELINDRE BYNG STREET LANDORE CABAN ISAAC ROADPENCLAWDD -

382 the London Gazette, 17 January, 1936

382 THE LONDON GAZETTE, 17 JANUARY, 1936 an interest sufficient for the presentation of a 1894, that the Minister of Agriculture and Memorial, praying that the Order in respect Fisheries has made the following Order:—. of which the Memorial is presented shall not become law without confirmation by Parlia- Order No. 5386. ment. (Dated 15th January, 1936.) Copies of the sealed Orders have been de- FOOT-AND-MOUTH DISEASE (INFECTED posited, together with copies of the Schemes, AREAS) ORDER OF 1936 (No. 5). as amended, and of the maps referred to in the Schemes, at the office of the Clerk of the SUBJECT. Catchment Board, 21, Tower Street, Ipswich, Further contracts the South Wales Foot-and- for public inspection for a period of thirty-one Mouth Disease Infected Area, as from the 21st days from the date of this notice, and may be January, 1936, to the area as described in the inspected during the ordinary office hours. Schedule. (Sgd.) A. T. A. Dobson, Principal Assistant Secretary. Ministry of Agriculture and Fisheries, SCHEDULE. 10, Whitehall Place, Contracted Infected Area. London, S.W.I. 16th January, 1936. An Area comprising:— In the county of Glamorgan. The county borough of Swansea. The borough of Neath. The petty session divisions of Pontardawe MINISTRY OF AGRICULTURE AND and Neath (except the parishes of Dylais FISHERIES. Higher, Neath Higher, Blaengwrach, Resolven and Glyne). LAND DRAINAGE ACT, 1930. The parishes of Mawr, Llangyfelach, Gower- River Ouse (Yorks.) Catchment Board. ton, Llanrhidian Higher, so much of the Dalton Award. -

Llanrhidian Higher Community Council Minutes of the Finance

Llanrhidian Higher Community Council Minutes of the Finance & Property Sub-Committee Meeting Held Remotely on Zoom on Monday, 8th March 2021 at 6.00 p.m. Present: Councillor P Tucker (Chair) presided Councillors: N Doyle, S Phillips and T Snell Also Present: Councillor A Lewis-Pudduck (Minute No.90 only) Officers: J Parkhouse – Clerk to the Community Council 87. Apologies for Absence Apologies for absence were received from Councillors L Davies and M Roberts. 88. Disclosures of Personal and Prejudicial Interests In accordance with the Code of Conduct adopted by Llanrhidian Higher Community Council, no interests were declared. 89. Minutes Resolved that the Minutes of the Finance and Property Sub-Committee meeting held on 2nd November 2020 be signed and approved as a correct record. 90. Hanging Baskets Update Further to discussions that took place at the Community Council meeting held on 18th February 2021, the Clerk provided Councillors with an update he had received from Swansea Council. The Sub-Committee discussed the options available for the location of two 3 tier planters in Crofty, Llanmorlais and some additional off the main road sites. Resolved that: - 1) The Clerk orders two 3-tier planters from Swansea Council to be placed in front of Crofty Nursery, Pencaerfenni Lane and on New Road, at the entrance to Pencaerfenni Lane, Crofty; 2) The Clerk works with Councillor Mark Thomas to identify possible additional locations for flowers off the main road in the Penclawdd and Llanmorlais Wards. 91. Future Projects The Sub-Committee discussed various options available for future projects and highlighted the need to have site visits to all the Council’s sites, particularly both playgrounds. -

Swansea Sustainability Trail a Trail of Community Projects That Demonstrate Different Aspects of Sustainability in Practical, Interesting and Inspiring Ways

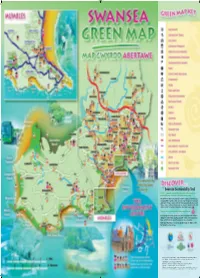

Swansea Sustainability Trail A Trail of community projects that demonstrate different aspects of sustainability in practical, interesting and inspiring ways. The On The Trail Guide contains details of all the locations on the Trail, but is also packed full of useful, realistic and easy steps to help you become more sustainable. Pick up a copy or download it from www.sustainableswansea.net There is also a curriculum based guide for schools to show how visits and activities on the Trail can be an invaluable educational resource. Trail sites are shown on the Green Map using this icon: Special group visits can be organised and supported by Sustainable Swansea staff, and for a limited time, funding is available to help cover transport costs. Please call 01792 480200 or visit the website for more information. Watch out for Trail Blazers; fun and educational activities for children, on the Trail during the school holidays. Reproduced from the Ordnance Survey Digital Map with the permission of the Controller of H.M.S.O. Crown Copyright - City & County of Swansea • Dinas a Sir Abertawe - Licence No. 100023509. 16855-07 CG Designed at Designprint 01792 544200 To receive this information in an alternative format, please contact 01792 480200 Green Map Icons © Modern World Design 1996-2005. All rights reserved. Disclaimer Swansea Environmental Forum makes makes no warranties, expressed or implied, regarding errors or omissions and assumes no legal liability or responsibility related to the use of the information on this map. Energy 21 The Pines Country Club - Treboeth 22 Tir John Civic Amenity Site - St. Thomas 1 Energy Efficiency Advice Centre -13 Craddock Street, Swansea. -

South Wales Railway. NOTICE Is Hereby Given, That Application Is

4005 South Wales Railway. sannor, Llanharry, Llanharrcn, Llanilitf, church otherwise Eglwys Llangrallo, Coychurch OTICE is hereby given, that application is higher, Coychurch lower, Pencoed, Peterston N intended to be made to Parliament in the super Montein otherwise Capel Llanbad, Llandy- ensuing session, for an Act or Acts to authorize fodwg otherwise Eglwys Glynn Ogwr, Saint the construction and maintenance of a railway or Mary Hill, Llangard, Treose, Penlline otherwise railways, with all proper approaches and con- Penlywynd, Colwinstone, Ewenny, Saint Brides veniences, and with such piers, basins, break- major, Saint Brides Lampha, Soutfcerndown, waters, landing plaeeBj and other works, as may Coyty, Coyty higher, Coyty lower, Saint Brides be necessary in connection therewith, commencing minor otherwise Llansaintfred, Ynisawdre, Llan- by a junction with the Cheltenham and Great gonoyd otherwise Llangynwd, Llangonoyd higher, "Western Union Railway, at or near the point Llangonoyd lower otherwise Boyder, Llangonoyd where the said railway crosses the turnpike road Middle, Cwmdu, Lalestone, Lalestone higher, from Gloucester to Stroud, at Standish, in the Lalestone lower, Trenewydd otherwise Newcastle, county of Gloucester, and terminating on the Newcastle higher, Newcastle lower, Oldcastle, north-western shore of the bay or harbour of Fish- Bridgend, Merthyr Mawr,. Tythegston, Tythegston guard, and near to a point there known by the higher, Tythegston lower, Newton Nottage, Pyle, name of Goodwic-pier, in the county of Pem- Sker, Kenfig otherwise Mawdland, Margam, broke; which said intended railway or railways, Hafod-y-poth, Brombill, Trissant, Kenfig, Abe- and other works connected therewith, will pass rafon, Michaelstone super Afon, Michaelstone from, in, through, or into, or be situate within the super Afon higher, Michaelstone super Afoii several parishes, townships, and extra-parochial lower, Baglan, Baglan higher, Baglan lower, or other places following, or some of them (that Britton Ferry, Glyn Corwg Blaengwrach, Neath, is to say), Standishs Oxlinch.