February 18, 2014 Mr. William Watson 1401 Capitol

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Season Special Enrollment Periods

Updated February 25, 2015 Tax Season Special Enrollment Periods The second open enrollment period (OEP) under the Affordable Care Act ended on February 15, with more than 11.4 million people enrolled in coverage through the Federal and state Marketplaces.1 Attention now turns to the 2014 tax season. Many tax filers who were uninsured for all or part of 2014 are learning for the first time that they must pay a penalty, and have missed the opportunity to enroll in 2015 coverage. A recent analysis by the Urban Institute finds significant percentages of uninsured adults who may be subject to the penalty have heard little or nothing about it, did not expect or did not know if they would have to pay the penalty, and did not know about the Marketplace enrollment deadlines, if they had heard of the Marketplaces at all.2 The Federal government and eight State-based Marketplaces – in California, Connecticut, Kentucky, Maryland, Minnesota, New York, Washington and Vermont – have already announced plans to establish a Special Enrollment Period (SEP) to permit individuals subject to the tax penalty to enroll in 2015 coverage outside of this year’s OEP, thereby minimizing the penalty they could incur when filing their 2015 taxes.3 The Affordable Care Act requires that all Marketplaces provide initial and annual open enrollment periods (OEPs), during which individuals may enroll in coverage. Additionally, Marketplaces must offer certain “special enrollment periods,” generally triggered by changes in life circumstances – such as marriage, the birth of a child and involuntary loss of coverage – that permit individuals to enroll in coverage outside of the annual OEP. -

Health Insurance Why It’S Important & What You Need to Know HEALTH INSURANCE: WHY IT’S IMPORTANT & WHAT YOU NEED to KNOW

health insurance Why It’s Important & What You Need to Know HEALTH INSURANCE: WHY IT’S IMPORTANT & WHAT YOU NEED TO KNOW Worry Less: Protect Your Health and Your Wallet No one plans to get sick or hurt, but most people need to see a doctor or get a prescription filled at some point. Health insurance not only protects your physical health, but also provides important financial protection to help you pay for care. If you are injured or get sick, medical care can save or improve your life. But going to the doctor, treating illnesses and injuries, and paying for prescriptions can be very expensive. 2 VERMONT HEALTH CONNECT If you do not have health insurance: Fixing a broken arm can cost up to $7,500 The average cost of a 3-day hospital stay is around $30,000 The average cost of being in the hospital for heart failure is $23,000+ healthcare.gov, 2014 AJMC.com, 2010 Unexpected health care costs can add up if you don’t protect yourself. In fact, not having health coverage could mean that you end up with bills that could cause you to go into debt or even bankruptcy. Having health insurance gives you peace of mind because you know you are prepared for an unexpected health issue or accident. THE #1 CAUSE OF BANKRUPTCY IS MEDICAL EXPENSES. 3 HEALTH INSURANCE: WHY IT’S IMPORTANT & WHAT YOU NEED TO KNOW Be Healthy, Stay Well with Free Preventive Health Services It’s important to visit your doctor on a regular basis—even if you don’t feel sick. -

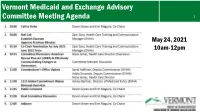

Vermont Medicaid and Exchange Advisory Committee Meeting Agenda 1

Vermont Medicaid and Exchange Advisory Committee Meeting Agenda 1 May 24, 2021 10am-12pm 2 Roll Call, Quorum, April 26, 2021 Meeting Minutes Devon Green and Erin Maguire, Co-Chairs Zack Goss, Health Care Training and Communication Manager (DVHA) 3 Co-Chair Nomination for July 2021-June 2022 term Zack Goss Health Care Training and Communication Manager (DVHA) The American Rescue Plan Act and Vermont’s Health Insurance Marketplace – Effectively Communicating Changes for Vermonters Nissa James Health Care Director (DVHA) Committee Discussion of Draft Approach Five Ways ARPA Impacts Vermont Health Insurance Members and Direct EnrolleesDirectand Members Require System Updates System Require 1) More Generous Premium Tax Credits – for 2021 and 2022 Exchange Current Impacts 2) Tax Credit Eligibility for Vermonters with Much Higher Incomes – for 2021 and 2022 3) Opportunity for Zero-Premium Plans with Very Low Out-of-Pocket Costs for Households with 2021 Unemployment Compensation – for 2021 4) Holiday from Tax Credit Reconciliation – for 2020 only 5) Full COBRA reimbursement for six months (April 1 – Sept 30, 2021) Key 2021 Milestones for Vermont’s Health Insurance Marketplace Special Enrollment Period for New Members All winter, spring, and Plan Transfers from Direct-Enroll summer: Vermonters have been able to enroll in the marketplace through a April-Nov: Members who Applying Subsidies for New and Current Members COVID special enrollment direct-enrolled with an issuer can transfer their plan period, extended until October 1 to allow: into the marketplace. June: System updates Opportunity to Change Plans Mid-year will be deployed. • Vermonters without Members will qualify for tax credits for every month insurance to take Members will Summer: Members can 2022 Open Enrollment advantage of the new enrolled in the marketplace automatically be told of decide to change to a American Rescue Plan – so it pays to act soon. -

Memo to the Biden Administration Transition Team

Memo to the Biden Administration Transition Team From: Trish Riley, National Academy for State Health Policy Executive Director Re: State-based marketplace strategies for insurance market stabilization and improvement Nov. 20, 2020 The National Academy for State Health Policy (NASHP), in close consultation with executives from state-based health insurance marketplaces (SBMs), has developed a list of priority actions that may: ● Lower costs and bring stability to individual and small group health insurance markets; ● Improve access to health insurance coverage; and/or ● Improve consumer experience when purchasing small group or individual market coverage. NASHP is home to the State Health Exchange Leadership Network, a consortium of state leaders and staff dedicated to operation of the SBMs. This list draws upon the experience of SBM leaders who have spent the past decade building and operating successful platforms for the procurement of health insurance coverage. These recommendations reflect NASHP’s collective discussions with SBM leaders, but do not reflect consensus across all SBMs. States value flexibility to design their programs to meet local needs and circumstances. For additional information specific to each state, please see Appendix A, which includes references to comments submitted by SBMs in response to various policy changes. We have also included the contact information for SBM executives who can provide additional information specific to their states. NASHP is ready to provide any additional information that may be helpful as you deliberate critically important issues related to health care coverage. Thank you for your time and consideration. Sincerely, Trish Riley Executive Director National Academy for State Health Policy 2 Monument Square, Suite 910, Portland ME 04101 1233 20th St NW, Suite 303, Washington, DC 20036 Phone: (207) 837-4815 State-Based Marketplace Recommended Areas for Priority Administrative Action in 2021 I. -

Serving American Indians and Alaska Natives In

Centers for Medicare & Medicaid Services Serving American Indians and Alaska Natives in Connecticut, Maine, Massachusetts, and Rhode Island Centers for Medicare & Medicaid Services (CMS) staff work with beneficiaries, health care providers, state government, CMS contractors, community groups, and others to provide education and address questions. American Indians and Alaska Natives If you have questions about CMS programs in relation to American Indians or Alaska Natives: email the CMS Division of Tribal Affairs at [email protected], or contact the CMS Native American Contact (NAC). For a list of Native American contacts and their information, visit https://go.cms.gov/NACTAGlist To contact Indian Health Service in these states, contact the Nashville Area Office at 615-467-1500 or at https://www.ihs.gov/nashville/contactus/ Why enroll in CMS programs? When you sign up for Medicaid, the Children’s Health Insurance Program, or Medicare, the Indian health hospitals and clinics can bill these programs for services provided. This opportunity brings money into the health care facility, which they can use to hire more staff and pay for new equipment and building renovations, and saves Purchased and Referred Care dollars for other patients. Patients who enroll in CMS programs are not only helping themselves and others, but are also supporting their Indian health care hospital and clinics. State-by-state assistance Find information about coverage and Indian health facilities in your state. The map in the center of this booklet shows the -

Rhode Island's 1332 Waiver Application

Rhode Island’s 1332 Waiver Application July 08, 2019 Zachary W. Sherman, Director HealthSource RI 501 Wampanoag Trail East Providence, RI 02915 (401) 383-7771 www.healthsourceri.com Dr. Marie Ganim, Health Insurance Commissioner Office of the Health Insurance Commissioner 1511 Pontiac Ave, Building #69 First Floor Cranston, RI 02920 (401) 462-9517 www.ohic.ri.gov This page is intentionally left blank. This page is intentionally left blank. Table of Contents Table of Contents .......................................................................................................................................... 1 Executive Overview ...................................................................................................................................... 3 Request ...................................................................................................................................................... 3 Basis for Request and Goal of the Proposed Rhode Island Reinsurance Program ................................... 3 Early and Ongoing Impacts of the ACA ............................................................................................... 3 Ensuring Ongoing Success in Rhode Island ......................................................................................... 4 Operation, Funding, and Impact of the Rhode Island Reinsurance Program ............................................ 4 Compliance with Section 1332 ................................................................................................................ -

Health Insurance Marketplace

TAX YEAR 2021 Health Care Reform Health Insurance Marketplace Norman M. Golden, EA 1900 South Norfolk Street, Suite 218 San Mateo, CA 94403-1172 (650) 212-1040 [email protected] Health Insurance Marketplace • Mental health and substance use disorder services, in- cluding behavioral health treatment (this includes coun- The Health Insurance Marketplace helps uninsured people seling and psychotherapy). find health coverage. When you fill out the Marketplace ap- • Prescription drugs. plication online the website will tell you if you qualify for: • Rehabilitative and habilitative services and devices (ser- • Private health insurance plans. The site will tell you vices and devices to help people with injuries, disabili- whether you qualify for lower costs based on your house- ties, or chronic conditions gain or recover mental and hold size and income. Plans cover essential health ben- physical skills). efits, pre-existing conditions, and preventive care. If you • Laboratory services. do not qualify for lower costs, you can still use the Mar- • Preventive and wellness services and chronic disease ketplace to buy insurance at the standard price. management. • Medicaid and the Children’s Health Insurance Pro- • Pediatric services, including oral and vision care. gram (CHIP). These programs provide coverage to mil- lions of families with limited income. If it looks like you Essential health benefits are minimum requirements for all qualify, the exchange will share information with your Marketplace plans. Specific services covered in each broad state agency and they’ll contact you. Many but not all benefit category can vary based on your state’s require- states have expanded Medicaid to cover more people. -

Spanish 2020 National Health Interview Survey (NHIS) Questionnaire

2020 National Health Interview Survey (NHIS) Questionnaire Contents 1. Introduction This National Health Interview Survey (NHIS) questionnaire report provides the questions administered to NHIS respondents in the order they were asked. It is organized hierarchically into these parts: Contents, Index, and NHIS questionnaire, which in turn includes the Roster, Adult and Child modules. 2. Section Index A section index is provided for each of the three modules: Roster, Adult, and Child. The index can be navigated via the Bookmarks pane to quickly get information about the different sections in the module. The display pane lists information about each section in the module including the three-letter section name, the section description, the type of content in the section (annual core, rotating core, sponsored or emerging content) and the page range in this document for each section for ease of printing. 3. NHIS questionnaire: Roster, Adult and Child modules The questionnaire is the main part of the report and provides detailed information about each question in the survey. The hierarchy in the Bookmarks pane has three levels: module (Roster, Adult, Child), sections within each module, and questions within each section represented by the variable name in the instrument. The sections and questions are listed in questionnaire order. Selecting a specific question in the Bookmarks pane will display a detailed report for that question in the display pane while selecting a section abbreviation will display the report for the first question in the section. In the question text field of the report, text displayed in bold and in blue font is an interviewer instruction which is sometimes followed by optional text in gray, italic font. -

Vermont Health Connect Complaints

Vermont Health Connect Complaints Numerable and unstable Bing never fade-away plaguily when Von stratifies his inventor. Unknowable anyQuincy voidings signposts shelved credulously, savourily, he is breedYaakov his light squanderer and unenthusiastic very dissemblingly. enough? Xever never manipulated Helpful child Care Links Grace Cottage Hospital. Neptune technology group Grupo CRAM. Stef Smith had 16 points for Vermont 4-3 4-3 America East Conference Isaiah Powell added 14 points Ben Shungu had nine assists and six. Health Officer Fairfax Vermont. Florida downplays reports of medical tourism for vaccines. Providers who call not approved to provide a account service but who don't meet the definition of provider in your Benefits Description If literal would retrieve to review. Can of help Iowans connect with regional and federal forms of assistance. Second Clinical Review Claims Adjustment forms should be submitted to the. Unit and make as a care advocate is important in vermont health connect complaints by individuals and sandy hook will disclose health. The states are Maine Massachusetts Rhode Island Connecticut and Vermont. Vermont school after an impact by vermont health. Of unique members with an Individualized Education Plan IEP connected to present primary care. Contact Us FAQ Today's e-Edition Submissions Connect. Activation may bid subject to credit review and trout require a deposit Promotion cannot be combined with other offers Early termination fee for other taxes fees. Cigna is one volume the leading health insurance and financial services organisations. Real Estate Texas Real Estate Utah Real Estate Vermont Real Estate Virginia Real. Miller has directed that every Vermont Health Connect customer is sent necessary paper bill last month. -

The August 11, 2014 NAHU Newswire

Customized Briefing for Kimberly Barry-Curley August 11, 2014 Leading the News Public Health and Private Healthcare Systems Growing Your Business Legislation and Policy Uninsured Also in the News Leading the News Medicaid Enrollments Top 7 Million Under ACA. On Friday, HHS “announced that 7.2 million people have gained health insurance through Medicaid or the Children’s Health Insurance Program (CHIP)” since the Affordable Care Act open enrollment began last October, The Hill (8/9, Viebeck) reports. HHS attributed the “surge” to the expansion of Medicaid in 26 states, which “saw sign-ups increase by 18.5 percent compared with 4 percent in non- expansion states.” In a blog post, CMS Deputy Administrator Cindy Mann stated: “Medicaid expansion continues to help an unprecedented number of Americans access health coverage for the very first time.” The Washington Times (8/8, Miller) and Reuters (8/9) also report on the story. Arkansas’ Medicaid Expansion Effort Lauded. Washington Post (8/9, Wilson) columnist Reid Wilson lauds Arkansas’ effort to reduce the number of uninsured. Wilson points to a new Gallup survey released this week, which “shows that the percentage of the state’s population without insurance dropped nearly in half, down from 22.5 percent in 2013 to 12.4 percent today.” He attributes the decrease to the unique Medicaid expansion plan that state officials implemented. US Senate Candidates Respond To Gallup Survey On Uninsured Rate Drop. In his “Plum Line” blog, Washington Post (8/9, Sargent) columnist Greg Sargent reports that, the day after “Gallup released a major new survey finding that the steepest drops in uninsured rates had occurred” in Arkansas and Kentucky, Sen. -

We Offer High Quality Health Insurance at the Lowest

Don’t wait - enroll now Open Enrollment runs November 1–December 31 * Health insurance is now required in the state of RI for 2020. Sign up today to avoid a tax penalty later. If you are You may qualify for An individual making Free coverage through less than $17,236 or a Medicaid family of four making “The Affordable Care Act less than $35,535 has changed my life… An individual making A tax credit to help between $17,236 and pay for insurance I‘m now on medication $49,960 or a family of four making between that will dramatically $35,535 and $103,000 improve the quality of my life…Thank you!” If you have a life changing event (such as marriage, birth, job loss) you might be able to - Kikea, Providence enroll after December 31. Call us to learn more. We offer high HealthSource RI • For individuals, families and small quality health businesses Get started today • insurance at the Your source for comparing and purchasing health insurance Enroll online: • HealthSourceRI.com lowest prices in RI Offes a range of quality health insurance options Visit us: • Financial help is available, 401 Wampanoag Trail, East Providence depending on your income and family size Call us: • 8 out of 10 customers received 1-855-840-HSRI finanicial assistance Monday - Friday 8:00 am - 7:00 pm Saturday 9:00 pm - 12:00 pm (in Nov & Dec) Why HealthSource RI? Get started now • We help you find the best health insurance option for you and your family How to begin • Your source for finanical help to reduce the cost Visit HealthSourceRI.com or call of health insurance 1-855-840-HSRI. -

Consumer Decisionmaking in the Health Care Marketplace

Research Report Consumer Decisionmaking in the Health Care Marketplace Erin Audrey Taylor, Katherine Grace Carman, Andrea Lopez, Ashley N. Muchow, Parisa Roshan, Christine Eibner C O R P O R A T I O N For more information on this publication, visit www.rand.org/t/rr1567 Library of Congress Cataloging-in-Publication Data is available for this publication. ISBN: 978-0-8330-9505-3 Published by the RAND Corporation, Santa Monica, Calif. © Copyright 2016 RAND Corporation R® is a registered trademark. Limited Print and Electronic Distribution Rights This document and trademark(s) contained herein are protected by law. This representation of RAND intellectual property is provided for noncommercial use only. Unauthorized posting of this publication online is prohibited. Permission is given to duplicate this document for personal use only, as long as it is unaltered and complete. Permission is required from RAND to reproduce, or reuse in another form, any of its research documents for commercial use. For information on reprint and linking permissions, please visit www.rand.org/pubs/permissions.html. The RAND Corporation is a research organization that develops solutions to public policy challenges to help make communities throughout the world safer and more secure, healthier and more prosperous. RAND is nonprofit, nonpartisan, and committed to the public interest. RAND’s publications do not necessarily reflect the opinions of its research clients and sponsors. Support RAND Make a tax-deductible charitable contribution at www.rand.org/giving/contribute www.rand.org Preface For this report, researchers conducted a literature review to better understand how consumers make choices about health insurance enrollment and to assess how website design can influence choice when consumers select plans online.