Hold Separate Stipulation and Order : U.S. V. Nexstar Broadcasting Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Graham Holdings Company 2014 Annual Report

GRAHAM HOLDINGS 2014 ANNUAL REPORT REVENUE BY PRINCIPAL OPERATIONS n EDUCATION 61% n CABLE 23% n TELEVISION BROADCASTING 10% n OTHER BUSINESSES 6% FINANCIAL HIGHLIGHTS (in thousands, except per share amounts) 2014 2013 Change Operating revenues $ 3,535,166 $ 3,407,911 4% Income from operations $ 407,932 $ 319,169 28% Net income attributable to common shares $ 1,292,996 $ 236,010 — Diluted earnings per common share from continuing operations $ 138.88 $ 23.36 — Diluted earnings per common share $ 195.03 $ 32.05 — Dividends per common share $ 10.20 $ — — Common stockholders’ equity per share $ 541.54 $ 446.73 21% Diluted average number of common shares outstanding 6,559 7,333 –11% INCOME FROM NET INCOME ATTRIBUTABLE OPERATING REVENUES OPERATIONS TO COMMON SHARES ($ in millions) ($ in millions) ($ in millions) 3,861 582 1,293 3,453 3,535 3,373 3,408 408 314 319 149 277 236 116 131 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 RETURN ON DILUTED EARNINGS PER AVERAGE COMMON COMMON SHARE FROM DILUTED EARNINGS STOCKHOLDERS’ EQUITY* CONTINUING OPERATIONS PER COMMON SHARE ($) ($) 46.6% 138.88 195.03 38.16 9.8% 9.0% 23.36 31.04 32.05 5.2% 17.32 4.4% 14.70 17.39 6.40 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 * Computed on a comparable basis, excluding the impact of the adjustment for pensions and other postretirement plans on average common stockholders’ equity. 2014 ANNUAL REPORT 1 To OUR SHAREHOLDERS Quite a lot happened in 2014. -

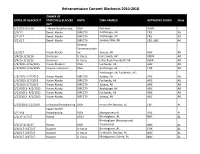

Retrans Blackouts 2010-2018

Retransmission Consent Blackouts 2010-2018 OWNER OF DATES OF BLACKOUT STATION(S) BLACKED MVPD DMA NAME(S) NETWORKS DOWN State OUT 6/12/16-9/5/16 Tribune Broadcasting DISH National WGN - 2/3/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV Juneau-Stika, AK CBS, NBC AK General CoMMunication 12/5/17 Vision Alaska Inc. Juneau, AK ABC AK 3/4/16-3/10/16 Univision U-Verse Fort SMitH, AK KXUN AK 3/4/16-3/10/16 Univision U-Verse Little Rock-Pine Bluff, AK KLRA AK 1/2/2015-1/16/2015 Vision Alaska II DISH Fairbanks, AK ABC AK 1/2/2015-1/16/2015 Coastal Television DISH AncHorage, AK FOX AK AncHorage, AK; Fairbanks, AK; 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV AncHorage, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/23/2018-2/2/2018 Lockwood Broadcasting DISH Huntsville-Decatur, AL CW AL SagaMoreHill 5/22/18 Broadcasting DISH MontgoMery AL ABC AL 1/1/17-1/7/17 Hearst AT&T BirMingHaM, AL NBC AL BirMingHaM (Anniston and 3/3/17-4/26/17 Hearst DISH Tuscaloosa) NBC AL 3/16/17-3/27/17 RaycoM U-Verse BirMingHaM, AL FOX AL 3/16/17-3/27/17 RaycoM U-Verse Huntsville-Decatur, AL NBC AL 3/16/17-3/27/17 RaycoM U-Verse MontgoMery-SelMa, AL NBC AL Retransmission Consent Blackouts 2010-2018 6/12/16-9/5/16 Tribune Broadcasting DISH -

Cablefax Dailytm Tuesday — May 7, 2019 What the Industry Reads First Volume 30 / No

www.cablefaxdaily.com, Published by Access Intelligence, LLC, Tel: 301-354-2101 Cablefax DailyTM Tuesday — May 7, 2019 What the Industry Reads First Volume 30 / No. 087 Retrans Watch: Nexstar Sues DirecTV Over Fees for Unlaunched Station When Nexstar came forward with its plan to buy Tribune, there were objections from some distributors that claim the broadcaster is a bad actor when it comes to retransmission consent negotiations. But this time around, Nexstar is pointing the finger at the other side of the negotiating table. It has suedDirecTV in a NY federal court, claiming breach of contract. At issue is an “unlaunched station fee” that it says DirecTV agreed to pay for not being required to immediately launch Nexstar station WHAG (aka WDVM). The Hagerstown, MD, station lost its affiliation with NBC on July 1, 2016. “DirecTV now erroneously claims that its obligation to pay the unlaunched station fee depends on the station retaining its network affiliation. Nothing in the contract supports DirecTV’s wishful thinking,” Nexstar told the court. “Indeed, the contract plainly places the risk on DirecTV that the station might lose its network affiliation during the contract’s term.” Reached for comment, an AT&T spokesperson said, “While we hope to resolve this with Nexstar, we dispute their claims and plan to respond.” WHAG made retrans waves earlier this year, with Antietam Broadband losing it on Jan 1 (it remains off the provider’s lineup). DISH and Verizon Fios carry the channel, which offers local news for the area. Comcast carries the station in-market, but stopped carrying it out-of-market in March. -

Nexstar Media Group to Host First Televised Debate in Race for Mississippi Governor

NEXSTAR MEDIA GROUP TO HOST FIRST TELEVISED DEBATE IN RACE FOR MISSISSIPPI GOVERNOR Nexstar Stations Partner with Select Broadcasters to Bring Live General Election Debate Coverage to Local Voters Across Mississippi Jackson, MS and IRVING, Texas (Oct 7, 2019) – Nexstar Media Group, Inc. (Nasdaq: NXST) (the “Company”) announced today that it will host the first live televised statewide debate in the race for Mississippi Governor between Lt. Governor Tate Reeves (R) and Attorney General Jim Hood (D) on Thursday, October 10 at 7 p.m. The Mississippi Governor’s Debate will last one hour. The debate will air on five Nexstar Broadcasting, Inc., stations across the state, including WJTV-TV (CBS), WHLT-TV (CBS), KZUP-CD (Ind), WREG-TV (CBS), and WFNA-TV (CW), in addition to select television broadcast partners including WMDN-TV (CBS) and WTVA-TV (ABC), and WXXV-TV (NBC), and radio partners SuperTalk, Mississippi Public Broadcasting, and Jackson State University. Local viewers may also access a live-stream of the debate online by visiting their local Nexstar station’s website (see table below for more information). The Mississippi Governor’s Debate is scheduled to take place on the campus of The University of Southern Mississippi at the Joe Paul Theater in Thad Cochran Center, 121 West Memorial Drive, in Hattiesburg. The debate will be moderated by Byron Brown, anchorman and political reporter for WJTV-TV, and Greg Hurst, anchorman. All questions to the candidates will be focused on topical local and regional issues impacting communities across Mississippi, including education, health care, infrastructure and the economy, as well as candidate- specific subjects. -

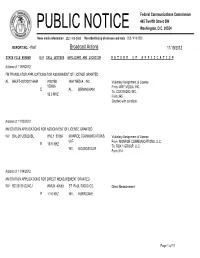

Broadcast Actions 11/19/2012

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 47867 Broadcast Actions 11/19/2012 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 11/09/2012 FM TRANSLATOR APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED AL BALFT-20120911AAM W222BK WAY MEDIA , INC. Voluntary Assignment of License 150836 From: WAY MEDIA, INC. E AL , BIRMINGHAM To: COX RADIO, INC. 92.3 MHZ Form 345 Granted with condition. Actions of: 11/13/2012 AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED WV BAL-20120822ABL WVLY 53369 MONROE COMMUNICATIONS, Voluntary Assignment of License LLC From: MONROE COMMUNICATIONS, LLC E 1370 KHZ To: RCK 1 GROUP, LLC WV , MOUNDSVILLE Form 314 Actions of: 11/14/2012 AM STATION APPLICATIONS FOR DIRECT MEASUREMENT GRANTED WV BZ-20121022ACJ WMUX 42653 ST. PAUL RADIO CO. Direct Measurement P 1110 KHZ WV , HURRICANE Page 1 of 11 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 47867 Broadcast Actions 11/19/2012 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 11/14/2012 CLASS A TV APPLICATIONS FOR LICENSE TO COVER GRANTED VA BLTVA-20010712ACY WKIN-LP 27503 HOLSTON VALLEY Application to convert: BLTTV-19830502IJ to BROADCASTING CORPORATION Class A station status. -

Ex Parte Notice: GN Docket No

Via ECFS July 3, 2017 Ms. Marlene H. Dortch Secretary Federal Communications Commission 445 12th Street, S.W. Washington, D.C. 20554 Re: Ex Parte Notice: GN Docket No. 16-142, Authorizing Permissive Use of the “Next Generation” Broadcast Television Standard Dear Ms. Dortch: On June 29, 2017, the undersigned along with Rebecca Hanson – Sr. Vice President for Strategy and Policy for Sinclair Broadcast Group, Mark Aitken – Vice President for New Technology, Sinclair Broadcast Group and John Hane – outside counsel with Pillsbury Winthrop Shaw Pittman met with members of the Commission staff to discuss the issues raised in the above- captioned proceeding. A list of those in attendance is attached. The presentation focused on the tension that appears to undergird most of the issues raised in the proceeding: how does the Commission maintain universal service while also enabling innovation? That concern permeates virtually all the issues raised in the NPRM and is significantly complicated by not having a transitionary second channel to support the deployment of the new, non-backward compatible standard. The Commission, broadcasters and other stakeholders must do the best they can within that constraining framework. We noted that true universal broadcast service does not exist today. The current ATSC 1.0 standard, based on the 8 VSB modulation protocol, does not work well inside buildings or support mobile reception. Those deficiencies disenfranchise millions of viewers, who expect their communications services to work everywhere. The ATSC 3.0 (“Next Gen”) standard overcomes those deficiencies. But bridging the gap between ATSC 1.0 and Next Gen without dedicated transition channels necessitates some temporary tradeoffs. -

Residential Healthcare Group Acquisition.Pdf

Graham Holdings Acquires Majority Interest in Residential Healthcare Group WASHINGTON—July 3, 2014—Graham Holdings Company (NYSE: GHC) today announced it has acquired a majority interest in Residential Healthcare Group, Inc., the parent company of Residential Home Health and Residential Hospice, leading providers of skilled home health care and hospice services in Michigan and Illinois. Mike Lewis, chairman and chief executive officer, and the Residential Healthcare Group management team will continue to operate the businesses. The purchase price was not disclosed. Residential Home Health, founded in 2001, and Residential Hospice, founded in 2011, are in-home, on-site and on-call providers based in Troy, MI. They offer a wide range of services and an experienced and caring staff of nurses, therapists, medical social workers, personal and spiritual care attendants and other medical professionals. Donald E. Graham, chairman and chief executive officer of Graham Holdings, said: “Our acquisition of Residential Healthcare Group is part of Graham Holdings’ ongoing strategy of acquiring companies with demonstrated earnings potential and strong management teams attracted to our long-term investment horizon. Residential Healthcare is an acquisition that fits our decentralized operating philosophy. We are a diverse group of businesses sharing common goals and values but each with its own identity and workplace culture, and with management responsible for its operations.” ____ About Graham Holdings Company (www.ghco.com) Graham Holdings Company (NYSE: GHC) is a diversified education and media company whose principal operations include educational services, television broadcasting, cable systems and online, print and local TV news. The Company owns Kaplan, a leading global provider of educational services; Post–Newsweek Stations (WDIV–Detroit, KPRC–Houston, WKMG–Orlando, KSAT–San Antonio, WJXT–Jacksonville); Cable ONE, serving small-city subscribers in 19 midwestern, western and southern states; The Slate Group (Slate, Slate V, TheRoot); and Foreign Policy. -

May 22, 2018 Marlene H. Dortch Secretary Federal Communications

May 22, 2018 Marlene H. Dortch Secretary Federal Communications Commission 445 12th Street SW Washington DC 20554 Re: Rules and Policies to Promote New Entry and Ownership Diversity in the Broadcasting Services, MB Docket Nos. 17-289, 14-50, 09-182, 07-294 Dear Ms. Dortch: I am the President and CEO of Bayou City Broadcasting, LLC (BCB), licensee of Stations WEVV-TV, Evansville, Indiana (CBS, Fox); KADN, Lafayette, Louisiana (Fox, MyNetwork TV); and KLAF-LP, Lafayette, Louisiana (NBC). As an African-American television station owner who is passionate about both broadcasting and diversity, I am writing to support the Commission’s adoption of an incubator program and to underscore the need for such a program to enhance diversity and new entry into the broadcast industry.1 A 29-year veteran of the broadcast industry, I have seen first-hand the challenges of transitioning from management to ownership. I began my career in 1989 as an Account Executive for Station WTTV in my hometown of Indianapolis, Indiana. After 18 years in the industry, I founded Bayou City Broadcasting Company with the goal of owning and operating television broadcast stations. With this transition in mind, I applied to the National Association of Broadcasters Education Foundation (NABEF) Broadcast Leadership Training (BLT) program, a 10-month 1 To foster greater diversity and new entry in broadcasting, I regularly mentor and teach diverse executives and prospective owners about leadership and management. I also serve on a number of boards and committees focused on diversity issues, including the Board of Directors of the National Association of Broadcasters Education Foundation (NABEF), the Board of Directors of the National Association of Black Owned Broadcasters (NABOB), and the Broadcast Diversity and Development Working Group of the FCC’s Advisory Committee on Diversity and Digital Empowerment. -

GHC Sale of the Root.Com.Pdf

Graham Holdings Company Announces Sale of The Root.com ARLINGTON, VA—May 21, 2015— Graham Holdings Company (NYSE: GHC) announced today that it sold The Root.com<http://TheRoot.com>, an on-line magazine focused on news, opinions, culture and entertainment from the perspective of African Americans, to La Fabrica, a division of Univision Interactive Media, Inc. The Root launched in 2008. "Donna Byrd, publisher, and Henry Louis Gates, co-founder, established The Root and made it the success it is today. We are extremely proud and grateful for all they have accomplished, and we are excited for the new growth opportunities today's sale gives them," said Donald E. Graham, Chairman and CEO of Graham Holdings. ___________________________________________ About Graham Holdings Company (www.ghco.com) Graham Holdings Company (NYSE: GHC) is a diversified education and media company whose principal operations include educational services, television broadcasting, cable systems and online services, print and local TV news. The Company owns Kaplan, a leading global provider of educational services; Graham Media Group (WDIV–Detroit, KPRC–Houston, WKMG–Orlando, KSAT–San Antonio, WJXT–Jacksonville); Cable ONE, serving small-city subscribers in 19 midwestern, western and southern states; The Slate Group (Slate and Panoply); and Foreign Policy. The Company also owns Trove, a digital team focused on innovation and experimentation with emerging technologies; SocialCode, a leading social marketing solutions company; Celtic Healthcare; Forney Corporation; Joyce/Dayton Corp; and Residential Healthcare Group. # # # Contact: Pinkie Mayfield (703) 345-6450 [email protected] . -

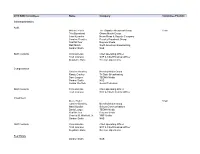

2019 Committees Roster.Xlsx

2019 NAB Committees Name Company Committee Position Joint Committees Audit Michael Fiorile The Dispatch Broadcast Group Chair Trila Bumstead Ohana Media Group John Kueneke News-Press & Gazette Company Caroline Beasley Beasley Broadcast Group Paul McTear Raycom Media Matt Mnich North American Broadcasting Gordon Smith NAB Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Stephanie Bone Director, Operations Compensation Caroline Beasley Beasley Media Group Randy Gravley Tri State Broadcasting Dave Lougee TEGNA Media Gordon Smith NAB Jordan Wertlieb Hearst Television Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Investment Steve Fisher Chair Caroline Beasley Beasley Media Group Marci Burdick Schurz Communications David Lougee TEGNA Media Paul McTear Raycom Media Charles M. Warfield, Jr. YMF Media Gordon Smith NAB Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Stephanie Bone Director, Operations Real Estate Gordon Smith NAB 2019 NAB Committees Name Company Committee Position Caroline Beasley Beasley Media Group Michael Fiorile The Dispatch Broadcast Group Paul Karpowicz Meredith Corporation Charles M. Warfield, Jr. YMF Media Staff Contact Steve Newberry EVP, Strategic Planning and Industry Affairs Bylaws Committee Darrell Brown Bonneville International Corp. Susan Fox The Walt Disney Company Kathy Clements Tribune Broadcasting Company John Zimmer Zimmer Radio of Mid-Missouri, Inc. Carolyn Becker Riverfront Broadcasting LLC Collin Jones Cumulus Media Inc. Caroline Beasley Beasley Media Group Randy Gravley Tri State Communications Inc Jordan Wertlieb Hearst Television Inc. Staff Contact Rick Kaplan General Counsel and EVP, Legal and Regulatory Affairs Dues Committee Tom Walker Mid-West Family Broadcasting Dave Santrella Salem Media Group Joe DiScipio Fox Television Stations, LLC Ralph Oakley Quincy Media, Inc. -

Graham Holdings Company Announces Virtual Investor Day

Graham Holdings Company Announces Virtual Investor Day October 30, 2020 ARLINGTON, Va.--(BUSINESS WIRE)--Oct. 30, 2020-- Graham Holdings Company (NYSE: GHC) announced today that it will hold a virtual Investor Day on Thursday, December 3, 2020. The live webcast will be held from 1:00 p.m. to 3:00 p.m. Eastern Time (ET), and will include audio and presentation slides. There will be a discussion of the Company’s operations and financials, and feature presentations from the Graham Holdings management team. Registration is required. Please visit the Company’s website at http://www.ghco.com to access registration and event information, and to submit questions. Interested parties unable to participate in the live webcast will be able to view and listen to an archived recording, which will be available at www.ghco.com/speeches shortly following the conclusion of the event. About Graham Holdings: Graham Holdings Company (NYSE: GHC) is a diversified holding company whose principal operations include educational services; television broadcasting; online, print and local TV news; home health and hospice care; custom manufacturing; automotive; and, restaurant venues. The Company owns Kaplan, a leading global diversified education services leader; Graham Media Group (WDIV–Detroit, KPRC–Houston, WKMG–Orlando, KSAT–San Antonio, WJXT–Jacksonville, WCWJ-Jacksonville, WSLS-Roanoke); The Slate Group; Foreign Policy; Megaphone and Pinna. The Company also owns Code3 (formerly SocialCode) and Decile, leading social marketing solutions companies; Graham Healthcare -

Graham Media Group and Nexstar Broadcasting Group Complete Deal to Acquire WCWJ-TV and WSLS-TV

Graham Media Group and Nexstar Broadcasting Group Complete Deal to Acquire WCWJ-TV and WSLS-TV CHICAGO--(BUSINESS WIRE) – January 17, 2017 -- Graham Media Group, Inc., a Graham Holdings Company (NYSE: GHC) subsidiary, and Nexstar Broadcasting Group, Inc. reported today that they have completed the transaction announced May 27, 2016 in which Graham Media Group, Inc. (GMG) has acquired WCWJ, the CW affiliate television station in Jacksonville, FL and WSLS, the NBC affiliate television station in Roanoke, VA for $60 million in cash and the assumption of certain liabilities, including pension obligations. Graham Media Group, Inc. will continue to operate both stations under their current network affiliations. “GMG is thrilled to welcome Roanoke’s WSLS, another strong news-focused NBC affiliate, to our top-ranked NBC sister stations in Houston and Detroit. We are equally excited about adding WCWJ as one of the strongest CW affiliates in the country. Pairing WCWJ with WJXT creates a powerful duopoly serving the Jacksonville market”, said Emily Barr, president and chief executive officer, Graham Media Group. About Graham Media Group Graham Media Group, Inc. (www.GrahamMedia.com), a subsidiary of Graham Holdings Company (NYSE: GHC), owns five local TV stations—each in a top-50 market and all recognized as news leaders—reaching 6.5% of U.S. television households: KPRC–Houston and WDIV–Detroit (NBC); KSAT–San Antonio (ABC); WKMG–Orlando (CBS); and WJXT– Jacksonville (independent). The stations also broadcast digital channels focused on classic television and operate market-leading websites, mobile sites and mobile apps that deliver breaking news, weather and community news, reaching millions of users across each platform.