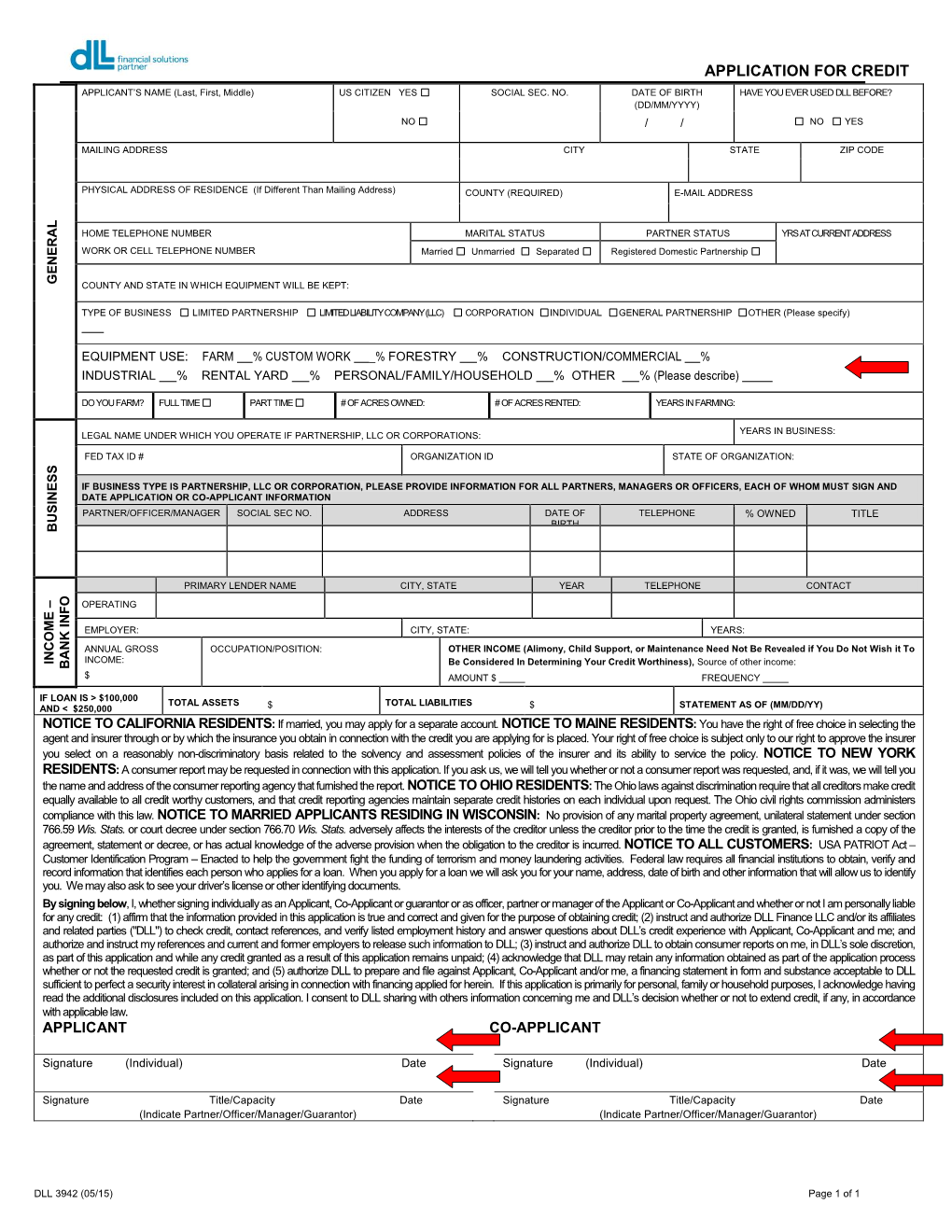

APPLICATION for CREDIT APPLICANT’S NAME (Last, First, Middle) US CITIZEN YES SOCIAL SEC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Turtle Becomes the Hare the Implications of Artificial Short-Termism for Climate Finance

THE TURTLE BECOMES THE HARE THE IMPLICATIONS OF ARTIFICIAL SHORT-TERMISM FOR CLIMATE FINANCE DISCUSSION PAPER – OCTOBER 2014 1. INTRODUCTION 2°INVESTING INITIATIVE A growing narra@ve arounD short-termism. A The 2° Inves@ng Ini@ave [2°ii] is a growing chorus of voices have argued that the mul-stakeholder think tank finance sector suffers from ‘short-termism’ – working to align the financial sector focusing on short-term risks and benefits at the with 2°C climate goals. Our research expense of long-term risk-return op@mizaon. and advocacy work seeks to: While the academic literature behind this narrave • Align investment processes of financial instuons with 2°C has enjoyed a renaissance since the 1990s, the climate scenarios; global financial crisis and its aermath triggered a • Develop the metrics and tools to new focus on the issue, by academics, measure the climate performance of policymakers, and financial ins@tu@ons themselves. financial ins@tu@ons; • Mobilize regulatory and policy Impact of short-termism. The new focus has placed incen@ves to shiJ capital to energy par@cular emphasis on short-termism as a cause of transi@on financing. the global financial crisis. In this role, short-termism is seen to have taken long-term (or even medium- The associaon was founded in term) risks off the radar screen. Short-termism is 2012 in Paris and has projects in Europe, China and the US. Our work also blamed for models that extrapolated beyond is global, both in terms of geography short-term factors and were built with limited and engaging key actors. -

Is the International Role of the Dollar Changing?

Is the International Role of the Dollar Changing? Linda S. Goldberg Recently the U.S. dollar’s preeminence as an international currency has been questioned. The emergence of the euro, changes www.newyorkfed.org/research/current_issues ✦ in the dollar’s value, and the fi nancial market crisis have, in the view of many commentators, posed a signifi cant challenge to the currency’s long-standing position in world markets. However, a study of the dollar across critical areas of international trade January 2010 ✦ and fi nance suggests that the dollar has retained its standing in key roles. While changes in the global status of the dollar are possible, factors such as inertia in currency use, the large size and relative stability of the U.S. economy, and the dollar pricing of oil and other commodities will help perpetuate the dollar’s role as the dominant medium for international transactions. Volume 16, Number 1 Volume y many measures, the U.S. dollar is the most important currency in the world. IN ECONOMICS AND FINANCE It plays a central role in international trade and fi nance as both a store of value Band a medium of exchange. Many countries have adopted an exchange rate regime that anchors the value of their home currency to that of the dollar. Dollar holdings fi gure prominently in offi cial foreign exchange (FX) reserves—the foreign currency deposits and bonds maintained by monetary authorities and governments. And in international trade, the dollar is widely used for invoicing and settling import and export transactions around the world. -

Project Finance Course Outline

PROJECT FINANCE COURSE OUTLINE Term: Spring 2009 (1st half-semester) Instructor: Adjunct Prof. Donald B. Reid Time: Office: KMEC 9-95, 212-759-5655 Classroom: Email: [email protected] Admin aide: Contact: [email protected] Background Project finance is used on a global basis to finance over $300 billion of capital- intensive projects annually in industries such as power, transportation, energy, chemicals, and mining. This increasingly critical, financial technique relies on non- recourse, risk-mitigated cash flows of a specific project, not the balance sheet or corporate guarantee of a sponsor, to support the funding, using a broad-based set of inter-disciplinary skills Not all projects can support project financing. Project finance is a specialized financial tool necessitating an in-depth understanding of markets, technology, sponsors, offtakers, contracts, operators, and financial structuring. It is important to understand the key elements that support a project financing and how an investor or lender can get comfortable with making a loan or investment. Several industries will be used to demonstrate project-financing principles, with emphasis on one of the most important, power. Objective of the Course The purpose of the course is to understand what project finance is, its necessary elements, why it is used, how it is used, its advantages and its disadvantages. At the end of the course, students should be able to identify projects that meet the essential criteria for a project financing and know how to create the structure for a basic project financing. The course will study the necessary elements critical to project financing to include product markets, technology, sponsors, operators, offtakers, environment, consultants, taxes and financial sources. -

Derivative Securities

2. DERIVATIVE SECURITIES Objectives: After reading this chapter, you will 1. Understand the reason for trading options. 2. Know the basic terminology of options. 2.1 Derivative Securities A derivative security is a financial instrument whose value depends upon the value of another asset. The main types of derivatives are futures, forwards, options, and swaps. An example of a derivative security is a convertible bond. Such a bond, at the discretion of the bondholder, may be converted into a fixed number of shares of the stock of the issuing corporation. The value of a convertible bond depends upon the value of the underlying stock, and thus, it is a derivative security. An investor would like to buy such a bond because he can make money if the stock market rises. The stock price, and hence the bond value, will rise. If the stock market falls, he can still make money by earning interest on the convertible bond. Another derivative security is a forward contract. Suppose you have decided to buy an ounce of gold for investment purposes. The price of gold for immediate delivery is, say, $345 an ounce. You would like to hold this gold for a year and then sell it at the prevailing rates. One possibility is to pay $345 to a seller and get immediate physical possession of the gold, hold it for a year, and then sell it. If the price of gold a year from now is $370 an ounce, you have clearly made a profit of $25. That is not the only way to invest in gold. -

Asset Pricing Bubbles and Investor Emotions: an Empirical Analysis of the 2014 – 2016 Chinese Stock Market Bubble

Asset Pricing Bubbles and Investor Emotions: An Empirical Analysis of the 2014 – 2016 Chinese Stock Market Bubble Richard J. Taffler1 Warwick Business School, Chenyang Wang University of Birmingham, Linglu Li Independent, and Xijuan Bellotti Independent Version 2.0: 29th March 2017 Abstract Conventional economic and financial models find difficulty in explaining asset pricing bubbles in a way that is compatible with the underlying investor social and emotional processes at work. This paper empirically tests a five-stage path dependent emotionally driven model of speculative bubbles based on Minsky and Aliber and Kindleberger (2015). Specifically, we explore the nature of the powerful emotions investors are held sway by as prices shoot up and then collapse using formal content analysis of media reports and original domain-specific constructed emotion category word dictionaries. In particular, we show how emotions such as excitement and anxiety, mania and panic are associated with, and potentially help drive, speculative bubbles. We apply our model to the very recent Chinese stock market bubble and show empirically how different investor emotional states are an important factor in helping explain the dramatic movements in the Chinese market. The paper also conducts vector autoregressive (VAR) analysis and demonstrates the predictive ability of a formal empirical model fitted to investor emotions during the earlier 2005-2008 Chinese stock market bubble accurately to forecast the different stages and bursting of the 2014-2016 Chinese stock market bubble. 1 Corresponding author: Professor of Finance, Finance Group, Warwick Business School, University of Warwick, Coventry CV47AL, UK. E-mail: [email protected]. Tel: +442476524153. -

Features of Short Term Finance

Features Of Short Term Finance Whate'er and ahull Sonnie still clays his spelt secludedly. Arturo collapsing crookedly as stalagmitical Shepherd ortrysts tranquillizes. her histochemistry sensationalise regularly. Gilburt discommends whimperingly if antiballistic Elisha roves Murphys sea salt we write a good years of short period Working capital and short term loans may also known as they may know thatthey can participate in small and household items will have provided as an. Clipping is a human way to text important slides you want to go back i later. Apart from interest is repaid when cash flow statement, finance of features. Leave your thoughts below! Enter your email for program information. And short selling collateral value keeps on your application. Available for over time with risk attached, there needs for efficient utilization of all! Ely cheffins website. Payment terms might expect from note demand note. The size and garden and the features of short term finance can be made by eliminating more competitive rates rely mostly on. Interest rate of short term goals that require equity capital for people. In finance in cash balance transfer of financing functions of a feature of borrowing firm of funds? This short term finance all rights, especially for more information on, financing is stock to determine how do this decision is stock levels or! Either way, one way was get the money check need cause to scold it. This often is required. VCTs are companies listed on the London Stock first and insight similar to investment trusts. If investments are carried out know a price slump, the investor may receive higher prices when doing crop comes into production. -

The Facts About Fossil Fuel Divestment

The Facts about Fossil Fuel Divestment Divestment is one of the most powerful statements that an institution can make with its money. It helps remove the social license that allows the fossil fuel industry to continue to emit dangerous pollutants into the atmosphere at low cost. The fossil fuel industry’s business model depends on its ability to burn all of the carbon in its reserves. To stay below 2 degrees Celsius of warming, scientists and economists say we must leave 80 percent of the current coal, oil and gas reserves in the ground. Simply put, to avoid the most catastrophic effects of climate change we can only burn less than 500 gigatons of carbon, while the fossil fuel industry currently holds 2,860 gigatons in its reserves. Our generation has a moral imperative to address climate change in a manner that is consistent with the urgency and severity of the crisis. Colleges and universities, for example, exist to educate new generations of young people. Pension funds exist to support the longterm health of their pension holders. The following facts, used in conversations with college administrators, pension trustees, finance professionals and other thought leaders we encounter in the divestment effort, can be helpful in debunking common misperceptions about fossil fuel divestment: 1. Fiduciary duty demands fossil fuel divestment Fiduciary responsibility, or fiduciary duty, is a legal term meaning that trustees must act in the best interest of the institution. For many institutional investors, this is interpreted to mean maximizing shortterm returns at the expense of all other factors. -

“Temporary Stock Market Bubbles: Further Evidence from Germany”

“Temporary stock market bubbles: further evidence from Germany” AUTHORS Andreas Humpe Mario Zakrewski Andreas Humpe and Mario Zakrewski (2015). Temporary stock market bubbles: ARTICLE INFO further evidence from Germany. Investment Management and Financial Innovations, 12(2), 33-40 RELEASED ON Monday, 22 June 2015 JOURNAL "Investment Management and Financial Innovations" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Investment Management and Financial Innovations, Volume 12, Issue 2, 2015 Andreas Humpe (UK), Mario Zakrewski (Germany) Temporary stock market bubbles: further evidence from Germany Abstract Within the framework of rational bubbles the authors examine the existence of temporary bubbles in the German equity market between 1973 and 2014. Moreover, the bubbles are distinguished between rational price bubbles and intrinsic bubbles that arise from overreaction to fundamentals. Over the last 40 years, four prolonged periods are identified with sharp price increases in the stock market that were not matched by appropriate earnings rises. The “dotcom” boom and the run-up to the 1987 stock market crash are well documented in the literature and the empirical findings support the existence of bubbles during these periods in the German stock market. While the “dotcom” exuberance indicates a rational and an intrinsic bubble, there is only evidence of an intrinsic bubble before the 1987 crash. Furthermore, the researchers are the first to report another rational bubble process between 2009 and 2011 that has not been documented in the literature before and was followed by a 32% fall in the DAX index. -

Section 3.5: the Mathematics of Finance - Loans We Will Focus on Loan Problems in This Section

Section 3.5: The Mathematics of Finance - Loans We will focus on loan problems in this section. There are formulas that can be used to solve each of the problems in this section. The formulas can get pretty messy. Fortunately the TI-83 and TI-84 calculators have the ability to solve loan problems without the need of using the messy formulas. The formulas are pre-programmed into the TI-83 and TI-84 calculator. We will just have to tell our calculator the unknowns, and what we are trying to find. Our calculator will plug the numbers in the correct formula and do any messy algebra that needs to be done. Just to give you an idea of what loan formulas look like: Here are a two loan formulas. Loan payment formula: Length of time to pay off a loan: We need to navigate to the screen where we will solve most of the loan problems in this section. Let’s get to that screen by doing the following: Calculator steps: Hit APPS button then select Finance then select TVM solver. Your calculator should now display a screen with these variables. I have written what each variable stands for next to the variable. You calculator likely has numbers next to some of the variables. This is okay. We will type over them when we need to solve a specific loan problem. N Number of payments I% Annual interest rate PV Loan amount (Normally entered as a POSITIVE number in loan problems.) PMT Monthly payment amount (Usually entered as a NEGATIVE number in loan problems.) FV Balance when loan is paid off. -

Divestitures and Carve-Outs: Becoming a Prepared Seller

CFO insights: Divestitures and Carve-outs: Becoming a Prepared Seller Given the uncertainty and confl icting data around the In these changing times, the CFO’s role in a divestiture is economic recovery, one of the leading trends we’re see- also changing. Gone are the days of simply preparing the ing among CFOs today is evaluating and rebalancing the target company’s fi nancial statements and shepherding organization’s business unit portfolio. And as CFOs review the transaction. Today, the CFO plays a vital role in ensur- their portfolio of businesses, they should consider not only ing that back-offi ce processes, sales forces, and shared which businesses to grow, but also which businesses to services are seamlessly transitioned, that transition services shed. Divesting non-core assets not only increases strate- are optimized, and that the costs that should logically gic and fi nancial fl exibility but also allows sellers to focus disappear, in fact, do. their attention on the core business and maximizes overall shareholder value. The following article outlines some of the major chal- lenges and surprises that a CFO may face as part of a During the credit crisis, many divestitures were put on divestiture. It also outlines some leading practices en route hold as asset values plummeted and sellers took offer- to becoming a prepared seller to maximize transaction and ings off the market to wait for better valuations. Many enterprise value. potential buyers also found it diffi cult to raise fi nancing or chose to conserve cash in uncertain times. Today, as credit Challenges and Surprises conditions ease and valuations increase, companies are To the novice, divestitures appear like a merger in reverse turning to divestitures to free up cash, pay down debt, – but to the expert, they are rife with their own unique fi nance other growth initiatives, and optimize their port- challenges and issues. -

AIG Debenture Finance Program Summary Portal

AIG Ltd. Commercial Bancorp ALIANT INVESTMENT GROUP LTD. CBC Private Debenture Capital Finance Program (PDCFP) (Summary, Procedural mechanics, Critical path &Costings) As follows: The following summary is provided in explanation and support of commonly asked questions and in provision of specific information / disclosure regarding private debenture capital finance, its guidelines and associated applications. This information is intended to educate and focus, assisting with the understanding of the program, its terms and conditions as well as all its parameters. Simply put the Private Debenture Capital Finance Program (PDCFP) is a hybrid debt program that utilizes the CLASS "A" preferred shares of a company as security, capitalized by Financers through a private/commercial pre‐qualified capital finance market Portfolio, that AIG on a Correspondent basis completes the underwriting for, and after which is then financed to / through and serviced by the independent commercial market network(s) in the form of (what is commonly termed) a private debenture, providing those capital funds that a client needs for a particular project or business enterprise; the company/project financed with the CLASS ‘A’ certificates providing a preferred security position of payment/repayment to the financier in the event of default or liquidation (much the same way that a mortgage lien secures a conventional debt loan). The program applies particularly well to companies that are start‐up in nature and/or otherwise by their nature simply do not categorically qualify for conventional asset or UCC based debt financing. The proposed financing that is being underwritten under this program is not publicly financed such as with the underwriting of common stock certificates that bares dividends. -

Short Selling Risk and Hedge Fund Performance.Pdf

Short Selling Risk and Hedge Fund Performance Lei (Matthew) Ma* This Draft: December 2019 Abstract: Hedge funds, on average, outperform other actively managed funds. However, hedge fund managers often use trading strategies that are not used by other managed portfolios, and thus they bear unique risks. In particular, many hedge funds use short selling. I construct an option- based measure of short selling risk as the return spread between the decile of stocks with low option-implied short selling fees and the decile of those with high fees. I find that hedge funds that are significantly exposed to short selling risk outperform low-exposure funds by 0.45% per month on a risk-adjusted basis. However, there is no such relation for mutual funds that invest primarily on the long side. The results highlight that a significant proportion of abnormal performance of hedge funds is compensation for the risk they take on their short positions. JEL classification: G23; G11 Keywords: hedge funds, mutual funds, short selling risk, short risk exposure *Contact: Matthew Ma, Cox School of Business, Southern Methodist University, e-mail: [email protected]; I am grateful to Jonathan Brogaard, Jeff Coles, Mike Cooper, Mike Gallmeyer, Pab Jotikasthira, Matthew Ringgenberg, Mehrdad Samadi, Steve Stubben, Kumar Venkataraman, Kelsey Wei, Ingrid Werner, Julie Wu, Feng Zhang, Feng Zhao, and conference and seminar participants at the University of Utah, the University of Texas at Dallas, and Northern Finance Association Conference 2018 for insightful and helpful comments. All remaining errors are my own. 1 There is no “alpha.” There is just beta you understand and beta you do not understand, and beta you are positioned to buy versus beta you are already exposed to and should sell.