Nobel Laureates Meet Policy Makers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Monetary History of the United States, 1867-1960’

JOURNALOF Monetary ECONOMICS ELSEVIER Journal of Monetary Economics 34 (I 994) 5- 16 Review of Milton Friedman and Anna J. Schwartz’s ‘A monetary history of the United States, 1867-1960’ Robert E. Lucas, Jr. Department qf Economics, University of Chicago, Chicago, IL 60637, USA (Received October 1993; final version received December 1993) Key words: Monetary history; Monetary policy JEL classijcation: E5; B22 A contribution to monetary economics reviewed again after 30 years - quite an occasion! Keynes’s General Theory has certainly had reappraisals on many anniversaries, and perhaps Patinkin’s Money, Interest and Prices. I cannot think of any others. Milton Friedman and Anna Schwartz’s A Monetary History qf the United States has become a classic. People are even beginning to quote from it out of context in support of views entirely different from any advanced in the book, echoing the compliment - if that is what it is - so often paid to Keynes. Why do people still read and cite A Monetary History? One reason, certainly, is its beautiful time series on the money supply and its components, extended back to 1867, painstakingly documented and conveniently presented. Such a gift to the profession merits a long life, perhaps even immortality. But I think it is clear that A Monetary History is much more than a collection of useful time series. The book played an important - perhaps even decisive - role in the 1960s’ debates over stabilization policy between Keynesians and monetarists. It organ- ized nearly a century of U.S. macroeconomic evidence in a way that has had great influence on subsequent statistical and theoretical research. -

The Influence of Jan Tinbergen on Dutch Economic Policy

De Economist https://doi.org/10.1007/s10645-019-09333-1 The Infuence of Jan Tinbergen on Dutch Economic Policy F. J. H. Don1 © The Author(s) 2019 Abstract From the mid-1920s to the early 1960s, Jan Tinbergen was actively engaged in discussions about Dutch economic policy. He was the frst director of the Central Planning Bureau, from 1945 to 1955. It took quite some time and efort to fnd an efective role for this Bureau vis-à-vis the political decision makers in the REA, a subgroup of the Council of Ministers. Partly as a result of that, Tinbergen’s direct infuence on Dutch (macro)economic policy appears to have been rather small until 1950. In that year two new advisory bodies were established, the Social and Eco- nomic Council (SER) and the Central Economic Committee. Tinbergen was an infuential member of both, which efectively raised his impact on economic pol- icy. In the early ffties he played an important role in shaping the Dutch consen- sus economy. In addition, his indirect infuence has been substantial, as the methods and tools that he developed gained widespread acceptance in the Netherlands and in many other countries. Keywords Consensus economy · Macroeconomic policy · Planning · Policy advice · Tinbergen JEL Classifcation E600 · E610 · N140 The author is a former director of the CPB (1994–2006). He is grateful to Peter van den Berg, André de Jong, Kees van Paridon, Jarig van Sinderen and Bas ter Weel for their comments on earlier drafts. André de Jong also kindly granted access to several documents from his private archive, largely stemming from CPB sources. -

Jan Tinbergen

Jan Tinbergen NOBEL LAUREATE JAN TINBERGEN was born in 1903 in The Hague, the Netherlands. He received his doctorate in physics from the University of Leiden in 1929, and since then has been honored with twenty other degrees in economics and the social sciences. He received the Erasmus Prize of the European Cultural Foundation in 1967, and he shared the first Nobel Memorial Prize in Economic Science in 1969. He was Professor of Development Planning, Erasmus University, Rot- terdam (previously Netherlands School of Economics), part time in 1933- 55, and full time in 1955-73; Director of the Central Planning Bureau, The Hague, 1945-55; and Professor of International Economic Coopera- tion, University of Leiden, 1973-75. Utilizing his early contributions to econometrics, he laid the founda- tions for modern short-term economic policies and emphasized empirical macroeconomics while Director of the Central Planning Bureau. Since the mid-1950s, Tinbergen bas concentrated on the methods and practice of planning for long-term development. His early work on development was published as The Design of Development (Baltimore, Md.: Johns Hopkins University Press, 1958). Some of his other books, originally published or translated into English, include An Econometric Approach to Business Cycle Problems (Paris: Hermann, 1937); Statistical Testing of Business Cycle Theories, 2 vols. (Geneva: League of Nations, 1939); International Economic Cooperation (Amsterdam: Elsevier Economische Bibliotheek, 1945); Business Cycles in the United Kingdom, 1870-1914 (Amsterdam: North-Holland, 1951); On the Theory of Economic Policy (Amsterdam: North-Holland, 1952); Centralization and Decentralization in Economic Policy (Amsterdam: North-Holland, 1954); Economic Policy: Principles and Design (Amster- dam: North-Holland, 1956); Selected Papers, L. -

The Nobel Prize in Economics Turns 50

AEXXXX10.1177/0569434519852429The American EconomistSanderson and Siegfried 852429research-article2019 Article The American Economist 2019, Vol. 64(2) 167 –182 The Nobel Prize in © The Author(s) 2019 Article reuse guidelines: Economics Turns 50 sagepub.com/journals-permissions https://doi.org/10.1177/0569434519852429DOI: 10.1177/0569434519852429 journals.sagepub.com/home/aex Allen R. Sanderson1 and John J. Siegfried2 Abstract The first Sveriges Riksbank Prizes in Economic Sciences in Memory of Alfred Nobel were awarded in 1969, 50 years ago. In this essay, we provide the historical origins of this sixth “Nobel” field, background information on the recipients, their nationalities, educational backgrounds, institutional affiliations, and collaborations with their esteemed colleagues. We describe the contributions of a sample of laureates to economics and the social and political world around them. We also address—and speculate—on both some of their could-have-been contemporaries who were not chosen, as well as directions the field of economics and its practitioners are possibly headed in the years ahead, and thus where future laureates may be found. JEL Classifications: A1, B3 Keywords Economics Nobel Prize Introduction The 1895 will of Swedish scientist Alfred Nobel specified that his estate be used to create annual awards in five categories—physics, chemistry, physiology or medicine, literature, and peace—to recognize individuals whose contributions have conferred “the greatest benefit on mankind.” Nobel Prizes in these five fields were -

Macroeconomic Dynamics at the Cowles Commission from the 1930S to the 1950S

MACROECONOMIC DYNAMICS AT THE COWLES COMMISSION FROM THE 1930S TO THE 1950S By Robert W. Dimand May 2019 COWLES FOUNDATION DISCUSSION PAPER NO. 2195 COWLES FOUNDATION FOR RESEARCH IN ECONOMICS YALE UNIVERSITY Box 208281 New Haven, Connecticut 06520-8281 http://cowles.yale.edu/ Macroeconomic Dynamics at the Cowles Commission from the 1930s to the 1950s Robert W. Dimand Department of Economics Brock University 1812 Sir Isaac Brock Way St. Catharines, Ontario L2S 3A1 Canada Telephone: 1-905-688-5550 x. 3125 Fax: 1-905-688-6388 E-mail: [email protected] Keywords: macroeconomic dynamics, Cowles Commission, business cycles, Lawrence R. Klein, Tjalling C. Koopmans Abstract: This paper explores the development of dynamic modelling of macroeconomic fluctuations at the Cowles Commission from Roos, Dynamic Economics (Cowles Monograph No. 1, 1934) and Davis, Analysis of Economic Time Series (Cowles Monograph No. 6, 1941) to Koopmans, ed., Statistical Inference in Dynamic Economic Models (Cowles Monograph No. 10, 1950) and Klein’s Economic Fluctuations in the United States, 1921-1941 (Cowles Monograph No. 11, 1950), emphasizing the emergence of a distinctive Cowles Commission approach to structural modelling of macroeconomic fluctuations influenced by Cowles Commission work on structural estimation of simulation equations models, as advanced by Haavelmo (“A Probability Approach to Econometrics,” Cowles Commission Paper No. 4, 1944) and in Cowles Monographs Nos. 10 and 14. This paper is part of a larger project, a history of the Cowles Commission and Foundation commissioned by the Cowles Foundation for Research in Economics at Yale University. Presented at the Association Charles Gide workshop “Macroeconomics: Dynamic Histories. When Statics is no longer Enough,” Colmar, May 16-19, 2019. -

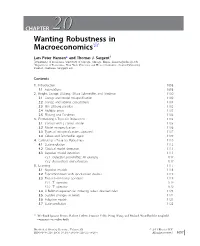

CHAPTER 2020 Wanting Robustness in Macroeconomics$

CHAPTER 2020 Wanting Robustness in Macroeconomics$ Lars Peter Hansen* and Thomas J. Sargent{ * Department of Economics, University of Chicago, Chicago, Illinois. [email protected] { Department of Economics, New York University and Hoover Institution, Stanford University, Stanford, California. [email protected] Contents 1. Introduction 1098 1.1 Foundations 1098 2. Knight, Savage, Ellsberg, Gilboa-Schmeidler, and Friedman 1100 2.1 Savage and model misspecification 1100 2.2 Savage and rational expectations 1101 2.3 The Ellsberg paradox 1102 2.4 Multiple priors 1103 2.5 Ellsberg and Friedman 1104 3. Formalizing a Taste for Robustness 1105 3.1 Control with a correct model 1105 3.2 Model misspecification 1106 3.3 Types of misspecifications captured 1107 3.4 Gilboa and Schmeidler again 1109 4. Calibrating a Taste for Robustness 1110 4.1 State evolution 1112 4.2 Classical model detection 1113 4.3 Bayesian model detection 1113 4.3.1 Detection probabilities: An example 1114 4.3.2 Reservations and extensions 1117 5. Learning 1117 5.1 Bayesian models 1118 5.2 Experimentation with specification doubts 1119 5.3 Two risk-sensitivity operators 1119 5.3.1 T1 operator 1119 5.3.2 T2 operator 1120 5.4 A Bellman equation for inducing robust decision rules 1121 5.5 Sudden changes in beliefs 1122 5.6 Adaptive models 1123 5.7 State prediction 1125 $ We thank Ignacio Presno, Robert Tetlow, Franc¸ois Velde, Neng Wang, and Michael Woodford for insightful comments on earlier drafts. Handbook of Monetary Economics, Volume 3B # 2011 Elsevier B.V. ISSN 0169-7218, DOI: 10.1016/S0169-7218(11)03026-7 All rights reserved. -

Trygve Haavelmo, James J. Heckman, Daniel L. Mcfadden, Robert F

Trygve Haavelmo, James J. Heckman, Daniel L. McFadden, Robert F. Engle and Clive WJ. Granger Edited by Howard R. Vane Professor of Economics Liverpool John Moores University, UK and Chris Mulhearn Reader in Economics Liverpool John Moores University, UK PIONEERING PAPERS OF THE NOBEL MEMORIAL LAUREATES IN ECONOMICS An Elgar Reference Collection Cheltenham, UK • Northampton, MA, USA Contents Acknowledgements ix General Introduction Howard R. Vane and Chris Mulhearn xi PART I TRYGVE HAAVELMO Introduction to Part I: Trygve Haavelmo (1911-99) 3 1. Trygve Haavelmo (1943a), 'The Statistical Implications of a System of Simultaneous Equations', Econometrica, 11 (1), January, 1-12 7 2. Trygve Haavelmo (1943b), 'Statistical Testing of Business-Cycle Theories', Review of Economic Statistics, 25 (1), February, 13-18 19 3. Trygve Haavelmo (1944), 'The Probability Approach in Econometrics', Econometrica, 12, Supplement, July, iii-viii, 1-115 25 4. M.A. Girshick and Trygve Haavelmo (1947), 'Statistical Analysis of the Demand for Food: Examples of Simultaneous Estimation of Structural Equations', Econometrica, 15 (2), April, 79-110 146 PART II JAMES J. HECKMAN Introduction to Part II: James J. Heckman (b. 1944) 181 5. James Heckman (1974), 'Shadow Prices, Market Wages, and Labor Supply', Econometrica, 42 (4), July, 679-94 185 6. James J. Heckman (1976), 'A Life-Cycle Model of Earnings, Learning, and Consumption', Journal of Political Economy, 84 (4, Part 2), August, S11-S44, references 201 7. James J. Heckman (1979), 'Sample Selection Bias as a Specification Error', Econometrica, 47 (1), January, 153-61 237 8. James Heckman (1990), 'Varieties of Selection Bias', American Economic Review, Papers and Proceedings, 80 (2), May, 313-18 246 9. -

The Transformation of Macroeconomic Policy and Research

K4_40319_Prescott_358-395 05-08-18 11.41 Sida 370 THE TRANSFORMATION OF MACROECONOMIC POLICY AND RESEARCH Prize Lecture, December 8, 2004 by Edward C. Prescott* Arizona State University, Tempe, and Federal Reserve Bank of Minneapolis, Minnesota, USA. 1. INTRODUCTION What I am going to describe for you is a revolution in macroeconomics, a transformation in methodology that has reshaped how we conduct our science. Prior to the transformation, macroeconomics was largely separate from the rest of economics. Indeed, some considered the study of macroeconomics fundamentally different and thought there was no hope of integrating macroeconomics with the rest of economics, that is, with neoclassical economics. Others held the view that neoclassical foundations for the empirically deter- mined macro relations would in time be developed. Neither view proved correct. Finn Kydland and I have been lucky to be a part of this revolution, and my address will focus heavily on our role in advancing this transformation. Now, all stories about transformation have three essential parts: the time prior to the key change, the transformative era, and the new period that has been impacted by the change. And that is the story I am going to tell: how macro- economic policy and research changed as the result of the transformation of macroeconomics from constructing a system of equations of the national accounts to an investigation of dynamic stochastic economies. Macroeconomics has progressed beyond the stage of searching for a theory to the stage of deriving the implications of theory. In this way, macroeconomics has become like the natural sciences. Unlike the natural sciences, though, macroeconomics involves people making decisions based upon what they think will happen, and what will happen depends upon what decisions they make. -

15 October 1998 PKESS CONFERENCE by NOBEL LAUREATE

15 October 1998 PKESS CONFERENCE BY NOBEL LAUREATE PROFESSOR AMARTYA SEN Professor Amartya Sen, the Indian philosopher and economist who was awarded the Nobel Prize for Economics, yesterday (14 October), said at a Headquarters press conference yesterday afternoon that globalization could be a major force for prosperity if adequately backed by good national policy. The main difficulty with globalization arose from failures in domestic policy, he said. Countries particularly threatened were those where human development had often been very poor. On balance, he said, major gains could be made by globalization. Even with the best scenario, there would be unexpected change, whether it arose from financial mismanagement or sudden changes in the world economy, and some people would suffer. A system of social safety nets would be needed, he said, adding that attention had to paid to that. Lack of social opportunities, such as literacy, good health care and macro-credit should be remedied. Globalization should be placed in a broader context and should be seen in terms of social and economic policies taken together. Professor Sen, who teaches at Trinity College in Cambridge, United Kingdom, was awarded the prize for his work on the causes of famine, on inequality and on measurement of poverty. He learned of the award in New York early Wednesday morning. He had arrived for a memorial lecture he would deliver at the United Nations on Thursday in honour of Mahbub ul Haq, a leading development thinker and creator of the widely acclaimed United Nations development programme Human Development Report. The memorial will be held in the Economic and Social Council chamber at 10:45 a.m. -

Pricing Uncertainty Induced by Climate Change∗

Pricing Uncertainty Induced by Climate Change∗ Michael Barnett William Brock Lars Peter Hansen Arizona State University University of Wisconsin University of Chicago and University of Missouri January 30, 2020 Abstract Geophysicists examine and document the repercussions for the earth’s climate induced by alternative emission scenarios and model specifications. Using simplified approximations, they produce tractable characterizations of the associated uncer- tainty. Meanwhile, economists write highly stylized damage functions to speculate about how climate change alters macroeconomic and growth opportunities. How can we assess both climate and emissions impacts, as well as uncertainty in the broadest sense, in social decision-making? We provide a framework for answering this ques- tion by embracing recent decision theory and tools from asset pricing, and we apply this structure with its interacting components to a revealing quantitative illustration. (JEL D81, E61, G12, G18, Q51, Q54) ∗We thank James Franke, Elisabeth Moyer, and Michael Stein of RDCEP for the help they have given us on this paper. Comments, suggestions and encouragement from Harrison Hong and Jose Scheinkman are most appreciated. We gratefully acknowledge Diana Petrova and Grace Tsiang for their assistance in preparing this manuscript, Erik Chavez for his comments, and Jiaming Wang, John Wilson, Han Xu, and especially Jieyao Wang for computational assistance. More extensive results and python scripts are avail- able at http://github.com/lphansen/Climate. The Financial support for this project was provided by the Alfred P. Sloan Foundation [grant G-2018-11113] and computational support was provided by the Research Computing Center at the University of Chicago. Send correspondence to Lars Peter Hansen, University of Chicago, 1126 E. -

ΒΙΒΛΙΟΓ ΡΑΦΙΑ Bibliography

Τεύχος 53, Οκτώβριος-Δεκέμβριος 2019 | Issue 53, October-December 2019 ΒΙΒΛΙΟΓ ΡΑΦΙΑ Bibliography Βραβείο Νόμπελ στην Οικονομική Επιστήμη Nobel Prize in Economics Τα τεύχη δημοσιεύονται στον ιστοχώρο της All issues are published online at the Bank’s website Τράπεζας: address: https://www.bankofgreece.gr/trapeza/kepoe https://www.bankofgreece.gr/en/the- t/h-vivliothhkh-ths-tte/e-ekdoseis-kai- bank/culture/library/e-publications-and- anakoinwseis announcements Τράπεζα της Ελλάδος. Κέντρο Πολιτισμού, Bank of Greece. Centre for Culture, Research and Έρευνας και Τεκμηρίωσης, Τμήμα Documentation, Library Section Βιβλιοθήκης Ελ. Βενιζέλου 21, 102 50 Αθήνα, 21 El. Venizelos Ave., 102 50 Athens, [email protected] Τηλ. 210-3202446, [email protected], Tel. +30-210-3202446, 3202396, 3203129 3202396, 3203129 Βιβλιογραφία, τεύχος 53, Οκτ.-Δεκ. 2019, Bibliography, issue 53, Oct.-Dec. 2019, Nobel Prize Βραβείο Νόμπελ στην Οικονομική Επιστήμη in Economics Συντελεστές: Α. Ναδάλη, Ε. Σεμερτζάκη, Γ. Contributors: A. Nadali, E. Semertzaki, G. Tsouri Τσούρη Βιβλιογραφία, αρ.53 (Οκτ.-Δεκ. 2019), Βραβείο Nobel στην Οικονομική Επιστήμη 1 Bibliography, no. 53, (Oct.-Dec. 2019), Nobel Prize in Economics Πίνακας περιεχομένων Εισαγωγή / Introduction 6 2019: Abhijit Banerjee, Esther Duflo and Michael Kremer 7 Μονογραφίες / Monographs ................................................................................................... 7 Δοκίμια Εργασίας / Working papers ...................................................................................... -

Hansen & Sargent 1980

Journal of Economic Dynamics and Control 2 (1980) 7-46. 0 North-Holland FORMULATING AND ESTIMATING DYNAMIC LINEAR RATIONAL EXPECTATIONS MODELS* Lars Peter HANSEN Carnegie-Mellon University, Pittsburgh, PA 15213, USA Thomas J. SARGENT University of Minnesota, and Federal Reserve Bank, Minneapolis, MN 55455, USA This paper describes methods for conveniently formulating and estimating dynamic linear econometric models under the hypothesis of rational expectations. An econometrically con- venient formula for the cross-equation rational expectations restrictions is derived. Models of error terms and the role of the concept of Granger causality in formulating rational expectations models are both discussed. Tests of the hypothesis of strict econometric exogeneity along the lines of Sims’s are compared with a test that is related to Wu’s. 1. Introduction This paper describes research which aims to provide tractable procedures for combining econometric methods with dynamic economic theory for the purpose of modeling and interpreting economic time series. That we are short of such methods was a message of Lucas’ (1976) criticism of procedures for econometric policy evaluation. Lucas pointed out that agents’ decision rules, e.g., dynamic demand and supply schedules, are predicted by economic theory to vary systematically with changes in the stochastic processes facing agents. This is true according to virtually any dynamic theory that attributes some degree of rationality to economic agents, e.g., various versions of ‘rational expectations’ and ‘Bayesian learning’ hypotheses. The implication of Lucas’ observation is that instead of estimating the parameters of decision rules, what should be estimated are the parameters of agents’ objective functions and of the random processes that they faced historically.