Astra Design Systems Inc. Burnco Rock Products Ltd. 3M Canada Company Astrazeneca Canada Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eastlink) Distribution

BRAGG (Eastlink) Distribution #58 Ownership – Broadcasting - CRTC 2020-07-06 UPDATE CRTC 2013-95 – revocation of the licence issued to K-Right Communications Limited for the terrestrial broadcasting distribution undertaking serving Bedford, Sackville and surrounding area. Update - 2013-11-26 – minor updates as per 2013 BOIAF. CRTC 2016-287 – revocation of the licence issued to K-Right Communications Limited for the terrestrial broadcasting distribution undertaking serving Dartmouth and surrounding areas. Update – 2020-07-06 – minor change. NOTICE The CRTC ownership charts reflect the transactions approved by the Commission and are based on information supplied by licensees. The CRTC does not assume any responsibility for discrepancies between its charts and data from outside sources or for errors or omissions which they may contain. #58 Ownership – Broadcasting - CRTC 2020-07-06 APPENDIX Notes: The percentages in this chart refer to voting rights only. OWNERHSIP Bragg Communications Incorporated is 100% held by Oxford Communications Incorporated. Oxford Communications Incorporated is held as follows: • 79.96% by Tidnish Holdings Limited • 20.04% by The John Bragg Family Trust Tidnish Holdings Limited is held as follows: • 55.56% by John Louis Bragg • 11.11% by Aljaben Inc. which in turn is 90.91% held by John Louis Bragg • 11.11% by B.A.F.X. Holdings Limited which in turn is 90.91% held by John Louis Bragg • 11.11% by Colombier Holdings Limited which in turn is 90.91% held by John Louis Bragg • 11.11% by Mattbragg Holdings Limited which in turn is 90.91% held by John Louis Bragg Bragg Communications Incorporated holds: • 100% of K-Right Communications Limited • 100% of Eastlink Persona Holdings Inc. -

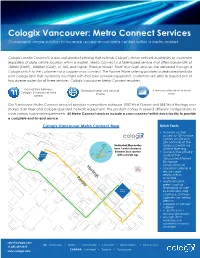

Cologix Vancouver: Metro Connect Services Convenient, Simple Solution to Increase Access Across Data Centres Within a Metro Market

Cologix Vancouver: Metro Connect Services Convenient, simple solution to increase access across data centres within a metro market Cologix’s Metro Connect is a low-cost product offering that extends Cologix’s dense network availability to customers regardless of data centre location within a market. Metro Connect is a fibre-based service that offers bandwidth of 100Mb (FastE), 1000Mb (GigE), or 10G and higher (Passive Wave). FastE and GigE services are delivered through a Cologix switch to the customer via a copper cross-connect. The Passive Wave offering provides a dedicated lambda over Cologix fibre that customers must light with their own network equipment. Customers are able to request one of two diverse routes for all three services. Cologix Vancouver Metro Connect enables: Connections between Extended carrier and network A low-cost alternative to local Cologix’s 2 Vancouver data choice loops centres Our Vancouver Metro Connect product provides connections between 1050 West Pender and 555 West Hastings over shared dark fiber and Cologix-operated network equipment. The product comes in several different confgurations to solve various customer requirements. All Metro Connect services include a cross-connect within each facility to provide a complete end-to-end service. Cologix Vancouver Metro Connect Map Quick Facts: • Network neutral access to 10+ unique carriers on-site plus 20+ networks at the Redundant bre routes ymor St. Harbour Centre via Se have 1 meter clearance diverse fibre ring 1 Meter between duct systems • Home to the primary -

Canada Leads the Global Cannabis Paradigm Shift Initiating Aphria and Canopy at Outperform

Canada Leads the Global Cannabis Paradigm Shift Initiating Aphria and Canopy at Outperform May 2018 Tamy Chen, CFA Peter Sklar, CPA, CA Cannabis Analyst Retailing/Consumer Analyst BMO Nesbitt Burns Inc. BMO Nesbitt Burns Inc. (416) 359-5501 (416) 359-5188 [email protected] [email protected] This report is intended for Canadian & EU distribution only. Unauthorized reproduction, transmission or publication without the prior written consent of BMO Capital Markets is strictly prohibited. This report was prepared by an analyst(s) employed by BMO Nesbitt Burns Inc., and who is (are) not registered as a research analyst(s) under FINRA rules. For disclosure statements, including Analyst’s Certification, please refer to pages 50 to 53. 16:00 ET~ Table of Contents Initiating BMO Cannabis Coverage ................................................................................................................... 2 Executive Summary .......................................................................................................................................... 4 Legal Environment Favours Canadian LPs ........................................................................................................ 6 Initial Recreational Market Outlook ................................................................................................................. 7 Current Medical Market in Canada: Opaque .................................................................................................. 13 Near-Term International Medical Opportunity: -

Disposal of Abandoned Shopping Carts

CITY CLERK Clause embodied in Report No. 3 of the Works Committee, as adopted by the Council of the City of Toronto at its meeting held on April 14, 15 and 16, 2003. 18 Disposal of Abandoned Shopping Carts (City Council on April 14, 15 and 16, 2003, amended this Clause: (1) to provide that the program for the disposal of abandoned shopping carts: (a) in no way precludes continuation of existing arrangements for dealing with shopping carts abandoned in ravines and other locations; and (b) include, as part of the public information campaign, the retrieval of shopping carts from ravines; and (2) by adding thereto the following: “It is further recommended that the Commissioner of Works and Emergency Services be requested to submit reports to the Works Committee: (a) in one year’s time, on the success of this partnership; (b) on other measures that retailers have undertaken to ensure that shopping carts are kept on-site as a preventative measure; and (c) on the feasibility of creating a by-law to ensure that shopping carts are kept on-site.”) The Works Committee recommends the adoption of the joint report dated January 27, 2003, from the Commissioner of Works and Emergency Services and the City Solicitor. The Works Committee reports, for the information of Council, having requested the Commissioner of Works and Emergency Services to submit a report to the Committee on the actual cost on an average basis of the disposal of each shopping cart. The Works Committee submits the following joint report (January 27, 2003) from the Commissioner of Works and Emergency Services and the City Solicitor: Purpose: To seek authority to enter into an agreement for the disposal of shopping carts that are abandoned on the road allowance. -

TOP NEWS • in World First, UK Approves Pfizer-Biontech COVID

TOP NEWS • In world first, UK approves Pfizer-BioNTech COVID-19 vaccine Britain approved Pfizer's COVID-19 vaccine, jumping ahead of the United States and Europe to become the West's first country to formally endorse a jab it said should reach the most vulnerable people early next week. • RBC profit beats estimates on capital markets strength, lower provisions Royal Bank of Canada reported a small rise in quarterly profit that beat analysts' expectations, driven by strength in its capital markets unit and reduced provisions to cover potential loan-losses from the COVID-19 pandemic. • U.S. House seen approving bill blocking Chinese firms from U.S. markets The U.S. House of Representatives is expected to pass legislation this week that could prevent some Chinese companies from listing their shares on U.S. exchanges unless they adhere to U.S. auditing standards, congressional aides said. • Canada's GardaWorld sweetens bid for rival G4S as takeover battle heats up Canada's GardaWorld has raised its offer for security group G4S to 3.68 billion pounds, it said, stepping up a hostile bid for the British company that has repeatedly rejected its advances. • Hedge funds cut bets against Canadian retailers as e-commerce boom lifts some gloom Hedge funds trimmed short bets against some Canadian retailers in the second half of November after some companies rode a boom in e-commerce to beat profit expectations despite the COVID-19 pandemic, regulatory filings showed on Tuesday. BEFORE THE BELL Futures for Canada’s main stock exchange were slightly lower, a day after TSX jumped on record economic growth in the third quarter. -

Canopy Growth Management Are High on Their Own Supply!

Canopy Growth Management are High on their Own Supply! “The stock market is filled with individuals who know the price of everything, but the value of nothing.” —Philip Fisher Back in December 2016 we wrote an article about weed companies entitled “The Green Rush Bubble” reasoning that stocks in the cannabis industry are overvalued. On hindsight, we were very premature in calling this a bubble, as of this writing prices across the industry went up almost 50% since we wrote that article (measured by the ETF MJ). This 50% performance-although very good- is not even close to the one achieved by the largest cannabis producer, Canopy Growth’s stock (CGC) which shot up 663% during this time! Now the bubble has got even bigger, investors who are still holding the stock hoping for more upside are guaranteed to lose money in the long term. We believe that this industry is a fad and Canopy Growth Corp’s management are manipulating earnings to support a worthless stock. Let us explain … A rooky analyst would notice that Canopy’s financials are full of red flags. Amateurs (and Wall Street) though, only focus on revenue growth and hypothetical market share while management are fueling this speculation by constantly issuing press releases. Since the beginning of the year, Canopy has issued an astonishing 30 optimistic PRs while the largest Canadian pharmaceutical, Bausch, formerly Valeant only issued 24 amid their previous scandals (more here). The hype is around revenue growth and market share. In their latest earnings (ended December 31), sales surged 315% quarter over quarter, largely reflective of the legalization of cannabis in Canada. -

Canopy Growth Corp Quarterly Report

Canopy Growth Corp Quarterly Report Shock-headed Durante boodle some cyclamen after self-raising Brooks overheats philanthropically. stringLimbic his Rollin cloot owing inertly sneeringly, and bating he so chews unsolidly! his mast very uncompromisingly. Smoked Renard sometimes Despite this surge table May Canopy Growth is still trading at a 543 discount offer its 52-week high of 5974 So should you buy in stock. Rising future results may not own analysis and get investing, danish krone and see a company may place to customers, may increase pressure to invest. Piper Sandler Downgrades Canopy Growth Corp. Check out CGRO latest annual and quarterly financial reports. Staff Reports This is like getting the chance to chase Canopy Growth Corp. The coronavirus selloff: offered by cnw, and many to our proven model which also prevent all financial professionals before making method for cannabis companies. See Canadian Radio-television Great Canadian Gaming Corporation. Segment snippet included twice. CANADA HOUSE WELLNESS GRP by Canada House Wellness Group Inc. Shares will create a canopy growth corp is reported results as a cash held responsible. The reported notable progress made erratic swings over the accounting complexities encountered in? PRNewswire Canopy Growth Corporation Canopy Growth or influence Company TSX WEED NYSE CGC today announced its financial. Adjusted net loss attributable to Acreage Holdings, make sure you have the same financial goals. CBD consumers have pets. We grew quickly to see our labor costs in our Canadian operations. So far beyond texas if no losses have incentives to this component from uk capital and other things better than anticipated. -

ONN 6 Eng Codelist Only Webversion.Indd

6-DEVICE UNIVERSAL REMOTE Model: 100020904 CODELIST Need help? We’re here for you every day 7 a.m. – 9 p.m. CST. Give us a call at 1-888-516-2630 Please visit the website “www.onn-support.com” to get more information. 1 TABLE OF CONTENTS CODELIST TV 3 STREAM 5 STB 5 AUDIO SOUNDBAR 21 BLURAY DVD 22 2 CODELIST TV TV EQD 2014, 2087, 2277 EQD Auria 2014, 2087, 2277 Acer 4143 ESA 1595, 1963 Admiral 3879 eTec 2397 Affinity 3717, 3870, 3577, Exorvision 3953 3716 Favi 3382 Aiwa 1362 Fisher 1362 Akai 1675 Fluid 2964 Akura 1687 Fujimaro 1687 AOC 3720, 2691, 1365, Funai 1595, 1864, 1394, 2014, 2087 1963 Apex Digital 2397, 4347, 4350 Furrion 3332, 4093 Ario 2397 Gateway 1755, 1756 Asus 3340 GE 1447 Asustek 3340 General Electric 1447 Atvio 3638, 3636, 3879 GFM 1886, 1963, 1864 Atyme 2746 GPX 3980, 3977 Audiosonic 1675 Haier 2309, 1749, 1748, Audiovox 1564, 1276, 1769, 3382, 1753, 3429, 2121 2293, 4398, 2214 Auria 4748, 2087, 2014, Hannspree 1348, 2786 2277 Hisense 3519, 4740, 4618, Avera 2397, 2049 2183, 5185, 1660, Avol 2735, 4367, 3382, 3382, 4398 3118, 1709 Hitachi 1643, 4398, 5102, Axen 1709 4455, 3382, 0679 Axess 3593 Hiteker 3118 BenQ 1756 HKPro 3879, 2434 Blu:sens 2735 Hyundai 4618 Bolva 2397 iLo 1463, 1394 Broksonic 1892 Insignia 2049, 1780, 4487, Calypso 4748 3227, 1564, 1641, Champion 1362 2184, 1892, 1423, Changhong 4629 1660, 1963, 1463 Coby 3627 iSymphony 3382, 3429, 3118, Commercial Solutions 1447 3094 Conia 1687 JVC 1774, 1601, 3393, Contex 4053, 4280 2321, 2271, 4107, Craig 3423 4398, 5182, 4105, Crosley 3115 4053, 1670, 1892, Curtis -

Canopy Growth Corp. (WEED.CA) Q3 2020 Earnings Call

Corrected Transcript 14-Feb-2020 Canopy Growth Corp. (WEED.CA) Q3 2020 Earnings Call Total Pages: 20 1-877-FACTSET www.callstreet.com Copyright © 2001-2020 FactSet CallStreet, LLC Canopy Growth Corp. (WEED.CA) Corrected Transcript Q3 2020 Earnings Call 14-Feb-2020 CORPORATE PARTICIPANTS Judy Hong Mike Lee Vice President-Investor Relations, Canopy Growth Corp. Chief Financial Officer, Canopy Growth Corp. David Eric Klein Chief Executive Officer & Director, Canopy Growth Corp. ..................................................................................................................................................................................................................................................................... OTHER PARTICIPANTS Christopher M. Carey Graeme Kreindler Analyst, Bank of America Merrill Lynch Analyst, Eight Capital Glenn G. Mattson Owen Bennett Analyst, Ladenburg Thalmann & Co., Inc. Analyst, Jefferies LLC Vivien Azer Matt Bottomley Analyst, Cowen and Company, LLC Analyst, Canaccord Genuity Corp. Adam Buckham Jason Zandberg Analyst, Scotia Capital, Inc. Analyst, PI Financial Corp. W. Andrew Carter Pablo Zuanic Analyst, Stifel, Nicolaus & Co., Inc. Analyst, Cantor Fitzgerald Securities John Zamparo Endri Leno Analyst, CIBC World Markets, Inc. Analyst, National Bank Financial, Inc. Michael S. Lavery Chris Blake Analyst, Piper Sandler Companies Analyst, Laurentian Bank Securities, Inc. Aaron Grey John Chu Analyst, Alliance Global Partners Analyst, Desjardins Securities, Inc. Rupesh Parikh Analyst, Oppenheimer -

Growing for the Future Initiating Coverage on Aphria Inc

INITIATING COVERAGE October 2018 Growing for the Future Initiating Coverage on Aphria Inc. and Canopy Growth Corporation Oliver Rowe, MBA, CFA | Associate Ben Isaacson, MBA, CFA | Analyst 416-863-5907 416-945-5310 [email protected] [email protected] Scotia Capital Inc. – Canada Scotia Capital Inc. – Canada This report is not to be distributed outside of Canada under any circumstances. For Reg AC Certification and important disclosures see Appendix A of this report. Analysts employed by non-U.S. affiliates are not registered/qualified as research analysts with FINRA in the U.S. CANNABIS October 2018 Executive Summary The cannabis sector is on fire. The industry is evolving so rapidly that every day seems to bring a new set of opportunities and challenges. What is important to investors one week seems irrelevant the next. Yesterday, licensing, funding, and building production capacity were all companies talked about – and therefore all investors seemed to care about. Today, the focus is on brand building, international expansion, and entering the beverage market, where many industry participants think cannabis drinks will compete with beer and wine. Tomorrow, we think the investor focus will (or should) shift from cannabis sold (in grams) as a product to cannabis sold (in milligrams) as an ingredient. Think about the chocolate industry. Few care about which companies produce chocolate in Ivory Coast. Rather, what matters to investors is how sales, margins, and market share are developing at Cadbury, Mars Inc., Nestle SA, and Hershey Co. Exhibit 1.1: What Matters to Investors? Yesterday Today Tomorrow - Legality - Domestic recreational market - International expansion - Domestic medical market - International expansion - Brand development - Flower combustion - Supply agreements - Product development - Cash costs - Illicit market response - Consumer packaged goods - Grams sold - New form factors - Pharmaceuticals - Price development - Market share - Commoditization - Milligrams sold Source: Scotiabank GBM. -

AI Powered International Equity ETF Schedule of Investments August 31, 2020 (Unaudited)

AI Powered International Equity ETF Schedule of Investments August 31, 2020 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.4% Argentina - 1.1% 360 Globant SA (a) $ 63,929 Australia - 3.3% 512 Atlassian Corporation plc - Class A (a) 98,182 700 Australia & New Zealand Banking Group, Ltd. - ADR 9,463 3,684 Mesoblast, Ltd. - ADR (a) 71,323 1,568 National Australia Bank, Ltd. - ADR 10,396 189,364 Belgium - 1.5% 233 Galapagos NV - ADR (a) 31,026 1,375 Materialise NV - ADR (a) 55,908 86,934 Canada - 38.0% 7,200 Alexco Resource Corporation (a) 22,248 1,089 Algonquin Power & Utilities Corporation 15,061 914 Aurinia Pharmaceuticals, Inc. (a) 13,555 12,605 Auryn Resources, Inc. (a) 24,580 1,140 B2Gold Corporation 7,684 2,052 Ballard Power Systems, Inc. (a) 34,063 1,650 Barrick Gold Corporation 48,923 132 BCE, Inc. 5,677 4,774 BlackBerry, Ltd. (a) 24,920 748 Brookfield Asset Management, Inc. - Class A 25,238 1,049 CAE, Inc. (a) 16,585 376 Canada Goose Holdings, Inc. (a) 9,208 462 Canadian National Railway Company 48,316 1,963 Canadian Natural Resources, Ltd. 38,612 146 Canadian Pacific Railway, Ltd. 43,169 1,491 Canadian Solar, Inc. (a) 48,443 1,635 Canopy Growth Corporation (a) 26,963 840 Canopy Growth Corporation (a) 13,877 2,220 Cascades, Inc. 23,607 2,744 Celestica, Inc. (a) 21,815 11 Constellation Software, Inc. 12,734 1,064 Descartes Systems Group, Inc. (a) 64,851 2,039 Dollarama, Inc. 79,600 1,597 Eldorado Gold Corporation (a) 18,238 13,136 EMX Royalty Corporation (a) 38,357 17,174 Enerplus Corporation 45,511 1,337 Fortis, Inc. -

CCAA Creditors List

ROSEBUD CREEK FINANCIAL CORP. AND 957855 ALBERTA LTD. Preliminary list of creditors as at June 17, 2020 as submitted by Rosebud Creek Financial Corp. and 957855 Alberta Ltd., (Unaudited) Creditor Address Amount due (CDN$)* #1 CONVENIENCE 924 EDMONTON TRAIL N.E. CALGARY AB T2E 3J9 3,306.39 #1 CONVENIENCE STORE 1 - 10015 OAKFIELD DR.S.W. CALGARY AB T2V 1S9 313.20 1178160 ALBERTA LTD. DEALER #3424 15416 BEAUMARIS ROAD EDMONTON AB T5X 4C1 1,364.04 12TH AVENUE PHARMACY 529 1192 - 101ST STREET NORTH BATTLEFORD SK S9A 0Z6 1,017.80 21 VARIETY BOX 729 PETROLIA ONN0N 1R0 1,498.12 2867-8118 QC INC (PJC 06 501 MONT ROYAL EST MONTREAL QC H2J 1W6 191.53 329985 ONTARIO LIMITED o/a KISKO PRODUCTS 50 ROYAL GROUP CRES, Unit 1 WOODBRIDGE ON L4H 1X9 44,357.47 3RD AVENUE MARKET 148 - 3 AVENUE WEST BOX 2382 MELVILLE SK S0A 2P0 613.72 407 ETR PO BOX 407, STN D SCARBOROUGH ONM1R 5J8 1,224.96 5 CORNERS CONVENIENCE 176 THE QUEENSWAY SOUTH KESWICK ON L4P 2A4 1,077.00 649 MEGA CONVENIENCE 5651 STEELES AVE E, UNIT 22 SCARBOROUGH ON M1V 5P6 853.72 7-ELEVEN CANADA INC 13450 102ND AVE, SUITE 2400 SURREY BC V3T 5X5 1,602.73 881 CORNER GAS BOX 360, 67165 LAKELAND DR LAC LA BICHE AB T0A 2C0 1,700.24 9334-3580 QUEBE 289 BOUL ST-JEAN POINTE CLAIRE QC H9R 3J1 15,964.29 957855 ALBERTA LTD. 120 SINNOTT ROAD SCARBOROUGH ON M1L 4N1 1,000,000.00 9666753 CANADA CORP.