This Is the Message

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GALAPAGOS NV (Name of Issuer)

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 13D Under the Securities Exchange Act of 1934 (Amendment No. )* GALAPAGOS NV (Name of Issuer) Ordinary Shares, no par value (Title of Class of Securities) 36315X101 (CUSIP Number) Gilead Sciences, Inc. 333 Lakeside Drive Foster City, California, 94404 650-574-3000 (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) July 14, 2019 (Date of Event Which Requires Filing of this Statement) If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. x Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d- 7(b) for other parties to whom copies are to be sent. *The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). -

Additional Details for the Item 4 of the Extraordinary General Meeting of Euronext N.V

CONTACT - Investor Relations: +33.1.70.48.24.17 ADDITIONAL DETAILS FOR THE ITEM 4 OF THE EXTRAORDINARY GENERAL MEETING OF EURONEXT N.V. ON 8 OCTOBER 2019 To ensure clear and sufficient understanding of the items submitted for shareholder approval at the Extraordinary General Meeting of Euronext N.V. on 8 October 2019, the following additional information regarding Item 4 – Proposal to amend the remuneration policy is disclosed. The reader is invited to refer to the full explanatory note document available on https://www.euronext.com/en/investor-relations/financial- calendar/egm-8102019, where the full remuneration policy is made available in Appendix 3. Refering to the notes related to Proposal 4, it is mentioned that “in accordance with the Remuneration policy, a benchmark analysis has been conducted against four different peer groups to assess compensation levels of the CEO. First two reference markets consist of European headquartered companies of comparable size and scope, primarily active in the Finance & IT industries (>20 companies) and relevant direct competitors (>20 companies). To complement these two peer group, an analysis was performed against two local markets on equivalent position (France where the CEO is based (>20 companies, and the Netherlands/AEX (>15 companies). This analysis shows that the current target total compensation package is positioned below European Market, significantly below the median of the French Market and the lower quartile of the Direct Competitors and slightly lower than the Dutch Market.” Furthermore, -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Aktiebeholdning Pr. 05.05.2021 Oversigt Over Investeringer I

Aktiebeholdning pr. 05.05.2021 Oversigt over investeringer i børsnoterede aktier som PenSam Pension har foretaget enten direkte eller gennem investeringsforeninger. Specifikation af beholdningen af børsnoterede aktier Land Selskab/aktie Branche Markedsværdi i kr. Argentina MercadoLibre Inc Consumer Discretionary 49.439.459 YPF SA Energy 1.195.299 Australia Afterpay Ltd Information Technology 7.516.309 AMP Ltd Financials 1.126.955 Ampol Ltd Energy 281.797 APA Group Utilities 2.536.557 Aristocrat Leisure Ltd Consumer Discretionary 27.487.387 ASX Ltd Financials 4.697.579 Aurizon Holdings Ltd Industrials 9.540.418 AusNet Services Utilities 612.886 Australia & New Zealand Banking Group Ltd Financials 21.696.049 Brambles Ltd Industrials 28.287.023 Coca-Cola Amatil Ltd Consumer Staples 1.445.126 Cochlear Ltd Health Care 2.148.881 Commonwealth Bank of Australia Financials 51.943.000 Computershare Ltd Information Technology 12.404.653 CSL Ltd Health Care 83.573.855 Dexus Real Estate 9.005.111 Evolution Mining Ltd Materials 1.690.740 Fortescue Metals Group Ltd Materials 19.528.992 Goodman Group Real Estate 10.217.406 GPT Group/The Real Estate 2.889.633 Insurance Australia Group Ltd Financials 3.939.805 Lendlease Corp Ltd Real Estate 2.589.152 Magellan Financial Group Ltd Financials 2.093.797 Medibank Pvt Ltd Financials 2.869.133 Mirvac Group Real Estate 3.496.016 National Australia Bank Ltd Financials 25.112.465 Newcrest Mining Ltd Materials 15.692.715 Northern Star Resources Ltd Materials 255.676 Oil Search Ltd Energy 460.619 QBE Insurance Group -

Annual REPORT 2013 77

ITOCHU CORPORATION ANNUAL REPORT 2013 77 Corporate Social Responsibility 78 CSR for ITOCHU Corporation 80 Activity Highlight: Resolving Social Issues through Business Striving to Resolve the Problems of Cotton Farmers in India through the Supply Chain Pre Organic Cotton Program 82 Documentary Report Project on Supply Chains Producing Lithium-Ion Batteries 85 ISO 26000 Core Subjects and ITOCHU’s Initiatives 86 Human Rights 87 Labor Practices 89 The Environment 91 Fair Operating Practices 92 Consumer Issues 93 Community Involvement and Development 78 ITOCHU CORPORATION ANNUAL REPORT 2013 CSR for ITOCHU Corporation ITOCHU Corporation is pursuing multifaceted corporate activities in various regions of the world and a wide range of fields. As such, ITOCHU is well aware of the impact of those activities on the global environment and society. For ITOCHU, CSR entails making a contribution to building sustainable societies through business activities. As a global company, it is our mission to be “Committed to the Global Good.” ITOCHU Mission and Values CSR Management System ITOCHU founder Chubei Itoh first launched a wholesale linen CSR Committee Examination and promotion of CSR policies and measures business in 1858. For more than 150 years since, ITOCHU has passed down the spirit of sampo yoshi (Good for the CSR Promotion & Global Environment Department, seller, Good for the buyer, and Good for society), a manage- Corporate Communications Division ment philosophy embraced by Ohmi merchants. Planning and proposal of CSR measures After considering ways to demonstrate its commitment CSR Taskforce to society as an international corporation and to put this Discussion of report production and CSR promotion measures commitment into practice, in 1992 ITOCHU formulated “Committed to the Global Good” as a corporate philosophy. -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

Employee Relations

Employee Relations As a general trading company that has a diverse range of businesses around the world, ITOCHU believes that its human resources are its greatest management asset. Accordingly, ITOCHU will proactively advance efforts to develop and strengthen human resources as the management foundation supporting the growth of its business activities. We will continue to pursue human resources initiatives, such as cultivating industry professionals and creating systems in which diverse human resources can flourish globally. Policies and Tasks for Fiscal 2014 For ITOCHU Corporation, human resources are its greatest management assets as a general trading company. “Brand-new Deal 2014,” our medium-term management plan launched from fiscal 2014, inherits the basic policies of the previous medium-term management plan and continues to outline a variety of initiatives pertaining to human resources, such as cultivating “industry professionals” and “strong human resources.” By executing the medium-term plan and these measures, we intend to further enhance the structure that will support utilization of our human resources, enabling diverse human resources to demonstrate their skills and abilities to the fullest. Fumihiko Kobayashi Managing Executive Officer, General Manager, Human Resources & General Affairs Division 56 Employee Relations Human Resource Development Supporting the “Seeking of New Opportunities” Human Resource Development Supporting the “Seeking of New Opportunities” Human resources are what support the stable, ongoing growth of ITOCHU Corporation. Our human resource development activities are available to employees throughout the Group, both domestically and in overseas blocs. Based on each employee’s work experience and abilities, we strive to help them develop into professionals who play an active role in their business field and to provide them with the skills necessary to manage business on a global level. -

Notice of Convocation the 59Th Ordinary General Meeting of Shareholders

Notice of Convocation The 59th Ordinary General Meeting of Shareholders The following is an English translation of the Notice of Convocation of the 59th Ordinary General Meeting of Shareholders of SECOM CO., LTD. to be held on June 25, 2020, except for the translation of the INSTRUCTION ON ONLINE VOTING and the ACCESS MAP FOR THE PLACE OF THE MEETING in the Notice. The Company provides this translation for your reference and convenience only and without any warranty as to its accuracy or otherwise. [English Translation] 1 Table of Contents Notice of Convocation of The 59th Ordinary General Meeting of Shareholders ····· 3 Reference Document Concerning the General Meeting of Shareholders ··············· 7 Business Report ····················································································· 16 Consolidated Financial Statements ······························································ 49 Non-Consolidated Financial Statements ······················································· 53 Auditors’ Reports ··················································································· 57 (Note) This Table of Contents is for this abridged English translation only, and not the same as that in the original Japanese documents. [English Translation] 2 Stock Exchange Code: 9735 June 3, 2020 Notice of Convocation of The 59th Ordinary General Meeting of Shareholders Dear Shareholders: Secom Co., Ltd. (the “Company”) hereby notifies you as follows that the 59th Ordinary General Meeting of Shareholders of the Company will be held as described below. In order to avoid the risk of COVID-19 infections at the meeting, we strongly recommend that shareholders exercise their voting rights by mail or via the Internet instead of attending the meeting in person. Please exercise your voting rights by mail or via the Internet after studying the Reference Document Concerning the General Meeting of Shareholders attached below and exercise your voting rights on or before 6:00 p.m. -

Water Leaders Summit Keynote Speaker

Water for the Future summi t&expo Water Leaders Summit Keynote speaker Kala Vairavamoorthy IWA Executive Director Professor Kala Vairavamoorthy is an internationally recognised water resource management expert, with particular expertise in urban water issues. He combines a strong engineering background with practical international experience. He has published extensively and has a strong international profile working closely with the World Bank, UN-Habitat, UNESCO, GWP, SIWI and the EU. Prior to joining the International Water Association, he was the Deputy Director General for Research at the International Water Management Institute. Kala has been a member of many International Scientific Committees. Currently he serves on the Stockholm’s World Water Week’s Scientific Program Committee and the Global Water Partnership’s Technical Committee. He was Co-chair of IWA’s Cities of the Future Program and also a member of Singapore International Water Week’s Program Committee. Graham Duxbury Chief Executive Officer, Groundwork, UK Graham Duxbury is Chief Executive of Groundwork UK, a leading NGO promoting community-led solutions to social, economic and environmental challenges in the UK. Graham was appointed Chief Executive in March 2014, having worked for Groundwork UK in a number of national roles for the previous 15 years. His responsibilities have encompassed building national relationships and partnerships, generating income, developing national programmes and leading on policy and strategic communications. Graham joined Groundwork UK in 1998, prior to which he undertook a number of communications roles in the voluntary, public and private sectors. Shan-Shan Guo Vice Chairman of Delta Electronics Foundation ‧Defined corporate’s branding strategy and consolidated its positioning under the “Smarter. -

Citi Pure Price Momentum Europe Long-Short Net TR Series II Index

Date: 23-May-21 Index Weights as of monthly rebalance date 12-May-21 Citi Pure Price Momentum Europe Long-Short Net TR Series II Index (CIISPME2) Long Exposure Short Exposure Constituent Bloomberg Ticker Constituent Name Weight(%) Constituent Bloomberg Ticker Constituent Name Weight(%) 1 1COV GY Equity Covestro AG 0.41% 1 ABBN SE Equity ABB LTD-REG -0.16% 2 AAL LN Equity Anglo American Plc 0.27% 2 ABN NA Equity ABN AMRO Group NV -0.29% 3 ABF LN Equity Associated British Foods 0.74% 3 ACA FP Equity Credit Agricole SA -0.89% 4 AC FP Equity Accor 0.32% 4 ADS GY Equity Adidas AG -0.96% 5 ADEN SE Equity ADECCO GROUP AG-REG 0.42% 5 AENA SQ Equity AENA SA -0.18% 6 ADM LN Equity Admiral Group 1.34% 6 AD NA Equity Ahold NV -0.87% 7 ADYEN NA Equity Adyen NV 0.25% 7 AI FP Equity Air Liquide -0.44% 8 AGN NA Equity Aegon NV 0.26% 8 ALFA SS Equity Alfa Laval AB -0.62% 9 AHT LN Equity Ashtead Group 2.81% 9 ALO FP Equity Alstom -1.02% 10 AKZA NA Equity AKZO NOBEL NV EUR0.50(POST REV SPLIT) 1.11% 10 ASSAB SS Equity Assa Abloy B -0.44% 11 ALC SE Equity ALCON AG CHF0.04 0.20% 11 ATO FP Equity AtoS -2.15% 12 ALV GY Equity Allianz SE 0.64% 12 AZN LN Equity AstraZeneca Plc -1.00% 13 AMBUB DC Equity Ambu A/S 0.10% 13 BA/ LN Equity BAE Systems Plc -1.05% 14 AMP IM Equity Amplifon SpA 0.58% 14 BAER SE Equity JULIUS BAER GROUP LTD -0.06% 15 AMS SQ Equity Amadeus IT Hldg SA 0.86% 15 BARC LN Equity Barclays -0.39% 16 VNA GY Equity Deutsche Annington Immobilien 0.03% 16 BATS LN Equity British American Tobacco Plc -0.47% 17 ANTO LN Equity Antofagasta Hldgs 0.44% 17 -

This Is the Message

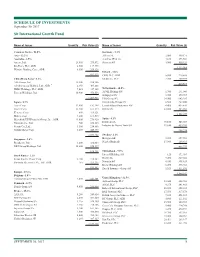

SCHEDULE OF INVESTMENTS September 30, 2017 Sit International Growth Fund Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 96.0% Germany - 5.3% Asia - 22.2% Allianz SE 2,000 449,171 Australia - 2.5% Aurelius SE & Co. 4,160 273,564 Amcor, Ltd. 23,400 279,872 Siemens AG 3,900 550,324 Rio Tinto, PLC, ADR 2,500 117,975 1,273,059 Westpac Banking Corp., ADR 8,300 209,326 Ireland - 1.8% 607,173 CRH, PLC, ADR 5,800 219,588 China/Hong Kong - 6.2% Medtronic, PLC 2,700 209,979 AIA Group, Ltd. 32,200 238,386 429,567 Alibaba Group Holding, Ltd., ADR * 2,350 405,868 HSBC Holdings, PLC, ADR 7,025 347,105 Netherlands - 10.5% Tencent Holdings, Ltd. 10,900 476,556 ASML Holding NV 1,700 291,040 Galapagos NV * 3,725 379,717 1,467,915 ING Groep NV 34,900 643,285 Japan - 8.7% Koninklijke Philips NV 6,500 267,800 Asics Corp. 12,900 192,398 LyondellBasell Industries NV 4,400 435,820 Daicel Corp. 13,400 161,574 RELX NV 22,800 485,033 Keyence Corp. 600 319,121 2,502,695 Makita Corp. 4,200 169,515 Mitsubishi UFJ Financial Group, Inc., ADR 43,000 276,920 Spain - 4.1% Nintendo Co., Ltd. 700 258,113 Iberdrola SA 70,100 545,069 Secom Co., Ltd. 3,500 254,886 Industria de Diseno Textil SA 11,650 439,205 Suzuki Motor Corp. 8,400 440,875 984,274 2,073,402 Sweden - 2.1% Singapore - 2.6% Hexagon AB 5,200 257,962 Broadcom, Ltd.