Updated Faqs Heerf II

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

INVESTMENT COMPANY ACT of 1940 Release No

SECURITIES AND EXCHANGE COMMISSION INVESTMENT COMPANY ACT OF 1940 Release No. 33817 / March 13, 2020 ORDER UNDER SECTION 6(c) AND SECTION 38(a) OF THE INVESTMENT COMPANY ACT OF 1940 GRANTING EXEMPTIONS FROM SPECIFIED PROVISIONS OF THE INVESTMENT COMPANY ACT AND CERTAIN RULES THEREUNDER; COMMISSION STATEMENT REGARDING PROSPECTUS DELIVERY The current outbreak of coronavirus disease 2019 (COVID-19) was first reported on December 31, 2019. The disease has led to disruptions to transportation, including buses, subways, trains and airplanes, and the imposition of quarantines around the world. The Commission has heard from industry representatives that COVID-19 may present challenges for boards of directors of registered management investment companies and business development companies (“BDCs”) to travel in order to meet the in-person voting requirements under the Investment Company Act of 1940 (the “Investment Company Act” or “the Act”) and rules thereunder. In addition, we recognize that registered management investment companies and unit investment trusts (together, “registered funds”) may face challenges if, as a result of COVID-19, personnel of registered fund managers or other third-party service providers that are necessary to prepare these reports become unavailable, or only available on a limited basis, in: (i) preparing or transmitting annual and semi-annual shareholder reports; and/or (ii) timely filing Forms N-CEN and N-PORT. We also understand that due to recent market movements certain registered closed-end funds (“closed-end funds”) and BDCs may seek to call or redeem securities and may face challenges in providing the advance notice required under Rule 23c-2. Finally, we appreciate that there may be difficulties in the timely delivery of registered fund prospectuses. -

Year of Saint Joseph

DIOCESE OF SACRAMENTO Office of Worship 2110 Broadway, Sacramento, CA 95818 - 916-733-0211 - [email protected] Year of Saint Joseph On the Solemnity of the Immaculate Conception in 2020, Pope Francis has released an apostolic letter about Saint Joseph and declared a “Year of St. Joseph” from December 8, 2020 to December 8, 2021. The letter, Patris Corde (“a Father’s heart”) was released on the 150th anniversary of the proclamation of Saint Joseph as patron of the Universal Church. It can be found here: http://www.vatican.va/content/francesco/en/apost_letters/documents/papa-francesco-lettera- ap_20201208_patris-corde.html The Diocese of Sacramento is observing this Year in many ways. Journey with Joseph Pilgrimage We will soon be announcing Saint Joseph pilgrimage sites across the Diocese. Indulgence The Apostolic Penitentiary issued a decree on December 8, 2020, formally announcing the decision of Pope Francis to celebrate the Year of Saint Joseph through December 8, 2021. Special opportunities to receive a plenary indulgence were also included, subject to the usual conditions: sacramental confession, reception of Holy Communion, prayer for the intentions of the Pope, and total detachment to all sin, including venial sin. Due to the ongoing coronavirus (COVID-19) pandemic, the Holy See made provision in its decree that persons who are currently unable to go to Mass or confession because of public health restrictions may defer reception of those two sacraments until they are able to do so. Those who are sick, suffering, or homebound may also receive the plenary indulgence by fulfilling as much as they are able and by offering their sorrows and sufferings to God through Saint Joseph, consoler of the sick and patron saint for receiving a good death. -

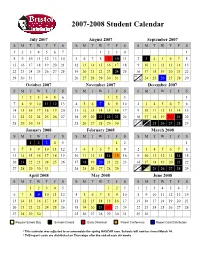

Approved Student Calendar

2007-2008 Student Calendar July 2007 August 2007 September 2007 SMTWT F S SMTWT F S SMTWT F S 1234567 1234 1 8910111213145678910 11 2 3 45678 15 16 17 18 19 20 21 12 13 14 15 16 17 18 9 10 11 12 13 14 15 22 23 24 25 26 27 28 19 20 21 22 23 24 25 16 17 18 19 20 21 22 23 29 30 31 26 27 28 29 30 31 30 24 25 26 27 28 29 October 2007 November 2007 December 2007 SMTWT F S SMTWT F S SMTWT F S 123456 123 1 7891011 12 134567 89102345678 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 30 31 25 26 27 28 29 January 2008 February 2008 March 2008 SMTWT F S SMTWT F S SMTWT F S 12345 12 1 67891011123456789 2345678 13 14 15 16 17 18 19 10 11 12 13 14 1516 9 1011121314 15 20 21 22 23 24 25 26 17 18 19 20 21 22 23 16 17 18 19 20 21 22 23 24 27 28 29 30 31 24 25 26 27 28 29 30 31 25 26 27 28 29 April 2008 May 2008 June 2008 SMTWT F S SMTWT F S SMTWT F S 12345 123 1234567 6789 10111245678910891011121314 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 27 28 29 30 25 26 27 28 29 30 31 29 30 Regular School Day Schools Closed Early Dismissal Parent Conference Report Card Distribution * This calendar was adjusted to accommodate the spring NASCAR race. -

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No. 33 Class & Market Administrator Payment Dates for Producer Milk Component Final Pool Producer Advance Prices Payment Dates Final Payment Due Partial Payment Due Pool Month Prices Release Date Payrolls Due & Pricing Factors PSF, Admin., MS Cooperative Nonmember Cooperative Nonmember January February 3 * February 13 February 22 December 23, 2020 February 16 ** February 16 February 17 Janaury 25 January 26 February March 3 * March 13 March 22 January 21 * March 15 March 16 March 17 February 25 February 26 March March 31 * April 13 April 22 February 18 * April 15 April 16 April 19 ** March 25 March 26 April May 5 May 13 May 22 March 17 * May 17 ** May 17 ** May 17 April 26 ** April 26 May June 3 * June 13 June 22 April 21 * June 15 June 16 June 17 May 25 May 26 June June 30 * July 13 July 22 May 19 * July 15 July 16 July 19 ** June 25 June 28 ** July August 4 * August 13 August 22 June 23 August 16 ** August 16 August 17 July 26 ** July 26 August September 1 * September 13 September 22 July 21 * September 15 September 16 September 17 August 25 August 26 September September 29 * October 13 October 22 August 18 * October 15 October 18 ** October 18 ** September 27 ** September 27 ** October November 3 * November 13 November 22 September 22 * November 15 November 16 November 17 October 25 October 26 November December 1 * December 13 December 22 October 20 * December 15 December 16 December 17 November 26 ** November 26 December January 5, 2022 January 13, 2022 January 22, 2022 November 17 * January 18, 2022 ** January 18, 2022 ** January 18, 2022 ** December 27 ** December 27 ** * If the release date does not fall on the 5th (Class & Component Prices) or 23rd (Advance Prices & Pricing Factors), the most current release preceding will be used in the price calculation. -

March 13, 2020 Disaster Proclamation

GOVERNOR GREG ABBOTT March 13, 2020 FILED IN THE OFFCE OF THE SECRETARY OF STATE IhZo M”O’CL0CK The Honorable Ruth R. Hughs 470 Secretary of State State Capitol Room YE.8 Se re ry of State Austin, Texas 78701 Dear Secretary Hughs: Pursuant to his powers as Governor of the State of Texas, Greg Abbott has issued the following: A proclamation certifying that COVID-1 9 poses an imminent threat of disaster in the state and declaring a state of disaster for all counties in Texas. The original proclamation is attached to this letter of transmittal. Governor GSD/gsd Attachment Posi OFFICE Box 12428 AUSTIN, TEXAS 78711 512-463-2000 (VoicE) DIAL 7-1-1 foR RELAY SERVICES PROCLAMATION BY THE (!i1nrtwr uftiittfr ufxuz TO ALL TO WHOM THESE PRESENTS SHALL COME: WHEREAS, the novel coronavirus (COVID-19) has been recognized globally as a contagious respiratory virus; and WHEREAS, as of March 13, 2020, there are more than 30 confirmed cases of COVID-l 9 located in multiple Texas counties; and WHEREAS, there are more than 50 Texans with pending tests for COVID-19 in Texas; and WHEREAS, some schools, universities, and other governmental entities are beginning to alter their schedules, and some venues are beginning to temporarily close, as precautionary responses to the increasing presence of COVID- 19 in Texas; and WHEREAS, costs incurred to prepare for and respond to COVID-19 are beginning to mount at the state and local levels; and WHEREAS, the State of Texas has already taken numerous steps to prepare for COVID 19, such as increasing laboratory testing capacity, coordinating preparedness efforts across state agencies, and working with local partners to promote appropriate mitigation efforts; and WHEREAS, it is critical to take additional steps to prepare for, respond to, and mitigate the spread of COVID-19 to protect the health and welfare of Texans; and WHEREAS, declaring a state of disaster will facilitate and expedite the use and deployment of resources to enhance preparedness and response. -

Early Dance Division Calendar 17-18

Early Dance Division 2017-2018 Session 1 September 9 – November 3 Monday Classes Tuesday Classes September 11 Class September 12 Class September 18 Class September 19 Class September 25 Class September 26 Class October 2 Class October 3 Class October 9 Class October 10 Class October 16 Class October 17 Class October 23 Class October 24 Class October 30 Last Class October 31 Last Class Wednesday Classes Thursday Classes September 13 Class September 14 Class September 20 Class September 21* Class September 27 Class September 28 Class October 4 Class October 5 Class October 11 Class October 12 Class October 18 Class October 19 Class October 25 Class October 26 Class November 1 Last Class November 2 Last Class Saturday Classes Sunday Classes September 9 Class September 10 Class September 16 Class September 17 Class September 23 Class September 24 Class September 30* Class October 1 Class October 7 Class October 8 Class October 14 Class October 15 Class October 21 Class October 22 Class October 28 Last Class October 29 Last Class *Absences due to the holiday will be granted an additional make-up class. Early Dance Division 2017-2018 Session 2 November 4 – January 22 Monday Classes Tuesday Classes November 6 Class November 7 Class November 13 Class November 14 Class November 20 No Class November 21 No Class November 27 Class November 28 Class December 4 Class December 5 Class December 11 Class December 12 Class December 18 Class December 19 Class December 25 No Class December 26 No Class January 1 No Class January 2 No Class January 8 Class -

WINE, CHEESE, and the GOSPEL – Monday, March 1, 2021 VERY REVEREND KRIS D

WINE, CHEESE, AND THE GOSPEL – Monday, March 1, 2021 VERY REVEREND KRIS D. STUBNA, S.T.D. THE YEAR OF SAINT JOSEPH 1. Pope Francis declared the Year of St. Joseph: December 8, 2020 a. 150th Anniversary of Joseph being named the patron of the universal Church b. Apostolic Letter: Patris Corde (The Heart of the Father) c. Goal: “every member of the faithful may strengthen their life of faith daily in complete fulfillment of God’s will.” d. Why do we have special years? (eg. Eucharist, Faith, Mercy) e. Plenary indulgence – requirements 2. Who is Saint Joseph? a. Luke 2:4 – “of the house and lineage of David.” The link between the Old and New covenant b. Matthew 1:19 – “a just man” c. Appearances of angels in a dream: to reveal God’s plan and invite Joseph’s acceptance d. He was the spouse of Mary and foster father of Jesus i. Embraced Mary as his wife ii. Took them to Bethlehem for the census iii. Fled to Egypt to protect them from Herod iv. Returned to Nazareth where he was a carpenter and provided for his family v. Took Jesus to the Temple – example of faith for Jesus and teacher of the faith 3. Role in the Church a. Early Church Fathers and many saints devoted to St. Joseph b. He has appeared with Mary at some apparitions (Knock and Fatima) c. March 19: Solemnity of Saint Joseph, Spouse of Mary d. May 1: Feast of Saint Joseph the Worker e. 1870: Pope Pius IX declared him Patron of the Universal Church f. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

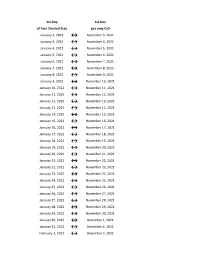

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 2, 2022 ↔ November 3, 2021 January 3, 2022 ↔ November 4, 2021 January 4, 2022 ↔ November 5, 2021 January 5, 2022 ↔ November 6, 2021 January 6, 2022 ↔ November 7, 2021 January 7, 2022 ↔ November 8, 2021 January 8, 2022 ↔ November 9, 2021 January 9, 2022 ↔ November 10, 2021 January 10, 2022 ↔ November 11, 2021 January 11, 2022 ↔ November 12, 2021 January 12, 2022 ↔ November 13, 2021 January 13, 2022 ↔ November 14, 2021 January 14, 2022 ↔ November 15, 2021 January 15, 2022 ↔ November 16, 2021 January 16, 2022 ↔ November 17, 2021 January 17, 2022 ↔ November 18, 2021 January 18, 2022 ↔ November 19, 2021 January 19, 2022 ↔ November 20, 2021 January 20, 2022 ↔ November 21, 2021 January 21, 2022 ↔ November 22, 2021 January 22, 2022 ↔ November 23, 2021 January 23, 2022 ↔ November 24, 2021 January 24, 2022 ↔ November 25, 2021 January 25, 2022 ↔ November 26, 2021 January 26, 2022 ↔ November 27, 2021 January 27, 2022 ↔ November 28, 2021 January 28, 2022 ↔ November 29, 2021 January 29, 2022 ↔ November 30, 2021 January 30, 2022 ↔ December 1, 2021 January 31, 2022 ↔ December 2, 2021 February 1, 2022 ↔ December 3, 2021 1st Day 1st Day of Your Desired Stay you may Call February 2, 2022 ↔ December 4, 2021 February 3, 2022 ↔ December 5, 2021 February 4, 2022 ↔ December 6, 2021 February 5, 2022 ↔ December 7, 2021 February 6, 2022 ↔ December 8, 2021 February 7, 2022 ↔ December 9, 2021 February 8, 2022 ↔ December 10, 2021 February 9, 2022 ↔ December 11, 2021 February 10, 2022 ↔ December 12, 2021 February -

Federal Register/Vol. 85, No. 8/Monday, January 13, 2020/Notices

Federal Register / Vol. 85, No. 8 / Monday, January 13, 2020 / Notices 1825 written request and payment of www.regulations.gov. Please submit National Science Foundation, 2415 reproduction costs. Please email your comments only and include your name, Eisenhower Avenue, Alexandria, VA request and payment to: Consent Decree company name (if any), and cite 22314. Telephone: 703–292–5055. Library, U.S. DOJ–ENRD, P.O. Box 7611, ‘‘Guidance for Regulation of Artificial SUPPLEMENTARY INFORMATION: On June Washington, DC 20044–7611. Intelligence Applications’’ in all 27, 2016 (81 FR 41451), NSF published Please enclose a check or money order correspondence. All comments received an interim final rule amending its for $128.50 (25 cents per page will be posted, without change or regulations to adjust, for inflation, the reproduction cost) payable to the United redaction, to www.regulations.gov, so maximum civil monetary penalties that States Treasury. commenters should not include may be imposed for violations of the information they do not wish to be Henry Friedman, Antarctic Conservation Act of 1978 posted (e.g., personal or confidential (ACA), as amended, 16 U.S.C. 2401 et Assistant Section Chief, Environmental business information). seq., and the Program Fraud Civil Enforcement Section, Environment and Natural Resources Division. FOR FURTHER INFORMATION CONTACT: Remedies Act of 1986 (PFCRA), 31 U.S.C. 3801, et seq. These adjustments [FR Doc. 2020–00265 Filed 1–10–20; 8:45 am] Alexander Hunt, Office of Management and Budget, Office of Information and are required by the 2015 Act. The 2015 BILLING CODE 4410–15–P Regulatory Affairs, at ahunt@ Act also requires agencies to make omb.eop.gov. -

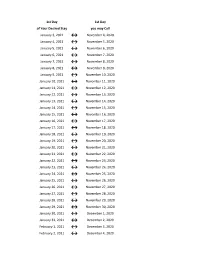

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

Pay Week Begin: Saturdays Pay Week End: Fridays Check Date

Pay Week Begin: Pay Week End: Due to UCP no later Check Date: Saturdays Fridays than Monday 7:30am week 1 December 10, 2016 December 16, 2016 December 19, 2016 December 30, 2016 week 2 December 17, 2016 December 23, 2016 December 26, 2016 week 1 December 24, 2016 December 30, 2016 January 2, 2017 January 13, 2017 week 2 December 31, 2016 January 6, 2017 January 9, 2017 week 1 January 7, 2017 January 13, 2017 January 16, 2017 January 27, 2017 week 2 January 14, 2017 January 20, 2017 January 23, 2017 January 21, 2017 January 27, 2017 week 1 January 30, 2017 February 10, 2017 week 2 January 28, 2017 February 3, 2017 February 6, 2017 week 1 February 4, 2017 February 10, 2017 February 13, 2017 February 24, 2017 week 2 February 11, 2017 February 17, 2017 February 20, 2017 March 3, 2017 week 1 February 18, 2017 February 24, 2017 February 27, 2017 ***1 Week Pay Period Transition*** week 1 February 25, 2017 March 3, 2017 March 6, 2017 March 17, 2017 week 2 March 4, 2017 March 10, 2017 March 13, 2017 week 1 March 11, 2017 March 17, 2017 March 20, 2017 March 31, 2017 week 2 March 18, 2017 March 24, 2017 March 27, 2017 week 1 March 25, 2017 March 31, 2017 April 3, 2017 April 14, 2017 week 2 April 1, 2017 April 7, 2017 April 10, 2017 week 1 April 8, 2017 April 14, 2017 April 17, 2017 April 28, 2017 week 2 April 15, 2017 April 21, 2017 April 24, 2017 week 1 April 22, 2017 April 28, 2017 May 1, 2017 May 12, 2017 week 2 April 29, 2017 May 5, 2017 May 8, 2017 week 1 May 6, 2017 May 12, 2017 May 15, 2017 May 26, 2017 week 2 May 13, 2017 May 19, 2017 May