Anton Philips (1874 - 1951)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

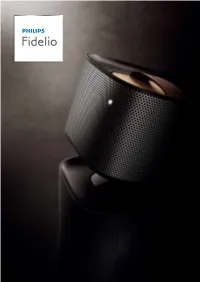

The Fidelio Wireless Hi-Fi Speaker Range Feature

Contents Obsessed with sound Philips sound heritage 05 Defining sound since the 1920s The radio goes global 06 A legend of the recording industry Obsessed with sound 08 The birth of portable audio 09 The CD revolution Pioneering connected audio 11 Fidelio heralds a new era Philips holds a special place within the world of Philips competencies audio. An admired innovator, Philips has defined 14 Fidelio sound 15 Golden Ears the standards of what we hear and how we 17 Design and acoustic engineering 18 Sound and acoustics innovation engineers experience it, bringing to consumers numerous 20 Product designers ground-breaking products such as portable Philips Fidelio 25 Headphones radio, compact cassette and recorder, compact M1BT S2 disc, and wireless Hi-Fi. With the launch of Philips 30 Portable speakers P9X premium Fidelio range, our obsession with sound 35 Docking speakers SoundSphere continues. Primo 40 Wireless Hi-Fi 44 Audio systems As we near a centenary in audio innovation, Sound towers 48 Home cinema sound we share our philosophy and introduce you E5 SoundSphere DesignLine to the people behind it. Join us on our sound SoundHub journey - Philips’ quest to improve and enhance The journey continues the listening experience of music lovers, offering them the most authentic sound possible: just as the artist intended. 2 3 Philips sound heritage Speech by Dutch Queen Wihelmina and Princess Juliana via a Philips short-wave Anton Philips, co-founder of Royal Philips N.V., with the one millionth radio set sold transmitter, 1927. in 1932. Defining sound since the 1920s The radio goes global For almost a century, Philips has pioneered audio innovations Philips’ next major innovation, introduced in 1927, was the that have transformed the way the world enjoys sound. -

Digital Pathology: the Dutch Perspective

Digital pathology: The Dutch perspective Paul J van Diest, MD, PhD Professor and Head, Department of Pathology University Medical Center Utrecht PO Box 85500, 3508 GA Utrecht The Netherlands [email protected] Professor of Oncology Johns Hopkins Oncology Center Baltimore, MD, USA Notice of Faculty Disclosure In accordance with ACCME guidelines, any individual in a position to influence and/or control the content of this ASCP CME activity has disclosed all relevant financial relationships within the past 12 months with commercial interests that provide products and/or services related to the content of this CME activity. The individual below has responded that he/she has no relevant financial relationship(s) with commercial interest(s) to disclose: Paul J. van Diest, MD, PhD Disclosures • member of advisory boards of Roche, Sectra, Philips (unpaid) • client of Hamamatsu, Sectra, Visiopharm, Leica, Aurora, Philips (paying heavily) • test scanners from Philips and Roche (no contract, no fee) • joint research projects with Philips UMCU Why The Netherlands? • “bunch-a-crazy dudes” • innovation is our middle name • not bound by too many rules and EU-FDA • strong believe in advantages in digital pathology Advantages of digital pathology • no more case assembly in the lab efficacy • quicker diagnostics efficacy • easy and more accurate measurements and counting patient safety/efficacy • better overview of tissue present patient safety • flagging missing slides patient safety • tracking viewing patient safety • automatic linking of images/reporting/LMS -

Royal Philips First Quarter 2016 Results Information Booklet

Royal Philips First Quarter 2016 Results Information booklet April 25th, 2016 1 Important information Forward-looking statements This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about our strategy, estimates of sales growth, future EBITA and future developments in our organic business. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include, but are not limited to, domestic and global economic and business conditions, developments within the euro zone, the successful implementation of our strategy and our ability to realize the benefits of this strategy, our ability to develop and market new products, changes in legislation, legal claims, changes in exchange and interest rates, changes in tax rates, pension costs and actuarial assumptions, raw materials and employee costs, our ability to identify and complete successful acquisitions and to integrate those acquisitions into our business, our ability to successfully exit certain businesses or restructure our operations, the rate of technological changes, political, economic and other developments in countries where Philips operates, industry consolidation and competition. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. -

Julienne Taba COFFEE TASTE ANALYSIS of an ESPRESSO COFFEE USING NUCLEAR MAGNETIC SPECROSCOPY

Julienne Taba COFFEE TASTE ANALYSIS OF AN ESPRESSO COFFEE USING NUCLEAR MAGNETIC SPECROSCOPY Bachelor’s Thesis CENTRAL OSTROBOTHNIA UNIVERSITY OF APPLIED SCIENCES Degree Programme in Chemistry and Technology March 2012 ABSTRACT CENTRAL OSTROBOTHNIA Date Author UNIVERSITY OF APPLIED SCIENCES Degree programme Name of thesis Instructor Pages Supervisor Key words INDEX OF ABBREVIATIONS HMDS: hexamethylsiloxane TCE: Tetrachloroethane NMR: Nuclear Magnetic Resonance ISO: International Organization for Standardization ICO: International Coffee Organization DMSO: dimethyl sulfoxide ACKNOLWEDGEMENT This work was performed at Koninklijke Philips Electronic N.V (Royal Philips Electronics), in the R&D department in Eindhoven Holland from July to December 2011. I would like to thank my supervisor Dr. Freek Suijver, for the opportunity of being part of the coffee project, his tutoring and his availability. I would like to express my gratitude to all the team members from the coffee project for their knowledge, time and friendliness: MSc Nicole Haex, Dr Nico Willard, Dr Johan Marra, and MSc Mart Te Velde A special thanks to Dr. Jeroen Pikkemaat for assisting me with his expertise on the NMR. Finally I want to thank Richard Schukkink for the great coffees; I have learned to enjoy the subtleties of a good cup of coffee. This work was supervised by MSc Jana Holm and Dr. Esko Johnson; I want to thank them both for their time and feedback. Table of Contents 1 INTRODUCTION ............................................................................................ -

De Stirlingkoelmachine Van Philips

HISTORIE RCC Koude & luchtbehandeling Tekst: Prof. Dr. Dirk van Delft De Stirlingkoelmachine van Philips Philips is opgericht in 1891 aan de Emmasingel in Eindhoven, nu locatie van ‘gevraagd een bekwaam jong doctor het Philips-museum. Aanvankelijk produceerde het bedrijf alleen kooldraad- in de natuurkunde, vooral ook goed lampen voor de internationale markt. Met groot succes, daarbij geholpen door experimentator’ – en op 2 januari het ontbreken in Nederland van een octrooiwet. De ‘gloeilampenfabriek uit 1914 ging Gilles Holst in Eindhoven het zuiden des lands’ kon straF eloos innovaties die elders waren uitgedacht aan de slag als directeur van het overnemen en verbeteren. De halfwattlamp, met in het glazen bolletje Philips Natuurkundig Laboratorium, gespiraliseerde wolfraamgloeidraden, werd in 1915 door Philips geïntrodu- kortweg NatLab. ceerd, een half jaar nadat concurrent General Electric in Schenectady (New Met Holst haalde Philips een York) de vereiste technologie in het eigen onderzoekslaboratorium had onderzoeker in huis die gepokt en ontwikkeld. gemazeld was in de wereld van de koudetechnologie. Holst was assistent in het befaamde cryogeen laboratorium van de Leidse fysicus oen in 1912 Nederland na 43 Niet alleen om nieuwe producten te en Nobelprijswinnaar Heike T jaar opnieuw een octrooiwet bedenken, maar ook om een Kamerlingh Onnes. In 1911 was hij kreeg, kwamen Gerard en patentenportefeuille te ontwikkelen nauw betrokken bij de ontdekking Anton Philips tot het inzicht dat, die het bedrijf strategisch kon van supergeleiding. In Eindhoven wilde Philips zijn positie veilig inzetten en te gelde maken. Er zorgde Holst voor een bijna acade- stellen, het ook een eigen onder- verscheen een advertentie in de misch onderzoeksklimaat, waarin zoekslaboratorium moest starten. -

The Philips Laboratory's X-Ray Department

Tensions within an Industrial Research Laboratory: The Philips Laboratory’s X-Ray Department between the Wars Downloaded from KEES BOERSMA Tensions arose in the X-ray department of the Philips research laboratory during the interwar period, caused by the interplay es.oxfordjournals.org among technological development, organizational culture, and in- dividual behavior. This article traces the efforts of Philips researchers to find a balance between their professional goals and status and the company’s strategy. The X-ray research, overseen by Gilles Holst, the laboratory’s director, and Albert Bouwers, the group leader for the X-ray department, was a financial failure despite at Vrije Universiteit Amsterdam on April 6, 2011 technological successes. Nevertheless, Bouwers was able to con- tinue his X-ray research, having gained the support of company owner Anton Philips. The narrative of the X-ray department allows us to explore not only the personal tensions between Holst and Enterprise & Society 4 (March 2003): 65–98. 2003 by the Business History Conference. All rights reserved. KEES BOERSMA is assistant professor at the Vrije Universiteit Amsterdam. Contact information: Faculty of Social Sciences, Vrije Universiteit, 1081 HV Amsterdam, The Netherlands. E-mail: [email protected]. Iamindebted to Ben van Gansewinkel, staff member of the Philips Company Archives (Eindhoven, the Netherlands) and the staff members of the Algemeen Rijks Archief (The Hague, the Netherlands), the Schenectady Museum Archives (Schenectady, New York), and the -

Corporate Restructuring in the Asian Electronics Market: Insights from Philips and Panasonic

Munich Personal RePEc Archive Corporate Restructuring in the Asian electronics market: Insights from Philips and Panasonic Reddy, Kotapati Srinivasa 2016 Online at https://mpra.ub.uni-muenchen.de/73663/ MPRA Paper No. 73663, posted 15 Sep 2016 10:39 UTC Corporate Restructuring in the Asian electronics market: Insights from Philips and Panasonic Kotapati Srinivasa Reddy Working version: 2016 1 Corporate Restructuring in the Asian electronics market: Insights from Philips and Panasonic Disguised Case and Teaching Note: Download from the Emerald Emerging Markets Case Studies Reddy, K.S., Agrawal, R., & Nangia, V. K. (2012). Drop-offs in the Asian electronics market: unloading Bolipps and Canssonic. Emerald Emerging Markets Case Studies, 2(8), 1-12. ABSTRACT (DON’T CITE THIS WORKING VERSION) Subject area of the Case: Business Policy and Strategy – Sell-off and Joint venture Student level and proposed courses: Graduation and Post Graduation (BBA, MBA and other management degrees). It includes lessons on Strategic Management and Multinational Business Environment. Brief overview of the Case: The surge in Asian electronics business becomes a global platform for international vendors and customers. Conversely, Chinese and Korean firms have become the foremost manufacturing & fabrication nucleus for electronic supplies in the world. This is also a roaring example of success from Asian developing nations. This case presents the fortune of Asian rivals in the electronics business that made Philips and Panasonic to redesign and reform their global tactics for long-term sustainable occurrence in the emerging economies market. Further, it also discusses the reasons behind their current mode of business and post deal issues. Expected learning outcomes: This case describes a way to impart the managerial and leadership strategies from the regular business operations happening in and around the world. -

Sega Special Back to Skool Mortal Kombat Gaming Ages

RG17 Cover UK.qxd:RG17 Cover UK.qxd 20/9/06 16:09 Page 1 retro gamer COMMODORE • SEGA • NINTENDO • ATARI • SINCLAIR • ARCADE * VOLUME TWO ISSUE FIVE Sega Special Game Gear, Mega-CD & Sonic Back to Skool ...with the game’s creators Gaming Ages Dawn of the digital era Mortal Kombat Blood ‘n’ guts gaming Retro Gamer 17 £5.99 UK $14.95 AUS V2 $27.70 NZ 05 Untitled-1 1 1/9/06 12:55:47 RG17 Intro/Contents.qxd:RG17 Intro/Contents.qxd 20/9/06 16:27 Page 3 <EDITORIAL> Editor = Martyn "Faxe & Dab" Carroll ([email protected]) Deputy Editor = Aaron Birch ([email protected]) Art Editor = Craig Chubb Sub Editors = Rachel White + James Clark Contributors = Alicia Ashby + Roy Birch Simon Brew + Richard Burton Jonti Davies + Adam Dawes Paul Drury + Frank Gasking Mark Green + Damien Kapa Craig LewisPer + Arne Sandvik Spanner Spencer + John Szczepaniak <PUBLISHING & ADVERTISING> Operations Manager = Glen Urquhart Group Sales Manager = Linda Henry Advertising Sales = Danny Bowler Accounts Manager = ow great are normally a problem in Retro take place in Kenilworth. Details Karen Battrick magazines? You Gamer, as by its very nature the are a bit thin on the ground at the Circulation Manager = hellocan buy them in a contents aren’t time-sensitive, but moment, but seeing as you’re Steve Hobbs Marketing Manager = shop, take them occasionally some of the things reading this in the future, further Iain "Chopper" Anderson H home, carry them we report can be a little old hat details are probably all over the Editorial Director = from room to room, read them at by the time you read them. -

Philips 2017 Annual Report

Investor Relations 15.1 In 2017, a dividend of EUR 0.80 per common share was Exchange rate (based on the “Noon Buying Rate”) EUR per USD paid in cash or shares, at the option of the shareholder. 2013 - 2017 For 48.3% of the shares, the shareholders elected for a period end average high low share dividend, resulting in the issue of 11,264,163 new 2013 0.7257 0.7532 0.7828 0.7238 common shares, leading to a 1.2% dilution. EUR 384 2014 0.8264 0.7533 0.8264 0.7180 million was paid in cash. See also section 3.5, Proposed 2015 0.9209 0.9018 0.9502 0.8323 distribution to shareholders, of this Annual Report. 2016 0.9477 0.9037 0.9639 0.8684 2017 0.8318 0.8867 0.9601 0.8305 ex-dividend date record date payment date Exchange rate per month (based on the “Noon Buying Euronext Rate”) EUR per USD Amsterdam May 7, 2018 May 8, 2018 June 6, 2018 2017 - 2018 New York highest rate lowest rate Stock Exchange May 7, 2018 May 8, 2018 June 6, 2018 August, 2017 0.8545 0.8316 September, 2017 0.8513 0.8305 October, 2017 0.8636 0.8441 Philips Group November, 2017 0.8638 0.8378 Dividend and dividend yield per common share 2008 - 2018 December, 2017 0.8529 0.8318 January, 2018 0.8388 0.8008 5.1% 4.6% 3.4% 3.3% 3.8% 3.3% 3.4% 2.4% 3.0% 2.8% 2.5% Yield in %1) Unless otherwise stated, for the convenience of the 2) 0.80 0.80 0.80 0.80 0.80 Dividend per reader, the translations of euros into US dollars 0.75 0.75 0.75 0.70 0.70 0.70 share in EUR appearing in this section have been made based on the closing rate on December 31, 2017 (USD 1 = EUR 0.8365). -

Technology Transfer Experiences at Philips and It's Spinoff's

Technology Transfer Conference Ljubljana 2011 Technology Transfer Experiences at Philips and it’s Spinoff’s Leon Tossaint former VP Philips Consumer Electronics Honourable Board Member SFPO Tossaint 4 Excellence 1 Royal Philips Electronics • Founded in 1891 by Gerard and Anton Philips Headquarters: • One of the largest global electronics companies with sales of around € 26 Billion Amsterdam, The • Profitable : € 1.446 million in Netherlands 2010 • Multinational workforce of around 120.000 employees • Active in the areas of Healthcare, Consumer Lifestyle and Lighting • Present in over 60 countries Tossaint 4 Excellence 2 Philips • is everywhere you go on the planet : products are sold in 200 countries • is ranked in the ‘top 50’ of world leading brands • is ranked in the global ‘top 50’ list of ‘Worlds Most Attractive Employers’ • is ranked in 2010 by Dow Jones as the global leader in sustainability • is a global top 3 player in healthcare • is number 1 in the global lighting market (50% bigger than nr 2) • is number 1 globally in electric shavers • is global market leader in automotive lighting Tossaint 4 Excellence 3 Philips, main Inventions • Compact Audio Cassette invented in 1962, which became world standard • Video Cassette, ‘Video 2000’, technically superior, VHS with better marketing became world standard • Compact Disc (CD), in 1982 together with Sony, became world standard • Digital Video Disc (DVD), in 1995, together with the entire computer and Consumer Electronic Industry • Blu-ray Disk, primarily developed by Philips and -

Cultuurwandel4daagse Dag 2 Beelden THEATER

cultuurwandel4daagse dag 2 beelden ± 6,5 km PARK EINDHOVEN THEATER PARK EINDHOVEN THEATER parktheater.nl cultuurwandel4daagse dag 2 beelden Rug naar het theater; oversteken en links op Dr. Schaepmanlaan - brug over en rechts het - Anne Frankplantsoen in 1. Anne Frank monument Rechts bij Jan Smitzlaan - links bij Jacob Catslaan het wandelpad volgen naar tuin bij Van Abbemuseum 2. Balzac Via Wal naar Stadhuisplein 3. Bevrijdingsmonument met soldaat, een burger en een verzetsstrijder Stadhuisplein oversteken - links Begijnhof - langs Catharinakerk naar hoek Rambam (Rechtestraat) (bovenaan op de de hoek van het gebouw) 4. Gaper Door de Rechtestraat - rechts bij Jan van Hooffstraat - over de Markt 5. Frits Philips 6. Jan van Hooff Links bij Vrijstraat - via Vrijstraat - rechts Nieuwe Emmasingel - langs het Philipsmuseum 7. Lampenmaakstertje Langs het Philipsmuseum en rechts bij Emmasingel 8. hoek Admirant; Dragers van het licht Links bij Mathildelaan naar Philipsstadion 9. Coen Dillen & Willy v/d Kuijlen Kruispunt weer oversteken en via Elisabeth tunnel (onder het spoor door) - rechts bij ’t Eindje en het Fellenoorpad verder volgen - rechts naar Vestdijktunnel 10. Vestdijktunnel noordzijde, v.l.n.r.: Het Geluid (vrouw met schelp) / De Tabak (man) / De Textiel (vrouw met doek) Vestdijktunnel zuidzijde, v.l.n.r. Het Verkeer (vrouw met wiel) / Het jonge bloeiende Eindhoven (vrouw met twee kinderen) / De Handel (Mercurius met gevleugelde helm en caducus) Vestdijktunnel vervolgen - richting 18 Septemberplein 11. Figurengroep van Mario Negri Oversteken naar het station - recht voor het station 12. Anton Philips Recht voor het station oversteken - Stationsplein - links bij Dommelstraat - rechts bij Tramstraat - naar Augustijnenkerk 13. Heilig Hartbeeld op de Augustijnenkerk Langs Augustijnenkerk - links kanaalstraat - over de Dommel rechts naar Bleekstraat - rechtdoor Bleekweg - links bij Stratumsedijk - doorlopen naar Joriskerk 14. -

The Birth of a Lamp Factory in 1891

222 PHILIPS TECHNICAL REVIEW VOLUME 23 THE BIRTH OF A LAMP FACTORY IN 1891 by N. A. HALBERTSMA *). 621.326.6(091) The writing of history depends on a certain degree and electricity, on the other hand, were used in the . of good fortune. Anyone taking a momentous ini-, first place for lighting. tiative, a man obsessed with an idea and struggling Oil lamps were of course known in antiquity. to give it form and substance, does not generally At the end of the 18th and the beginning of the feel the urge to set down his motives on paper or 19th century a variety of refined forms came on to describe the conditions in which he embarks on the scene. In 1813gas light made its appearance in the his work, revealing the opportunities, desiderata streets of London and Paris, and Berlin followed in and limitations of his day and age. Consequently 1826. Gas lighting in streets and houses was made the historian; who obviously cannot be content possible by the distribution of the gas from the gas- with extracting bare facts and relevant data from works through a network of pipes all over the town. official documents, but who seeks to reconstruct In London some 25 miles of gas mains had been laid motives and circumstances, usually has to rely on by the end of 1815. implicit information from many and various sour- The fundamental discoveries relating to the gener- ces, in particular from contemporary records that ation of electricity and the production of electric light chance to have heen preserved.