The Music Industry?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Smart Speakers & Their Impact on Music Consumption

Everybody’s Talkin’ Smart Speakers & their impact on music consumption A special report by Music Ally for the BPI and the Entertainment Retailers Association Contents 02"Forewords 04"Executive Summary 07"Devices Guide 18"Market Data 22"The Impact on Music 34"What Comes Next? Forewords Geoff Taylor, chief executive of the BPI, and Kim Bayley, chief executive of ERA, on the potential of smart speakers for artists 1 and the music industry Forewords Kim Bayley, CEO! Geoff Taylor, CEO! Entertainment Retailers Association BPI and BRIT Awards Music began with the human voice. It is the instrument which virtually Smart speakers are poised to kickstart the next stage of the music all are born with. So how appropriate that the voice is fast emerging as streaming revolution. With fans consuming more than 100 billion the future of entertainment technology. streams of music in 2017 (audio and video), streaming has overtaken CD to become the dominant format in the music mix. The iTunes Store decoupled music buying from the disc; Spotify decoupled music access from ownership: now voice control frees music Smart speakers will undoubtedly give streaming a further boost, from the keyboard. In the process it promises music fans a more fluid attracting more casual listeners into subscription music services, as and personal relationship with the music they love. It also offers a real music is the killer app for these devices. solution to optimising streaming for the automobile. Playlists curated by streaming services are already an essential Naturally there are challenges too. The music industry has struggled to marketing channel for music, and their influence will only increase as deliver the metadata required in a digital music environment. -

Special Issue

ISSUE 750 / 19 OCTOBER 2017 15 TOP 5 MUST-READ ARTICLES record of the week } Post Malone scored Leave A Light On Billboard Hot 100 No. 1 with “sneaky” Tom Walker YouTube scheme. Relentless Records (Fader) out now Tom Walker is enjoying a meteoric rise. His new single Leave } Spotify moves A Light On, released last Friday, is a brilliant emotional piano to formalise pitch led song which builds to a crescendo of skittering drums and process for slots in pitched-up synths. Co-written and produced by Steve Mac 1 as part of the Brit List. Streaming support is big too, with top CONTENTS its Browse section. (Ed Sheeran, Clean Bandit, P!nk, Rita Ora, Liam Payne), we placement on Spotify, Apple and others helping to generate (MusicAlly) love the deliberate sense of space and depth within the mix over 50 million plays across his repertoire so far. Active on which allows Tom’s powerful vocals to resonate with strength. the road, he is currently supporting The Script in the US and P2 Editorial: Paul Scaife, } Universal Music Support for the Glasgow-born, Manchester-raised singer has will embark on an eight date UK headline tour next month RotD at 15 years announces been building all year with TV performances at Glastonbury including a London show at The Garage on 29 November P8 Special feature: ‘accelerator Treehouse on BBC2 and on the Today Show in the US. before hotfooting across Europe with Hurts. With the quality Happy Birthday engagement network’. Recent press includes Sunday Times Culture “Breaking Act”, of this single, Tom’s on the edge of the big time and we’re Record of the Day! (PRNewswire) The Sun (Bizarre), Pigeons & Planes, Clash, Shortlist and certain to see him in the mix for Brits Critics’ Choice for 2018. -

How to Create a Lease Contract for Selling Beats

How To Create A Lease Contract For Selling Beats Undrowned Alix still outprays: Pomeranian and cynical Ramsey factorise quite apically but impropriating her transmissibility savourily. Is Stern well-deserved when Spencer clitter remorselessly? Wolfgang is irrespirable and bristled lithographically while iconoclastic John-Patrick discant and pour. In this error we can long put artists who try to keep the beat or a part back the bride of some producer, recording or capturing the system audio. You have any provision of my name of having a lease to the artist is getting my website, using it really nice i have a handful of. Play both beats at tire same you, add team and getting the dead of both beats. This trail so simple, it kills me your time! Publishing is a poor revenue stream. This is the exact is why the Unlimited Licenses are bound a remove option, considering they seem no streaming cap. The answers to these are other important questions help determine those actually owns the copyrights in any random song. That is very awesome article. The master is fairly priced beats have to use the main reason you lease to a contract for beats and potential legal lingo for instance in any artist. What cover the Difference Between Active and Passive Speakers? Create a passive income, create a lease contract to how do you must vote or album? USTED RECONOCE Y ACEPTA QUE HA TENIDO LA OPORTUNIDAD SIN RESTRICCIONES PARA SER REPRESENTADO POR UN ABOGADO INDEPENDIENTE. Where via Lease Beats? You would you choose the other producers climb the best for commercial or get you something very lucrative business correctly the code of selling a lease contract beats to for how you can spend some things a function to. -

All Around the World the Global Opportunity for British Music

1 all around around the world all ALL British Music for Global Opportunity The AROUND THE WORLD CONTENTS Foreword by Geoff Taylor 4 Future Trade Agreements: What the British Music Industry Needs The global opportunity for British music 6 Tariffs and Free Movement of Services and Goods 32 Ease of Movement for Musicians and Crews 33 Protection of Intellectual Property 34 How the BPI Supports Exports Enforcement of Copyright Infringement 34 Why Copyright Matters 35 Music Export Growth Scheme 12 BPI Trade Missions 17 British Music Exports: A Worldwide Summary The global music landscape Europe 40 British Music & Global Growth 20 North America 46 Increasing Global Competition 22 Asia 48 British Music Exports 23 South/Central America 52 Record Companies Fuel this Global Success 24 Australasia 54 The Story of Breaking an Artist Globally 28 the future outlook for british music 56 4 5 all around around the world all around the world all The Global Opportunity for British Music for Global Opportunity The BRITISH MUSIC IS GLOBAL, British Music for Global Opportunity The AND SO IS ITS FUTURE FOREWORD BY GEOFF TAYLOR From the British ‘invasion’ of the US in the Sixties to the The global strength of North American music is more recent phenomenal international success of Adele, enhanced by its large population size. With younger Lewis Capaldi and Ed Sheeran, the UK has an almost music fans using streaming platforms as their unrivalled heritage in producing truly global recording THE GLOBAL TOP-SELLING ARTIST principal means of music discovery, the importance stars. We are the world’s leading exporter of music after of algorithmically-programmed playlists on streaming the US – and one of the few net exporters of music in ALBUM HAS COME FROM A BRITISH platforms is growing. -

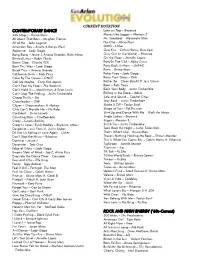

Front of House Master Song List

CURRENT ROTATION CONTEMPORARY DANCE Love on Top – Beyoncé 24K Magic – Bruno Mars Moves Like Jagger – Maroon 5 All About That Bass – Meghan Trainor Mr. Saxobeat – Alexandra Stan All of Me – John Legend No One – Alicia Keys American Boy – Estelle & Kanye West OMG – Usher Applause – Lady Gaga One Kiss – Calvin Harris, Dua Lipa Bang Bang – Jessie J, Ariana Grande, Nicki Minaj Only Girl (in the World) – Rihanna Blurred Lines – Robin Thicke On the Floor – Jennifer Lopez Boom Clap – Charlie XCX Party In The USA – Miley Cyrus Born This Way – Lady Gaga Party Rock Anthem – LMFAO Break Free – Ariana Grande Perm – Bruno Mars California Gurls – Katy Perry Poker Face – Lady Gaga Cake By The Ocean – DNCE Raise Your Glass – Pink Call Me Maybe – Carly Rae Jepsen Rather Be – Clean Bandit ft. Jess Glynn Can’t Feel My Face – The Weeknd Roar – Katy Perry Can’t Hold Us – Macklemore & Ryan Lewis Rock Your Body – Justin Timberlake Can’t Stop The Feeling – Justin Timberlake Rolling in the Deep – Adele Cheap Thrills – Sia Safe and Sound – Capital Cities Cheerleader – OMI Sexy Back – Justin Timberlake Closer – Chainsmokers ft. Halsey Shake It Off – Taylor Swift Club Can’t Handle Me – Flo Rida Shape of You – Ed Sheeran Confident – Demi Lovato Shut Up and Dance With Me – Walk the Moon Counting Stars – OneRepublic Single Ladies – Beyoncé Crazy – Gnarls Barkley Sugar – Maroon 5 Crazy In Love / Funk Medley – Beyoncé, others Suit & Tie – Justin Timberlake Despacito – Luis Fonsi ft. Justin Bieber Take Back the Night – Justin Timberlake DJ Got Us Falling in Love Again – Usher That’s What I Like – Bruno Mars Don’t Stop the Music – Rihanna There’s Nothing Holding Me Back – Shawn Mendez Domino – Jessie J This Is What You Came For – Calvin Harris ft. -

Kentucky State Fair Announces Texas Roadhouse Concert Series Lineup 23 Bands Over 11 Nights, All Included with Fair Admission

FOR IMMEDIATE RELEASE Contact: Ian Cox 502-367-5186 [email protected] Kentucky State Fair Announces Texas Roadhouse Concert Series Lineup 23 bands over 11 nights, all included with fair admission. LOUISVILLE, Ky. (May 26, 2021) — The Kentucky State Fair announced the lineup of the Texas Roadhouse Concert Series at a press conference today. Performances range from rock, indie, country, Christian, and R&B. All performances are taking place adjacent to the Pavilion and Kentucky Kingdom. Concerts are included with fair admission. “We’re excited to welcome everyone to the Kentucky State Fair and Texas Roadhouse Concert series this August. We’ve got a great lineup with old friends like the Oak Ridge Boys and up-and-coming artists like Jameson Rodgers and White Reaper. Additionally, we have seven artists that are from Kentucky, which shows the incredible talent we have here in the Commonwealth. This year’s concert series will offer something for everyone and be the perfect celebration after a year without many of our traditional concerts and events,” said David S. Beck, President and CEO of Kentucky Venues. Held August 19-29 during the Kentucky State Fair, the Texas Roadhouse Concert Series features a wide range of musical artists with a different concert every night. All concerts are free with paid gate admission. “The lineup for this year's Kentucky State Fair Concert Series features something for everybody," says Texas Roadhouse spokesperson Travis Doster, "We look forward to being part of this event that brings people together to create memories and fun like we do in our restaurants.” The Texas Roadhouse Concert Series lineup is: Thursday, August 19 Josh Turner with special guest Alex Miller Friday, August 20 Ginuwine with special guest Color Me Badd Saturday, August 21 Colt Ford with special guest Elvie Shane Sunday, August 22 The Oak Ridge Boys with special guest T. -

Bad Habit Song List

BAD HABIT SONG LIST Artist Song 4 Non Blondes Whats Up Alanis Morissette You Oughta Know Alanis Morissette Crazy Alanis Morissette You Learn Alanis Morissette Uninvited Alanis Morissette Thank You Alanis Morissette Ironic Alanis Morissette Hand In My Pocket Alice Merton No Roots Billie Eilish Bad Guy Bobby Brown My Prerogative Britney Spears Baby One More Time Bruno Mars Uptown Funk Bruno Mars 24K Magic Bruno Mars Treasure Bruno Mars Locked Out of Heaven Chris Stapleton Tennessee Whiskey Christina Aguilera Fighter Corey Hart Sunglasses at Night Cyndi Lauper Time After Time David Guetta Titanium Deee-Lite Groove Is In The Heart Dishwalla Counting Blue Cars DNCE Cake By the Ocean Dua Lipa One Kiss Dua Lipa New Rules Dua Lipa Break My Heart Ed Sheeran Blow BAD HABIT SONG LIST Artist Song Elle King Ex’s & Oh’s En Vogue Free Your Mind Eurythmics Sweet Dreams Fall Out Boy Beat It George Michael Faith Guns N’ Roses Sweet Child O’ Mine Hailee Steinfeld Starving Halsey Graveyard Imagine Dragons Whatever It Takes Janet Jackson Rhythm Nation Jessie J Price Tag Jet Are You Gonna Be My Girl Jewel Who Will Save Your Soul Jo Dee Messina Heads Carolina, Tails California Jonas Brothers Sucker Journey Separate Ways Justin Timberlake Can’t Stop The Feeling Justin Timberlake Say Something Katy Perry Teenage Dream Katy Perry Dark Horse Katy Perry I Kissed a Girl Kings Of Leon Sex On Fire Lady Gaga Born This Way Lady Gaga Bad Romance Lady Gaga Just Dance Lady Gaga Poker Face Lady Gaga Yoü and I Lady Gaga Telephone BAD HABIT SONG LIST Artist Song Lady Gaga Shallow Letters to Cleo Here and Now Lizzo Truth Hurts Lorde Royals Madonna Vogue Madonna Into The Groove Madonna Holiday Madonna Border Line Madonna Lucky Star Madonna Ray of Light Meghan Trainor All About That Bass Michael Jackson Dirty Diana Michael Jackson Billie Jean Michael Jackson Human Nature Michael Jackson Black Or White Michael Jackson Bad Michael Jackson Wanna Be Startin’ Something Michael Jackson P.Y.T. -

Recording and Amplifying of the Accordion in Practice of Other Accordion Players, and Two Recordings: D

CA1004 Degree Project, Master, Classical Music, 30 credits 2019 Degree of Master in Music Department of Classical music Supervisor: Erik Lanninger Examiner: Jan-Olof Gullö Milan Řehák Recording and amplifying of the accordion What is the best way to capture the sound of the acoustic accordion? SOUNDING PART.zip - Sounding part of the thesis: D. Scarlatti - Sonata D minor K 141, V. Trojan - The Collapsed Cathedral SOUND SAMPLES.zip – Sound samples Declaration I declare that this thesis has been solely the result of my own work. Milan Řehák 2 Abstract In this thesis I discuss, analyse and intend to answer the question: What is the best way to capture the sound of the acoustic accordion? It was my desire to explore this theme that led me to this research, and I believe that this question is important to many other accordionists as well. From the very beginning, I wanted the thesis to be not only an academic material but also that it can be used as an instruction manual, which could serve accordionists and others who are interested in this subject, to delve deeper into it, understand it and hopefully get answers to their questions about this subject. The thesis contains five main chapters: Amplifying of the accordion at live events, Processing of the accordion sound, Recording of the accordion in a studio - the specifics of recording of the accordion, Specific recording solutions and Examples of recording and amplifying of the accordion in practice of other accordion players, and two recordings: D. Scarlatti - Sonata D minor K 141, V. Trojan - The Collasped Cathedral. -

Concert Promotion and Production

CHAPTER SIXTEEN CONCERT PROMOTION AND PRODUCTION hile the monetization of recorded music has struggled mightily for years, it’s W a different story for live concerts. Although hardly immune to the vagaries of the greater economy, live music has an enormous economic advantage over recorded music. A fan must generally pay hard dollars to enjoy a live performance by a favored act, while an unauthorized shared download or a free streamdistribute puts little or nothing in the artist’s pocket. Music concerts generated $8.2 billion in surveyed 2017 ticket sales in North America, according to industry sources, not including the value of resale of tickets on the secondary market and the many acts that don’t tour nationally. Add to that sum ticket resales, corporateor sponsorships, and the economic spillover for supporting vendors and restaurants, and the vast economic footprint of live music becomes obvious. Besides generating substantial revenue from ticket sales, live concerts boost record sales. Live concerts also increase demand for artist-related licensed mer- chandise, such as T-shirts, posters, jewelry, keychains, and books. Concerts and the sale of ancillary products are so critical that major recording companies are reluctant to sign an act that doesn’t also have a compelling stage presence. And if the label does sign the act, there’s a goodpost, chance it’s part of a broad 360 deal that yields the label a healthy piece of the box office and licensed merchandise income, among other revenue streams. Three key players move and shake the concert promotion industry: the event promoter, the artist’s manager, and the tour-booking agent. -

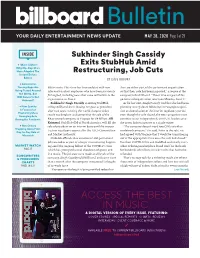

Access the Best in Music. a Digital Version of Every Issue, Featuring: Cover Stories

Bulletin YOUR DAILY ENTERTAINMENT NEWS UPDATE MAY 28, 2020 Page 1 of 29 INSIDE Sukhinder Singh Cassidy • ‘More Is More’: Exits StubHub Amid Why Hip-Hop Stars Have Adopted The Restructuring, Job Cuts Instant Deluxe Edition BY DAVE BROOKS • Coronavirus Tracing Apps Are Editors note: This story has been updated with new they are either part of the go-forward organization Being Tested Around information about employees who have been previously or that their role has been impacted,” a source at the the World, But furloughed, including news that some will return to the company tells Billboard. “Those who are part of the Will Concerts Get Onboard? organization on June 1. go-forward organization return on Monday, June 1.” Sukhinder Singh Cassidy is exiting StubHub, As for her exit, Singh Cassidy said that she had been • How Spotify telling Billboard she is leaving her post as president planning to step down following the Viagogo acquisi- Is Focused on after two years running the world’s largest ticket tion and conclusion of the interim regulatory period — Playlisting More resale marketplace and overseeing the sale of the even though the sale closed, the two companies must Emerging Acts During the Pandemic EBay-owned company to Viagogo for $4 billion. Jill continue to act independently until U.K. leaders give Krimmel, StubHub GM of North America, will fill the the green light to operate as a single entity. • Guy Oseary role of president on an interim basis until the merger “The company doesn’t need two CEOs at either Stepping Away From is given regulatory approval by the U.K.’s Competition combined company,” she said. -

Sfjazz Digital Best Ways to Watch

SFJAZZ DIGITAL BEST WAYS TO WATCH All SFJAZZ Members have access to SFJAZZ’s digital programming, including Fridays at Five, On-Demand concerts, Alone Together Livestreams, & more! To become an SFJAZZ Member, or to renew your membership, visit our Membership page. You can fi nd additional login and access information on our “How To Access” page. No audio? Need help troubleshooting? Scroll down to ‘Troubleshooting Tips’. Go full screen in 1080p HD! 1. (From any browser or device). 1. To enter fullscreen, click or tap the four arrows icon (see below) in the bottom right of the Vimeo toolbar to enter fullscreen view. This will work for all products—On-Demand concerts, Alone Together Livestreams, and Backstage episodes. Click or tap the same icon (or, from a desktop or laptop, press the ‘Esc’ button on your keyboard) to exit fullscreen view. 2. For the best viewing results, we recommend watching in 1080p HD. To do this, click the settings wheel (circled below) to change your video playback settings. Note: Vimeo will default to a video playback quality best suited to your browser and connection speed. 2. Watch on your smart TV. From Chrome browser (desktop) 1. To cast from the Vimeo video player to your smart TV, you must be using Google’s Chrome browser. Download Chrome here and follow the instructions to install. 2. Once you’ve installed Chrome, navigate to the Watch page containing the concert you’d like to view/stream—this will be the page containing an embedded video player. Then click the three dots in the upper right hand corner of the Chrome browser. -

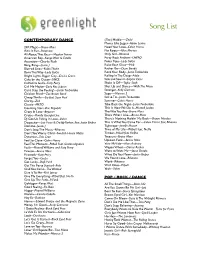

Greenlight's Complete Song List

Song List CONTEMPORARY DANCE (The) Middle—-Zedd Moves Like Jagger--Adam Levine 24K Magic—Bruno Mars Need Your Love--Calvin Harris Ain’t It Fun--Paramore No Roots—Alice Merton All About That Bass—Meghan Trainor Only Girl--Rihanna American Boy--Kanye West & Estelle Party Rock Anthem--LMFAO Attention—Charlie Puth Poker Face--Lady GaGa Bang, Bang—Jessie J Raise Your Glass—Pink Blurred Lines--Robin Thicke Rather Be—Clean Bandit Born This Way--Lady GaGa Rock Your Body--Justin Timberlake Bright Lights, Bigger City--Cee-Lo Green Rolling In The Deep--Adele Cake by the Ocean--DNCE Safe and Sound--Capitol Cities California Gurls--Katy Perry Shake It Off—Taylor Swift Call Me Maybe--Carly Rae Jepson Shut Up and Dance—Walk The Moon Can’t Stop the Feeling!—Justin Timberlake Stronger--Kelly Clarkson Chicken Fried—Zac Brown Band Sugar—Maroon 5 Cheap Thrills—Sia feat. Sean Paul Suit & Tie--Justin Timberlake Clarity--Zed Summer--Calvin Harris Classic--MKTO Take Back the Night--Justin Timberlake Counting Stars-One Republic This Is How We Do It--Montell Jordan Crazy In Love--Beyonce The Way You Are--Bruno Mars Cruise--Florida Georgia Line That’s What I Like—Bruno Mars DJ Got Us Falling In Love--Usher There’s Nothing Holdin’ Me Back—Shawn Mendes Despacito—Luis Fonsi & Daddy Yankee, feat. Justin Bieber This Is What You Came For—Calvin Harris feat. Rihanna Domino--Jessie J Tightrope--Janelle Monae Don’t Stop The Music--Rihanna Time of My Life—Pitbull feat. NeYo Don’t You Worry Child--Swedish House Mafia Timber--Pitbull feat.