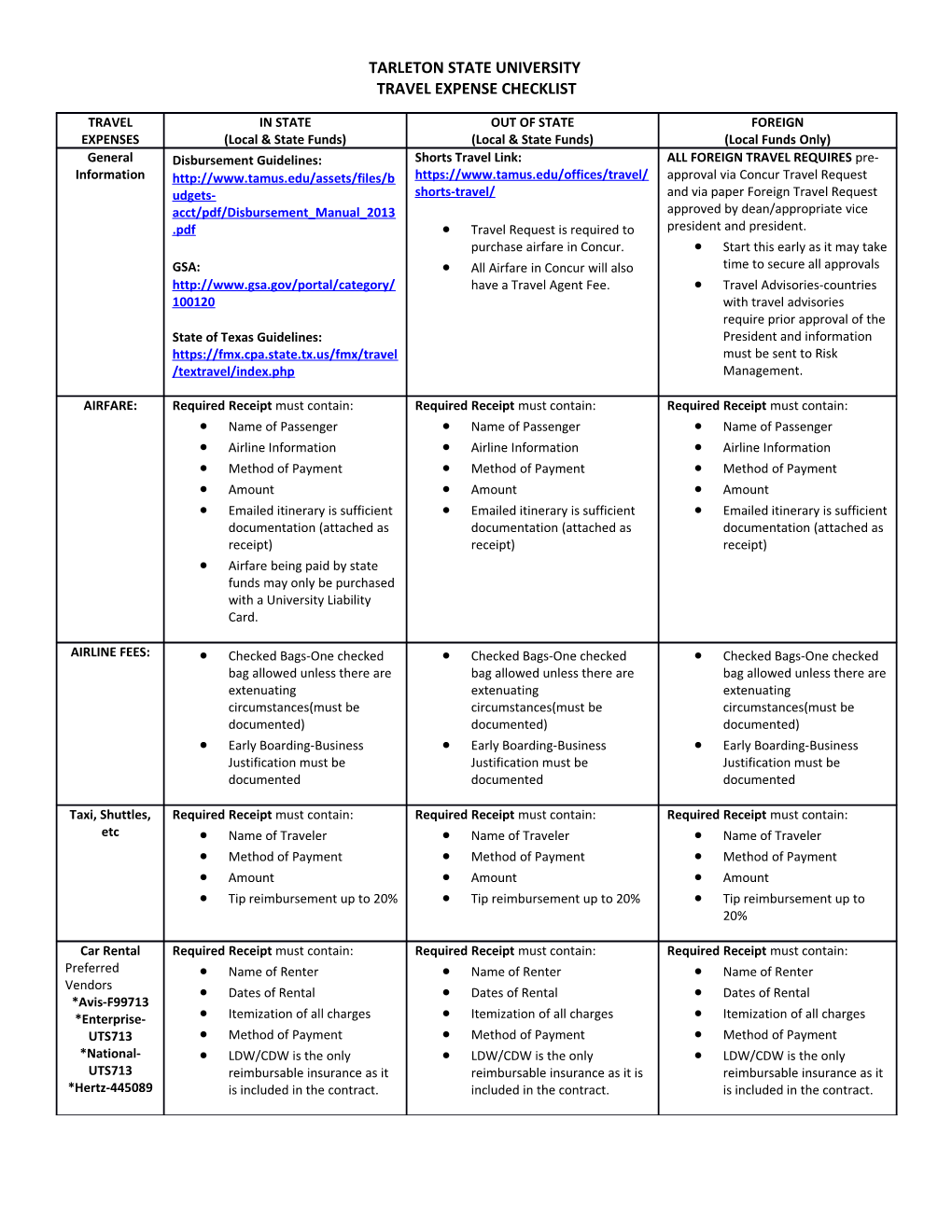

TARLETON STATE UNIVERSITY TRAVEL EXPENSE CHECKLIST

TRAVEL IN STATE OUT OF STATE FOREIGN EXPENSES (Local & State Funds) (Local & State Funds) (Local Funds Only) General Disbursement Guidelines: Shorts Travel Link: ALL FOREIGN TRAVEL REQUIRES pre- Information http://www.tamus.edu/assets/files/b https://www.tamus.edu/offices/travel/ approval via Concur Travel Request udgets- shorts-travel/ and via paper Foreign Travel Request acct/pdf/Disbursement_Manual_2013 approved by dean/appropriate vice .pdf Travel Request is required to president and president. purchase airfare in Concur. Start this early as it may take GSA: All Airfare in Concur will also time to secure all approvals http://www.gsa.gov/portal/category/ have a Travel Agent Fee. Travel Advisories-countries 100120 with travel advisories require prior approval of the State of Texas Guidelines: President and information https://fmx.cpa.state.tx.us/fmx/travel must be sent to Risk /textravel/index.php Management.

AIRFARE: Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: Name of Passenger Name of Passenger Name of Passenger Airline Information Airline Information Airline Information Method of Payment Method of Payment Method of Payment Amount Amount Amount Emailed itinerary is sufficient Emailed itinerary is sufficient Emailed itinerary is sufficient documentation (attached as documentation (attached as documentation (attached as receipt) receipt) receipt) Airfare being paid by state funds may only be purchased with a University Liability Card.

AIRLINE FEES: Checked Bags-One checked Checked Bags-One checked Checked Bags-One checked bag allowed unless there are bag allowed unless there are bag allowed unless there are extenuating extenuating extenuating circumstances(must be circumstances(must be circumstances(must be documented) documented) documented) Early Boarding-Business Early Boarding-Business Early Boarding-Business Justification must be Justification must be Justification must be documented documented documented

Taxi, Shuttles, Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: etc Name of Traveler Name of Traveler Name of Traveler Method of Payment Method of Payment Method of Payment Amount Amount Amount Tip reimbursement up to 20% Tip reimbursement up to 20% Tip reimbursement up to 20%

Car Rental Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: Preferred Name of Renter Name of Renter Name of Renter Vendors Dates of Rental Dates of Rental Dates of Rental *Avis-F99713 *Enterprise- Itemization of all charges Itemization of all charges Itemization of all charges UTS713 Method of Payment Method of Payment Method of Payment *National- LDW/CDW is the only LDW/CDW is the only LDW/CDW is the only UTS713 reimbursable insurance as it reimbursable insurance as it is reimbursable insurance as it *Hertz-445089 is included in the contract. included in the contract. is included in the contract. TARLETON STATE UNIVERSITY TRAVEL EXPENSE CHECKLIST

Lodging Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: Name of Guest Name of Guest Name of Guest Itemization of all expenses Itemization of all expenses Itemization of all expenses charged (day by day) charged (day by day) charged (day by day) Method of Payment Method of Payment Method of Payment May not be reimbursed for Texas Hotel Occupancy Tax (state tax)

Meals Must Provide: Must Provide: Must Provide: (Up to Day by Day breakdown for Day by Day breakdown for the Day by Day breakdown for maximum the actual cost of meals actual cost of meals the actual cost of meals based on GSA Tip reimbursement up to 20 Tip reimbursement up to 20 % Tip reimbursement up to 20 Rate) % (please note that tips are (please note that tips are not % not reimbursable on state reimbursable on state funds, If one meal is $75.00 or funds, must use local account must use local account for tips) more then receipt is for tips) If one meal is $75.00 or more required due to IRS If one meal is $75.00 or more then receipt is required due to requirements then receipt is required due IRS requirements to IRS requirements

Mileage Documentation of mileage Same as In state Mileage other Mileage to and from airport must be from: than: (use mileage calculator in (Up to the Concur mileage Calculator Mileage Vs Airfare Cost Concur) Federal Or Comparison must be Mileage Rate) Odometer readings with a completed. Mileage will only point to point breakdown be paid up to the lowest available cost of airfare plus Mileage can be claimed for any rental or in-state mileage one car out of every 4 to get to airport employees that have the same itinerary. Gasoline is not an allowable expense if mileage is being claimed.

Gasoline Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: Name of Traveler Name of Traveler Name of Traveler Amount of Purchase Amount of Purchase Amount of Purchase (if claiming gasoline for (if claiming gasoline for (if claiming gasoline for mileage reimbursement, mileage reimbursement, mileage reimbursement, amount must not exceed the amount must not exceed the amount must not exceed the allowable amount of mileage allowable amount of mileage allowable amount of based on federal mileage based on federal mileage rate) mileage based on federal rate) mileage rate)

Parking Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: Date Date Date Location Location Location Amount for each parking Amount for each parking Amount for each parking expense incurred expense incurred expense incurred

Registration Required Receipt must contain: Required Receipt must contain: Required Receipt must contain: Name of Person Attending Name of Person Attending Name of Person Attending Full Name of Conference (No Full Name of Conference (No Full Name of Conference (No TARLETON STATE UNIVERSITY TRAVEL EXPENSE CHECKLIST

abbreviations) abbreviations) abbreviations) Dates of Conference Dates of Conference Dates of Conference Itinerary or Business Purpose Itinerary or Business Purpose Itinerary or Business of attending Conference of attending Conference Purpose Incidentals: Any other travel related expenses: Any other travel related expenses: Any other travel related expenses: Must document expense was Must document expense was Must document expense (i.e. incurred for a business use. incurred for a business use. was incurred for a business Phone/Interne Must document date and Must document date and use. t amount amount Must document date and Tolls) amount

** Prospective Employees fall under the same guidelines at regular University Employees.

*Valid Exceptions for the purchase of travel services not on the State Travel Management Program Contract. If the cost is less than the contract price the exception does not have to be documented.

1. Unavailability of Contract Services 5. In Travel Status

2. Efficient use of services. 6. Group Program

3. Special Needs, Health, Safety, Physical Disability 7. Emergency Response

4. Custodian of Persons. 8. Legally Required Attendance

T.A.C Rule 125.3