Microcomputer Accounting Applications Computerized Semester Project Fall 2017

Overview/Objectives: The objective of this project is to reinforce the skills you have learned in this course including setting up a new company in QuickBooks and using QuickBooks to enter purchase, sales, inventory, and banking transactions. This project is also intended to enhance your critical thinking skills.

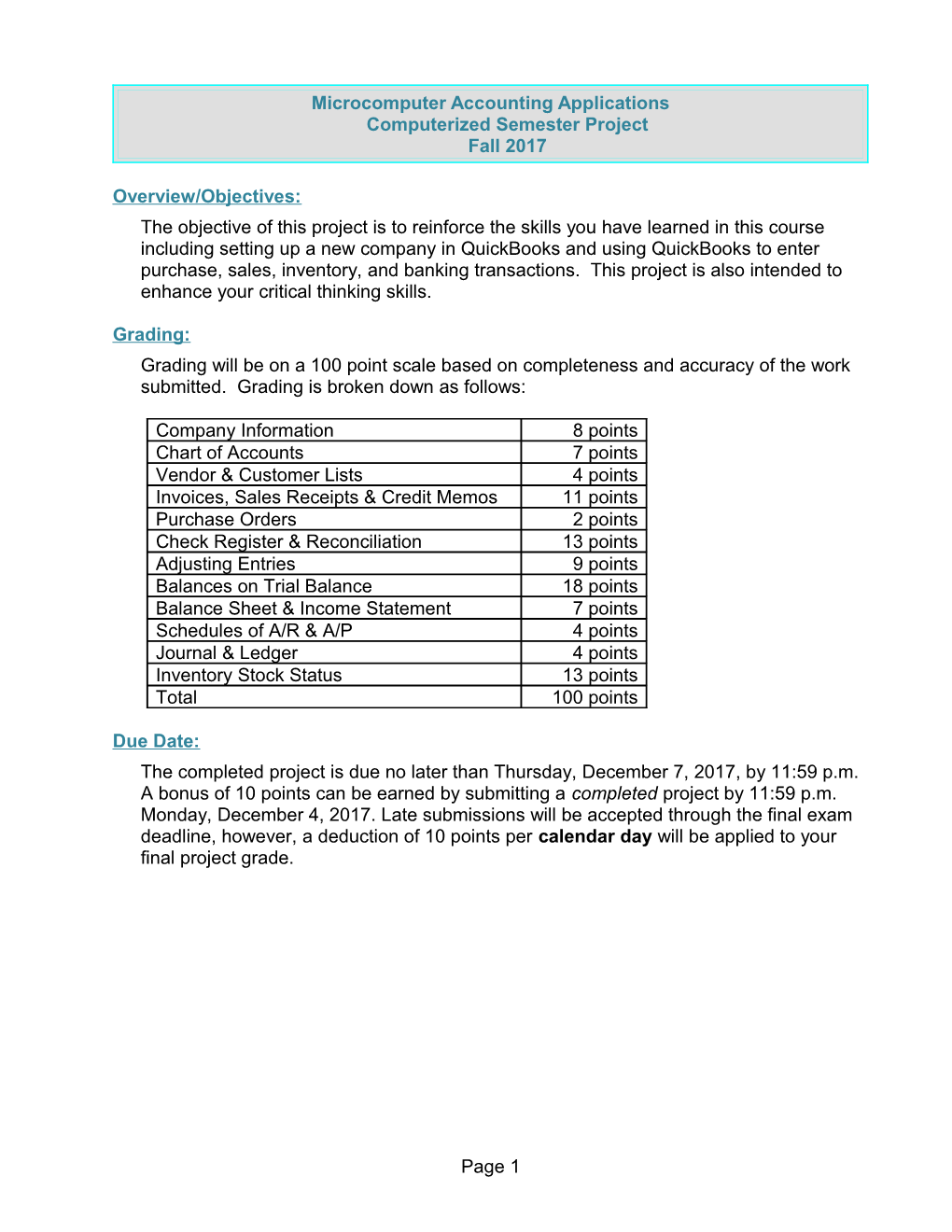

Grading: Grading will be on a 100 point scale based on completeness and accuracy of the work submitted. Grading is broken down as follows:

Company Information 8 points Chart of Accounts 7 points Vendor & Customer Lists 4 points Invoices, Sales Receipts & Credit Memos 11 points Purchase Orders 2 points Check Register & Reconciliation 13 points Adjusting Entries 9 points Balances on Trial Balance 18 points Balance Sheet & Income Statement 7 points Schedules of A/R & A/P 4 points Journal & Ledger 4 points Inventory Stock Status 13 points Total 100 points

Due Date: The completed project is due no later than Thursday, December 7, 2017, by 11:59 p.m. A bonus of 10 points can be earned by submitting a completed project by 11:59 p.m. Monday, December 4, 2017. Late submissions will be accepted through the final exam deadline, however, a deduction of 10 points per calendar day will be applied to your final project grade.

Page 1 Instructions: 1. Read the attached narrative information about Warren Nursery (page 9). 2. Apply the EasyStep Interview tool to set up a QuickBooks file for Warren Nursery. Use your critical thinking skills to extract the information needed in the EasyStep Interview from the narrative information. Additional information is provided below. It is recommended that you read through all the information provided before beginning the interview.

Additional information needed for the EasyStep interview: . While it is a recommended internal control procedure, for purposes of this assignment do not set a password for your QuickBooks file. If a password is assigned to your project, it is an automatic 5 point deduction. . Save the QuickBooks file to a working directory of your choice. Assign the file name Your Name F17. (The file name should be your name: i.e. Sally Smith F17.) . Although this business sells inventory as well as provides some landscaping services, identify the industry as a General Product-based Business. 3. After setting up the new company, edit the chart of accounts as follows: . Edit the Office Supplies account to change the name to Office Supplies Expense . Add an other current asset account named Office Supplies . Add an other current liability account name Unearned Landscaping Revenue . Add an income account named Landscaping Revenue . Add an other current liability account named Notes Payable-Current . Add an other current liability account named Interest Payable . Add a Cost of Goods Sold account named Purchase Discounts

Page 2 Instructions (continued): 4. Enter the customer and vendor information shown below in the appropriate QuickBooks List. Be sure to enter yourself as a customer using your name. You may use fictitious address information. Leave any fields for which you do not have information blank. Vendor List Customer List Summerstone Garden Suppliers James Booker 622 New Hope Road 726 West Sparta Street Harrison, OH 45030-0330 McMinnville, TN 37110 931-555-5441 Pioneer Tree Suppliers 23 Highway 56 Cameron Gracia McMinnville, TN 37110 606 Rivermont Drive McMinnville, TN 37110 Womack’s Farm & Nursery 931-555-8939 1081 Old Mill Road Fayetteville, GA 30215 Kate Edwards McMinnville Electric System 123 College Avenue 510 Main Street Morrison, TN 37357 McMinnville, TN 37110 931-555-8820

Cumberland Water & Sewer Anthony Adams 911 College Street 222 Westwood Avenue McMinnville, TN 37110 McMinnville, TN 37110

City Bank Your Name (student) 246 First Street Address McMinnville, TN 37110

Adamson’s Office Supply 342 Sparta Road McMinnville, TN 37110

Tennessee Department of Revenue 500 Deaderick Street Nashville, TN 37242

Page 3 Instructions (continued): 5. Enter the inventory items indicated below. Set up each category (Shrubs, Trees, etc), but enter no inventory amounts for the main category. Create each specific inventory part as a subitem under the appropriate category. The product description will be the same as the product name. The COGS Account will be Cost of Goods Sold and the Income Account will be Sales. The quantity on hand is as of October 1, 2017. Be very careful to enter the “quantity on hand” and “as of date” data correctly as it is very difficult to correct mistakes in this information later. Pioneer Tree Suppliers is the preferred vendor for dogwood trees. There are no preferred vendors for any other items. Sales Quantity Name Cost Price On Hand Shrubs Lilac $3.25 $11.99 6 on hand Forsythia $5.75 $21.99 9 on hand Hawthorne $4.00 $16.99 3 on hand Hydrangea $5.00 $19.99 10 on hand Butterfly Bush $2.50 $9.99 5 on hand

Trees Dogwood $2.50 $12.00 15 on hand Redbud $5.50 $22.00 5 on hand Sugar Maple $6.25 $26.00 6 on hand

Perennials Day Lilies, Giant $7.00 $29.99 20 on hand Day Lilies, Dwarf $5.50 $25.99 10 on hand Tennessee Iris $1.50 $5.99 30 on hand Moss Phlox $1.99 $7.99 15 on hand

6. Create a Sales Tax item named TN Tax. See the Narrative for more information needed to set up this item. Edit the Preferences for Sales Tax so that TN Tax is the most common sales tax item. 7. Enter the daily transactions for the month of October (not adjusting entries) found on pages 5-6.

Page 4 Transactions for the month of October 2017 Print checks each time bills are paid (remember that checks must be printed in order to assign a check number). Set the first check number to 101. On sales receipts and invoices, make sure that the sales tax is TN Tax.

Oct 5 Received and deposited $8,600 from City Bank in exchange for a 3-month, 9% note. 6 Ordered 45 dogwood trees from Pioneer Tree Suppliers. 8 Sold 4 forsythia bushes to Cameron Gracia who paid at the time of sale. (Make sure that TN Tax is the sales tax.) Transaction total is $96.10. 9 Sold 2 dogwood trees, 4 hydrangeas, 12 Tennessee Iris, and 3 moss phlox to Anthony Adams on account. (Make sure that TN Tax is the sales tax.) Transaction total is $218.29 10 Received the 45 dogwood trees from Pioneer Tree Suppliers along with Invoice 5636 for $112.50, terms 2/10, n/30. 11 Deposited cash sales receipts for the week. 12 Sold 3 butterfly bushes and 5 Tennessee Iris to Cameron Gracia. Customer paid at time of sale. (Make sure that TN Tax is the sales tax.) Transaction total is $65.46. 14 Ordered 50 giant and 35 dwarf day lilies from Summerstone Garden Suppliers. 14 Purchased $400 of supplies from Adamson’s Office Supplies. Paid bill at time of purchase. The office supplies were entered as an asset when purchased. 14 Received and paid the electric bill from McMinnville Electric System, $125. 15 Sold 20 giant day lilies to Kate Edwards. Customer paid at time of sale. (Make sure that TN Tax is the sales tax.) Transaction total is $655.28. 15 Paid Pioneer Tree Suppliers Invoice 5636 within the discount period. The discount account to be used is Purchase Discounts. 15 Received and paid the water bill from Cumberland Water & Sewer, $186. 16 Sold 3 redbud trees and 6 lilac bushes to James Booker on account. (Make sure that TN Tax is the sales tax.) Transaction total is $150.70. 18 Deposited cash sales receipts for the week. 19 Sold 20 dogwood trees to Anthony Adams on account. (Make sure that TN Tax is the sales tax.) 19 Joe Warren withdrew $1,500 for personal use. Write a check to Mr. Warren for the withdrawal (quick-add Joe Warren as an “Other” item.) 20 Sold 5 Sugar Maple trees to James Booker on account. (Make sure that TN Tax is the sales tax.) Transaction total is $142.03.

Page 5 Transactions for the month of October 2017 (continued): 22 Received a call from Anthony Adams who had just received his bill. He stated that Mr. Warren had agreed to sell the trees for $8 a piece which totals $160 plus tax. Mr. Warren confirmed this and stated that a corrected invoice should be issued on this sale. Void the original invoice sent to Mr. Adams and create a new invoice for Mr. Adams charging the discounted price for the dogwood trees. Transaction total is $174.80. 23 Received the 50 giant day lilies from Summerstone Garden Suppliers along with invoice WN123 for $350.00, terms Net 30. Did not receive any dwarf day lilies that were ordered. 23 Contracted with James Booker to perform landscaping services at a price of $2,800. James paid the full $2,800 but the work will be performed over the next 4 weeks. Record the receipt of the $2,800 as a Deposit in the Banking Navigator. Use the Unearned Landscaping Revenue account. 25 Sold 6 Tennessee iris and 2 moss phlox on account to (student). The customer will be you – select the customer account you set up for yourself in Step 4. (Make sure that TN Tax is the sales tax.) Transaction total is $56.72. 26 James Booker called. Two of the sugar maple trees sold to him on the 20th died. Warren Nursery agrees to issue a credit for the dead trees in the amount of $56.81 (the sales price plus sales tax) to be applied against outstanding invoice #4. 27 Received payment of $235.92 from James Booker for Invoices #2 & #4. Invoice #4 is for the sugar maples and credit has been given for two dead trees. 28 Sold 2 hydrangea bushes to Cameron Gracia on account. (Make sure that TN Tax is the sales tax.) Transaction total is $43.68. 29 Sold 3 moss phlox to Kate Edwards. Customer paid at time of sale. (Make sure that TN Tax is the sales tax.) Transaction total is $26.19. 30 Deposited all funds received for the week. 30 Remitted sales tax collected for October to the Tennessee Department of Revenue. 30 See Instruction #9 on page 7. Received the bank statement dated 10/20/17. Reconciled the bank statement.

Page 6 Instructions (continued): 9. Prepare a bank reconciliation using information from the attached Bank Statement. Memorize the Reconciliation Summary Report.

City Bank Bank Statement

Warren Nursery, Account TZ888 Period: 09/21/17 -10/20/17

Previous Balance $ 4,500.00 Deposits $ 9,416.84 Checks $ 2,025.00 Fees $ 20.00 Ending Balance $ 11,871.84

Transaction Detail Fees Service Charge $ 20.00 Deposits 10/5/17 $ 8,600.00 10/11/17 $ 96.10 10/18/17 $ 720.74 Checks 101 $ 400.00 102 $ 125.00 105 $ 1,500.00

Page 7 Instructions (continued): 10.Complete the following end-of-period activities. The accounting period ends October 30. . Create a Trial Balance (before adjustments). Set the date range to “All”. . Journalize the adjusting entries. Accrued interest on the note to City Bank. (Treat the note as having been held for the entire month.) Inventoried the office supplies and found that $125 of office supplies remain on hand at the end of the month. One week of work on the Booker landscaping project has been completed. . Create and memorize an Adjusted Trial Balance. Run the trial balance with the date range of “All”. Name the memorized report WN Adjusted Trial Balance . Create and memorize an Income Statement (Profit and Loss Statement). Change the title displayed at the top of the statement to read “Income Statement” and name the memorized report WN Income Statement. . Create and memorize a Balance Sheet. Name the memorized report WN Balance Sheet. . Create and memorize a Schedule of Accounts Payable. Name the memorized report WN Schedule of AP. . Create and memorize a Schedule of Accounts Receivable. Name the memorized report WN Schedule of AR. . Create and memorize an Inventory Stock Status by Item report as of 10/31/17. Eliminate the Pref Vendor and Reorder Pt columns from view. Name the memorized report WN Oct Inventory. . Create and memorize the Journal as of 10/31/17. Name the memorized report WN Journal. . Create and memorize the Ledger as of 10/31/17. Format the ledger for a traditional format (see Lesson 9 for a refresher). Name the memorized report WN Ledger. 11.Upload your completed file to the Warren Nursery Computer Project heading under Assignments in NS Online. You may upload your working file with the QBW extension or a portable file with the QBM extension.

Page 8 ACCT 2380 Semester Project Warren Nursery Developed by Laurie L. Swanson Nashville State Community College

Joe Warren owns and operates Warren Nursery, a sole proprietorship. Warren Nursery is located at 1510 Smithville Highway, McMinnville, Tennessee, 37110. Warren Nursery sells trees, shrubs, and perennial plants. Occasionally, Warren Nursery performs landscaping services as well. Customers can view Warren Nursery’s products at its Web site at www.WarrenNursery.com and can reach the business by phone at 931-555-8989.

Warren Nursery has been in business for 2 years as a retail operation and has a small but steady customer base. Since Warren Nursery is a retail operation, customers are charged sales tax of 9.25%. Sales tax is remitted to the Tennessee Department of Revenue monthly. Warren Nursery offers credit terms of n 30 to its customers. Some customers pay upon purchase while others take advantage of the credit. No customers owe Warren Nursery anything at this time; and the company has no outstanding accounts payable.

The nursery has three employees. An outside payroll service is used to calculate and generate paychecks. As the owner of the sole proprietorship, Joe Warren does not receive a paycheck.

Warren Nursery has had a checking account with City Bank since it began operations and does not currently have any loans from the bank. Warren Nursery does not use credit cards or have any lines of credit. The last bank statement received for Warren Nursery’s account TZ888 was dated 3/20/17 and the ending account balance was $4,500.

Up until this point, Warren Nursery has used Excel to maintain its accounting data. Warren Nursery prepares accrual-based accounting reports and gives the data to an independent CPA for review and for income tax preparation. While using Excel to maintain the accounting data has worked adequately, Joe feels an accounting package would be more efficient and effective for the small but growing business. Since Joe runs a small sole proprietorship, he has decided that QuickBooks is the accounting software package that best meets his needs. The company will use QuickBooks to track inventory, prepare product sales receipts and invoices, prepare purchase orders, enter bills, maintain Accounts Receivable and Accounts Payable, and generate accounting data.

Although Joe does not have an accounting background, he feels his bookkeeper, Sandra, will be comfortable using QuickBooks and they can consult the CPA with any questions. The company uses Federal Income Tax Form 1040 (sole proprietorship) and its tax ID number is 444-55-6666. Tax data is maintained for the standard tax year which runs from January 1 – December 31. Warren Nursery’s fiscal year begins on November 1 and ends October 31. The company will begin using QuickBooks on October 1, 2017.

Page 9