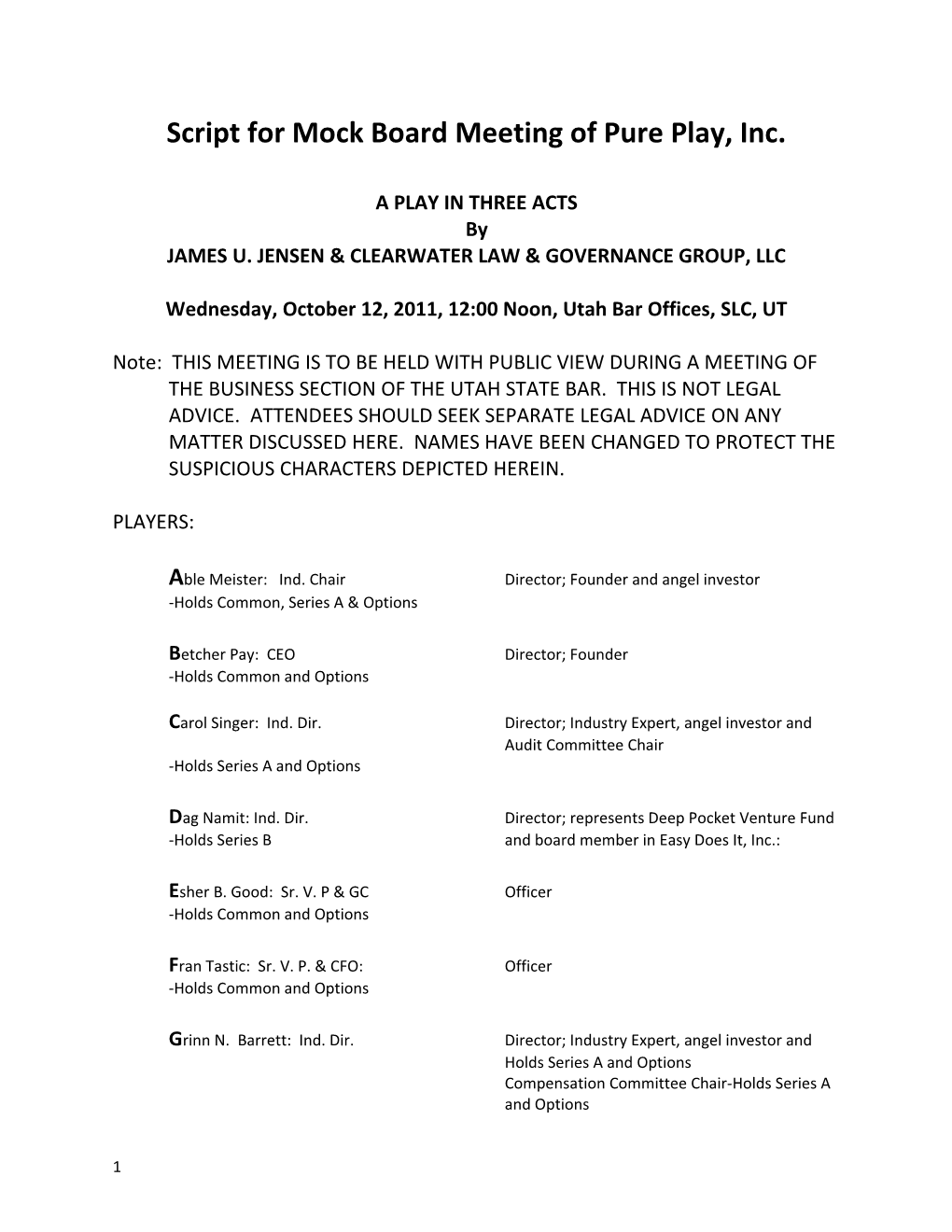

Script for Mock Board Meeting of Pure Play, Inc.

A PLAY IN THREE ACTS By JAMES U. JENSEN & CLEARWATER LAW & GOVERNANCE GROUP, LLC

Wednesday, October 12, 2011, 12:00 Noon, Utah Bar Offices, SLC, UT

Note: THIS MEETING IS TO BE HELD WITH PUBLIC VIEW DURING A MEETING OF THE BUSINESS SECTION OF THE UTAH STATE BAR. THIS IS NOT LEGAL ADVICE. ATTENDEES SHOULD SEEK SEPARATE LEGAL ADVICE ON ANY MATTER DISCUSSED HERE. NAMES HAVE BEEN CHANGED TO PROTECT THE SUSPICIOUS CHARACTERS DEPICTED HEREIN.

PLAYERS:

Able Meister: Ind. Chair Director; Founder and angel investor -Holds Common, Series A & Options

Betcher Pay: CEO Director; Founder -Holds Common and Options

Carol Singer: Ind. Dir. Director; Industry Expert, angel investor and Audit Committee Chair -Holds Series A and Options

Dag Namit: Ind. Dir. Director; represents Deep Pocket Venture Fund -Holds Series B and board member in Easy Does It, Inc.:

Esher B. Good: Sr. V. P & GC Officer -Holds Common and Options

Fran Tastic: Sr. V. P. & CFO: Officer -Holds Common and Options

Grinn N. Barrett: Ind. Dir. Director; Industry Expert, angel investor and Holds Series A and Options Compensation Committee Chair-Holds Series A and Options

1

ACT I

[The lights come up and the Meeting begins with Able, Carol, and Grinn seated at the table. Waiting nearby are Betcher, Dag, Fran and Esher.]

ABLE: Let’s go ahead and get started. Carol and Grinn, you and I are the only current outside board members. So we comprise an Executive Session of the Board and our agenda calls for us to do the work of an ad hoc nominating and governance committee. [1] Generally, we have not recorded minutes for these sessions and I just report into the full meeting minutes, any items we consider in executive session. Let’s do that today, too. We will be joined in our full session by our officers; meanwhile, Carol, you suggested inclusion of the topic of “Director Recruiting” on our agenda for this executive session. I note that Grinn has past familiarity with Deep Pockets VC Fund and its Board Nominee, Dag. And I think all three of us have experience with other boards. Carol, you have the floor.

CAROL: Well, Able and Grinn, as you know, our contract with Deep Pockets brought us some needed cash and the rolodex of a well-respected VC. And, Grinn, we are deeply grateful for the introduction. I know that the contract gave Deep the right to name a director, [2] but I was surprised that Deep’s long time CEO, Amazon Grace, was not named. I don’t know Dag Namit, although I hear good things about him. I just ask if we should go back to Deep and ask for Amazon or other more experienced nominees.

ABLE: Well, I checked with Esher, our General Counsel, on this issue, and the Agreement gives Deep Pockets the sole right to appoint. So, asking for a change might be a fool’s errand. Grinn, will you share your insights with us.

GRINN: Sure. Able, as you requested earlier, I have not kept my notes from the previous Board meeting [3] when we addressed the general issue of the Term Sheet for the Deep deal which included a “Director Nominee” provision. But I recall that we all expected that to be a part of the final agreement. In any event, I know both of these folks. Candidly, Dag is trying to make a name in the

2 community and I think Dag will be much more engaged and can bring any insights we request of Amazon. Or we can ask Amazon to come from time to time. Also, I think Dag will fit your culture [4] better than Amazon, who has a well-earned reputation of being occasionally wrong, but never in doubt.

CAROL: Well, we also have pending the request from Betcher, our CEO, that we add to the board that consultant to whom Betcher has been so attached for a long time. What’s the name? Flatter Ing—that should tell you something. I know that Flatter is a long term industry participant, just like me, [5] but I don’t see that we get any additional expertise on the board that way. Moreover, I take the position that a nominee from the CEO, starts with the premise that he/she is not an “independent director” so appointment of Flatter would violate our policy of having only one director from management. [6]

GRINN: Well, we currently have a mix of a “working board” and an “oversight board” because each of the three of us is engaged to some degree, with assisting management. So our pure role of oversight is compromised in that regard. [7] When we add someone from Deep Pockets the situations won’t change much because Deep Pockets is known to stay close to management in practice and to contract for control of various decisions in the company by written agreement. [8] On the other hand, I take your point about the issue of adding Flatter to our Board. That appointment doesn’t really add a new perspective to the board. And our CEO, Betcher, is no shrinking violet, and has a self-confident voice, so we would just expect a further supporting voice for management from someone like Flatter.

ABLE: These are good points, Grinn. I think that we can harmonize these points by moving at a deliberate speed in this area. While we are required to add one director now, and that will likely be Dag, if we add a second director at the same time that beings other complications. I see no compelling need to act now. I also want us to do a self-assessment [8] to identify the talents and skills that we want to add to our Board. And we need to be sure that Betcher and the other Officers support this approach. And of course, we should consider the views of other shareholders. When we started the Company, I discussed governance with several of the early individual investors (remember the seed money for our Series A shares?). Those other “Angel Investors” accepted the fact that none of them would be on our board and that we would add people as the need arose. [9]

3 Their only concern was that we avoid a situation where any one faction, Management or Investors would have a commanding control of the Board. They wanted us to have a culture where all factions were heard and yet the Company could move decisively when needed. That’s a tough standard, but we are all trying to keep that in the front of our thinking.

This delay in new appointment should not surprise Betcher. In building the agenda with Betcher for the full Board meeting, [10] I suggested to Betcher that I thought the Board would decline to add anyone else at this time. Let’s see how we get along with Dag, and with our self-assessment. Then we can re-visit this issue. I expect that Betcher is OK with that approach.

CAROL: OK. But we should move right along because we may have to give another seat to someone in any event if we agree to do the additional funding being suggested by Management. With that understanding, I can fully support your approach.

GRINN: I’m fine, too.

ABLE: Great. Carol, I see you moving toward the door to invite the others to join us, but we have one other issue on the agenda. And that is the issue of whether Dag will receive outside director compensation under our Directors’ compensation plan. [11] I think it is fairly common, that one who joins a board under contractual rights is performing under a contract of appointment and thus is not compensated.

CAROL: Able, you are right to raise that issue. I don’t recall either.

GRINN: From my experience, you are generally correct on the non- compensation issue, but I have seen it go the other way.

ABLE: If you will permit me, I will discuss it off line with Betcher. Perhaps he or one of our people raised it with Deep Pockets in the negotiations. There may even be a statement about it on their web page. So we can keep moving, I will bring it back to a further Executive Session meeting if [12] it appears that compensation is expected. Will that be acceptable?

4 CAROL: That sounds find. GRINN: Good.

[ABLE raises and moves toward the door. The lights fade.]

STATION BREAK: Here the Narrator, Players and guests will discuss a few issues presented by the meeting to this point.

Issues from Act One: 1. Executive Session and Minutes and ad hoc nominating and governance committee 2. Right to Appoint Director—Director Duties 3. Private Notes of Board Meeting 4. Board Culture vs. Imbedded 5. Board Diversity 6. Majority of Outside Directors 7. Board Oversight vs. Working Board 8. Board Self-Assessment and Integration of this drill into director selection 9. Lack of specific representation for minority shareholders 10. Independent Chair helps to build the Board Agenda 11. Directors set their own compensation 12. Chair can manage some matters off-line when trusted

ACT II

[The lights come up and ABLE motions to Betcher, Dag, Fran and Esher. They take seats at the table with Able, Carol and Grinn.]

ABLE: Welcome, Betcher, Fran and Esher. And welcome Dag. I believe that everyone knows everyone else. Dag, you met everyone as part of your due diligence. Ernest, will you take minutes of the meeting? We are now in full session. The minutes will reflect that all Board Members are present and that they have received and reviewed the Board Materials ahead of the meeting. [1]

Will you please reflect in the minutes, Esher, that the three Independent Directors held an executive session before this meeting—in some of our work we acted as an ad hoc nominating and governance committee. Based on our review and the Company’s contractual obligations, this ad hoc committee recommends

5 that the Board expand its positions by one and that Dag be named to fill that vacancy. The ad hoc nominating and governance committee is also recommending that no other additions to the Board should be made at this time. One other item was addressed by the ad hoc N&G Committee, and I will return to that in a moment. On the Deep Pockets nominee matter, the Chair will entertain a motion.

CAROL: I move the Board adopt the recommendation of the Independent Directors and that Dag be added to the Board to fill a newly created vacancy.

BETCHER: Second.

ABLE: All in favor.

[The 4 directors, Able, Betcher, Carol and Grinn, say “aye”.]

DAG: Thank you. I look forward to working with you to help PPI reach the potential we see.

ESHER: Able, I have just one clean-up item. Dag, will you stay after the meeting for a few minutes to get your “Board Book” [2] containing relevant information for our Board members. You may have this in your due diligence papers, but we collect it in one place as a convenience for all Board Directors. And we can work on adding you to our D & O insurance coverage. [3] Oh, and one more thing; you will need to sign the Company’s standard “Director’s Service Agreement.” [4]

DAG: Thanks. I will be happy to. I was going to work with Betcher on another matter, [5] so I will just come by your office after that.

ABLE: Betcher, as I mentioned a moment ago and as I suggested when you and I were preparing the agenda, I think we will not add another director just yet. Carol and I are recommending to the full board that we conduct a form of self- assessment before we seek further nominees. Betcher and Dag, do you agree with that approach?

BETCHER and DAG: Yes.

6 ABLE: Esher please put that in the minutes then. And Betcher?

BETCHER: I assumed we were headed in that direction and Fran and Esher have already begun. But I have asked Esher to address the question of confidentiality in this sensitive area.

ESHER: Briefly, it is fairly common for counsel to collect and consolidate the several responses on a Board Self-Assessment drill. And it is fairly common, that no copies of the document be retained, except the final consolidation. [6] I can go into it more fully at another time if you wish, but that is the approach we are recommending.

ABLE: Is there anything sinister about that?

ESHER: No, not at all. It is just careful house-keeping--just as the official minutes are the only record of the Board’s deliberations we will take the same approach here.

DAG: That is my understanding from other boards we work with. And the Nav-gri recommends this approach too.

CAROL: Nav-gri?

DAG: You know, the National Association of Very Greedy and Rich Investors. Nav-gri [7] has some good materials on self-assessment for private companies and I will send a reference to Betcher.

ABLE: Good. Let’s turn to agenda item number 2. Approval of the minutes. You have all read the draft minutes. [8] Are there any corrections?

BETCHER: Fran has raised with me the issue of our Equity Incentive Plan as addressed in the contract with Deep Pockets. [9] I would like to invite Fran to address this.

FRAN: In getting ready for this meeting, I noticed that the minutes fail to mention that changes in the Plan will be subject to the limits in the Deep Pockets Agreement. Recall that this issue was a negotiated item and was on the Term

7 Sheet considered by the Board. I think the minutes should reflect this and Esher has some simple added text to cover this. That is the highlighted part that was in the Board Materials.

ABLE: Good. Assuming that is acceptable to everyone, are there any other corrections? Hearing none, may I have a motion?

CAROL: I move approval as amended.

BETTAN: Seconded.

ABLE: All in favor?

[All directors say “aye”. Dag abstains as he was not then on the Board.]

ABLE: Then the minutes will be finalized as approved and filed with the records of the Company. Let’s move to Agenda Item number 3: the Business and Financial Presentations. Betcher, you have the floor.

BETCHER: I wanted you to hear from our Sales Vice President, but [10] I made the hard call to send the Sales Vice President to an important client meeting today. So you are stuck with me. I call your attention to tab 3 in the Board Materials. The good news is the bad news. The trends continue. You will see that last quarter our sales were on target with 2% over the prior quarter and are up by 12% over the same quarter year-on-year. But the sales cycle is further extended, receivables are now about 66 days, and our quantity purchases of raw materials have improved our gross margin, but are putting a real pinch on cash. We have had to delay many needed promotional items and cut back on R & D to find the cash for raw materials, sales support, and receivables. The bottom line is that even with the Deep Pocket cash, our growth is hampered with cash constraints. [11] Fran, do you wish to add anything on the business side before I ask you to address your Financial Report?

FRAN: Just this one note. We have a polemic matter on growing our people just now. In some areas we have too few people or our people are not growing at an acceptable rate. In other areas, we have some overlap of talent. As you read in the Board Materials, in the next item, Tab 5, the issue of human resource

8 management at our semi-autonomous subsidiary, [12] Easy Does It, Inc. continues to soak up senior management time. But I am getting ahead of myself. So I propose to just call the Board’s attention to a few key numbers. Please look at page 19 [13] in my report at the bottom line. Notice the projected sources and uses of cash summary. Our deepest short fall under current conditions and budget is that we will experience our largest cash shortage out nine months in the amounts shown there. [14] Then it starts to turn around. But. . . .

BETCHER: Fran, that sets the table nicely for the next item on the agenda. And, Able, I think, in the interest of time, that we should move to the next key action point in the Agenda. Much of what Fran was describing was operational and I don’t want to bother the Board with it. So can we move to Tab 4?

ABLE: Will that be acceptable with everyone?

DAG: We at Deep Pockets had identified this issue as part of our due diligence and have some ideas. So I am pleased to move to the next items.

ABLE: Ernest, will you just reflect in the minutes on this item that the Board considered the materials and heard a presentation form the CEO and CFO? [15]

ABLE: At this point, then, I propose that we move to tab 4 in the agenda and in the Board Materials—The Proposed Funding. Betcher, you have the floor.

BETCHER: Thank you. You other Directors know from reading the Board Materials that Management recommends the Convertible Debt Offering [16] using Deep Pockets [17] as our lead investor. This approach seems to have the least risk of completion and will allow management to re-focus on running the business rather than on funding the business. And the Convertible Debt will delay the need to strike a “valuation” for the company, [18] even if for just a few months, so that we can get back on track with our plan to break-even—which will now take about 12 months if we have this infusion. Fran or Esher, do you wish to add anything?

FRAN: I will just add that the proposed Term Sheet in the Board Materials was jointly prepared by us and Deep Pockets. We are really pleased that Deep

9 Pockets has expressed this confidence in us and is prepared to provide this funding.

CAROL: Is that right, Dag? I thought that Deep had a hole in its “deep” pockets and was out raising another fund.

DAG: Well, it’s true that we are raising our third fund. And we have great confidence in our ultimate success. And in any event, the funds for this proposal come out of our Second Fund, the same as with our initial investment. We have not negotiated all the terms for this convertible debt, but I feel we will be able to reach an agreement that will be a win-win situation.

BETCHER: Earnest, will you briefly describe the other approaches that we considered. You can refer to our memo in the Board Materials.

CAROL: Just a minute, everyone. Able, it seems that we are into a delicate area and the Company may lose some advantage if the other alternatives are discussed while the proponent of one alternative is present. Should we discuss these items without the help from Dag for the time being?

ABLE: That’s a good point Carol. Dag, even though you just got here, may I ask that you give us a few minutes to consider your proposal openly—seeing as your firm is potentially on the other side of the transaction? [19]

DAG: That is as it should be. I will just answer some calls while I wait. You know, as a VC, I have a short attention span anyway.

[DAG raises and moves toward the door. The lights fade.]

STATION BREAK: Here the Narrator, Players and guests will discuss a few issues presented by the meeting to this point.

Issues from Act 2: 1. Common to send Board Materials to Directors in advance 2. Board Book is one of several tools to keep Directors informed 3. Who specifies scope of D & O Insurance & double coverage questions 4. Director’s signed agreement vs. fiduciary duties

10 5. How, when and with what implications does one single director work with and gain information from Management—see also in note 13 6. Records retention policy, Board role 7. Many sources of information and information sharing 8. Approval of minutes. Implications 9. Board role in equity issuances, valuations for common when Company has preferred outstanding 10. Source of Management Information-CEO filtering and Director access to other executives— CEO control of the “information.” See also in note 7 11. Role of Management and Board in strategic planning 12. Board switches from working board to oversight board (or not) on semi-autonomous subsidiary--sometime only executives see the separated-out numbers so oversight at that level is muted 13. How voluminous are the Board Materials? Data vs. Information 14. Cash short fall must certainly be an important Board oversight matter 15. This short form approach is used and may be adequate but if trouble arises, the Board may come to wish it had a fuller record of deliberations 16. Convertible Debt is another major Board issue with many subtle and vexing implications- sole funding by an existing investor is replete with worth issues 17. Different funding from same investor presents thorny conflicts issues and tough oversight challenges 18. Company valuation and procrastination or “You can’t handle the truth” 19. This is just another example of the subtle ways in which a Board can encounter a potential Director Conflicting Interest Transaction

ACT III [The lights come up; Dag is absent and Able, Betcher, Carol, Fran, Esher and Grinn are seated at the table.]

CAROL: May I start? I have grave concerns about this proposal. I see the potential that the Company can get deeply into negotiations with Deep, no pun intended, and that Deep will continue to make demands to which Management will be unable to resist. I think you must have a back-up alternative that you believe in and that you pursue with equal vigor.

ABLE: Don’t hold back Carol. Tell us how you really feel. But candidly, I too, have concerns about this approach. I see the merits of a delay in getting a market place valuation, but I think we should get a reality check; I wonder if Deep will be motivated to help us find the other follow-on investors, knowing that they

11 are trying to protect their recent investment in the Series B that we just sold them. The calculus becomes a bit overwhelming when you think about 1) Deep’s interest in their current Series B, 2) Deep’s possible investment in a new Series C; and 3) the competing potential for Deep to have a collateral position in the convertible preferred.

GRINN: We have an additional complication. I think that Deep’s Second Fund is coming up on 8 years. That means that they will only want to invest short term money from here to their 10 year liquidation. So dependence on them, when we may be facing a long term climb under current market conditions, could put the Company in a risky situation. [1]

FRAN: Well, there may be something to that; and I expect that Deep would like to postpone adding a new professional investor to provide a market “valuation” so as to avoid any potential of a down round. [2] I know that neither Deep nor the Company wants a “down round” but the market seems quite soft; there is no telling which way this will turn. So I would hate to lose this option- even with its limitations.

CAROL: Betcher, do you feel that you are too close to Deep Pockets and Dag? [3]I know you go back a long ways. We could give you some help from the Board side if you need to play good-cop—bad-cop in any further negotiations with Deep.

BETTAN: Thanks, Carol, but I will be just fine. This is not my first county fair. What we really need from the Directors here is clarity of strategic objectives. Here I am, running the company, and having a wonderful time. I recognize that this funding proposal and our deepening cash constraints present us with a dilemma. The funding will put us on a higher platform and give us the potential to grow the Company to a higher value--at a later date and with risk. But at the same time, the potential for a happy “liquidation event” is considerably extended under that approach.

GRINN: That’s damning by faint praise. I can see a situation where only the late arriving investors will get anything because of the Liquidation Preferences. Deep seems to be positioning itself to benefit no matter which way this goes. And on behalf of the common shareholder, I want assurances that potential increased risk [4] will benefit us, not just the VCs who negotiate for liquidation

12 preferences and perhaps even security interests in the assets of the Company. There may be much more risk here than we first thought.

ABLE: Alright everyone. Let’s sit back in our seats. Grinn and Carol make good points. And it seems that Management prefers this approach, but recognizes that it may not suit the needs of our early investors. I agree with Betcher that the Board is the place where that decision should be made. And if we adopt a strategic vision, we can take into account the interests of each of the investor groups and management. [5] Esher, please tell us if Dag will be eligible to vote on the strategic vision matter or does his funding proposal conflict him on the more strategic item too?

ESHER: The short answer is no. The Utah statute on director conflicting interest transaction is applicable on the Deep proposal, but not clearly applicable on the strategic planning matter. On the narrow question of the Deep proposal to provide convertible debt financing, there is no doubt we have satisfied the first hurdle that the conflict must be disclosed. Under the statute, the transaction is then defensible if it is fair to the Corporation and the shareholders. Many Companies go through these transactions with a vote of the “disinterested” directors, as contemplated by the Statute. In some cases, particularly with Delaware corporations, you sometimes see companies seeking shareholder votes —and disqualifying the votes of shares held by the interested director—so they seek a vote of the disinterested shareholders. I would want to do more research before giving you definitive guidance. But I am not the right place to go for the question of fairness—that is the work of the Directors to consider an evaluation of terms AND price. Of course the Board can get expert advice on this matter and the Board is entitled to rely on that advice. [6] Carol raised an important issue of terms that are still to be negotiated, and we have not yet addressed the question of fairness in the valuation, the price.

GRINN: I have some concerns that Management assessment of cash flow short-fall can use some more rigor. Betcher, could you survive without the needed funding? I know you addressed this in the Board Materials, but if you took another look at it, might you find some options that you have discounted because of the attraction of more money? [7]

13 CAROL: Those are good questions and I could come up with a bunch more; but I don’t see us getting to the bottom of this today. May I suggest that we appoint a sub-committee comprised of Betcher, and me? We will call on Fran and Esher for support. Our charge will be to come back to the Board with a recommendation of the priority of our strategic interests, our appetite for risk and our optimum time horizon for a liquidation event. With that, the full board, or the Board excluding Dag, will then be enabled to adopt a favored funding approach and an acceptable alternative approach.

ABLE: You didn’t mention Dag on the subcommittee. Would you be willing to include Dag on the sub-committee? In fairness, Deep Pockets has a reputation of assisting troubled companies through hard times. Is that acceptable?

Esher: From a Corporate Governance perspective, each Director must discharge a fiduciary duty to all the shareholders, not just to his class or her series, so, in that sense, Dad has the same duty as you other Directors. [8]And, if you separate the establishment of strategic interests from tactical approaches, Dad would probably not be disqualified any more than any other director or officer.

CAROL: OK. Add Dag.

BETCHER: I am willing to take Carol’s approach, provided it doesn’t take too long. I have a business to run here, and if we are not going to raise more money, I need to make some hard choices.

FRAN: Betcher, I think we will be alright. As you know, we have been working on a long range business plan, and I think much of the work the Directors want has already been done. I am excited to tie-up the loose ends.

ABLE: Let’s take Carol’s suggestion as a motion. Do I have a second?

BETCHER: Second.

ABLE: With my vote that is unanimous as to the Directors present, at least. Esher, will you invite Dag to come back into the meeting.

14 [DAG enters and takes a seat at the table.]

ABLE: Dag, you will be pleased to know that you have joined a sub- committee of Directors, with Carol and Betcher, to recommend to the full Board our long range strategic plan objectives. We concluded that this approach will better enable us to sift through alternative financing ideas. And if we have clarity on that, we will be in a better spot to consider the Deep Pockets generous offer. Assuming agreement from all, at this point, then, I propose that we move to tab 5 in the agenda and in the Board Materials-- the Proposed Management Change at our Subsidiary, Easy Does It, Inc.

You all know that Betcher has been struggling with the Management issues at Easy. Recall that the founders left in a huff when they didn’t meet their earn-out bonuses, but the farm team seems to have come a long ways. The Board Materials separately presented the Easy financials, so you all know that it is now our strongest asset and contributing to earning at an even higher rate than it contributes to sales. Such is the way of a high margin business like Easy. Betcher, you have a management proposal. You have the floor.

ESHER: Let me point out that PPI is the sole shareholder of Easy, so we have absolute authority to control. Still, there are corporate formalities and we have consistently considered that when the Board considers matters at Easy, it is simultaneously meeting as the Board of Easy. [9] And I do the minutes that way.

ABLE: Thanks for the reminder, Esher. Betcher….

BETCHER: You know that Billy Bob and Waldorf, the two young Turks at Easy Does It, Inc. have an un-easy truce. Billy Bob is southern right down to the sand between his toes. Waldorf moved to Boston when he was young, but his German heritage is still quite dominant. Neither really likes living in Fargo at corporate headquarters, but they travel a great deal because suppliers and customers are so spread out. They are each capable and opportunistic in separate ways. I think we need them both. But I don’t feel that either is ready to be the CEO yet. So I propose to continue to perform that function. My proposal is that we appoint them as co-Presidents, while I continue to be the ultimate leader as CEO. That way, they can each have a strong business card to carry and they will both be

15 building a good resume. I think this approach will help us continue an evaluation of their work and that a winner should emerge in time. So that is my proposal. The compensation implications are in the Board Materials. [10]

CAROL: Betcher, this is the craziest proposal I ever heard. I can see your consultant’s hand all over it. What’s his name, Flatter Ing? All the studies I’ve read say this is a blow-up in the making. If they are that good, why don’t you just bring one of them up to headquarters and leave the other one there to run the store?

ABLE: Moving right along, Dag, I think you met these folks in your due diligence. What do you think?

DAG: Well, I agree with Betcher that they are capable and ambitious. It might work. I usually think we should leave management decisions to the CEO and defer to him or her. [11]

ABLE: Fran and Esher, have you worked with these fellows? What do you think?

FRAN: I am sure I can work with either or both of them if that is what Betcher wants. [11]

ESHER: I will be interested to see what the Board decides. That’s why you folks make the big bucks. [11]

ABLE: Grinn, it seems our high priced help think that discretion is the better part of valor; can you help us here?

GRINN: Carol is right that there is little evidence that this works over a long period of time. But Betcher may just have a short period of time in mind. Competition can be a healthy motivator sometimes. And customarily, as Dag said, these decisions are left to Management. Here, of course, Easy is such an important part of the potential success for PPI, that the Board has consistently provided oversight at the level of its wholly owned and semi-autonomous subsidiary. Betcher, how would you measure success of this effort? And how long would it go on?

16 BETCHER: I’m not sure about timing. It may depend on the decision about funding. We may not be able to afford both of them without the funding. And loss of either would be a challenge. That is why I have suggested this approach. And I think you will see that they continue to perform as they have been doing. That is how I measure success. Sales and earnings--Sales and earnings.

GRINN: And what about the idea of bringing one of them up to headquarters to work more directly with you. The Board would still be able to see the work of both of them that way and neither guy would be in the way of the other.

BETCHER: These are strong leaders—very forceful. I’ve already got Esher and Fran and my sales VP. I don’t need another spit-fire here. And besides, Easy Does It, Inc. really needs their leadership just now. This is not the time to lose either of them.

ABLE: May I suggest that we postpone decision on this proposal until we have the work of the Strategic Interests sub-committee? It is quite possible that their work will provide needed clarity on this issue.

CAROL: I so move.

DAG: Second.

ABLE: Betcher, can you accept this approach?

BETCHER: Not really; I have made some commitments to these fellows. I will just have to see what I can do. I would prefer to get a unanimous supporting vote today.

CAROL: Well that’s not going to happen.

BETCHER: OK, Carol.

ABLE: Well, let’s just record this as a majority vote. In the interest of time I propose that we pass to tab 6 in the agenda and in the Board Materials—The Proposed Amendment to the Incentive Equity Plan.

17 ABLE: As reflected in the Board Materials, Management is proposing that we adopt the new amendment to the Equity Incentive Plan. [4] And Management has proposed an allocation formula for distribution of new options to Management and to Directors. Betcher, can you summarize your proposal. Let’s assume that all directors are familiar with the materials in the Board Book.

BETCHER: As you have seen, we have reflected in the Board Materials what we think the market place is doing on equity compensation in today’s business climate. And I think there is broad support among our leadership for the proposal.

CAROL: It would be easy to be very supportive of this proposal. I like the idea that the Directors are getting a substantial boost in the number of options. This number is more in line with what I’ve seen, but is not outlandish. Still, I am concerned that the distribution seems top-heavy and fails to adequately reward the employees generally. Senior management seems to be taken care of very nicely here; thank you very much. [12]

ABLE: Any other comments?

FRAN: As I mentioned earlier, the contract with Deep Pockets addresses this issue. You will recall that we agreed to the grant for Betcher and the other members of Senior Management. So it may be that the Board has a contractual obligation to grant these options to Management. [13]The other options are just filling-out the dance card. Right, Esher?

ESHER: As Betcher suggested and Fran as emphasized, the Contract addresses this subject and the Management numbers are in the Contract with Deep Pockets. The numbers for the Directors and for other employees are not addressed in the Deep Pockets agreement. But the Management numbers have one proviso. In the language at the very beginning of the section is this proviso: “Except as the Board of PPI shall specifically find that good governance conditions require otherwise. . . .” So I hold the view that the Board is open to make a determination that some other numbers are required under current conditions.

GRINN: What does that mean? What is “good governance conditions” in this context?

18 ESHER: Well, it is pretty much what you say it is. If you discharge your duty of good faith, and your duty of care, and assuming that you have made yourselves adequately informed, your determination is the final. [14]

DAG: Look, Deep Pockets negotiated for the numbers that Betcher has in his proposal because we don’t want to have to deal with disgruntled management any time during our ownership. And we don’t really expect the Board to be better informed than we are on these subjects, since we deal with management incentives all the time. [15] Our experience is that highly motivated management is highly performing management.

ABLE: Well, actually, you have just joined a Board that is determined to do its best to discharge its duties and we are not accustomed to contracting-out the performance of our statutory duties. So, Dag, I think you will have to set aside what you felt you wanted as a contracting party. We expect that all directors will be discharging their duties to the Corporation. [15] We are very pleased to hear of your other experiences and we trust you will use that learning to help us do our work. OK?

DAG: OK. So maybe I overstated our position. We invested in PPI because of the people and the potential. We are committed to helping both succeed.

GRINN: I have one other matter I wish clarified. Am I correct that the options are in common stock and that Deep Pockets holds preferred?

DAG: Yes, that’s correct. But our ambition is that the Company will be so successful that we push right thru the rights and preferences given to the professional investors and into the space where we will all convert to common. Then everybody wins. We make each of our investments with that ambition.

ABLE: Well, this is a very interesting topic and we need to come to a conclusion. But we are out of time now, so we will put it on the agenda for the next meeting.

ABLE: Tab 7 calls for a lunch recess. This is always the most approved matter on the agenda. Without objection, I declare the meeting recessed.

19 [The lights come up.]

STATION BREAK: Here the Narrator, Players and guests will discuss a few issues presented by the meeting to this point.

Issues from Act 3: 1. It is always a matter for Director concern to match the time horizon and capability of an investor or investors with the business plan of the Company. 1. Down Rounds can be procrastinated but with increased pressure on the Directors to watch for conflicting interests and discharge of duties. 2. Directors may be tempted to “help” but notice that the oversight function will be compromised by such working contributions. 3. Risk discussions are all the rage since Dodd-Frank, but evaluation of ERM is a complex project that deserves off-meeting work and further meeting consideration. 4. For PPI, the discussion of a Strategic vision seems to be arriving late, but better late than never. 5. Fairness and valuation are two prominent examples of matters where the Board can seek expert advice. 6. This is a good example of director skepticism of Management numbers and an appropriate first request for further evaluations. 7. This statement of Directors’ duties to all shareholders is sometimes overlooked by directors representing a particular class of shares. 8. Of course this dual board meeting is not the only way to govern a subsidiary. Frequently only Management provide the Board for a subsidiary and sometimes that is only the CEO—a much more fluid approach. 9. Directors have a special duty to provide for CEO evaluation and succession. It is possible the Betcher would never tolerate a co-CEO at his level. 10. Wow. Three persons have declined to deal rigorously with the CEO’s proposal. It may surprise some directors to learn that it is very difficult to get candid statements from vice presidents when the CEO’s views are already out in the open. 11. It is the Board’s duty to determine executive compensation and it can be a very imperfect science. 12. The Company has previously agreed with Deep about the options for the CEO, this is not un- common, but it can receive less attention than it deserves when it is packaged as part of an external financing deal or as part of an acquisition. 13. The Business Judgment Rule is still good law and applicable when all the necessary steps are taken. 14. It is not uncommon for an “appointed or investor” director to assume that its contractual rights give it more control that the law contemplates. But sometimes those rights are actually contracted away.

Copyright 2011 Clearwater Law & Governance Group, LLC

20