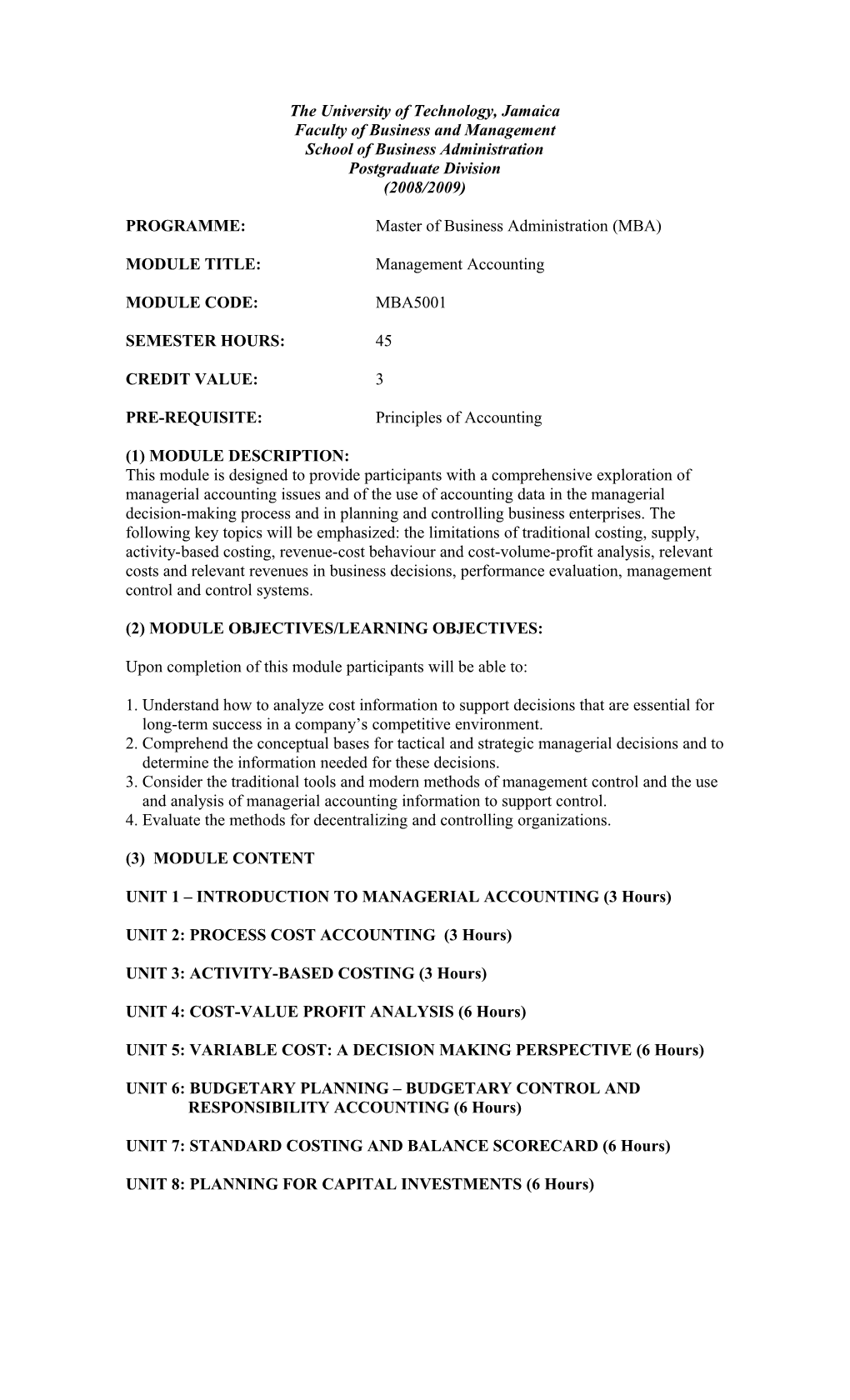

The University of Technology, Jamaica Faculty of Business and Management School of Business Administration Postgraduate Division (2008/2009)

PROGRAMME: Master of Business Administration (MBA)

MODULE TITLE: Management Accounting

MODULE CODE: MBA5001

SEMESTER HOURS: 45

CREDIT VALUE: 3

PRE-REQUISITE: Principles of Accounting

(1) MODULE DESCRIPTION: This module is designed to provide participants with a comprehensive exploration of managerial accounting issues and of the use of accounting data in the managerial decision-making process and in planning and controlling business enterprises. The following key topics will be emphasized: the limitations of traditional costing, supply, activity-based costing, revenue-cost behaviour and cost-volume-profit analysis, relevant costs and relevant revenues in business decisions, performance evaluation, management control and control systems.

(2) MODULE OBJECTIVES/LEARNING OBJECTIVES:

Upon completion of this module participants will be able to:

1. Understand how to analyze cost information to support decisions that are essential for long-term success in a company’s competitive environment. 2. Comprehend the conceptual bases for tactical and strategic managerial decisions and to determine the information needed for these decisions. 3. Consider the traditional tools and modern methods of management control and the use and analysis of managerial accounting information to support control. 4. Evaluate the methods for decentralizing and controlling organizations.

(3) MODULE CONTENT

UNIT 1 – INTRODUCTION TO MANAGERIAL ACCOUNTING (3 Hours)

UNIT 2: PROCESS COST ACCOUNTING (3 Hours)

UNIT 3: ACTIVITY-BASED COSTING (3 Hours)

UNIT 4: COST-VALUE PROFIT ANALYSIS (6 Hours)

UNIT 5: VARIABLE COST: A DECISION MAKING PERSPECTIVE (6 Hours)

UNIT 6: BUDGETARY PLANNING – BUDGETARY CONTROL AND RESPONSIBILITY ACCOUNTING (6 Hours)

UNIT 7: STANDARD COSTING AND BALANCE SCORECARD (6 Hours)

UNIT 8: PLANNING FOR CAPITAL INVESTMENTS (6 Hours) LEARNING AND TEACHING APPROACHES

Class work consists of discussing selected topics from each chapter, reviewing the assigned problems in the syllabus, and presentations of assigned reading materials and cases. Graduate students are presumed to have a high level of motivation; therefore each student is expected to be present and adequately prepared for each class meeting. Maximum benefits from the course can only be obtained by active participation of the student.

5. ASSESSMENT PROCEDURES

Individual Project 20% Group case write-ups 20% In-class case assignment 15% Midterm 20% Final Exam 25% Total 100%

6. BREAKDOWN OF HOURS

Instructional Hours 36 Case Analysis 3 Assessment 5 Total 45

Textbooks, References and Learning Materials

Text: J.I. Weygandt, D.E. Kiesa & P.D. Kimmel (2004) Managerial Accounting: Tools for Business decision making. Third Edition; John Wesley & Sons, Inc

R.W. Hilton (2006): Managerial Accounting 6th edition McGraw-Hill