Group Quote Request Form (group size 51+) Broker name Broker number Date submitted Requested effectice date

Type Current carrier Association Type of industry Rates

New Change Reinstatement Composite Age/Sex Broker fax no. Broker phone no. Broker e-mail Group name Group no.

Group contact name Group phone no. Group address City, State, ZIP code SIC Code

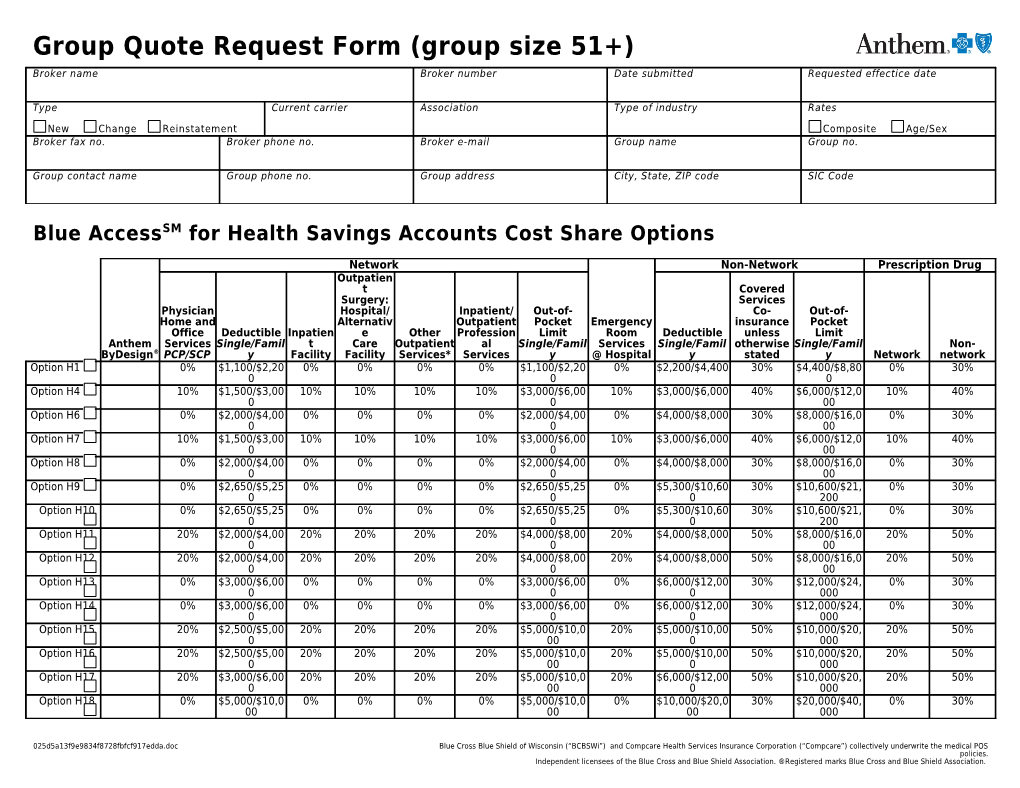

Blue AccessSM for Health Savings Accounts Cost Share Options

Network Non-Network Prescription Drug Outpatien t Covered Surgery: Services Physician Hospital/ Inpatient/ Out-of- Co- Out-of- Home and Alternativ Outpatient Pocket Emergency insurance Pocket Office Deductible Inpatien e Other Profession Limit Room Deductible unless Limit Anthem Services Single/Famil t Care Outpatient al Single/Famil Services Single/Famil otherwise Single/Famil Non- ByDesign® PCP/SCP y Facility Facility Services* Services y @ Hospital y stated y Network network Option H1 0% $1,100/$2,20 0% 0% 0% 0% $1,100/$2,20 0% $2,200/$4,400 30% $4,400/$8,80 0% 30% 0 0 0 Option H4 10% $1,500/$3,00 10% 10% 10% 10% $3,000/$6,00 10% $3,000/$6,000 40% $6,000/$12,0 10% 40% 0 0 00 Option H6 0% $2,000/$4,00 0% 0% 0% 0% $2,000/$4,00 0% $4,000/$8,000 30% $8,000/$16,0 0% 30% 0 0 00 Option H7 10% $1,500/$3,00 10% 10% 10% 10% $3,000/$6,00 10% $3,000/$6,000 40% $6,000/$12,0 10% 40% 0 0 00 Option H8 0% $2,000/$4,00 0% 0% 0% 0% $2,000/$4,00 0% $4,000/$8,000 30% $8,000/$16,0 0% 30% 0 0 00 Option H9 0% $2,650/$5,25 0% 0% 0% 0% $2,650/$5,25 0% $5,300/$10,60 30% $10,600/$21, 0% 30% 0 0 0 200 Option H10 0% $2,650/$5,25 0% 0% 0% 0% $2,650/$5,25 0% $5,300/$10,60 30% $10,600/$21, 0% 30% 0 0 0 200 Option H11 20% $2,000/$4,00 20% 20% 20% 20% $4,000/$8,00 20% $4,000/$8,000 50% $8,000/$16,0 20% 50% 0 0 00 Option H12 20% $2,000/$4,00 20% 20% 20% 20% $4,000/$8,00 20% $4,000/$8,000 50% $8,000/$16,0 20% 50% 0 0 00 Option H13 0% $3,000/$6,00 0% 0% 0% 0% $3,000/$6,00 0% $6,000/$12,00 30% $12,000/$24, 0% 30% 0 0 0 000 Option H14 0% $3,000/$6,00 0% 0% 0% 0% $3,000/$6,00 0% $6,000/$12,00 30% $12,000/$24, 0% 30% 0 0 0 000 Option H15 20% $2,500/$5,00 20% 20% 20% 20% $5,000/$10,0 20% $5,000/$10,00 50% $10,000/$20, 20% 50% 0 00 0 000 Option H16 20% $2,500/$5,00 20% 20% 20% 20% $5,000/$10,0 20% $5,000/$10,00 50% $10,000/$20, 20% 50% 0 00 0 000 Option H17 20% $3,000/$6,00 20% 20% 20% 20% $5,000/$10,0 20% $6,000/$12,00 50% $10,000/$20, 20% 50% 0 00 0 000 Option H18 0% $5,000/$10,0 0% 0% 0% 0% $5,000/$10,0 0% $10,000/$20,0 30% $20,000/$40, 0% 30% 00 00 00 000

025d5a13f9e9834f8728fbfcf917edda.doc Blue Cross Blue Shield of Wisconsin (“BCBSWi”) and Compcare Health Services Insurance Corporation (“Compcare”) collectively underwrite the medical POS policies. Independent licensees of the Blue Cross and Blue Shield Association. ®Registered marks Blue Cross and Blue Shield Association. Option H19 0% $5,000/$10,0 0% 0% 0% 0% $5,000/$10,0 0% $10,000/$20,0 30% $20,000/$40, 0% 30% 00 00 00 000 0% means no coinsurance up to the maximum allowable amount. Additional coinsurance and limits apply. Refer to the benefit summary for detailed information. For Options H1, H4, H6, H9, H11, H13, H15 and H18, no deductible/coinsurance up to the maximum allowable amount for Preventive Care Services (Network only).

This benefit description is intended to be a brief outline of coverage. The entire provisions of benefits and exclusions are contained in the Group Contract. In the event of a conflict between the Group Contract and this description, the terms of the Group Contract will prevail.

Group Name: Blue AccessSM for Health Savings Accounts Cost Share Options (Family Deductible is 2 times Single)

Network Non-Network Prescription Drug Outpatien t Covered Physician Surgery: Services Home Hospital/ Inpatient/ Out-of- Co- Out-of- and Alternativ Outpatient Pocket Emergency insurance Pocket Office Deductible Inpatien e Other Profession Limit Room Deductible unless Limit Anthem Services Single/Famil t Care Outpatient al Single/Famil Services Single/Famil otherwise Single/Famil Non- ByDesign® PCP/SCP y Facility Facility Services* Services y @ Hospital y stated y Network network Option E1 0% $2,650/$5,250 0% 0% 0% 0% $2,650/$5,25 0% $5,300/$10,60 30% $10,600/$21,2 0% 30% 0 0 00 Option E2 0% $2,650/$5,250 0% 0% 0% 0% $2,650/$5,25 0% $5,300/$10,60 30% $10,600/$21,2 0% 30% 0 0 00 Option E3 0% $3,000/$6,000 0% 0% 0% 0% $3,000/$6,00 0% $6,000/$12,00 30% $12,000/$24,0 0% 30% 0 0 00 Option E4 0% $3,000/$6,000 0% 0% 0% 0% $3,000/$6,00 0% $6,000/$12,00 30% $12,000/$24,0 0% 30% 0 0 00 Option E5 20% $2,500/$5,000 20% 20% 20% 20% $5,000/$10,0 20% $5,000/$10,00 50% $10,000/$20,0 20% 50% 00 0 00 Option E6 20% $2,500/$5,000 20% 20% 20% 20% $5,000/$10,0 20% $5,000/$10,00 50% $10,000/$20,0 20% 50% 00 0 00 Option E7 20% $3,000/$6,000 20% 20% 20% 20% $5,000/$10,0 20% $6,000/$12,00 50% $10,000/$20,0 20% 50% 00 0 00 Option E8 0% $5,000/$10,00 0% 0% 0% 0% $5,000/$10,0 0% $10,000/$20,0 30% $20,000/$40,0 0% 30% 0 00 00 00 Option E9 0% $5,000/$10,00 0% 0% 0% 0% $5,000/$10,0 0% $10,000/$20,0 30% $20,000/$40,0 0% 30% 0 00 00 00 0% means no coinsurance up to the maximum allowable amount. Additional coinsurance and limits apply. Refer to the benefit summary for detailed information. For Options E1, E3, E5 and E8, no deductible/coinsurance up to the maximum allowable amount for Preventive Care Services (Network only).

Notes: Deductible(s) apply only to covered medical services listed with a percentage (%) coinsurance (including prescription drugs).

025d5a13f9e9834f8728fbfcf917edda.doc Blue Cross Blue Shield of Wisconsin (“BCBSWi”) and Compcare Health Services Insurance Corporation (“Compcare”) collectively underwrite the medical POS policies. Independent licensees of the Blue Cross and Blue Shield Association. ®Registered marks Blue Cross and Blue Shield Association. Once the family deductible is satisfied by either one member or all members collectively, then the percentage (%) coinsurance will be required for the family until the family out-of-pocket is satisfied. Does not apply to the embedded deductible options. Childhood immunizations (Network) – No Cost Share up to the maximum allowable amount.

*Other Outpatient Services include, but are not limited to, Allergy Testing, Physical Medicine Therapy through Day Rehabilitation programs, Ambulance Service, DME, Home Care Services (including Private Duty Nursing), Hospice Care, MRAs, MRIs, PETS, C-Scans, Nuclear Cardiology Imaging Studies and Ultrasounds.

Anthem ByDesign Buy-up Notes: Select one Buy-up Option (mark a “B” in the box next to the option number). Select one Core Option (mark a “C” in the box next to the option number). For Buy-up Dental/Life selections, refer to Specialty Cost Share Option Sheet.

Group Name:

All Health Options include the following (except as noted):

025d5a13f9e9834f8728fbfcf917edda.doc Blue Cross Blue Shield of Wisconsin (“BCBSWi”) and Compcare Health Services Insurance Corporation (“Compcare”) collectively underwrite the medical POS policies. Independent licensees of the Blue Cross and Blue Shield Association. ®Registered marks Blue Cross and Blue Shield Association. All deductibles and coinsurance apply toward the out-of-pocket limit including prescription drugs.

(Excludes Non-network Human Organ and Tissue Transplant (HOTT) services). Durable Medical Equipment and Orthotics (Network and Non-network combined): Network and Non-network deductibles, copayments, coinsurance and out-of-pocket limits are Subject to benefit maximum of $4,000 per calendar year (excluding Prosthetic Devices and separate and Medical Supplies). do not accumulate toward each other. Prosthetic Devices -- $4,000 limit per calendar year. $5 million medical lifetime maximum for all covered medical services. However, once the medical lifetime maximum is met, no additional prescription drug claims will be paid. Physical Medicine and Rehabilitation (Network and Non-network combined): Benefit period = calendar year. Limited to 60 days per calendar year, includes Day Rehabilitation programs. Prescription Drug: - 30-day supply for Network and Non-network pharmacy (does not include drugs obtained Outpatient Therapy (Network and Non-network combined): through mail Physical Therapy: 20 visits service pharmacy). Occupational Therapy: 20 visits - Certain diabetic and asthmatic supplies are not covered at Non-network pharmacies (except Speech Therapy: 20 visits Diabetic test strips). Anthem Rx Mail Service: Behavioral Health Services: - 90-day supply Mental Health/Substance Abuse (Network and Non-network combined): - Non-network not covered. Inpatient: 20 days Outpatient: 20 visits Ambulance/Hospice/Urgent Care Facility: Transitional Care Services: 15 visits Paid at the Network Cost Share. Kidney Disease Treatment: Skilled Nursing Facility (Network and Non-network combined): $30,000 calendar year maximum (Network and Non-network combined) and applies toward Limited to 30 days per admission. the medical lifetime maximum. Cornea transplants are paid the same as any other medical coverage benefit. Home Care Services (Network and Non-network combined): Limited to 90 visits per calendar year (excludes Private Duty Nursing). Private Duty Nursing – limited to $50,000 annually with a lifetime maximum of $100,000.

100+group size only:

Dependent Eligibility Medicare Rx Option End of Wrap Calend End of To Subsidy* ar Year Month Birthd Waiver ay *Subsidy is only available to 100+ size groups Age 18; 23, federal tax exemption (ASO only) Age 19 Age 19; 21, full-time student Age 19; 23, full-time student Age 19; 24, full-time student Age 19; 25, full-time student Note: Bolded text is the standard Dependent Eligibility.

Refer to the 51+ Specialty CSOS for life and dental information.

025d5a13f9e9834f8728fbfcf917edda.doc Blue Cross Blue Shield of Wisconsin (“BCBSWi”) and Compcare Health Services Insurance Corporation (“Compcare”) collectively underwrite the medical POS policies. Independent licensees of the Blue Cross and Blue Shield Association. ®Registered marks Blue Cross and Blue Shield Association.