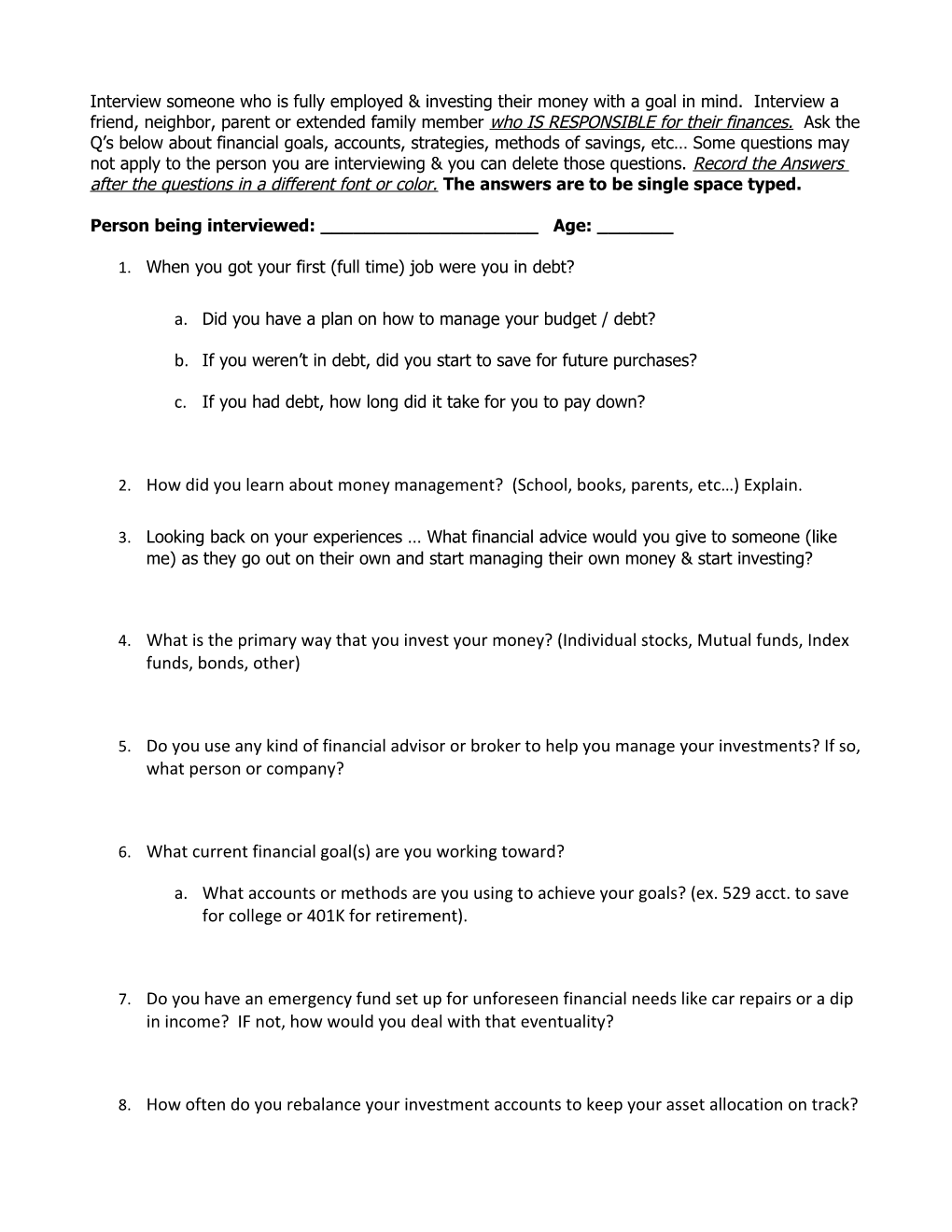

Interview someone who is fully employed & investing their money with a goal in mind. Interview a friend, neighbor, parent or extended family member who IS RESPONSIBLE for their finances. Ask the Q’s below about financial goals, accounts, strategies, methods of savings, etc… Some questions may not apply to the person you are interviewing & you can delete those questions. Record the Answers after the questions in a different font or color. The answers are to be single space typed.

Person being interviewed: ______Age: ______

1. When you got your first (full time) job were you in debt?

a. Did you have a plan on how to manage your budget / debt?

b. If you weren’t in debt, did you start to save for future purchases?

c. If you had debt, how long did it take for you to pay down?

2. How did you learn about money management? (School, books, parents, etc…) Explain.

3. Looking back on your experiences … What financial advice would you give to someone (like me) as they go out on their own and start managing their own money & start investing?

4. What is the primary way that you invest your money? (Individual stocks, Mutual funds, Index funds, bonds, other)

5. Do you use any kind of financial advisor or broker to help you manage your investments? If so, what person or company?

6. What current financial goal(s) are you working toward?

a. What accounts or methods are you using to achieve your goals? (ex. 529 acct. to save for college or 401K for retirement).

7. Do you have an emergency fund set up for unforeseen financial needs like car repairs or a dip in income? IF not, how would you deal with that eventuality?

8. How often do you rebalance your investment accounts to keep your asset allocation on track? 9. Do you regularly pay off your credit card balances in full?

10. How do you manage your monthly spending & budget & credit card(s)?

a. Which of these do you use? Auto bill pay, Direct deposit, Overdraft protection.

11. Are you planning on Social Security income helping in your retirement plans?

12. Do you have a 401K, IRA, Roth IRA or Pension set up for retirement?

a. If so, which ones and what percentage are you going to rely on each for your retirement?

b. If not, what do you plan on doing for retirement and when do you think you’ll start working toward your goal?

13. At what age do plan on retiring? ______