Z

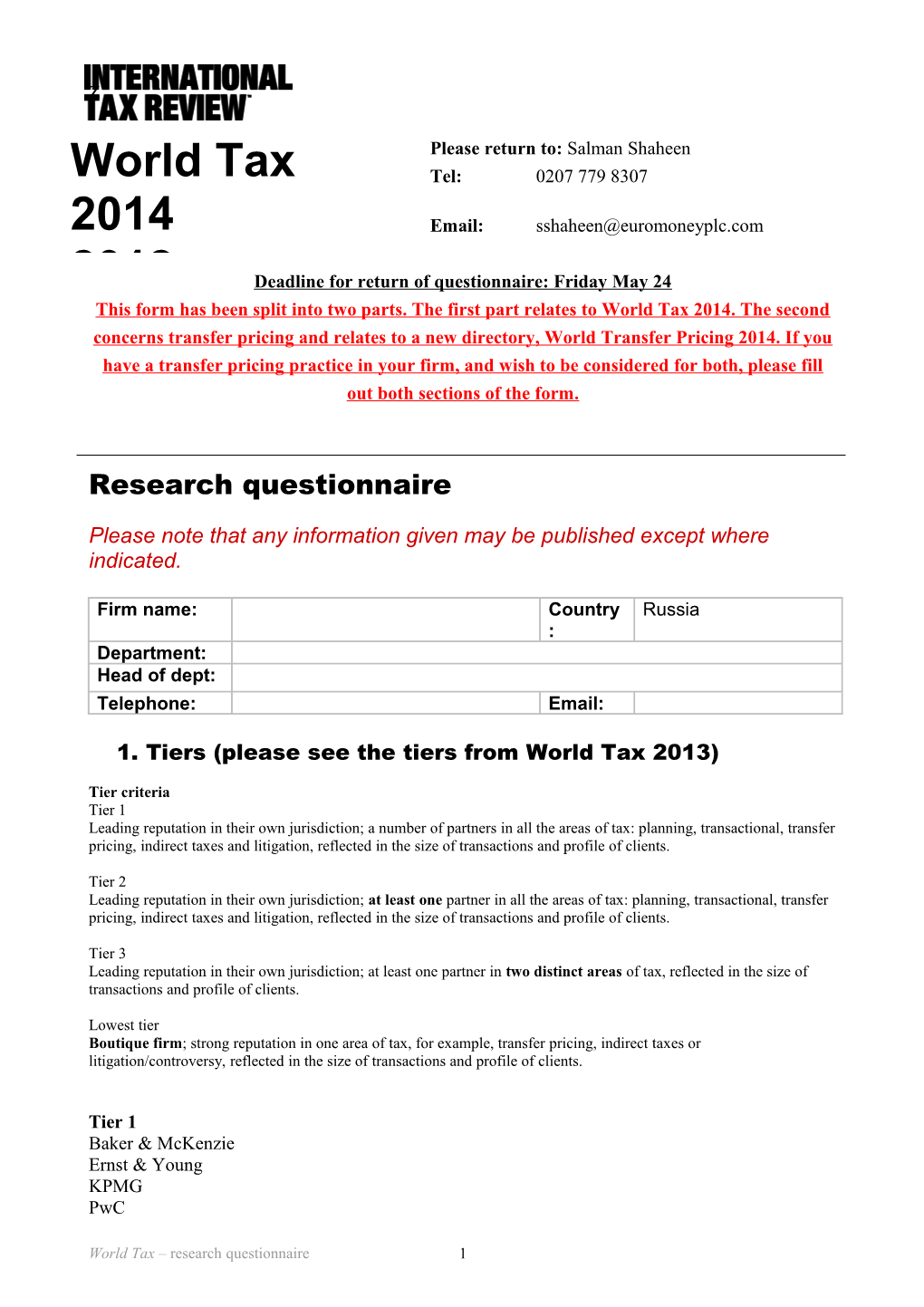

Please return to: Salman Shaheen World Tax Tel: 0207 779 8307

2014 Email: [email protected]

2012 Deadline for return of questionnaire: Friday May 24 This form has been split into two parts. The first part relates to World Tax 2014. The second concerns transfer pricing and relates to a new directory, World Transfer Pricing 2014. If you have a transfer pricing practice in your firm, and wish to be considered for both, please fill out both sections of the form.

Research questionnaire

Please note that any information given may be published except where indicated.

Firm name: Country Russia : Department: Head of dept: Telephone: Email:

1. Tiers (please see the tiers from World Tax 2013)

Tier criteria Tier 1 Leading reputation in their own jurisdiction; a number of partners in all the areas of tax: planning, transactional, transfer pricing, indirect taxes and litigation, reflected in the size of transactions and profile of clients.

Tier 2 Leading reputation in their own jurisdiction; at least one partner in all the areas of tax: planning, transactional, transfer pricing, indirect taxes and litigation, reflected in the size of transactions and profile of clients.

Tier 3 Leading reputation in their own jurisdiction; at least one partner in two distinct areas of tax, reflected in the size of transactions and profile of clients.

Lowest tier Boutique firm; strong reputation in one area of tax, for example, transfer pricing, indirect taxes or litigation/controversy, reflected in the size of transactions and profile of clients.

Tier 1 Baker & McKenzie Ernst & Young KPMG PwC

World Tax – research questionnaire 1 Tier 2 Deloitte Dentons Pepeliaev Group - Taxand

Tier 3 CMS Russia Goltsblat BLP Herbert Smith Freehills Linklaters White & Case

Tier 4 Alrud Clifford Chance DLA Piper Noerr YUST

TIER 1 – (strongest) - Which firm(s) should not be in Tier 1?......

TIER 2 - Which firm(s) should not be in Tier 2?......

TIER 3 - Which firm(s) should not be in Tier 3?......

TIER 4 – Which firms(s) should not be in Tier 4?

Are there any firms missing from the rankings? If so, which tier? Firm Tier 1. 2. 3.

Which firm(s) tax practice has noticeably declined over the past year?...... Why?…………………………………………………………………………………………

Which firm(s) tax practice has particularly improved over the past year?...... Why?...... World Tax – research questionnaire 2 Specialist areas - Recommend up to three individuals with specialist skills in the following areas (please do not include advisers from your own firm):

Corporate Tax Individual’s name Firm 1. 2. 3.

Tax controversy Individual’s name Firm/Chambers and litigatio n (includi ng barriste rs if applicab le) 1. 2. 3.

Capital markets Individual’s name Firm & financial products 1. 2. 3.

Cross-border Individual’s name Firm structuri ng 1. 2. 3.

M&A Individual’s name Firm 1. 2. 3.

Indirect Tax Individual’s name Firm 1. 2. 3.

World Tax – research questionnaire 3 2. Personnel

How many professionals are in your practice?

Partners Other fee earners

Indirect tax Corporate tax Tax disputes

Please give the names and details of any tax professionals who have joined your department since May 2012 (continue on a separate sheet if necessary).

Name From (position) Date hired

Please give the names and details of any tax professionals who have left your department since May 2012 (continue on a separate sheet if necessary).

Name To (position) Date left

3. Clients

Please give the name of five key clients that your firm has advised in the past two years (this information is for publication). Please also provide us with contact information for each of these clients so we can contact them for independent market research (the contact information will not be published).

Company: Contact name: Position: Telephone: Email: OK to contact? [Y/N]

World Tax – research questionnaire 4 4. Recent work This information is for publication.

Please give the details of the most innovative transactions and other tax work (no more than three each for corporate tax, tax disputes and indirect tax) your tax practice has advised on since May 2012, which can be used for publication.

CORPORATE Matter 1 Matter 2 Matter 3 TAX Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

World Tax – research questionnaire 5 INDIRECT TAX Matter 1 Matter 2 Matter 3 Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

World Tax – research questionnaire 6 TAX DISPUTES Matter 1 Matter 2 Matter 3 Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

5. Synopsis

Please give any other details of your tax practice which you would like us to take into consideration:

World Tax – research questionnaire 7 Z

Part 2

Please return to: Tel: +44 (0)20 7779 Fax: +44 (0)20 7779 Email:

Deadline for return of questionnaire: Friday May 24 This form has been split into two parts. The first part relates to World Tax 2014. The second concerns transfer pricing and relates to a new directory, World Transfer Pricing 2014. If you have a transfer pricing practice in your firm, and wish to be considered for both, please fill out both sections of the form.

Research questionnaire

Please note that any information given may be published except where indicated.

Firm name: Country : Department: Head of dept: Telephone: Email:

1. Tiers (please nominate the transfer pricing service providers in your jurisdiction and the tier you believe they belong in)

Tiers and methodology 1 Firms have a leading reputation in their jurisdiction. They have a varied portfolio of work. They offer a range of transfer pricing services. They boast a variety of different clients.

2 Firms have a leading reputation in their jurisdiction. They have a varied portfolio of work. They offer a range of transfer pricing services.

3 Firms have a leading reputation in their jurisdiction. They have a varied portfolio of work.

World Tax – research questionnaire 8 Tier 1

Tier 2

Tier 3

Which firm(s) transfer pricing practice has noticeably declined over the past year?...... Why?…………………………………………………………………………………………

Which firm(s) transfer pricing practice has particularly improved over the past year?...... Why?......

Specialist areas - Recommend up to three individuals with specialist skills in the following areas (please do not include advisers from your own firm):

TP Disputes Individual’s name Firm 1. 2. 3.

APA negotiation Individual’s name Firm/Chambers 1. 2. 3.

World Tax – research questionnaire 9 Documentation Individual’s name Firm project manage ment 1. 2. 3.

Other Individual’s name Firm 1. 2. 3.

2. Personnel

How many transfer pricing professionals are in your practice?

Partners Other fee earners

Please give the names and details of any transfer pricing professionals who have joined your department since May 2012 (continue on a separate sheet if necessary).

Name From (position) Date hired

Please give the names and details of any transfer pricing professionals who have left your department since May 2012 (continue on a separate sheet if necessary).

Name To (position) Date left

3. Clients

Please give the name of five key transfer pricing clients that your firm has advised in the past two years (this information is for publication), who can be contacted for independent market research. Please also provide us with contact information for each of these clients (the contact information will not be published).

World Tax – research questionnaire 10 Company: Contact name: Position: Telephone: Email: OK to contact? [Y/N]

4. Recent work This information is for publication.

Please give the details of the most innovative transfer pricing matters your practice has advised on since May 2012, which can be used for publication.

Matter 1

Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

World Tax – research questionnaire 11 Matter 2

Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

Matter 3

World Tax – research questionnaire 12 Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

Matter 4

Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

5. Synopsis

Please give any other details of your transfer pricing practice which you would like us to take into consideration: World Tax – research questionnaire 13 World Tax – research questionnaire 14