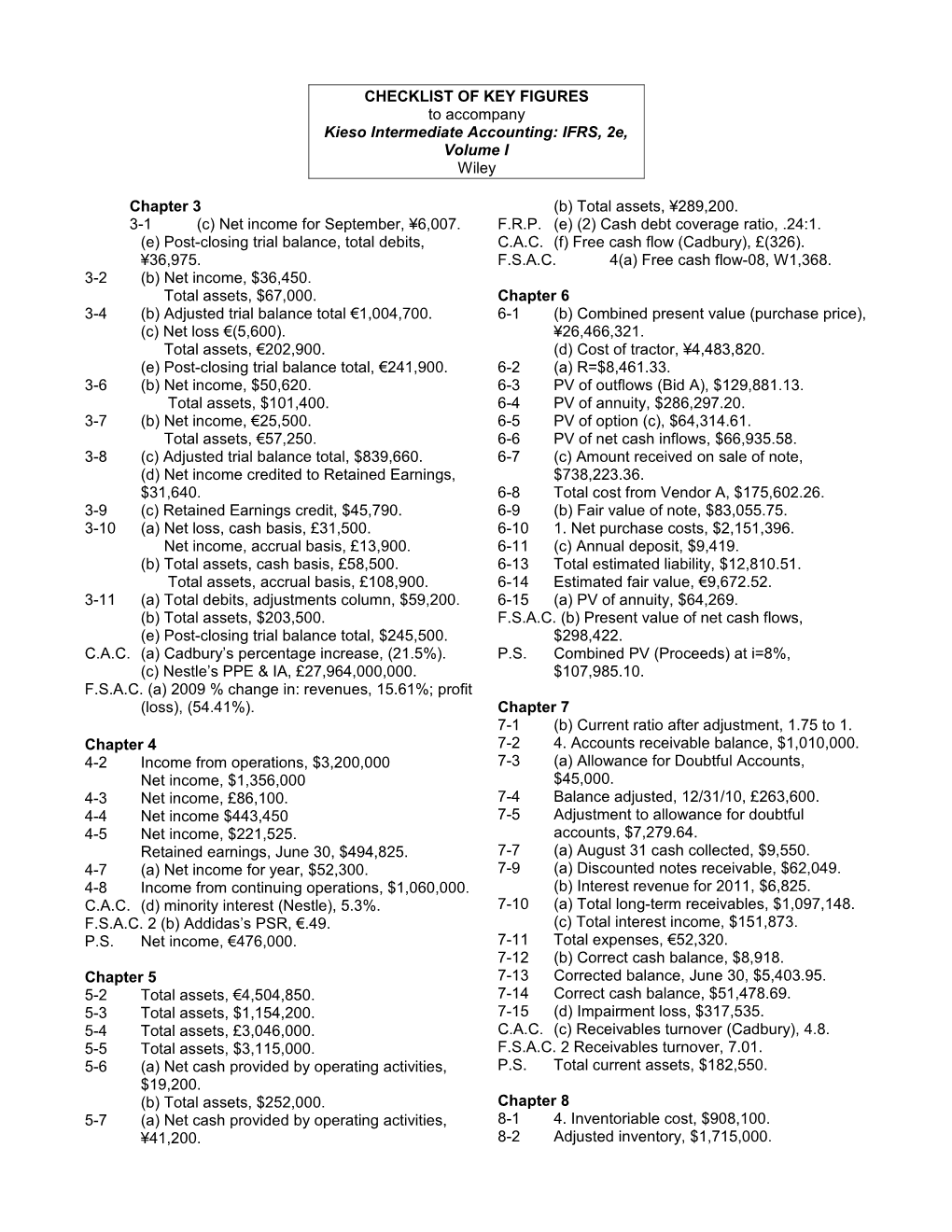

CHECKLIST OF KEY FIGURES to accompany Kieso Intermediate Accounting: IFRS, 2e, Volume I Wiley

Chapter 3 (b) Total assets, ¥289,200. 3-1 (c) Net income for September, ¥6,007. F.R.P. (e) (2) Cash debt coverage ratio, .24:1. (e) Post-closing trial balance, total debits, C.A.C. (f) Free cash flow (Cadbury), £(326). ¥36,975. F.S.A.C. 4(a) Free cash flow-08, W1,368. 3-2 (b) Net income, $36,450. Total assets, $67,000. Chapter 6 3-4 (b) Adjusted trial balance total €1,004,700. 6-1 (b) Combined present value (purchase price), (c) Net loss €(5,600). ¥26,466,321. Total assets, €202,900. (d) Cost of tractor, ¥4,483,820. (e) Post-closing trial balance total, €241,900. 6-2 (a) R=$8,461.33. 3-6 (b) Net income, $50,620. 6-3 PV of outflows (Bid A), $129,881.13. Total assets, $101,400. 6-4 PV of annuity, $286,297.20. 3-7 (b) Net income, €25,500. 6-5 PV of option (c), $64,314.61. Total assets, €57,250. 6-6 PV of net cash inflows, $66,935.58. 3-8 (c) Adjusted trial balance total, $839,660. 6-7 (c) Amount received on sale of note, (d) Net income credited to Retained Earnings, $738,223.36. $31,640. 6-8 Total cost from Vendor A, $175,602.26. 3-9 (c) Retained Earnings credit, $45,790. 6-9 (b) Fair value of note, $83,055.75. 3-10 (a) Net loss, cash basis, £31,500. 6-10 1. Net purchase costs, $2,151,396. Net income, accrual basis, £13,900. 6-11 (c) Annual deposit, $9,419. (b) Total assets, cash basis, £58,500. 6-13 Total estimated liability, $12,810.51. Total assets, accrual basis, £108,900. 6-14 Estimated fair value, €9,672.52. 3-11 (a) Total debits, adjustments column, $59,200. 6-15 (a) PV of annuity, $64,269. (b) Total assets, $203,500. F.S.A.C. (b) Present value of net cash flows, (e) Post-closing trial balance total, $245,500. $298,422. C.A.C. (a) Cadbury’s percentage increase, (21.5%). P.S. Combined PV (Proceeds) at i=8%, (c) Nestle’s PPE & IA, £27,964,000,000. $107,985.10. F.S.A.C. (a) 2009 % change in: revenues, 15.61%; profit (loss), (54.41%). Chapter 7 7-1 (b) Current ratio after adjustment, 1.75 to 1. Chapter 4 7-2 4. Accounts receivable balance, $1,010,000. 4-2 Income from operations, $3,200,000 7-3 (a) Allowance for Doubtful Accounts, Net income, $1,356,000 $45,000. 4-3 Net income, £86,100. 7-4 Balance adjusted, 12/31/10, £263,600. 4-4 Net income $443,450 7-5 Adjustment to allowance for doubtful 4-5 Net income, $221,525. accounts, $7,279.64. Retained earnings, June 30, $494,825. 7-7 (a) August 31 cash collected, $9,550. 4-7 (a) Net income for year, $52,300. 7-9 (a) Discounted notes receivable, $62,049. 4-8 Income from continuing operations, $1,060,000. (b) Interest revenue for 2011, $6,825. C.A.C. (d) minority interest (Nestle), 5.3%. 7-10 (a) Total long-term receivables, $1,097,148. F.S.A.C. 2 (b) Addidas’s PSR, €.49. (c) Total interest income, $151,873. P.S. Net income, €476,000. 7-11 Total expenses, €52,320. 7-12 (b) Correct cash balance, $8,918. Chapter 5 7-13 Corrected balance, June 30, $5,403.95. 5-2 Total assets, €4,504,850. 7-14 Correct cash balance, $51,478.69. 5-3 Total assets, $1,154,200. 7-15 (d) Impairment loss, $317,535. 5-4 Total assets, £3,046,000. C.A.C. (c) Receivables turnover (Cadbury), 4.8. 5-5 Total assets, $3,115,000. F.S.A.C. 2 Receivables turnover, 7.01. 5-6 (a) Net cash provided by operating activities, P.S. Total current assets, $182,550. $19,200. (b) Total assets, $252,000. Chapter 8 5-7 (a) Net cash provided by operating activities, 8-1 4. Inventoriable cost, $908,100. ¥41,200. 8-2 Adjusted inventory, $1,715,000. 8-4 (b) Ave. Cost inventory, $1,917.33. 8-5 (b) Ave. Cost inventory, ¥3,463. 11-8 (a) Accumulated depreciation (DDB method), 8-6 (d) Perpetual FIFO cost of goods sold, €87,100. 12/31/10, $806,400. Moving average inventory balance, €28,600. 11-9 © Loss on impairment, $1,900,000. 8-7 (b) LIFO inventory, $1,915. 11-10 (a) Impairment loss $33,581. 8-8 (b)2 LIFO inventory, $3,350. © Recovery of impairment loss $20,149. 8-9 (d) Perpetual LIFO cost of goods sold, $92,000. 11-11 (b) Current year profit £2,094,400. (f) Moving average inventory balance, $28,600.. 11-12 (b) Total depreciation $5,250. 8-10 New amount for retained earnings at 12/31/11 11-13 © Unrealized gain on revaluation – land $226,400. $500. 8-11 (a) 6. Cost of goods sold, $11,799,080. 11-14 (b) Other comprehensive income 12/31/12 8-12 (b) Inventory at 12/31/10 $766,500. $2,500. 8-13 Inventory at 12/31/10 $73,192. C.A.C. (c) (3) Rate of return on assets (Nestle), 8-14 (a) Inventory at 12/31/10, $110,600. 17.2%. F.S.A.C. 1 (a) Income before taxes, $15,306,000. P.S. Gain on sale, $29,000. F.S.A.C. 3 FIFO cost of sales-07, $29,249. Chapter 12 Chapter 9 12-1 Patent amortization for 2010, $10,777. 9-2 (a)2 Gain to be recorded $(12,300). 12-2 (c) Carrying value, 12/31/11, $48,000. 9-3 (b) 12/31/11 Loss due to market decline, $7,000. 12-3 (b) Total expenses for 2010, $61,288. 9-4 (d) Total effect on income €50,000. 12-4 (b) Patent, $72,600. 9-5 Fire loss on inventory, ¥58,250. 12-5 (c) Impairment loss, $200,000. 9-6 Inventory fire loss, €50,700. 12-6 (a) Total intangibles, £203,700. 9-7 (b) Inventory at LCNRV, HK$52,290. F.R.P. (b) Percentage of sales revenue-2007, 9-8 Ending inventory at cost, $305,000. 20.7%. 9-9 (a) Ending inventory at LCNRV, £64,588. C.A.C. (a) (2) Percentage of total assets (Nestle), 9-10 (a) Raw materials inventory, $237,400. 35.3%. 9-11 (a) Loss due to market decline, ¥790. P.S. Impairment loss, $16,250. F.R.P. (d) Inventory turnover 12.23. C.A.C. (d) Days to sell inventory (Nestle), 72 days. Chapter 13 P.S. Loss due to market decline, $4,000. 13-3 Total income tax withholding for month, $104. 13-4 (a) Total income tax withholding, $3,350. Chapter 10 13-5 (b) Warranty expense, $136,000. 10-1 (a) Land balance- 12/31/10, £1,614,000. 13-7 (a) (3) Warranty expense, $117,000. 10-2 (a) Machinery and equipment balance- 12/31/10, 13-8 Cost of estimated claims outstanding, $1,295,000. €23,100. 10-3 (a) 1. Land, $188,700. 13-9 (b) Premium expense for 2011, $78,000. Building, $136,250. 13.12 (3) Premium expense for 2010, $54,000. 10-5 (b) Cost of building, $3,423,000. 13-14 1. Liability balance, $224,300. 10.6 (b) Building balance- 12/31/11, $682,248. F.R.P. (b) Acid-test ratio, .35. 10.7 (b) Avoidable interest, $140,000. C.A.C. (b) Acid-test ratio (Cadbury), .54. 10-8 3. Gain recognized-Liston, $10,000. 10-9 (b) Gain deferred-Wiggins, $12,000. Chapter 14 10-10 (c) Gain recognized-Marshall, €8,000. 14-1 (e) Bond interest expense -2004, $11,322. 10-11 (b) Transaction 1, asset cost, $23,115. 14.2 (c) Loss on redemption, $41,945. F.S.A.C. (d) Free cash flow, €643,000,000. 14.3 (c) Quarterly payments, €4,503. P.S. Pretax loss, $1,000. 14-5 (b) Depreciation expense-2011, $67,961.20. (c) Interest expense-2012, $45,078.66. Chapter 11 14-6 (b) Interest expense, 12/31/10, $10,598.82. 11-1 (a) Depreciation base (SL), $86,400. (d) Interest Expense-2012, $5,706.46. 11-2 Depreciation expense-2011 (SYD method), 14-7 (a) Loss on bond redemption, 1/2/11, €19,250. ¥3,042,888. 11-3 (d) Depreciation expense-Asset E, $5,600. 14-8 1. Proceeds from sale of bonds (Sanford 11-4 (a) Semitrucks balance, 12/31/11, ¥152,000. Co.), 3/1/10, $472,090. (b) Depreciation expense adjustment in 2011 Bonds Payable credited 12/31/10, $2,350. credit of ¥14,000. 2. Bonds Payable debited 12/1/10, $2,707. 11-5 (b) 2011Depreciation expense (Bldg.), £9,900. 14-9 12/31/10 Interest expense credited $351.45. 11-6 (13) $52,000. 1/2/11 Gain on redemption $61,847.82 11-7 (b) Depreciation expense - 2009 (SYD method), 14-10 (d) Loss on extinguishment of bonds, $23,800. Rs602,104. 14-11 (b) Gain on extinguishment of debt $301,123. 14-12 © Gain on extinguishment of debt $1,712,400. 14-13 (b) Gain on extinguishment of debt $47,411. 14-14 (a) Interest expense for 2010 $65,699. F.R.P. (b) Times interest earned, 8.70 times. C.A.C. (a) Times interest earned (Cadbury), 8.92 times. P.S. Bond price, $5,307,228.36.