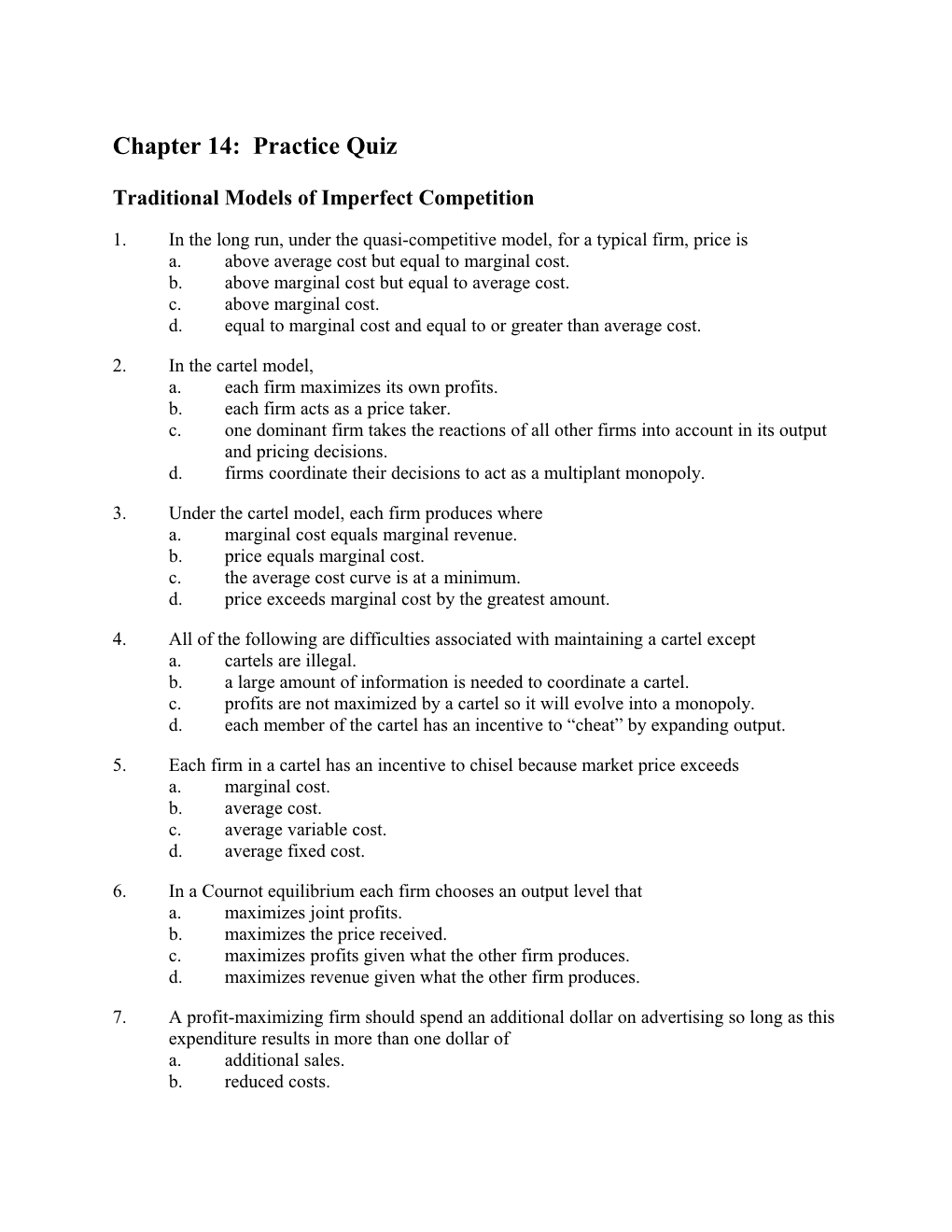

Chapter 14: Practice Quiz

Traditional Models of Imperfect Competition

1. In the long run, under the quasi-competitive model, for a typical firm, price is a. above average cost but equal to marginal cost. b. above marginal cost but equal to average cost. c. above marginal cost. d. equal to marginal cost and equal to or greater than average cost.

2. In the cartel model, a. each firm maximizes its own profits. b. each firm acts as a price taker. c. one dominant firm takes the reactions of all other firms into account in its output and pricing decisions. d. firms coordinate their decisions to act as a multiplant monopoly.

3. Under the cartel model, each firm produces where a. marginal cost equals marginal revenue. b. price equals marginal cost. c. the average cost curve is at a minimum. d. price exceeds marginal cost by the greatest amount.

4. All of the following are difficulties associated with maintaining a cartel except a. cartels are illegal. b. a large amount of information is needed to coordinate a cartel. c. profits are not maximized by a cartel so it will evolve into a monopoly. d. each member of the cartel has an incentive to “cheat” by expanding output.

5. Each firm in a cartel has an incentive to chisel because market price exceeds a. marginal cost. b. average cost. c. average variable cost. d. average fixed cost.

6. In a Cournot equilibrium each firm chooses an output level that a. maximizes joint profits. b. maximizes the price received. c. maximizes profits given what the other firm produces. d. maximizes revenue given what the other firm produces.

7. A profit-maximizing firm should spend an additional dollar on advertising so long as this expenditure results in more than one dollar of a. additional sales. b. reduced costs. c. increased profits. d. demand.

8. In a contestable market a. barriers to entry must exist. b. economic profits are positive. c. entry and exit is costless. d. all firms are price takers.

9. Membership in a product group can be measured by a. cross price elasticities of demand. b. returns to scale. c. economies of scope. d. demand income effects.

10. In the Hotelling model of spatial competition, profits arise from a. monopoly power. b. rents based on locational advantage. c. the ability to price discriminate. d. increasing returns to scale.

The following questions are based on a duopoly in which market demand is given by

P(Q) = 420 – 2Q and each firm has costs of

TC(q) = 200 + q2

11. The joint profit maximizing quantity is a. 35.0 b. 42.0 c. 48.5 d. 52.5 e. 56.0

12. The Nash equilibrium quantity is a. 35.0 b. 42.0 c. 48.5 d. 52.5 e. 56.0

13. If one firm is producing the joint profit maximizing quantity and the other firm decides to cheat in such a way as to maximize its profits, the cheating firm will produce a quantity of

162 Chapter 14/Traditional Models of Imperfect Competition 163 a. 42.0 b. 48.5 c. 52.5 d. 56.0 e. 60.0

163 Answers

1. d 2. d 3. a 4. c 5. a 6. c 7. c 8. c 9. a 10. b 11. b 12. d 13. d

164