North Seattle Community College Business, Engineering, & Information Technologies Division

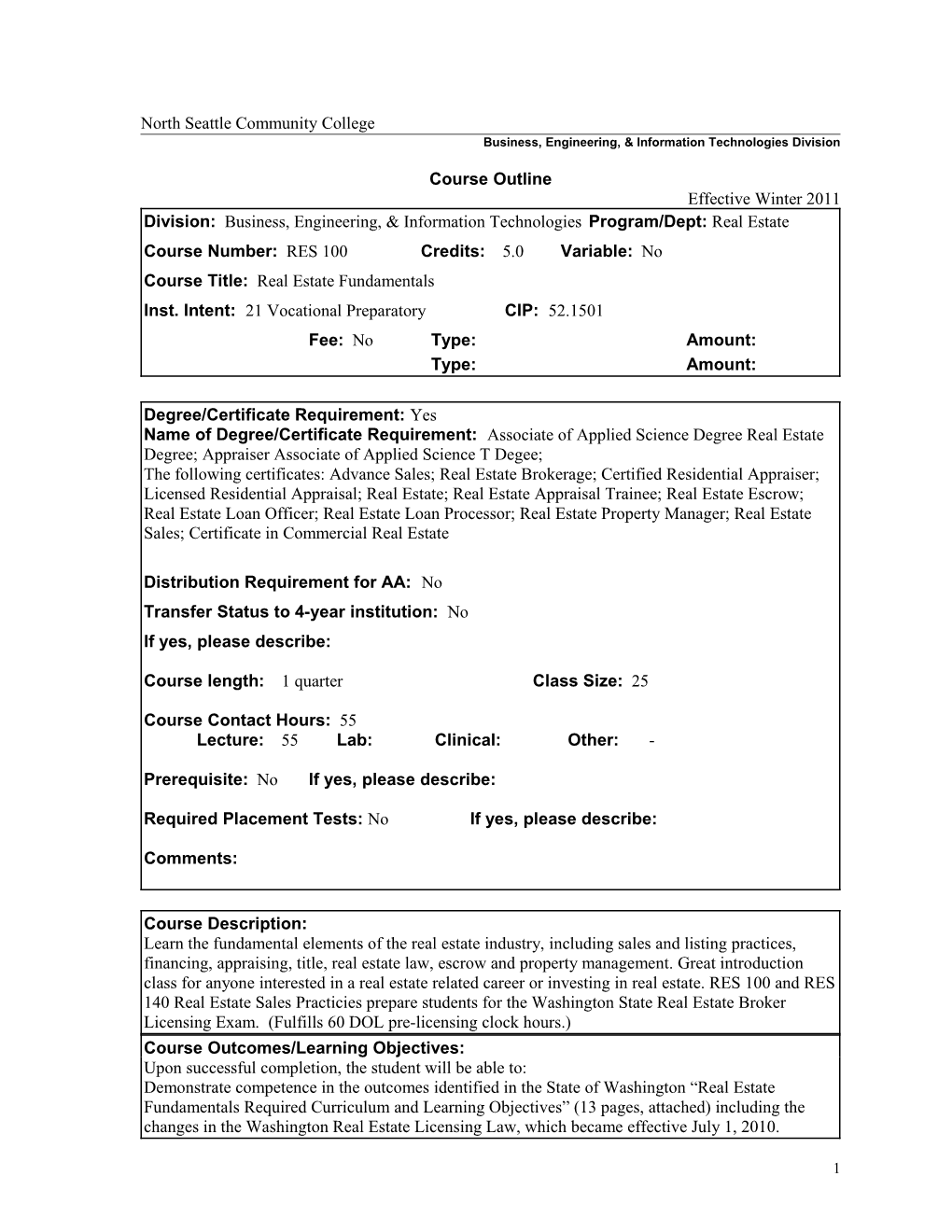

Course Outline Effective Winter 2011 Division: Business, Engineering, & Information Technologies Program/Dept: Real Estate Course Number: RES 100 Credits: 5.0 Variable: No Course Title: Real Estate Fundamentals Inst. Intent: 21 Vocational Preparatory CIP: 52.1501 Fee: No Type: Amount: Type: Amount:

Degree/Certificate Requirement: Yes Name of Degree/Certificate Requirement: Associate of Applied Science Degree Real Estate Degree; Appraiser Associate of Applied Science T Degee; The following certificates: Advance Sales; Real Estate Brokerage; Certified Residential Appraiser; Licensed Residential Appraisal; Real Estate; Real Estate Appraisal Trainee; Real Estate Escrow; Real Estate Loan Officer; Real Estate Loan Processor; Real Estate Property Manager; Real Estate Sales; Certificate in Commercial Real Estate

Distribution Requirement for AA: No Transfer Status to 4-year institution: No If yes, please describe:

Course length: 1 quarter Class Size: 25

Course Contact Hours: 55 Lecture: 55 Lab: Clinical: Other: -

Prerequisite: No If yes, please describe:

Required Placement Tests: No If yes, please describe:

Comments:

Course Description: Learn the fundamental elements of the real estate industry, including sales and listing practices, financing, appraising, title, real estate law, escrow and property management. Great introduction class for anyone interested in a real estate related career or investing in real estate. RES 100 and RES 140 Real Estate Sales Practicies prepare students for the Washington State Real Estate Broker Licensing Exam. (Fulfills 60 DOL pre-licensing clock hours.) Course Outcomes/Learning Objectives: Upon successful completion, the student will be able to: Demonstrate competence in the outcomes identified in the State of Washington “Real Estate Fundamentals Required Curriculum and Learning Objectives” (13 pages, attached) including the changes in the Washington Real Estate Licensing Law, which became effective July 1, 2010.

1 NSCC Essential Learning Outcomes and/or Related Instructional Outcomes (for technical courses) Met by Course: (list each outcome): Intellectual and Practical Skills, including: 1. Critical thinking and problem solving 2. Quantitative Reasoning Personal and Social Responsibility, including: 1. Ethical Awareness and Personal Integrity

Topical Outline and/or Major Divisions: 1. Real Estate As A Career

2. Real Property Ownership, Rights, Interests and Land Use Controls a. Real Property vs Personal Property

b. Legal Description Methods c. Estates in Land – Freeholds and Leaseholds

d. Methods of Holding Title

e. Voluntary and Involuntary Transfers

f. Title Insurance & Recording

g. Encumbrances – Liens and Non-Financial

h. Public and Private Use Restrictions

3. Contract Law – in General, and for Real Estate

a. Purchase and Sale Agreements

b. Contingency Clauses

c. Disclosure Laws

d. Contracts between Brokers and the Brokerage Firm

e. Option Contracts

4. Agency Law and Brokerage Relationships

a. Between Sellers and Brokers

b. Between Buyers and Brokers

c. Between Brokers and the Brokerage Firm/Managing Brokers

d. Between Brokers and “The General Public”

5. Listing Agreements and Procedures

6. The Selling Process

2 7. Real Estate Valuation – Appraisals

a. Market Value Approach

b. Income Approach

c. Cost Approach

8. Real Estate Finance

a. Types of Lenders

b. Basic Loan Features and Terms

c. Residential Financing Programs

d. Predatory Lending

e. The Secondary Mortgage Market

9. Escrow and Settlement Process

a. RESPA

b. Calculating and Prorating Closing Costs

c. Licensing of Escrow Officers

10. Leasing, Property Management and the Residential Landlord Tenant Act

a. Residential Landlord-Tenant Issues

b. Commercial Landlord-Tenant Issues

11. Real Estate License Law (18.85 RCW; 18.86 RCW; 18.235 RCW; WAC 308-124 all parts)

a. Licensing Requirements for Brokers and Managing Brokers

b. Regulation of Business Practices

c. Anti-Trust Issues in Real Estate

d. Disciplinary Actions

12. Fair Housing Issues and Consumer Protection

a. Federal Anti-Discrimination Laws

b. State Anti-Discrimination Laws

13. Federal Income Taxation Issues

a. Deductions for Residential and Income Properties

3 b. Capital Gains & Losses

c. Non-recognition Transactions

14. Real Estate Math Issues

Course Requirements (Expectations of Students) Students will be expected to: Attend class sessions Complete assigned readings Complete all assignments, projects and examinations based on deadlines established by the instructor

Methods of Assessment/Evaluation: Tests, projects and assignments as determined by instructor. Final grades are assigned according to published grading standards for the course.

Required Text(s) and/or Materials: To be determined by instructor

Supplemental Text(s) and/or Materials: As designated by instructor.

Outline Developed by: Richard Duce Date: Sept 1, 1986 Revised by: Nancy JG Adelson Date: May 17, 2004, April 5, 2006 Revised by: Nancy JG Adelson Date: October 5, 2007 Revised by: Nancy JG Adelson Date: May 14, 2008 Revised by: Larry Hopt and Nancy JG Adelson Date: August 8, 2010 Revised by: Nancy JG Adelson Date: October 1, 2010

Updated 10-1-10 njga

4