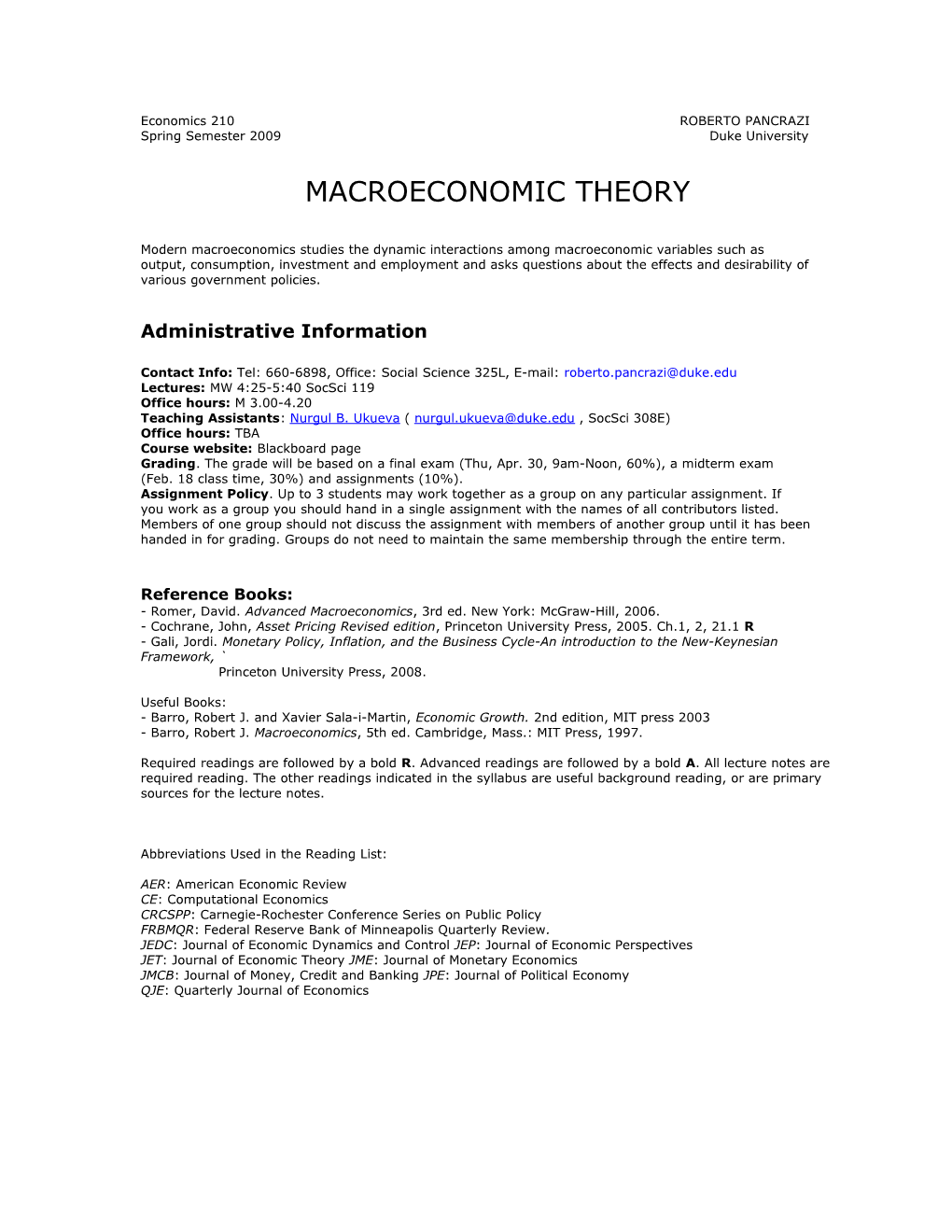

Economics 210 ROBERTO PANCRAZI Spring Semester 2009 Duke University

MACROECONOMIC THEORY

Modern macroeconomics studies the dynamic interactions among macroeconomic variables such as output, consumption, investment and employment and asks questions about the effects and desirability of various government policies.

Administrative Information

Contact Info: Tel: 660-6898, Office: Social Science 325L, E-mail: [email protected] Lectures: MW 4:25-5:40 SocSci 119 Office hours: M 3.00-4.20 Teaching Assistants: Nurgul B. Ukueva ( [email protected] , SocSci 308E) Office hours: TBA Course website: Blackboard page Grading. The grade will be based on a final exam (Thu, Apr. 30, 9am-Noon, 60%), a midterm exam (Feb. 18 class time, 30%) and assignments (10%). Assignment Policy. Up to 3 students may work together as a group on any particular assignment. If you work as a group you should hand in a single assignment with the names of all contributors listed. Members of one group should not discuss the assignment with members of another group until it has been handed in for grading. Groups do not need to maintain the same membership through the entire term.

Reference Books: - Romer, David. Advanced Macroeconomics, 3rd ed. New York: McGraw-Hill, 2006. - Cochrane, John, Asset Pricing Revised edition, Princeton University Press, 2005. Ch.1, 2, 21.1 R - Gali, Jordi. Monetary Policy, Inflation, and the Business Cycle-An introduction to the New-Keynesian Framework, ` Princeton University Press, 2008.

Useful Books: - Barro, Robert J. and Xavier Sala-i-Martin, Economic Growth. 2nd edition, MIT press 2003 - Barro, Robert J. Macroeconomics, 5th ed. Cambridge, Mass.: MIT Press, 1997.

Required readings are followed by a bold R. Advanced readings are followed by a bold A. All lecture notes are required reading. The other readings indicated in the syllabus are useful background reading, or are primary sources for the lecture notes.

Abbreviations Used in the Reading List:

AER: American Economic Review CE: Computational Economics CRCSPP: Carnegie-Rochester Conference Series on Public Policy FRBMQR: Federal Reserve Bank of Minneapolis Quarterly Review. JEDC: Journal of Economic Dynamics and Control JEP: Journal of Economic Perspectives JET: Journal of Economic Theory JME: Journal of Monetary Economics JMCB: Journal of Money, Credit and Banking JPE: Journal of Political Economy QJE: Quarterly Journal of Economics

1. ECONOMIC GROWTH

1a. The Solow Model - Romer, §1 R - Barro, Sala-i-Martin, §1.1 1.2 A - Barro, §11

1b. The Neoclassical Model - Romer, §2.1 – 2.5 R - Barro, Sala-i-Martin, § 2.1-2.6 A - King, Robert G. and Sergio Rebelo (1993) Transitional dynamics and economic growth in the neoclassical model, AER, 83, 908.31. - Klenow, Peter J. and Andrés Rodríguez-Clare (1998) The neoclassical revival in growth economics: Has it gone too far? in: B. Bernanke and J. Rotemberg eds., NBER Macroeconomics Annual 1997. Cambridge, Mass.: MIT Press, pp 73.102. - Mankiw, N. Gregory, David Romer and David N. Weil (1992) A contribution to the empirics of economic growth, QJE, 107, 407.37.

1d. The Stochastic Neoclassical Growth Model

2. CONSUMPTION

- Romer, §7 R - Hall, Robert E. (1978) Stochastic implications of the life cycle-permanent income hypothesis: Theory and evidence, JPE, 86, 971.87. e

3. REAL BUSINESS CYCLE MODELS

3a. What are We Trying to Explain? - King, Robert G. and Sergio T. Rebelo (1999) Resuscitating real business cycles, in: Handbook, Vol. 1B, 927.1007. Secs 1.2. R - Stock, James H. and Mark W. Watson (1999) Business cycle fluctuations in U.S. macroeconomic time series, in Handbook, Vol. 1A, 3.64. R - Hodrick, Robert J. and Edward C. Prescott (1997) Postwar U.S. business cycles: An empirical investigation, JMCB, 29, 1.16. - King, Robert G. and Sergio T. Rebelo (1993) Low frequency filtering and real business cycles, JEDC, 17, 207.31. - Canova, Fabio (1998) Detrending and business cycle facts, JME, 41, 475.512. - Burnside, Craig (1998) Detrending and business cycle facts: A comment, JME, 41, 513.32.

3b. The Basics of an RBC Model - King and Rebelo (1999) Sec 3. R - Barro, §2, 3, 5, 6, 9

- Kydland, Finn E. and Edward C. Prescott (1982) Time to build and aggregate fluctuations, Econometrica, 50, 1345.70. - Lucas, Robert E. Jr. (1977) Understanding business cycles, CRCSPP, 5, 7.29. - Lucas, Robert E. Jr. (1980) Methods and problems in business cycle theory, JMCB, 12, 696.715.

3c. Putting Theory into Practice - King and Rebelo (1999) Secs 4.1.4.4 and 5. R - Burnside, Craig (1999) Real business cycle models: Linear approximation and GMM estimation, World Bank, mimeo.

3.d:. Early Critiques and Defenses of the RBC Model (READING) - King and Rebelo (1999) Sec 4.5, 6.1. 4. ASSET PRICING

- Cochrane, John, Asset Pricing Revised edition, Princeton University Press, 2005. Ch.1, 2, 21.1 R - Kocherlakota, Narayana (1996), The Equity Premium: It’s Still a Puzzle, Journal of Economic Literature, Vol. XXXIV, March, pp.42-71

5. IMPERFECT COMPETITION, NOMINAL RIGIDITIES AND MONETARY POLICY

- Gali, §1-5 R

5a. Review of Traditional Keynesian Models -Romer, §5 R

5b. The Empirical Facts of Interest - Stock and Watson (1999), full citation above in Sec 3a. R - Christiano, Lawrence J., Martin Eichenbaum and Charles Evans (2001) Nominal rigidities and the dynamic effects of a shock to monetary policy, Northwestern University, mimeo. Secs. 1.2. - Christiano, Lawrence J., Martin Eichenbaum and Charles Evans (1999) Monetary policy shocks: What have we learned and to what end? in: Handbook, Vol. 1A, 65.148. Working paper version is downloadable.

5c. Models: Imperfect Information - Romer, §6.1.6.3 R - Rotemberg, Julio J. and Michael Woodford (1995) Dynamic general equilibrium models with imperfectly competitive product markets, in: Thomas F. Cooley, ed., Frontiers of Business Cycle Research. Princeton: Princeton University Press, 243.93. Working paper version is downloadable. - Rotemberg, Julio J. and Michael Woodford (1999) The cyclical behavior of prices and costs, in: Handbook, Vol. 1B, 1051.135. Working paper version is downloadable. Re