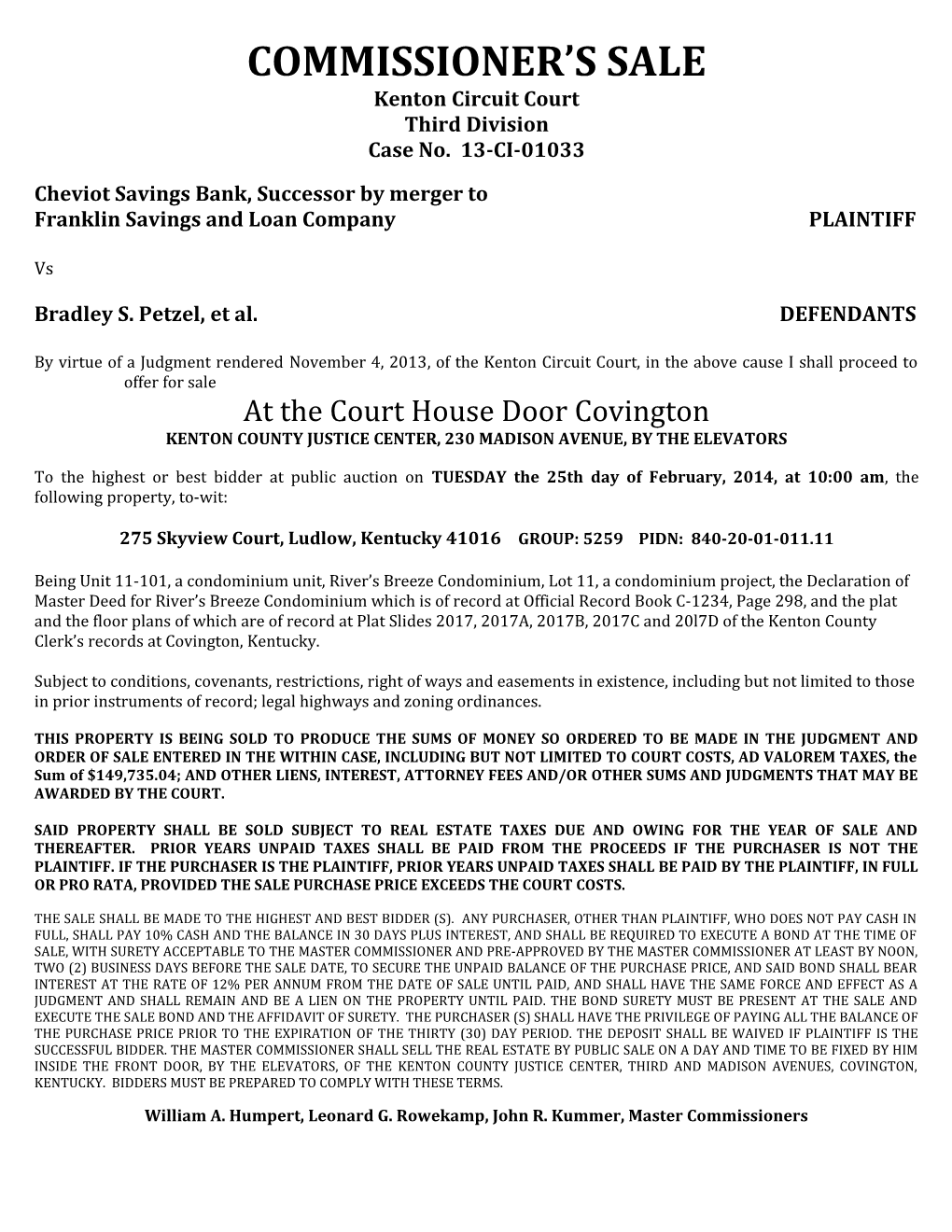

COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01033

Cheviot Savings Bank, Successor by merger to Franklin Savings and Loan Company PLAINTIFF

Vs

Bradley S. Petzel, et al. DEFENDANTS

By virtue of a Judgment rendered November 4, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

275 Skyview Court, Ludlow, Kentucky 41016 GROUP: 5259 PIDN: 840-20-01-011.11

Being Unit 11-101, a condominium unit, River’s Breeze Condominium, Lot 11, a condominium project, the Declaration of Master Deed for River’s Breeze Condominium which is of record at Official Record Book C-1234, Page 298, and the plat and the floor plans of which are of record at Plat Slides 2017, 2017A, 2017B, 2017C and 20l7D of the Kenton County Clerk’s records at Covington, Kentucky.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $149,735.04; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-00659

Wells Fargo Bank, N.A. PLAINTIFF

Vs

Connie Sue Kunzelman, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

1549 Crosswinds Drive, Independence, Kentucky 41051 GROUP: IND PIDN: 031-00-02-112.00

Being all of Lot No. ONE HUNDRED TWELVE (112), SHERBOURNE SUBDIVISION, SECTION 8, as shown on Plat Slides A- 774, A-775 and A-776 of the Kenton County Clerk’s Records at Independence, Kentucky.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $284,244.99; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-00703

U.S. Bank National Association as successor by mergerto U.S. Bank National Association ND PLAINTIFF

Vs

Dale Y. Hall, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

509 Grouse Court, Elsmere, Kentucky 41018 GROUP: 4915 PIDN: 016-20-00-001.63

BEING ALL OF LOT NO. 61 OF RIPPLE CREEK SUBDIVISION, SECTION 3, AS SHOWN ON PLAT NO. 1632 OF THE KENTON COUNTY CLERKS RECORDS AT COVINGTON, KENTUCKY.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $115,855.21; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 11-CI-02124

Jamos Fund 1 LP PLAINTIFF

Vs

Deborah Sturgeon, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

1562 Eastern Avenue, Covington, Kentucky 41011 GROUP: 1736 PIDN: 055-31-20-016.00

Situate in the city of Covington, County of Kenton and Commonwealth of Kentucky, to wit: Beginning at a point on the east side of Eastern Avenue 77½ feet south of the southeast corner of Eastern Avenue and Patton Street: thence southwardly along the east line of Eastern Avenue 22½ feet, and from this frontage extending back eastwardly between parallel lines 115 feet and being the south portion of Lots 53, 54 and 55, Patton Subdivision.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $6,734.21; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Case No. 10-CI-02043 FIRST DIVISION Tax Ease Investments 1, LLC Plaintiff Vs U.S. Bank, National Association, successor Defendant/CounterClaimant Vs Emma Scalf, Trustee, et al Defendants

By virtue of a Judgment rendered October 25, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

8574 Decoursey Pike, Fairview, Ky 41015 GROUP: IND PIDN: 058-40-00-109.00

Beginning at a point in the center line of the DeCoursey Pike, said point being 665.5 feet north of the Southeast corner of Peffer original 27.9 acre tract; thence north 87° 30’ W. 650 feet; thence North 37° 05’ W. 737.2 feet; thence South 78° E. along Ray Culbertson’ s south line 1153 feet to the center line of DeCoursey Pike; thence along the center line of DeCoursey Pike South 3° W. 375 feet to the place of beginning and containing 10 acres more or less.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $18,349.78; Ky Tax Bill; Tax Ease; Kenneth Grob; US Bank custodian; Kenton County; City of Fairview; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN THIRTY DAYS PLUS INTEREST AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 08-CI-01743

The Huntington National Bank PLAINTIFF Vs U.S. Bank National Association DEFENDANT/CROSS-CLAIMANT Vs Herman Bowles, et al. DEFENDANTS

By virtue of a Judgment rendered October 31, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

2019 & 2021 Donaldson Avenue, Covington, Kentucky 41014 GROUP: 930 PIDN: 055-14-13-003.00

Part of Lot Number Sixteen (16) and all of Lot No. Seventeen (17) of Howard and Company Subdivision, beginning at a point in the west line of Donaldson Avenue 118.83 feet north of the north line of Twenty-first Street, thence along the west line of Donaldson Avenue in a northwesterly direction 51.67 feet to the northeast corner of Lot No. 17; thence along the north line of Lot No. 17 in a southwesterly direction and at right angles to Donaldson Avenue 86 feet to the east line of the L. & N. Railroad property; thence along the east line of the L. & N. Railroad property and in a southeasterly direction 54.67 feet; thence in a northeasterly direction and parallel to the first mentioned line a distance of 105.5 feet to the west line of Donaldson Avenue and the place of beginning.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $4,058.71; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 09-CI-02369

U.S Bank National Association, as Trustee PLAINTIFF

Vs

Jerry Anneken, et al. DEFENDANTS

By virtue of a Judgment rendered December 29, 2009, and an Order rendered January 27, 2014, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

416 Olivia Lane, Fort Wright, Kentucky 41011 GROUP: 3658 PIDN: 042-10-00-267.00

Being all of Lot 52A and the Southeast twenty (20) feet of Lot No. 53 of George Krucutajans Addition in Fort Wright, Block C, as shown on Original Plat 686, in the Office of the Clerk of the County Court of Kenton County, at Covington, Kentucky. There is excepted from the foregoing, the property conveyed in Deed Book 921, Page 109, conveyed by Rosella Hoertain to the Commonwealth of Kentucky Transportation Cabinet and recorded on July 1, 1986, in the Office aforesaid.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $188,210.50; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Fourth Division Case No. 12-CI-01089

Bank of America, N.A. PLAINTIFF

Vs

Unknown Executor/Administrator, Heirs and/or Devisees to the Estate of Jo Anne Baldwin, et al. DEFENDANTS

By virtue of a Judgment rendered November 5, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

5408 Madison Pike, Independence, Kentucky 41051 GROUP: IND PIDN: 047-20-00-002.00

Being Lot No. One (1) of Alta June Manor Subdivision as shown by plat of said Subdivision recorded in Plat Book 8, Page 25 Slide B-202, in the office of the Kenton County Clerk at Independence, Kentucky.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $148,938.02; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 10-CI-03289

U.S. Bank National Association, as successor Trustee PLAINTIFF

Vs

Julia Phillips, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

106 Ridgewood Drive, Erlanger, Kentucky 41018 GROUP: IND PIDN: 017-30-08-024.00

Situate in the City of Erlanger, County of Kenton and State of Kentucky and being all of Lot Numbered 20 of Spring Valley II Subdivision, Section Three as Recorded in Plat Book 20, Page 11 (now Plat Slide B-501) of the Clerk’s Record’s at Kenton County, Kentucky at Independence.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $133,003.50; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASE R IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01115

M&T Bank PLAINTIFF

Vs

Kevin R. Thompson, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

10204 Scarlet Oak Drive, Independence, Kentucky 41051 GROUP: IND PIDN: 018-00-02-005.00

BEING all of Lot No Five (5) Section One (1), as same appears on Plat Slide A-521 of the Kenton County Clerk’s records at Independence, Kentucky. The Oaks Subdivision.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $138,893.52; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01437

Wells Fargo Bank, N.A. PLAINTIFF

Vs

Kristy Evans, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

2710 Tanglewood Court, Ft. Mitchell, Kentucky 41017 GROUP: 4531 PIDN: 001-40-03-035.00

Being Lot No. Four Hundred Ninety-Eight (498), Amsterdam Village Subdivision, Section No. Twenty-Seven A (27-A), as shown by Original Plat No. 1279 of the Kenton County Clerk’s Records at Covington, Kentucky.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $142,603.16; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-00881

CitiMortgage, Inc. PLAINTIFF

Vs

Leslie S. Rudd, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

1084 Galvin Street, Elsmere, Kentucky 41018 GROUP: 4407 PIDN: 016-10-01-241.01

Being all of Lot No.32 of Block B of Henry-Galvin Subdivision as shown on the plat of same recorded as Plat No. 1186 of the records of the Kenton County Clerk’s office at Covington, Kentucky.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $54,541.43; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Fourth Division Case No. 11-CI-03142

The Bank of New York Mellon fka The Bank of New York, as trustee PLAINTIFF

Vs

Lois Johnson, et al. DEFENDANTS

By virtue of a Judgment rendered November 5, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

556 Grouse Court, Elsmere, Kentucky 41018 GROUP: 4916 PIDN: 016-20-00-001.76

Being all of Lot No. 74 of Ripple Creek Subdivision, section 3, as shown on Plat No. 1632 of the Kenton County Clerk’s records at Covington, Kentucky.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $98,228.85; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01025

U.S. Bank National Association a/k/a U.S. Bank, NA PLAINTIFF Vs Matthew L. Highhouse, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

649 Sycamore Drive, Independence, Kentucky 41051 GROUP: IND PIDN: 061-30-00-037.01

Lying and being in Kenton County, Kentucky in the Plantation Heights Subdivision and in Lot 133 and 132 of said Subdivision and more particularly described as follows, to-wit: BEGINNING at an iron pipe found at the intersection of the right-of-way lines of Cherry Drive and Pawpaw Drive, a corner to the original Lot 132; thence with the right-of-way line of Cherry Drive, N 53° 00’ 00” E - 21.26 feet to an iron pin set, thence with new made lines partitioning the Grantor’s property, S 17° 09’ 55” E -118.21 feet to an iron pin set; thence, S 86° 22’ 33” E- 330.65 feet to an iron pin set in the line of Louis Clinkenbeard (Deed Book 123, Page 4690; thence with the lines of Clinkenbeard, S 42° 28’ 51” W 143.40 feet to a iron pipe found in the corner of Lot 87 of said Subdivision; thence with lines of Lots 87, 88, and 89, N 84° 27’ 55” W- 222.62 feet to a corner post in the East right-of-way line of Papaw Drive; thence with said East right-of-way line, N 17° 09’ 55” W- 214.92 feet to the place of beginning containing 0.7650 acres more or less exclusive of all right-of-ways or easements of record. The above description is in accordance with a survey made by Hicks & Mann, Inc. on 01 August, 1996.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $175,202.68; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS. William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Fourth Division Case No. 13-CI-01480

JPMorgan Chase Bank, National Association PLAINTIFF

Vs

Robert M. Gaines, et al. DEFENDANTS

By virtue of a Judgment rendered November 5, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

647 Badger Court, Independence, Kentucky 41051 GROUP: IND PIDN: 007-00-01-580.00

Being all of Lot 580 Glenhurst Subdivision, Section 20, as shown on plat recorded in Slide No. I-864, of the Kenton County Clerk’s Records at Independence, Kentucky. Subject to Restrictive Covenants as recorded in Official Records Book I-464, Page 101, and to restrictions and easements of record. There are excepted from the warranty covenants set forth in prior conveyances, matters of zoning, conditions and restrictions, and easements of record.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $125,861.54; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Third Division Case No. 13-CI-01820

Ocwen Loan Servicing, LLC PLAINTIFF

Vs

Robert Slater, et al. DEFENDANTS

By virtue of a Judgment rendered October 28, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

130 Derby Drive, Crittenden, Kentucky 41030 GROUP: IND PIDN: 025-00-01-002.00

The Following described real estate, County of Kenton, Commonwealth of Kentucky, to-wit: Being all of Lot Number 2 of Blue Grass Estates Subdivision, Section One, as shown on Plat Slide 196-A of the Kenton County Court Clerk’s Records at Independence, Kentucky. Included is a 1999 Fleetwood, Stoneridge 28’ X 56’ Mobile Home, Serial Number TNFLX27A/B52708SSR12.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $107,555.72; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Fourth Division Case No. 10-CI-01842

JPMC Specialty Mortgage LLC f/k/a WM Specialty Mortgage LLC PLAINTIFF

Vs

Thomas Butts, Jr., et al. DEFENDANTS

By virtue of a Judgment rendered September 17, 2012, and Orders rendered February 7, 2013 and November 5, 2013, of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

3703 Sigma Drive, Erlanger, Kentucky 41018 GROUP: 4107 PIDN: 016-30-06-019.00

IN THE CITY OF ERLANGER, COUNTY OF KENTON, AND COMMONWEALTH OF KENTUCKY, TO WIT: BEING ALL OF LOT NO. TWO HUNDRED TWENTY EIGHT (228), LEXINGTON ESTATES SUBDIVISION, SECTION SIX (6) AS SHOWN ON ORIGINAL PLAT NO. 965 OF THE KENTON COUNTY CLERK’S RECORDS AT COVINGTON, KENTUCKY.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $105,231.62; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN 30 DAYS PLUS INTEREST, AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners COMMISSIONER’S SALE Kenton Circuit Court Case No. 07-CI-02142 FOURTH DIVISION Equity Trust Custodian fbo Phil Zeltzman/Account #88 708/IRA PLAINTIFF Vs Amy N. Beach, et al DEFENDANTS

By virtue of a Judgment rendered July 1, 2008, and Orders rendered November 6, 2013 of the Kenton Circuit Court, in the above cause I shall proceed to offer for sale At the Court House Door Covington KENTON COUNTY JUSTICE CENTER, 230 MADISON AVENUE, BY THE ELEVATORS

To the highest or best bidder at public auction on TUESDAY the 25th day of February, 2014, at 10:00 am, the following property, to-wit:

3160 Birch Avenue, Erlanger, Ky 41018 GROUP: 3616 PIDN: 015-10-07-016.00

Being all of Lot No. 78 of the Maywood Subdivision, Section 2, as shown on the plat of said subdivision, recorded as original plat no. 663 in the Office of the Kenton County Clerk at Covington, Kentucky.

The property herein conveyed is subject to certain restrictions recorded in Miscellaneous Book 31 at Page 212 of said records.

Subject to conditions, covenants, restrictions, right of ways and easements in existence, including but not limited to those in prior instruments of record; legal highways and zoning ordinances.

THIS PROPERTY IS BEING SOLD TO PRODUCE THE SUMS OF MONEY SO ORDERED TO BE MADE IN THE JUDGMENT AND ORDER OF SALE ENTERED IN THE WITHIN CASE, INCLUDING BUT NOT LIMITED TO COURT COSTS, AD VALOREM TAXES, the Sum of $89,588.42; AND OTHER LIENS, INTEREST, ATTORNEY FEES AND/OR OTHER SUMS AND JUDGMENTS THAT MAY BE AWARDED BY THE COURT.

SAID PROPERTY SHALL BE SOLD SUBJECT TO REAL ESTATE TAXES DUE AND OWING FOR THE YEAR OF SALE AND THEREAFTER. PRIOR YEARS UNPAID TAXES SHALL BE PAID FROM THE PROCEEDS IF THE PURCHASER IS NOT THE PLAINTIFF. IF THE PURCHASER IS THE PLAINTIFF, PRIOR YEARS UNPAID TAXES SHALL BE PAID BY THE PLAINTIFF, IN FULL OR PRO RATA, PROVIDED THE SALE PURCHASE PRICE EXCEEDS THE COURT COSTS.

THE SALE SHALL BE MADE TO THE HIGHEST AND BEST BIDDER (S). ANY PURCHASER, OTHER THAN PLAINTIFF, WHO DOES NOT PAY CASH IN FULL, SHALL PAY 10% CASH AND THE BALANCE IN THIRTY DAYS PLUS INTEREST AND SHALL BE REQUIRED TO EXECUTE A BOND AT THE TIME OF SALE, WITH SURETY ACCEPTABLE TO THE MASTER COMMISSIONER AND PRE-APPROVED BY THE MASTER COMMISSIONER AT LEAST BY NOON, TWO (2) BUSINESS DAYS BEFORE THE SALE DATE, TO SECURE THE UNPAID BALANCE OF THE PURCHASE PRICE, AND SAID BOND SHALL BEAR INTEREST AT THE RATE OF 12% PER ANNUM FROM THE DATE OF SALE UNTIL PAID, AND SHALL HAVE THE SAME FORCE AND EFFECT AS A JUDGMENT AND SHALL REMAIN AND BE A LIEN ON THE PROPERTY UNTIL PAID. THE BOND SURETY MUST BE PRESENT AT THE SALE AND EXECUTE THE SALE BOND AND THE AFFIDAVIT OF SURETY. THE PURCHASER (S) SHALL HAVE THE PRIVILEGE OF PAYING ALL THE BALANCE OF THE PURCHASE PRICE PRIOR TO THE EXPIRATION OF THE THIRTY (30) DAY PERIOD. THE DEPOSIT SHALL BE WAIVED IF PLAINTIFF IS THE SUCCESSFUL BIDDER. THE MASTER COMMISSIONER SHALL SELL THE REAL ESTATE BY PUBLIC SALE ON A DAY AND TIME TO BE FIXED BY HIM INSIDE THE FRONT DOOR, BY THE ELEVATORS, OF THE KENTON COUNTY JUSTICE CENTER, THIRD AND MADISON AVENUES, COVINGTON, KENTUCKY. BIDDERS MUST BE PREPARED TO COMPLY WITH THESE TERMS.

William A. Humpert, Leonard G. Rowekamp, John R. Kummer, Master Commissioners