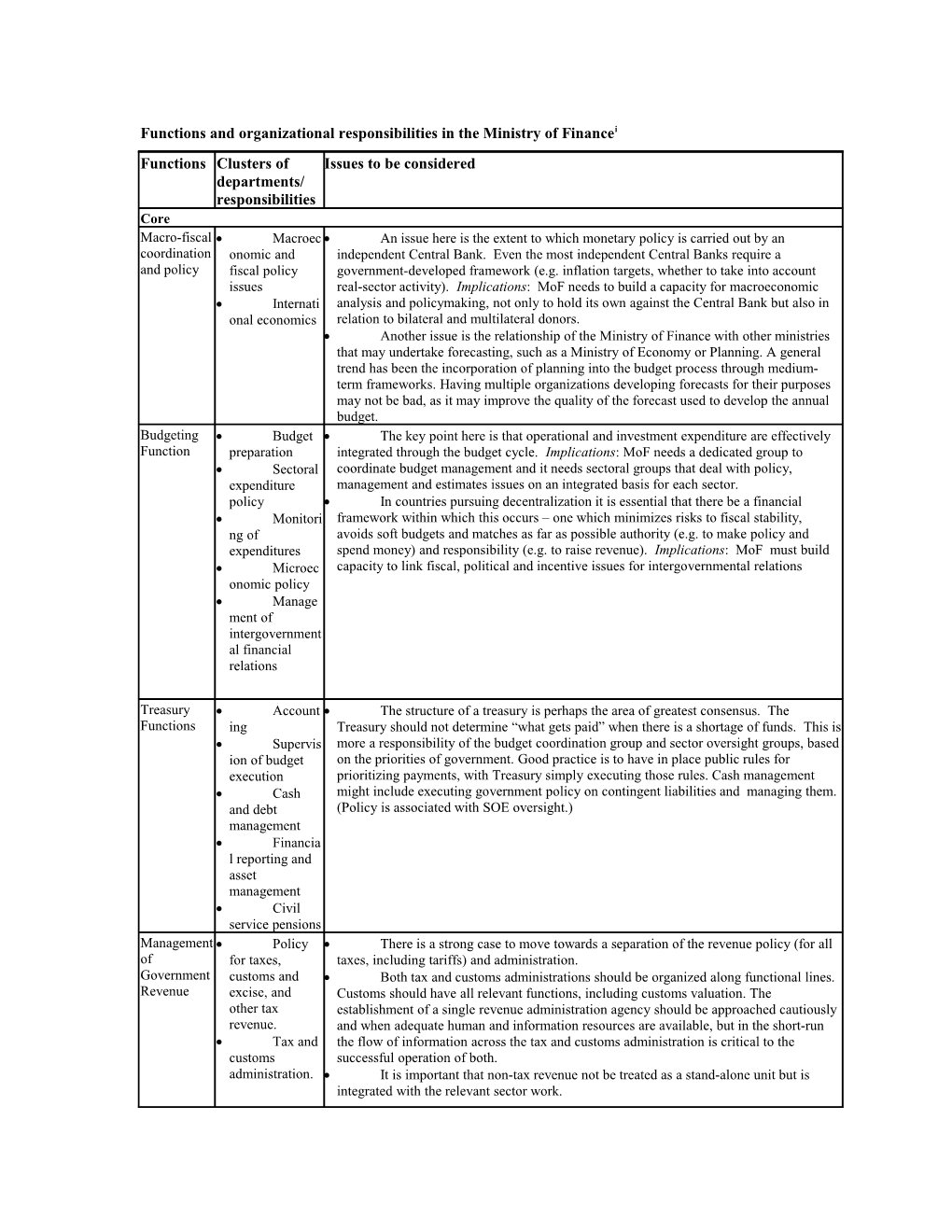

Functions and organizational responsibilities in the Ministry of Financei Functions Clusters of Issues to be considered departments/ responsibilities Core Macro-fiscal Macroec An issue here is the extent to which monetary policy is carried out by an coordination onomic and independent Central Bank. Even the most independent Central Banks require a and policy fiscal policy government-developed framework (e.g. inflation targets, whether to take into account issues real-sector activity). Implications: MoF needs to build a capacity for macroeconomic Internati analysis and policymaking, not only to hold its own against the Central Bank but also in onal economics relation to bilateral and multilateral donors. Another issue is the relationship of the Ministry of Finance with other ministries that may undertake forecasting, such as a Ministry of Economy or Planning. A general trend has been the incorporation of planning into the budget process through medium- term frameworks. Having multiple organizations developing forecasts for their purposes may not be bad, as it may improve the quality of the forecast used to develop the annual budget. Budgeting Budget The key point here is that operational and investment expenditure are effectively Function preparation integrated through the budget cycle. Implications: MoF needs a dedicated group to Sectoral coordinate budget management and it needs sectoral groups that deal with policy, expenditure management and estimates issues on an integrated basis for each sector. policy In countries pursuing decentralization it is essential that there be a financial Monitori framework within which this occurs – one which minimizes risks to fiscal stability, ng of avoids soft budgets and matches as far as possible authority (e.g. to make policy and expenditures spend money) and responsibility (e.g. to raise revenue). Implications: MoF must build Microec capacity to link fiscal, political and incentive issues for intergovernmental relations onomic policy Manage ment of intergovernment al financial relations

Treasury Account The structure of a treasury is perhaps the area of greatest consensus. The Functions ing Treasury should not determine “what gets paid” when there is a shortage of funds. This is Supervis more a responsibility of the budget coordination group and sector oversight groups, based ion of budget on the priorities of government. Good practice is to have in place public rules for execution prioritizing payments, with Treasury simply executing those rules. Cash management Cash might include executing government policy on contingent liabilities and managing them. and debt (Policy is associated with SOE oversight.) management Financia l reporting and asset management Civil service pensions Management Policy There is a strong case to move towards a separation of the revenue policy (for all of for taxes, taxes, including tariffs) and administration. Government customs and Both tax and customs administrations should be organized along functional lines. Revenue excise, and Customs should have all relevant functions, including customs valuation. The other tax establishment of a single revenue administration agency should be approached cautiously revenue. and when adequate human and information resources are available, but in the short-run Tax and the flow of information across the tax and customs administration is critical to the customs successful operation of both. administration. It is important that non-tax revenue not be treated as a stand-alone unit but is integrated with the relevant sector work. 2

Accompanying responsibilities Financial Regulati Political oversight of financial markets is often with the MoF, but the actual Sector on of financial regulator may be the central bank or a separate agency. Business sector regulation is Regulation markets and the usually separate from financial market regulation. business sector Although arguably financial market regulation is not a core public finance function, it is undertaken by the MoF in many smaller countries by default Establishing private sector accounting and auditing standards is an essential aspect of regulating financial markets, and in more developed countries is undertaken by standards boards outside the MoF. Aid Aid This is a key issue for countries dependent on foreign aid. There is a very strong management mobilization case for a single entity managing aid and that that entity should be MoF. The strongest Guarant argument is the need to incorporate this source of revenue in the budget and, particularly, ees to subject activities being funded to the same rigorous scrutiny that other activities funded Donor from domestic sources should be subjected to during budget formulation. The aid desks management entity should function to facilitate, not obstruct, and avoid interference in ministries’ budget proposals or project selection. (Schiavo-Campo and Tommasi: 1999). The sectoral groups within the Expenditure Group in MoF should ensure that consideration of aid-funded projects is within a broad sector strategy at the ministry level. Personnel Recruit The case for including government-wide personnel management in the MoF management ment revolves around the fact that personnel costs usually account for the largest share of the Perform budget. The case against including personnel management in MoF is that it will almost ance certainly lead to an emphasis on the cost side, at the expense of management issues. Promoti While there are examples of countries where personnel management is located with the on budget agency (Canada, Ireland), there are many more examples of countries where it is Remune located in a separate central agency. Two key points here are that (i) Government should ration not be held hostage to a personnel agency being able to approve new staffing without Payroll consideration of the budget constraint – financial availabilities should drive staffing, not Personn the other way around - and (ii) pay policy, because of both its macro and budgetary el Management implications, should probably be the responsibility of MoF (budgeting function). If Information centralized, the payroll system should be located in the Treasury. It is essential that the Systems payroll and personnel management records are fully reconciled. Procurement Policy There is a case for centralizing procurement in a country, relating to economies of Regulati scale and to concerns about corruption. However, this must be balanced by the on considerable evidence that devolution of (most) procurement to line ministries is more Central likely to lead to better value for money. Such devolution must be supported by a hard tender board budget constraint, sector strategies and effective audit. A separate agency, e.g. in the central administration department, is often found in transition and developing countries. Oversight of Policy There is a good case for having a unit responsible for policy in relation to SOEs State Owned Guidelin within MoF but the day-to-day interaction between MoF and individual SOEs (either Enterprises, es through their parent ministry or directly) on issues to do with capital injections, subsidies Extra- Capital and dividends should be undertaken by the relevant sector group in Government budgetary injections Expenditure. Policy on guarantees and other contingent liabilities may reside here as well funds Operatin (execution of the policy might be with Treasury). g subsidies Internal Policy, There is a case for an internal audit unit to be established in MOF. Such a unit Audit guidelines and should provide support to and possibly even regulate internal audit at the line ministry regulations and agency level. In favor of this approach is that if MoF does not do this it will be Operatio unlikely to have sufficient authority based in any other central agency. It is also the case ns that internal audit is concerned with organizational systems and operations and many of these relate to the management of financial resources. Extending the mandate of a central internal audit unit to manage or undertake internal audit activities has the advantage of consistency of approach; of targeting scarce resources on substantial risk areas; and of keeping line ministries on their toes. Against this, such an approach could weaken accountability at the line ministry level and undermines the authority of ministry heads. 3

National Regiona Agreements with neighboring countries and fiscal implications of regional economy l cooperation agreements, and bilateral investment agreements Investm The scope of this function depends critically on the existence or not of a separate ent treaties and planning agency or ministry. agreements Policy is an important MoF function, but implementation should generally be the Capital responsibility of a separate agency (under MoF oversight, or if independent, following investment and very clear rules for reporting and accounting (gross), audit, transfer of balances to developmental treasury) plans Privatiza tion policy i Adapted from ‘Organizational Responsibilities in the Ministry of Finance,’ Reforming Fiscal and Economic Management in Afghanistan. The World Bank, 2004.