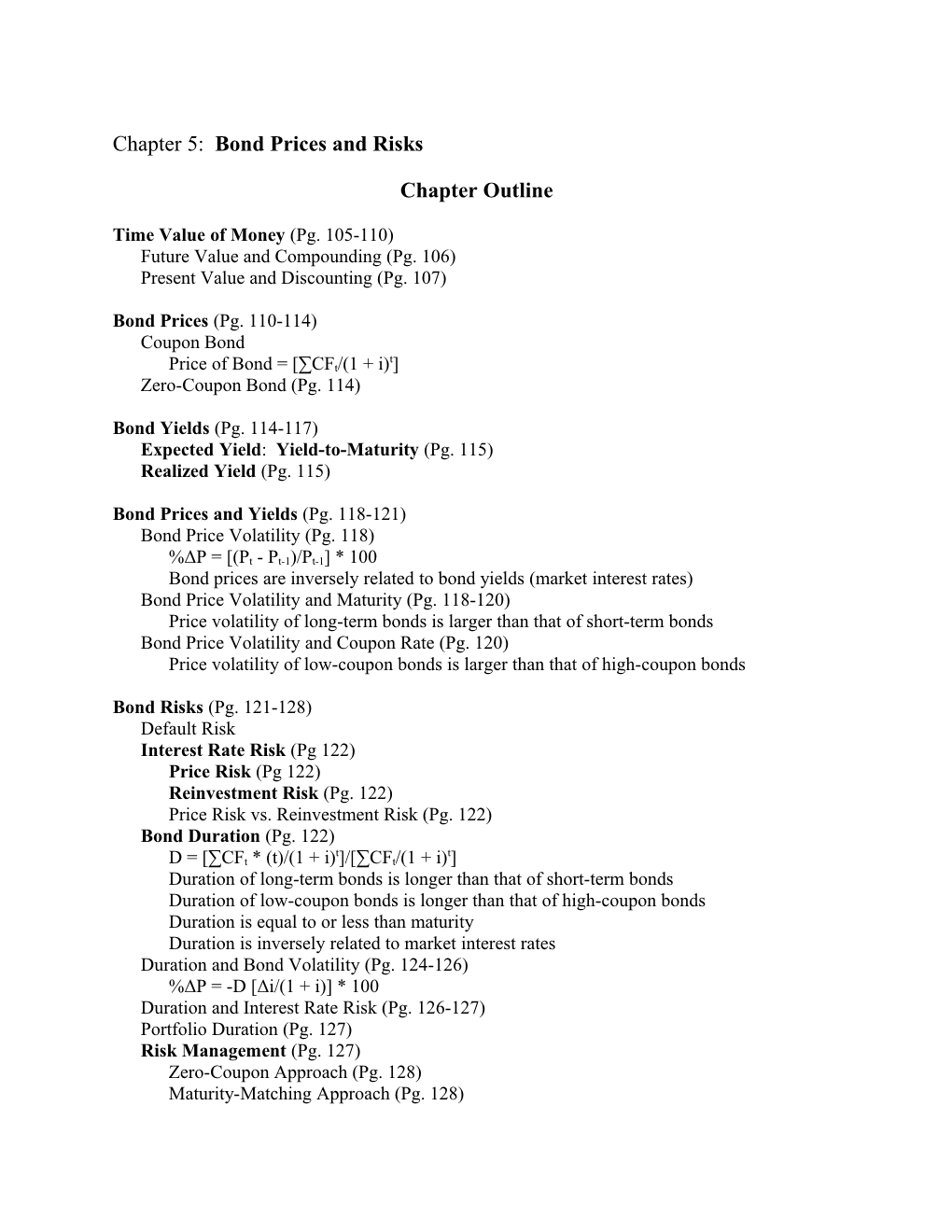

Chapter 5: Bond Prices and Risks

Chapter Outline

Time Value of Money (Pg. 105-110) Future Value and Compounding (Pg. 106) Present Value and Discounting (Pg. 107)

Bond Prices (Pg. 110-114) Coupon Bond t Price of Bond = [∑CFt/(1 + i) ] Zero-Coupon Bond (Pg. 114)

Bond Yields (Pg. 114-117) Expected Yield: Yield-to-Maturity (Pg. 115) Realized Yield (Pg. 115)

Bond Prices and Yields (Pg. 118-121) Bond Price Volatility (Pg. 118) %ΔP = [(Pt - Pt-1)/Pt-1] * 100 Bond prices are inversely related to bond yields (market interest rates) Bond Price Volatility and Maturity (Pg. 118-120) Price volatility of long-term bonds is larger than that of short-term bonds Bond Price Volatility and Coupon Rate (Pg. 120) Price volatility of low-coupon bonds is larger than that of high-coupon bonds

Bond Risks (Pg. 121-128) Default Risk Interest Rate Risk (Pg 122) Price Risk (Pg 122) Reinvestment Risk (Pg. 122) Price Risk vs. Reinvestment Risk (Pg. 122) Bond Duration (Pg. 122) t t D = [∑CFt * (t)/(1 + i) ]/[∑CFt/(1 + i) ] Duration of long-term bonds is longer than that of short-term bonds Duration of low-coupon bonds is longer than that of high-coupon bonds Duration is equal to or less than maturity Duration is inversely related to market interest rates Duration and Bond Volatility (Pg. 124-126) %ΔP = -D [Δi/(1 + i)] * 100 Duration and Interest Rate Risk (Pg. 126-127) Portfolio Duration (Pg. 127) Risk Management (Pg. 127) Zero-Coupon Approach (Pg. 128) Maturity-Matching Approach (Pg. 128) 2

Duration Matching Approach (Pg. 128)

Chapter Key Points

1. Interest rate movements affect the prices of assets and liabilities of investors and financial institutions.

2. The price of a bond is the present value of a stream of cash flows discounted at the market interest rate. The price varies to provide the buyer with the market interest rate.

3. Bonds have risks that affect the price and yield. The expected yield is influenced by changes in market interest rates. Bond prices and yields are determined simultaneously in financial markets and, most important; there is an inverse relationship between prices and yields.

4. Bond yields may be classified as (a) expected yield such as the yield-to-maturity, which ignores reinvestment risk and assumes coupon reinvestment at the yield-to-maturity rate, or (b) realized yield which is the holding-period yield.

5. Interest rate risk includes price risk and reinvestment risk. Price risk and reinvestment risk offset one another in varying degrees as market interest rates vary.

6. Bond volatility is used as a measure for interest rate risk. Bond volatility is directly related to bond’s maturity, and inversely related to bond’s coupon rate and current market interest rates.

7. Duration is the ratio of the sum of the discounted, time-weighted cash flows divided by the price of security. Duration is used as a proxy measure for interest rate risk because it is also directly related to bond’s maturity, and inversely related to bond’s coupon rate and current market interest rates. It changes each day! The higher the duration, the greater is bond volatility and interest rate risk.

8. Duration is the holding period sufficient to balance price and reinvestment risks assuring the investor the yield to maturity. It is a time point where price and reinvestment risks are offset; and is a mean of managing interest rate risk by matching the durations of sources and uses of funds. Matching maturities gives no recognition to the varied coupons reinvestment.

9. Duration matching works to immunize investors against interest rate changes if (a) interest rates change only once by a small amount, (b) the initial yield curve is flat, and (c) interest rates change in a parallel fashion, i.e., short-term and long-term interest rates change by the same amount.