______Your name and Perm #

Econ 234A John Hartman Test 1 February 6, 2013

Instructions:

You have 60 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students.

Each question shows how many points it is worth. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution.

Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue.

You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating.

Unless otherwise specified, you can assume the following: Negative internal rates of return are not possible.

You are allowed to turn in your test early if there are at least 10 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 10 minutes of the test.

Your test should have 4 problems, some with multiple parts. The maximum possible point total is 45 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test.

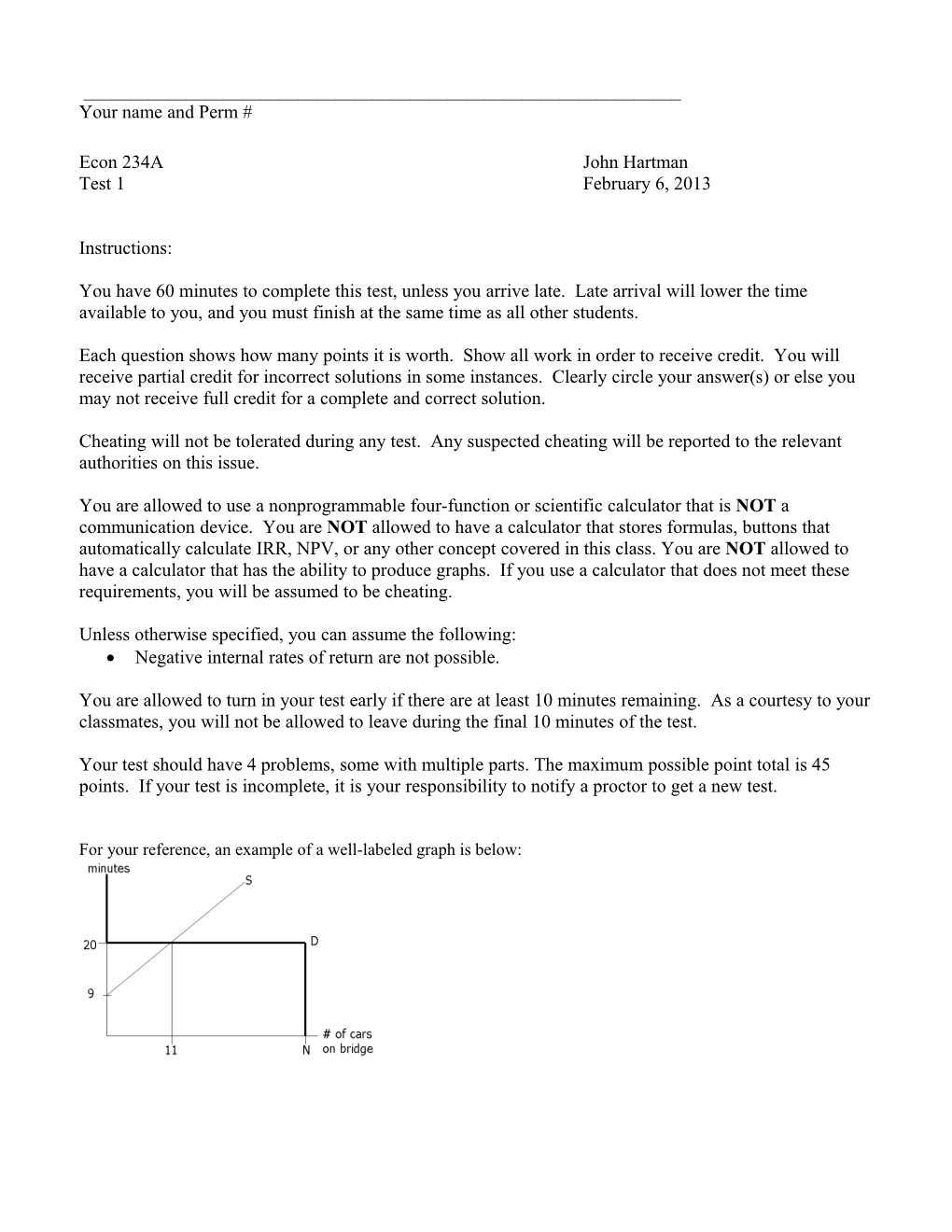

For your reference, an example of a well-labeled graph is below: For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution.

1. (14 points) Suppose that you are advising a couple with two young children about how much they need to save for college. The two children are three years apart in age. One child will start college 10 years from today and the other will start 13 years from today. You estimate the children’s annual cost of education will be $60,000 per year per child, payable at the beginning of each school year. We assume four years of college expenses for each child. The effective annual interest rate is 9%. When you ask the couple how they plan to save for their children’s college funds, they tell you that they want to make 10 equal deposits of $X each year, starting today. The total of these payments will be exactly enough to cover all of their children’s college expenses. Find X. (Note: You can use the next page to solve this problem also.) (Continue to solve problem 1 here if needed. Please leave this page blank if the entire solution to problem 1 is on the previous page.) 2. (12 points) Suzanne is quoted a price for a bond of $550. However, the bond has a $500 face value. It pays a 12% coupon two more times before the bond matures. The first coupon will be paid later today and the second will be one year from today. Two years from today, the bond matures and the life of the bond will be over. If interest rates suddenly fall by 1 percentage point later today, how much will the price of the bond change at the end of today? (Note: An example of a 1 percentage point drop is when r drops from 14% to 13%.) 3. (9 points) Jacob has just finalized a loan contract at UUU National Bank. He will receive $10,000 today, and must make equal daily payments to pay off the loan over the next year. The stated annual interest rate is 10.95%, and interest is compounded daily. How much will Jacob have to pay every day to pay off the loan one year from today? (You can assume there are 365 days this year.) 4. (9 points) Jack Splat works for Fatsteaks, Inc. He is considering investing in a special steel steak cooker that will only work for one day. The day the cooker will work will be one year from today. If he purchases the machine, he must pay $500 today and $600 two years from today to pay off its cost. If the machine is purchased, a single benefit of $1,099 is received one year from today. For what effective annual discount rates should Jack Splat purchase the new machine? You can assume that there are no other mutually exclusive projects to consider in making this decision. (Note: Analyze only non-negative discount rates.)