BAT4M Accounting Mr. Ruston Student Name: ______BAT4M Financial Accounting Final Summative Evaluation Task: Choose and complete the stated number of questions in each block. Block A: Choose 2 of 5 Block B: Choose 2 of 3 Block C: Choose 2 of 4 Block D: Choose 2 of 4 In total, you will respond to 8 of 16 proposed questions.

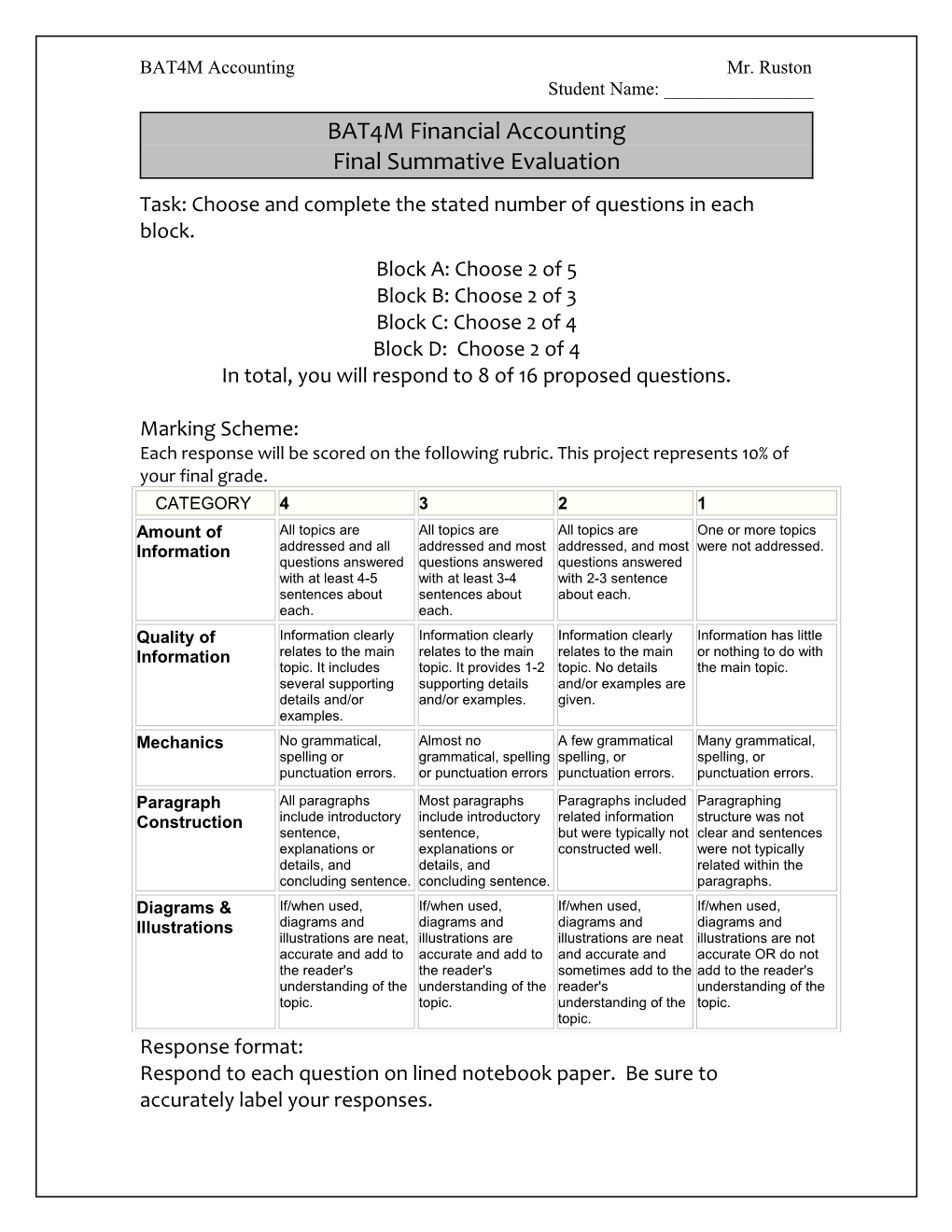

Marking Scheme: Each response will be scored on the following rubric. This project represents 10% of your final grade. CATEGORY 4 3 2 1 Amount of All topics are All topics are All topics are One or more topics Information addressed and all addressed and most addressed, and most were not addressed. questions answered questions answered questions answered with at least 4-5 with at least 3-4 with 2-3 sentence sentences about sentences about about each. each. each. Quality of Information clearly Information clearly Information clearly Information has little Information relates to the main relates to the main relates to the main or nothing to do with topic. It includes topic. It provides 1-2 topic. No details the main topic. several supporting supporting details and/or examples are details and/or and/or examples. given. examples. Mechanics No grammatical, Almost no A few grammatical Many grammatical, spelling or grammatical, spelling spelling, or spelling, or punctuation errors. or punctuation errors punctuation errors. punctuation errors. Paragraph All paragraphs Most paragraphs Paragraphs included Paragraphing Construction include introductory include introductory related information structure was not sentence, sentence, but were typically not clear and sentences explanations or explanations or constructed well. were not typically details, and details, and related within the concluding sentence. concluding sentence. paragraphs. Diagrams & If/when used, If/when used, If/when used, If/when used, Illustrations diagrams and diagrams and diagrams and diagrams and illustrations are neat, illustrations are illustrations are neat illustrations are not accurate and add to accurate and add to and accurate and accurate OR do not the reader's the reader's sometimes add to the add to the reader's understanding of the understanding of the reader's understanding of the topic. topic. understanding of the topic. topic. Response format: Respond to each question on lined notebook paper. Be sure to accurately label your responses. BAT4M Accounting Mr. Ruston Student Name: ______Block A Chapters 1 – 4 Choose 2 of 5

A1. Vu Hang is the assistant chief accountant at Staples Co, a manufacturer of computer chips and cellular phones. The company presently has total sales of $20 million. It is the end of the first quarter. Vu is hurriedly trying to prepare a general ledger trial balance so that quarterly financial statements can be prepared. The total credits on the trial balance exceed the debits by $1,000.

In order to meet the 4 p.m. deadline, Vu decides to force the debits and credits into balance by adding the amount of the difference to the Equipment account. She chose Equipment because it is one of the larger account balances. Percentagewise, it will be the least misstated. She believes that the difference will not affect anyone’s decisions. She wishes that she had more time to find the error, but realizes that the financial statements are already late.

Questions: (a) Who are the stakeholders in this situation? (b) What ethical issues are involved? (c) What are Vu’s alternatives?

A2. In reviewing the accounts of Marylee Co. at the end of the year, you discover that adjusting entries have not been made. Write a memo to Mary Lee Virgil, the owner of Marylee Co., that explains the following: the nature and purpose of adjusting entries, why adjusting entries are needed, and how her financial statements could be affected by the lack of adjustments. Give specific examples that are related to the various types of adjusting entries. BAT4M Accounting Mr. Ruston Student Name: ______A3. The following ledger accounts are used by Crawford Greyhound Park: Accounts Receivable Prepaid Printing Prepaid Rent Unearned Admissions Revenue Printing Expense Rent Expense Admissions Revenue Concessions Revenue

Instructions For each of the following transactions below, prepare the journal entry (if one is required) to record the initial transaction and then prepare the adjusting entry, if any, required on September 30, the end of the fiscal year. (a) On September 1, paid rent on the track facility for three months, $180,000. (b) On September 1, sold season tickets for admission to the racetrack. The racing season is year-round with 25 racing days each month. Season ticket sales totalled $900,000. (c) On September 1, borrowed $150,000 from First Canadian Bank by issuing a 5% note payable due in three months. (d) On September 6, schedules for 20 racing days in September, 25 racing days in October, and 15 racing days in November were printed for $3,000. (e) The accountant for the concessions company reported that gross receipts for September were $140,000. Ten percent is due to Crawford and will be remitted by October 11.

A4. A new sales representative, Eddy Werhl, has just received his copy of the month- end financial reports. He is puzzled by the term “unearned revenue." He left the following e-mail message for you on the company's bulletin board system: What is this??? Creative Accounting, or what??? Line item 12 on year-to- date financials shows over $25Gs in Unearned Revenue!!! Come on! Either we earned it, or we didn't ... Right??! Is this how you lower our commissions? Reply to e.wehrl.ca

Required: Write a response to send to Eddy. BAT4M Accounting Mr. Ruston Student Name: ______

A5. A work sheet is an optional working tool used by accountants to facilitate the preparation of financial statements. Consider the steps followed in preparing a work sheet. How does the use of a work sheet assist the accountant? Could financial statements be prepared without a work sheet? Evaluate how the process would differ. Consider factors such as timeliness, accuracy, and efficiency in your evaluation.

Block B Chapters 5,6 Choose 2 of 3

B1. FIFO and average cost are the two most common cost flow assumptions made in costing inventories. The amounts assigned to the same inventory items on hand may be different under each cost flow assumption. If a company has no beginning inventory, explain the difference in ending inventory values under the FIFO and average cost bases when the price of inventory items purchased during the period have been (1) increasing, (2) decreasing, and (3) remained constant.

B2. The periodic and the perpetual inventory systems are two methods that companies use to account for inventories. Briefly describe the major features of each system and explain why a physical inventory is necessary under both systems.

B3. Young Company uses the periodic inventory system to account for inventories. Information related to Young Company's inventory at October 31 is given below:

October 1 Beginning inventory 400 units @ $10.00 = $ 4,000 8 Purchase 800 units @ $10.40 = 8,320 16 Purchase 600 units @ $10.80 = 6,480 24 Purchase 200 units @ $11.60 = 2,320 Total units and cost 2,000 units $21,120 Instructions 1. Show calculations to value the ending inventory using the FIFO cost assumption if 600 units remain on hand at October 31. 2. Show calculations to value the ending inventory using the weighted average cost method if 600 units remain on hand at October 31. 3. Show calculations to value the ending inventory using the LIFO cost assumption if 600 units remain on hand at October 31. BAT4M Accounting Mr. Ruston Student Name: ______

Block C Chapters 9,10 Choose 2 of 4 C1. Management can choose between two bases in calculating the estimated uncollectible accounts under the allowance method. One basis emphasizes an income statement viewpoint whereas the other emphasizes a balance sheet viewpoint. Identify the two bases and contrast the two approaches. How do the different points of view affect the amount recognized as Bad Debts Expense during the accounting period?

C2. Lois, a friend of yours, overheard a discussion at work about changes her employer wants to make in accounting for uncollectible accounts. Lois knows little about accounting, but since you’ve taken some classes with Mr. Ruston, she figures you are a good source to ask. Specifically, she asks you to explain the differences between the direct write-off and allowance methods for uncollectible accounts. In a letter, explain to Lois the methods of accounting for uncollectibles. Be sure to discuss the differences among these methods.

C3. During the current year, Fairly Company incurred several expenditures. Briefly explain whether the expenditures listed below should be recorded as an operating expense or as an intangible asset. If you view the expenditure as an intangible asset, indicate the number of years over which the asset should be amortized. Explain your answer. (a) Spent $30,000 in legal costs in a patent defence suit. The patent was unsuccessfully defended. (b) Purchased a trademark from another company. The trademark can be renewed indefinitely. Fairly Company expected the trademark to contribute to revenue indefinitely. (c) Fairly Company acquires a patent for $2,000,000. The company selling the patent has spent $1,000,000 on the research and development of it. The patent has a remaining life of 15 years. (d) Fairly Company is spending considerable time and money in developing a different patent for another product. So far $3,000,000 has been spent this year on research. Fairly Company is very confident it will obtain this patent in the next few years.

C4. Distinguish between the different types of tangible assets and explain the difference between tangible and intangible assets. BAT4M Accounting Mr. Ruston Student Name: ______

Block D Chapters 13, 14/15 Choose 2 of 4

D1. Define partnership 2) List 4 advantages and 4 disadvantages of partnerships 3) outline the difference between limited and general partnerships.

D2. Sansouci Corporation is authorized to issue an unlimited number of no par value common shares and 1,000,000 shares of no par value preferred shares. During 2001, its first year of operation, the company has the following share transactions. Jan. 1 Paid the province $2,000 for incorporation fees. Jan. 15 Issued 500,000 preferred shares at $7 per share. Cumulative dividends not yet declared were $1/share. Jan. 30 Lawyers for the company accepted 500 common shares as payment for legal services rendered in helping the company incorporate. The legal services are estimated to have a value of $6,000. The shares were actively trading at $10 per share. July 2 Issued 100,000 common shares for land. The land had an asking price of $900,000. The shares are currently selling on a provincial exchange at $8 per share. Dec. 6 Net income for 2001 was $200,000.

Instructions (a) Journalize the transactions for Sansouci Corporation. (b) Prepare the shareholders’ equity section of the balance sheet.

D3. Identify at least six characteristics of the corporate form of business organization. Contrast each one with the partnership form of organization.

D4. Companies frequently issue both preferred shares and common shares. What are the major differences in the rights of shareholders between these two classes of shares?