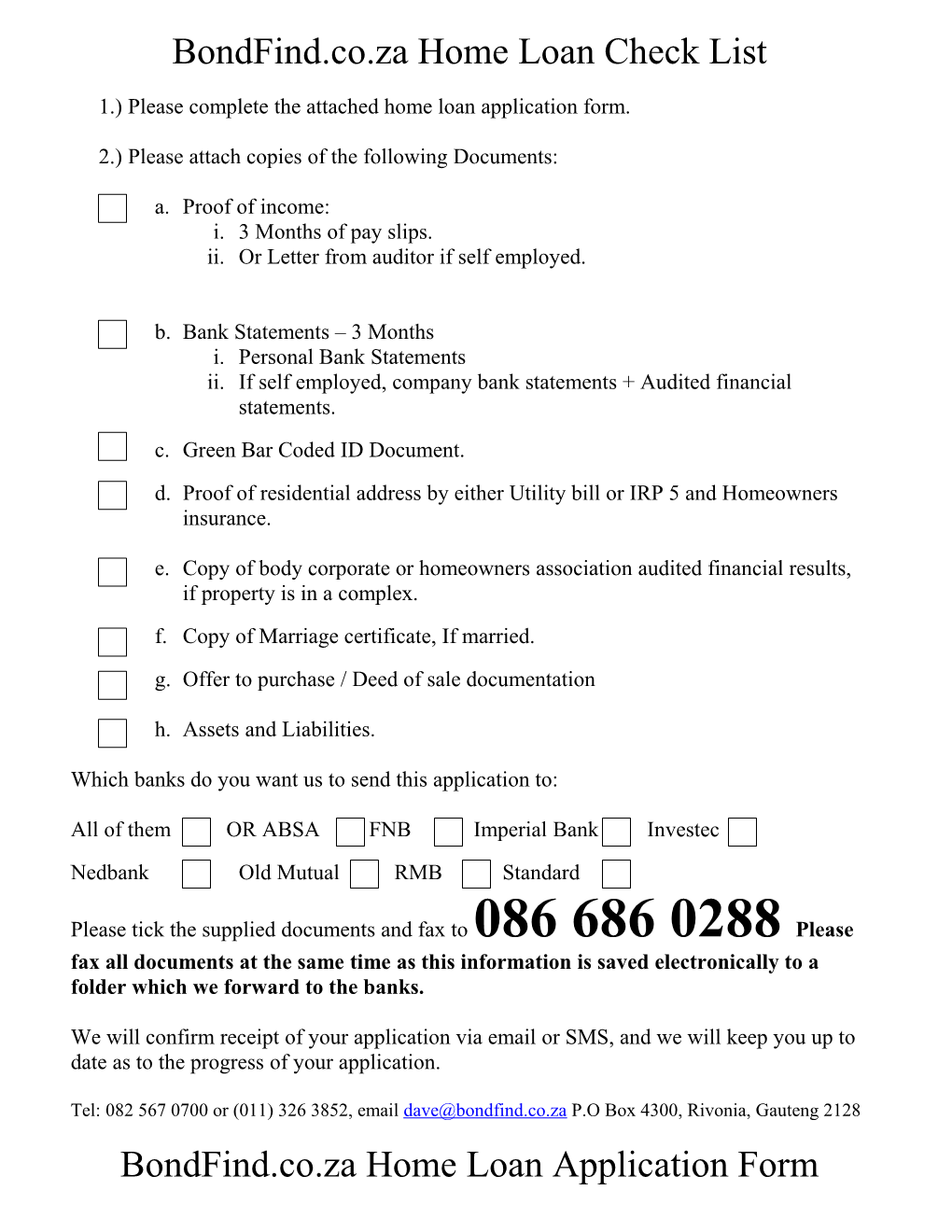

BondFind.co.za Home Loan Check List

1.) Please complete the attached home loan application form.

2.) Please attach copies of the following Documents:

a. Proof of income: i. 3 Months of pay slips. ii. Or Letter from auditor if self employed.

b. Bank Statements – 3 Months i. Personal Bank Statements ii. If self employed, company bank statements + Audited financial statements. c. Green Bar Coded ID Document. d. Proof of residential address by either Utility bill or IRP 5 and Homeowners insurance.

e. Copy of body corporate or homeowners association audited financial results, if property is in a complex. f. Copy of Marriage certificate, If married. g. Offer to purchase / Deed of sale documentation

h. Assets and Liabilities.

Which banks do you want us to send this application to:

All of them OR ABSA FNB Imperial Bank Investec Nedbank Old Mutual RMB Standard

Please tick the supplied documents and fax to 086 686 0288 Please fax all documents at the same time as this information is saved electronically to a folder which we forward to the banks.

We will confirm receipt of your application via email or SMS, and we will keep you up to date as to the progress of your application.

Tel: 082 567 0700 or (011) 326 3852, email [email protected] P.O Box 4300, Rivonia, Gauteng 2128 BondFind.co.za Home Loan Application Form Date: Originator Reference:

Applicants Details (Please ensure all fields are completed and tick applicable )

Application Type

Individual Joint (With Spouse) Joint Other With Surety Co/Trust/CC

Name in which Bond is to be registered:

Main Applicant Title: (Mr/Mrs/Miss/Dr/etc): Initials:

First Name: Surname:

SARS Income Tax No: Date of Birth: D D M M Y Y Y Y ID Number:

Present physical address:

Suburb: City: Postal Code:

Present postal address:

Suburb: City: Postal Code:

Tel No Work: ( ) Tel No Home: ( )

Fax No: ( ) Cell: E-mail

Period at present address: Owner Tenant Other

If the property is to be registered in a Company, Trust, CC, please state

Full Name of Company/Trust/CC

Registration Number: Nature of business:

Language Preference: English Afrikaans Gender: Male Female

Marital Status: Married: Single: Divorced: Separated Widow/ed/er

Number of dependants:

Are you a South African Citizen? Yes No if no, are you a permanent resident? Yes No

If no, country of permanent residence: Permit No:

Type of Identification: Nationality:

1. Banking Details Originator Reference:

Account Type Bank Branch Name Branch Code Acc Holder Account Number

Cheque Personal loan

Fixed Deposit

Trans / Savings

Credit Card

Home Loan

Other

Employment Details

Are you self-employed? Yes No Occupation / Business:

Name of Employer: Employment sector:

Highest educational level: Occupational level:

Period with present employer: Years: Months: Employee No:

Employer Tel: ( ) How long has business been operating:

Previous Employers Name:

Have you ever been declared insolvent? Yes No if Yes, date rehabilitated

Loan details

Is this the first time you’ve purchased property? Yes No Purpose of new property:

Do you have an existing home loan acc: Yes No with which Bank:

Purchase Price: Other Fees: Other costs:

Date of Purchase: Loan amount requ’d:

Repayment period: Monthly repayments:

Loan to value ratio: Do you have a deposit or collateral? Yes No

Cash R Collateral Security R Total Deposit R

Are you bound by any surety agreements: Yes No if Yes, details:

2. Originator Reference:

How will installments be made? Debit Order Salary Stop Order Cash Other

Type of account: Current Savings

Sellers Name: Sellers Tel No: ( ) If building loan: Contract Price R Land Price R

Is the contractor NHBRC Reg? Yes No Name: Tel No ( )

Property Details

Property Description / Erf No:

Street Address: Suburb:

City: Postal Code:

Property Type: House Townhouse Cluster Flat Land Land area: m2

If Sectional Title – Unit No: Section No: Complex Name:

Parking Bay / Garage No’s: Property currently bonded to:

Is property? Freehold Leasehold Insurers details : ( )

Body Corporates Contact No: ( ) Managing Agents Contact No: ( )

Contact details to do Property Valuation: Name: Tel:

Second Applicant: Is Spouse? Yes No Surety

Title: (Mr/Mrs/Miss/Dr/etc): Initials: Surname:

First Name: Date of Birth: D D M M Y Y Y Y ID Number: SARS Income Tax No:

Present physical address:

Suburb: City: Postal Code:

Present postal address:

Suburb: City: Postal Code:

Tel No Work: ( ) Tel No Home: ( )

Fax No: ( ) Cell: E-mail

Language Preference: English Afrikaans Gender: Male Female

3. Originator Reference:

Marital Status: Married: Single: Divorced: Separated Widow/ed/er

Are you a South African Citizen? Yes No if no, are you a permanent resident? Yes No

If no, country of permanent residence: Permit No: Type of Identification: Nationality:

Banking Details Account Type Bank Branch Name Branch Code Acc Holder Account Number

Cheque

Personal loan

Fixed Deposit

Trans / Savings

Credit Card

Home Loan

Other

Employment Details

Are you self-employed? Yes No Occupation / Business:

Name of Employer: Employment sector:

Highest educational level: Occupational level:

Period with present employer: Years: Months: Employee No:

Employer Tel: ( ) How long has business been operating:

Previous Employers Name:

Have you ever been declared insolvent? Yes No if Yes, date rehabilitated

Are you bound by any surety agreements: Yes No if Yes, details:

Life Assurance

In order to protect your investment would you like us to arrange a consultant to contact you with regards to life cover over this property? Yes No

4. Originator Reference: Insurance

Would you like a consultant to contact you with regards to homeowners insurance – This should be covered by your levies in a sectional title complex. Yes No

Attorney

If the seller has appointed no attorney, would you like us to refer one to you? Yes No (We have freelance attorneys, notaries and conveyancers on our books which will offer you reduced rates)

Income Statement (If application in joint names, include details of spouse under App2)

INCOME (Per Month) APP1 APP2 TOTAL

Gross Salary R R R

Housing Allowance R R R

Commission R R R

Overtime R R R

Investments R R R

Rental Income R R R

Other (Specify) R R R

Fringe Benefits R R R

Net income (co-applicant) R R R

TOTAL INCOME R R R

EXPENSES

Bond repayments / Rental R R R

HP / Loan installments R R R

Overdraft Interest R R R

Credit Cards R R R

Lights, Water, Rates, Levies R R R

Insurance – Short Term R R R

Assurance – Life R R R

Petrol / Vehicle Maintenance R R R

5. Originator Reference: EXPENSES (Cont.)

Clothing R R R

Telephone / Cell Phone R R R

TV Rental / Mnet / DSTV R R R

Vehicle repayment R R R 2nd Vehicle repayment R R R

Pension R R R

Medical Aid R R R

PAYE Contribution R R R

UIF R R R

Food / Groceries / Liquor R R R

Repairs and maintenance R R R

Domestic Wages R R R

Medical Costs R R R

Education R R R

Entertainment / Sport R R R

Alimony / maintenance R R R

Other (Specify) R R R

TOTAL EXPENSES R R R

ADDITIONAL INFORMATION

6.

Originator Reference:

DECLARATION

The purchase price includes NO cost items and is solely for the purchase of the property OR

The purchase price includes (Tick applicable blocks)

Commissions R Legal fees, Bond registration fees, etc R

A deposit or contribution R

Outstanding rates / taxes and levies R

Renovation / Maintenance R

Cost of movables / Furnishings R

I/ We understand that any home loan offer made by a Bank is subject to the valuation of the property.

I / We declare that to the best of my / our knowledge and belief that the particulars set out in this home loan application are true and correct and no information which might affect the decision of the Bank has been intentionally withheld.

I / We acknowledge that I / We shall be liable for the administration fees and wasted cost incurred by the Bank and attorneys in the event of me / us withdrawing from the home loan granted, once I have given the bank the go ahead to conduct a valuation.

I/ We acknowledge that some of the information furnished by me / us in the application within the course of granting the loan or registration of any bond in connection therewith, may be disclosed to persons who are not in the employ of the Bank but whose services will be utilised by the bank and I / We therefore consent to the bank disclosing such information to any such persons.

I / we hereby authorize the Bank to furnish or to disclose any information arising from any agreement entered into the Bank to any credit bureau.

I / We hereby appoint www.BondFind.co.za as my / our sole agent to obtain mortgage loan finance for this property on my / our behalf.

APPLICANT

NAME: SIGNATURE DATE

CO-APPLICANT / CONSENTING SPOUSE (Cop Marriages)

NAME: SIGNATURE DATE

7.