1. Post-implementation Reviews: Required

The status of PIRs required is updated regularly as the Office of Best Practice Regulation receives information from departments and agencies. In total, 93 PIRs have been required under the Australian Government’s PIR requirements. To date 66 PIRs have been completed and published on the OBPR website. As at the week ending 17 February 2017, there are 13 instances where the regulation has been implemented and a PIR still requires completion, and in five instances the relevant measure has not yet been implemented. Nine PIRs are currently non-compliant as they were not completed in the required timeframe. Information on PIRs that are completed and published can be found in the associated table, Post- implementation Reviews: Completed and Published. The post-implementation review guidance note1 provides advice on the preparation of PIRs and compliance with the Government’s requirements.

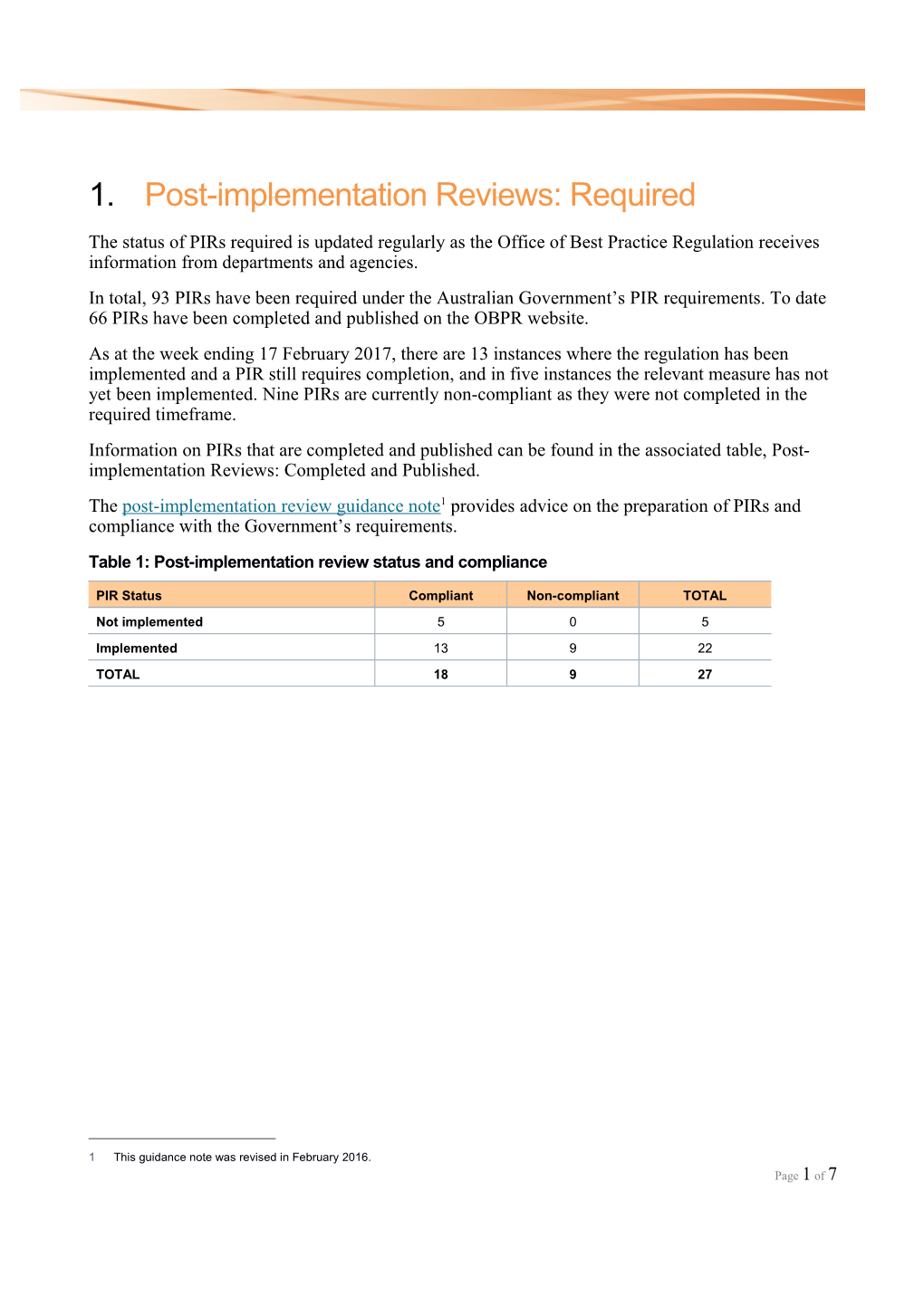

Table 1: Post-implementation review status and compliance

PIR Status Compliant Non-compliant TOTAL Not implemented 5 0 5 Implemented 13 9 22 TOTAL 18 9 27

1 This guidance note was revised in February 2016. Page 1 of 7 Contents

Page 2 of 7 Australian Accounting Standards Board

Title of regulatory proposal Reason for Implementati PIR Due Date Description of regulatory proposal PIR on date Compliance Reducing the Financial Reporting Burden: A Second Tier of Requirements for General Purpose Financial Non- Statements Non- Complianc June 2010 June 2015a Provides a second tier of requirements for general Compliantb e purpose financial statements to reduce the financial reporting burden. a The OBPR agreed to the AASB’s request to defer the commencement date for the PIR to coincide with an expected review of the relevant standards by the International Accounting Board. b The AASB has advised that it is preparing a PIR of this decision. The PIR is expected to be completed by 30 June 2016.

Australian Prudential Regulation Authority

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance Implementing Basel III Liquidity Reforms in Australia Implements reporting and liquidity governance Substantial January requirements for Authorised Deposit-taking Institutions January 2014 Compliant (ADIs) in Australia. Impact 2019

Department of Communications and the Arts

Title of regulatory proposal Reason for Implementati PIR Due Date Description of regulatory proposal PIR on date Compliance

Convergence Reviewa

Non- Decision not to issue spectrum or broadcast licenses for E/c March 2013 March 2015 Compliant a fourth ‘free to air’ television network.

Changes to media ownership and control rules Substantial Not Removes the cross-media ownership rule that prevents .. Compliant mergers that involve more than two of three regulated Impact Implemented media platforms in any commercial radio licence area. Improved Competition in Telecommunications Marketsa E/c June 2016 June 2018 Compliant Proposes structural or functional separation of Telstra wholesale and retail operations.

Problem Gamblinga

Non- Non- Ban the promotion of live odds during sports coverage. July 2013 July 2015 compliance Compliant

Resale Royalty Right for Visual Artists Bill 2008c Non- Non- Complianc June 2010 June 2013d Establishes an inalienable resale royalty right for visual Compliant artists. e a These matters were originally reported under the Department of Broadband, Communications and the Digital Economy. However, on 18 September 2013 the Department was renamed the Department of Communications. On 21 September 2015 the Department was renamed the Department of Communications and the Arts.

Page 3 of 7 b Completed but not yet published c These matters were previously reported under the Attorney-General‘s Department. However on 20 September 2015 these matters were transferred to the Department of Communications and the Arts. d OBPR agreed that the commencement of this PIR could be delayed to allow the agency to collect data. However, the PIR was not completed by the revised due date.

E/c Exceptional circumstances were granted by the Prime Minister. .. Not applicable

Department of Education and Training

Title of regulatory proposal Reason for Implementati PIR Due Date Description of regulatory proposal PIR on date Compliance Higher Education Reforms Reforms to higher education sector, including Substantial Not .. Compliant deregulation of tuition fees, changes to Government Impact implemented subsidies and extension of demand driven funding system. .. Not applicable Department of the Environment

Title of regulatory proposal Reason for Implementati PIR Due Date Description of regulatory proposal PIR on date Compliance New fishing activities of size and scale unprecedented in Commonwealth marine areasa September Non- E/c June 2015b Extension of legislative powers available under the 2012 Compliant Environment Protection and Biodiversity Conservation Act 1999. Greater Protection for Water Resourcesa Amending national environmental law to require federal Non- E/c June 2013 June 2015 assessment and approval of coal seam gas and large Compliant coal mining developments that have a significant impact on a water resource. a These matters were previously reported under the Department of Sustainability, Environment, Water, Population and Communities. However, on 18 September 2013 these matters were transferred to the Department of the Environment. b The OBPR provided the Department with an extension to finalise the PIR for this proposal. E/c Exceptional circumstances were granted by the Prime Minister.

Department of Foreign Affairs and Trade

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance China-Australia Free Trade Agreement (ChAFTA) Substantial December December Compliant Conclusions of negotiations on the China-Australia Free Impact 2015 2020 Trade Agreement Japan Australian Economic Partnership Agreement (JAEPA) Substantial January January 2015 Compliant Conclusion of negotiations on the Japan-Australia Impact 2020 Economic Partnership Agreement Trans-Pacific Partnership (TPP) Agreement Substantial Not .. Compliant Conclusion of negotiations on the Trans-Pacific Impact Implemented Partnership Agreement.

.. Not applicable

Page 4 of 7 Department of Health

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance Fairer Private Health Insurance Incentives Bill 2009a Non- E/c July 2012 June 2015b Introduces three new private health insurance incentive Compliant tiers. a These matters were previously reported under the Department of Health and Ageing. However, on 18 September 2013 the Department was renamed the Department of Health. b The OBPR provided the Department with an extension to finalise the PIR for this proposal. E/c Exceptional circumstances were granted by the Prime Minister

Department of Immigration and Border Protection

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance Organised Crime on the Waterfronta Non- Not complianc .. Compliant A package of measures to combat organised crime and Implementedb strengthen security on the waterfront. e a Responsibility for this PIR was transferred from the Attorney-General’s Department to the Department of Immigration and Border Protection. b Although certain parts of this package have already been implemented, the main regulatory aspects have not yet been implemented. .. Not applicable

Department of Infrastructure and Regional Development

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance Coastal Shipping Reform Substantial Not … Compliant Amend arrangements for vessels and crew trading Impact Implemented between Australian ports. Qantas Sale Amendment Bill 2014 Non- Remove the foreign ownership and other restrictions that E/c August 2014 August 2016 apply to Qantas but do not apply to other airlines based in Complianta Australia a The Department is currently consulting with stakeholders. The status of this PIR will be changed to compliant once it is finalised and published on the OBPR’s website. E/c Exceptional circumstances were granted by the Prime Minister. .. Not applicable

Department of Social Services

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance

Problem Gamblinga

Non- Introduce a $250 daily withdrawal limit from ATMs in February February complianc Compliantb gaming venues (excluding casinos). 2014 2016 e a These matters were previously reported under the Department of Families, Housing, Community Services and Indigenous Affairs. However, on 18 September 2013 these matters were transferred to the Department of Social Services. b The Department of Social Services has confirmed that these amendments do not reflect Government policy and will not be progressed. As such this PIR does not need to be completed.

Page 5 of 7 The Treasury

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance

Future of Financial Advice

Prospective ban on up-front and trailing commissions Non- Compliant and like payments for both individual and group risk July 2013 July 2017a compliance insurance within superannuation. Requirement for advisers to renew client agreement to Non- July 2013 July 2017a Compliant ongoing advice fees every two years (opt-in regime). compliance Non- Ban on soft dollar benefits over $300 per benefit. July 2013 July 2017a Compliant compliance Limited carve-out for basic products from the ban on Non- Compliant certain conflicted remuneration structures and best July 2013 July 2017a interests duty. compliance Non- Access to scaled financial advice. July 2013 July 2017a Compliant compliance Government Response to Australia’s Future Tax System Review

Better targeting of not-for-profit tax concessions. E/c July 2014 July 2016 Compliantb

Implementation of the United States Foreign Account Tax Compliance Act in Australia Substantial The intergovernmental agreement seeks to limit the July 2014 July 2019 Compliant compliance costs and other impacts for Australian Impact financial institutions associated with complying with US tax information reporting requirements. Future of Financial Advice Amendments Substantial Amendments aimed at reducing the complexity and March 2016 March 2021 Compliant compliance costs associated with the Future of Impact Financial Advice (FOFA). a The OBPR allowed additional time to complete these PIRs as the regulation has not been fully implemented. b. The Treasury has confirmed that these amendments do not reflect Government policy and will not be progressed. As such this PIR does not need to be completed. c The OBPR granted the Department an extension in order to complete the PIR for this proposal. d Completed but not yet published E/c Exceptional circumstances were granted by the Prime Minister.

Page 6 of 7 Joint Proposals

Cross Portfolio - Department of Defence/Department of Industry, Innovation and Science

Title of regulatory proposal Reason Implementati PIR Due Date Description of regulatory proposal for PIR on date Compliance Government’s Response to the Review of the Woomera Prohibited Area (Defence/Industry)a Non- E/c August 2014 August 2016 Implements a new framework for managing Department Compliantb of Defence and non-Defence use of the Woomera Prohibited Area. a This matter was previously reported under the Department of Resources, Energy and Tourism. However, on 18 September 2013 this matter was transferred to the Department of Industry. b The status of this PIR will be changed to compliant once it is finalised and published on the OBPR website. E/c Exceptional circumstances were granted by the Prime Minister.

Page 7 of 7