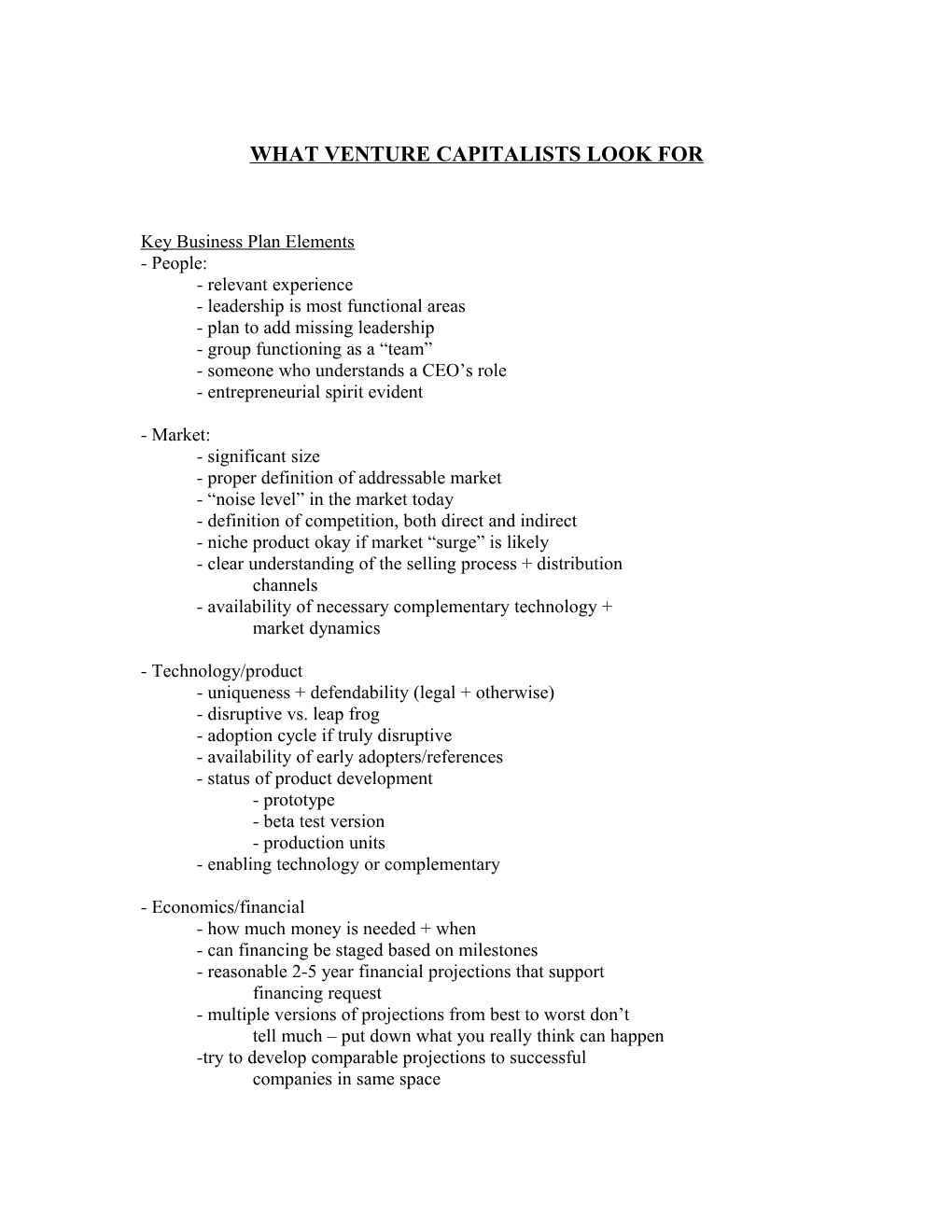

WHAT VENTURE CAPITALISTS LOOK FOR

Key Business Plan Elements - People: - relevant experience - leadership is most functional areas - plan to add missing leadership - group functioning as a “team” - someone who understands a CEO’s role - entrepreneurial spirit evident

- Market: - significant size - proper definition of addressable market - “noise level” in the market today - definition of competition, both direct and indirect - niche product okay if market “surge” is likely - clear understanding of the selling process + distribution channels - availability of necessary complementary technology + market dynamics

- Technology/product - uniqueness + defendability (legal + otherwise) - disruptive vs. leap frog - adoption cycle if truly disruptive - availability of early adopters/references - status of product development - prototype - beta test version - production units - enabling technology or complementary

- Economics/financial - how much money is needed + when - can financing be staged based on milestones - reasonable 2-5 year financial projections that support financing request - multiple versions of projections from best to worst don’t tell much – put down what you really think can happen -try to develop comparable projections to successful companies in same space Business Plan Tips - Talk about successful companies in your space – gives investor comfort that the market is real

- Focus on past successes of the team as a predictor of the future

- It should be clearly evident that plan was put together as a team, not by outsiders or just one member of the team. Don’t change the plan every time someone gives you a piece of advice – your plan becomes an obvious patchwork.

- Stress by example how background of team is tailored to needs of the new venture

- Credibly define addressable market and your plan to capture a significant share of it

- Be reasonable about projected growth and costs structure necessary to achieve such growth – use comparable if possible

- Do not overly stress first mover advantage – rather stress strategies that help build long term barriers to entry for others

- Do not over stress how proprietary your technology is - it is much more important to show how the technology satisfies a large, unfilled customer need

- Don’t bother to ask for non-disclosure agreement up front –VC’s don’t sign these, and it just gives an easy reason to say “no”.

- Choose an investor that through research you know addresses your technology, markets and size and get a personal introduction everywhere possible